Professional Documents

Culture Documents

Sepa File

Uploaded by

Rajendra PilludaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sepa File

Uploaded by

Rajendra PilludaCopyright:

Available Formats

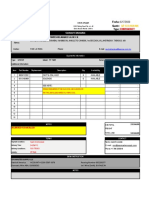

Customer Credit Transfer Initiation V3 pain.001.001.

03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

Customer Credit Transfer Initiation <CstmrCdtTrfInitn> R R R R

1.0 GroupHeader <GrpHdr> [1..1] Component R R R R

1.1 MessageIdentification <MsgId> [1..1] Text Max 35 R R R R This tag contains the Payment Instruction ID, which is similar to the batch ID for that payment process run. Please confirm if this is correct.

1.2 CreationDateTime <CreDtTm> [1..1] DateTime R R R This is the date and time that the XML message is R This is the date and time that the XML message is Is the date time format correct? Example: 2016-05-02T15:48:55

created. created.

1.6 NumberOfTransactions <NbOfTxs> [1..1] Text Max 15 Numeric R R R Total number of credit transfer transactions in the R Total number of credit transfer transactions in the

entire message. This value will be validated. If totals entire message. This value will be validated. If totals

are not equal, entire file will be rejected. are not equal, entire file will be rejected.

1.7 ControlSum <CtrlSum> [0..1] Quantity O O O The sum is the hash total of values in Instructed O The sum is the hash total of values in Instructed

Amount or Equivalent Amount in the entire message. If Amount in the entire message. If <CtrlSum> is

<CtrlSum> is included, the value will be validated. If included, the value will be validated. If totals are not

totals are not equal, entire file will be rejected. equal, entire file will be rejected.

1.8 InitiatingParty <InitgPty> [1..1] R R R This tag identifies the sender of the message. R This tag identifies the sender of the message.

9.1.0 Name <Nm> [0..1] Text Max 140 O O O Name may be included; must also include Id to identify O Name may be included; must also include Id to identify

sender. sender.

9.1.12 Identification <Id> [0..1] R R R R

9.1.13 OrganisationIdentification <OrgId> [1..1] R R R Only one Id preferred R Only one Id allowed

9.1.14 BICOrBEI <BICOrBEI> [0..1] Identifier O O O Identification of sending party O Identification of sending party This tag is currently not included and is mentioned as optional. Please

9.1.15 Other <Othr> [0..n] O O O R confirm if this is expected. If required, please provide what value should be

9.1.16 Identification <Id> [1..1] Text Max 35 R R R Identification of sending party R Identification of sending party displayed here.

9.1.17 SchemeName <SchmeNm> [0..1] O O O O The child tag below this 'Cd' is mentioned as required. In that case we will need to display this as well.

9.1.18 Code <Cd> [1..1] Code R R R Identify the sending party identification type R Identify the sending party identification type Please confirm if this is required, and how do we obtain the values mentioned here for a particular supplier.

CUST √ √ √ √

DUNS √ √ √ √

EMPL √ √ √ √

GS1G √ √ √ √

TXID √ √ √ √

2.0 PaymentInformation <PmtInf> [1..n] Component R R R R

2.1 PaymentInformationIdentification <PmtInfId> [1..1] Text Max 35 R R R Used as Consoldiated Posting reference; equivalent to R Used as Consoldiated Posting reference; equivalent to

Batch Number. Maximum of 16 characters. Batch Number. Maximum of 16 characters.

If populated for US ACH, first 10 characters will be used

for batching.

2.2 PaymentMethod <PmtMtd> [1..1] Code R R R R

CHK √

TRF √ √ √

2.3 BatchBooking <BtchBookg> [0..1] Indicator O O O Consolidated Posting is dependent upon payment type O Consolidated Posting is dependent upon payment type

and clearing system processing. and clearing system processing.

1 or true = Consolidated Posting 1 or true = Consolidated Posting

0 or false = Single Posting 0 or false = Single Posting

2.4 NumberOfTransactions <NbOfTxs> [0..1] Text Max 15 Numeric O O O Total number of credit transfer transactions within the O Total number of credit transfer transactions within the

Payment Information Batch. This value will be Payment Information Batch. This value will be

validated. If totals are not equal, entire Payment validated. If totals are not equal, entire Payment

Infomration block will be rejected. Infomration block will be rejected.

2.5 ControlSum <CtrlSum> [0..1] Quantity O O O The sum is the hash total of values in Instructed O The sum is the hash total of values in Instructed

Amount or Equivalent Amount within the Payment Amount or Equivalent Amount within the Payment

Information Batch. . If <CtrlSum> is included, the Information Batch. . If <CtrlSum> is included, the

value will be validated. If totals are not equal, entire value will be validated. If totals are not equal, entire

Payment Infomration block will be rejected. Payment Infomration block will be rejected.

2.6 PaymentTypeInformation <PmtTpInf> [0..1] Component R R R - For Check Required at either at Payment or Transaction Level, but R Required at either at Payment or Transaction Level, but

Issue and should not be present at both levels. If populated at should not be present at both levels. If populated at

ePayables Card both, value at Transaction level will take precedence. both, value at Transaction level will take precedence.

