Professional Documents

Culture Documents

Direction: Please Write The Correct Answer in The Space Provided Before The Number

Uploaded by

JanaelaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Direction: Please Write The Correct Answer in The Space Provided Before The Number

Uploaded by

JanaelaCopyright:

Available Formats

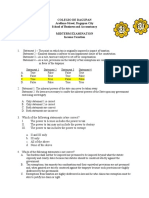

Name: Date:

Group Name: Subject: TAXATION

Direction: Please write the correct answer in the space provided before the number.

1. Compute the tax payable after tax credit of then estate of a resident decedent based on the

following data:

Net estate, Philippines P1,200,000

Net estate, Country A (after P12,000 estate tax paid) 188,000

Net estate, Country b (after P8,000 estate tax paid) 100,000

Net estate, Country C (80,000)

A citizen-decedent died 2018 with the following data:

Philippines USA

Gross Estate P14,200,000 P4,400,000

Allowable Deductions 6,400,000 2,200,000

(Excluding standard

deduction)

Estate Tax paid - 150,000

2. How much is the estate tax payable in the Philippines assuming the decedent is a non-

resident citizen?

3. How much is the estate tax payable in the Philippines assuming the decedent is a non-

resident alien?

You might also like

- Financial Accounting and ReportingDocument26 pagesFinancial Accounting and ReportingJanaela89% (45)

- Tax 01 Prefinals Sept 9 2018 BSA4 Answer KeyDocument11 pagesTax 01 Prefinals Sept 9 2018 BSA4 Answer KeyJohn Carlo Dela CruzNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- Albano June29 EstateDonorsVAT AnswerKeyDocument5 pagesAlbano June29 EstateDonorsVAT AnswerKeySteven OrtizNo ratings yet

- Transfer Taxes Multiple Choice ProblemsDocument14 pagesTransfer Taxes Multiple Choice Problemsnbragas0% (1)

- TaxationDocument7 pagesTaxationAltair ColtraineNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Taxation Deduction QuestionnaireDocument5 pagesTaxation Deduction QuestionnaireJanaela100% (1)

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- Taxation Material 3Document11 pagesTaxation Material 3Shaira BugayongNo ratings yet

- Estate Tax Activities (Questions)Document4 pagesEstate Tax Activities (Questions)Christine Nathalie BalmesNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- RESA 41 - Tax First Preboard (May 2021) (Key Answer)Document17 pagesRESA 41 - Tax First Preboard (May 2021) (Key Answer)Aldrine CasilangNo ratings yet

- Income Tax For IndividualsDocument11 pagesIncome Tax For IndividualsJoel Christian Mascariña100% (1)

- Estate-Tax ProblemsDocument3 pagesEstate-Tax ProblemsSharjaaahNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- TaxationDocument10 pagesTaxationSteven Mark MananguNo ratings yet

- Midterm With Answer Exam CompressDocument13 pagesMidterm With Answer Exam CompressMark John BetitoNo ratings yet

- Estate and Donor'S TaxDocument10 pagesEstate and Donor'S TaxJoseph MangahasNo ratings yet

- MidtermDocument13 pagesMidtermAlexandra Nicole IsaacNo ratings yet

- Copy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditDocument2 pagesCopy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditMitsuke MitsukeNo ratings yet

- Practice Set No. 1 - Estate Tax - QuestionnaireDocument6 pagesPractice Set No. 1 - Estate Tax - QuestionnaireAeron Arroyo IINo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- 598481Document10 pages598481btstanNo ratings yet

- Chapter 5Document6 pagesChapter 5Briggs Navarro BaguioNo ratings yet

- Transfer Tax Prelim ExamDocument4 pagesTransfer Tax Prelim ExamSalma AbdullahNo ratings yet

- Tax Credit For Foreign Estate Tax Paid and Net Distributable EstateDocument16 pagesTax Credit For Foreign Estate Tax Paid and Net Distributable EstateAlmeera KalidNo ratings yet

- Estate Tax HW8Document12 pagesEstate Tax HW8ALYZA ANGELA ORNEDONo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- Pre-Week (Llamado)Document25 pagesPre-Week (Llamado)Mischievous MaeNo ratings yet

- Tax-May 2Document1 pageTax-May 2Ella ApeloNo ratings yet

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- Answer KeyDocument4 pagesAnswer KeyMohammad AmpasoNo ratings yet

- ACAE 18 - Deduction From Gross EstateDocument4 pagesACAE 18 - Deduction From Gross Estatechen dalitNo ratings yet

- Taxn03b DrillDocument1 pageTaxn03b Drillsmosaldana.cvtNo ratings yet

- Preparation of Income Tax Return IndividualDocument2 pagesPreparation of Income Tax Return IndividualFRAULIEN GLINKA FANUGAONo ratings yet

- TX2 101Document3 pagesTX2 101Pau SantosNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Midterm Examination Income TaxationDocument16 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Midterm Examination Income TaxationMaryjoy Sarzadilla JuanataNo ratings yet

- Chapter 5Document9 pagesChapter 5Rygiem Dela CruzNo ratings yet

- Estate 1Document5 pagesEstate 1Israel MarquezNo ratings yet

- Activity 6Document4 pagesActivity 6Mystic LoverNo ratings yet

- Sample Estate Tax ProblemDocument14 pagesSample Estate Tax ProblemAiza MadumNo ratings yet

