Professional Documents

Culture Documents

OBN 2 - Avalon Holdings - Issue 17

Uploaded by

Nate TobikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OBN 2 - Avalon Holdings - Issue 17

Uploaded by

Nate TobikCopyright:

Available Formats

THE ODDBALL STOCKS NEWSLETTER 6

Avalon Holdings

Ticker: AWX Price: $2.60

I worked in a factory one summer break during college. I never set out to

work in a factory, but my parents believed that I needed factory experience

to balance out growing up in an upper middle class area and to learn the

value of a dollar. While friends were busy with internships that involved

filing papers and getting coffee, I worked in an auto parts factory. Perhaps I

should consider myself fortunate as my brothers worked construction and

welded.

I’m not sure if this experience taught me the value of a dollar or not, but I

did learn some useful trade skills. But one thing I do remember from my

factory days was getting stuck taking out the trash. Some workers liked this

job because there was a wooded area by the dumpster they could take a nap

in (apparently lengthy trash trips were expected). I hated it because the

dumpsters were filled with metal, oil, and other industrial waste.

One afternoon while on trash duty with a co-worker a giant tank truck

pulled up. Like any good factory worker we proceeded to shoot the breeze

with the driver for a half hour just killing time. Little did I know that that

conversation would provide enlightenment with respect to an investment a

mere 16 years later.

The driver worked for a specialty waste company located in the Youngstown,

Ohio area. He said entry-level drivers started at $60,000, a good salary in

2001, especially for driving a truck. The drivers had routes through the rust

belt stopping at different industrial facilities draining the sludge out of

dumpsters and waste tanks. Industrial sludge is toxic and requires special

handling. Factories pay a lot of money to remove this stuff before their

trash can be recycled.

The auto parts factory I worked at was a metal stamping plant. Steel came

to the factory in rolls and was fed into stamping machines. The machines

pushed thousands of pounds of weight down on to metal dies that then

formed the sheet metal. Think of it like stamping out Christmas cookies

with a Rudolph stamp, except with metal. When you stamp out cookies you

never use all of the dough, there’s always scrap pieces left. It’s the same

with stamping out metal. The question is how do you dispose of dumpsters

full of discarded metal pieces? Most of it is melted down and recycled, but

along with the metal scraps there is a lot of oil and other heavy chemical

lubricants mixed in. These fluids sink to the bottom of the dumpsters and

can leak onto the ground.

Copyright Red River Research Inc. 2017

THE ODDBALL STOCKS NEWSLETTER 7

The waste hauler who I spoke with that day specialized in transporting and

disposing of these heavy chemicals. So I was very intrigued when I found an

Ohio-based company called Avalon Holdings in which the primary business is

specialty waste disposal.

In 2016 the company generated $44.3m of revenue (up from $38m in 2015)

from waste hauling and related brokerage services. First quarter 2017

revenue was on track with 2016’s pace. A portion of the company’s revenue

is produced by project-based work. For example, there might be a

construction site that needs waste removed until a building is completed.

Other waste revenue comes from continuing sources, such as the factory I

worked at in college.

One area of potential growth for the company is disposing of salt water and

fracking fluid from the natural gas fracking activity in Ohio. This looked like

a promising business venture for Avalon Holdings until August of 2014 when

a seismic “event” occurred potentially as a result of their waste disposal.

The way companies dispose of drilling waste is to pump it back into the

ground to fill the hole that natural gas or oil left when it was extracted. In

theory this makes perfect sense, but geologists aren’t quite sure of the actual

impact of doing so.

Following the seismic “event,” Avalon Holdings was ordered by the Ohio

Department of Natural Resources to stop their saltwater waste injections

and this decision is now tied up in the Ohio courts. In February of 2017, the

court issued their final order stating that they didn’t believe the company

had caused this situation and that other seismic activity of a similar nature

had been observed in the same area. In theory this judgment opened the

door for the company to continue their salt water injections, however the

regulators filed a Motion to Stay the next day. In a separate action the

company filed suit against the Ohio Department of Natural Resources

alleging an illegal taking and unclear rules and regulations.

For those who love court dramas this could become quite a show. But, for

investors it will probably just mean years of legal bills before there is a

definitive outcome. In fact, the company may decide to move on from

saltwater wells regardless of the litigation outcome. They mention in their

2016 annual report that they weren’t even sure if they would re-open their

wells if permitted.

