Professional Documents

Culture Documents

Estimasi Biaya Proyek: Modul Perkuliahan

Uploaded by

IyanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estimasi Biaya Proyek: Modul Perkuliahan

Uploaded by

IyanCopyright:

Available Formats

MODUL PERKULIAHAN

Estimasi Biaya

Proyek

Lanjutan Basic Concept of Capital

Investment

Fakultas Program Studi Tatap Muka Kode MK Disusun Oleh

10

Fakultas Teknik Sipil MK11031 Mirnayani,ST. MT

Teknik

Abstract Kompetensi

Matakuliah Estimasi Biaya mengenai Mahasiswa mampu menjelaskan

cara dalam memperkirakan dan tentang Basic Concept of Capital

menghitung biaya proyek dalam Investment

hubungannya dengan Rekayasa

Ekonomi dalam dunia konstruksi

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

1 Mirnayani, ST, MT http://www.mercubuana.ac.id

A. Engineering Economy Overview

Why Engineering Economy is Important to Engineers (and other professionals).

Engineers “Design”

Engineers must be concerned with the economic aspects of designs and projects

they recommend and perform

Analysis

Design

Synthesis

Engineers must work within the realm of economics and justification of engineering

projects.

• Work with limited funds (capital)

• Capital is not unlimited – rationed

• Capital does not belong to the firm

Belongs to the Owners of the firm

Capital is not “free”…it has a “cost”

• ENGINEERING ECONOMY is involved with the formulation, estimation, and

evaluation of economic outcomes when alternatives to accomplish a defined purpose

are available.

• ENGINEERING ECONOMY is involved with the applications of defined mathematical

relationships that aid in the comparison of economic alternatives.

• Knowledge of Engineering Economy will have a significant impact on you, personally.

Make proper economic comparisons

In your profession : Private sector, Public sector

In your personal life

B. Role of Engineering Economy in Decision Making

Remember: People make decisions – not “tools”

Engineering Economy is a set of tools that aid in decision making – but will not make

the decision for you

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

2 Mirnayani, ST MT http://www.mercubuana.ac.id

Engineering economy is based mainly on estimates of future events – must deal with

the future and risk and uncertainty

• The parameters within an engineering economy problem can and will vary over time

• Parameters that can vary will dictate a numerical outcome – apply and understand

Sensitivity Analysis

• Sensitivity Analysis plays a major role in the assessment of most, if not all,

engineering economy problems

• The use of spreadsheets is now common and students need to master this valuable

tool as an analysis aid

Time Value of Money

Money can “make” money if Invested

Centers around an interest rate

The change in the amount of money over a given time period is called the time value

of money; by far, the most important concept in engineering economy

Problem-Solving Approach

1. Understand the Problem

2. Collect all relevant data/information

3. Define the feasible alternatives

4. Evaluate each alternative

5. Select the “best” alternative

6. Implement and monitor

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

3 Mirnayani, ST MT http://www.mercubuana.ac.id

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

4 Mirnayani, ST MT http://www.mercubuana.ac.id

C. Performing and Engineering Economy Study

Performing a Study

• To have a problem, one must have alternatives (two or more ways to solve a

problem)

• Alternative ways to solve a problem must first be identified

• Estimate the cash flows for the alternatives

• Analyze the cash flows for each alternative

Needed Parameters

• First cost (investment amounts)

• Estimates of useful or project life

• Estimated future cash flows (revenues and expenses and salvage values)

• Interest rate

• Inflation and tax effects

Cash Flows

• Estimate flows of money coming into the firm – revenues salvage values, etc.

(magnitude and timing) – positive cash flows

• Estimates of investment costs, operating costs, taxes paid – negative cash flows

Alternatives

• To analyze, one must have:

Concept of the time value of Money

An Interest Rate

Some measure of economic worth

• Evaluate and weigh

• Factor in noneconomic parameters

• Select, implement, and monitor

Each problem will have at least one alternative – DO NOTHING

• May not be free and may have future costs associated

• Do not overlook this option!

• Goal: Define, Evaluate, Select and Execute

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

5 Mirnayani, ST MT http://www.mercubuana.ac.id

More Alternatives

• Goal: Define, Evaluate, Select and Execute

• Select One and only one from a set of feasible alternatives

• Once an alternative is selected, the remaining alternatives are excluded at that point.

