Professional Documents

Culture Documents

Adverse Action

Uploaded by

coreyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adverse Action

Uploaded by

coreyCopyright:

Available Formats

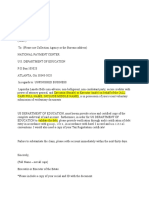

Adverse Action Notice

Date: 11/30/2018

Member's Name: Jason A Polovich Member/Account Number: 0024837503

Member's Address: 13010 PHOEBE CT WEEKI WACHEE FL 34614

Description of Account, Transaction, or Requested Credit: Used Auto Loan

ACTION TAKEN AFFECTING CREDIT REQUEST OR EXISTING CREDIT

Date of Loan Request: 11/28/2018 Amount of Loan Requested $ 13000.00

We are unable to process your application because we require Your credit has been terminated for the following account:

the following information to make a decision:

We are unable to extend credit on the terms you requested but can offer

If we do not receive this information by credit on the following terms:

we will be unable to consider your application.

X We are unable to extend credit to you at this time.

Your credit limit has been decreased to $ If this offer is acceptable to you, please notify us no later than

We are unable to honor your request to increase your credit limit. at the address at the top of this notice.

Other:

ACTION TAKEN AFFECTING SHARE DRAFT/CHECKING OR OTHER ACCOUNT OR SERVICE

At this time we are unable to offer you: ATM card Debit card Share draft/checking account

We have terminated/closed your: ATM card Debit card Share draft/checking account

We have suspended your: ATM card Debit card Share draft/checking account

Other:

PART I - PRINCIPAL REASON(S) FOR CREDIT DENIAL, TERMINATION, OR OTHER ACTION TAKEN

This section must be completed in all instances.

Incomplete identity information X Limited credit experience

Unable to verify identity Poor credit performance with us

Credit application incomplete Delinquent past or present credit obligations with others

Insufficient number of credit references provided Collection action or judgment

Unacceptable type of credit references provided Garnishment or attachment

Unable to verify credit references Foreclosure or repossession

Temporary or irregular employment Bankruptcy

Unable to verify employment X Number of recent inquiries on credit bureau report

Length of employment Value or type of collateral not sufficient

Income insufficient for amount of credit requested We do not offer the type of credit requested

Excessive obligations in relation to income You are not eligible for membership in this credit union

Unable to verify income X Other, specify:

Length of residence Number of recently opened new credit accounts

Temporary residence

Unable to verify residence

No credit file

PART II - DISCLOSURE OF USE OF INFORMATION OBTAINED FROM AN OUTSIDE SOURCE

This section should be completed if the credit decision was based in whole or in part on information that has been obtained from an outside source.

Section A applies only if consumer reporting agency information is used. Section B applies only if an outside source other than a consumer reporting

agency is used.

SECTION A

X Our credit decision was based in whole or in part on information obtained in a report from a consumer reporting agency listed on the next page.

You have a right under the Fair Credit Reporting Act to know the information contained in your credit file at the consumer reporting agency. The

reporting agency played no part in our decision and is unable to supply specific reasons why we have denied credit to you.

You also have a right to a free copy of your report from the reporting agency, if you request it no later than 60 days after you receive this notice. In

addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter

with the reporting agency.

PLEASE SEE NEXT PAGE FOR EQUAL CREDIT OPPORTUNITY ACT NOTICE

FOR CREDIT UNION USE ONLY

Employee initials:________________________________________________________________________________ Date mailed or delivered: ________________

CUNA Mutual Group 1980, 82, 84, 86, 90,

2000, 01, 03, 06-08, 10-12 All Rights Reserved MXX07A-e

PART II - DISCLOSURE OF USE OF INFORMATION OBTAINED FROM AN OUTSIDE SOURCE (continued)

We obtained information from the following consumer reporting agency to make our decision about the action(s) on the previous page:

Experian X TransUnion Equifax

701 Experian Parkway P.O. Box 1000 P.O. Box 740241

P.O. Box 2002 Chester, PA 19022 Atlanta, GA 30374-0241

Allen, TX 75013 1.800.888.4213 1.800.685.1111

1.888.397.3742 www.transunion.com/myoptions www.equifax.com

www.experian.com/reportaccess

Name of Consumer Reporting Agency:

Street Address: Telephone Number:

City, State, Zip: Website Address:

TransUnion

X We also obtained your credit score from ____________________________________________________________ and used it in making our credit

(single consumer reporting agency)

decision. Your credit score is a number that reflects the information in your credit report. Your credit score can change, depending on how the

information in your credit report changes.

