Professional Documents

Culture Documents

Case Study Income

Uploaded by

nasera zamaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study Income

Uploaded by

nasera zamaniCopyright:

Available Formats

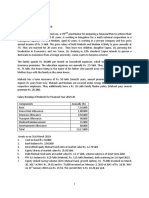

CASE STUDY

Business Standard analyses

one family’s finances and

suggests a way forward

THE GUPTAS

Pankaj (32), Shalini (29), Kripa (2)

RESIDE IN NET ANNUAL INCOME RATING

Navi Mumbai ~10.92 lakh 5/10

>STATUS & GOALS

Pankaj and Shalini work in different call centres in

Mumbai. They have a two-year-old daughter, looked after

by a full-time maid. Their primary goal is to buy a house

and plan for their daughter’s education and marriage

Basic expenses (~) Per month (~) Annual (~)

Household and lifestyle 41,000 4,92,000

Rent 14,000 1,68,000

Insurance premium 10,833 1,30,000

Vacation 5,000 60,000

Total 70,833 8,50,000

Monthly income: ~91, 000 Net monthly surplus: ~20, 167

>GOALS

BUYING A FLAT DAUGHTER’S COLLEGE &

(2016 ) POSTGRADUATION

(2032 - 2036) (Annual inflation

9 per cent)

Current Value: Current Value: Future value:

~50 lakh ~35 lakh ~1.72 crore

RETIREMENT (2044)

(Annual inflation seven per cent, annual rate of return on

corpus nine per cent) (Life expectancy – 85 years)

Current annual Future annual Corpus

expenses: expenses: required:

~ 5.52 lakh ~36.70 lakh ~7.41 crore

Assets ~ Liabilities ~

Savings account 59,000

Fixed deposit 2,75,000

EPF 3,65,000

Insurance cash value 4,38,000

Equity mutual funds 4,27,000

1,56,4000 0

Net worth 1,56,4000

>FINDINGS

EMERGENCY FUND: Funds maintained in fixed deposits for

emergency purpose equivalent to four months of expenses

LIFE INSURANCE: Pankaj is covered for ~11 lakh, while

Shalini is covered for ~9 lakh through unit-linked

insurance policies (Ulips)

HEALTH INSURANCE: Both their employers provide a family

floater mediclaim cover of ~3 lakh. They don’t have a

separate cover

INVESTMENTS: Investments are spread across mutual funds,

Ulips and fixed deposits. The equity allocation is 58 per cent,

including Ulips

LIABILITIES: They don’t have any liabilities

>RECOMMENDATIONS

EMERGENCY FUND: The couple needs to maintain ~1 lakh in

joint savings bank account and can additionally maintain

~1.10 lakh in liquid funds

ACCIDENT INSURANCE: The couple needs to take a ~25-lakh

personal accident plan, with a temporary total disability of

~5 lakh for each. The premium for this will be ~8,000

approximately

LIFE INSURANCE: Pankaj needs to take a life cover of ~1.5

crore, while Shalini should take a cover of ~75 lakh. The term

should be 30 years and total premium for online term plan

will be ~30,000

HEALTH INSURANCE: They need to buy a separate family

floater health insurance policy of ~3 lakh. Premium for this

will be approximately ~7,000

>PLANNING FOR GOALS

BUYING A FLAT (2016): Considering the present surplus and

possible rent saving, the couple can go for a maximum loan

of ~35 lakh, which means they need to arrange the

remaining ~15 lakh, not possible at present. They need to

invest the surplus in recurring deposits for two years, along

with investment of any variable pay into liquid funds to

create a corpus for down-payment

Annual rate of return assumed: Six per cent post tax on RD

and liquid funds

Daughter’s college & postgraduation (2032 - 2036) : The

couple’s three Ulip policies will help fund the first three years

of their daughter’s education. They need to invest ~12,500 per

month in large-cap funds for 16 years to fund her post-

graduation goal. If they invest the surplus for the house, the

investments required for this goal will increase with each year

of delay

Annual rate of return assumed: 12 per cent on the large-cap

funds portfolio

Retirement (2044) : The couple’s EPF will be worth ~1.92 crore

in the year 2044. Since they will use the insurance maturities

for daughter’s education and mutual fund investments for

paying the down-payment for a flat, the monthly SIP amount

(in 70 per cent multi-cap funds and 30 per cent debt) required

to bridge the retirement corpus is ~20,000. Due to priority of

buying a flat, this investment is currently not possible

Annual rate of return assumed: 8 per cent on EPF, 12 per cent

on the mutual funds portfolio for the period considered

Plan by Steven Fernandes, certified financial planner, chief planner,

Proficient Financial Planners

You might also like

- Physics Practical File Class 12Document20 pagesPhysics Practical File Class 12nasera zamani50% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Case Study For CFP Final ModuleDocument3 pagesCase Study For CFP Final ModuleImran Ansari0% (2)

