Professional Documents

Culture Documents

Investment Decisions Problems 2

Uploaded by

MussaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Decisions Problems 2

Uploaded by

MussaCopyright:

Available Formats

EDBAS 202 Corporate Financial Management

Capital Budgeting – Additional Problems 2

1. Alpha company is considering a new product line to supplement its range line. It is anticipated

that the new product line will involve cash investment of Rs.700,000 at time 0 and 1 million in

year 1. After-tax cash inflows of Rs.250,000 are expected in year 2, Rs.300,000 in year 3, Rs.

350,000 in year 4 and Rs.400,000 each year thereafter through year 10. Though the product line

might be viable after year 10, the company prefers to be conservative and end all calculations

at that time.

(a) If the required rate of return is 15%, what is the NPV of the project? Is it acceptable? What is

the IRR?

(b) What would be the case if the required rate of return was 10%?

(c) What is the project’s payback period?

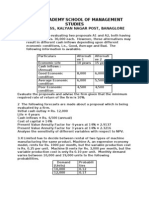

2. ABC Ltd. is evaluating three investment situations: (1) produce a new line of aluminium blivets,

(2) expand its existing blivet line to include several new sizes, and (3) develop a new, higher

quality line of blivet. If only the project in question is undertaken, the expected present values

and the amounts of investment required are as follows:

Project Investment required (Rs) Present value of future cash flows (Rs)

1 200,000 290,000

2 115,000 185,000

3 270,000 400,000

If projects 1 and 2 are jointly undertaken, there will be no economies; the investment required and

present values will simply be the sum of the parts. With projects 1 and 3, economies are possible in

investment because one of the machines acquired can be used in both production processes. The total

investment required for projects 1 and 3 combined is Rs. 440,000. If projects 2 and 3 are undertaken,

there are economies to be achieved in marketing and producing the products but not in investment. The

expected present value of future cash flows for projects 2 and 3 combined is Rs. 620,000. If all three

projects are undertaken simultaneously, the economies noted above will still hold. However, a Rs.

125,000 extension on the plant will be necessary, as space is not available for all three projects. Which

project or projects should be chosen?

Asanka Ranasinghe MBA (Colombo), BBA (Finance), ACMA, CGMA

EDBAS 202 Corporate Financial Management

3. XYZ Company is planning to buy new machinery for Rs. 200,000. The machinery has a

depreciation life of 5 years. As a result of buying the new machinery, XYZ Company will sell the

existing machinery at Rs. 50,000. The existing machinery was purchased 3 years ago for Rs.100,

000. The company must pay Rs. 4,000 for delivery and Rs. 9,000 for installation of the new

machinery. Assume tax rates of 34%. Net working capital does not change. Depreciation at cost

20% in year 1, 32% in year 2, and 19% in year 3.

(a) Determine the initial cost of the project.

(b)What would be the initial cost of the project if the existing machinery was sold at Rs. 20,000?

4. Amtarc plc produces Tarcs with a machine which is now four years old. The management team

estimates that this machine has a useful life of four more years before it will be sold for scrap,

raising £10,000. Q-leap, a manufacturer of machines suitable for Tarc production, has offered

its new computer controlled Q-2000 to Amtarc for a cost of £800,000 payable immediately. If

Amtarc sold its existing machine now, on the secondhand market, it would receive £70,000. (Its

book accounting value, after depreciation, is £150,000.) The Q-2000 will have a life of four

years before being sold for scrap for £20,000. The attractive features of the Q-2000 are its lower

raw material wastage and its reduced labour requirements. Selling price and variable overhead

will be the same as for the old machine. The accountants have prepared the figures shown

below on the assumption that output will remain constant at last year’s level of 100,000 Tarcs

per annum.

Asanka Ranasinghe MBA (Colombo), BBA (Finance), ACMA, CGMA

EDBAS 202 Corporate Financial Management

An additional benefit of the Q-2000 will be the reduction in required raw material buffer stocks –

releasing £120,000 at the outset. However, because of the lower labour needs, redundancy payments

of £50,000 will be necessary after one year.

Assume

No inflation or tax.

The required rate of return is 10 per cent.

To simplify the analysis sales, labour costs, raw material costs and variable overhead costs

all occur on the last day of each year.

Using the NPV method decide whether to continue using the old machine or to purchase the Q-

2000.

