Professional Documents

Culture Documents

Event Note - Govt Raises FII Limit G-Secs and Corporate Bonds

Uploaded by

kotler_2006Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Event Note - Govt Raises FII Limit G-Secs and Corporate Bonds

Uploaded by

kotler_2006Copyright:

Available Formats

Event Note: Govt raises FII limit in G-Securities & Corporate bonds

Event: The government on 23rd September’10, raised FII investment limit in the debt market

to USD30 Bn (INR136,712

(INR136 712 crore) from USD20 Bn (INR91,141

(INR91 141 crore) and slashed its

borrowing plan by INR100 Bn in H2’11.

Impact: We believe this move is going to have a positive impact on the Indian debt

market. FIIs can now invest USD10 Bn in the government securities market instead of USD5

Bn and pump USD20 Bn into the corporate debt market, up from USD15 Bn. However, in

the corporate debt market, they can pump the additional USD5 Bn only into bonds of

infrastructure companies with a maturity of five years or more. FIIs have so far invested

about USD17.2 Bn in the debt market. They have touched the USD5 Bn limit in the

government securities market and is about to meet the USD15 Bn limit in the corporate bond

market.

We expect a limited impact of this on the corporate bond market in the mid term. However

higher limit would give a major boost to infrastructure funding as large portion of fresh debt

issuance would come from infrastructure companies and the money would directly go

towards execution of projects. In the government securities market where FIIs have already

touched USD5 Bn limit, we may see some short rally in government bond prices. This may

help the banks who holds significant portion in government securities to earn Mark-To-

Market (MTM) profit.

On the other hand Govt has slashed its H2’11 borrowing programme by INR100 Bn, which

may lessen the supply of bonds in the market. This would result to an increase in bond prices

and softening of bench mark bond yield.yield This also helps Banks in MTM profit. profit For

infrastructure companies whose corporate debt paper yield is based on benchmark yield , this

step means lesser burden on them as outgoing interest will be lower.

We see this as an early stage of development of India’s debt market. However over-exposure

to FIIs money (which are not sticky in nature historically), may increase interest outflow and

make the domestic debt market vulnerable. Again, more FII money coming into the market

will also boost domestic currency. Any excessive appreciation in INR may hurt export sector.

Analyst – Abhisek Sasmal

033-3051-2000

asasmal@microsec.in Microsec Research reports are also available on Bloomberg <MCLI>

24th September’ 2010 Microsec Research

Pressure on 10 yr

10 year Benchmark yield % Benchmark bond

8.2

yield as Govt slashed

its H2’11 borrowing

8 programme.

However it is still

7.8

very lucrative for

7.6 FIIs as govt bond

yields in other

7.4 developed market is

7.2

close to their all time

low.

7

6.8

Apr‐10 May‐10 Jun‐10 Jul‐10 Aug‐10 Sep‐10

Source: Bloomberg, RBI

Liquidity still tight which is preventing Banks in more Infrastructure lending Policy rates normalization

INR Bn (LHS)

10%

9%

8%

7%

6%

5%

4%

3%

2%

CRR Repo Rate Reverse Repo

Source: RBI, Microsec Research Source: RBI, Microsec Research

Trading in Corporate Bonds (in INR Bn) We expect this trend

to reverse slowlyy as

800

more and more debt

700 issuance from infra

600 companies to hit the

500 debt market. Less

availability of bank

400

credit opens this

300 avenue for

200 corporates . Increase

100 in FII limit may help

in this cause.

0

Source: SEBI, Microsec Research

24th September’ 2010 Microsec Research

Microsec Research

Kolkata

Investment Banking

Azimganj House, 2ndd Floor

7, Camac Street, Kolkata – 700 017, India

Tel: 91 33 2282 9330, Fax: 91 33 2282 9335

Brokerage and Wealth Management

Shivam Chambers, 1st Floor

53 Syed Amir Ali Avenue

53, Avenue, Kolkata – 700 019

019, India

Tel: 91 33 3051 2000, Fax: 91 33 3051 2020

Mumbai

74 A, Mittal Tower, 7th Floor

210, Nariman Point, Mumbai – 400 021, India

Tel: 91 22 2285 5544, Fax: 91 22 2285 5548

Email: info@microsec.in

www.microsec.in

Disclaimer

This document is prepared by the research team of Microsec Capital Ltd. (hereinafter referred as “MCL”) circulated for purely information purpose to

the authorized recipient and should not be replicated or quoted or circulated to any person in any form. This document should not be interpreted as an