- WM Unit 8 Retirement Planning 6th Jan 2022Document32 pagesWM Unit 8 Retirement Planning 6th Jan 2022Aarti GuptaNo ratings yet

- Module 5 Amortization and MortgageDocument4 pagesModule 5 Amortization and Mortgageanjie kamidNo ratings yet

- Accounting For Cooperative SocietiesDocument31 pagesAccounting For Cooperative SocietiesAbdul Kadir ArsiwalaNo ratings yet

- Wealth Management Group 8: Name Roll NoDocument16 pagesWealth Management Group 8: Name Roll NoAdii AdityaNo ratings yet

- Food and Beverage Control Systems Can Help You Introduce The Same Financial Rigour To Your Dining Establishment or Catering Company That YouDocument11 pagesFood and Beverage Control Systems Can Help You Introduce The Same Financial Rigour To Your Dining Establishment or Catering Company That Younarinder singh saini100% (4)

- (Updated) 5 Ad Strategies We Use To Repeatedly Signup 30-50 Clients Per MonthDocument27 pages(Updated) 5 Ad Strategies We Use To Repeatedly Signup 30-50 Clients Per MonthRyan LuedeckeNo ratings yet

- The Power of Compound Interest How to Grow your Wealth over TimeFrom EverandThe Power of Compound Interest How to Grow your Wealth over TimeNo ratings yet

- Case Study: Realty CheckDocument1 pageCase Study: Realty Checkkill_my_kloneNo ratings yet

- Case Study: Status & GoalsDocument1 pageCase Study: Status & GoalsBhaktiNo ratings yet

- Personal Fin Group 6 PowerpointDocument40 pagesPersonal Fin Group 6 PowerpointFTU.CS2 Nguyễn Lý Minh NhưNo ratings yet

- WM Final Disha Saxena Jn180269Document13 pagesWM Final Disha Saxena Jn180269Disha SaxenaNo ratings yet

- Business Standard analyses one woman's finances after divorce and suggests a way forwardDocument52 pagesBusiness Standard analyses one woman's finances after divorce and suggests a way forwardRahulNo ratings yet

- Case Study: PointDocument1 pageCase Study: PointprasadzinjurdeNo ratings yet

- Financial Plan Report: ABC Yadnya Academy Pvt. Ltd. DD MMM YyyyDocument24 pagesFinancial Plan Report: ABC Yadnya Academy Pvt. Ltd. DD MMM YyyyAravind MauryaNo ratings yet

- Sample Financial Plan ReportDocument24 pagesSample Financial Plan ReportKarthik GundaNo ratings yet

- Family Finances Case Study: The GuptasDocument1 pageFamily Finances Case Study: The Guptaskill_my_kloneNo ratings yet

- NMHYDWM001Document29 pagesNMHYDWM001SHAWKATMANZOORNo ratings yet

- Case CDocument3 pagesCase Cnaveen0037No ratings yet

- Financial Plan: Jaipuria Institute of Management LucknowDocument7 pagesFinancial Plan: Jaipuria Institute of Management Lucknowmak_max11No ratings yet

- Insurance Need AnalysisDocument5 pagesInsurance Need AnalysisAshish1002No ratings yet

- Tutorial PFPDocument20 pagesTutorial PFPGAW KAH YAN KITTYNo ratings yet

- Systematic Investment Plan: DSP Blackrock Mutual FundDocument28 pagesSystematic Investment Plan: DSP Blackrock Mutual FundmynksharmaNo ratings yet

- Case Study: Family ProfileDocument1 pageCase Study: Family ProfileSatyaki PatraNo ratings yet

- Time Value of Money Problems SolvedDocument13 pagesTime Value of Money Problems SolvedGajendra Singh Raghav50% (2)

- Gupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementDocument11 pagesGupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementAnand YadavNo ratings yet

- RP and EB Vishnu Kant BhadauriaDocument6 pagesRP and EB Vishnu Kant Bhadauriavishnu bhadauriaNo ratings yet

- NMHYDWM069Document24 pagesNMHYDWM069SHAWKATMANZOORNo ratings yet

- Wealth Management: Group AssignmentDocument11 pagesWealth Management: Group Assignmentsimran guptaNo ratings yet

- Time Value of MoneyDocument32 pagesTime Value of MoneyHariom Singh100% (1)

