Professional Documents

Culture Documents

TDS Challan 06-05-18

Uploaded by

sandipgarg0 ratings0% found this document useful (0 votes)

262 views1 pageTDS Challan

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTDS Challan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

262 views1 pageTDS Challan 06-05-18

Uploaded by

sandipgargTDS Challan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

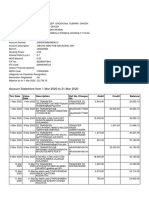

CHALLAN NO.

Tax Applicable Assessment

/ ITNS Year

(0020) COMPANY DEDUCTEES ✔ (0021) NON-COMPANY DEDUCTEES

ITNS 281 2019-20

Tax Deduction MUML07390F

Account

Number :

Full Name : LATX XXXG

Complete A-3/104 Oxford Village Wanowrie Pune MAHARASHTRA-411040

Address with

City & State :

Tel. No. : 0

Nature of Payment

94A-null

Type of Payment

✔ (400) TDS/TCS Regular Assessment (Raised by I.T.

(200) TDS/TCS Payable by Taxpayer Deptt.)

Details of Payment FOR USE IN RECEIVING BANK

Amount (in Rs. only) Debit to A/c / Cheque credited on

Income Tax: 4,200.00 06/05/2018 (dd/MM/yyyy)

Surcharge: 0.00 Payment Status : Success

Education Cess: 0.00 Bank Reference No. : 1446722789

Interest: 0.00 SPACE FOR BANK SEAL

Penalty: 0.00 ICICI Bank

Others: 0.00 Uttam Nagar, New Delhi

Fee: 0.00 CIN

Total: 4,200.00 BSR Code : 6390340

Total (in words): Tender Date : 060518

Crores Lakhs Thousands Hundreds Tens Units Challan Serial No. : 50556

Zero Zero Four Two Zero Zero

Debit to A/c: 003801502724

Date: 06/05/2018 Rs : 4,200.00

Internet Banking Payment through

Drawn on: ICICI Bank

Taxpayers Counterfoil Payment Status : Success

Tax Deduction Account MUML07390F Bank Reference No. : 1446722789

Number : SPACE FOR BANK SEAL

Received From : LATX XXXG ICICI Bank

Paid in Cash / Debit to 003801502724 Uttam Nagar, New Delhi

A/c / Cheque No :

CIN

For Rs. : 4,200.00

BSR Code : 6390340

Rupees Four Thousand Two Hundred

Rs (in words) : and Zero paise only Tender Date : 060518

Internet Banking Payment through Challan Serial No. : 50556

Drawn On : ICICI Bank(0021) NON-COMPANY

DEDUCTEES

(200) TDS/TCS Payable by Taxpayer

On Account of : Rs : 4,200.00

from (94A) null

For the Assessment 2019-20

Year :

You might also like

- Anita SahgalDocument3 pagesAnita SahgalNaveen AsthanaNo ratings yet

- Retention Account Statement KO5775 PDFDocument4 pagesRetention Account Statement KO5775 PDFAravinda ShettyNo ratings yet

- Commodities Account Opening Form: Document Significance PAGE(s)Document47 pagesCommodities Account Opening Form: Document Significance PAGE(s)surprise MFNo ratings yet

- Bangladesh Army Sainik Recruitement: Admit CardDocument1 pageBangladesh Army Sainik Recruitement: Admit CardPD Saidpur 150 MW SCPPPNo ratings yet

- Account Statement 011219 290220Document14 pagesAccount Statement 011219 290220ManishNo ratings yet

- Aadhaar FormDocument3 pagesAadhaar FormNABIN DEURINo ratings yet

- Zerodha Securities Private Limited: Transaction With Holding StatementDocument1 pageZerodha Securities Private Limited: Transaction With Holding StatementArun KumarNo ratings yet

- Tax - Invoice: Burckhardt Compression (India) Pvt. LTDDocument1 pageTax - Invoice: Burckhardt Compression (India) Pvt. LTDYOGESHNo ratings yet

- PDF 441907670270322Document1 pagePDF 441907670270322shryeasNo ratings yet

- Indian Income Tax Return Acknowledgement FormDocument1 pageIndian Income Tax Return Acknowledgement FormRahulMahajanNo ratings yet

- Account Statement From 11 Apr 2020 To 11 Oct 2020Document15 pagesAccount Statement From 11 Apr 2020 To 11 Oct 2020AnandapriyaNo ratings yet