5. Consider the case of a car rental firm which is considering a switch to a new type of car. The

cars cost £10,000 and a choice has to be made between four alternative (mutually exclusive)

projects (four alternative regular replacement cycles). Project 1 is to sell the cars on the

secondhand market after one year for £7,000. Project 2 is to sell after two years for £5,000.

Projects 3 and are three-year and four-year cycles and will produce £3,000 and £1,000

respectively on the secondhand market. The cost of maintenance rises from £500 in the first

year to £900 in the second, £1,200 in the third and £2,500 in the fourth. The cars are not worth

keeping for more than four years because of the bad publicity associated with breakdowns. The

revenue streams and other costs are unaffected by which cycle is selected.

6. The estimated net earnings for the XYZ Company in the next 3 years are Rs. 100,000 Rs. 150,000

and Rs. 200,000. The annual depreciation amounts for those years are estimated as Rs. 30,000

Rs. 40,000 and Rs. 45,000 As a result of starting a new project, the estimated net earnings will

be Rs. 120,000 Rs. 165,000 and Rs. 230,000 and the annual depreciation will increase to Rs.

45,000, Rs. 62,000 and Rs. 66,000. To make it simple, assume that the tax rate is 40%. Calculate

the incremental cash flow of the new project.

7. A cosmetic company is considering to introduce a new lotion which is useful both in winters and

summers. The manufacturing equipment will cost Rs. 5,60,000. The expected life of the

equipment is 8 years. The company is thinking of selling the lotion in a single standard pack of

50 grams at Rs. 12 each pack. It is estimated that variable cost per pack would be Rs. 6 and

annual fixed cost, Rs. 450,000. Fixed cost includes (straight line) depreciation of Rs. 70,000 and

allocated overheads of Rs. 30,000. The company expects to sell 100,000 packs of the lotion each

year. Assume that the tax rate is 45% and straight line depreciation is allowed for tax purposes.

If the opportunity cost of capital is 12%, should the company manufacture the lotion?

Asanka Ranasinghe MBA (Colombo), BBA (Finance), ACMA, CGMA

EDBAS 202 Corporate Financial Management

8. The existing earnings under two conditions are given.

Year Existing Machine (Rs.) New Machine (Rs.)

1 100,000 150,000

2 140, 000 250,000

3 280,000 350,000

4 400,000 450,000

5 510,000 550,000

The existing machine was purchased 3 years ago at Rs. 400,000. A new machine is under

consideration for replacement at a cost of Rs. 600,000. Depreciation life is 5 years in both cases,

and the tax rate is 34%. Use the depreciation rates of 20% for year 1, 32% for year 2, 19% for

year 3, 15% for year 4, and 14% for year 5. Determine the incremental cash flow for replacing

the existing machine.

9. A company is considering two mutually exclusive projects. Both require an initial cash outlay of

Rs. 10,000 each and have a life of five years. The company’s required rate of return is 10% and

pays tax at a 50% rate. The projects will be depreciated on a straight line basis. The before

taxes cash flows expected to be generated by the projects are as follows:

Year Project A (Rs.) Project B (Rs.)

1 4,000 6,000

2 4,000 3,000

3 4,000 2,000

4 4,000 5,000

5 4,000 5,000

Calculate for each project: (a) the payback (b) the NPV (c) IRR (d) PI (e) ARR Which project

should be accepted and Why?

Asanka Ranasinghe MBA (Colombo), BBA (Finance), ACMA, CGMA

EDBAS 202 Corporate Financial Management

10. The general manager of the engineering division of Modern Engineering Company is considering

the replacement of a six-year old equipment. The company has to incur excessive maintenance

cost on the equipment. The equipment has a zero written down value. It can be modernized at

a cost of Rs. 120,000, enhancing its economic life to 5 years. The equipment could be sold for

Rs. 20,000 after 5 years. The modernization of equipment would help in material handling and

in reducing labour and maintenance and repair costs. The company has yet another alternative.

It can buy a new machine at a cost of Rs. 300,000 with an economic life of 5 years with a

terminal value of Rs. 60,000. The new machine is expected to be more efficient in reducing

costs of material, labour and maintenance and repair etc. The annual costs are as follows:

Existing Equipment Modernization New Equipment

Wages and salaries 40,000 30,700 11,800

Supervision 20,000 9,500 7,000

Maintenance 28,000 8,000 2,500

Power 20,000 18,000 15,000

Total 108,000 66,200 36,300

The company has a tax rate of 50% and a required rate of return of 10%. Assume straight-line

depreciation for tax purposes, and tax on the sale of equipment. Should the company

modernize its equipment or buy new equipment?