- PLAN FOR A COMFORTABLE RETIREMENTDocument11 pagesPLAN FOR A COMFORTABLE RETIREMENTReign Ashley RamizaresNo ratings yet

- Alpesh RathodDocument7 pagesAlpesh Rathodriteshg000007No ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneypptdineshNo ratings yet

- Time Value of MoneyDocument32 pagesTime Value of MoneyHariom Singh100% (1)

- Overview of Time Value of MoneyDocument48 pagesOverview of Time Value of MoneyKathleen MarcialNo ratings yet

- Wealth ManagementDocument178 pagesWealth Managementgauravshahi21967% (3)

- 302time Value of MoneyDocument69 pages302time Value of MoneypujaadiNo ratings yet

- Wealth ManagementDocument17 pagesWealth ManagementSaurabh PrasadNo ratings yet

- Test - Chapter 2 Time Value of MoneyDocument18 pagesTest - Chapter 2 Time Value of Moneyk60.2112150055No ratings yet

- NMHYDWM070Document21 pagesNMHYDWM070SHAWKATMANZOORNo ratings yet

- Tutorial Set 1Document8 pagesTutorial Set 1Jephthah BansahNo ratings yet

- Retirement PlanningDocument6 pagesRetirement Planningdaddyyankee995No ratings yet

- Man Acc 1Document4 pagesMan Acc 1KathleneGabrielAzasHaoNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneyAswinrkrishnaNo ratings yet

- NMHYDWM019Document33 pagesNMHYDWM019SHAWKATMANZOORNo ratings yet

- Práctica 2 Fin I 2021Document4 pagesPráctica 2 Fin I 2021Brenda123No ratings yet

- Time Value of Money TVMDocument48 pagesTime Value of Money TVMNikita KumariNo ratings yet

- Qs - Time Value of MoneyDocument25 pagesQs - Time Value of Moneyanon_849853749No ratings yet

- Assignment of Personal Financial Planning: TopicDocument9 pagesAssignment of Personal Financial Planning: Topicvikas anandNo ratings yet

- Sahanubhuti UniqueDocument10 pagesSahanubhuti UniquePrashanth JogimuttNo ratings yet

- 01prelim FIN 103 Answer KeyDocument7 pages01prelim FIN 103 Answer KeyevaNo ratings yet

- Qs - Time Value of MoneyDocument30 pagesQs - Time Value of MoneyVenkataramanan ThiruNo ratings yet

- Module I: Introduction To Financial ManagementDocument10 pagesModule I: Introduction To Financial ManagementPruthvi BalekundriNo ratings yet

- FinanceDocument9 pagesFinancecrystalNo ratings yet

- Financial Planning & Wealth ManagementDocument20 pagesFinancial Planning & Wealth ManagementHetviNo ratings yet

- Mahehs 2019Document3 pagesMahehs 2019Aditya BohraNo ratings yet

- ICA2 Wk5Document2 pagesICA2 Wk5shaishtashiraj100No ratings yet

- Topic 2 Principles of Money-Time RelationshipDocument28 pagesTopic 2 Principles of Money-Time RelationshipJeshua Llorera0% (1)

- FIN 1050 - Final ExamDocument6 pagesFIN 1050 - Final ExamKathi100% (1)

- Financial plan for Ashwin and familyDocument3 pagesFinancial plan for Ashwin and familyAditya BohraNo ratings yet

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANNo ratings yet

- Retirement Plan 2Document11 pagesRetirement Plan 2Reign Ashley RamizaresNo ratings yet

- BME-A PREVIOUS YEAR QUESTIONSDocument6 pagesBME-A PREVIOUS YEAR QUESTIONSYash RaoNo ratings yet

- I) Insertion, Deletion, and Traversal in BST.: Abu Musaddiq Zamani 2K19/MC/008Document14 pagesI) Insertion, Deletion, and Traversal in BST.: Abu Musaddiq Zamani 2K19/MC/008nasera zamaniNo ratings yet

- Certificate source code acknowledgementDocument1 pageCertificate source code acknowledgementnasera zamaniNo ratings yet

- Programme On QueriesDocument11 pagesProgramme On Queriesnasera zamaniNo ratings yet

- 313 Lab Manual NewDocument155 pages313 Lab Manual NewEzhilarasiPazhanivel100% (1)

- JEE Main 2019 Final Answer Key PDFDocument16 pagesJEE Main 2019 Final Answer Key PDFnasera zamaniNo ratings yet

- AC Generator New Project 1Document16 pagesAC Generator New Project 1JyotsanaNo ratings yet