Out of the $44.3m in revenue the waste business produced in 2016, it

generated $2.7m in pre-tax income. In 2015 it generated $1.7m in pre-tax

income from $38m in revenue. If Avalon Holdings were simply a waste

manager we could look at their assets, slap a multiple on their income and

call it a day.

Copyright Red River Research Inc. 2017

THE ODDBALL STOCKS NEWSLETTER 8

Let’s stop here for a quick minute and review some basic facts about the

company. They have a market cap of $9.8m, which is tiny, and seemingly

very strange when looking just at the waste management company. At

current prices, the market is saying that $2.7m in pre-tax waste hauling

income is only worth $9.8m, a 3.63x multiple.

So what’s dragging down the price? In addition to the waste management

business, there is another half to the company that I haven’t mentioned yet.

This would be Avalon Clubs and Resorts, which is a combination of three golf

courses and the Avalon Inn, a newly remodeled hotel abutting the Avalon

Golf and Country Club property.

It seems crazy that a profitable waste company would acquire money-losing

golf courses and then pile on with a hotel. But is it? I have a small

confession to make. If I ever came into silly money, or had funds to spend

on fun purchases, I’d probably consider buying uneconomical things like ski

resorts. Why? Because I like to ski and from what I understand there’s

nothing like skiing at your very own resort. I view golf course ownership in

the same way. The executives at Avalon Holdings enjoy golf, and these are

status purchases. The problem is they’re using shareholder money, not their

own funds, for these purchases.

The primary reason golf courses are a problem is because less people are

playing golf. According to a recent Bloomberg article, the number of people

who played golf in 2016 was 20 million, down from 30 million in 2001.

That’s a big drop. The sport is in decline. The average age of a golfer is 44

and younger people have less and less desire to play golf.

Personally, I have a few anecdotal observations regarding this. When I was

growing up my father was a salesman, and in sales playing golf was

mandatory. Beyond playing for work he played in leagues, along with

playing a night a week and the occasional weekend. It was pounded into our

heads as little kids that success in business meant being able to play golf.

My brothers took lessons as kids and enjoyed it, but that didn’t translate into

them playing when they were older. I took lessons in my late 20’s, which

coincided with the birth of my first son. I struggled to find time to play a

game that required up to six hours on a weekend day with a young child at

home. As it turned out, I didn’t need to play golf to do well in business. The

generation that believed it was necessary to succeed has passed into the next

world known as retirement (or they’re close to it).

It’s not that golf is a bad game, in fact it’s very enjoyable! It’s just that

times have changed. Joining a country club isn’t something that’s important

to the younger generation. This struck me as so odd that for a while I

specifically asked any successful person under 40 if they knew anyone who

was a member of a country club. The answer was crickets.

Copyright Red River Research Inc. 2017

THE ODDBALL STOCKS NEWSLETTER 9

We experienced a golf glut in this country with overbuilding and lofty

aspirations that met a different reality. Courses are closing, especially in

rural areas that don’t have the population to support them.

Avalon Clubs and Resorts is experiencing these same problems. They cite

that country club memberships are stable, but aren’t at the level needed for

their desired profitability.

The company’s Clubs and Resorts division reported revenue of $17.1m in

2016 compared to $14.9m in 2015. The increase in revenue is likely due to

increased occupancy in their hotel, as well as from country club related fees.

By that I mean dining revenue, banquet revenue, and non-golf revenue. The

golf courses themselves generated $4.7m in revenue from 4,615 members.

Their Clubs and Resorts division reported $300,000 in operating income in

2016, almost all of it from their hotel. Let’s take a moment to talk about the

company’s hotel. While the golf courses are a drag on income, the hotel is

an interesting acquisition that’s showing potential.

In 2014 the company purchased the Avalon Inn, which is adjacent to one of

their country clubs. They envisioned offering a complete vacation

experience where visitors could relax at the hotel, eat at on-site dining

facilities and play golf. A stay at the hotel entitles a visitor to play at any of

the three golf courses, eat at one of 12 restaurants, play tennis, swim at the

pool and use the spa. It’s actually quite a package.

The resort is located in Warren, Ohio, which is near Youngstown, Ohio and

Sharon, Pennsylvania. Youngstown has a bad reputation as a dilapidated

steel town. It deserves the reputation, but Warren is nice. Historically, the

steel money of Youngstown lived in Warren. Warren is also close to

Cleveland and Pittsburgh, both of which are roughly an hour drive away.

