Professional Documents

Culture Documents

Attachment

Uploaded by

Ressa LiniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Attachment

Uploaded by

Ressa LiniCopyright:

Available Formats

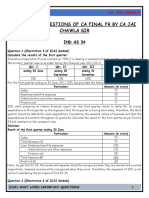

Jawaban 1

a. Peralatan kantor A (Straight Line)

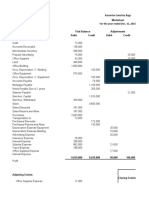

BOOK VALUE BOOK

DEPRECIABLE ANNUAL ACCUMULATE

YEAR BEGINNING RATE VALUE END

COST DEPRECIATION DEPRECIATION

OF YEAR OF YEAR

2014 52.000.000 50.000.000 20% X 5.000.000 5.000.000 47.000.000

6/12

2015 47.000.000 50.000.000 20% 10.000.000 15.000.000 37.000.000

2016 37.000.000 50.000.000 20% x 3.333.333 18.333.333 33.666.667

4/12

Peralatan kantor B (Straight Line)

BOOK VALUE BOOK

DEPRECIABLE ANNUAL ACCUMULATE

YEAR BEGINNING RATE VALUE END

COST DEPRECIATION DEPRECIATION

OF YEAR OF YEAR

2016 75.000.000 70.000.000 20% X 9.333.333 9.333.333 65.666.667

8/12

2017 65.666.667 70.000.000 20% 14.000.000 23.333.333 51.666.667

ACCOUNT TITLES AND

DATE REF DEBIT CREDIT

EXPLANATION

July

3 Office Equipment A 52.000.000

14

Cash 52.000.000

Des 14 31 Depreciation Expense 5.000.000

Acc. Dep – Office Equip A 5.000.000

Des 15 31 Depreciation Expense 10.000.000

Acc. Dep – Office Equip A 10.000.000

April

20 Depreciation Expense 3.333.333

16

Acc. Dep – Office Equip A 3.333.333

April

20 Cash 18.000.000

16

Acc. Dep – Offive Equip A 18.333.333

Loss on Sale 15.666.667

Office Equipment A 52.000.000

April

20 Office Equipment B 75.000.000

16

Cash 75.000.000

Des 16 31 Depreciation Expense 9.333.333

Acc. Dep – Office Equip B 9.333.333

b. Peralatan Toko C (Double Declining)

BOOK VALUE ACCUMULATE

ANNUAL BOOK

YEAR BEGINNING RATE DEPRECIATIO

DEPRECIATION VALUE

YEAR N

2015 48.000.000 40% 19.200.000 19.200.000 28.800.000

2016 28.800.000 40% 11.520.000 30.720.000 17.280.000

ACCOUNT TITLES AND

DATE REF DEBIT CREDIT

EXPLANATION

Jan 15 5 Store Equipment C 48.000.000

Cash 48.000.000

Des 15 31 Depreciation Expense 19.200.000

Acc. Dep – Store Equip C 19.200.000

Des 16 31 Depreciation Expense 11.520.000

Acc. Dep – Store Equip C 11.520.000

Jan 17 5 Acc. Dep – Store Equip C 30.720.000

Loss on Disposal 17.280.000

Store Equipment C 48.000.000

c. Mesin G (Unit of Activity)

