Professional Documents

Culture Documents

Caso 2 Coursera

Uploaded by

hyjulioCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caso 2 Coursera

Uploaded by

hyjulioCopyright:

Available Formats

M-1298-E

Rev. 5/2016

Dodot: The Introduction of a Basic Line in the Iberian Peninsula

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

In the spring of 2009, the general manager for the Iberian region of Procter & Gamble (P&G) met

with the top management team of Arbora & Ausonia (A&A), the joint venture between P&G and

its Spanish partner dating back to 1989. A&A, which operated as a complete independent entity,

was responsible for the manufacturing and commercialization of P&G’s baby-care, feminine-care

and hygiene products. The purpose of the meeting was to evaluate the progress of the recent

decision by Mercadona (the largest retail chain in the Iberian Peninsula) to significantly reduce

the number of references in most product categories with the objective of lowering prices for

consumers, a shift that promised to revolutionize the retail landscape in Spain.

P&G continued to be the unquestionable worldwide leader in baby- and child-care products.

Kimberly-Clark (K-C), which owned the Huggies franchise, was the only other formidable

worldwide competitor. Pampers was one of P&G’s largest franchises with worldwide sales of

approximately €12 billion. In the Iberian Peninsula, A&A operated in the diaper category with

the brand name Dodot and the company prided itself on being at the forefront of innovation

since the launch of the first disposable diaper in Spain in 1971. A&A overwhelmingly

dominated the nappies, diapers, and pants category in Iberia. However, market share in diapers

had eased in Portugal from 75% to 70% over the past five years, while in Spain the descent

was from 60% to 55% over the previous seven-year period.1 Competitors such as Mercadona,

Carrefour and Pingo Doce wooed consumers with lower-price versions. Now A&A was

considering introducing a brand at a price point just below Huggies Super Seco or 20% below

the price of A&A’s flagship Dodot Etapas brand. The new brand, Dodot Básico, was to be

available only at some supermarket retail chains and discounters, and to receive neither

advertising nor trade marketing support. While the company’s vice president of sales, Victor

Solís, viewed the move favorably, CFO Carlos Fernandez and others were more skeptical and

viewed the strategy as facilitating private label trial.

1 Source: Euromonitor International, trade associations, trade and general press, and casewriter analysis.

This case was prepared by Justyna Gorecka-Pietrucha, Researcher, under the supervision of Professor Mario Capizzani,

as the basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative

situation. This case is not intended to endorse the company or to serve as a primary source of data regarding the

company. Only public information sources were used by the authors. Some of the information in this document

has been modified or altered for teaching purposes. November 2012. Revised in May 2016.

Copyright © 2012 IESE. To order copies contact IESE Publishing via www.iesep.com. Alternatively, write to iesep@iesep.com

or call +34 932 536 558.

No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any

form or by any means – electronic, mechanical, photocopying, recording, or otherwise – without the permission of IESE.

Last edited: 5/17/16

1

M-1298-E Dodot: The Introduction of a Basic Line in the Iberian Peninsula

The Iberian Diaper Market

In 2008, approximately 480 million diapers were sold in Portugal and 2.03 billion were sold in

Spain. Typically, a customer would pay between €15 and €27 for a 60 – 160 unit pack of

diapers. Over the past five years, the market’s annual unit growth rate averaged 2.1%. Major

suppliers were A&A, Kimberly-Clark (K-C) and brands from the largest retail distributors such

as Mercadona, El Corte Ingles (ECI) and Carrefour. P&G manufactured and sold only branded

products, whereas the majority of private labels were sourced from one of three suppliers: SCA,

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

Sofidel and K-C itself. Diapers were mainly distributed through super and hypermarkets (61%

of sales), discount retailers (15%), small grocery retailers and convenience stores (11%), health

& beauty retailers and pharmacies (7.5%) and other stores (5.5%).

Estimates of market share by volume are presented in Table 1.

Table 1

Approximate unit market share at the beginning of 2009

Brand Spain Portugal

Dodot 55% 70%

Huggies 16% 12%

Distribution label 24% 17%

Other 4% 1%

Pampers and Huggies competed in a global battle for dominance of the diaper category.