Investment / taxation/ legal advice. While the information contained in the report has been procured in good faith, from sources considered to be

reliable, no statement in the report should be considered to be complete or accurate. Therefore, it should only be relied upon at one’s own risk. MCL is

not soliciting any action based on the report. No indication is intended from the report that the transaction undertaken based on the information

contained in this report will be profitable or that they will not result in losses. Investors must make their own investment decisions based on their

specific investment objectives and financial position and using such independent advisors, as they believe necessary. We and our

affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this material may: (a) from time to time, have

long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation discussed herein or act as advisor or lender I borrower to such company (ies) or

have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted

upon the information contained here.

Neither the Firm, nor its directors, employees, agents, representatives shall be liable for any damages whether direct or indirect, incidental, special or

consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

24th September’ 2010 Microsec Research

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDocument2 pagesIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSANo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Agony of ReformDocument3 pagesAgony of ReformHarmon SolanteNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Competition Act: Assignment ONDocument11 pagesCompetition Act: Assignment ONSahil RanaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Manual Goldfinger EA MT4Document6 pagesManual Goldfinger EA MT4Mr. ZaiNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

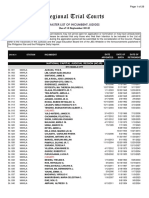

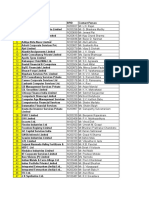

- Regional Trial Courts: Master List of Incumbent JudgesDocument26 pagesRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Sbi Code of ConductDocument5 pagesSbi Code of ConductNaved Shaikh0% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- PaySlip 05 201911 5552Document1 pagePaySlip 05 201911 5552KumarNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Presentation NGODocument6 pagesPresentation NGODulani PinkyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Why The Strengths Are Interesting?: FormulationDocument5 pagesWhy The Strengths Are Interesting?: FormulationTang Zhen HaoNo ratings yet

- Production Planning & Control: The Management of OperationsDocument8 pagesProduction Planning & Control: The Management of OperationsMarco Antonio CuetoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- DSE at A GlanceDocument27 pagesDSE at A GlanceMahbubul HaqueNo ratings yet

- DX210WDocument13 pagesDX210WScanner Camiones CáceresNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HPAS Prelims 2019 Test Series Free Mock Test PDFDocument39 pagesHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- QQy 5 N OKBej DP 2 U 8 MDocument4 pagesQQy 5 N OKBej DP 2 U 8 MAaditi yadavNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Design Analysis of The Lotus Seven S4 (Type 60) PDFDocument18 pagesDesign Analysis of The Lotus Seven S4 (Type 60) PDFChristian Villa100% (4)

- Contact Details of RTAsDocument18 pagesContact Details of RTAsmugdha janiNo ratings yet

- P1 Ii2005Document3 pagesP1 Ii2005Boris YanguezNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- S03 - Chapter 5 Job Order Costing Without AnswersDocument2 pagesS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- FM.04.02.01 Project Demobilization Checklist Rev2Document2 pagesFM.04.02.01 Project Demobilization Checklist Rev2alex100% (3)

- JK Fenner (India) LimitedDocument55 pagesJK Fenner (India) LimitedvenothNo ratings yet

- Belt and Road InitiativeDocument17 pagesBelt and Road Initiativetahi69100% (2)

- Latihan Soal PT CahayaDocument20 pagesLatihan Soal PT CahayaAisyah Sakinah PutriNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Quasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British AirwaysDocument12 pagesQuasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British Airwaysbabyclaire17No ratings yet

- Monsoon 2023 Registration NoticeDocument2 pagesMonsoon 2023 Registration NoticeAbhinav AbhiNo ratings yet

- Project On SurveyorsDocument40 pagesProject On SurveyorsamitNo ratings yet

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Paul Romer: Ideas, Nonrivalry, and Endogenous GrowthDocument4 pagesPaul Romer: Ideas, Nonrivalry, and Endogenous GrowthJuan Pablo ÁlvarezNo ratings yet

- MHO ProposalDocument4 pagesMHO ProposalLGU PadadaNo ratings yet

- 002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFDocument7 pages002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFBenjamin MartinezNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)