𝐻𝑃−𝑁𝑅 300.000.000−30.000.000

Depreciation cost/unit = = = 2700

𝐸𝑠𝑡𝑖𝑚𝑎𝑠𝑖 𝑡𝑜𝑡𝑎𝑙 100.000

ANNUAL ACCUMULATE BOOK

YEAR ESTIMASI COST/UNIT

DEPRECIATION DEPRECIATION VALUE

2015 22.000 2700 59.400.000 59.400.000 240.600.000

2016 21.000 2700 56.700.000 116.100.000 183.900.000

2017 11.000 2700 29.700.000 145.800.000 154.200.000

ACCOUNT TITLES AND

DATE REF DEBIT CREDIT

EXPLANATION

Mei 15 2 Machine G 300.000.000

Cash 300.000.000

Des 15 31 Depreciation Expense 59.400.000

Acc. Dep – Machine G 59.400.000

Des 16 31 Depreciation Expense 56.700.000

Acc. Dep – Machine G 56.700.000

Juni 17 12 Depreciation Expense 29.700.000

Acc. Dep – Store Equip C 29.700.000

Juni 17 12 Cash 180.000.000

Acc. Dep – Store Equip C 145.800.000

Gain on Sale 25.800.000

Machine G 300.000

d. Gedung (Straight Line)

