Professional Documents

Culture Documents

Bank (Ing) On Data Science

Uploaded by

kpbhimaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank (Ing) On Data Science

Uploaded by

kpbhimaniCopyright:

Available Formats

• Cognizant 20-20 Insights

Bank(ing) on Data Science

By embracing data science tools and technologies, banks can more

effectively inform strategic decision-making, reducing uncertainty

and eliminating analysis-paralysis.

Executive Summary banks can more effectively compete on code and

gain incredible competitive advantage. Companies

Amid the ever-present big data buzz, some large

such as Google, Pandora, Netflix, Amazon — and

global banks have mastered the art of using

many others — are winning decisively in their

data science to improve customer engagement,

markets because of their refined ability to mine

revamp products and optimize marketing

insight from the digital information surrounding

outreach, risk management, pricing and ongoing

people, organizations and devices, or what we call

cost reductions. Meanwhile, others are still trying

a Code Halo™. When properly harnessed, Code

to make sense of where these emerging technolo-

Halos contain a treasure trove of business value.1

gies and techniques fit in. At some point, banks of

all sizes, shapes and forms need to incorporate This white paper details the growing importance

data science into their operating models. of Code Halos in data science and analytics ini-

tiatives. Importantly, it highlights potential areas

The future of banking will be determined by how

of fit, ways to overcome challenges and a recom-

well banks use technology to maximize their

mended implementation strategy for key data

accumulated wealth of transactional and interac-

science initiatives.

tional data to better understand hidden patterns

of customer behavior. Using these insights, they

Banking’s Evolving World

can make necessary service improvements and

customize existing offerings to properly align the In the aftermath of last decade’s global financial

right products with the right customers. meltdown, the banking industry is undergoing a

radical transformation due to rapidly changing

To successfully implement data science, banks consumer behaviors and expectations; more

need to start small and adopt a structured stringent regulatory guidelines; and a highly

approach, based on a strategic roadmap. Banks competitive environment with a proliferation of

that can analyze the data they collect and utilize new channels (mobile banking and social media)

it for strategic decision-making will maximize and competitors (nonbanks, such as Paypal and

their competitive advantage; those that cannot Google Wallet).

will place their profitability, if not their survival,

at risk. This ongoing transformation, while difficult, is

also opening doors to new opportunities. Banks

By understanding data and applying insights must ensure that they can cost-effectively acquire

gleaned from customers, partners and employees, new customers while retaining existing ones. And

cognizant 20-20 insights | june 2014

to expand their reach and profitability, they must addition of newer sources, including Web server

also tighten their focus on the expanding digital logs, Internet clickstreams, social media activity

world. Analytics, big data and data science can and mobile-phone call details, has opened the

unlock a world of new possibilities. With proper floodgates on the data sets that can be mined for

use of data science, banks can better understand meaning.

prospect/customer relationships by exploring

ever-changing transactional and interactional However, this is easier said than done, as these

behaviors. New digital marketing technologies, data sets come in a variety of structured, semi-

such as Web sites, e-mail, mobile apps and social structured and unstructured formats, and arrive

networks, are helping banks better target their at an ever-increasing velocity and complexity.

customers and improve engagement. Moreover, Analyzing this data is now mission-critical, since

advanced segmentation strategies are helping it can provide more timely and precise insights

them boost their marketing effectiveness by iden- to guide business planning and decision-making.

tifying niches based on consumer behavior. With so much transparent content generated

daily through social media, data science can

Growing Importance of Data Science help banks deliver a consistent and integrated

The goal of data science is to extract hidden customer experience.

insights and knowledge from data. In our view,

To use this data for business advantage, banks

the key word is “science,” since, done properly,

must set up data analysis teams to collect, sift and

data science requires a systematic study of obser-

apply meaning from this data to advance business

vation, backed by proven scientific techniques.