Default Position

• If all of the proposed alternatives are not economically desirable then…

• One usually defaults to the DO-NOTHING alternative

Taxes

• Taxes represent a significant negative cash flow to the for-profit firm.

• A realistic economic analysis must assess the impact of taxes. Called and AFTER-

TAX cash flow analysis

• Not considering taxes is called a BEFORE-TAX Cash Flow analysis.

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

6 Mirnayani, ST MT http://www.mercubuana.ac.id

• A Before-Tax cash flow analysis (while not as accurate) is often performed as a

preliminary analysis.

• A final, more complete analysis should be performed using an After-Tax analysis

• Both are valuable analysis approaches

Inflation Effects

• A social-economic occurrence in which there is more currency competing for

constrained goods and services

• Where a country’s currency becomes worth less over time, thus requiring more of the

currency to purchase the same amount of goods or services in a time period

• Inflation impacts:

Purchasing Power (reduces)

Operating Costs (increases)

Rate of Return on Investments (reduces)

D. Terminology and Symbols

• P = value or amount of money at a time designated as the present or time 0. Also,

P is referred to as present worth (PW), present value (PV), net present value (NPV),

discounted cash flow (DCF), and capitalized cost (CC); dollars

• F = value or amount of money at some future time. Also, F is called future worth

(FW) and future value (FV); dollars

• A = series of consecutive, equal, end-of-period amounts of money. Also, A is called

the annual worth (AW) and equivalent uniform annual worth (EUAW); dollars per

year, dollars per month

• n = number of interest periods; years, months, days

• i = interest rate or rate of return per time period; percent per year, percent per

month

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

7 Mirnayani, ST MT http://www.mercubuana.ac.id

• t = time, stated in periods; years, months, days, etc

P and F Amounts

• The symbols P and F represent one-time occurrences:

• Specifically:

• It should be clear that a present value P represents a single sum of money at some

time prior to a future value F

• This is an important basic point to remember

Annual Amounts

• It is important to note that the symbol A always represents a uniform amount (i.e., the

same amount each period) that extends through consecutive interest periods.

• Cash Flow diagram for annual amounts might look like the following:

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

8 Mirnayani, ST MT http://www.mercubuana.ac.id

Interest Rate – i% per period

• The interest rate i is assumed to be a compound rate, unless specifically stated as

“simple interest”

• The rate i is expressed in percent per interest period; for example, 12% per year.

For many engineering economy problems:

Involve the dimension of time

At least 4 of the symbols { P, F, A, i% and n }

At least 3 of 4 are either estimated or assumed to be known with certainty.

Excel’s Financial Functions

• To find the present value P: PV(i%,n,A,F)

• To find the future value F: FV(i%,n,A,P)

• To find the equal, periodic value A:

PMT(i%,n,P,F)

• To find the number of periods n:

NPER(i%,A,P,F)

• To find the compound interest rate i:

RATE(n,A,P,F)

• To find the compound interest rate i:

IRR(first_ cell:last_ cell)

• To find the present value P of any series:

NPV(i%,second_cell_last cell) + first cell

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

9 Mirnayani, ST MT http://www.mercubuana.ac.id

Daftar Pustaka

1. Iman Soeharto, Manajemen Konstruksi, 1999.

2. Donald S Barrie, Manajemen Konstruksi Profesional, 1995.

3. Asianto, Project Cost Estimation and Control, 2003.

4. Tung Au, Handbook of Basic Concept of Capital Investment, 1990.

5. Leland Blank and Anthony Tarquin, Engineering Economic, 2011

6. Stephen D Schuette and Roger W Liska, Building Construction Estimation 2nd Edition,

1998

‘18 Estimasi Biaya Proyek Pusat Bahan Ajar dan eLearning

10 Mirnayani, ST MT http://www.mercubuana.ac.id

You might also like

- Modul 10 - EstimasiBiaya & Rekayasa Ekonomi - Ali SunandarDocument10 pagesModul 10 - EstimasiBiaya & Rekayasa Ekonomi - Ali SunandarAndi Ra Mi'rajNo ratings yet