Data Only

2.7 InstructionPriority <InstrPrty> [0..1] Code O O Based on whether priority processing vs. normal

processing is offered by the bank.

HIGH √ √

NORM √ √

2.8 ServiceLevel <SvcLvl> [0..1] Choice Component R R R R

2.9 Code <Cd> [1..1] Code R R

BKTR √ √ Book Transfers

URGP √ Wire or High Value Transactions

URNS √ Wire or High Value Transactions thru a Net Settlement

clearing

NURG √ ACH or Low Value Transactions

SEPA SEPA Transactions √ Only acceptable value for SEPA transactions

2.11 LocalInstrument <LclInstrm> [0..1] C C

2.12 Code <Cd> [1..1] Code R Required only for US ACH transactions

CCD √

CTX √

PPD √

IAT √

2.13 Proprietary <Prtry> [1..1] Text Max 35 C Value of 'CII' - Required for Check Issue Information for

US or Canada

Value of 'CCC' - Required for ePayables (Card)

transaction

2.14 CategoryPurpose <CtgyPurp> [0..1] O O The child tag below this 'Cd' is mentioned as required. In that case we will need to display this as well.

2.15 Code <Cd> [1..1] Code R R Please confirm if this is required, and how do we obtain the values mentioned here for a particular supplier.

CASH

CCRD

CORT

DCRD

DIVI √ √

GOVT

HEDG

ICCP

IDCP

INTC

INTE

LOAN

PENS √ √

SALA √ √

SECU

SSBE

SUPP

TAXS √ √

TRAD

TREA

VATX

WHLD

2.17 RequestedExecutionDate <ReqdExctnDt> [1..1] DateTime R R R Effective entry date of transaction R Effective entry date of transaction Is the date format correct? Example: 2016-05-02

2.19 Debtor <Dbtr> [1..1] R R R Ordering party R Ordering party

9.1.0 Name <Nm> [0..1] Text Max 140 R R R Ordering party name. R Ordering party name.

Maximum of 70 characters for US Checks which will be Maximum of 70 Latin characters.

split into two name lines of 35 characters for check

printing.

Maximum of 70 Latin characters outside of US.

Maximum of 30 Local Language characters for China

Maximum of 35 Local Language characters for Japan

and Taiwan.

9.1.1 PostalAddress <PstlAdr> [0..1] R R R R

9.1.5 StreetName <StrtNm> [0..1] Text Max 70 O O O If <StrtNm> and <BldgNb> are populated, the data O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1 the first address information used, followed by only 1

line of <AdrLine>. line of <AdrLine>.

9.1.6 BuildingNumber <BldgNb> [0..1] Text Max 16 O O O O - OCtry

9.1.7 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt Dpdt

9.1.8 TownName (City) <TwnNm> [0..1] Text Max 35 O O O O

9.1.9 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 O O O Required for US, Canada and Australia

9.1.10 Country <Ctry> [0..1] Code R R R Valid 2 character country code R Valid 2 character country code

9.1.11 AddressLine <AdrLine> [0..7] Text Max 70 O O O Two address lines from <AdrLine> will be used if O Two address lines from <AdrLine> will be used if

<StrtNm> and <BldgNb> are not populated <StrtNm> and <BldgNb> are not populated

9.1.12 Identification <Id> [0..1] O O O O

9.1.13 OrganisationIdentification <OrgId> [1..1] R R R R

9.1.14 BICOrBEI <BICOrBEI> [0..1] Identifier O O O O

9.1.15 Other <Othr> [0..n] C C C Required for US ACH - ACH Originator Id O

Confidential 11/07/2018 Page 1 of 8

Customer Credit Transfer Initiation V3 pain.001.001.03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

9.1.16 Identification <Id> [1..1] Text Max 35 R R R The debtor identification is required if a Code is R The debtor identification is required if a Code is The value is currently the legal entity registration number for the debtor and is 99068-06917. Is this correct?

provided in the Scheme Name component. provided in the Scheme Name component.

If the code used is BANK, the identification code is the If the code used is BANK, the identification code is the

Global Advice Client Id. Global Advice Client Id.

9.1.17 SchemeName <SchmeNm> [0..1] C C C C Is this component required? We have both Cd and Prtry tags below this, among which one is required. If required, please provide correct mapping.

9.1.18 Code <Cd> [1..1] Code XOR XOR XOR If <Cd> is populated, <Prtry> should not be populated. R Same as above

Use BANK to identify that the value in <Id> tag is a Use BANK to identify that the value in <Id> tag is a

BANK √ √ √ √

Global Advice Client Id Global Advice Client Id

CUST √ √ √

DUNS √ √ √

EMPL √ √ √

GS1G √ √ √

TXID √ √ √

CHID √ Use CHID for required US ACH - ACH Originator Id

9.1.19 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR - Required If <Prtry> is populated, <Cd> should not be populated. Same as above

for ePayables

and Brazil Value of EPBL (ePayables CRI Reference) for ePayables

Convenio Card transactions.

traansactions Value of CONVENIO when transaction in Brazil

2.20 DebtorAccount <DbtrAcct> [1..1] R R R Ordering party account R Ordering party account

1.1.0 Identification <Id> [1..1] R R R Only one account number allowed. R Either <IBAN> or <Other> must be populated.

Only one account number allowed.

