Professional Documents

Culture Documents

Review Exercises 8

Uploaded by

ukhyeonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review Exercises 8

Uploaded by

ukhyeonCopyright:

Available Formats

Review Exercises 8

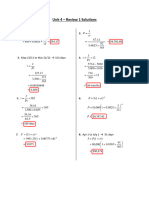

Review Exercise 8, Solution 1:

We have P = $1950, S = $2129.55, r = 6.5% p.a. = 0.065

I = S − P = 2125 − 1950 = $175

I = Prt

I 175

t= = = 1.380670… years

Pr 1950× 0.065

Therefore, in terms of days, t = 1.380670... – 1 = 0.380670 × 12 = 4.568040… months (rounded off to 5

months)

Therefore, it will take 1 year and 5 months for the investment to accumulate to the given value.

Review Exercise 8, Solution 3:

From the days table,

June 4: 155th day of the year

Dec 31: 365th day of the year

Therefore, in 2017, we have 365 − 155 = 210 days

Apr 3: 93rd day of the year

Therefore, in 2018 we have 93 days

Total days in the given period = 210 + 93 = 303 days

303

I = Prt = (4225) (0.072) ( ) = $252.527671... = $252.53

365

Therefore, the repayment amount to be paid = 4225 + 252.53 = $4477.53 and out of this amount, the

interest is $252.53.

Review Exercise 8, Solution 5:

P = S (1 + rt) −1

182 -1

= 20000 (1 + 0.0525 × )

365

= $19,489.79456...

= $19,489.79

Therefore, the price of the Treasury bill on the issue date was $19,489.79.

Review Exercise 8, Solution 7:

Let ‘r’ be the monthly rate of interest Merilyn was charging the employee.

S = P (1 + rt)

4600 = 4000 (1 + r × 8)

Last updated: June 18.2017

1.15 = 1 + 8r

Therefore, 8r = 0.15

0.15

r= = 0.225

8

12

The bank offers an interest 1.5% less than that offered by her to her employee.

The interest rate offered by the bank = 0.22 − 0.015 = 0.21

8

Therefore, the amount she would have had in her bank S = 4000 (1 + 0.21 × ) = $4560

12

Review Exercise 8, Solution 9:

Let the amount he would have to pay at the end of 2 years to clear the balance be ‘x’

9

In 9 months, the balance is: 10,000 (1 + 0.04 × ) = $10,300

12

A payment of $2500 is made in 9 months:

10,300 – 2500 = $7800

6

In 15 months, the balance is: 7800 (1+ 0.04 × ) = $7956

12

A payment of $5000 is made in 9 months:

7956 – 5000 = $2956

9

X = 2956(1+ 0.04 × )

12

X = $3044.68

Therefore, an amount of $3044.68 paid at the end of two years will settle the loan.

Review Exercise 8, Solution 11:

Let the single payment Nikkita would make in 9 months that would settle both payments be ‘x’

Let S1 be the equivalent value on the focal date of $3500.00 (paid in 6 months). Therefore, t1 = 9 − 6 = 3

months

Let P2 be the equivalent value on the focal date of $2500.00 (paid in 11 months). Therefore, t2 = 11 − 9 = 2

months

We have S1 + P2 = x

P1 (1 + rt1) + S2 (1 + rt2)−1 = x

3500 (1 + 0.0075 × 3) + 2500 (1 + 0.0075 × 2)-1 = x

3578.75 + 2463.054187... = x

Last updated: June 18.2017

We get x = $6041.804187... = $6041.80

Therefore, a single payment of $6041.80 in 9 months will settle both payments.

Review Exercise 8, Solution 13:

Since it is an interest bearing note, the principal is the face value.

First calculate the maturity value of the note.

180

S = 7500 (1 + 0.0625 × )

365

= $7731.164384...

Now since it is sold after 70 days.

110

The time remaining is 180 − 70 = 110 days = years

365

P = S (1 + rt) -1

110 -1

=7731.164384... (1 + 0.09 × )

365

= 7527.007202… = $7527.01

Therefore, the proceeds of the note are $7527.01.

Review Exercise 8, Solution 15:

Since it is a non-interest bearing note, the maturity value is 6 months (0.5 years) from the date of issue and

is the face value of the note.