Your credit score is: 692 Date: 11/28/2018 Scores range from a low of 300 to a high of 850

Key factors that adversely affected your credit score

Proportion of balances to credit limits on bank/national revolving or other revolving accounts is too high

Proportion of loan balances to loan amounts is too high

Length of time revolving accounts have been established

Length of time accounts have been established

Number of recent inquiries on credit bureau report

SECTION B

Our credit decision was based in whole or in part on information obtained from an affiliate or from an outside source other than a consumer

reporting agency. Under the Fair Credit Reporting Act, you have the right to make a written request, no later than 60 days after you receive this

notice, for disclosure of the nature of this information. To receive this disclosure, contact the credit union.

EQUAL CREDIT OPPORTUNITY ACT NOTICE

The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national

origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant's income

derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act.

The Federal agency that administers compliance with this law concerning this creditor is listed below.

NOTE: If your credit union is federally chartered, its name will end with the words "Federal Credit Union" or the letters "FCU". If your credit union is

state chartered, the end of its name will not contain the word "Federal" in the last three words or the letter "F" in the last three letters if its name is

abbreviated.

FEDERAL CHARTERED CREDIT UNIONS

Over $10 billion in assets: Bureau of Consumer Financial Protection, 1700 G Street NW., Washington, DC 20006

Assets $10 billion and under: National Credit Union Administration, Office of Consumer Protection, 1775 Duke Street, Alexandria, VA

22314

STATE CHARTERED CREDIT UNIONS

Federal Trade Commission, Equal Credit Opportunity, Washington, DC 20580

CONNECTICUT NOTICE

THE CONNECTICUT HOME MORTGAGE DISCLOSURE ACT PROHIBITS DISCRIMINATION AGAINST HOME PURCHASE LOAN, HOME

IMPROVEMENT LOAN OR OTHER MORTGAGE LOAN APPLICANTS SOLELY ON THE BASIS OF THE LOCATION OF THE PROPERTY TO

BE USED AS SECURITY. THE AGENCY WHICH ENFORCES COMPLIANCE WITH THIS LAW IS:

DEPARTMENT OF BANKING

260 CONSTITUTION PLAZA

HARTFORD, CONNECTICUT 06103

IF YOU BELIEVE YOU HAVE BEEN UNFAIRLY DISCRIMINATED AGAINST, YOU MAY FILE A WRITTEN COMPLAINT WITH THE

COMMISSIONER OF BANKING AT THE ABOVE ADDRESS.

If you have any questions regarding any of the information on this document,

please contact us at the credit union address or phone number listed.

MXX07A-e

You might also like

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- A Summary of Your Rights Under The Fair Credit Reporting ActDocument4 pagesA Summary of Your Rights Under The Fair Credit Reporting ActKathieNo ratings yet

- Permissible PurposeDocument1 pagePermissible PurposeG.T. HensleyNo ratings yet

- Frivolous Dispute ResponseDocument1 pageFrivolous Dispute ResponseRoberto MonterrosaNo ratings yet

- Model Credit Union Law 2015Document80 pagesModel Credit Union Law 2015DuyAnh NguyễnNo ratings yet

- 1099 File Check ListDocument1 page1099 File Check ListkakoslipNo ratings yet

- Assignments of DebtsDocument17 pagesAssignments of DebtsWahanze RemmyNo ratings yet

- Discover Bank v. ShimerDocument4 pagesDiscover Bank v. ShimerKenneth SandersNo ratings yet

- 1 Contract - Offer and AcceptanceDocument3 pages1 Contract - Offer and AcceptanceJulianne Mari WongNo ratings yet

