Professional Documents

Culture Documents

VAT202e - Notice of Change of Tax Period Iro The Submission of A Return VAT 201 - External Form PDF

Uploaded by

anzani0 ratings0% found this document useful (0 votes)

69 views2 pagesOriginal Title

VAT202e - Notice of Change of Tax Period iro the Submission of a Return VAT 201 - External Form.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

69 views2 pagesVAT202e - Notice of Change of Tax Period Iro The Submission of A Return VAT 201 - External Form PDF

Uploaded by

anzaniCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

WY VALUE-ADDED TAX rari

Notice of change of tax period in respedt ofthe submission ofa retum

(war 201)

Enguilos should bs aceressed to SARS:

ranch ote

tl Fax

email

Trading or other name

The Category which are presently applicable to you for the purpose of submission of VAT retums (VAT 201), is

indicated with an X below.

| Category A- The period of two months ending January, March, May, July, Seplember and November

| Category B- The period of two months ending February, Api, June, August, Ociber and December

| catmaery 0-1 pt simon sng os

Category E - The period of twelve months ending,

Category F - The period of four months ending onthe last day of February, June and October.

The following Category for the purpose of submission of VAT returns (VAT 201) will be applicable to all your

enterprises, excluding those which are in Category D, E or F as indicated:

Caregory A oF Category B (r Catogory C

Category D- The period of six months ending, and

Category E- The period of twelve months ending,

Category F - Four-monthly period ending,

‘The reason for the change in Category i

4

i

that the total vale of taxable supplies exceeds R 30 milion as contemplate in section 27(3) (a) () f the Act or

that the total value of taxable supplies i kel to exceed the limit of R 30 millon as contemplated in section 27(3) a) (i) of the Act or

In accordance with you application forthe change ofa tx period; or

you repeatedly detaulted in performing your obligations under the Act oF

the lola valuelantcipated total value of taxable eupplies (excluding VAT) exceeds or will exceed R 1,5 millon per annum oF

in terms ofa decision made by this offee

‘The final tum (VAT 201) which must be submitted under Category:

+ isthe retum for the period ending

“Tho fist return (VAT 201) which must be submitted under Category

+s the retun forthe period ending

+ and ifthe Category Dis applicable, the fst

return (VAT 201) forthe six months ending,

turn (VAT 201) which you must submit fr this Catagory is the

+ and ifthe Category E's applicable, the fst return (VAT 201) which you must submit fr this Category is the

Felurn (VAT 207) forthe twelve months ending,

+ and ifthe Category Fis applicable, the frst retum (VAT 201) which you must submit for this Category is the

‘rotur (VAT 201) for the fouth months ending,

‘Name & Sumame (Team Member) ‘Signature (Team Member)

for SARS branch ace

Date

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Chief Vho-Masia Revised PlanDocument1 pageChief Vho-Masia Revised PlananzaniNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

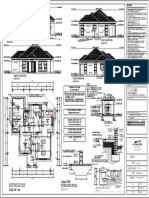

- Ground Floor: Back Elevation Side ElevationDocument1 pageGround Floor: Back Elevation Side ElevationanzaniNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

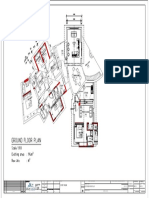

- Dimakatso Ntihe Site Plan A3Document1 pageDimakatso Ntihe Site Plan A3anzaniNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chief Vho-Masia Revised PlanDocument1 pageChief Vho-Masia Revised PlananzaniNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Ribisi Velly PDFDocument1 pageRibisi Velly PDFanzaniNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Drainage Layout: Scale 1:100 Area: 370 MDocument1 pageDrainage Layout: Scale 1:100 Area: 370 ManzaniNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Concrete roof tiles on trusses and 50mm glass fibre insulationDocument1 pageConcrete roof tiles on trusses and 50mm glass fibre insulationanzaniNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Firt Floor Plan A1 PDFDocument1 pageFirt Floor Plan A1 PDFanzaniNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- KZN Revised FenceDocument1 pageKZN Revised FenceanzaniNo ratings yet

- Toilet Layout PlanDocument1 pageToilet Layout PlananzaniNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

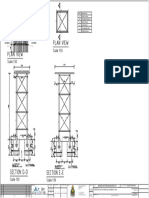

- Elevated Water Tank PDFDocument1 pageElevated Water Tank PDFanzaniNo ratings yet

- 30° roof galvanized IBR sheetsDocument1 page30° roof galvanized IBR sheetsanzaniNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Chauke Deon A1 PageDocument1 pageChauke Deon A1 PageanzaniNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Electrical Layout: Scale 1:100 Area: 370 MDocument1 pageElectrical Layout: Scale 1:100 Area: 370 ManzaniNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- 80A Distribution Box LayoutDocument1 page80A Distribution Box LayoutanzaniNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Cover PageDocument1 pageCover PageanzaniNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- EBE ArchitectureDocument35 pagesEBE ArchitectureanzaniNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Solidworks TutorialDocument116 pagesSolidworks Tutorialmaloy75% (4)

- Bachelor of Architecture: Qualification Code: BPAR17 - NQF Level 8 (480 Credits)Document8 pagesBachelor of Architecture: Qualification Code: BPAR17 - NQF Level 8 (480 Credits)anzaniNo ratings yet

- Diploma in Industrial Design: RemarksDocument5 pagesDiploma in Industrial Design: RemarksanzaniNo ratings yet