Using the days table:

Aug 8: 220th day of the year

Oct 30: 303rd day of the year

Difference = 303 − 220 = 83 days

83

Now since it is sold in 83 days (i.e. years).

365

The term of the note is six months. Six months from August 8, 2017 is February 8, 2017.

Aug 8: 220th day of the year

Feb 8: 39th day of the year

The number of day is: (365 – 220) + 39 = 184 days

The time remaining is 184 – 83 = 101

P = S (1 + rt)-1

101 -1

= 1750 (1 + 0.0675 × )

365

Last updated: June 18.2017

= $1717.912686...

= $1717.91

Therefore, the proceeds of the note are $1717.91.

Review Exercise 8, Solution 17:

Let the size of the each of the two equal payments be ‘x’

Let P1 be the equivalent value on the focal date of ‘x’ paid in 5 months

Let P2 be the equivalent value on the focal date of ‘x’ paid in 16 months

Assume that Roanna borrowed $2500 now, that is, on the focal date.

Therefore, we have P1 + P2 = 2500

Therefore, S1 (1 + rt1)−1 + S2 (1 + rt2)-1 = 2500

5 -1 16 -1

x (1 + 0.07 × ) + x (1 + 0.07 × ) = 2500

12 12

0.971659... x + 0.914634... x = 2500

1.886294... x = 2500

Therefore, x = $1325.350085... = $1325.35

Therefore, the two equal payments are $1325.35 each will settle the loan.

Review Exercise 8, Solution 19:

Let S be the total amount repaid and S1 and S2 the amounts repaid after 5 and 10 months respectively.

10 5

12,800(1 + 0.065× ) =2 x + x (1 + 0.065× )

12 12

13,493.333333… = 2 x + 1.027083… x

S1= $4457.54

S2=$8915.08

Therefore, the amount of payment in five months is $4457.54 and the payment in ten months is $8915.08.

Review Exercise 8, Solution 21:

8 6

15,000(1 + 0.0475×1) = 10,000(1 + 0.0475 × ) + x (1 + 0.0475× )+ x

12 12

15,712.50 = 10,316.666667… + 1.02375… x + x

5395.833333… = 2.02375… x

x = 2666.254890… = $2666.25

Therefore, the size of the equal payments is $2666.25.

Exercise 8.3, Solution 23:

Last updated: June 18.2017

To compute for the interest of the investment in 9 months, find the difference of the maturity value after 6

months and 15 months,

$4,725 - $4,590 = $135

Then, for 15 months, the interest will be…

$135/9 months = $15

$15 x 15 months = $225

The amount invested is,

$4,725 – $225 = $4,500

I 22 5

r= = = 0.12 ... = 12 % p.a.

Pt 4,500 1.42

Therefore the amount invested is $4,500 and the interest rate is 12 % p.a.

Last updated: June 18.2017

You might also like

- Exercises 8.3Document6 pagesExercises 8.3ukhyeonNo ratings yet

- Exercises 8.1Document6 pagesExercises 8.1ukhyeonNo ratings yet

- Chapter 1. Simple Interest and Simple Discount 1.1 Simple InterestDocument80 pagesChapter 1. Simple Interest and Simple Discount 1.1 Simple InterestKì Hyö JüngNo ratings yet

- Ass 3 Answer Key01Document2 pagesAss 3 Answer Key01JAN ERWIN LACUESTANo ratings yet

- FM Textbook Solutions Chapter 1 Second EditionDocument6 pagesFM Textbook Solutions Chapter 1 Second EditionlibredescargaNo ratings yet

- Simple InterestDocument8 pagesSimple InterestCatherine PerosNo ratings yet

- Exam 2 Review SolnsDocument10 pagesExam 2 Review SolnsMuhammad EahteshamNo ratings yet

- Unit 4 Review 1 Solutions - NEGATIVE ExponentsDocument5 pagesUnit 4 Review 1 Solutions - NEGATIVE Exponentsofficial.timilsinashishirNo ratings yet

- Banking Extra PracticeDocument17 pagesBanking Extra PracticeSubham PatiNo ratings yet

- Engineering Economy LectureDocument16 pagesEngineering Economy LectureEphraim RamosNo ratings yet

- Mathematics of Investment 3Document21 pagesMathematics of Investment 3Reichstein CaduaNo ratings yet