Asanka Ranasinghe MBA (Colombo), BBA (Finance), ACMA, CGMA

You might also like

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Capital Budgeting Exercises for New Product Lines and MachineryDocument2 pagesCapital Budgeting Exercises for New Product Lines and MachinerybdiitNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- Capital Budgeting ExercisesDocument3 pagesCapital Budgeting ExercisesSaket SumanNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- Project Finance and Appraisal TutorialDocument3 pagesProject Finance and Appraisal TutorialAjay MeenaNo ratings yet

- Investment Appraisal TAE TESTDocument2 pagesInvestment Appraisal TAE TESTJames MartinNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Capital Budgeting Techniques for Investment EvaluationDocument5 pagesCapital Budgeting Techniques for Investment EvaluationUday Gowda0% (1)

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNo ratings yet

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNo ratings yet

- Capital Budgeting3Document1 pageCapital Budgeting3Avishek GhosalNo ratings yet

- Capital Budgeting ProblemsDocument2 pagesCapital Budgeting Problemsvijayadarshini vNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- BREAK-EVEN ANALYSIS AND NEW DESIGN ECONOMICSDocument7 pagesBREAK-EVEN ANALYSIS AND NEW DESIGN ECONOMICSGarima PalNo ratings yet

- Project Financial Appraisal and SelectionDocument5 pagesProject Financial Appraisal and SelectionAbhishek KarekarNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Exercise Chapter 6Document3 pagesExercise Chapter 6Siti AishahNo ratings yet

- 2015-Spring-F18-CIA Revision Practice QuestionsDocument2 pages2015-Spring-F18-CIA Revision Practice QuestionsMayal AhmedNo ratings yet

- Capital Budgeting NPV Analysis for Earth Mover ProjectDocument6 pagesCapital Budgeting NPV Analysis for Earth Mover ProjectMarcoBonaparte0% (1)

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- A Mining Company Is Considering To Open A New Coal MineDocument4 pagesA Mining Company Is Considering To Open A New Coal MineD Y Patil Institute of MCA and MBANo ratings yet

- EconomicsDocument2 pagesEconomicsPradeep ChandrasekaranNo ratings yet

- CA-Inter-FM-SM-Q-MTP-2-May-2024-castudynotes-comDocument12 pagesCA-Inter-FM-SM-Q-MTP-2-May-2024-castudynotes-comsaurabhNo ratings yet

- Economic Analysis and Cost EvaluationDocument2 pagesEconomic Analysis and Cost EvaluationchandrasekarcncetNo ratings yet

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- Tutorial Sheet 2Document2 pagesTutorial Sheet 2siamesamuel229No ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- M 2012 June PDFDocument21 pagesM 2012 June PDFMoses LukNo ratings yet

- Capital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachDocument4 pagesCapital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachAnshuman AggarwalNo ratings yet

- Question Bank - Economics For EngineersDocument3 pagesQuestion Bank - Economics For EngineersAnurag AnandNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingHooriaNo ratings yet

- Questions on Capital Budgeting TechniquesDocument6 pagesQuestions on Capital Budgeting Techniqueskaf_scitNo ratings yet

- Projected Statement of Contribution Margin for ALDocument4 pagesProjected Statement of Contribution Margin for ALbinuNo ratings yet

- Capital Budgeting Decision Cash Flow AnalysisDocument20 pagesCapital Budgeting Decision Cash Flow Analysisprachik87No ratings yet

- ECON F315 - FIN F315 - Compre QP PDFDocument3 pagesECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- Capital BudgetingDocument2 pagesCapital BudgetingEdmon ManalotoNo ratings yet

- Time Value of Money SumsDocument13 pagesTime Value of Money SumsrahulNo ratings yet

- Capital Budgeting Additional Exercises and CasesDocument4 pagesCapital Budgeting Additional Exercises and CasesSayan MitraNo ratings yet

- Project FinanceDocument19 pagesProject FinancejahidkhanNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingKhushi RaniNo ratings yet