goals. According to Gartner, big data in the

Data science builds on elements, techniques

banking industry has the highest level of oppor-

and theories from many fields, including signal

tunity because of the high volume and velocity of

processing, mathematics, probability models,

data in play. Moreover, 78% of CFOs have labeled

machine learning, computer programming,

BI and analytics as the top technology initiative

statistics, data engineering, pattern recognition

for their departments — beating out even financial

and learning, visualization, uncertainty modeling,

management applications.3

data warehousing and high-performance

computing. The exponential growth of data, par- Key Inputs for Data Science

ticularly unstructured data, makes big data an

As noted earlier, data can be broadly categorized

important aspect of data science. Every day, 2.5

as structured and unstructured. At a broad level,

exabytes of data are created; just one exabyte

structured data comprises transactional data,

is equal to 50,000 years’ worth of DVD-quality

which includes customer buying/spending habits,

video.2

and unstructured data can be obtained from

For years, financial institutions have leveraged various social media sites, such as Facebook and

customer insights gleaned from systems of record Twitter. Precise analysis of social data is of great

to manage risk and fraud, as well as to improve importance because it provides valuable insight

product development, marketing and customer into individual customers’ likes, dislikes, prefer-

communications. Today, new and enhanced ences, etc.

technologies, coupled with the availability of a

Analysis of both structured and unstructured data

vast pool of structured and unstructured data,

can help banks better target the right product to

allows for real-time, multichannel decision-mak-

the right customer at the right time. For example,

ing processes that can save money and increase

by correlating the social activities (unstructured

revenues.

data) of a customer with a spending pattern

Many banks are just beginning to consolidate and (structured data), banks can customize and

utilize the internal data elements at their disposal, optimize the timing of their product offerings.

such as debit and credit transactions, purchase

For even more precise targeting, organizations

histories, channel usage, communication prefer-

can add new third-party data sources, compiled

ences, loyalty behavior, etc. And when it comes

from a variety of sources, such as public reposi-

to big data, banks have collected large amounts

tories, mobile devices and cars. As such, data

of information from a variety of sources, such as

science involves three aspects of data: velocity,

transaction details and spending behaviors. The

volume and diversity (see Figure 1).

cognizant 20-20 insights 2

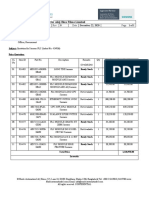

Data Science Trio

Velocity

• Batch process

• Near real-time

• Real-time

Diversity

• Structure transactional data Volume

• Unstructured/semi-structured data • • Records in terabytes,

from social source petabytes

Figure 1

Data Science: Usage Areas For example, using a mobile app, banks can

analyze individual consumer behaviors and

Many business areas can benefit from data sci-

spending activities and combine that data with

ence (see Figure 2). To properly ascertain how

credit bureau information. When analyzed, the

customers prefer to be served, banks can apply

resulting insights can lead to better targeted

such data science techniques as hypothesis test-

messaging around a potential offer, such as a

ing, crowdsourcing, data fusion and integration,

pre-approved home loan to a customer who is

machine learning, natural language processing,

qualified based on analysis of the data contained

signal processing, simulation, time series analysis

in his transactional files and interactions on social

and visualization. Using the insights gleaned from

media.

these approaches, marketers can derive the right

marketing strategy through a mix of marketing The vast amounts of online data have much

messages and offers that resonate with individual to offer banks seeking consumer insights. For

customers and segments. instance, by combining information from travel

Web sites and spending patterns gleaned from

internal databases, banks can optimize their

Applying Data Science product mix and offers. Analysis of transactional

behavior like recency, frequency and monetary

value can be sliced and diced to derive customer

profiles that can improve the effectiveness and

efficiency of targeted marketing efforts. An

Consumer example is an Australian bank that is working

Sentiment

with a retailer to better understand where the

retailers’ customers live, when and where they

Fraud Intelligent

Forecasting shop, and how much they spend. This informa-

Detection Data tion is then used to refine the retailer’s branch

Science Areas

location/relocation strategy.4

of Usage

Another example is a bank that uses point of sale

Customer Consumer data to determine whether a customer frequents

Service Profiling a certain area for shopping or lunch and then use

this information to deliver online offers that are

Target highly personalized even to the type of food the

Marketing

customer prefers, increasing the probability that

the offer would be accepted. Adding device-spe-

cific capabilities, the offer could be delivered by

Figure 2 SMS at the most logical time for decision-making.