- Chapter 1. Simple Interest and Simple Discount 1.1 Simple InterestDocument76 pagesChapter 1. Simple Interest and Simple Discount 1.1 Simple Interestmaria glayza corcueraNo ratings yet

- CheatSheet Interest Calculation PDFDocument4 pagesCheatSheet Interest Calculation PDFdev4c-1No ratings yet

- Homework 3 - StudentDocument6 pagesHomework 3 - StudentMarket FarmersNo ratings yet

- Fundamentals of Business Math Canadian 3rd Edition Jerome Solutions ManualDocument21 pagesFundamentals of Business Math Canadian 3rd Edition Jerome Solutions Manualnorianenclasphxnu100% (23)

- Exercises 9.6: Exercise 9.6, Solution 1: Principal Maturity Value Nominal InterestDocument7 pagesExercises 9.6: Exercise 9.6, Solution 1: Principal Maturity Value Nominal InterestMia PhanNo ratings yet

- Engineering Econ FinalsDocument10 pagesEngineering Econ FinalsIvan Morise AtienzaNo ratings yet

- Lesson 11 9.2 Compound Interest Future ValueDocument7 pagesLesson 11 9.2 Compound Interest Future ValueSandro SerdiñaNo ratings yet

- Module 3 Problem SetDocument6 pagesModule 3 Problem SetPiands FernandsNo ratings yet

- Chapter 2 - Banking (30 Marks) Time: 1hr 15 MinDocument5 pagesChapter 2 - Banking (30 Marks) Time: 1hr 15 MinRohan MehtaNo ratings yet

- Practice 07Document8 pagesPractice 07daddy bobaNo ratings yet

- Lesson 4.2 Mathematics of Finance FinalDocument38 pagesLesson 4.2 Mathematics of Finance FinaltemplaalexanderjhonNo ratings yet

- S.2 Mathematics - Hire PurchaseDocument6 pagesS.2 Mathematics - Hire PurchaseGabriel100% (1)

- Mathematics in The Modern World Simple InterestDocument18 pagesMathematics in The Modern World Simple InterestMarwin BartolomeNo ratings yet

- Business Mathematics Midterm ExamDocument10 pagesBusiness Mathematics Midterm ExamYasmin BeltranNo ratings yet

- Sample Problems Solutions Sections 2.3 & 2.4.: R P P M A R MDocument5 pagesSample Problems Solutions Sections 2.3 & 2.4.: R P P M A R MTerry Clarice DecatoriaNo ratings yet

- MATH 109 Amortization: The Monthly PaymentDocument8 pagesMATH 109 Amortization: The Monthly PaymentEarl Jan TampusNo ratings yet

- Business Finance Peirson 11e CH 3Document24 pagesBusiness Finance Peirson 11e CH 3RitaNo ratings yet

- Engineering EconomicsDocument23 pagesEngineering EconomicsSymonne MateoNo ratings yet

- Economics: Ordinary and Exact Simple InterestDocument5 pagesEconomics: Ordinary and Exact Simple InterestLoiza Joi MulanoNo ratings yet

- Maths Chap 2 BankingDocument13 pagesMaths Chap 2 BankingBikramjit MajumdarNo ratings yet

- 3.1 Simple InterestDocument43 pages3.1 Simple InterestAhmed salah el zeinyNo ratings yet

- Basic Mathematics Assignment 2 2024Document5 pagesBasic Mathematics Assignment 2 2024Lintsi HipetwaNo ratings yet

- Mathematics of Finance Solutions To ReviDocument6 pagesMathematics of Finance Solutions To ReviUrjiNo ratings yet

- Simple Annuity: General MathematicsDocument18 pagesSimple Annuity: General MathematicsAezcel SunicoNo ratings yet

- Simple Interest 1Document88 pagesSimple Interest 1Sean Ray Silva DelgadoNo ratings yet

- MATH 1030-004, Quiz 5 Solution Spring 2011: APR N NyDocument2 pagesMATH 1030-004, Quiz 5 Solution Spring 2011: APR N NyWaqar Ali SoomroNo ratings yet

- Annuity SeatworkDocument3 pagesAnnuity SeatworkerinlomioNo ratings yet

- Contemporary Business Mathematics Canadian 10th Edition Hummelbrunner Solutions ManualDocument40 pagesContemporary Business Mathematics Canadian 10th Edition Hummelbrunner Solutions Manualgarconshudder.4m4fs100% (20)