Huggies’ worldwide sales of €5.5 billion in 2008 made it only half of Pampers’ size.

Furthermore, in Western Europe that market share gap was widening as analysts expected

Pampers’ unit volume to grow at more than 3% vs. less than 1% for Huggies.2 In Spain and

Portugal, Dodot commanded large name recognition, to the point where there was a time in

Spain in which diapers were simply called “Dodoties.” A&A produced annually approximately

one and a half billion diapers in its plant in Alicante, from where it served its entire Iberian

operation. Training pants (imported from other P&G European plants), complemented the

product offering, but diapers constituted approximately 95% of the share of retail sales.

Wipes were the other product complementing the baby-care category.

Private labels as a group had grown sales in Spain at close to 9% a year over the previous

four years, while in Portugal they had grown at over 20% in a similar period, debunking

Huggies to achieve a combined number two market share position. Huggies, nevertheless,

thanks to an intensive promotional strategy, had managed to retain a stable market share

quota in Portugal, while only shedding three percentage points in Spain during the same

period.

2 “Nappies war intensifies in Europe, but Asia is bigger prize,” May 2010, Euromonitor.

2 IESE Business School-University of Navarra

Dodot: The Introduction of a Basic Line in the Iberian Peninsula M-1298-E

Category Pricing

Dodot’s Etapas brand was the standard for the industry and it represented more than 70% of

all the diapers sold by A&A in 2008. Exhibit 1 shows the average non-discounted retail price

per unit for representative products.

As shown in Exhibit 1, there were four price tiers in the market. Dodot Etapas, the largest

selling brand by far, set the premium brand at €0.26 per unit. A&A’s gross margins for

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

diapers were estimated to be about 45%. Both A&A and K-C offered super-premium brands,

Dodot Activity and Huggies Super Seco Ultra, targeted at the highest quality shoppers. In

2010, A&A was planning to introduce its most advanced Dodot Activity product, which

would replace cellulose pulp from the diaper core with an absorbent gel material. This

technology would help produce the driest and thinnest diaper on the market (see Exhibit 3b

for promotional material).

Huggies’ flagship brand, Huggies Super Seco, anchored the economy brand at 15% below the

premium tier product. Huggies’ gross margin was believed to be around 25%. Finally, most

distributors’ labels made up the price tier with Mercadona, Carrefour and Hypercor diapers

constituting over two-thirds of the volume share of that price tier. While some of the diapers

in this price group were “branded” products, others were simply sold under the retailer’s

brand (e.g., Carrefour). Most parents easily recognized brands belonging to large supermarket

chains. On average, these “price brands” were priced about 35% – 40% lower than Dodot

Etapas. Dealer percentage margins were typically higher for private label products.3

Consumer Insights

A typical family could expect to spend around €1,500 on disposable diapers by the time a

toddler was potty trained.4 Usage intensity normally decreased as the child evolved and it

typically ranged from seven to twelve diapers per day for small babies to four to eight

diapers per day for toddlers.

Exhibit 2 shows the birth rates and expected fertility rates for Spain and Portugal.

Often supermarket chains offered diaper packs on sale, where the second pack was heavily

discounted, a practice that had intensified with the economic crisis affecting Portugal and

Spain. In some instances the discount was more than 50% off the price of the first pack.

Packs came in multiple unit sizes to accommodate different households’ usage and storage

capacity. This fact made unit price comparison somewhat difficult. In addition, pack sizes

varied among the different supermarket chains. Diaper sizes typically ranged from sizes one

to six depending on the weight of the baby, with sizes three to five constituting the largest

volume of sales.

Dodot advertised heavily, e.g., spending approximately €15 million on diapers, training

pants, and wipes in the Iberian Peninsula in 2008, more than three times what K-C spent on

3 Case writer’s note: For the purpose of calculation in the case analysis, a good approximation is that distributor mark-up on

A&A diapers averaged 15%; other supplier diapers yielded a 20% distributor mark-up.

