Professional Documents

Culture Documents

Allama Iqbal College, Goheer Campus,: Bahawalpur

Uploaded by

Muhammad Qaisar LatifOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allama Iqbal College, Goheer Campus,: Bahawalpur

Uploaded by

Muhammad Qaisar LatifCopyright:

Available Formats

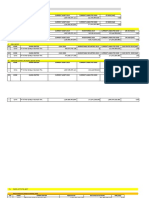

Allama Iqbal College, Goheer Campus,

Bahawalpur

Ratios Analysis

A) Liquidity Ratios:

1) Current Ratio= Current Assets/ Current Liabilities

2) Quick Ratio= Quick Assets*/ Current Liabilities

3) Net Working Capital= Current Assets – Current Liabilities

*Quick Assets= Current Assets – Inventories

B) Debt Ratios:

4) Debt Ratio= Total Debt/ Total Assets

5) Debt to Equity Ratio= Total Debt/ Equity

6) Long Term Debt to Equity Ratio= Long Term Debt/ Equity

7) Total Capitalization Ratio= Long Term Debt/ Equity + Long Term Debt

8) Time Interest Earned Ratio= Earnings before Interest and Taxes (EBIT)/ Interest

9) Fixed Payment Coverage Ratio= EBIT + Lease Payment

Interest + Lease Payments+ {[(Principal+ Preferred

Stock Dividends)] x [1 (1-t)]}

C) Activities Ratios

10) Account Receivable Turnover Ratio= Net Cr. Sales/ Average Account Receivables

11) Average Collection Period= No. of Days in a year/ Account Receivable Turnover Ratio

12) Account Payable Turnover Ratio= Net Cr. Purchase or CGS/ Average Account Payables

13) Average Payment Period= No. of Days in a Year/ Account Payable Turnover Ratio

14) Inventory Turnover Ratio= Cost of Goods Sold/ Average Inventory

15) Average Age of Inventory= No. of days in a year/ Inventory Turnover Ratio

16) Fixed Assets Turnover= Sales/ Net Fixed Assets

17) Total Assets Turnover= Sales/ Total Assets

D) Profitability Ratios:

18) Gross Profit Margin= Gross Profit/ Sales* 100

19) Operating Profit Margin= Operating Profit/ Sales* 100

20) Net Profit Margin= Net Profit/ Sales* 100

21) Earnings per share (EPS) = Earnings available for Common Shareholders/

No. of Shares outstanding

22) Dividend per Share= Total Dividend/ No. of Shares outstanding

23) Return on Assets= Earnings available for Common Shareholders/ Total Assets

24) Return on Equity= Earnings available for Common Shareholders/ Equity

25) Price/Earnings Ratio= Market Price per Share/ Earning per Share

26) Market/ Book (M/B) Ratio= Market Price per Share/ Book Value per Share*

*Book Value per Share= Common Stock Equity/ No. of Shares Outstanding

27) Earning Yield= Earnings per share/ Market price per share

28) Dividend Yield= Dividend per share/ Market price per Share

29) Dividend Payout Ratio= Dividend per share/ Earning per share

30) Operating Cycle= Average Collection period+ Average Age of Inventory

31) Cash Conversion Cycle= Operating Cycle – Average Payment period

Instructor: Qaisar Latif qaisar.latif26@gmail.com

You might also like

- Ratio Analysis FormulaeDocument3 pagesRatio Analysis FormulaeKalyani ShindeNo ratings yet

- Financial Ratios ListDocument1 pageFinancial Ratios Listbibekmishra8107No ratings yet

- CFA L1 Entire FRA Notes Summary Part 2Document3 pagesCFA L1 Entire FRA Notes Summary Part 2Nishant SenapatiNo ratings yet

- Financial Management Ratio AnalysisDocument1 pageFinancial Management Ratio AnalysisAmrita GhartiNo ratings yet

- Accounting Equations: SubjectDocument2 pagesAccounting Equations: SubjectYuxuan ChenNo ratings yet

- Ratio Analysis: Important FormulaDocument4 pagesRatio Analysis: Important FormulaHarsh Vardhan KatnaNo ratings yet

- I) Short Term Solvency or Liquidity Ratios Or: InterestDocument2 pagesI) Short Term Solvency or Liquidity Ratios Or: InterestSonia DalviNo ratings yet