- Lecture6 - ES301 Engineering EconomicsDocument43 pagesLecture6 - ES301 Engineering EconomicsLory Liza Bulay-ogNo ratings yet

- Chapter 6 Math of FinanceDocument10 pagesChapter 6 Math of FinanceEmmanuel Santos IINo ratings yet

- S R I A R I: Annuity Due Amount and Present ValueDocument2 pagesS R I A R I: Annuity Due Amount and Present ValueRya Cindy Marie AlcidNo ratings yet

- DiscountDocument5 pagesDiscountMark Christian Cortez EstrellaNo ratings yet

- Module 4 - AnnuitiesDocument9 pagesModule 4 - AnnuitiesBern Austin EsguerraNo ratings yet

- Chapter 2Document11 pagesChapter 2nptel4successNo ratings yet

- Business Math - Chapter 1 Questions and SolutionsDocument3 pagesBusiness Math - Chapter 1 Questions and Solutionsgrace paragasNo ratings yet

- Unit 2 Time and Money DDocument5 pagesUnit 2 Time and Money DCarmelo Janiza LavareyNo ratings yet

- Compound Interest DiscussionDocument8 pagesCompound Interest DiscussionBaoooNo ratings yet

- Chapter 3 - Annuities Part BDocument21 pagesChapter 3 - Annuities Part BNicole DantesNo ratings yet

- Mathematics of FinanceDocument40 pagesMathematics of FinanceshineNo ratings yet

- Compound InterestDocument20 pagesCompound InterestKarla Anexine ValenciaNo ratings yet

- Jakia, Finance MathsDocument13 pagesJakia, Finance MathsangelNo ratings yet

- Chapter 3 Review Quiz SolutionsDocument4 pagesChapter 3 Review Quiz SolutionsA. ZNo ratings yet

- Gemmw: Mathematics in The Modern World Module 4: Consumer Math Learning OutcomesDocument24 pagesGemmw: Mathematics in The Modern World Module 4: Consumer Math Learning OutcomesMary Grace Angeles50% (2)

- Annuity DueDocument32 pagesAnnuity DueerinlomioNo ratings yet

- Answer: A ExplanationDocument1 pageAnswer: A ExplanationftrszrfycNo ratings yet

- Week 4 ADocument9 pagesWeek 4 AsunkenNo ratings yet

- FM Textbook Solutions Chapter 2 Second Edition PDFDocument11 pagesFM Textbook Solutions Chapter 2 Second Edition PDFlibredescarga100% (1)

- fm2 Practice QuestionsDocument3 pagesfm2 Practice Questionsbudi272007_138375163No ratings yet

- Physics 30 Formula Sheet NewDocument4 pagesPhysics 30 Formula Sheet NewukhyeonNo ratings yet

- Temperature Vs LengthDocument3 pagesTemperature Vs LengthukhyeonNo ratings yet

- Work Book 22Document1 pageWork Book 22ukhyeonNo ratings yet

- Dictionary of Interjections (Aww, Dics Oh, Ah, Eek, Oops)Document6 pagesDictionary of Interjections (Aww, Dics Oh, Ah, Eek, Oops)ukhyeonNo ratings yet

- Run-Time Type Information Typeid Const Cast Dynamic - Cast Reinterpret Cast Static CastDocument1 pageRun-Time Type Information Typeid Const Cast Dynamic - Cast Reinterpret Cast Static CastukhyeonNo ratings yet

- Restricted CoursDocument20 pagesRestricted CoursukhyeonNo ratings yet

- Children's Hospital: West C Ampus D RDocument1 pageChildren's Hospital: West C Ampus D RukhyeonNo ratings yet

- Wrong!!Document2 pagesWrong!!ukhyeonNo ratings yet

- ENGG 233 Computing For EngineersDocument1 pageENGG 233 Computing For EngineersukhyeonNo ratings yet

- Course Tuition 2012-13Document10 pagesCourse Tuition 2012-13ukhyeonNo ratings yet

- Inflation and Its Impact On Project Cash FlowsDocument45 pagesInflation and Its Impact On Project Cash FlowsukhyeonNo ratings yet

- I'm Afraid I've Jumped Ahead A Bit in Our Story.: English NewDocument1 pageI'm Afraid I've Jumped Ahead A Bit in Our Story.: English NewukhyeonNo ratings yet