4 The Organization for Consumers and Users in Spain (OCU) estimated an average of 5,700 diapers per child.

IESE Business School-University of Navarra 3

M-1298-E Dodot: The Introduction of a Basic Line in the Iberian Peninsula

Huggies. Traditionally, A&A advertising had emphasized its new product innovations and

product benefits. In addition, it ran a partnership with UNICEF on all packs of the Dodot

brand, offering a free tetanus vaccine with each pack sold. Furthermore, P&G invested

heavily in R&D by testing over three million diapers every year on more than 25,000 babies

and infants, an investment that private label brands could not match.

People typically compared diapers based on absorption capacity, skin irritation, leakage, strap

adhesiveness, fit and price. Among these attributes, parents were most concerned with avoiding

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

diaper rash. A small percentage of households actually bought more than one brand, favoring

extra absorption capacity for night time. Actual differences among diapers were unclear, yet

people in Europe often showed high levels of loyalty to one brand even in tough economic

times. Despite many reviews available on the Internet, independent consumer reports were

difficult to find. A 2008 comparison conducted by a large supermarket chain concluded that

most brands yielded satisfactory results, with the exception of super-premium brands, which

typically yielded very satisfactory results, 5 while a study by the Spanish Organization for

Consumers and Users (OCU) concluded that some private label brands performed as well as

some branded products and in some cases even better.6 Several blogs available online for first-

time parents recommended sampling several brands before committing to one.

The hassle in quality comparison implied that the choice between brands was mostly a matter

of personal preference, brand attachment, and wallet size. Diego Marquez, A&A’s marketing

director for diapers commented that

“the importance of brand name in consumer decision making is still very strong; on the

other hand, if the economic crisis deepens, there might be a growing body of price-

sensitive consumers. In other words, we are likely to see more growth in private label and

promotional activity.”

A&A’s own research on Iberian consumers had shown that 45% of buyers were “Dodot loyals,”

less than 10% were “Huggies loyals”, 30% were samplers, and 15% shopped based on price.

New Dodot Marketing Strategy

Starting in 2010, A&A was planning a major repositioning of its diaper product line. New Dry &

Adapt Technology would result in the introduction of a new Dodot Activity product to be

named “iPañal” (“iFralda” in Portugal). At the same time, the economic situation fostered the

creation of value brands. Altogether, three kinds of diapers would be offered (see Exhibit 3):

1. New Dodot Activity or “iPañal” – to replace the old Activity product in the Super-

premium segment. It would be advertised as the thinnest and driest of all diapers on the

market and positioned as the “the most comfortable for the baby” (see Exhibit 3b). It

would retail at a 25% surplus over the premium Etapas brand and would be priced to the

trade at only a 3% premium over the current Activity product. The new Dodot Activity

would receive heavy advertising support reaching 40% of Dodot’s marketing budget.

5 Consumer Eroski, April 2008, http://revista.consumer.es/web/es/20080401/actualidad/analisis2/72493_2.php.

6 http://www.ocu.org/consumo-familia/nc/consejos/panales-cual-comprar.

4 IESE Business School-University of Navarra

Dodot: The Introduction of a Basic Line in the Iberian Peninsula M-1298-E

2. Dodot Etapas – would remain the flagship product promoted as standard diapers for

every single stage of a baby’s development. Etapas would continue to receive 60% of

the entire marketing budget.

3. Dodot Básico – a value product line to give Dodot a presence in the economy tier at a

price roughly 25% below Dodot Etapas. Its pack would promote “Dodot quality at

a basic price.”

Key aspects of the marketing plan of Dodot Básico were:

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

Minimum to no advertising support.

Offered only in selected distribution channels (i.e., mainly supermarkets and discounters).7

Available in large and super large unit packs only (>100 units).

Sold at specified prices (i.e., no discounts or promotions).

Offered only in most commonly used sizes: three to five.

Thinking about 2010, Marquez pondered whether the new marketing strategy would help his

unit drive both earnings and market share growth. He thought that, at the very least, the new

product line had potential to allow them to be more selective in targeting certain customer

segments. At the same time, he wondered what alternative strategies could better help him

achieve his objectives.