- Ratios AllDocument2 pagesRatios Allnikita sharmaNo ratings yet

- Ratio - Basics: Liquidity Ratios (Short Term Solvency Ratios)Document5 pagesRatio - Basics: Liquidity Ratios (Short Term Solvency Ratios)Avijash ShrivastavaNo ratings yet

- Ratio WorkDocument6 pagesRatio WorkNATIONAL FARMERS PRODUCER COMPANYNo ratings yet

- 04 Fs Analysis With StudentDocument10 pages04 Fs Analysis With StudentarianasNo ratings yet

- 1 Rec Formula ResearchDocument20 pages1 Rec Formula Researchbhobot riveraNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosahmedmostafaibrahim22No ratings yet

- Ratios FormulasDocument1 pageRatios FormulasShakeelNo ratings yet

- Ration DefinitionsDocument5 pagesRation DefinitionsMohamedNo ratings yet

- A) Liquidity Ratios: - Current Ratio - Acid Test Ratio - Working CapitalDocument3 pagesA) Liquidity Ratios: - Current Ratio - Acid Test Ratio - Working CapitalFariha MaqboolNo ratings yet

- Cfa Program Level II Financial Ratio List20Document2 pagesCfa Program Level II Financial Ratio List20ArijitNo ratings yet

- Accounting Equations: SubjectDocument2 pagesAccounting Equations: SubjectHenry CaoNo ratings yet

- Formulae Sheet: Page 1 of 1Document1 pageFormulae Sheet: Page 1 of 1lady mathsNo ratings yet

- Formulae A Level BusinessDocument1 pageFormulae A Level BusinesscoconutfoldersNo ratings yet

- CMA USA Ratio Definitions 2015Document4 pagesCMA USA Ratio Definitions 2015Shameem JazirNo ratings yet

- 02 Fs AnalysisDocument14 pages02 Fs AnalysisWilsonNo ratings yet

- Debit: Cash / Bank Account Credit: Share Capital AccountDocument2 pagesDebit: Cash / Bank Account Credit: Share Capital AccountAkram HussainNo ratings yet

- Common Financial & Accounting Ratios & FormulasDocument1 pageCommon Financial & Accounting Ratios & FormulasJaydie Cruz100% (1)

- Caiib-Abm-Important FormulaDocument3 pagesCaiib-Abm-Important FormulaVasimNo ratings yet

- Chapter 2: Nature of Financial Accounting Principles: 3.8 Matching ConceptsDocument6 pagesChapter 2: Nature of Financial Accounting Principles: 3.8 Matching ConceptsRavikumar GandhiNo ratings yet

- Investment Analysis FormulasDocument2 pagesInvestment Analysis FormulasNESIBE ERBASNo ratings yet

- A. Li Quidity Ratios:-: 1. Current RatioDocument5 pagesA. Li Quidity Ratios:-: 1. Current RatioGyanam SaikiaNo ratings yet

- Accounting Formulas: Short Term Solvency or Liquidity RatiosDocument2 pagesAccounting Formulas: Short Term Solvency or Liquidity RatiosTambro IsbNo ratings yet

- RatiosDocument2 pagesRatiosashish_20kNo ratings yet

- Ratio Analysis: Dr. Divya Gakhar Asst. Professor, USMSDocument7 pagesRatio Analysis: Dr. Divya Gakhar Asst. Professor, USMSSumit GargNo ratings yet

- Important FormulasDocument4 pagesImportant FormulasRakesh Ranjan JhaNo ratings yet

- Financial Accounting Ratio Anaylsis FormulasDocument2 pagesFinancial Accounting Ratio Anaylsis Formulasbasit111100% (1)

- Ecnomic Notes 1Document26 pagesEcnomic Notes 1ehnzdhmNo ratings yet

- Amended No. of VariablesDocument6 pagesAmended No. of VariablesRaxiq KhanNo ratings yet

- Ratio Formula: S Liabilitie Current Assets CurrentDocument3 pagesRatio Formula: S Liabilitie Current Assets CurrentpsrikanthmbaNo ratings yet

- Formula For RatioDocument1 pageFormula For Ratioraju710@gmail.comNo ratings yet

- Formula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDocument10 pagesFormula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDilip KumarNo ratings yet

- Fin 440 Lecture 4Document2 pagesFin 440 Lecture 4Sparkïñg KønaNo ratings yet

- Financial Ratio Summary Sheet: Page 1 of 3 Financial RatiosDocument3 pagesFinancial Ratio Summary Sheet: Page 1 of 3 Financial RatiostserafimNo ratings yet