These little resorts are popular in this area. As a side note, I live in

Pittsburgh and have been to and through Warren in the past, although I

haven’t been to this resort.

Pennsylvania has a number of resorts similar to the Avalon Inn, such as

Nemacolin Woodlands Resort, Bedford Springs Resort, and in West Virginia,

Oglebay Resort. The resorts are a destination for company outings, or

couples and families looking to get away for a few days. This isn’t the type

of place you’d fly in from New York City or Los Angeles to visit, but it would

be a nice weekend away from the kids, or a weekend away from the wife

(husband) with golfing buddies.

Copyright Red River Research Inc. 2017

THE ODDBALL STOCKS NEWSLETTER 10

The point being that what Avalon Holdings has built isn’t unique. Rather,

it’s a popular business model that has stood the test of time (many of the

resorts I named have been around for years).

The Avalon Inn looks very nice from pictures on the Internet. They have a

4.7 star review on Google from 181 reviews. On TripAdvisor they have 85

reviews and an average rating of 4.5. I know employees are probably on

there giving themselves five star reviews, but with almost 300 reviews

online I’m not sure how much sway employees have at this point. The resort

is seemingly nice and well received.

The company has been updating the hotel since it acquired it and expects to

spend another $4-6m to complete the transformation. What’s encouraging

for shareholders is that the hotel is pulling its weight financially even

though it isn’t completely remodeled and is in the midst of a complete

renovation. The good news is that once the renovations are complete

occupancy and customer satisfaction should be higher, which in turn should

translate into higher revenue and profits.

Hotels and golf courses have a high break-even point due to operating costs.

There is a lot involved in keeping the doors of a hotel, or the greens of a golf

course, open. But, once the break-even point has been hit almost any

additional revenue falls straight to the bottom line. The hotel appears to be

operating slightly north of this break-even point, while the golf courses are

hovering near it. Even a slight uptick in business could be substantial.

Well, here we are with almost four pages of text and no discussion of

valuation yet! Let’s dive in. The company’s market cap is $9.8m, which as

noted is tiny. It’s even tinier compared to their book value and earnings (ex-

Clubs and Resorts).

The company’s book value is $37.8m, meaning they trade for 25.9% of such

amount. Many investors, considering the declines discussed above, would

argue that golf is dead. Of course, any sector that isn’t “hot” is by definition

dead. In addition, these same investors might argue that waste management

isn’t a compounding machine or scalable, or an asset-light company. All of

these things are true, but I’d argue that 25% of book value is unreasonably

low, especially when the company has some considerable tangible assets.

Let’s look at those assets. The company breaks them down as follows:

Copyright Red River Research Inc. 2017

THE ODDBALL STOCKS NEWSLETTER 11

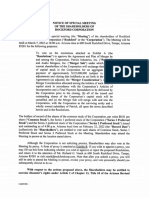

They have $14m in land, $34m in buildings, another $9m in machinery,

$445k worth of vehicles and $6m worth of office furniture.

Let’s suppose that their land is junk and only worth 75% of what it was

acquired for years ago. So now our new land value is $10m. Let’s further

haircut their buildings by 50% giving them a new value of $17m. Let’s go

further and assume the machinery could only be sold for 50% of its purchase

price, which would be $4.5m. Finally, let’s say that everything else they own

is completely worthless. Add all of this up, net out their $11m in debt, and

the value is $20m, still double their current market cap.

I’m not implying that the company is going to liquidate or advocating that

they should liquidate. But, the point is that even with draconian cuts to the

value of their assets it’s still possible to come up with a value that far

exceeds the current value assessed by the market. However, the problem

with assets is that unless they’re readily salable it’s hard to value them if

they don’t generate some sort of return.

The most easily valuable segment is the company’s waste business. As

discussed above, it earned $2.7m pre-tax in 2016 and $1.7m pre-tax in 2015.

At a very reasonable 10x multiple the waste segment alone could be worth

$17m-27m. The company’s waste income fluctuates, but is substantial. In

2011, for point of reference, they earned $3.5m pre-tax from waste, while in

2010 they did $2.5m. I mention these older results to show that the last year

or two wasn’t a flash in the pan. Avalon Holding’s waste operations have

been consistent cash generators.

On their own it’s pretty easy to say the waste operations are worth at least

$20m, or more than double the current market cap. The big question mark is

their resort operations which have masked the profitability of the waste

operations. The open issue is whether this portion of the business has any

actual value, or whether it should be written off as worthless.