1.1.1 IBAN <IBAN> [1..1] Identifier XOR

1.1.2 Other <Othr> [1..1] O O O O

1.1.3 Identification <Id> [1..1] Text Max 34 R R R For US and LATAM IWC, populate local account XOR If IBAN is not populated, tag must only contain 8 digit This displays the bank account number of the debtor. Please confirm if this is correct.

number. BofAML account number.

For all other non-US accounts, tag must contain 8 digit If non-US multibank, populate multibank account

BofAML account number. number

If non-US multibank, populate multibank account

number

1.1.4 SchemeName <SchmeNm> [0..1] O The child tag Cd below this is mentioned as required for SEPA. DO we need this tag as well?

1.1.5 Code <Cd> [1..1] Code R DO we need this tag since it is mentioned as required for SEPA? Also, if required will there be one value always 'BBAN'?

BBAN √

CUID

UPIC

1.1.8 Type <Tp> [0..1] O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt Required to US and JP

If not populated, default used for processing will be the

classification of a Checking/Demand Account type

(equivalent value of '2' for JP).

1.1.9 Code <Cd> [1..1] Code XOR XOR XOR If <Cd> is populated, <Prtry> should not be populated.

CACC √ √ √ Applicable to US; equivalent to Checking/Demand

Account type

CASH √ √ √ Equivalent to Checking/Demand Account type

CHAR √ √ √ Equivalent to Checking/Demand Account type

CISH √ √ √ Equivalent to Checking/Demand Account type

COMM √ √ √ Equivalent to Checking/Demand Account type

LOAN √ √ √ Equivalent to Checking/Demand Account type

MGLD √ √ √ Equivalent to Checking/Demand Account type

MOMA √ √ √ Applicable to JP (equivalent value of '4')

NREX √ √ √ Equivalent to Checking/Demand Account type

ODFT √ √ √ Equivalent to Checking/Demand Account type

ONDP √ √ √ Equivalent to Checking/Demand Account type

SACC √ √ √ Equivalent to Checking/Demand Account type

SLRY √ √ √ Equivalent to Checking/Demand Account type

SVGS √ √ √ Applicable to US

Applicable to Japan (equivalent value of '1')

TAXE √ √ √ Equivalent to Checking/Demand Account type

TRAS √ √ √ Equivalent to Checking/Demand Account type

1.1.10 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR If <Prtry> is populated, <Cd> should not be populated.

Value of 'OTHER" - Applicable to Japan (equivalent

value of' '9')

Value of 'CARD' - Applicable to ePayables Card

transactions.

1.1.11 Currency <Ccy> [0..1] Code R R R R

2.21 DebtorAgent <DbtrAgt> [1..1] R R R Ordering Party bank R Ordering Party bank

6.1.0 FinancialInstitutionIdentification <FinInstnId> [1..1] R R R Recommendation: More than one Id can be populated R Recommendation: More than one Id can be populated

and the bank will decide which one is necessary based and the bank will decide which one is necessary based

on payment type. on payment type.

6.1.1 BIC <BIC> [0..1] Identifier C C C BIC may be used instead of Brnchid/Id, but only for R BIC may be used instead of Brnchid/Id, but only for

non-US BofAML branches non-US BofAML branches

6.1.2 ClearingSystemMemberIdentification <ClrSysMmbId> [0..1] C C C Are these set of tags not required for SEPA?

6.1.3 ClearingSystemIdentification <ClrSysId> [0..1] O O O Identification of a specific Clearing System Identification

is not necessary.

6.1.4 Code <Cd> [1..1] Code XOR XOR XOR Only valid codes from ISO 20022 External Code List are

permitted (www.ISO20022.org ).

AUBSB

ATBLZ

CACPA

CNAPS

DEBLZ

GRBIC

HKNCC

INFSC

IENCC

ITNCC

JPZGN

NZNCC

PLKNR

PTNCC

RUCBC

SGIBG

ZANCC

ESNCC

SESBA

CHBCC

CHSIC

TWNCC

GBDSC

USPID

USABA

6.1.5 Proprietary <Prtry> [1..1] XOR XOR XOR May contain value of XXXXX = Unidentified Clearing

System Member Code

6.1.6 MemberIdentification <MmbId> [1..1] Text Max 35 R R R Bank Id (ABA, Routing Number, Sort Code)

6.1.7 Name <Nm> [0..1] Text Max 140 O O O

6.1.8 PostalAddress <PstlAdr> [0..1] R R R R

6.1.17 Country <Ctry> [0..1] Code R R R Valid 2 character country code R Valid 2 character country code

6.1.19 Other <Othr> [0..1] C C C C

6.1.20 Identification <Id> [1..1] Text Max 35 R R R The Bank Id may be populated in Other/Id instead of R The Bank Id may be populated in Other/Id instead of This will contain the bank identification number. Please confirm.

under ClrSysMmbId/ClrSysId/MmbId. under ClrSysMmbId/ClrSysId/MmbId.

BofAML Branch Id for non-US branches BofAML Branch Id for non-US branches

Multibank code must be populated here or under Multibank code must be populated here or under

Branch Id/Id. Branch Id/Id.