7 Mercadona, the second largest retailer in Spain with a 13% market share for distribution, had declined to stock the new Dodot

Básico product line.

IESE Business School-University of Navarra 5

M-1298-E Dodot: The Introduction of a Basic Line in the Iberian Peninsula

Exhibit 1

Price Tiers in Diaper Market in Portugal and Spain Defined by Mean Retail

Sales Price (in €)

Product/Brand Portugal Spain Index

Super-premium brands

Dodot Activity 0.27 0.31 (122)

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

Huggies Super-Seco Ultra 0.23 0.29 (112)

Premium brands

Dodot Etapas 0.22 0.26 (100)

Economy brands

Huggies Super-Seco 0.19 0.22 (85)

Price brands

Eroski - 0.16 (64)

Mercadona (Deliplus) - 0.16

Lidl 0.14 0.16

Hipercor (Aliada) 0.14 0.15

Carrefour 0.13 0.15 (60)

Día/Minipreço 0.13 0.15

Pingo Doce 0.13 - (59)

Intermarché 0.13 -

Note: Numbers in ( ) are indices indicating relative price with respect to Dodot Etapas.

Source: Retailers’ non-promotional average posted prices for size four diapers and case writer analysis.

Exhibit 2

Demographic Statistics: Birth Rate per 1,000 People (BRPT) and Fertility Rate (FR)

in Portugal and Spain

2005 2006 2007 2008 2009 2010E 2015E

BRPT Portugal 10.70 10.90 10.90 11.30 11.20 10.90 9.60

FR Portugal 1.33 1.36 1.38 1.46 1.47 1.47 1.49

BRPT Spain 10.80 10.70 10.60 10.50 10.30 10.10 9.30

FR Spain 1.47 1.47 1.48 1.49 1.49 1.50 1.52

Source: Datamonitor and Eurostat.

6 IESE Business School-University of Navarra

Dodot: The Introduction of a Basic Line in the Iberian Peninsula M-1298-E

Exhibit 3

New Proposed Dodot Product Line Starting in 2010: Activity, Etapas and Básico

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

Exhibit 3b

Upcoming Dodot Activity With Dry & Adapt Technology – the “iPañal” (i.e., “iDiaper”)

Source: Arbora & Ausonia.

IESE Business School-University of Navarra 7

M-1298-E Dodot: The Introduction of a Basic Line in the Iberian Peninsula

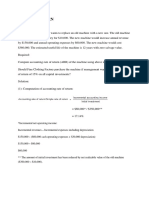

Exhibit 4

A&A Annual Income Statement

Annual Income Statement (in €m)

2009 (F) 2008

Net Sales 625 655

This document is an authorized copy for the course "Understanding Your Customers" taught by prof. Mario Capizzani.

Subsidies for operating costs – 0

Other operating income 0

Total revenue 620 651

Costs of goods sold 256 285

Gross profit 364 366

Service cost 87 96

Total payroll cost 71 71

Cost of stock depreciation and amortization -0.1 -0.2

Fixed assets depreciation and amortization 36 45

Other operating costs 0.8 0.9

Net operating income 169 152

Total financial income 2 6

Total expenses 0.8 1

Profit after extraordinary items and before tax

Tax 170 158

Total taxation 46 41

Net profit 125 116

Source: Dun & Bradstreet.

8 IESE Business School-University of Navarra

You might also like

- 5a. Dodot CaseDocument8 pages5a. Dodot Casedavidix4998No ratings yet

- When Will P - G Play To Win AgainDocument3 pagesWhen Will P - G Play To Win AgainhelloharumiNo ratings yet

- Appendix (Attach Pictures or Evidences To Support The Cotent)Document4 pagesAppendix (Attach Pictures or Evidences To Support The Cotent)noor-us- sabaNo ratings yet

- Case For Discussion On August 1Document13 pagesCase For Discussion On August 1Abhishek VermaNo ratings yet

- Pampers Marketing SampleDocument7 pagesPampers Marketing SampleAll AssignmentHelpNo ratings yet