- Adverse Action NoticeDocument2 pagesAdverse Action Noticehyeso leeNo ratings yet

- Affidavi BeneficiaryDocument1 pageAffidavi Beneficiaryferryberryhill100% (1)

- IV. Fair Lending - Fair Lending Laws and Regulations: Supplement I 12 CFR Part 1002Document25 pagesIV. Fair Lending - Fair Lending Laws and Regulations: Supplement I 12 CFR Part 1002Priya DasNo ratings yet

- Credit ApplicationDocument3 pagesCredit ApplicationShelbyElliottNo ratings yet

- US Internal Revenue Service: F1099a - 1998Document6 pagesUS Internal Revenue Service: F1099a - 1998IRSNo ratings yet

- Chapter 5 Group 4 REPORT 1Document47 pagesChapter 5 Group 4 REPORT 1Soguilon Jay Ann V.No ratings yet

- 24 Hour Hard Inquiry RemovalDocument8 pages24 Hour Hard Inquiry Removalwadealexus50No ratings yet

- Form 231 - Power of Attorney - Notarize It 2Document2 pagesForm 231 - Power of Attorney - Notarize It 2Hï FrequencyNo ratings yet

- Fraud Reversal Investigation - w9 RequestDocument2 pagesFraud Reversal Investigation - w9 Requestcamwills275% (4)

- Us Bank NoteDocument2 pagesUs Bank NoteLamario StillwellNo ratings yet

- Equifax Inc., A Corporation v. Federal Trade Commission, 678 F.2d 1047, 11th Cir. (1982)Document11 pagesEquifax Inc., A Corporation v. Federal Trade Commission, 678 F.2d 1047, 11th Cir. (1982)Scribd Government DocsNo ratings yet

- Ach Payment - Facebook-Discharge Debt LetterDocument2 pagesAch Payment - Facebook-Discharge Debt LetterJohnson DamitaNo ratings yet

- ChexSystems ID Theft AffidavitDocument4 pagesChexSystems ID Theft AffidavitPeggy PattenNo ratings yet

- OCC Guidance On Unfair or Deceptive Acts or Practices Advisory-Letter-2002-3Document8 pagesOCC Guidance On Unfair or Deceptive Acts or Practices Advisory-Letter-2002-3Charlton ButlerNo ratings yet

- Sally Jacobs Obama SR USCIS File FOIA AppealDocument60 pagesSally Jacobs Obama SR USCIS File FOIA AppealhsmathersNo ratings yet

- UnpublishedDocument23 pagesUnpublishedScribd Government DocsNo ratings yet

- Credit Inquiry Removal RequestDocument1 pageCredit Inquiry Removal RequestRoberto MonterrosaNo ratings yet

- Letter To Stefanie Isser Goldblatt, CFPB Senior Litigation Counsel Dec-23-2015Document131 pagesLetter To Stefanie Isser Goldblatt, CFPB Senior Litigation Counsel Dec-23-2015Neil Gillespie100% (1)

- Gordon v. Paypal - ComplaintDocument22 pagesGordon v. Paypal - ComplaintAdam SteinbaughNo ratings yet

- 2021.09.23 - Direct Forgiveness Lender ListDocument31 pages2021.09.23 - Direct Forgiveness Lender ListCharles GoodwinNo ratings yet

- Indigency Application (Completed) PDFDocument4 pagesIndigency Application (Completed) PDFdcarson90No ratings yet

- Bill of ExchangeDocument13 pagesBill of ExchangeShiwaniSharmaNo ratings yet

- Consent For Background Screening: Certification & Release - AcceptedDocument9 pagesConsent For Background Screening: Certification & Release - AcceptedpragmsNo ratings yet

- Information Referral: Section A - Information About The Person or Business You Are ReportingDocument3 pagesInformation Referral: Section A - Information About The Person or Business You Are ReportingEMV ISLANDNo ratings yet

- US Internal Revenue Service: f709 - 2005Document4 pagesUS Internal Revenue Service: f709 - 2005IRS100% (1)