BOOK VALUE BOOK

DEPRECIABLE ANNUAL ACCUMULATE

YEAR BEGINNING RATE VALUE END

COST DEPRECIATION DEPRECIATION

OF YEAR OF YEAR

2015 72.000.000 60.000.000 10% X 4.000.000 4.000.000 68.000.000

8/12

2015 68.000.000 60.000.000 10% 6.000.000 10.000.000 62.000.000

2016 62.000.000 60.000.000 10% 6.000.000 16.000.000 56.000.000

ACCOUNT TITLES AND

DATE REF DEBIT CREDIT

EXPLANATION

Mei 15 5 Land 200.000.000

Building 72.000.000

Cash 272.000.000

Des 15 31 Depreciation Expense 4.000.000

Acc. Dep – Building 4.000.000

Des 16 31 Depreciation Expense 6.000.000

Acc. Dep – Building 6.000.000

Des 17 31 Depreciation Expense 6.000.000

Acc. Dep – Building 6.000.000

Jawaban 2

a. Straight Line

BOOK VALUE BOOK

DEPRECIABLE ANNUAL ACCUMULATE

YEAR BEGINNING RATE VALUE END

COST DEPRECIATION DEPRECIATION

OF YEAR OF YEAR

2016 520.000.000 500.000.000 20% X 33.333.333 33.333.333 486.666.667

4/12

2017 486.666.667 500.000.000 20% 100.000.000 133.333.333 386.666.667

2018 386.666.667 500.000.000 20% 100.000.000 233.333.333 286.666.667

2019 286.666.667 500.000.000 20% 100.000.000 333.333.333 186.666.667

ACCOUNT TITLES AND

DATE REF DEBIT CREDIT

EXPLANATION

Sept 16 10 Machine 520.000.000

Cash 520.000.000

Des 16 31 Depreciation Expense 33.333.333

Acc. Dep – Machine 33.333.333

Des 17 31 Depreciation Expense 100.000.000

Acc. Dep – Machine 100.000.000

Des 18 31 Depreciation Expense 100.000.000

Acc. Dep – Machine 100.000.000

Des 19 31 Depreciation Expense 100.000.000

Acc. Dep – Machine 100.000.000

1 Truck 100.000.000

Acc. Dep – Machine 333.333.333

Loss on Change 86.666.667

Machine 520.000.000

2 Cash 150.000.000

Acc. Dep – Machine 333.333.333

Loss on Sale 36.666.667

Machine 520.000.000

3 Machine – New 236.666.667

Acc. Dep – Machine 333.333.333

Cash 50.000.000

Machine – Old 520.000.000

4 Acc. Dep – Machine 333.333.333

Loss on Disposal 186.666.667

Machine 520.000.000

b. Double Declining

BOOK VALUE

ANNUAL ACCUMULATE

YEAR BEGINNING RATE BOOK VALUE

DEPRECIATION DEPRECIATION

YEAR

2016 520.000.000 40% x 69.333.333 69.333.333 450.666.667

4/12

2017 450.666.667 40% 180.266.667 249.600.000 270.400.000

2018 270.400.000 40% 108.160.000 357.760.000 162.240.000

2019 162.240.000 40% 64.896.000 422.656.000 97.344.000

ACCOUNT TITLES AND

DATE REF DEBIT CREDIT

EXPLANATION

Sept 16 10 Machine 520.000.000

Cash 520.000.000

Des 16 31 Depreciation Expense 69.333.333

Acc. Dep – Machine 69.333.333

Des 17 31 Depreciation Expense 180.266.667

Acc. Dep – Machine 180.266.667

Des 18 31 Depreciation Expense 108.160.000

Acc. Dep – Machine 108.160.000

Des 19 31 Depreciation Expense 64.896.000

Acc. Dep – Machine 64.896.000

1 Truck 100.000.000

Acc. Dep – Machine 422.656.000

Gain on Change 2.656.000

Machine 520.000.000

2 Cash 150.000.000

Acc. Dep – Machine 422.656.000

Gain on Sale 52.656.000

Machine 520.000.000

3 Machine – New 147.344.000

Acc. Dep – Machine 422.656.000

Cash 50.000.000

Machine – Old 520.000.000

4 Acc. Dep – Machine 422.656.000

Loss on Disposal 97.344.000

Machine 520.000.000

c. Unit of Activity

𝐻𝑃−𝑁𝑅 520.000.000−20.000.000

Depreciation cost/unit = 𝐸𝑠𝑡𝑖𝑚𝑎𝑠𝑖 𝑡𝑜𝑡𝑎𝑙

= 100.000

= 5.000

ANNUAL ACCUMULATE

YEAR ESTIMASI COST/UNIT BOOK VALUE

DEPRECIATION DEPRECIATION

2016 20.000 5000 100.000.000 100.000.000 420.000.000

2017 10.000 5000 50.000.000 150.000.000 370.000.000

2018 20.000 5000 100.000.000 250.000.000 270.000.000

2019 30.000 5000 150.000.000 400.000.000 120.000.000

ACCOUNT TITLES AND

DATE REF DEBIT CREDIT

EXPLANATION

Sept 16 10 Machine 520.000.000

Cash 520.000.000

Des 16 31 Depreciation Expense 100.000.000

Acc. Dep – Machine 100.000.000

Des 17 31 Depreciation Expense 50.000.000

Acc. Dep – Machine 50.000.000

Des 18 31 Depreciation Expense 100.000.000

Acc. Dep – Machine 100.000.000

Des 19 31 Depreciation Expense 150.000.000

Acc. Dep – Machine 150.000.000

1 Truck 100.000.000

Acc. Dep – Machine 400.000.000

Loss on Change 20.000.000

Machine 520.000.000

2 Cash 150.000.000

Acc. Dep – Machine 400.000.000

Gain on Sale 30.000.000

Machine 520.000.000

3 Machine – New 170.000.000

Acc. Dep – Machine 400.000.000

Cash 50.000.000

Machine – Old 520.000.000

4 Acc. Dep – Machine 400.000.000

Loss on Disposal 120.000.000

Machine 520.000.000

Jawaban 3