- Green White Minimalist Modern Real Estate Presentation - 20230901 - 232523 - 0000Document20 pagesGreen White Minimalist Modern Real Estate Presentation - 20230901 - 232523 - 0000Aanam SalwaNo ratings yet

- 3 Procter & Gamble CaseDocument2 pages3 Procter & Gamble CaseLeah Lou CamadduNo ratings yet

- Evolution of Strategy at P&GDocument1 pageEvolution of Strategy at P&GJohan Sebastian PantojaNo ratings yet

- Pgjapancase PDFDocument2 pagesPgjapancase PDFCuong Bui Phu0% (1)

- Head Shoulder PakistanDocument29 pagesHead Shoulder PakistanFatima Sabahat100% (1)

- Procter and Gamble 1929 CrisisDocument2 pagesProcter and Gamble 1929 CrisisCriss NicoletaNo ratings yet

- Parle G 1Document22 pagesParle G 1Pranita PotnisNo ratings yet

- Re Branding of Fail Product - A Case Study of CAMYDocument14 pagesRe Branding of Fail Product - A Case Study of CAMYdijam_78692% (13)

- Procter and Gamble India LimitedDocument68 pagesProcter and Gamble India Limitedten_ishan88No ratings yet

- Procter & GambleDocument6 pagesProcter & GambleDenise KimNo ratings yet

- Consumer Behaviour Parle GDocument5 pagesConsumer Behaviour Parle GRuchika SinghNo ratings yet

- Procter & GambleDocument40 pagesProcter & GambleAnshu Bhadoria67% (3)

- P&G Case SolutionsDocument6 pagesP&G Case SolutionsMarianAbraham60% (5)

- Presentation MainDocument13 pagesPresentation MainMDNo ratings yet

- 01 Activity 1 SMDocument1 page01 Activity 1 SMJosie Lou RanqueNo ratings yet

- Marketing Project Tide Vs RinDocument39 pagesMarketing Project Tide Vs RinBlessyBrize890% (1)

- Parle-G PLCDocument6 pagesParle-G PLCShruti KumariNo ratings yet

- How Fogg Stays Ahead in Deos - Business Standard News PDFDocument7 pagesHow Fogg Stays Ahead in Deos - Business Standard News PDFram kumarNo ratings yet

- How Fogg Stays Ahead in Deos - Business Standard News PDFDocument7 pagesHow Fogg Stays Ahead in Deos - Business Standard News PDFram kumarNo ratings yet

- ICLA Report-CosmeticsDocument11 pagesICLA Report-CosmeticsAnand BhagwaniNo ratings yet

- Pampers Term ProjectDocument20 pagesPampers Term ProjectAbdul Razzak100% (1)

- Competitor PositioningDocument2 pagesCompetitor PositioningHarshith KdNo ratings yet

- Parle G Marketing ProjectDocument8 pagesParle G Marketing ProjectSoumya TalwarNo ratings yet

- AD Review FrootiDocument17 pagesAD Review FrootiabhijitdeoghariaNo ratings yet

- Diaper War: Delhi School of ManagementDocument39 pagesDiaper War: Delhi School of ManagementAnkit Malik100% (1)

- Colgate Case StudyDocument9 pagesColgate Case Studyguulleed99_265184442No ratings yet

- CASES For MGT. Seminar - MarketingDocument6 pagesCASES For MGT. Seminar - MarketingSim BelsondraNo ratings yet

- ParleDocument14 pagesParlePooja Mittal100% (1)

- P&GDocument34 pagesP&GPankaj SachanNo ratings yet

- ProcterDocument9 pagesProcteranon-513952No ratings yet

- Rising Tide (CH 6)Document2 pagesRising Tide (CH 6)Sakshi MaheshwariNo ratings yet

- Product Strategy & Management: Pantene: Building A Global Beauty BrandDocument7 pagesProduct Strategy & Management: Pantene: Building A Global Beauty BrandvinayNo ratings yet

- CASE METHODOLOGY - ColgateDocument11 pagesCASE METHODOLOGY - ColgateFakhrul Anour AbdullahNo ratings yet

