Professional Documents

Culture Documents

Clarification About The Formatting of The Project: Word Limit

Uploaded by

Anchit JassalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Clarification About The Formatting of The Project: Word Limit

Uploaded by

Anchit JassalCopyright:

Available Formats

Clarification about the formatting of the project

For Topic 1 – Cases

Chapter - 1 Dispute in the respective case

(individually)

Chapter - 2 Principle laid in the respective case

(individually)

Chapter – 3 Nexus b/w principle laid in both the

cases

(combined)

Word Limit –2500 - 3000 words for entire project

For Topic 2 – Countries

Chapter – 1 Brief details about the country

(individually)

Chapter – 2 Policies related to Government

Revenue

Tax Revenues & Non-Tax Revenues

(Individually)

Chapter – 3 Laws related to Direct Tax

- Rate/Slab of taxation for Individuals

& Companies

- List of exempted income

- List of deductions

(Individually)

Chapter – 4 If the country has ratified GST or VAT

-Year in which GST/VAT was ratified

-Rates

-Comparison of the country’s

economical growth before & after the

(Individually)

Chapter – 5 Laws related to Indirect Tax —

Customs, Sales Tax

Rate of taxes, List of Commodities &

Services

(Individually)

Chapter – 6 Sanctions/Penalties/Fines on

Individuals & Companies for evading

the taxes

(Individually)

Chapter – 7 Law(s) or characteristic(s) in both the

countries that can be inculcated in

Indian Taxation System

OR

Law(s) or characteristic(s) that are

similar or dissimilar in both the

countries

(Combined)

Word Limit – There is no word limit. However, try to be precise in accordance

with the chapters mentioned herein

You might also like

- Icai International TaxDocument5 pagesIcai International TaxDheeraj YadavNo ratings yet

- Income Tax Basic Concepts May - 22Document15 pagesIncome Tax Basic Concepts May - 22josephgeorgesciNo ratings yet

- General PrinciplesDocument5 pagesGeneral PrinciplesGraceGolimlimNo ratings yet

- Taxation Notes (Tabag)Document10 pagesTaxation Notes (Tabag)Mary Angeline SalvaneraNo ratings yet

- Labor Law Notes: Part I: Labor StandardsDocument11 pagesLabor Law Notes: Part I: Labor Standardsbcar0% (1)

- Revised Direct Tax CodeDocument37 pagesRevised Direct Tax Codepankaj_adv5314No ratings yet

- Taxation Notes (Tabag)Document10 pagesTaxation Notes (Tabag)Mary Angeline SalvaneraNo ratings yet

- Taxation Chapter 2Document6 pagesTaxation Chapter 26tjc26t7kxNo ratings yet

- 1 Basic Principles of TaxationDocument13 pages1 Basic Principles of TaxationElsie GenovaNo ratings yet

- Module 02 - Taxes, Laws, Systems and AdministrationDocument22 pagesModule 02 - Taxes, Laws, Systems and AdministrationElla Marie Lopez0% (1)

- Country Wage Fixation Methods and TrendsDocument3 pagesCountry Wage Fixation Methods and TrendsShikha SrivastavaNo ratings yet

- Income Tax Basic Concepts CA Inter AY21-22Document15 pagesIncome Tax Basic Concepts CA Inter AY21-22josephgeorgesciNo ratings yet

- CA Inter Income Tax Basic ConceptDocument16 pagesCA Inter Income Tax Basic Concepttauseefalam917No ratings yet

- Royalty FTS by CA. Sudin Sabnis 1Document64 pagesRoyalty FTS by CA. Sudin Sabnis 1Bhagyashree JainNo ratings yet

- Federal Preemption and Dormant Commerce Clause AnalysisDocument4 pagesFederal Preemption and Dormant Commerce Clause AnalysisKeiara PatherNo ratings yet

- GST Question Bank - by CA Yachana Mutha BhuratDocument349 pagesGST Question Bank - by CA Yachana Mutha BhuratP LAVANYA100% (1)

- Presentation On GSTDocument24 pagesPresentation On GSTsajidneki365No ratings yet

- Basic Concepts of Law (Tax)Document36 pagesBasic Concepts of Law (Tax)SobiyaNo ratings yet

- GST Unit 1 ADocument39 pagesGST Unit 1 AMukul BhatnagarNo ratings yet

- Goods and Services Tax: Basic ConceptsDocument11 pagesGoods and Services Tax: Basic ConceptsVenkatraman NatarajanNo ratings yet

- Tybcom Notes On GSTDocument9 pagesTybcom Notes On GSTJIYA DOSHI100% (1)

- GST QB-CA Yachana Mutha Bhurat - May 2020 PDFDocument491 pagesGST QB-CA Yachana Mutha Bhurat - May 2020 PDFkishoreji0% (1)