- Billing Summary Contact Us: Date Item AmountDocument2 pagesBilling Summary Contact Us: Date Item AmountPrince Marcos CortezNo ratings yet

- Claim For Lost, Stolen, or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen, or Destroyed United States Savings BondsMr McBrideNo ratings yet

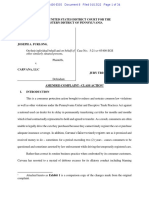

- Carvana Class-Action LawsuitDocument34 pagesCarvana Class-Action LawsuitMallory SofastaiiNo ratings yet

- Five Star Application FormDocument5 pagesFive Star Application Formkamran1983No ratings yet

- Tax Remedies: Buslaw3 Atty. MGCDDocument42 pagesTax Remedies: Buslaw3 Atty. MGCDLourenzo GardiolaNo ratings yet

- 1 Disclosure StatementDocument3 pages1 Disclosure Statementkim100% (1)

- Instructions For Completing The Id Theft AffidavitDocument8 pagesInstructions For Completing The Id Theft Affidavitgarcia85100% (1)

- Peixoto, Angel - IRS Form 2848Document2 pagesPeixoto, Angel - IRS Form 2848MariaNo ratings yet

- Electronic or PDF Remittance Advice Request Form InstructionsDocument1 pageElectronic or PDF Remittance Advice Request Form Instructionsapi-240084111No ratings yet

- FCRA Notice PDFDocument2 pagesFCRA Notice PDFLucas De Oliveira100% (1)

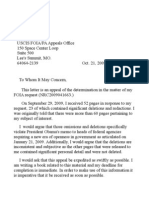

- Nov FOIA Request GmailDocument6 pagesNov FOIA Request GmailJohn Hugh DeMastriNo ratings yet

- Credit Acceptance ContractDocument23 pagesCredit Acceptance Contractrosado197777No ratings yet

- PDF 0093 Annual Report Request FormDocument1 pagePDF 0093 Annual Report Request FormAdolfo Montero TerretoNo ratings yet

- UCC1 FINANCING STATEMENT Dawud Bey Creditor Wells Fargo Bank DebtorDocument1 pageUCC1 FINANCING STATEMENT Dawud Bey Creditor Wells Fargo Bank DebtorBilal Yusef El Abdullah BeyNo ratings yet

- SBPC Letter Regarding Climb CreditDocument25 pagesSBPC Letter Regarding Climb CreditAarthiNo ratings yet

- Andrew Ladick v. Gerald J. Van Gemert Law Offices of Gerald J. Van Gemert, A Professional Corporation, 146 F.3d 1205, 10th Cir. (1998)Document4 pagesAndrew Ladick v. Gerald J. Van Gemert Law Offices of Gerald J. Van Gemert, A Professional Corporation, 146 F.3d 1205, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- Closed School Loan Discharge FormDocument5 pagesClosed School Loan Discharge FormLiza GeorgeNo ratings yet

- Foods StampsDocument6 pagesFoods Stampsapi-2728605280% (1)

- Fss 4Document2 pagesFss 4Russell Hartill100% (1)

- Application For Assistance: Division of Welfare and Supportive ServicesDocument17 pagesApplication For Assistance: Division of Welfare and Supportive ServicesspunisphunNo ratings yet

- De 1000 MDocument2 pagesDe 1000 MAnonymous ghzKEH21fNo ratings yet

- Form - FR2046 - Selected Balance Sheet Items For Discount Window BorrowersDocument1 pageForm - FR2046 - Selected Balance Sheet Items For Discount Window BorrowersPratus WilliamsNo ratings yet

- Frivolous Dispute Response AlternativeDocument1 pageFrivolous Dispute Response AlternativeRoberto MonterrosaNo ratings yet

- BanksandbankingDocument6 pagesBanksandbankingRene SmithNo ratings yet

- Ewellery Ndustry: Presentation OnDocument26 pagesEwellery Ndustry: Presentation Onharishgnr0% (1)

- VB 850Document333 pagesVB 850Laura ValentinaNo ratings yet

- Planas V Comelec - FinalDocument2 pagesPlanas V Comelec - FinalEdwino Nudo Barbosa Jr.100% (1)

