Professional Documents

Culture Documents

Case 2

Uploaded by

Saurabh SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 2

Uploaded by

Saurabh SinghCopyright:

Available Formats

1.

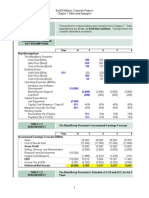

John Crockett Furniture Company is considering adding a new line to its product mix

and that the capital budgeting analysis is being conducted by Joan Samuels, a recently

graduated MBA. The production line would be set up in unused space in Crockett’s

main plant. The machinery’s invoice price would be approximately $200000, another

$10000 in shipping charges would be required and it would cost an additional $30000

to install the equipment. The machinery has an economic life of 4 years and

depreciation is charged on straight line method. The machinery is expected to have a

salvage value of $25000.

The new line would generate incremental sales of 1250 units per year for 4 years at an

incremental cost of $100 per unit in the first year, excluding depreciation. Each unit can be

sold for $200 in the first year. The sale price and the cost are both expected to increase by

3% per year due to inflation. Further, to handle the new line, the firm’s net working capital

is expected to be 12% of sales. Working capital level is adjusted at the beginning of the

year in relation to the sales expected for the year. At the end of the useful life, working

capital will be liquidated. The firm’s tax rate is 30% and the cost of capital is 10%.

a. Estimate the cash flows for the project distinctly showing the initial cash flows,

operating cash flows and terminal cash flows

b. Calculate the NPV and the IRR for the project.

c. How will you deal with the following situations while estimating cash flows

i. Assume that the plant space could be leased out to another firm @$25000 per

year, should this be considered in your analysis?

ii. How will you treat with interest expenses and dividends when calculating

project cash flows?

iii. Finally, assume that the new product line is expected to decrease the sales of

the firm’s other lines by $50000, should this be considered in your analysis, if

so, how?

Assume that Joan Samuels is confident of her estimates of all the variables that affect the

project’s cash flows except for unit sales and sales price. If product acceptance is poor, unit

sales will be 900 units a year and the unit price would be $160; a strong consumer response

would produce sales of 1600 units and a unit price of $240. Construct a scenario analysis for

the poor acceptance and excellent acceptance and determine the NPV for the scenarios.

Ignore the salvage value and working capital requirements while estimating cash flows in this

case. Joan believes that there is a 25% chance of poor acceptance, 25% chance of excellent

acceptance and 50% chance of average acceptance (base case of 1250 units). What will be the

project’s expected NPV, standard deviation and coefficient of variation?

You might also like

- Shrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisDocument12 pagesShrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisHayat Omer Malik100% (1)

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNo ratings yet

- Pixonix Inc - Currency Exposure Session IXDocument3 pagesPixonix Inc - Currency Exposure Session IXshiv50% (2)

- Impact of Clean Air Act on Southern CompanyDocument3 pagesImpact of Clean Air Act on Southern CompanyMrinmay KulkarniNo ratings yet

- Chapter 7 Student File After 1st ClassDocument10 pagesChapter 7 Student File After 1st Classasflkhaf2No ratings yet

- PGPM FM I Glim Assignment 3 2014Document5 pagesPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- Capital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachDocument4 pagesCapital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachAnshuman AggarwalNo ratings yet

- If The Coat FitsDocument4 pagesIf The Coat FitsAngelica OlescoNo ratings yet

- AccountingDocument12 pagesAccountingpearl042008No ratings yet

- Analyzing Project Cash Flows and NPVDocument21 pagesAnalyzing Project Cash Flows and NPVAkash KumarNo ratings yet

- PRQZ 2Document26 pagesPRQZ 2Hoa Long ĐởmNo ratings yet

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- Session-11 - Venture Capital Valuation Problem SetDocument2 pagesSession-11 - Venture Capital Valuation Problem SetSaurabh SinghNo ratings yet

- Finance and Accounting Interview QuestionsDocument13 pagesFinance and Accounting Interview QuestionsSaurabh SinghNo ratings yet

- Assignment Capital Budgeting Mini ProjectDocument2 pagesAssignment Capital Budgeting Mini ProjectArslanNo ratings yet

- Final Paper20 Revised Business ValuationDocument698 pagesFinal Paper20 Revised Business ValuationSukumar100% (5)

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 pagesCorporate Finance I: Home Assignment 2 Due by January 30RahulNo ratings yet