- TreesDocument6 pagesTreesrajeshsupremNo ratings yet

- Account Statement For Account:2962002100013400: Branch DetailsDocument3 pagesAccount Statement For Account:2962002100013400: Branch DetailsBest Auto TechNo ratings yet

- '400072'-Vijay ChavanDocument1 page'400072'-Vijay ChavanrdrupnawarNo ratings yet

- Aug 2016Document1 pageAug 2016Vaibhav SinNo ratings yet

- KMC Certificate of Enlistment e-ReceiptDocument1 pageKMC Certificate of Enlistment e-ReceiptRidan DasNo ratings yet

- ITR Acknowledgement AY 21-22Document1 pageITR Acknowledgement AY 21-22Rimple SanchlaNo ratings yet

- GSTR3B 09ehmpm8928j1zf 062021Document2 pagesGSTR3B 09ehmpm8928j1zf 062021Ankur mittalNo ratings yet

- SDCTS0008257510 PDFDocument4 pagesSDCTS0008257510 PDFPrashanth GugulothNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- GSTR1 08axvpp9576c1zl 062018 PDFDocument5 pagesGSTR1 08axvpp9576c1zl 062018 PDFkrishan chaturvediNo ratings yet

- Tax Invoice for Detergent PurchaseDocument1 pageTax Invoice for Detergent PurchaseSuryaNo ratings yet

- Appointment SlipDocument1 pageAppointment SlipSwapnil RoyNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHunterNo ratings yet

- Sample Bank StatementDocument9 pagesSample Bank Statementemma adeoyeNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)muhammad kamranNo ratings yet

- Renewal Premium ReceiptDocument1 pageRenewal Premium ReceiptRakesh KumarNo ratings yet

- GST Invoice No.211920ST001 MumbaiDocument2 pagesGST Invoice No.211920ST001 Mumbaitanish mahamunkarNo ratings yet

- PDFDocument19 pagesPDFRam SriNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Ref - No. 2302875-11218095-5: Sakib AkhtarDocument5 pagesRef - No. 2302875-11218095-5: Sakib AkhtarMONISH NAYARNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNo ratings yet

- HDFC Mukesh Statement Jan 2017Document2 pagesHDFC Mukesh Statement Jan 2017MEEN SNo ratings yet

- Your Bank Statement SummaryDocument12 pagesYour Bank Statement SummaryAman GuptaNo ratings yet

- Telephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaDocument3 pagesTelephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaRamnish MishraNo ratings yet

- For Zomato Limited (Formerly Known As Zomato Private Limited and Zomato Media Private Limited)Document1 pageFor Zomato Limited (Formerly Known As Zomato Private Limited and Zomato Media Private Limited)Shubham ShrivasNo ratings yet

- Sep2015Document2 pagesSep2015Sidhantha JainNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document1 pageHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Devender5194No ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Liquiloans Statement 2022-04-01 To 2022-04-15Document1 pageLiquiloans Statement 2022-04-01 To 2022-04-15raghuraman1511No ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshyam krishnaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBalajiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAmit GodaraNo ratings yet

- Fee Receipt: Student Name: Kunal Dhudhraj BiswakarmaDocument1 pageFee Receipt: Student Name: Kunal Dhudhraj BiswakarmaKunal Dudhraj BiswakarmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- PDFContent 1Document1 pagePDFContent 1savan anvekarNo ratings yet

- Tax Invoice: Taxes RateDocument1 pageTax Invoice: Taxes RateSUBHAM SINGHNo ratings yet

- 03042019224526gx5uv42zidemow71fn Estatement 032019 1876Document5 pages03042019224526gx5uv42zidemow71fn Estatement 032019 1876Sai GaneshNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument13 pagesITR-2 Indian Income Tax Return: Part A-GENHarish100% (1)

- Tax Invoice for Flight Booking from Delhi to PuneDocument2 pagesTax Invoice for Flight Booking from Delhi to PuneVishnu RajNo ratings yet

- AxisDocument2 pagesAxisMukeshChoudharyNo ratings yet

- TDS Payment Challan For AmitDocument1 pageTDS Payment Challan For AmitManishaRThube0% (1)

- Quater 1Document3 pagesQuater 1सर्व ब्राह्मण समाज संगठनNo ratings yet

- Account Statement From 1 Mar 2020 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Mar 2020 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSubhadeep GhoshNo ratings yet

- Qfix Payment Consolidated Fee Receipt PDFDocument1 pageQfix Payment Consolidated Fee Receipt PDFDibya Dey100% (1)