6.1.25 BranchIdentification <BrnchId> [0..1] R R R The branch code should be explicitly stated here versus O The branch code should be explicitly stated here versus

being combined with Clearing System Member Id. being combined with Clearing System Member ID

6.1.26 Identification <Id> [0..1] Text Max 35 R R R BofAML Branch Id for non-US branches R BofAML Branch Id for non-US branches

Multibank code must be populated here or under

Other/Id.

2.23 UltimateDebtor <UltmtDbtr> [0..1] O O O Ultimate Ordering party O Ultimate Ordering party This is mentioned as Optional and 'Only populate if with 'Pay On Behalf' data. '. Can we remove this set?

Only populate if with 'Pay On Behalf' data. This will Only populate if with 'Pay On Behalf' data. This will

take precedence over Debtor information. take precedence over Debtor information.

Confidential 11/07/2018 Page 2 of 8

Customer Credit Transfer Initiation V3 pain.001.001.03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

9.1.0 Name <Nm> [0..1] Text Max 140 R R R Ultimate Ordering party name R Ultimate Ordering party name

Maximum of 70 characters for US Checks which will be Maximum of 70 Latin characters.

split into two name lines of 35 characters for check

printing.

Maximum of 70 Latin characters outside of US.

Maximum of 30 Local Language characters for China

Maximum of 35 Local Language characters for Japan

and Taiwan.

9.1.1 PostalAddress <PstlAdr> [0..1] C C C Ultimate Ordering party address R Ultimate Ordering party address

9.1.5 StreetName <StrtNm> [0..1] Text Max 70 O O O If <StrtNm> and <BldgNb> are populated, the data O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1 the first address information used, followed by only 1

line of <AdrLine>. line of <AdrLine>.

9.1.6 BuildingNumber <BldgNb> [0..1] Text Max 16 O O O O

9.1.7 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt O - Ctry

Dpdt

9.1.8 TownName <TwnNm> [0..1] Text Max 35 O O O O

9.1.9 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 O O O Required for US, Canada and Australia

9.1.10 Country <Ctry> [0..1] Code R R R Valid 2 character country code R Valid 2 character country code

9.1.11 AddressLine <AdrLine> [0..7] Text Max 70 O O O Two address lines from <AdrLine> will be used if O Two address lines from <AdrLine> will be used if

<StrtNm> and <BldgNb> are not populated <StrtNm> and <BldgNb> are not populated

9.1.12 Identification <Id> [0..1] O O O O

9.1.13 OrganisationIdentification <OrgId> [1..1] O O O R

9.1.14 BICOrBEI <BICOrBEI> [0..1] Identifier O O O O

9.1.15 Other <Othr> [0..n] O O O O

9.1.16 Identification <Id> [1..1] Text Max 35 R R R R

9.1.17 SchemeName <SchmeNm> [0..1] O O O O

9.1.18 Code <Cd> [1..1] Code XOR XOR XOR If <Cd> is populated, <Prtry> should not be populated R

√ √ Use BANK to identify that the value in <Id> tag is a √ Use BANK to identify that the value in <Id> tag is a

BANK

Global Advice Client Id Global Advice Client Id

CUST √ √ √ √

DUNS √ √ √ √

EMPL √ √ √ √

GS1G √ √ √ √

TXID √ √ √ √

9.1.19 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR - Required If <Prtry> is populated, <Cd> should not be populated.

for ePayables

and Brazil Value of EPBL (ePayables CRI Reference) for ePayables

Convenio Card transactions.

transactions Value of CONVENIO when transaction in Brazil

2.24 ChargeBearer <ChrgBr> [0..1] Code O O If a batch of transactions are being sent, use at O If a batch of transactions are being sent, use at

payment level; else use <ChrgBr> at Transaction level. payment level; else use <ChrgBr> at Transaction level.

If the charge bearer code is not provided, the bank will If the charge bearer code is not provided, the bank will

default it to SHAR. default it to SLEV or SHAR.

CRED √ √

DEBT √ √

SHAR √ √

SLEV √

2.27 CreditTransferTransactionInformation <CdtTrfTxInf> [1..n] R R R A single occurrence of <CdtTrfTxInf> may be R A single occurrence of <CdtTrfTxInf> may be

populated. If multiple occurrences, <PmtInf> data populated. If multiple occurrences, <PmtInf> data

content will apply to all transactions. content will apply to all transactions.

2.28 PaymentIdentification <PmtId> [1..1] R R R R

2.29 InstructionIdentification <InstrId> [0..1] Text Max 35 O O O If populated, Id will be returned only to ordering party O If populated, Id will be returned only to ordering party Currently this value is same as EndToEndId, which is the unique payment reference number. Do we retain this or remove this tag?

in reporting. Limited to 16 characters. in reporting. Limited to 16 characters.

2.30 EndToEndIdentification <EndToEndId> [1..1] Text Max 35 R R R Payment Reference - goes with payment from debtor R Payment Reference - goes with payment from debtor

to creditor and travels through clearing system. to creditor and travels through clearing system.

Used for duplicable checking; MUST be unique for at Used for duplicable checking; MUST be unique for at

least 32 days. least 32 days.

Limited to 15 characters for US ACH and 16 characters Maximum 30 characters.

for US Wires.