- Common Financial & Accounting Ratios & Formulas Cheat Sheet: by ViaDocument1 pageCommon Financial & Accounting Ratios & Formulas Cheat Sheet: by ViaSheron Jude SeneviratneNo ratings yet

- List of Formulas Used in Different Financial CalculationsDocument2 pagesList of Formulas Used in Different Financial CalculationsRaja Muaz Ahmad KhanNo ratings yet

- Go To and Click Sing Up To RegisterDocument16 pagesGo To and Click Sing Up To RegisterRana AhmadNo ratings yet

- I) Short Term Solvency or Liquidity Ratios: Net IncomeDocument2 pagesI) Short Term Solvency or Liquidity Ratios: Net Incomedude devilNo ratings yet

- 4 Financial Statement AnalysisDocument13 pages4 Financial Statement AnalysisAdnan RizviNo ratings yet

- Bata Ratio AnalysisDocument22 pagesBata Ratio Analysissaba_spice0% (1)

- Chapter 4Document3 pagesChapter 4longlths180310No ratings yet

- Ratio Formula:-: Liquidity RatiosDocument2 pagesRatio Formula:-: Liquidity Ratiosrupeshdahake8586No ratings yet

- CMA FormulaDocument4 pagesCMA FormulaKanniha SuryavanshiNo ratings yet

- MGT201 Financial Management Formulas Lect 1 To 22Document13 pagesMGT201 Financial Management Formulas Lect 1 To 22Farhan UL HaqNo ratings yet

- Final Exam Cheat-SheetDocument1 pageFinal Exam Cheat-SheetPaolo TipoNo ratings yet

- RatiosDocument2 pagesRatiosDeepal ShahNo ratings yet

- O o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Document3 pagesO o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Ana C. RichiezNo ratings yet

- AfM 8 - Tools For Financial AnalysisDocument12 pagesAfM 8 - Tools For Financial AnalysisjaymursalieNo ratings yet

- CA IPCC FM Charts For All Chapters by CA Mayank KothariDocument4 pagesCA IPCC FM Charts For All Chapters by CA Mayank Kotharishanky63167% (3)

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Payment Slip For Deposit of CGT On Purchase of Immovable PropertyDocument1 pagePayment Slip For Deposit of CGT On Purchase of Immovable PropertyMuhammad Qaisar LatifNo ratings yet

- Payment Slip For Deposit of CGT On Purchase of Immovable PropertyDocument1 pagePayment Slip For Deposit of CGT On Purchase of Immovable PropertyMuhammad Qaisar LatifNo ratings yet

- Payment Slip For Deposit of CGT On Purchase of Immovable PropertyDocument1 pagePayment Slip For Deposit of CGT On Purchase of Immovable PropertyMuhammad Qaisar LatifNo ratings yet

- Payment Slip For Deposit of CGT On Purchase of Immovable PropertyDocument1 pagePayment Slip For Deposit of CGT On Purchase of Immovable PropertyMuhammad Qaisar LatifNo ratings yet

- It 000100418367 2020 11 PDFDocument1 pageIt 000100418367 2020 11 PDFMuhammad Qaisar LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 42730325Document1 pageIncome Tax Payment Challan: PSID #: 42730325Muhammad Qaisar LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 42751407Document1 pageIncome Tax Payment Challan: PSID #: 42751407Muhammad Qaisar LatifNo ratings yet

- Intro Gender 11Document46 pagesIntro Gender 11Momal KhawajaNo ratings yet

- Income Tax Payment Challan: PSID #: 42125287Document1 pageIncome Tax Payment Challan: PSID #: 42125287Muhammad Qaisar LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 42719670Document1 pageIncome Tax Payment Challan: PSID #: 42719670Muhammad Qaisar LatifNo ratings yet

- SyllabusDocument11 pagesSyllabusMuhammad Qaisar LatifNo ratings yet

- 99 Names of Allah...Document3 pages99 Names of Allah...Muhammad Qaisar LatifNo ratings yet

- 99 Names of AllahDocument12 pages99 Names of AllahMuhammad Qaisar LatifNo ratings yet

- 99 Names of AllahDocument12 pages99 Names of AllahMuhammad Qaisar LatifNo ratings yet