- Muloho A3 Page SizeDocument1 pageMuloho A3 Page SizeanzaniNo ratings yet

- Khuthi Munarini - A4Document1 pageKhuthi Munarini - A4anzaniNo ratings yet

- Electrical Layout: Side Elevation Back ElevationDocument1 pageElectrical Layout: Side Elevation Back ElevationanzaniNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bachelor of Architecture: (Qualification Type: Professional Bachelor's Degree)Document10 pagesBachelor of Architecture: (Qualification Type: Professional Bachelor's Degree)anzaniNo ratings yet

- Architecture WebDocument20 pagesArchitecture WebanzaniNo ratings yet

- Bachelor of The Built Environment in Architecture: Steve Biko Campus (S5 Level 5)Document2 pagesBachelor of The Built Environment in Architecture: Steve Biko Campus (S5 Level 5)anzaniNo ratings yet

- Architects 2Document302 pagesArchitects 2anzaniNo ratings yet

- Bachelor of Architectural StudiesDocument9 pagesBachelor of Architectural StudiesanzaniNo ratings yet

- Architects 2Document302 pagesArchitects 2anzaniNo ratings yet

- Experiential Training Exit Interview GuideDocument3 pagesExperiential Training Exit Interview GuideanzaniNo ratings yet

- 2011 TJC Prelim H2 Econs Paper 2Document3 pages2011 TJC Prelim H2 Econs Paper 2Declan RajNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Construction Economics Semester Project FinalDocument92 pagesConstruction Economics Semester Project Finalyared kebede100% (1)

- Tax Invoice: 8by8 SolutionsDocument1 pageTax Invoice: 8by8 SolutionsZionrayNo ratings yet

- Maths Frameworking 3.1 AnswersDocument47 pagesMaths Frameworking 3.1 AnswersOkuse AdohNo ratings yet

- Miners' Guild - Mining in LythiaDocument16 pagesMiners' Guild - Mining in LythiaA.J. GrundNo ratings yet

- IBA Approved TransportersDocument42 pagesIBA Approved TransportersParam Saxena60% (35)

- Roche Holdings AG Funding The Genentech AcquistionDocument8 pagesRoche Holdings AG Funding The Genentech AcquistionIrka Dewi TanemaruNo ratings yet

- Questions: Financial & Cost Accounting - PAPER-CDocument4 pagesQuestions: Financial & Cost Accounting - PAPER-CMuhammad Behram KhanNo ratings yet

- Module 4 - IMDocument46 pagesModule 4 - IMDHWANI DEDHIANo ratings yet

- VCE Summer Internship Program 2021: Their CharacterDocument5 pagesVCE Summer Internship Program 2021: Their CharacterKetan PandeyNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- China Pakistan Economic Corridoor: Prestented by Waleed Babar B-Com Part 2Document9 pagesChina Pakistan Economic Corridoor: Prestented by Waleed Babar B-Com Part 2Sana KhanNo ratings yet

- Transfer and Business TaxationDocument78 pagesTransfer and Business TaxationLeianneNo ratings yet

- Microeconomics SyllabusDocument3 pagesMicroeconomics SyllabusPaulyne Pascual100% (1)

- WBS11 01 Que 20190118Document20 pagesWBS11 01 Que 20190118Rashedul HassanNo ratings yet

- Model 3009 Series II Improved Instruction BookDocument16 pagesModel 3009 Series II Improved Instruction Bookvincen chenNo ratings yet

- Tech 1Document10 pagesTech 1evansparrowNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument30 pagesIas 1 Presentation of Financial Statementsesulawyer2001No ratings yet

- GAD Major Bridge Cum VUP LVUP SVUP 4.50m ClearanceDocument9 pagesGAD Major Bridge Cum VUP LVUP SVUP 4.50m ClearanceVipin cNo ratings yet

- The Train We Never Expected Coming and We Weren'T Prepared: Carmela Amular Marasigan Reaction PaperDocument2 pagesThe Train We Never Expected Coming and We Weren'T Prepared: Carmela Amular Marasigan Reaction PaperIrene baeNo ratings yet

- OdishaDocument12 pagesOdishaANKIT DWIVEDINo ratings yet

- Self Help Group Upsc Notes 14Document5 pagesSelf Help Group Upsc Notes 14Ajay RohithNo ratings yet

- Live Project On Inventory Problem of Big BazaarDocument32 pagesLive Project On Inventory Problem of Big Bazaarlokeshsharma8845% (11)

- KPMG Familiar Challenges New SolutionsDocument40 pagesKPMG Familiar Challenges New SolutionsAmy GongNo ratings yet

- Profit RatesDocument3 pagesProfit RatesRashid AhmadaniNo ratings yet

- Quiz - Game TheoryDocument2 pagesQuiz - Game TheoryRaunak Agarwal50% (2)

- Powergrid: Yash Bhuthada SAP ID - 74011919001Document32 pagesPowergrid: Yash Bhuthada SAP ID - 74011919001YASH BHUTADANo ratings yet

- Inventory ManagementDocument17 pagesInventory ManagementMunyaradzi MhlangaNo ratings yet

- ECONOMICS P1 M18 To J22 C.VDocument428 pagesECONOMICS P1 M18 To J22 C.VsukaNo ratings yet

- Introduction To Business: QCF Level 4 UnitDocument164 pagesIntroduction To Business: QCF Level 4 UnitMark AminNo ratings yet

- Stamp Swap Out Form Under 200 Pounds v1.6Document2 pagesStamp Swap Out Form Under 200 Pounds v1.6trevarevaNo ratings yet