Maximum of 10 charactesr for China, Japan and

Taiwan.

Maximum 30 characters for all other countires.

2.6 PaymentTypeInformation <PmtTpInf> [0..1] Component R R R - For Check Required at either at Payment or Transaction Level, but R Required at either at Payment or Transaction Level, but Since this is present at payment level, it is not included here at the transaction level. Please confirm if this is correct.

Issue and should not be present at both levels. If populated at should not be present at both levels. If populated at

ePayables Card both, value at Transaction level will take precedence. both, value at Transaction level will take precedence.

Data Only

2.7 InstructionPriority <InstrPrty> [0..1] Code O O Based on whether priority processing vs. normal

processing is offered by the bank.

HIGH √ √

NORM √ √

2.8 ServiceLevel <SvcLvl> [0..1] Choice Component R R R R

2.9 Code <Cd> [1..1] Code R R R

BKTR √ √ Book Transfers

URGP √ Wire or High Value Transactions

URNS √ Wire or High Value Transactions thru a Net Settlement

NURG √ clearing

ACH or Low Value Transactions

SEPA SEPA Transactions √ Only acceptable value for SEPA transactions

2.11 LocalInstrument <LclInstrm> [0..1] C C

2.12 Code <Cd> [1..1] Code R Required only for US ACH transactions

CCD √

CTX √

PPD √

IAT √

2.13 Proprietary <Prtry> [1..1] Text Max 35 C Value of 'CII' - Required for Check Issue Information for

US or Canada

Value of 'CCC' - Required for ePayables (Card)

transaction

2.14 CategoryPurpose <CtgyPurp> [0..1] O O

2.15 Code <Cd> [1..1] Code R R

CASH

CCRD

CORT

DCRD

DIVI √ √

GOVT

HEDG

ICCP

IDCP

INTC

INTE

LOAN

PENS √ √

SALA √ √

SECU

SSBE

SUPP

TAXS √ √

TRAD

TREA

VATX

WHLD

2.42 Amount <Amt> [1..1] R R R Only one amount can be shown. R

2.43 InstructedAmount <InstdAmt Ccy="AAA"> [1..1] Amount XOR XOR XOR R

2.44 EquivalentAmount <EqvtAmt> [1..1] XOR XOR XOR Applicable only to BFX transactions to indicate a Fixed This set is not being displayed since it is optional and only for BFX. Please confirm if this is correct.

Debit Amount

2.45 Amount <Amt Ccy="AAA"> [1..1] Amount R R R Amount that is to be debited.

2.46 CurrencyOfTransfer <CcyOfTrf> [1..1] Code R R R Currency of transaction paid to Creditor.

Confidential 11/07/2018 Page 3 of 8

Customer Credit Transfer Initiation V3 pain.001.001.03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

2.51 ChargeBearer <ChrgBr> [0..1] Code O O If a batch of transactions are being sent, use at O If a batch of transactions are being sent, use at

payment level; else use <ChrgBr> at Transaction level. payment level; else use <ChrgBr> at Transaction level.

If the charge bearer code is not provided, the bank will If the charge bearer code is not provided, the bank will

default it to SHAR. default it to SLEV or SHAR.

CRED √ √

DEBT √ √

SHAR √ √

SLEV √

2.52 ChequeInstruction <ChqInstr> [0..1] R Required for Check/Cheque printing services and Drafts.

2.53 ChequeType <ChqTp> [0..1] Code R

BCHQ O Draft which does not contain local language characters

CCCH O Corporate Check/Cheque

CCHQ O Corporate Check/Cheque

DRFT C Draft containing local language characters

2.54 ChequeNumber <ChqNb> [0..1] Text Max 35 R Required only for Customer Cheques

Populate only if is information different from

2.55 ChequeFrom <ChqFr> [0..1] C Debtor/Ultimate Debtor. Will override Debtor/Ultimate

Debtor data.

2.56 Name <Nm> [1..1] Text Max 140 O Maximum of 70 characters for US Checks which will be

split into two name lines of 35 characters for check

printing.

Maximum of 70 Latin characters outside of US.

Maximum of 30 Local Language characters for China

Maximum of 35 Local Language characters for Japan

and Taiwan.

2.57 Address <Adr> [1..1] O

10.1.3 StreetName <StrtNm> [0..1] Text Max 70 O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1

line of <AdrLine>.

10.1.4 BuildingNumber <BldgNb> [0..1] Text Max 16 O

10.1.5 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt

10.1.6 TownName <TwnNm> [0..1] Text Max 35 O

10.1.7 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 O Required for US, Canada and Australia

10.1.8 Country <Ctry> [0..1] Code R Valid 2 character country code

O Two address lines from <AdrLine> will be used if

10.1.9 AddressLine <AdrLine> [0..7] Text Max 70

<StrtNm> and <BldgNb> are not populated

Defines how Check/Cheque or Draft is to be delivered.

2.58 DeliveryMethod <DlvryMtd> [0..1] C

2.59 Code <Cd> [1..1] Code XOR If <Cd> is populated, <Prtry> should not be populated.

A code from the list in the schema should be used.