In my view one of the better moves the company made was to acquire the

hotel adjacent to one of their golf properties. By acquiring and remodeling

the hotel they’re working to add value to their entire set of properties.

Initial indications seem to show that this is working. Last year while their

golf courses lost money the hotel made up for the loss and generated a tiny

bit of profit.

Someone is probably reading this and saying to themselves, “I bet an activist

could come in and ‘encourage’ management to sell the resorts to unlock

value.” The problem with this line of thinking is there are two classes of

stock: the A shares that elect two directors, and the B shares that elect three

directors. The CEO of the company, Ronald Klingle, owns 99% of the B

shares, effectively warding off any potential activist. In addition to the CEO

Copyright Red River Research Inc. 2017

THE ODDBALL STOCKS NEWSLETTER 12

control, the top three executives earn a combined $844k, which is a

considerable amount for such a small company.

Even with the insider majority control and the executive salaries, I would

argue that this company is worth much more than 25% of book value. We

can come up with all sorts of dire scenarios in which the company’s assets

are impaired. Maybe their land isn’t worth all that much, or maybe the

resort is worthless.

The question is whether what they own is worth more than 25 cents on the

dollar. I would argue that the results of the waste division alone give these

assets a value in the range of 50 cents on the dollar, if not more. Beyond

that, the hotel and golf courses are a bit of a wildcard. Maybe things turn

out well and the company gets a boost. But, even in the worst-case scenario

it’s hard to argue that Avalon Holdings is worth so little. The company

might not be worth book value, but even at 50% or 75% of book value this

provides investors the opportunity for an outsized gain.

Copyright Red River Research Inc. 2017

Subscribe to the Oddball Stocks Newsletter:

https://gumroad.com/l/oddball

The Oddball Stocks Newsletter and any excerpts therefrom (the “Content”) contained herein is

copyrighted and use of the Content is governed by the Oddball Media User Agreement. Please email

editor@oddballnewsletter.com for a copy.

In particular, please note that the User Agreement provides that:

The Content is not investment advice or recommendations or any other sort of professional advice

whatsoever, including but not limited to legal, tax, or accounting advice. If you desire investment,

legal, tax, accounting, or any other type of advice, you must obtain it for yourself from a qualified

professional. Before making any investment decision, you should carefully verify relevant facts for

yourself and discuss the decision with appropriate professional advisers who are familiar with your

specific situation and goals.

Some of the owners of Oddball Media, and some of the Newsletter's writers, guest writers,

interviewees, contributors, and editors (together the “Oddball Affiliates”) are or may be in business as

investment advisers or other types of professional advisers. However, the Oddball Affiliates still are not

your advisers nor are they providing any advice to you, unless you have contracted with any of them

separately. The Oddball Affiliates will have a variety of possible interests in any of the companies

mentioned in the Content These interests may conflict with yours if you own, purchase, or sell

securities of any of these companies. The Oddball Affiliates may buy or sell shares in any of the

companies, for themselves or for clients, either before or after the publication of a Newsletter.

The Content is not guaranteed to be accurate or complete and comes with no warranties of any kind.

You agree that any use by you of the Content is at your sole risk and acknowledge that it is provided

"AS IS" and that Oddball Media and the Oddball Affiliates disclaim all warranties of any kind, express

or implied, including, but not limited to, merchantability and fitness for a particular purpose or use.

Oddball Media and the Oddball Affiliates specifically disclaim any liability, whether based in contract,

tort, strict liability, or otherwise, for any direct, indirect, incidental, consequential, or special damages

arising out of or in any way connected with access to or use of the Content. In the event that any of the

foregoing limitations and disclaimers is ineffective, you agree that the maximum liability to you shall

be the total of the fees that you have paid to us. You agree that any dispute arising from, relating to, or

in any manner connected with your use of the Content shall be construed under and resolved in

accordance with the laws of the State of Arizona. Any such dispute shall be litigated only in the state or

federal courts of Maricopa County, Arizona, to the personal jurisdiction of which you hereby consent.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Laws of EnglandDocument725 pagesLaws of EnglandgastonNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- SEC Rule 15c2-11restricted Securities: New AmendmentsDocument162 pagesSEC Rule 15c2-11restricted Securities: New AmendmentsNate TobikNo ratings yet