- Subject: Engineering Economics & Financial Management (HUM 3051)Document4 pagesSubject: Engineering Economics & Financial Management (HUM 3051)Gaurav KhandelwalNo ratings yet

- AFM Capital Budgeting AssignmentDocument5 pagesAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Q and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Document95 pagesQ and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Samuel Dwumfour100% (1)

- Dfi 305 - DL Assg July 2012Document6 pagesDfi 305 - DL Assg July 2012jhouvanNo ratings yet

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- CapbudgetingproblemsDocument3 pagesCapbudgetingproblemsVishal PaithankarNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Bank Reconciliation 1Document32 pagesBank Reconciliation 1MussaNo ratings yet

- Savoir EPS Calculation for Years 20X4-20X6Document1 pageSavoir EPS Calculation for Years 20X4-20X6MussaNo ratings yet

- Consumer Purchasing and Consumer CreditsDocument31 pagesConsumer Purchasing and Consumer CreditsMussaNo ratings yet

- Sales and MarketingDocument1 pageSales and MarketingMussaNo ratings yet

- Business Planning and DevelopmentDocument19 pagesBusiness Planning and DevelopmentMussaNo ratings yet

- Lecture 2Document6 pagesLecture 2MussaNo ratings yet

- Employment IncomeDocument14 pagesEmployment IncomeMussaNo ratings yet

- Consultants Client RelationshipDocument33 pagesConsultants Client RelationshipMussaNo ratings yet

- Implementing an Information SystemDocument4 pagesImplementing an Information SystemMussaNo ratings yet

- Business Planning and DevelopmentDocument36 pagesBusiness Planning and DevelopmentMussaNo ratings yet

- Management Information Systems (MIS) : Ethical, Economic and Social Issues in Information SystemsDocument6 pagesManagement Information Systems (MIS) : Ethical, Economic and Social Issues in Information SystemsMussaNo ratings yet

- Corporate Strategy AnalysisDocument68 pagesCorporate Strategy AnalysisMussaNo ratings yet

- Implementing an Information SystemDocument4 pagesImplementing an Information SystemMussaNo ratings yet

- Lease UpdateDocument23 pagesLease UpdateMussaNo ratings yet

- PESTEL Analysis For CokeDocument3 pagesPESTEL Analysis For Cokeowaiskhan007100% (5)

- Strategic Management Questions: Question OneDocument2 pagesStrategic Management Questions: Question OneMussaNo ratings yet

- CIMA Strategic Analysis ToolsDocument16 pagesCIMA Strategic Analysis ToolsWYNBAD100% (1)

- MS 311 Prerequisite Management Information Systems CourseDocument10 pagesMS 311 Prerequisite Management Information Systems CourseMussaNo ratings yet

- Swot and Pestal Analysis of Coca Cola BY Yousaf Abbasi Executive SummaryDocument13 pagesSwot and Pestal Analysis of Coca Cola BY Yousaf Abbasi Executive SummaryMussaNo ratings yet

- Article1379494818 - Massoi and NormanDocument8 pagesArticle1379494818 - Massoi and NormanMussaNo ratings yet

- 05GeneralInternalControl NotesDocument13 pages05GeneralInternalControl NotesMussaNo ratings yet

- How to Conduct a SWOT AnalysisDocument37 pagesHow to Conduct a SWOT Analysisgerang jegegNo ratings yet

- Chapter 11 Swot AnalysisDocument32 pagesChapter 11 Swot AnalysisMussaNo ratings yet

- Types and Objectives of Economic IntegrationDocument2 pagesTypes and Objectives of Economic IntegrationMussaNo ratings yet

- PESTEL Analysis For CokeDocument3 pagesPESTEL Analysis For Cokeowaiskhan007100% (5)

- SWOT and PEST analysis templatesDocument5 pagesSWOT and PEST analysis templatesCoolmaharana MaharanaNo ratings yet

- PEST Analysis: Factors Which Impact Upon Them. It Can Be Used To Consider FactorsDocument2 pagesPEST Analysis: Factors Which Impact Upon Them. It Can Be Used To Consider FactorsMussaNo ratings yet

- Internal Audit Roles & ResponsibilitiesDocument10 pagesInternal Audit Roles & ResponsibilitiesMussaNo ratings yet

- Professional Ethics Guide Auditors Clients PublicDocument18 pagesProfessional Ethics Guide Auditors Clients PublicMussaNo ratings yet