DATE ACCOUNT TITLES AND EXPLANATION REF DEBIT CREDIT

Sept 11 Cash 6.000.000

Share Capital - Ordinary 6.000.000

Sept 15 Cash 3.000.000

Share Capital - Ordinary 3.000.000

Okt 2 Cash 1.500.000

Share Capital - Ordinary 1.000.000

Share Premium - Ordinary 500.000

Okt 10 Cash 7.000.000

Share Capital – Preference 4.000.000

Share Premium - Preference 3.000.000

Okt 19 Share Capital – Treasury 1.500.000

Cash 1.500.000

Nov 5 Cash 50.000

Share Premium – Treasury 100.000

Share Capital – Treasury 150.000

Nov 17 Cash 1.000.000

Share Capital – Treasury 750.000

Share Premium - Treasury 250.000

Nov 21 Cash 32.000.000

Share Capital – Preference 20.000.000

Share Premium - Preference 12.000.000

Nov 25 Cash Dividend/Retained Earning 500.000.000

Dividend Payable 500.000.000

Dec 10 Dividend Payable 500.000.000

Cash 500.000.000

Dec 20 Share Dividend 500.000*

Ordinary Share Dividen DIstributalbe 250.000

Share Premium -Ordinary 250.000

*(5%x10.000) x 1000

Jawaban 4

DATE ACCOUNT TITLES AND EXPLANATION REF DEBIT CREDIT

Jan 2 Cash 1.700.000

Share Capital - Ordinary 1.500.000

Share Premium - Ordinary 200.000

Feb 5 Cash 3.200.000

Share Capital – Ordinary 3.000.000

Share Premium - Ordinary 200.000

Feb 15 Machine 6.000.000

Share Capital – Ordinary 4.500.000

Share Premium - Ordinary 1.500.000

mar 25 Cash 500.000

Share Premium – Ordinary 250.000

Share Capital - Ordinary 750.000

Apr 28 Cash 2.000.000

Share Premium – Ordinary 1.750.000

Share Capital - Ordinary 3.750.000

Mei 3 Share Capital – Treasury 4.800.000

Cash 4.800.000

Mei 6 Share Capital – Treasury 3.600.000

Cash 3.600.000

Juni 7 Cash 2.800.000

Share Capital – Treasury 1.600.000

Share Premium - Treasury 1.200.000

Juni 17 Cash 6.000.000

Share Capital – Treasury 3.200.000

Share Premium - Treasury 2.800.000

Juli 8 Cash 1.700.000

Share Capital – Treasury 900.000

Share Premium - Treasury 800.000

Nov 9 Cash 3.600.000

Share Capital – Treasury 1.800.000

Share Premium - Treasury 1.800.000

Des 3 Cash Dividen 15.000.000

Dividen Payable 15.000.000

Des 26 Dividen Payable 15.000.000

Cash 15.000.000

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Problem I - SolutionsDocument10 pagesProblem I - SolutionsDing CostaNo ratings yet

- Output Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IDocument9 pagesOutput Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IRhealyn Patan-ao LaderaNo ratings yet

- Output Fabm1 Ladera Rhealyn Patan Ao Bsa I PDFDocument9 pagesOutput Fabm1 Ladera Rhealyn Patan Ao Bsa I PDFHaries Vi Traboc Micolob100% (1)

- Corazon Tabaranza Worksheet For The Month Ended December 31, 20ADocument9 pagesCorazon Tabaranza Worksheet For The Month Ended December 31, 20AHaries Vi Traboc MicolobNo ratings yet

- Ujikom PT Cahaya 18-19Document37 pagesUjikom PT Cahaya 18-19Jessyca GunawanNo ratings yet

- Appendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessDocument14 pagesAppendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessLan Hương Trần ThịNo ratings yet

- Financial Analysis Exercise PDFDocument2 pagesFinancial Analysis Exercise PDFKharen BermudezNo ratings yet

- Departmental Accounting IllustrationsDocument13 pagesDepartmental Accounting IllustrationsHarsha BabyNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- ExpensesDocument3 pagesExpensesJezerie Kaye T. FerrerNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- B. (Basis of Findings Is The Missallocation of Payment From Zebra Computers)Document6 pagesB. (Basis of Findings Is The Missallocation of Payment From Zebra Computers)Kathlyn Joyce SumangNo ratings yet

- The Answer For The Exercise of Trading Company The ABC StoreDocument6 pagesThe Answer For The Exercise of Trading Company The ABC StoreSajakul SornNo ratings yet

- AccountingDocument16 pagesAccountingSheridan AcosmistNo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- Review Answer SheetDocument13 pagesReview Answer SheetKeycee Rhaye RivasNo ratings yet

- Technopreneurship PPT Presentation Group 1Document57 pagesTechnopreneurship PPT Presentation Group 1Mia ElizabethNo ratings yet

- Practice Problem Set 9 - Long ProblemDocument7 pagesPractice Problem Set 9 - Long ProblemMarian Augelio PolancoNo ratings yet

- UAS Pengantar AkuntansiDocument16 pagesUAS Pengantar Akuntansikanisa.agustinapnNo ratings yet