- Intellectual Property Law Bar Questions and Suggested AnswersDocument24 pagesIntellectual Property Law Bar Questions and Suggested AnswersVictoria Escobal93% (15)

- Notice of Intent To File A LawsuitDocument2 pagesNotice of Intent To File A LawsuitFreedomofMind80% (5)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Motion For Preliminary InjunctionDocument5 pagesMotion For Preliminary InjunctionIndiana Public Media NewsNo ratings yet

- OBN - UNIF - Issue 33 (January 2021)Document1 pageOBN - UNIF - Issue 33 (January 2021)Nate TobikNo ratings yet

- Parliamentary Procedure SampleDocument4 pagesParliamentary Procedure SampleCecille Romana0% (1)

- OBN - Small Bank Snapshot - Issue 31Document6 pagesOBN - Small Bank Snapshot - Issue 31Nate TobikNo ratings yet

- Obn - Gwox - Issue 34 (March 2021)Document1 pageObn - Gwox - Issue 34 (March 2021)Nate TobikNo ratings yet

- Stat Con Case Digests 2Document7 pagesStat Con Case Digests 2Nix Yu100% (1)

- Berkshire's Performance vs. The S&P 500Document11 pagesBerkshire's Performance vs. The S&P 500Joseph AdinolfiNo ratings yet

- OBN - BKUTK - Issue 32 (November 2020)Document1 pageOBN - BKUTK - Issue 32 (November 2020)Nate TobikNo ratings yet

- Company Updates: Allied First BankDocument1 pageCompany Updates: Allied First BankNate TobikNo ratings yet

- Case 3:09 CV 02053 JPDocument9 pagesCase 3:09 CV 02053 JPvpjNo ratings yet

- Rule 69 Partition: Prepared By: Aileen M. Gaviola Jennifer Mae A. NovelaDocument37 pagesRule 69 Partition: Prepared By: Aileen M. Gaviola Jennifer Mae A. NovelaolofuzyatotzNo ratings yet

- A Brief Summary of Contract Law: Key Terms, Common Defenses and General RecommendationsDocument3 pagesA Brief Summary of Contract Law: Key Terms, Common Defenses and General RecommendationsHunt and Associates, PC100% (1)

- PNB vs. Bank of New YorkDocument3 pagesPNB vs. Bank of New YorkPaula GasparNo ratings yet

- OBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Document2 pagesOBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Nate TobikNo ratings yet

- Feature: Q&A With Sam Haskell of Colarion PartnersDocument7 pagesFeature: Q&A With Sam Haskell of Colarion PartnersNate TobikNo ratings yet

- Eric Speron Pages From Oddball - Newsletter - Issue - 36Document7 pagesEric Speron Pages From Oddball - Newsletter - Issue - 36Nate Tobik100% (1)

- LICOA Investment Schedule 12 31 2021Document32 pagesLICOA Investment Schedule 12 31 2021Nate TobikNo ratings yet

- The Law Firm of Chavez Miranda Aseoche Vs Restituto Lazaro and Rodel Morta AC 7045 (2016)Document5 pagesThe Law Firm of Chavez Miranda Aseoche Vs Restituto Lazaro and Rodel Morta AC 7045 (2016)M Azeneth JJNo ratings yet

- 18 Victorias Milling Co., Inc. v. Court of AppealsDocument2 pages18 Victorias Milling Co., Inc. v. Court of AppealsalexjalecoNo ratings yet

- OBN - Small Banks - Issue 32 (November 2020)Document2 pagesOBN - Small Banks - Issue 32 (November 2020)Nate TobikNo ratings yet

- OBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Document3 pagesOBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Nate TobikNo ratings yet

- Construction Management AgreementDocument4 pagesConstruction Management AgreementRocketLawyer100% (1)

- Velasco Vs Poizat Case DigestDocument2 pagesVelasco Vs Poizat Case DigestMai Reamico100% (1)

- PCGG V Sandiganbayan DigestsDocument4 pagesPCGG V Sandiganbayan DigestsMaribeth G. TumaliuanNo ratings yet

- AFBA - Merger Agreement and Fairness Opinion - March 2022Document114 pagesAFBA - Merger Agreement and Fairness Opinion - March 2022Nate Tobik100% (1)

- LICOA Order OrderDocument2 pagesLICOA Order OrderNate TobikNo ratings yet

- Hanover Fiscal Q2 2022Document7 pagesHanover Fiscal Q2 2022Nate TobikNo ratings yet