- CH 08Document12 pagesCH 08AlJabir KpNo ratings yet

- Replace Bottling Machine Investment AnalysisDocument11 pagesReplace Bottling Machine Investment AnalysisAli SajidNo ratings yet

- Cash Flow Estimation Chapter 11Document4 pagesCash Flow Estimation Chapter 11Venus TumbagaNo ratings yet

- Capital Budgeting NPV Analysis for Earth Mover ProjectDocument6 pagesCapital Budgeting NPV Analysis for Earth Mover ProjectMarcoBonaparte0% (1)

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- Homework - Cash Flow PrinciplesDocument2 pagesHomework - Cash Flow PrinciplesCristina Maria ConstantinescuNo ratings yet

- Managerial Economics Practice Set 1 2018Document9 pagesManagerial Economics Practice Set 1 2018Sir Jay265No ratings yet

- 404 - WCM ExerciseDocument9 pages404 - WCM ExerciseChloe Quirona Policios0% (2)

- Assignment 4Document2 pagesAssignment 4Cheung HarveyNo ratings yet

- Capital Budgeting 2Document3 pagesCapital Budgeting 2mlexarNo ratings yet

- Pisa Pizza healthier pizza sales projectionsDocument6 pagesPisa Pizza healthier pizza sales projectionskarol nicole valero melo100% (1)

- Tennessee-Atlantic Paper Company capital investment analysisDocument3 pagesTennessee-Atlantic Paper Company capital investment analysisYasir AamirNo ratings yet

- HW 1, FIN 604, Sadhana JoshiDocument40 pagesHW 1, FIN 604, Sadhana JoshiSadhana JoshiNo ratings yet

- MBA Graduate Considers Fast Food Franchise InvestmentsDocument4 pagesMBA Graduate Considers Fast Food Franchise InvestmentsTran PhuongNo ratings yet

- ENIN 255 Homework 2Document3 pagesENIN 255 Homework 2Faris alharbiNo ratings yet

- MasDocument2 pagesMasEmma Mariz GarciaNo ratings yet

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaNo ratings yet

- Part 2 Long Term Decision 1Document4 pagesPart 2 Long Term Decision 1Aye Mya KhineNo ratings yet

- Ch11 13ed CF Estimation MinicMasterDocument20 pagesCh11 13ed CF Estimation MinicMasterAnoop SlathiaNo ratings yet

- FM W11Document5 pagesFM W11Syifa AureliaNo ratings yet

- Chapter 13 - SeatworkDocument8 pagesChapter 13 - SeatworkNicole ClaireNo ratings yet

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- EBIT & fixed costs impact of production changesDocument3 pagesEBIT & fixed costs impact of production changesNguyen Trong Bang (K16HCM)No ratings yet

- Define Incremental Cash Flow 1 Should You Subtract InterestDocument1 pageDefine Incremental Cash Flow 1 Should You Subtract InterestAmit PandeyNo ratings yet

- Problem 12-1aDocument8 pagesProblem 12-1aJose Ramon AlemanNo ratings yet

- Practice Problems - Making Capital Investment DecisionsDocument2 pagesPractice Problems - Making Capital Investment DecisionsHello KittyNo ratings yet

- ESERCIZI SUL CALCOLO DEL TASSO INTERNO DI RENDIMENTO E DEL VALORE ATTUALE NETTODocument27 pagesESERCIZI SUL CALCOLO DEL TASSO INTERNO DI RENDIMENTO E DEL VALORE ATTUALE NETTOSeverina MallariNo ratings yet

- FIN515 W3 Problem SetDocument3 pagesFIN515 W3 Problem Sethy_saingheng_7602609No ratings yet

- Allied Food Capital BudgetingDocument4 pagesAllied Food Capital BudgetingHaznetta HowellNo ratings yet

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- Iii Semester Endterm Examination November 2016Document3 pagesIii Semester Endterm Examination November 2016Gautam KumarNo ratings yet

- Group Assignment@FM IIDocument2 pagesGroup Assignment@FM IIsamuel debebe100% (1)

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document4 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- Quiz 6 Financial MarketDocument2 pagesQuiz 6 Financial MarketjanuaryNo ratings yet

- III SEMESTER ENDTERM EXAMINATION NOVEMBER 2016Document3 pagesIII SEMESTER ENDTERM EXAMINATION NOVEMBER 2016Nithyananda PatelNo ratings yet