cognizant 20-20 insights 3

This is the same approach perfected by Amazon Analytics techniques can also play a signifi-

and other retailers. cant role in the early warning, detection and

monitoring of fraud. These techniques allow

Unstructured data, such as social media com- organizations to extract, analyze, interpret and

ments, can help banks gain insight into what cus- transform business data to help detect potential

tomers like and don’t like about various brands, instances of fraud and implement effective fraud

products and service and also gather feedback monitoring programs (see sidebar).

about their own products and services. By closely

tracking customer comments, banks can quickly Advanced data science techniques could enable

identify issues and take action to improve the cus- institutions to improve underwriting decisions

tomer experience. The instant feedback of social and increase revenues while reducing risk costs.

media also enables banks to capitalize on oppor- These techniques can be fruitful across all asset

tunities to proactively counteract negative per- classes, all types of credit risk models and the

ceptions, exceeding customer expectations and entire credit life cycle, including profit maximiza-

driving loyalty. Banks can also use social media tion and portfolio management.

data to target customers with offers or services

aligned with recent life events (e.g., graduation, For debt collections and recoveries, analytics

marriage, new job). is a critical part of the process, as it can enable

organizations to create an accurate picture of

Data science can help banks recognize behavior the customer’s propensity and ability to pay and,

patterns, providing a complete view of individual therefore, the amount likely to be recovered. This

customers and segments. For example, when a behavioral scoring is used to segment customers

customer enters a bank, customer representa- and prioritize collections activities to maximize

tives can be better equipped to offer the right recoveries and reduce collections costs.

products and provide a quicker resolution to

customer queries by analyzing their Code Halos. Overcoming Challenges

Data science can also be used by banks to analyze What follows are the common obstacles banks

the average cost for each channel (e.g., call center, encounter when attempting to implement an

branch banking, etc.) and design strategies to effective data science strategy.

migrate customers to low-cost channels.

Quick Take

Applying Data Science to Detect Fraud Before The Fact

As an early warning system, data science solutions false positive rates (declines on legitimate trans-

can help banks quickly identify potentially actions).

fraudulent behavior before the fraud becomes

material. For example, individual cardholders are Text analytics of unstructured data can help banks

creatures of habit. Cardholders have “favorites“ identify patterns of information that indicate the

or recurrences over a wide variety of objects in likelihood of fraud. Text mining of insurance claim

their transaction streams. These objects might descriptions (written and recorded) provided by

include favorite ATMs that are close to work or bogus claimants uncovered some very interest-

home or gas stations along a daily commute, as ing facts. It turns out that certain phraseologies

well as preferred grocery stores and online sites (the use of “ed” rather than “ing” on the end of

for shopping. verbs, for instance), are extremely indicative of

fraudulent claims. This is due to the different ways

An analytics technique that could be used to in which people relay stories they actually expe-

improve fraud management is to identify card- rienced vs. those they concocted; for instance “I

holder favorites, in order to distinguish between was walking” is indicative of someone recounting

“in-pattern,” or normal, customer spending and an actual experience whereas “I walked” often

“out-of-pattern” suspicious transaction activity. turns out to be indicative of someone describing

This enables faster fraud detection at much lower a fictitious event.

cognizant 20-20 insights 4

Data Volume tions and patterns. They also need to communi-

Over the last decade, banks have accumulated cate their findings and recommendations to top

huge volumes of data, especially following the leadership. Some of the top skills required for

introduction of smartphones, tablets and now data scientists include analytics know-how, statis-

wearables that enable multi-channel access; tical acumen, domain expertise data mining and

however, many still suffer from a scarcity of the ability to clearly and effectively communicate.

insight. Managing enormous data sets, as well as

analyzing and correlating structured, semi-struc- Looking Forward

tured and unstructured formats, makes the data Today’s knowledge economy provides businesses

science job increasingly complex. of all kinds with access to big data that’s growing

exponentially in volume, variety, velocity and

Distinguishing “signal” (meaningful insight) complexity. With more data coming from more

from “noise” (massive amounts of unmanaged sources faster than ever, the questions will only

data) remains a fundamental challenge and a continue to unfold. Some examples:

significant opportunity. There are various data

cleansing techniques, such as clustering, outlier • What is your organization’s data science

detection, etc., that can help organizations find strategy?

correlations within date sets.