- Coos County Cookie Cart Sales Dialogue TemplateDocument4 pagesCoos County Cookie Cart Sales Dialogue Templateapi-255835791No ratings yet

- Social MarketingDocument28 pagesSocial MarketingProfessor Sameer Kulkarni99% (110)

- Brand Preferrence of Packaged MilkDocument73 pagesBrand Preferrence of Packaged MilkSUKUMAR82% (17)

- Database Sec Training RizaDocument24 pagesDatabase Sec Training RizaRIZA MAHARDIKANo ratings yet

- Elpp Project 1 Lean Startup For Enterprises Final 3Document16 pagesElpp Project 1 Lean Startup For Enterprises Final 3macrocosmoNo ratings yet

- Asian Paints PDFDocument36 pagesAsian Paints PDFPreeti AroraNo ratings yet

- Anna Whitehouse ResumeDocument1 pageAnna Whitehouse Resumeapi-210293689No ratings yet

- Comparision Between Online & Offline ShoppingDocument57 pagesComparision Between Online & Offline ShoppingSarita Sonar93% (15)

- Strategic Marketing, 3 Edition: Chapter 3: Environmental and Internal Analysis: Market Information and IntelligenceDocument17 pagesStrategic Marketing, 3 Edition: Chapter 3: Environmental and Internal Analysis: Market Information and IntelligenceQadeer SarwarNo ratings yet

- Social Media PlanDocument14 pagesSocial Media Planapi-301266788No ratings yet

- Barringer E3 TB 14 PDFDocument18 pagesBarringer E3 TB 14 PDFXiAo LengNo ratings yet

- Strategic and Change Management AssignmentDocument21 pagesStrategic and Change Management AssignmentcarmensavvaNo ratings yet

- INSEEC Groupe 2013-2014 Exchange Program Fact SheetDocument7 pagesINSEEC Groupe 2013-2014 Exchange Program Fact SheetIamaBillionaireNo ratings yet

- Entrepreneur vs Intrapreneur roles and key differencesDocument1 pageEntrepreneur vs Intrapreneur roles and key differenceserrajeshmba100% (2)

- Titan Company LTDDocument4 pagesTitan Company LTDUdit SrivastavaNo ratings yet

- Warehouse Floor PlanDocument1 pageWarehouse Floor PlanErnest RussellNo ratings yet

- Managing Markets: Perfect Competition to MonopolyDocument47 pagesManaging Markets: Perfect Competition to MonopolyLukito EminiyatiNo ratings yet

- 3BHS839153D01 LC Status ACS1000 After Main Board Upgrade AMC34Document2 pages3BHS839153D01 LC Status ACS1000 After Main Board Upgrade AMC34prajeshNo ratings yet

- Duracell Market ResearchDocument3 pagesDuracell Market ResearchKarel César Licona LasterosNo ratings yet

- Assignment MKT Customer Loyalty & CRMDocument3 pagesAssignment MKT Customer Loyalty & CRMLea Abou NasrNo ratings yet

- Date Received: SuppliersDocument9 pagesDate Received: SuppliersHoven MacasinagNo ratings yet

- Quality Management: Satisfy Stated or Implied Needs."Document4 pagesQuality Management: Satisfy Stated or Implied Needs."zakirno19248No ratings yet

- Ac TM SB Year 6 pp06-08 Fillable Saveable-2Document3 pagesAc TM SB Year 6 pp06-08 Fillable Saveable-2api-394727402No ratings yet

- INNOVATION AND IT MANAGEMENT Lecturer Notes For All UnitsDocument229 pagesINNOVATION AND IT MANAGEMENT Lecturer Notes For All UnitsPadmavathi Meda83% (6)

- Pita Pit franchise analysis and competitive advantagesDocument6 pagesPita Pit franchise analysis and competitive advantagesepic99No ratings yet

- TRD JRN 0209Document8 pagesTRD JRN 0209علی ایروانیNo ratings yet

- SidoDocument4 pagesSidoUmesh PardeshiNo ratings yet

- ASROTEX Group - Knit Garment ManufacturerDocument10 pagesASROTEX Group - Knit Garment ManufacturerGarmentLearner67% (3)

- Patagonia CaseDocument2 pagesPatagonia CaseSofia CastelliNo ratings yet

- SutherlandDocument8 pagesSutherlandKavitha KalaimaniNo ratings yet