- MM 45313 07 New....Document5 pagesMM 45313 07 New....Abdurehman Ullah khanNo ratings yet

- 3-Sesión 3-Danone-Think Global Act Local PDFDocument6 pages3-Sesión 3-Danone-Think Global Act Local PDFRobinson Castro PeinadoNo ratings yet

- Parle-G Final Report...Document13 pagesParle-G Final Report...zebaishhNo ratings yet

- A16 - PresentationDocument21 pagesA16 - Presentationfrancisco.fcarvalho00No ratings yet

- Process Costing of ParlegDocument38 pagesProcess Costing of ParlegHemant AherNo ratings yet

- Ikuee Av32dDocument5 pagesIkuee Av32dSaniaNo ratings yet

- Different For GambleDocument2 pagesDifferent For GambleTamanna SinghNo ratings yet

- Millennium Edition (Prentice Hall 2000) Throws Some Light OnDocument10 pagesMillennium Edition (Prentice Hall 2000) Throws Some Light OnIshaNo ratings yet

- Procter and GambleDocument26 pagesProcter and GambleAbeeha MahmoodNo ratings yet

- Procter & Gamble: BackgroundDocument4 pagesProcter & Gamble: BackgroundSaloni GoyalNo ratings yet

- Case Simulation PGDocument2 pagesCase Simulation PGManu BhikshamNo ratings yet

- The Evolution of Strategy at P - G 1Document2 pagesThe Evolution of Strategy at P - G 1Vy VyNo ratings yet

- Assignment Maarketing PlanDocument15 pagesAssignment Maarketing Planjanimubarkob23No ratings yet

- Parle GDocument16 pagesParle GKhanjan HariyaniNo ratings yet

- Case On Parle GDocument5 pagesCase On Parle GpushkargtmNo ratings yet

- Pampers 7 PDFDocument10 pagesPampers 7 PDFAdeelNo ratings yet

- The Game-Changer (Review and Analysis of Lafley and Charan's Book)From EverandThe Game-Changer (Review and Analysis of Lafley and Charan's Book)No ratings yet

- Citizen Brand: 10 Commandments for Transforming Brands in a Consumer DemocracyFrom EverandCitizen Brand: 10 Commandments for Transforming Brands in a Consumer DemocracyNo ratings yet

- From Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationFrom EverandFrom Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationRating: 3 out of 5 stars3/5 (1)

- Building Brand Equity: The Importance, Examples & How to Measure ItFrom EverandBuilding Brand Equity: The Importance, Examples & How to Measure ItNo ratings yet

- Hult Brand Book 2022 23 MastersDocument62 pagesHult Brand Book 2022 23 MastershyjulioNo ratings yet

- Hult Brand Book 2022 23 MastersDocument62 pagesHult Brand Book 2022 23 MastershyjulioNo ratings yet

- Trade and Integration Monitor 2020 The COVID 19 Shock Building Trade Resilience For After The PandemicDocument75 pagesTrade and Integration Monitor 2020 The COVID 19 Shock Building Trade Resilience For After The PandemichyjulioNo ratings yet

- Determinism and Indeterminism From Physi PDFDocument7 pagesDeterminism and Indeterminism From Physi PDFhyjulioNo ratings yet

- Desing CreativityDocument175 pagesDesing CreativityhyjulioNo ratings yet

- 2015 Book DesignThinkingResearch PDFDocument287 pages2015 Book DesignThinkingResearch PDFgilmermace_5No ratings yet

- Brand ExtensionDocument28 pagesBrand ExtensionRajat BhattacharjeeNo ratings yet

- Design Thinking BookDocument287 pagesDesign Thinking Bookhyjulio100% (5)

- Annual Financial Statements 2007Document0 pagesAnnual Financial Statements 2007hyjulioNo ratings yet

- If You Want 2015 CFA Stuff (Notes, Practice Exams.Document6 pagesIf You Want 2015 CFA Stuff (Notes, Practice Exams.GoldArktosNo ratings yet

- Service InnovationDocument220 pagesService InnovationhyjulioNo ratings yet

- Information Resource ManagementDocument39 pagesInformation Resource ManagementHiko Saba100% (1)