- Aadhaar Updation FormDocument2 pagesAadhaar Updation FormBharath JayaramanNo ratings yet

- Smart Privilege: Key HighlightsDocument1 pageSmart Privilege: Key HighlightsYogesh MeenaNo ratings yet

- Tax Payment Challan for Company DeducteesDocument1 pageTax Payment Challan for Company DeducteesMadhyam JeswaniNo ratings yet

- Direct Tax ReportDocument1 pageDirect Tax Reportgiri00767098No ratings yet

- View Tax Payment Details: Reference Number: 29973328Document1 pageView Tax Payment Details: Reference Number: 29973328arjuntyagi22No ratings yet

- Sid For Bharat Bond Etf - April 2030Document61 pagesSid For Bharat Bond Etf - April 2030Akhil AggarwalNo ratings yet

- Quant Finance BooksDocument1 pageQuant Finance BookssandipgargNo ratings yet

- Guidelines for Special Counsel EngagementDocument2 pagesGuidelines for Special Counsel Engagementsandipgarg100% (1)

- Bhasin Group Typical Plan: Sector 143, NoidaDocument1 pageBhasin Group Typical Plan: Sector 143, NoidasandipgargNo ratings yet

- IAP Draft Instruction 2 MarchDocument37 pagesIAP Draft Instruction 2 MarchsandipgargNo ratings yet

- RS22689Document11 pagesRS22689sandipgargNo ratings yet

- Bob PPT Q2 18Document58 pagesBob PPT Q2 18sandipgargNo ratings yet

- Implementation of Cadre Restructuring 1Document1 pageImplementation of Cadre Restructuring 1sandipgargNo ratings yet

- Ashok Leyland Q3Document7 pagesAshok Leyland Q3sandipgargNo ratings yet

- Form DIR-3 PDFDocument1 pageForm DIR-3 PDFsandipgargNo ratings yet

- Print ForewordDocument3 pagesPrint ForewordsandipgargNo ratings yet

- Inv No.88 - Sandip Garg (INR 12,000)Document1 pageInv No.88 - Sandip Garg (INR 12,000)sandipgargNo ratings yet

- KundliDocument20 pagesKundlisandipgargNo ratings yet

- Sbi Q3 16Document7 pagesSbi Q3 16sandipgargNo ratings yet

- Casual Labourers Scheme Provides Temporary StatusDocument3 pagesCasual Labourers Scheme Provides Temporary StatussandipgargNo ratings yet

- AnnualReport2015 16Document397 pagesAnnualReport2015 16sandipgargNo ratings yet

- Interpretation of Statutes-BCASDocument49 pagesInterpretation of Statutes-BCASsandipgargNo ratings yet

- An 1 Instrcution No.21 of 2015Document3 pagesAn 1 Instrcution No.21 of 2015sandipgargNo ratings yet

- Reducing Litigation ThaneDocument38 pagesReducing Litigation ThanesandipgargNo ratings yet

- CM Drought ReliefDocument10 pagesCM Drought ReliefsandipgargNo ratings yet

- Facts and Issue: The Assessee Following Mercantile System of Accounting, Did NotDocument4 pagesFacts and Issue: The Assessee Following Mercantile System of Accounting, Did NotsandipgargNo ratings yet

- Pune Furniture Stores ListingDocument4 pagesPune Furniture Stores ListingsandipgargNo ratings yet

- Circulars SummaryDocument4 pagesCirculars SummarysandipgargNo ratings yet

- Reducing Litigation NashikDocument28 pagesReducing Litigation NashiksandipgargNo ratings yet

- CCI DG Advt. 31 01 14Document5 pagesCCI DG Advt. 31 01 14sandipgargNo ratings yet

- Grievance SGDocument41 pagesGrievance SGsandipgargNo ratings yet

- GSTDocument6 pagesGSTsandipgargNo ratings yet

- Cenvat Credit PDFDocument38 pagesCenvat Credit PDFsaumitra_mNo ratings yet

- IIS Civil ListDocument19 pagesIIS Civil Listsandipgarg100% (1)

- People Vs Jaime Jose y Gomez, Et Al.Document2 pagesPeople Vs Jaime Jose y Gomez, Et Al.Anonymous NqaBAyNo ratings yet

- Establishing Conviction Integrity Programs FinalReport Ecm Pro 073583Document86 pagesEstablishing Conviction Integrity Programs FinalReport Ecm Pro 073583niraj_sdNo ratings yet