- Statistics First TermDocument5 pagesStatistics First TermMuhammad Qaisar LatifNo ratings yet

- Chapter 5 Macay Holding Inc Group 4Document5 pagesChapter 5 Macay Holding Inc Group 4ivy melgarNo ratings yet

- Task 4 Sales Pitch Citi BankDocument1 pageTask 4 Sales Pitch Citi BankNishaal GoundarNo ratings yet

- Financial Analysis of Manila Water and MayniladDocument37 pagesFinancial Analysis of Manila Water and MayniladWo Rance100% (1)

- Background On Mortgages: Mortgage MarketsDocument7 pagesBackground On Mortgages: Mortgage MarketsPaw VerdilloNo ratings yet

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- Tugas Rasio WilmarDocument7 pagesTugas Rasio WilmarMuslim HabibieNo ratings yet

- Analysis of L&T Finance IPODocument5 pagesAnalysis of L&T Finance IPOHimanshu JoshiNo ratings yet

- Chapter 2Document35 pagesChapter 2Kate ManalansanNo ratings yet

- Interview With Dr. J. Mark Mobius of Franklin Templeton InvestmentsDocument6 pagesInterview With Dr. J. Mark Mobius of Franklin Templeton InvestmentsMichael Cano LombardoNo ratings yet

- A Study On Fundamental Analysis of Reliance Industries LimitedDocument5 pagesA Study On Fundamental Analysis of Reliance Industries LimitedHusna TakreemaNo ratings yet

- Blocktrading How Don't DoDocument3 pagesBlocktrading How Don't Dobhama.waranNo ratings yet

- How To Pick An Exit Strategy For Your Small BusinessDocument6 pagesHow To Pick An Exit Strategy For Your Small BusinessFaheem JuttNo ratings yet

- Mock MCQ Test: Subject: Investment ManagementDocument14 pagesMock MCQ Test: Subject: Investment ManagementAshlinJoel BangeraNo ratings yet

- Course Overview: ContentsDocument8 pagesCourse Overview: ContentsArindam GhoshNo ratings yet

- Technical Analysis of The Financial Markets - A Comprehensive Guide To Trading Methods and Applications by John J. Murphy (1999)Document582 pagesTechnical Analysis of The Financial Markets - A Comprehensive Guide To Trading Methods and Applications by John J. Murphy (1999)gss34gs432gw2agNo ratings yet

- Nurul Aryani - Quis 2Document3 pagesNurul Aryani - Quis 2Nurul AryaniNo ratings yet

- ECN358Document3 pagesECN358reddepedoNo ratings yet

- George C Lane - LANE StochasticsDocument6 pagesGeorge C Lane - LANE Stochasticsgeyi2008100% (2)

- Gains On Disposition of PropertyDocument4 pagesGains On Disposition of PropertyGian Carlo RamonesNo ratings yet

- Cipm Principles StudysessionsDocument13 pagesCipm Principles StudysessionsGurDeepSiNghNo ratings yet

- BComDocument3 pagesBComChristy jamesNo ratings yet

- Zoltan Pozsar Bretton III - Apr 12 2022Document8 pagesZoltan Pozsar Bretton III - Apr 12 2022ryantongyanNo ratings yet

- Alternative Investments and EquityDocument613 pagesAlternative Investments and EquitySen RinaNo ratings yet

- Banyan Tree Growth Capital LLC Vs Axiom Cordages LMH202007052018105990COM951276Document57 pagesBanyan Tree Growth Capital LLC Vs Axiom Cordages LMH202007052018105990COM951276Kumar KartikNo ratings yet

- Pulz ElectronicsDocument37 pagesPulz ElectronicsBandaru NarendrababuNo ratings yet

- Fly by Night CaseDocument3 pagesFly by Night CaseRaghadShawaheen0% (1)

- How To ThinkorswimDocument83 pagesHow To ThinkorswimAsad Durrani100% (1)

- Discussion Materials, Dated May 20, 2010, of Goldman SachsDocument29 pagesDiscussion Materials, Dated May 20, 2010, of Goldman Sachsmayorlad100% (1)

- Notice List of Approved DEMIs and PSPs FINAL 1Document5 pagesNotice List of Approved DEMIs and PSPs FINAL 1Fuaad DodooNo ratings yet

- Chap 3Document29 pagesChap 3kimngan.nguyen8803No ratings yet