MLDB √

MLCD √

MLFA √

CRDB √

CRCD √

CRFA √

PUDB √

PUCD

PUFA

RGDB

RGCD

RGFA

2.60 Proprietary <Prtry> [1..1] Text Max 35 XOR If <Prtry> is populated, <Cd> should not be populated.

BofAML assigned codes for custom delivery services.

2.61 DeliverTo <DlvrTo> [0..1] O Populate only if information is different from

Creditor/Ultimate Creditor. Will override

Creditor/Ultimate Creditor data.

2.62 Name <Nm> [1..1] Text Max 140 O Maximum of 70 characters for US Checks which will be

split into two name lines of 35 characters for check

printing.

Maximum of 70 Latin characters outside of US.

Maximum of 30 Local Language characters for China

Maximum of 35 Local Language characters for Japan

and Taiwan.

2.63 Address <Adr> [1..1] O

10.1.3 StreetName <StrtNm> [0..1] Text Max 70 O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1

line of <AdrLine>.

10.1.4 BuildingNumber <BldgNb> [0..1] Text Max 16 O

10.1.5 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt

10.1.6 TownName <TwnNm> [0..1] Text Max 35 O

10.1.7 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 O Required for US, Canada and Australia

10.1.8 Country <Ctry> [0..1] Code R Valid 2 character country code

10.1.9 AddressLine <AdrLine> [0..7] Text Max 70 O Two address lines from <AdrLine> will be used if

<StrtNm> and <BldgNb> are not populated

2.67 MemoField <MemoFld> [0..2] Text Max 35 O Free form-text to print on Check/Cheque

2.69 PrintLocation <PrtLctn> [0..1] Text Max 35 O Value of "DPS" if Canadian cheques are to be printed at

BofAML Canadian branch

2.70 UltimateDebtor <UltmtDbtr> [0..1] O O O Ultimate Ordering party O Ultimate Ordering party The Ultimate Debtor set is mentioned as optional but 'Only populate if with

Only populate if with 'Pay On Behalf' data. This will Only populate if with 'Pay On Behalf' data. This will 'Pay On Behalf' data.'. Is this required?

take precedence over Debtor information. take precedence over Debtor information.

9.1.0 Name <Nm> [0..1] Text Max 140 R R R Ultimate Ordering party name R Ultimate Ordering party name

Maximum of 70 characters for US Checks which will be Maximum of 70 Latin characters.

split into two name lines of 35 characters for check

printing.

Maximum of 70 Latin characters outside of US.

Maximum of 30 Local Language characters for China

Maximum of 35 Local Language characters for Japan

and Taiwan.

9.1.1 PostalAddress <PstlAdr> [0..1] C C C R

9.1.5 StreetName <StrtNm> [0..1] Text Max 70 O O O If <StrtNm> and <BldgNb> are populated, the data O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1 the first address information used, followed by only 1

line of <AdrLine>. line of <AdrLine>.

9.1.6 BuildingNumber <BldgNb> [0..1] Text Max 16 O O O O

9.1.7 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt O

9.1.8 TownName <TwnNm> [0..1] Text Max 35 O O O O

9.1.9 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 O O O Required for US, Canada and Australia

9.1.10 Country <Ctry> [0..1] Code R R R Valid 2 character country code R Valid 2 character country code

9.1.11 AddressLine <AdrLine> [0..7] Text Max 70 O O O Two address lines from <AdrLine> will be used if O Two address lines from <AdrLine> will be used if

<StrtNm> and <BldgNb> are not populated <StrtNm> and <BldgNb> are not populated

9.1.12 Identification <Id> [0..1] O O O O

9.1.13 OrganisationIdentification <OrgId> [1..1] C C C R

9.1.14 BICOrBEI <BICOrBEI> [0..1] Identifier O O O O

9.1.15 Other <Othr> [0..n] O O O O

9.1.16 Identification <Id> [1..1] Text Max 35 R R R R

9.1.17 SchemeName <SchmeNm> [0..1] O O O O

9.1.18 Code <Cd> [1..1] Code XOR XOR XOR If <Cd> is populated, <Prtry> should not be populated R

Use BANK to identify that the value in <Id> tag is a √ Use BANK to identify that the value in <Id> tag is a

BANK √ √ √

Global Advice Client Id Global Advice Client Id

CUST √ √ √ Use CUST for required US ACH - ACH Originator Id √

DUNS √ √ √ √

EMPL √ √ √ √

GS1G √ √ √ √

TXID √ √ √ √

9.1.19 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR - Required If <Prtry> is populated, <Cd> should not be populated.

for ePayables

and Brazil Value of EPBL (ePayables CRI Reference) for ePayables

Convenio Card transactions.

transactions Value of CONVENIO when transaction in Brazil

9.1.21 PrivateIdentification <PrvtId> [1..1] C C C Required if payment is for Child Support. Please confirm if this set is required. Mentioned here as 'Required if payment is for Child Support.'.

Confidential 11/07/2018 Page 4 of 8

Customer Credit Transfer Initiation V3 pain.001.001.03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

9.1.27 Other <Othr> [0..n] O O O

9.1.28 Identification <Id> [1..1] Text Max 35 R R R Required if payment is for Child Support.

9.1.29 SchemeName <SchmeNm> [0..1] O O O

9.1.30 Code <Cd> [1..1] Code R R R Required if payment is for Child Support.

ARNU

CCPT

CUST

DRLC

EMPL

NIDN

SOSE √ √ √

TXID

9.1.33 CountryOfResidence <CtryOfRes> [0..1] Code O O O Conditional upon country rules O

2.71 IntermediaryAgent1 <IntrmyAgt1> [0..1] O O Intermediary Agents below are not included. Please confirm if this is correct.