- Tan Vernon Jay Homework 6Document9 pagesTan Vernon Jay Homework 6ASHANTI JANE EREDIANONo ratings yet

- Advanced Accounting 3Document1 pageAdvanced Accounting 3Tax TrainingNo ratings yet

- Sarmiento - Prefinal Accounting ActivityDocument11 pagesSarmiento - Prefinal Accounting ActivityNicole SarmientoNo ratings yet

- Assignment No. 6Document14 pagesAssignment No. 6Angela MacailaoNo ratings yet

- Answer Key For Module 4 To 10 1Document8 pagesAnswer Key For Module 4 To 10 1mae annNo ratings yet

- Mas ReviewerDocument14 pagesMas ReviewerMichelle AvilesNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Worksheet Complete Exercise ns3Document8 pagesWorksheet Complete Exercise ns3Steven consueloNo ratings yet

- 2020 Expenses: What SUP, Inc. Income Statement For The Year EndedDocument5 pages2020 Expenses: What SUP, Inc. Income Statement For The Year EndedRi BNo ratings yet

- Abigail Santos Boutique, Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- AssignmentDocument1 pageAssignmentwajihaabid441No ratings yet

- POWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Document30 pagesPOWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Phaelyn YambaoNo ratings yet

- Project and Risk AnalysisDocument2 pagesProject and Risk AnalysisvipukNo ratings yet

- Computation For Exercise 1Document10 pagesComputation For Exercise 1Xyzra AlfonsoNo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- 10 Column Worksheet FormDocument1 page10 Column Worksheet Formcatherinemariposa001No ratings yet

- Work Sheet Moises Dondoyano Information SystemDocument1 pageWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)

- 2017 Fall Solution: Sales BudgetDocument3 pages2017 Fall Solution: Sales BudgetRaam Tha BossNo ratings yet

- Santiago Pest Control General Journal For The Month of November 2021 Date 2021 Account Title Debit CreditDocument10 pagesSantiago Pest Control General Journal For The Month of November 2021 Date 2021 Account Title Debit CreditItsRenz YTNo ratings yet

- Fin420 AssignmentDocument2 pagesFin420 Assignment2023607226No ratings yet

- Target Market Every Month 3,600.00 Average Sales Per Customer 25.00Document4 pagesTarget Market Every Month 3,600.00 Average Sales Per Customer 25.00Mark Harold RaspadoNo ratings yet

- Module 3 DepreciationDocument4 pagesModule 3 DepreciationLouie Jay JadraqueNo ratings yet

- L18.12 UTS 1718 v3Document11 pagesL18.12 UTS 1718 v3AnggiNo ratings yet

- John Bala Company Worksheet: Unadjusted Trial Balance DebitDocument9 pagesJohn Bala Company Worksheet: Unadjusted Trial Balance DebitJekoeNo ratings yet

- Date Account Debit Credit: T Accounts CashDocument8 pagesDate Account Debit Credit: T Accounts CashFiona SolacitoNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- DSCR Calculation-RAJ SHOES HOUSEDocument7 pagesDSCR Calculation-RAJ SHOES HOUSEPRADEEP KUMAR VISHWAKARMANo ratings yet

- Answers To CH 2 - FTW ProblemsDocument14 pagesAnswers To CH 2 - FTW ProblemsJuanito Jr. LagnoNo ratings yet

- Financial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsDocument4 pagesFinancial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsRajay BramwellNo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- Past Paper Answers - 2017 (B) : Business Name:-NM Company LTDDocument42 pagesPast Paper Answers - 2017 (B) : Business Name:-NM Company LTDName of RoshanNo ratings yet

- SM 9Document12 pagesSM 9wtfNo ratings yet

- PTAccountingDocument13 pagesPTAccountingLAN ONLINENo ratings yet

- CalculationDocument8 pagesCalculationTheva LetchumananNo ratings yet

- CashflowDocument5 pagesCashflowHanan SalmanNo ratings yet

- RRP 2021 Economy TerminologyDocument64 pagesRRP 2021 Economy TerminologytibowehoxNo ratings yet