- Jee Main Answer KeyDocument4 pagesJee Main Answer Keynasera zamaniNo ratings yet

- Chemistry2 2Document52 pagesChemistry2 2nasera zamaniNo ratings yet

- B57a77 PDFDocument8 pagesB57a77 PDFnasera zamaniNo ratings yet

- Delhi Metro Route Map: With Phase 3 RoutesDocument1 pageDelhi Metro Route Map: With Phase 3 RoutesDevamKhuranaNo ratings yet

- AITS-2014-CRT-I-JEEM+ADV Advanced PAPER-1 Solutions ANSWER SOLUTION PDFDocument11 pagesAITS-2014-CRT-I-JEEM+ADV Advanced PAPER-1 Solutions ANSWER SOLUTION PDFDushyant SinghNo ratings yet

- Construction of Garbage Bins & Recycling ReceptacleDocument1 pageConstruction of Garbage Bins & Recycling Receptaclejoan dalilisNo ratings yet

- Assignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessDocument62 pagesAssignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessNguyễn AnNo ratings yet

- Midterm Principles LSCM 2021-2022Document4 pagesMidterm Principles LSCM 2021-2022Ngo HieuNo ratings yet

- Final ManuscriptDocument65 pagesFinal ManuscriptJackie SalemNo ratings yet

- Nike Strategic Problems and SolutionsDocument8 pagesNike Strategic Problems and SolutionsMaeNo ratings yet

- Labh PDFDocument5 pagesLabh PDFNon ChalantNo ratings yet

- Estimate Inventory Value Using Gross Profit MethodDocument2 pagesEstimate Inventory Value Using Gross Profit MethodJoanne Rheena BooNo ratings yet

- List of Cases Part V - MortgageDocument2 pagesList of Cases Part V - MortgageJ Heje EstarNo ratings yet

- Swot Analysis of Demat Account Services Reliance SecuritiesDocument53 pagesSwot Analysis of Demat Account Services Reliance SecuritiesSumit Kumar67% (3)

- 7 ElevenDocument9 pages7 ElevenJoshua TingabngabNo ratings yet

- SSLG Id Merch Project ProposalDocument5 pagesSSLG Id Merch Project ProposalCharles Carcel TrinidadNo ratings yet

- The Economic Life of Project Is An Asset From The Angle of Maximization of The Project ValueDocument12 pagesThe Economic Life of Project Is An Asset From The Angle of Maximization of The Project ValueUjjwal KheriaNo ratings yet

- Quality StatementsDocument5 pagesQuality StatementsMeeran MohideenNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceSunny SinghNo ratings yet

- Kasus Beauvellie Furniture-SendDocument5 pagesKasus Beauvellie Furniture-Send06. Ni Komang Ayu Trisia Dewi0% (1)

- Business Incubation Training ProgramDocument10 pagesBusiness Incubation Training ProgramJeji HirboraNo ratings yet

- CEL 2105 Worksheet 5 (Week 5) SEM220202021Document4 pagesCEL 2105 Worksheet 5 (Week 5) SEM220202021Luqman A-refNo ratings yet

- Resume - Shantanu - Semi Qualified - KanpurDocument5 pagesResume - Shantanu - Semi Qualified - KanpurAnuj GoyalNo ratings yet

- Value Research Stock Advisor - Sterlite TechnologiesDocument32 pagesValue Research Stock Advisor - Sterlite TechnologiesjesprileNo ratings yet

- TYPES OF BUSINESS PLAn g9Document15 pagesTYPES OF BUSINESS PLAn g9Jhaymie NapolesNo ratings yet

- Assignment of GSTDocument4 pagesAssignment of GSTRohan KhullarNo ratings yet

- Tugas 2 - Analisis Informasi Keuangan - AisyahdenyDocument3 pagesTugas 2 - Analisis Informasi Keuangan - AisyahdenyJosh SaktiNo ratings yet

- A Triple Bottom Line Examination of Product Cannibalisation and Remanufacturing: A Review and Research AgendaDocument17 pagesA Triple Bottom Line Examination of Product Cannibalisation and Remanufacturing: A Review and Research AgendaOkey OkorieNo ratings yet

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- Starbucks Product Life CycleDocument25 pagesStarbucks Product Life CycleJerry Mathai0% (1)

- FPS modifies slogan to highlight delivery aspectsDocument6 pagesFPS modifies slogan to highlight delivery aspectsYi ZaraNo ratings yet

- The Difference Between: Branding MarketingDocument10 pagesThe Difference Between: Branding MarketingayuNo ratings yet