6.1.0 FinancialInstitutionIdentification <FinInstnId> [1..1] R R Either BIC or Bank Id of the intermediary bank is

required

6.1.1 BIC <BIC> [0..1] Identifier O O

6.1.2 ClearingSystemMemberIdentification <ClrSysMmbId> [0..1] O O

Identification of a specific Clearing System Identification

6.1.3 ClearingSystemIdentification <ClrSysId> [0..1] O O

is not necessary.

Only valid codes from ISO 20022 External Code List are

6.1.4 Code <Cd> [1..1] Code XOR XOR permitted (www.ISO20022.org ).

May contain value of XXXXX = Unidentified Clearing

6.1.5 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR System Member Code

Bank Id (ABA, Routing Number, Sort Code) may also be

6.1.6 MemberIdentification <MmbId> [1..1] Text Max 35 R R populated in <Othr/Id>, but not both.

6.1.7 Name <Nm> [0..1] Text Max 140 R R

6.1.8 PostalAddress <PstlAdr> [0..1] R R

6.1.14 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt O - Ctry Dpdt

6.1.15 TownName <TwnNm> [0..1] Text Max 35 O O

6.1.16 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 O O Required for US, Canada and Australia

6.1.17 Country <Ctry> [0..1] Code R R Valid 2 character country code

6.1.19 Other <Othr> [0..1] O O

6.1.20 Identification <Id> [1..1] Text Max 35 O O Bank Id (ABA, Routing Number, Sort Code) may also be

populated in <ClrSysMmbId/ClrSysId/MmbId>, but not

both.

2.73 IntermediaryAgent2 <IntrmyAgt2> [0..1] C Use of the second intermediary agent is only applicable

to the International ACH (IAT) transactions

6.1.0 FinancialInstitutionIdentification <FinInstnId> [1..1] R

6.1.1 BIC <BIC> [0..1] Identifier O Either BIC or Bank ID is required

6.1.2 ClearingSystemMemberIdentification <ClrSysMmbId> [0..1] O

6.1.3 ClearingSystemIdentification <ClrSysId> [0..1] O

6.1.4 Code <Cd> [1..1] Code XOR

6.1.5 Proprietary <Prtry> [1..1] Text Max 35 XOR May contain value of XXXXX = Unidentified Clearing

System Member Code

6.1.6 MemberIdentification <MmbId> [1..1] Text Max 35 R Bank Id (ABA, Routing Number, Sort Code) may also be

populated in <Othr/Id>, but not both.

6.1.7 Name <Nm> [0..1] Text Max 140 R

6.1.8 PostalAddress <PstlAdr> [0..1] R

6.1.17 Country <Ctry> [0..1] Code R Valid 2 character country code

6.1.19 Other <Othr> [0..1]

6.1.20 Identification <Id> [1..1] Text Max 35 Bank Id (ABA, Routing Number, Sort Code) may also be

populated in <ClrSysMmbId/ClrSysId/MmbId>, but not

O both.

2.75 IntermediaryAgent3 <IntrmyAgt3> [0..1] C Use of the third intermediary agent is only applicable to

the International ACH (IAT) transactions

6.1.0 FinancialInstitutionIdentification <FinInstnId> [1..1] R

6.1.1 BIC <BIC> [0..1] Identifier O Either BIC or Bank ID is required

6.1.2 ClearingSystemMemberIdentification <ClrSysMmbId> [0..1] O

6.1.3 ClearingSystemIdentification <ClrSysId> [0..1] O

6.1.4 Code <Cd> [1..1] Code XOR

6.1.5 Proprietary <Prtry> [1..1] Text Max 35 XOR May contain value of XXXXX = Unidentified Clearing

System Member Code

6.1.6 MemberIdentification <MmbId> [1..1] Text Max 35 R Bank Id (ABA, Routing Number, Sort Code) may also be

populated in <Othr/Id>, but not both.

6.1.8 PostalAddress <PstlAdr> [0..1] R

6.1.17 Country <Ctry> [0..1] Code R Valid 2 character country code

6.1.19 Other <Othr> [0..1] O

6.1.20 Identification <Id> [1..1] Text Max 35 Bank Id (ABA, Routing Number, Sort Code) may also be

populated in <ClrSysMmbId/ClrSysId/MmbId>, but not

O both.

2.77 CreditorAgent <CdtrAgt> [0..1] R R Receiving party bank R Receiving party bank

6.1.0 FinancialInstitutionIdentification <FinInstnId> [1..1] R R Recommendation: More than one Id can be populated R Recommendation: More than one Id can be populated

and the bank will decide which one is necessary based and the bank will decide which one is necessary based

on payment type. on payment type.

6.1.1 BIC <BIC> [0..1] Identifier O O Either BIC or bank ID is required R Required for SEPA Credit Transfer

6.1.2 ClearingSystemMemberIdentification <ClrSysMmbId> [0..1] O O Is this set required, since one of the tags below 'MmbId' is mentioned as required?