- LICOA Annual Statement 12 31 2021Document61 pagesLICOA Annual Statement 12 31 2021Nate TobikNo ratings yet

- Bank of Utica (BKUTK) - Shareholder Letter - 02 01 2022Document5 pagesBank of Utica (BKUTK) - Shareholder Letter - 02 01 2022Nate TobikNo ratings yet

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikNo ratings yet

- Bank of Utica (BKUTK) - Annual Report - FY 2021Document35 pagesBank of Utica (BKUTK) - Annual Report - FY 2021Nate TobikNo ratings yet

- SHLTR 490641Document1 pageSHLTR 490641Nate TobikNo ratings yet

- Rockford Corporation - Notice of Special MeetingDocument28 pagesRockford Corporation - Notice of Special MeetingNate TobikNo ratings yet

- PARF - Final Liquidating Distribution - December 2021Document1 pagePARF - Final Liquidating Distribution - December 2021Nate TobikNo ratings yet

- Hanover Foods Corp 2021 Annual ReportDocument31 pagesHanover Foods Corp 2021 Annual ReportNate TobikNo ratings yet

- OBN - AFBA - Issue 36 (August 2021)Document1 pageOBN - AFBA - Issue 36 (August 2021)Nate TobikNo ratings yet

- OBN - Delaware Chancery Corner - Issue 33 (January 2021)Document1 pageOBN - Delaware Chancery Corner - Issue 33 (January 2021)Nate TobikNo ratings yet

- LICOA Quarterly Statement Q3 2021Document36 pagesLICOA Quarterly Statement Q3 2021Nate TobikNo ratings yet

- Catahoula ExcerptDocument6 pagesCatahoula ExcerptNate TobikNo ratings yet

- Hanover Fiscal Q1 2022 EarningsDocument7 pagesHanover Fiscal Q1 2022 EarningsNate TobikNo ratings yet

- Catahoula Pages From Oddball Newsletter Issue 36Document6 pagesCatahoula Pages From Oddball Newsletter Issue 36Nate TobikNo ratings yet

- Metropolitan Bank & Trust Company vs. CADocument4 pagesMetropolitan Bank & Trust Company vs. CAJetJuárezNo ratings yet

- Rfbt1 Oblico Lecture NotesDocument18 pagesRfbt1 Oblico Lecture NotesArturoNo ratings yet

- Catholic Bishop Land Dispute ResolvedDocument6 pagesCatholic Bishop Land Dispute ResolvedNeren O. NievaNo ratings yet

- CITATIONDocument4 pagesCITATIONnaveen KumarNo ratings yet

- G.R. No. 70623 PDFDocument6 pagesG.R. No. 70623 PDFAlex Viray LucinarioNo ratings yet

- PERCY Et Al v. MENU FOODS - Document No. 1Document3 pagesPERCY Et Al v. MENU FOODS - Document No. 1Justia.comNo ratings yet

- Boyer Roxas v. RoxasDocument5 pagesBoyer Roxas v. RoxasMarion Yves MosonesNo ratings yet

- Comelec V NoynayDocument3 pagesComelec V NoynayJosef MacanasNo ratings yet

- Application For USB Vendor ID SublicenseDocument1 pageApplication For USB Vendor ID Sublicensef.cordella5397No ratings yet

- Further Rebuttal To Castagliuolo TFB No. 2013-10,162 (6D), Rule 3-5.2Document109 pagesFurther Rebuttal To Castagliuolo TFB No. 2013-10,162 (6D), Rule 3-5.2Neil GillespieNo ratings yet

- Idaho 1Document17 pagesIdaho 1JamesMurtaghMD.comNo ratings yet

- Gauthier Biomedical v. Bradshaw Medical - ComplaintDocument10 pagesGauthier Biomedical v. Bradshaw Medical - ComplaintSarah BursteinNo ratings yet

- OMEGA-HB-3000 Brinell Hardness Tester Instruction ManualDocument47 pagesOMEGA-HB-3000 Brinell Hardness Tester Instruction ManualManjunath GowdaNo ratings yet

- Trafigura Newsnight Press ReleaseDocument1 pageTrafigura Newsnight Press ReleaseBren-RNo ratings yet

- Kambulow Vs TACF LawsuitDocument54 pagesKambulow Vs TACF LawsuitwalthopeNo ratings yet