- Evolution of BankingDocument73 pagesEvolution of BankingKavita KohliNo ratings yet

- Orca Share Media1579219923157Document10 pagesOrca Share Media1579219923157leejongsuk44% (9)

- Commerce 1 PDFDocument14 pagesCommerce 1 PDFAnonymous AOS81PvLeiNo ratings yet

- Vimal Chandra Grover Vs Bank of India On 26 April, 2000Document8 pagesVimal Chandra Grover Vs Bank of India On 26 April, 2000Taannyya TiwariNo ratings yet

- Auditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresDocument12 pagesAuditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresnikNo ratings yet

- OJT Sample ReportDocument9 pagesOJT Sample ReportRavenna Dela CruzNo ratings yet

- 03 InterestRateSwapsDocument123 pages03 InterestRateSwapsAlexandra Hsiajsnaks100% (1)

- Q1 Classify The Following Accovints and Give Short Explanation Also. (1) Dhanesh Shah's AccountDocument3 pagesQ1 Classify The Following Accovints and Give Short Explanation Also. (1) Dhanesh Shah's Accountapi-232747878No ratings yet

- HTTP WWWDocument76 pagesHTTP WWWMark DaminNo ratings yet

- The Unfinished Nation - Chapter 23Document2 pagesThe Unfinished Nation - Chapter 23John Frandolig100% (1)

- Social Security System of The Philippines (SSS) : Angeles University FoundationDocument13 pagesSocial Security System of The Philippines (SSS) : Angeles University FoundationLois DanielleNo ratings yet

- RB Millionaire Roadmap Ebook v7-1Document24 pagesRB Millionaire Roadmap Ebook v7-1Jam AmirNo ratings yet

- Phil CompetitivenessDocument70 pagesPhil Competitivenessvlabrague6426No ratings yet

- Canlas Vs CA (Digest)Document1 pageCanlas Vs CA (Digest)Dhin Carag100% (1)

- CH 14 ADocument19 pagesCH 14 ADamMayXanhNo ratings yet

- Scribd Letter To Donald Tusk Regarding EU and UK Trade Deal After Brexit.Document1 pageScribd Letter To Donald Tusk Regarding EU and UK Trade Deal After Brexit.morganistNo ratings yet

- Australia Second Round Review (2017)Document130 pagesAustralia Second Round Review (2017)OECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Fund Flow Statement 2Document13 pagesFund Flow Statement 2Rajendra GawateNo ratings yet

- Babe 1 Time Value QuestionsDocument9 pagesBabe 1 Time Value QuestionsCatherine LegaspiNo ratings yet

- 8 The Silver Lining in Paatalo v. JPMorgan Chase Bank NA Et AlDocument3 pages8 The Silver Lining in Paatalo v. JPMorgan Chase Bank NA Et AlDeontosNo ratings yet

- DPLC Program Development Loan ApplicationDocument10 pagesDPLC Program Development Loan ApplicationmamaNo ratings yet

- CASE NO.5 Lembaga Minyak Sawit Malaysia v. Arunamari Plantations SDN BHD - HSKDocument15 pagesCASE NO.5 Lembaga Minyak Sawit Malaysia v. Arunamari Plantations SDN BHD - HSKJmaal BerneNo ratings yet

- Gen Math Q2 Module 6Document27 pagesGen Math Q2 Module 6Larilyn Benicta100% (1)

- CH 15 - Pricing DecisionsDocument56 pagesCH 15 - Pricing DecisionsNouman ChNo ratings yet

- Group Coursework - MBA IDocument11 pagesGroup Coursework - MBA IBuatienoNo ratings yet

- CH 3-Valuation of Bond and SharesDocument40 pagesCH 3-Valuation of Bond and SharesJyoti Bansal67% (3)

- Section 9 CasesDocument6 pagesSection 9 CasesBenn DegusmanNo ratings yet

- Tax Planning and Managerial DecisionDocument163 pagesTax Planning and Managerial DecisionDr Linda Mary Simon100% (2)

- Real Estate Cashflow and Financial Modelling PDFDocument6 pagesReal Estate Cashflow and Financial Modelling PDFadonisghlNo ratings yet

- Challenges - and - Opportunities - in - Rice MechanizationDocument36 pagesChallenges - and - Opportunities - in - Rice MechanizationDavid ArabesNo ratings yet