- Prelim TaskDocument4 pagesPrelim TaskJohn Francis RosasNo ratings yet

- Assignment Transfer Tax ComputationDocument3 pagesAssignment Transfer Tax ComputationAngelyn SamandeNo ratings yet

- Use The Data For The Next Four QuestionsDocument8 pagesUse The Data For The Next Four QuestionsNo FaceNo ratings yet

- Quiz On Estate TaxDocument4 pagesQuiz On Estate TaxRenz CastroNo ratings yet

- Practice Set 1Document4 pagesPractice Set 1Shiela Mae BautistaNo ratings yet

- Net Esate and Estate TaxDocument3 pagesNet Esate and Estate TaxCHRISTINE GALANGNo ratings yet

- Im Tax Week2Document56 pagesIm Tax Week2Elaiza Marie YnzonNo ratings yet

- Practice Set 1Document11 pagesPractice Set 1IVY JOY SIONOSANo ratings yet

- Donors Tax Handout 3Document5 pagesDonors Tax Handout 3Xerez SingsonNo ratings yet

- Tax Practice Set 3Document3 pagesTax Practice Set 3Russel RuizNo ratings yet

- Estate Tax ProblemDocument1 pageEstate Tax ProblemHulaan MoNo ratings yet

- Individual Taxpayers - Sample ProblemsDocument4 pagesIndividual Taxpayers - Sample ProblemsBpNo ratings yet

- Cagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IDocument3 pagesCagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IJenelyn BeltranNo ratings yet

- Corporation ActivityDocument4 pagesCorporation ActivityLFGS FinalsNo ratings yet

- Taxation Individuals-QUESTIONSDocument2 pagesTaxation Individuals-QUESTIONSAB CloydNo ratings yet

- Taxation Elims 1Document3 pagesTaxation Elims 1Valerie Faye BadajosNo ratings yet

- Bir LetterDocument1 pageBir LetterJanaelaNo ratings yet

- Sitio Dacuman, Brgy. Ipil Surigao City: Dawoo Hotel & Leisure IncDocument2 pagesSitio Dacuman, Brgy. Ipil Surigao City: Dawoo Hotel & Leisure IncJanaelaNo ratings yet

- Annex F - Jfy MarketingDocument2 pagesAnnex F - Jfy MarketingJanaelaNo ratings yet

- Bir LetterDocument1 pageBir LetterJanaelaNo ratings yet

- 1601-C TaxpayersDocument5 pages1601-C TaxpayersJanaelaNo ratings yet

- Annex F - Jfy MarketingDocument2 pagesAnnex F - Jfy MarketingJanaelaNo ratings yet

- Harbor Daily FormDocument2 pagesHarbor Daily FormJanaelaNo ratings yet

- Secretary'S Certificate: SUBSCRIBED AND SWORN To Before Me This - Day of - , 2018.Document1 pageSecretary'S Certificate: SUBSCRIBED AND SWORN To Before Me This - Day of - , 2018.JanaelaNo ratings yet

- AUTHORIZATION SalaryDocument1 pageAUTHORIZATION SalaryJanaelaNo ratings yet

- Concept Map: Children in The Court RoomDocument1 pageConcept Map: Children in The Court RoomThelma PelaezNo ratings yet

- Direction: Please Write The Correct Answer in The Space Provided Before The NumberDocument1 pageDirection: Please Write The Correct Answer in The Space Provided Before The NumberJanaelaNo ratings yet

- Group 5: Cuadrillero, Janaela Paula Edaño, Mariane Martinez, Hannah Faith Astronomo, ReymarieDocument13 pagesGroup 5: Cuadrillero, Janaela Paula Edaño, Mariane Martinez, Hannah Faith Astronomo, ReymarieJanaelaNo ratings yet

- Experts in The Court Room: Physical Documentary ScientificDocument1 pageExperts in The Court Room: Physical Documentary ScientificThelma PelaezNo ratings yet

- Fraud Investigation & Dispute Services Regulatory ComplianceDocument4 pagesFraud Investigation & Dispute Services Regulatory ComplianceJanaelaNo ratings yet

- KPMGPPT 170201141630Document24 pagesKPMGPPT 170201141630JanaelaNo ratings yet

- Kelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountDocument5 pagesKelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountJanaelaNo ratings yet

- Ernst and YoungDocument19 pagesErnst and YoungJanaelaNo ratings yet

- KPMGPPT 170201141630Document24 pagesKPMGPPT 170201141630JanaelaNo ratings yet

- Management ConsultancyDocument12 pagesManagement ConsultancyJanaelaNo ratings yet

- Authorization Letter BxuDocument1 pageAuthorization Letter BxuJanaelaNo ratings yet

- Management ConsultancyDocument12 pagesManagement ConsultancyJanaelaNo ratings yet

- Introduction For Estate Tax QuizDocument1 pageIntroduction For Estate Tax QuizJanaelaNo ratings yet

- Oct. 9, 2018 Shipment Collection - RevisedDocument4 pagesOct. 9, 2018 Shipment Collection - RevisedJanaelaNo ratings yet

- Memorandum in Conduct of 3Rd Philippine Accountancy CongressDocument3 pagesMemorandum in Conduct of 3Rd Philippine Accountancy CongressJanaelaNo ratings yet

- Effective Time Management Important Vs UrgentDocument3 pagesEffective Time Management Important Vs UrgentJanaelaNo ratings yet

- Billing For RJRDocument19 pagesBilling For RJRJanaelaNo ratings yet

- Chapter 041Document248 pagesChapter 041abeNo ratings yet