- Engineering Economy ConceptsDocument10 pagesEngineering Economy Conceptsilham fdhlman11No ratings yet

- Chapter 1 PresentationDocument39 pagesChapter 1 PresentationSagni Oo ChambNo ratings yet

- Modul 11 EstimasiBiayaDocument10 pagesModul 11 EstimasiBiayailham fdhlman11No ratings yet

- Introduction To Engineering EconomyDocument42 pagesIntroduction To Engineering EconomyPuput YusdaNo ratings yet

- Kuliah 01 - Introduction To Engineering Economy 230221Document110 pagesKuliah 01 - Introduction To Engineering Economy 230221reprano PNo ratings yet

- Financial Modeling BasicsDocument28 pagesFinancial Modeling BasicsOmer Crestiani100% (1)

- Engineering Economy Course Student 1Document32 pagesEngineering Economy Course Student 1Baesl 2000No ratings yet

- Project Selection Methods & Approval CriteriaDocument38 pagesProject Selection Methods & Approval CriteriaKaikala Ram Charan TejNo ratings yet

- BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022Document35 pagesBCO126 Mathematics of Finance: 3 Ects Spring Semester 2022summerNo ratings yet

- Lectures 6and 7 EE Mar14thDocument48 pagesLectures 6and 7 EE Mar14thrahmatullah.basyouniNo ratings yet

- Introduction To Engineering Economics SummerDocument62 pagesIntroduction To Engineering Economics SummerMamaru Nibret DesyalewNo ratings yet

- Chapter 3Document29 pagesChapter 3S Varun SubramanyamNo ratings yet

- Oaf 624 Course OutlineDocument8 pagesOaf 624 Course OutlinecmgimwaNo ratings yet

- 1.0 Financial Modeling Intro v2Document28 pages1.0 Financial Modeling Intro v2Arif JamaliNo ratings yet

- Ch6 Investment EvaluationDocument27 pagesCh6 Investment EvaluationAshenafi Belete AlemayehuNo ratings yet

- UU-Project Chapter 3Document74 pagesUU-Project Chapter 3Kiya Tesfaye100% (1)

- Basic Economic Principles: Chethan S.GowdaDocument30 pagesBasic Economic Principles: Chethan S.GowdaTodesa HinkosaNo ratings yet

- Project Integration MGTDocument45 pagesProject Integration MGTAhmad PadhilNo ratings yet

- Capital BudgetingDocument36 pagesCapital BudgetingShweta SaxenaNo ratings yet

- PAE AcFn621Ch-4a Project Alaysis and SelectionDocument42 pagesPAE AcFn621Ch-4a Project Alaysis and SelectionProf. Dr. Anbalagan ChinniahNo ratings yet

- Project Selection MethodsDocument50 pagesProject Selection MethodsMuhammad Mubeen Iqbal PuriNo ratings yet

- Materi EkotekDocument92 pagesMateri EkotekJoshua AdityaNo ratings yet

- Introduction To Engineering EconomyDocument17 pagesIntroduction To Engineering EconomyMahammad YusifNo ratings yet

- Lecture 1-Financial AnalysisDocument13 pagesLecture 1-Financial Analysisharsimran KaurNo ratings yet

- Project Evaluation Course OverviewDocument5 pagesProject Evaluation Course OverviewSadia FarahNo ratings yet

- PCM, Chapter 1Document25 pagesPCM, Chapter 1SISAYNo ratings yet

- Engineering Economics - PengantarDocument17 pagesEngineering Economics - Pengantarrochimbakti3579No ratings yet

- PMBOK Chapter 6 - CostDocument39 pagesPMBOK Chapter 6 - CostlatehoursNo ratings yet

- Chapter 7:project Cost ManagementDocument49 pagesChapter 7:project Cost ManagementM. Talha NadeemNo ratings yet

- Risk Analysis and FinanceDocument65 pagesRisk Analysis and Financeyan_upuuNo ratings yet

- Econ - 1Document25 pagesEcon - 1Adrianne CespedesNo ratings yet

- Engineering Economics PW AnalysisDocument23 pagesEngineering Economics PW AnalysisInam Ur RahmanNo ratings yet

- EE 1 - 2019 SessionDocument39 pagesEE 1 - 2019 SessionAfras Ahmad0% (1)