- GST Question BankDocument359 pagesGST Question BankSiddhesh Kamat AzrekarNo ratings yet

- Income Tax BasicsDocument20 pagesIncome Tax BasicsShivajee SNo ratings yet

- Prof. Ashish R. Chourasiya: Goods & Service Tax: IntroductionDocument36 pagesProf. Ashish R. Chourasiya: Goods & Service Tax: IntroductionAJAY PHENOMNo ratings yet

- Income Tax & GST: 2 Mark Questions With Answers - (Calicut University)Document2 pagesIncome Tax & GST: 2 Mark Questions With Answers - (Calicut University)Ashwini GanigerNo ratings yet

- Chapter 2 - Taxes, Tax Laws, and Tax AdministrationDocument12 pagesChapter 2 - Taxes, Tax Laws, and Tax AdministrationAbraham Chin100% (3)

- Indian Direct of Vat,: PaperDocument8 pagesIndian Direct of Vat,: PaperNikhil KalyanNo ratings yet

- General Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaDocument137 pagesGeneral Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaMarvin Marciano DiñoNo ratings yet

- Taxation Law Review Prelims Finals PeriodDocument118 pagesTaxation Law Review Prelims Finals Periodmarcus.pebenitojrNo ratings yet

- GST - C-1Document13 pagesGST - C-1Aanam BansalNo ratings yet

- Ca Inter GST Question Bank 1 1 PDFDocument63 pagesCa Inter GST Question Bank 1 1 PDFTreesa DevasiaNo ratings yet

- ACTAX-3153-N002-Intro To Income Taxation PDFDocument5 pagesACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNo ratings yet

- CTRP Package 2 Cost-Benefit Analysis Draft October 2019Document61 pagesCTRP Package 2 Cost-Benefit Analysis Draft October 2019miron68No ratings yet

- Finance Electives HandoutsDocument21 pagesFinance Electives HandoutsNandini KumarNo ratings yet

- Taxation 1Document61 pagesTaxation 1lucky javellanaNo ratings yet

- Income Tax May23 Free ResourcesDocument321 pagesIncome Tax May23 Free ResourcesPurna PatelNo ratings yet

- Guidelines For Final Project Submissions: 3/9/2020 Girish Balasubramanian MBA-2019-21 1Document21 pagesGuidelines For Final Project Submissions: 3/9/2020 Girish Balasubramanian MBA-2019-21 1Siddhi GoelNo ratings yet

- GST Question Bank-CA Cs HubDocument63 pagesGST Question Bank-CA Cs Hubhcsharma19670% (1)

- Basic Concepts and Marginal ReliefDocument61 pagesBasic Concepts and Marginal ReliefAARCHI JAINNo ratings yet

- Double Tax Treaties and Their Application in UgandaDocument9 pagesDouble Tax Treaties and Their Application in UgandaGerald ObalimNo ratings yet

- GST Council Meeting Presentation on Model GST LawDocument70 pagesGST Council Meeting Presentation on Model GST LawRahul AkellaNo ratings yet

- Income Tax Basic ComponentDocument72 pagesIncome Tax Basic ComponentRohit SinghNo ratings yet

- South Western Federal Taxation 2013 Corporations Partnerships Estates and Trusts 36th Edition Hoffman Solutions ManualDocument25 pagesSouth Western Federal Taxation 2013 Corporations Partnerships Estates and Trusts 36th Edition Hoffman Solutions ManualGregoryStricklandgtak100% (40)

- 1 Conceptual FrameworkDocument11 pages1 Conceptual FrameworkYong Kwang HanNo ratings yet

- Favorite Bar Exam Topics (1999-2008)Document61 pagesFavorite Bar Exam Topics (1999-2008)Lien PatrickNo ratings yet

- Test Schedule Unit Wise CS Executive Dec-23Document19 pagesTest Schedule Unit Wise CS Executive Dec-23Gungun ChetaniNo ratings yet

- Philippine Tax System Schedular vs GlobalDocument11 pagesPhilippine Tax System Schedular vs GlobalThrizaCzarinaQ.GarciaNo ratings yet

- Dwnload Full South Western Federal Taxation 2013 Corporations Partnerships Estates and Trusts 36th Edition Hoffman Solutions Manual PDFDocument35 pagesDwnload Full South Western Federal Taxation 2013 Corporations Partnerships Estates and Trusts 36th Edition Hoffman Solutions Manual PDFfredasparkszxk54b100% (12)

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxTEst User 44452No ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxGANGARAJU NALINo ratings yet

- Adobe Scan 31-Aug-2020 PDFDocument13 pagesAdobe Scan 31-Aug-2020 PDFanalytic rkNo ratings yet