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocument3 pagesFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohNo ratings yet

- Case Study Before UTS LD21-20221028051637Document5 pagesCase Study Before UTS LD21-20221028051637Abbas MayhessaNo ratings yet

- essay_BSDocument1 pageessay_BSthaindnds180468No ratings yet

- Incremental cash flows and NPV of Miller Corporation's new productDocument5 pagesIncremental cash flows and NPV of Miller Corporation's new producttrelvisd0% (1)

- Rustic Wood Toy Manufacturing Cash Flow AnalysisDocument2 pagesRustic Wood Toy Manufacturing Cash Flow AnalysispratitatriasalinNo ratings yet

- Fin3n Cap Budgeting Quiz 1Document1 pageFin3n Cap Budgeting Quiz 1Kirsten Marie EximNo ratings yet

- Estimating Cash Flows for Customized Box Manufacturing ProjectDocument2 pagesEstimating Cash Flows for Customized Box Manufacturing ProjectShivu YatiNo ratings yet

- Incremental Analysis GuideDocument4 pagesIncremental Analysis Guidedestinyv07100% (1)

- Capital Budgeting ExercisesDocument2 pagesCapital Budgeting Exercisesmai.duong.001No ratings yet

- Cash Flow Estimation Problem SetDocument6 pagesCash Flow Estimation Problem SetmehdiNo ratings yet

- Chapter 7 Capital Budgeting and Cashflow (Autosaved)Document53 pagesChapter 7 Capital Budgeting and Cashflow (Autosaved)Kim ThoaNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- CoreEL TechnologiesDocument10 pagesCoreEL TechnologiesSaurabh SinghNo ratings yet

- Courtesy: CFA InstituteDocument46 pagesCourtesy: CFA InstituteSaurabh SinghNo ratings yet

- Executive Director Centre For International Business Studies Clinical Professor of International FinanceDocument25 pagesExecutive Director Centre For International Business Studies Clinical Professor of International FinanceSaurabh SinghNo ratings yet

- Q2. Outline The Markets That The Company Is Selling/ Can Sell ToDocument1 pageQ2. Outline The Markets That The Company Is Selling/ Can Sell ToSaurabh SinghNo ratings yet

- Mednet confronts click-through competitionDocument15 pagesMednet confronts click-through competitionSaurabh SinghNo ratings yet

- Cost of capital analysis and optimal capital structureDocument24 pagesCost of capital analysis and optimal capital structureSaurabh SinghNo ratings yet

- B2B Marketing Research - AssignmentDocument23 pagesB2B Marketing Research - AssignmentSaurabh Singh0% (1)

- Tata Ace New Product Development ApproachesDocument8 pagesTata Ace New Product Development ApproachesSaurabh SinghNo ratings yet

- Session 20Document2 pagesSession 20Saurabh SinghNo ratings yet

- Session IVDocument2 pagesSession IVSaurabh SinghNo ratings yet

- Session II ProblemsDocument1 pageSession II ProblemsSaurabh SinghNo ratings yet

- Monetary Policy of RBI - Clarification On FrequencyDocument3 pagesMonetary Policy of RBI - Clarification On FrequencySaurabh SinghNo ratings yet

- Session 11Document18 pagesSession 11Saurabh SinghNo ratings yet

- Solution Source After Tax Cost Weights Total CostDocument2 pagesSolution Source After Tax Cost Weights Total CostSaurabh SinghNo ratings yet

- MYbank's use of big data and algorithms for small loansDocument4 pagesMYbank's use of big data and algorithms for small loansSaurabh Singh60% (5)

- Traveled To 70Document1 pageTraveled To 70Saurabh SinghNo ratings yet

- HUL AnalysisDocument4 pagesHUL AnalysisSaurabh SinghNo ratings yet

- Learning Diary - Business Negotiation 4Document4 pagesLearning Diary - Business Negotiation 4Saurabh SinghNo ratings yet

- Accounts All DefinitionsDocument21 pagesAccounts All Definitionskarthy143No ratings yet

- Tata Steel Options AssignmentDocument37 pagesTata Steel Options AssignmentSaurabh SinghNo ratings yet

- IKEA Case Study: Strategic Marketing & Management - Gaining Competitive Advantage in An International ContextDocument10 pagesIKEA Case Study: Strategic Marketing & Management - Gaining Competitive Advantage in An International ContextSaurabh SinghNo ratings yet