- Approve SK BudgetDocument2 pagesApprove SK BudgetEdz Votefornoymar Del RosarioNo ratings yet

- COLDPLAY - A Head Full of Dreams Tour - 1 PDFDocument3 pagesCOLDPLAY - A Head Full of Dreams Tour - 1 PDFVicky WardhanaNo ratings yet

- Joining TimeDocument7 pagesJoining TimeVangara HarshuNo ratings yet

- Consultancy Agreement PDFDocument5 pagesConsultancy Agreement PDFHuguesNo ratings yet

- Michael Angelo Blackwell v. Department of Offender Rehabilitation, 807 F.2d 914, 11th Cir. (1987)Document3 pagesMichael Angelo Blackwell v. Department of Offender Rehabilitation, 807 F.2d 914, 11th Cir. (1987)Scribd Government DocsNo ratings yet

- Administering An EstateDocument14 pagesAdministering An EstateAJ AJ100% (1)

- Attorney General's Report: Sexual Assaults Committed by Priests Against Minors (Manchester, NH - 2003)Document160 pagesAttorney General's Report: Sexual Assaults Committed by Priests Against Minors (Manchester, NH - 2003)Vatican Crimes ExposedNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- SPECIAL POWER O-WPS OfficeDocument4 pagesSPECIAL POWER O-WPS OfficeKaori SakiNo ratings yet

- Surrendered Driver License/ID Cards: Out-Of-State Transfers and Florida Renewals and ReplacementsDocument1 pageSurrendered Driver License/ID Cards: Out-Of-State Transfers and Florida Renewals and ReplacementsAldoSolsaNo ratings yet

- Roshell V. Gasing-Bs Criminology 1st Year - Cri 121-1090Document2 pagesRoshell V. Gasing-Bs Criminology 1st Year - Cri 121-1090roshell GasingNo ratings yet

- Persons and Family Law NotesDocument10 pagesPersons and Family Law NotesMaria Dana BrillantesNo ratings yet

- Contract-Trucking and Hauling Atty Welan Calag SurigaoDocument6 pagesContract-Trucking and Hauling Atty Welan Calag SurigaoWelan Calag83% (6)

- Heirs of Racaza v. Sps Abay-AbayDocument2 pagesHeirs of Racaza v. Sps Abay-AbayRostum AgapitoNo ratings yet

- Legal Studies Cases ProjectDocument19 pagesLegal Studies Cases Projectanant121001No ratings yet

- Quezon City Times May IssueDocument21 pagesQuezon City Times May IssueiloveqctimesNo ratings yet

- PLJ Volume 85 Issue 1 2 The Supreme Court and International Law Problems and Approaches in Philippine Practice Merlin M. MagallonaDocument101 pagesPLJ Volume 85 Issue 1 2 The Supreme Court and International Law Problems and Approaches in Philippine Practice Merlin M. MagallonaNicole Stephanie WeeNo ratings yet

- Umar's Reforms and Strong AdministrationDocument2 pagesUmar's Reforms and Strong Administrationhati1100% (1)

- Calatagan Golf Club Stock Foreclosure CaseDocument2 pagesCalatagan Golf Club Stock Foreclosure Casejenny martinez100% (1)

- Jones v. Forniss Et Al (INMATE2) - Document No. 3Document6 pagesJones v. Forniss Et Al (INMATE2) - Document No. 3Justia.comNo ratings yet

- E20934 Payslip Aug2022Document1 pageE20934 Payslip Aug2022vikramNo ratings yet

- 37 Philippines Communications Satellite Corp. v. Alcuaz PDFDocument5 pages37 Philippines Communications Satellite Corp. v. Alcuaz PDFKJPL_1987No ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- Apuyan JRDocument5 pagesApuyan JRKitem Kadatuan Jr.0% (1)

- MOFA Attestation GuidelinesDocument4 pagesMOFA Attestation GuidelinesMuhammad Fahad Raza25% (4)

- Income Tax Rules for Estates and TrustsDocument2 pagesIncome Tax Rules for Estates and Trustsfrostysimbamagi meowNo ratings yet

- Gliceria Marella Vs ReyesDocument1 pageGliceria Marella Vs ReyesLinus ReyesNo ratings yet

- Benguet Electric Cooperative vs NLRC (1992Document4 pagesBenguet Electric Cooperative vs NLRC (1992Naia Gonzales100% (1)