• How is your enterprise combining new and

existing data sources to make better decisions?

Budget Constraints

Banks must be willing to invest significantly in • How could new data sources, including social,

people, infrastructure and platforms to effective- sensors, location and video, help improve your

ly analyze and make strategic decisions from big organization’s business performance?

data. Beyond these investments, such initiatives • Will your organization take advantage of big

also need to strategically align with the bank’s data or remain paralyzed through endless

overall vision and business mission. Such initia- analysis?

tives require qualitative and quantitative scrutiny

A savvy, experienced team of data science con-

in order to prioritize the projects with the highest

sultants can help organizations create a roadmap

payback. Priorities can be determined by strategic

that results in a meaningful, business-aligned

and tactical benefits, cost, duration, people and

approach to data science. Experts can help

technology availability.

implement data science technologies, manage big

Privacy Concerns data, accurately predict customer demand and

make better decisions faster than ever before.

Gaining permission to use and process data from

mobile and social media is a huge challenge. The best approach is to start small rather than

Numerous concerns have been raised over setting off a big bang. The mantra for successful

identity theft, privacy and social media stalking, data science projects depends on the organiza-

among other issues. Within the bank, it is also tion’s business objectives, but one constant is

important to ensure that the right people across focus and agility. For example, if the business

the organization (i.e., bank decision-makers) can need is to define customer segments to drive

access the right data, at the right time. pricing-elasticity models, the IT organization

should first discover which customer data needs

Organizations must also decide who owns the

to be gathered before building an enterprise data

data before a data science project is implement-

warehouse and an enterprise analytics platform.

ed, so that accountability and workflow can be

Experts can develop an initial proof of concept by

properly set and followed.

analyzing the internal, external, structured and

Skilled Talent unstructured data and conclude with meaningful,

There is a huge demand for data scientists, and business-aligned recommendations.

the pool of available talent is insufficient to meet

A blueprint can help guide the organization to

the needs of every organization. Finding highly

develop and implement data science solutions in

skilled data scientists is not easy; they do not

ways that deliver business value. From there, an

simply report on data but look at it from many

implementation strategy followed by a detailed

angles, running complex queries to find correla-

plan can be built (see Figure 3, next page).

cognizant 20-20 insights 5

Data Science Implementation Plan

Detailed

ailed

Implementatio

Implementati

ion implementatio

on

strategy plan

Concept

cept note/

note

proof off concept

pro

I

Internal, external,

social data analysis by

data science

consultant

B siness

Bus

objective

Figure 3

Footnotes

1

For more information on Code Halos, please see our white paper, “Code Rules: A Playbook for Managing

at the Crossroads,” or our recently published book, Code Halos: How the Digital Lives of People, Things

and Organizations Are Changing the Rules of Business.

2

Wikipedia definition, http://en.wikipedia.org/wiki/Big_data.

3

“Three Reasons Why BI and Analytics Is The Top CFO Initiative,” Domo,

http://www.domo.com/learn/3-reasons-why-bi-analytics-is-the-top-cfo-initiative.

4

Anthony Duffy, “Unlocking the Potential of Big Data,” Banking Technology,

http://www.bankingtech.com/58812/unlocking-the-potential-of-big-data/.