- For Email Daily Thermetrics TSTC Product BrochureDocument5 pagesFor Email Daily Thermetrics TSTC Product BrochureIlkuNo ratings yet

- Musings On A Rodin CoilDocument2 pagesMusings On A Rodin CoilWFSCAO100% (1)

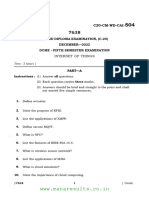

- WWW - Manaresults.co - In: Internet of ThingsDocument3 pagesWWW - Manaresults.co - In: Internet of Thingsbabudurga700No ratings yet

- Part A Plan: Simple Calculater Using Switch CaseDocument7 pagesPart A Plan: Simple Calculater Using Switch CaseRahul B. FereNo ratings yet

- Mathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Document6 pagesMathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Kenneth NuñezNo ratings yet

- Chapter 1.4Document11 pagesChapter 1.4Gie AndalNo ratings yet

- Pediatric Skills For OT Assistants 3rd Ed.Document645 pagesPediatric Skills For OT Assistants 3rd Ed.Patrice Escobar100% (1)

- Harga H2H Pula-Paket Data - Saldo EWallet v31012022Document10 pagesHarga H2H Pula-Paket Data - Saldo EWallet v31012022lala cemiNo ratings yet

- Software Hackathon Problem StatementsDocument2 pagesSoftware Hackathon Problem StatementsLinusNelson100% (2)

- Is 10719 (Iso 1302) - 1Document1 pageIs 10719 (Iso 1302) - 1Svapnesh ParikhNo ratings yet

- Faculty of Business and Law Assignment Brief Mode E and R RegulationsDocument4 pagesFaculty of Business and Law Assignment Brief Mode E and R RegulationsSyeda Sana Batool RizviNo ratings yet

- Chap 06 Ans Part 2Document18 pagesChap 06 Ans Part 2Janelle Joyce MuhiNo ratings yet

- Mathematical Geophysics: Class One Amin KhalilDocument13 pagesMathematical Geophysics: Class One Amin KhalilAmin KhalilNo ratings yet

- Tax Accounting Jones CH 4 HW SolutionsDocument7 pagesTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraNo ratings yet

- Tank Emission Calculation FormDocument12 pagesTank Emission Calculation FormOmarTraficanteDelacasitosNo ratings yet

- Journalism Cover Letter TemplateDocument6 pagesJournalism Cover Letter Templateafaydebwo100% (2)

- SPIE Oil & Gas Services: Pressure VesselsDocument56 pagesSPIE Oil & Gas Services: Pressure VesselsSadashiw PatilNo ratings yet

- Catalogue of The Herbert Allen Collection of English PorcelainDocument298 pagesCatalogue of The Herbert Allen Collection of English PorcelainPuiu Vasile ChiojdoiuNo ratings yet

- Ril Competitive AdvantageDocument7 pagesRil Competitive AdvantageMohitNo ratings yet

- Land Use Paln in La Trinidad BenguetDocument19 pagesLand Use Paln in La Trinidad BenguetErin FontanillaNo ratings yet

- Alphacenter Utilities: Installation GuideDocument24 pagesAlphacenter Utilities: Installation GuideJeffersoOnn JulcamanyanNo ratings yet

- Actus Reus and Mens Rea New MergedDocument4 pagesActus Reus and Mens Rea New MergedHoorNo ratings yet

- MPPWD 2014 SOR CH 1 To 5 in ExcelDocument66 pagesMPPWD 2014 SOR CH 1 To 5 in ExcelElvis GrayNo ratings yet

- Cinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Document8 pagesCinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Social Scientists' AssociationNo ratings yet

- TRX Documentation20130403 PDFDocument49 pagesTRX Documentation20130403 PDFakasameNo ratings yet

- Coursework For ResumeDocument7 pagesCoursework For Resumeafjwdxrctmsmwf100% (2)

- Salva v. MakalintalDocument2 pagesSalva v. MakalintalGain DeeNo ratings yet