- Chapter 13-Inv Center TranspferpricingDocument41 pagesChapter 13-Inv Center TranspferpricingKaren hapukNo ratings yet

- Pt. Indofood 2011-2012Document2 pagesPt. Indofood 2011-2012Intan Noviana SafitriNo ratings yet

- Introduction To Salaries Wages Income and BenefitsDocument14 pagesIntroduction To Salaries Wages Income and BenefitsYAHIKOヤヒコYUICHIゆいちNo ratings yet

- Research ProjectDocument28 pagesResearch ProjectNayomi Ekanayake100% (1)

- Furnmart Ltd. (FURNMART-BW) - Interim Report For Period End 31-Jan-2018 (English) PDFDocument1 pageFurnmart Ltd. (FURNMART-BW) - Interim Report For Period End 31-Jan-2018 (English) PDFmisterbeNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVivek SinghNo ratings yet

- E-Portfolio (PAS 1)Document6 pagesE-Portfolio (PAS 1)Kaye NaranjoNo ratings yet

- Income Tax Calculator 2023Document50 pagesIncome Tax Calculator 2023TARUN PRASADNo ratings yet

- Mankiw Economics - Chapter 23Document54 pagesMankiw Economics - Chapter 23Er Wynn33% (3)

- Develop and Understand TaxationDocument26 pagesDevelop and Understand TaxationNigussie BerhanuNo ratings yet

- Ind As 34Document3 pagesInd As 34qwertyNo ratings yet

- Intermediate Accounting I - Chapter 1Document35 pagesIntermediate Accounting I - Chapter 1Wijdan Saleem EdwanNo ratings yet

- RandDocument16 pagesRandMmNo ratings yet

- Pay SlipDocument1 pagePay Slipgopal venuNo ratings yet

- Macro Economics KLE Law College NotesDocument193 pagesMacro Economics KLE Law College Noteslakshmipriyats1532No ratings yet

- SL InstalsDocument4 pagesSL InstalsMarjorie Kate PagaoaNo ratings yet

- Magtabog Hwchap3Document5 pagesMagtabog Hwchap3Jerickho JNo ratings yet

- Week 4 Course Material For Income TaxationDocument12 pagesWeek 4 Course Material For Income TaxationAshly MateoNo ratings yet

- Assignment 2 MIS 207 1612631030Document6 pagesAssignment 2 MIS 207 1612631030shamim islam limonNo ratings yet

- Straight Line MethodsDocument3 pagesStraight Line MethodsAsif BalochNo ratings yet

- Business ProposalDocument4 pagesBusiness ProposalCatherine Avila IINo ratings yet

- Whole 72Document187 pagesWhole 72Kule89No ratings yet

- VHINSON - Intermediate Accounting 3 (2023 - 2024 Edition) - 99Document1 pageVHINSON - Intermediate Accounting 3 (2023 - 2024 Edition) - 99Alyssa NacionNo ratings yet

- ReSA B44 FAR Final PB Exam Questions Answers and SolutionsDocument22 pagesReSA B44 FAR Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- Minggu 05 EKONOMI WILAYAH 2019 PDFDocument56 pagesMinggu 05 EKONOMI WILAYAH 2019 PDFLutfi AjiNo ratings yet

- Sample Paper-05 (2016-17) Economics Class - XII Time Allowed: 3 Hours Maximum Marks: 100 AnswersDocument6 pagesSample Paper-05 (2016-17) Economics Class - XII Time Allowed: 3 Hours Maximum Marks: 100 AnswerspariteotiaNo ratings yet

- Img 20200707 0003 PDFDocument26 pagesImg 20200707 0003 PDFJade MarieNo ratings yet

- Code Qualification Gross SalaryDocument6 pagesCode Qualification Gross SalaryLatoya ThompsonNo ratings yet

- World Inequality Report 2022Document236 pagesWorld Inequality Report 2022Susy DávilaNo ratings yet