About the Authors

Shantanu Dubey is a Consultant within Cognizant Business Consulting’s Banking and Financial Services

Practice. He has over seven years of business and IT consulting experience in implementation of BASEL,

regulatory reporting, business intelligence and core banking solutions. Shantanu also has experience

working with leading banks on product development, business process optimization, business require-

ments management and gap analysis across various geographic locations. He holds a bachelor’s

degree in information and technology engineering from RGPV Bhopal, and a post-graduate diploma in

management from I2it Pune. Shantanu can be reached at Shantanu.dubey@cognizant.com.

Siddhartha Nainwani is a Consultant within Cognizant Business Consulting’s Banking and Financial

Services Practice. He has over seven years of business and IT consulting experience, working with

leading banks in business process management, business analysis and test management across various

geographic locations. Siddhartha holds a bachelor’s degree in engineering in information technology

from Shivaji University, Maharashtra, and a master’s degree in management from ICFAI Business School,

Mumbai. He can be reached at Siddhartha.Nainwani@cognizant.com.

cognizant 20-20 insights 6

About Cognizant

Cognizant (NASDAQ: CTSH) is a leading provider of information technology, consulting, and business process out-

sourcing services, dedicated to helping the world’s leading companies build stronger businesses. Headquartered in

Teaneck, New Jersey (U.S.), Cognizant combines a passion for client satisfaction, technology innovation, deep industry

and business process expertise, and a global, collaborative workforce that embodies the future of work. With over 75

development and delivery centers worldwide and approximately 178,600 employees as of March 31, 2014, Cognizant

is a member of the NASDAQ-100, the S&P 500, the Forbes Global 2000, and the Fortune 500 and is ranked among

the top performing and fastest growing companies in the world. Visit us online at www.cognizant.com or follow us on

Twitter: Cognizant.

World Headquarters European Headquarters India Operations Headquarters

500 Frank W. Burr Blvd. 1 Kingdom Street #5/535, Old Mahabalipuram Road

Teaneck, NJ 07666 USA Paddington Central Okkiyam Pettai, Thoraipakkam

Phone: +1 201 801 0233 London W2 6BD Chennai, 600 096 India

Fax: +1 201 801 0243 Phone: +44 (0) 20 7297 7600 Phone: +91 (0) 44 4209 6000

Toll Free: +1 888 937 3277 Fax: +44 (0) 20 7121 0102 Fax: +91 (0) 44 4209 6060

Email: inquiry@cognizant.com Email: infouk@cognizant.com Email: inquiryindia@cognizant.com

© Copyright 2014, Cognizant. All rights reserved. No part of this document may be reproduced, stored in a retrieval system, transmitted in any form or by any

means, electronic, mechanical, photocopying, recording, or otherwise, without the express written permission from Cognizant. The information contained herein is

subject to change without notice. All other trademarks mentioned herein are the property of their respective owners.

You might also like

- Using The Firo BDocument24 pagesUsing The Firo Bmorris tobingNo ratings yet

- Product: CatalogueDocument92 pagesProduct: CataloguekpbhimaniNo ratings yet

- Using The Firo BDocument24 pagesUsing The Firo Bmorris tobingNo ratings yet

- Nimata IntegrationDocument2 pagesNimata IntegrationkpbhimaniNo ratings yet

- Hadoop TutorialDocument22 pagesHadoop TutorialkpbhimaniNo ratings yet

- Big Data For Enterprise 519135 PDFDocument16 pagesBig Data For Enterprise 519135 PDFElidaNo ratings yet

- Global Mobile Market Fact Book 2008Document60 pagesGlobal Mobile Market Fact Book 2008kpbhimaniNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Data SheetDocument56 pagesData SheetfaycelNo ratings yet

- D E S C R I P T I O N: Acknowledgement Receipt For EquipmentDocument2 pagesD E S C R I P T I O N: Acknowledgement Receipt For EquipmentTindusNiobetoNo ratings yet

- Swelab Alfa Plus User Manual V12Document100 pagesSwelab Alfa Plus User Manual V12ERICKNo ratings yet

- Cameron International Corporation: FORM 10-KDocument31 pagesCameron International Corporation: FORM 10-KMehdi SoltaniNo ratings yet