- Oracle Cloud Fusion Tax 12092016 V1.0Document44 pagesOracle Cloud Fusion Tax 12092016 V1.0prasadv19806273100% (1)

- Basic Quality ConceptDocument11 pagesBasic Quality ConceptJer RyNo ratings yet

- E-Commerce in IndiaDocument4 pagesE-Commerce in IndiaSohail AhmadNo ratings yet

- Industry AnalysisDocument15 pagesIndustry Analysisarchanabaskota026No ratings yet

- Case Study - A Rush To Failure?Document3 pagesCase Study - A Rush To Failure?Nic Sarayba100% (2)

- Audit and Assurance June 2011 Marks PlanDocument15 pagesAudit and Assurance June 2011 Marks Planjakariauzzal100% (1)

- Benchmarking: Strategies For Product DevelopmentDocument27 pagesBenchmarking: Strategies For Product DevelopmentVinoth RajaNo ratings yet

- The Need For Big Data Governance Collibra MaprDocument8 pagesThe Need For Big Data Governance Collibra Maprsayhi2sudarshanNo ratings yet

- Hershey v. LBB ImportsDocument50 pagesHershey v. LBB ImportsMark JaffeNo ratings yet

- Miss Samantha D Erlston Doreen 56 B High RD Edenvale 1609: Transactions in RAND (ZAR) Accrued Bank ChargesDocument2 pagesMiss Samantha D Erlston Doreen 56 B High RD Edenvale 1609: Transactions in RAND (ZAR) Accrued Bank ChargesSamantha Erlston100% (1)

- Women TrainingDocument19 pagesWomen TrainingvsgunaNo ratings yet

- Presentacion Ramo 1Document8 pagesPresentacion Ramo 1jhonNo ratings yet

- Professional MDocument24 pagesProfessional Mmusa219No ratings yet

- A) List and Explain 5 Possible Problem That Can Be Faced by A Company Without Proper Human Resouces ManagementDocument9 pagesA) List and Explain 5 Possible Problem That Can Be Faced by A Company Without Proper Human Resouces Managementzakuan79No ratings yet

- VKCDocument8 pagesVKCVaishnav Chandran k0% (1)

- PSM Auditing (Presentation)Document25 pagesPSM Auditing (Presentation)kanakarao1100% (1)

- Guinness 6th EdDocument2 pagesGuinness 6th Edachikungu2225No ratings yet

- DBA Weights-PowerShares ETFsDocument7 pagesDBA Weights-PowerShares ETFsfredtag4393No ratings yet

- InternalAuditSOP 012413Document29 pagesInternalAuditSOP 012413Rony Lesbt100% (3)

- How Is Industry' Defined Under Labour Laws in India?Document13 pagesHow Is Industry' Defined Under Labour Laws in India?Arhum KhanNo ratings yet

- The ASEAN Digital Revolution - Full Report - A.T PDFDocument36 pagesThe ASEAN Digital Revolution - Full Report - A.T PDFMegan BlanchardNo ratings yet

- Prac2 ReviewerDocument12 pagesPrac2 ReviewerRay Jhon Ortiz0% (1)

- Rencana Bisnis Art Box Creative and Coworking SpaceDocument2 pagesRencana Bisnis Art Box Creative and Coworking SpacesupadiNo ratings yet

- COMPANY A - BPM Assessment - Final PDFDocument35 pagesCOMPANY A - BPM Assessment - Final PDFhussein jardali100% (1)

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- TNPSC Maths Only QuestionsDocument22 pagesTNPSC Maths Only QuestionsSri RamNo ratings yet

- Rev.1 - Conciliation of RevenuessDocument101 pagesRev.1 - Conciliation of RevenuessMirandaNo ratings yet

- Hibernate Reference EnversDocument42 pagesHibernate Reference EnverslifedjNo ratings yet

- Presented By: Namrata Singh Samiksha Sahej Grover Sonal MidhaDocument35 pagesPresented By: Namrata Singh Samiksha Sahej Grover Sonal MidhaYatin ChopraNo ratings yet