- Development and Engineering EconomicsDocument23 pagesDevelopment and Engineering Economicsfentawmelaku1993No ratings yet

- Em 5 Unit 1 Introduction Part 1Document7 pagesEm 5 Unit 1 Introduction Part 1MOBILEE CANCERERNo ratings yet

- Lect Plan Financial ManagementDocument4 pagesLect Plan Financial Managementlokesh_arya1No ratings yet

- Lecture 1 Introduction To Engineering Economy PDFDocument32 pagesLecture 1 Introduction To Engineering Economy PDFFrendick LegaspiNo ratings yet

- Project Appraisal-1: Overview: Chapter 1Document35 pagesProject Appraisal-1: Overview: Chapter 1a11235No ratings yet

- Chapter 1 Engineering EconomyDocument13 pagesChapter 1 Engineering EconomyKen RualloNo ratings yet

- UMB - MTS - Chapter 2 Integration Project ManagementDocument44 pagesUMB - MTS - Chapter 2 Integration Project ManagementKartika Sri RahayuNo ratings yet

- 7.project Cost MGTDocument37 pages7.project Cost MGTWere ArnoldNo ratings yet

- PMP Cost Management ProcessesDocument53 pagesPMP Cost Management ProcessesRasha Al KhatibNo ratings yet

- Project Selection and AppraisalDocument25 pagesProject Selection and AppraisalPooja KumariNo ratings yet

- Postdoctoral Resercher, Institute of National Economy, Romanian Academy, Bucharest, RomaniaDocument4 pagesPostdoctoral Resercher, Institute of National Economy, Romanian Academy, Bucharest, RomaniaHà ThùyNo ratings yet

- LN02-Introduction To Engineering EconomicsDocument17 pagesLN02-Introduction To Engineering Economicsmehedi hasanNo ratings yet

- Investment EvaluationDocument29 pagesInvestment EvaluationFreedom YenesewNo ratings yet

- Eng EconomyDocument33 pagesEng EconomyOtwua ArthurNo ratings yet

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajNo ratings yet

- Notes - EE 1Document37 pagesNotes - EE 1Ayeshá KhánNo ratings yet

- Lecture 1Document35 pagesLecture 1teamhighlandersnustNo ratings yet

- Module IiDocument38 pagesModule Iishuchi606No ratings yet

- Lecture1 2018Document63 pagesLecture1 2018ismailNo ratings yet

- Capital Investment DecisionsDocument20 pagesCapital Investment Decisionsmubasheralijamro0% (1)

- Engineering Economics & Management MS490: Lecture # 1Document22 pagesEngineering Economics & Management MS490: Lecture # 1ayeshaqayyummNo ratings yet

- Chapter 1 PDFDocument14 pagesChapter 1 PDFआदित्य राज अधिकारीNo ratings yet

- Engineering Economics Decision ToolDocument93 pagesEngineering Economics Decision Tooldemoz asfaw100% (2)

- Project EvaluationDocument88 pagesProject EvaluationOkothMagsNo ratings yet

- LECTURE NUMBER ONE Nature and Scope of Economics - Definition and Scope of Engineering EconomicsDocument61 pagesLECTURE NUMBER ONE Nature and Scope of Economics - Definition and Scope of Engineering Economicsnickokinyunyu11No ratings yet

- Show Me the Money: How to Determine ROI in People, Projects, and ProgramsFrom EverandShow Me the Money: How to Determine ROI in People, Projects, and ProgramsRating: 4 out of 5 stars4/5 (13)

- 7 C's of Business LetterDocument3 pages7 C's of Business LetterGladys Forte100% (2)

- Chemical Engineering Assignment SubmissionDocument10 pagesChemical Engineering Assignment SubmissionFahad KamranNo ratings yet

- Love Your Design Getting Started GuideDocument14 pagesLove Your Design Getting Started GuideOnalevel100% (9)

- 31 Legacy of Ancient Greece (Contributions)Document10 pages31 Legacy of Ancient Greece (Contributions)LyreNo ratings yet

- Inventory ManagementDocument60 pagesInventory Managementdrashti0% (1)

- 199-Article Text-434-1-10-20200626Document11 pages199-Article Text-434-1-10-20200626ryan renaldiNo ratings yet