- EPW, Vol.58, Issue No.44, 04 Nov 2023Document66 pagesEPW, Vol.58, Issue No.44, 04 Nov 2023akashupscmadeeaseNo ratings yet

- E7d61 139.new Directions in Race Ethnicity and CrimeDocument208 pagesE7d61 139.new Directions in Race Ethnicity and CrimeFlia Rincon Garcia SoyGabyNo ratings yet

- بتول ماجد سعيد (تقرير السيطرة على تلوث الهواء)Document5 pagesبتول ماجد سعيد (تقرير السيطرة على تلوث الهواء)Batool MagedNo ratings yet

- Project Name: Repair of Afam Vi Boiler (HRSG) Evaporator TubesDocument12 pagesProject Name: Repair of Afam Vi Boiler (HRSG) Evaporator TubesLeann WeaverNo ratings yet

- "Organized Crime" and "Organized Crime": Indeterminate Problems of Definition. Hagan Frank E.Document12 pages"Organized Crime" and "Organized Crime": Indeterminate Problems of Definition. Hagan Frank E.Gaston AvilaNo ratings yet

- Gas Compressor SizingDocument1 pageGas Compressor SizingNohemigdeliaLucenaNo ratings yet

- Class 12 Physics Derivations Shobhit NirwanDocument6 pagesClass 12 Physics Derivations Shobhit Nirwanaastha.sawlaniNo ratings yet

- Cash Flow July 2021Document25 pagesCash Flow July 2021pratima jadhavNo ratings yet

- Technical Sheet Racloflex NTDocument2 pagesTechnical Sheet Racloflex NTAnthony AngNo ratings yet

- Pitch DeckDocument21 pagesPitch DeckIANo ratings yet

- Leveriza Heights SubdivisionDocument4 pagesLeveriza Heights SubdivisionTabordan AlmaeNo ratings yet

- Sabian Aspect OrbsDocument8 pagesSabian Aspect Orbsellaella13100% (2)

- solidworks ขั้นพื้นฐานDocument74 pagessolidworks ขั้นพื้นฐานChonTicha'No ratings yet

- Section 1 Company Overview StandardsDocument34 pagesSection 1 Company Overview StandardsChris MedeirosNo ratings yet

- Designed For Severe ServiceDocument28 pagesDesigned For Severe ServiceAnthonyNo ratings yet

- BIOAVAILABILITY AND BIOEQUIVALANCE STUDIES Final - PPTX'Document32 pagesBIOAVAILABILITY AND BIOEQUIVALANCE STUDIES Final - PPTX'Md TayfuzzamanNo ratings yet

- Group Case Study Rubric 3Document3 pagesGroup Case Study Rubric 3Saraswathi Asirvatham67% (3)

- LC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Document2 pagesLC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Mahadi Hassan ShemulNo ratings yet

- Bridge Over BrahmaputraDocument38 pagesBridge Over BrahmaputraRahul DevNo ratings yet

- Poster-Shading PaperDocument1 pagePoster-Shading PaperOsama AljenabiNo ratings yet

- Levels of CommunicationDocument3 pagesLevels of CommunicationAiyaz ShaikhNo ratings yet

- (Gray Meyer) Analysis and Design of Analog Integrated Circuits 5th CroppedDocument60 pages(Gray Meyer) Analysis and Design of Analog Integrated Circuits 5th CroppedvishalwinsNo ratings yet

- Diverging Lenses - Object-Image Relations: Previously in Lesson 5 Double Concave LensesDocument2 pagesDiverging Lenses - Object-Image Relations: Previously in Lesson 5 Double Concave LensesleonNo ratings yet

- Structural Design Basis ReportDocument31 pagesStructural Design Basis ReportRajaram100% (1)

- Aditya Academy Syllabus-II 2020Document7 pagesAditya Academy Syllabus-II 2020Tarun MajumdarNo ratings yet

- Calculating Free Energies Using Adaptive Biasing Force MethodDocument14 pagesCalculating Free Energies Using Adaptive Biasing Force MethodAmin SagarNo ratings yet