- Long Call: End July Action G/L Premium TOTALDocument34 pagesLong Call: End July Action G/L Premium TOTALSaurabh SinghNo ratings yet

- Financial Institutions and Markets Case Study On Trading in SecuritiesDocument4 pagesFinancial Institutions and Markets Case Study On Trading in SecuritiesSaurabh SinghNo ratings yet

- Acquisition of Freecharge by AXIS Bank: Group 7Document11 pagesAcquisition of Freecharge by AXIS Bank: Group 7Saurabh SinghNo ratings yet

- ZOMATODocument1 pageZOMATOSaurabh SinghNo ratings yet

- IPO Case Analysis Group AssignmentDocument4 pagesIPO Case Analysis Group AssignmentSaurabh SinghNo ratings yet

- A New Evaluation Procedure in Real Estate Projects: Jpif 29,3Document17 pagesA New Evaluation Procedure in Real Estate Projects: Jpif 29,3Tony BuNo ratings yet

- Corporate Finance Chapter 001Document35 pagesCorporate Finance Chapter 001thuy37No ratings yet

- Exercise Cash FlowDocument5 pagesExercise Cash FlowSiti AishahNo ratings yet

- 15-Step Tutorial on Finance ConceptsDocument15 pages15-Step Tutorial on Finance ConceptsAninda DuttaNo ratings yet

- Advanced Corporate Finance (Mesznik) SP2016Document7 pagesAdvanced Corporate Finance (Mesznik) SP2016darwin12No ratings yet

- MAC Summary of FormulasDocument25 pagesMAC Summary of FormulasRuNo ratings yet

- Word Business Case TemplateDocument5 pagesWord Business Case TemplateSanthosh Kumar Setty100% (1)

- CH 12 - The Basics of Capital BudgetingDocument11 pagesCH 12 - The Basics of Capital BudgetingMuhtar RasyidNo ratings yet

- Wind energy feasibility of 2MW projectDocument7 pagesWind energy feasibility of 2MW projectJigneshSaradavaNo ratings yet

- Mark Scheme June 2016: ResultsDocument20 pagesMark Scheme June 2016: ResultsAung Zaw HtweNo ratings yet

- Malaysian Business Evaluation ReportDocument19 pagesMalaysian Business Evaluation ReportClaireNo ratings yet

- HBS Ameritrade Corporate Finance Case Study SolutionDocument6 pagesHBS Ameritrade Corporate Finance Case Study SolutionEugene Nikolaychuk100% (5)

- 11 12 NPV Ror PBP BCRDocument18 pages11 12 NPV Ror PBP BCRizmehsjjjjNo ratings yet

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelNo ratings yet

- CP 0Document29 pagesCP 0Indra PermanaNo ratings yet

- Financial Management: An OverviewDocument90 pagesFinancial Management: An OverviewGebreNo ratings yet

- Revision Pack and AnsjjwersDocument34 pagesRevision Pack and AnsjjwersShree Punetha PeremaloNo ratings yet

- Majestic Gold NI 43-101 August 2013Document191 pagesMajestic Gold NI 43-101 August 2013MJSgetgoingNo ratings yet

- Waste Management: I.M. Chethana S. Illankoon, Weisheng LuDocument10 pagesWaste Management: I.M. Chethana S. Illankoon, Weisheng LuMateo Camilo AstudilloNo ratings yet

- Chapter 12 - NewDocument16 pagesChapter 12 - Newshadow033333No ratings yet

- Capital Investment DecisionsDocument23 pagesCapital Investment DecisionsLindinkosi MdluliNo ratings yet

- 9 Capital Budgeting Class ProblemDocument8 pages9 Capital Budgeting Class Problemowen.berthetNo ratings yet

- Course Outline - FIN 501 - Riyashad - SPRING 2017Document6 pagesCourse Outline - FIN 501 - Riyashad - SPRING 2017Tasnuva Tabassum TrishaNo ratings yet

- Chapter 09 & 10 Engineering Economic Analysis and Profitability Analysis - ModifiedDocument42 pagesChapter 09 & 10 Engineering Economic Analysis and Profitability Analysis - ModifiedIbrahim Al-HammadiNo ratings yet

- Determination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFDocument5 pagesDetermination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFRenzo MurilloNo ratings yet

- TVM NPVDocument86 pagesTVM NPVChristine Joy Guinhawa DalisayNo ratings yet