- GST Taxmann ComDocument42 pagesGST Taxmann CommythilibhuvaneswariNo ratings yet

- 110B Only Micro CH 18Document15 pages110B Only Micro CH 18izelvilliNo ratings yet

- GST Taxmann Com2Document35 pagesGST Taxmann Com2Kamna AgrwalNo ratings yet

- Goods & Service Tax (GST) Is A Huge Reform For Indirect Taxation in IndiaDocument49 pagesGoods & Service Tax (GST) Is A Huge Reform For Indirect Taxation in IndiaGauharNo ratings yet

- The Horizon Europe MGA: General Overview and State of PlayDocument35 pagesThe Horizon Europe MGA: General Overview and State of PlayagostinolongoNo ratings yet

- June 2015 Paper 1 (Question Paper)Document4 pagesJune 2015 Paper 1 (Question Paper)pedro morenoNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Global Business Workshop Presentation DueDocument5 pagesGlobal Business Workshop Presentation DueAnchit JassalNo ratings yet

- Kenta Siddhant HW InstructionsDocument1 pageKenta Siddhant HW InstructionsAnchit JassalNo ratings yet

- SC upholds cancellation of Pappu Yadav's bail for jail violationsDocument9 pagesSC upholds cancellation of Pappu Yadav's bail for jail violationsAnchit JassalNo ratings yet

- Clause 49Document15 pagesClause 49ananda_joshi5178No ratings yet

- Financial Management Time Value of Money Practice QuestionsDocument1 pageFinancial Management Time Value of Money Practice QuestionsAnchit JassalNo ratings yet

- Bail Sitharam MaharashtraDocument79 pagesBail Sitharam MaharashtraAnchit JassalNo ratings yet

- Bail Maharashtra DharendraDocument8 pagesBail Maharashtra DharendraAnchit JassalNo ratings yet

- Arrest L Ram Narain SinghDocument17 pagesArrest L Ram Narain SinghAnchit JassalNo ratings yet

- STEPS AND DOCUMENTS DURING A CRIMINAL INVESTIGATIONDocument4 pagesSTEPS AND DOCUMENTS DURING A CRIMINAL INVESTIGATIONAnchit Jassal100% (1)

- Bail Maharashtra DharendraDocument8 pagesBail Maharashtra DharendraAnchit JassalNo ratings yet

- Police Can Seek Custody of Accused Who Are Arrested Even After Filing of Charge Sheet - Supreme CourtDocument13 pagesPolice Can Seek Custody of Accused Who Are Arrested Even After Filing of Charge Sheet - Supreme CourtLive LawNo ratings yet

- Corporate Governance & Finance: Theories of CGDocument36 pagesCorporate Governance & Finance: Theories of CGAnchit JassalNo ratings yet

- Job Analysis: Introduction, Importance, Methods EtcDocument18 pagesJob Analysis: Introduction, Importance, Methods EtcAnchit JassalNo ratings yet

- Board CommitteesDocument33 pagesBoard CommitteesAnchit JassalNo ratings yet

- Final Draft UK Corporate Governance Code 2016Document37 pagesFinal Draft UK Corporate Governance Code 2016Andrej KatonaNo ratings yet

- Paper On SurrogacyDocument14 pagesPaper On SurrogacyAnchit JassalNo ratings yet

- CG in India, UK & USADocument50 pagesCG in India, UK & USAAnchit JassalNo ratings yet

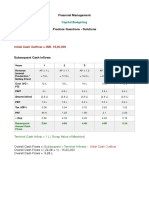

- Financial Management Capital Budgeting Practice Questions SolutionsDocument5 pagesFinancial Management Capital Budgeting Practice Questions SolutionsAnchit JassalNo ratings yet

- E-Supply Chain 12th FebDocument17 pagesE-Supply Chain 12th FebAnchit JassalNo ratings yet

- Performance AppraisalDocument31 pagesPerformance AppraisalAnchit Jassal100% (1)

- Human Resources and Total Quality Management: Academic Year 2017-18 Semester IV Teaching PlanDocument18 pagesHuman Resources and Total Quality Management: Academic Year 2017-18 Semester IV Teaching PlanAnchit JassalNo ratings yet

- Becoming A Non-Exec Director - 17sep2014Document36 pagesBecoming A Non-Exec Director - 17sep2014Mr_SelimNo ratings yet

- Quality CircleDocument8 pagesQuality CircleAnchit JassalNo ratings yet

- 27th Jan E-Business - Arch - Design - Issues 2251Document6 pages27th Jan E-Business - Arch - Design - Issues 2251Anchit JassalNo ratings yet