- Materials Technical Specification.: Stainless SteelDocument6 pagesMaterials Technical Specification.: Stainless SteelMario TirabassiNo ratings yet

- Section 3.4: Buffer Overflow Attack: Defense TechniquesDocument26 pagesSection 3.4: Buffer Overflow Attack: Defense TechniquesAdeenNo ratings yet

- How To Approach To Case Study Type Questions and MCQsDocument4 pagesHow To Approach To Case Study Type Questions and MCQsKushang ShahNo ratings yet

- CHB1 Assignmen5Document2 pagesCHB1 Assignmen5anhspidermenNo ratings yet

- University Reserch Worksheet PDFDocument7 pagesUniversity Reserch Worksheet PDFapi-410567922No ratings yet

- Course-PM SSY135 Wireless Communications 21-22Document7 pagesCourse-PM SSY135 Wireless Communications 21-22Amirhossein MohsenianNo ratings yet

- Exp-1. Evacuative Tube ConcentratorDocument8 pagesExp-1. Evacuative Tube ConcentratorWaseem Nawaz MohammedNo ratings yet

- Rules For Assigning Activity Points: Apj Abdul Kalam Technological UniversityDocument6 pagesRules For Assigning Activity Points: Apj Abdul Kalam Technological UniversityAnonymous KyLhn6No ratings yet

- The Production and Interpretation of Ritual Transformation Experience: A Study on the Method of Physical Actions of the Baishatun Mazu PilgrimageDocument36 pagesThe Production and Interpretation of Ritual Transformation Experience: A Study on the Method of Physical Actions of the Baishatun Mazu PilgrimageMinmin HsuNo ratings yet

- Hyd Schematic 2658487205 - 005Document3 pagesHyd Schematic 2658487205 - 005Angelo Solorzano100% (2)

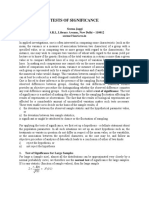

- 5 Tests of Significance SeemaDocument8 pages5 Tests of Significance SeemaFinance dmsrdeNo ratings yet

- Smell Detectives: An Olfactory History of Nineteenth-Century Urban AmericaDocument35 pagesSmell Detectives: An Olfactory History of Nineteenth-Century Urban AmericaUniversity of Washington PressNo ratings yet

- AsdfgDocument2 pagesAsdfgTejendra PachhaiNo ratings yet

- WORK ORDER TITLEDocument2 pagesWORK ORDER TITLEDesign V-Tork ControlsNo ratings yet

- 3.1-Pile Design Calculation For Boundary (p1 To p50)Document24 pages3.1-Pile Design Calculation For Boundary (p1 To p50)layaljamal2No ratings yet

- 1136 E01-ML01DP5 Usermanual EN V1.2Document11 pages1136 E01-ML01DP5 Usermanual EN V1.2HectorNo ratings yet

- Th255, Th255c Axle Cat ServiceDocument280 pagesTh255, Th255c Axle Cat ServiceKevine KhaledNo ratings yet

- Lolita An Intelligent and Charming Holstein Cow Consumes Only TwoDocument1 pageLolita An Intelligent and Charming Holstein Cow Consumes Only Twotrilocksp SinghNo ratings yet

- ASIA INTERNATIONAL FURNITURE MATERIALS CONTRACTDocument2 pagesASIA INTERNATIONAL FURNITURE MATERIALS CONTRACTSALOME URUCHI AGUILARNo ratings yet

- Information HandoutsDocument6 pagesInformation HandoutsPooja Marwadkar TupcheNo ratings yet

- READING 4.1 - Language and The Perception of Space, Motion, and TimeDocument10 pagesREADING 4.1 - Language and The Perception of Space, Motion, and TimeBan MaiNo ratings yet

- Running Head:: Describe The Uses of Waiting Line AnalysesDocument6 pagesRunning Head:: Describe The Uses of Waiting Line AnalysesHenry AnubiNo ratings yet

- 21st Century Literature Exam SpecsDocument2 pages21st Century Literature Exam SpecsRachel Anne Valois LptNo ratings yet

- Overhead Water Tank Structural AnalysisDocument28 pagesOverhead Water Tank Structural Analysiscollins unanka100% (3)