- ExitInterview PDFDocument4 pagesExitInterview PDFHarsh GargNo ratings yet

- Female As Karta of The FamilyDocument28 pagesFemale As Karta of The Familyjayneelparikh100% (3)

- LL.B. Internship Report InsightsDocument7 pagesLL.B. Internship Report InsightsAnklesh0850% (14)

- Teaching Plan - Family Law I July-October 2017 PDFDocument28 pagesTeaching Plan - Family Law I July-October 2017 PDFAnchit JassalNo ratings yet

- JJ Act 2015 - Jan 2016Document44 pagesJJ Act 2015 - Jan 2016Anonymous EAineTizNo ratings yet

- Personal Laws and The Constitution in India PDFDocument9 pagesPersonal Laws and The Constitution in India PDFAnchit JassalNo ratings yet

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFDocument50 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFTwsif Tanvir Tanoy92% (13)

- 270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)Document3 pages270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)yogarajanNo ratings yet

- Allen ModuleDocument1 pageAllen ModuleDaksh S100% (1)

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- Axis Statement Kirandeep KaurDocument2 pagesAxis Statement Kirandeep KaurTanvi DhingraNo ratings yet

- GST in IndiaDocument11 pagesGST in IndiarameshNo ratings yet

- UCP 600 (Bilingual Version)Document40 pagesUCP 600 (Bilingual Version)HendraImaSasmita85% (27)

- SFLF 730372319 en PDFDocument1 pageSFLF 730372319 en PDFHenri BlankNo ratings yet

- Unit 5Document6 pagesUnit 5deepshrmNo ratings yet

- Paytm E-Ticket for Guwahati to Vijayawada flightDocument3 pagesPaytm E-Ticket for Guwahati to Vijayawada flightCHINNABABUNo ratings yet

- Module 1 - General Principles in TaxationDocument15 pagesModule 1 - General Principles in TaxationMaryrose SumulongNo ratings yet

- 20 Traders Royal Bank V Radio Phil NetworkDocument2 pages20 Traders Royal Bank V Radio Phil NetworkMichelle BernardoNo ratings yet

- Digital Payment Report on USR PAY SystemDocument5 pagesDigital Payment Report on USR PAY Systemcharsaubees420No ratings yet

- Income Tax Ruling Explains Salary and WagesDocument11 pagesIncome Tax Ruling Explains Salary and WagesAbedNo ratings yet

- Aces vs. CIRDocument4 pagesAces vs. CIR2216268100% (1)

- Vedha Lodge: DATE: March 12, 2015 RECEIPT #: 2015-335Document3 pagesVedha Lodge: DATE: March 12, 2015 RECEIPT #: 2015-335Kathiravan JayaramanNo ratings yet

- Kashato Shirts: General JournalDocument34 pagesKashato Shirts: General JournalJade Cruz100% (1)

- HITEC University HITEC University HITEC UniversityDocument2 pagesHITEC University HITEC University HITEC UniversityOsama IrfanNo ratings yet

- VAT Registration and Compliance RequirementsDocument34 pagesVAT Registration and Compliance RequirementsNatalie SerranoNo ratings yet

- Black Book Payment BankDocument62 pagesBlack Book Payment BankVicky VishwakarmaNo ratings yet

- Poonawalla TowersDocument3 pagesPoonawalla TowersezycredNo ratings yet

- KoinX-Complete Tax Report - OptionsDocument13 pagesKoinX-Complete Tax Report - OptionsBhavsmeetforeverNo ratings yet

- Billing Statement: Food Panda Philippines, IncDocument2 pagesBilling Statement: Food Panda Philippines, IncP’wee SalamatNo ratings yet

- InvocalDocument1 pageInvocalbaiju bawraNo ratings yet

- Bull V. United States (295 U.S. 247, 1935) : Their Prompt and Certain Availability Is An Imperious Need."Document2 pagesBull V. United States (295 U.S. 247, 1935) : Their Prompt and Certain Availability Is An Imperious Need."Em Alayza100% (2)

- Electronic BankingDocument8 pagesElectronic BankingBatch 27No ratings yet

- Liberty University's 990 Income Tax FormDocument111 pagesLiberty University's 990 Income Tax FormWSETNo ratings yet

- Offshore Vessel InvoiceDocument3 pagesOffshore Vessel Invoicemichael seanNo ratings yet

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument28 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

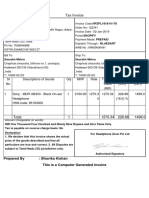

- Tax Invoice: SI No. Descriptions of Goods Qty MRP Rate Taxable Value (INR) Igst (INR) Amount (INR)Document1 pageTax Invoice: SI No. Descriptions of Goods Qty MRP Rate Taxable Value (INR) Igst (INR) Amount (INR)Saurabh MehraNo ratings yet