6.1.3 ClearingSystemIdentification <ClrSysId> [0..1] O O

6.1.4 Code <Cd> [1..1] Code XOR XOR If <Cd> is populated, <Prtry> should not be populated.

6.1.5 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR May contain value of XXXXX = Unidentified Clearing

System Member Code

6.1.6 MemberIdentification <MmbId> [1..1] Text Max 35 R R Bank Id (ABA, Routing Number, Sort Code) may also be

populated in <Othr/Id>, but not both.

6.1.7 Name <Nm> [0..1] Text Max 140 C C Required for US IAT transactions

6.1.8 PostalAddress <PstlAdr> [0..1] R R R R

6.1.12 StreetName <StrtNm> [0..1] Text Max 70 O O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1

line of <AdrLine>.

6.1.16 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 O C Required for US, Canada and Australia

6.1.17 Country <Ctry> [0..1] Code R R Valid 2 character country code R

6.1.18 AddressLine <AdrLine> [0..7] Text Max 70 Two address lines from <AdrLine> will be used if

O O <StrtNm> and <BldgNb> are not populated

6.1.19 Other <Othr> [0..1] O O Is this required since Id below is mentioned as required?

6.1.20 Identification <Id> [1..1] Text Max 35 R R Bank Id (ABA, Routing Number, Sort Code) may also be

populated in <<ClrSysMmbId/ClrSysId/MmbId>, but

not both.

2.78 CreditorAgentAccount <CdtrAgtAcct> [0..1] C C Only used for the Building Society payments of United Is this set required here? Mentioned here as 'Only used for the Building Society payments of United Kingdom and Ireland'.

Kingdom and Ireland

1.1.0 Identification <Id> [1..1] R R

1.1.2 Other <Othr> [1..1] R R

1.1.3 Identification <Id> [1..1] Text Max 34 R R

2.79 Creditor <Cdtr> [0..1] R R R Receiving party R Receiving party

9.1.0 Name <Nm> [0..1] Text Max 140 R R R Receiving party name R Receiving party name

Maximum of 70 characters for US Checks which will be

split into two name lines of 35 characters for check

printing.

Maximum of 70 Latin characters outside of US.

Maximum of 30 Local Language characters for China

Maximum of 35 Local Language characters for Japan

and Taiwan.

9.1.1 PostalAddress <PstlAdr> [0..1] R R R R

9.1.5 StreetName <StrtNm> [0..1] Text Max 70 O O O If <StrtNm> and <BldgNb> are populated, the data O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1 the first address information used, followed by only 1

line of <AdrLine>. line of <AdrLine>.

9.1.6 BuildingNumber <BldgNb> [0..1] Text Max 16 O O O O

9.1.7 PostCode <PstCd> [0..1] Text Max 16 O - Ctry

O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt Dpdt

9.1.8 TownName <TwnNm> [0..1] Text Max 35 O O O O

9.1.9 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 C C C Required for US, Canada and Australia

9.1.10 Country <Ctry> [0..1] Code R R R Valid 2 character country code R Valid 2 character country code

9.1.11 AddressLine <AdrLine> [0..7] Text Max 70 O O O Two address lines from <AdrLine> will be used if O Two address lines from <AdrLine> will be used if

<StrtNm> and <BldgNb> are not populated <StrtNm> and <BldgNb> are not populated

9.1.12 Identification <Id> [0..1] O O O O

Confidential 11/07/2018 Page 5 of 8

Customer Credit Transfer Initiation V3 pain.001.001.03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

9.1.13 OrganisationIdentification <OrgId> [1..1] XOR XOR XOR Either <OrgID> or <PrvtId> is required XOR Either <OrgID> or <PrvtId> is required

9.1.14 BICOrBEI <BICOrBEI> [0..1] Identifier O O O O

9.1.15 Other <Othr> [0..n] C C C O

9.1.16 Identification <Id> [1..1] Text Max 35 R R R The creditor identification is required if a Code is R The creditor identification is required if a Code is

provided in the Scheme Name component. provided in the Scheme Name component.

Required for Global Advice; populated with Vendor Id Required for Global Advice; populated with Vendor Id

Required to be populated with US and Canada check

vendor number

9.1.17 SchemeName <SchmeNm> [0..1] O O O O This is mentioned as required for SEPA. Should we include this?

9.1.18 Code <Cd> [1..1] Code XOR XOR XOR R How is the value decided for this tag if required?

BANK √ √ √ Use BANK to identify that the value in <Id> tag is a √ Use BANK to identify that the value in <Id> tag is a

Global Advice Vendor Id Global Advice Vendor Id

CUST √ √ Use CUST to identify that the valude in <Id> tag is a √

US and Canada Check vendor number

DUNS √ √ √ √

EMPL √ √ √ √

GS1G √ √ √ √

TXID √ √ √ √

9.1.19 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR Value of EMBARGO when transaction in LATAM

9.1.21 PrivateIdentification <PrvtId> [1..1] XOR XOR XOR Either <OrgID> or <PrvtId> is required XOR Either <OrgID> or <PrvtId> is required Is this set required?

9.1.22 DateAndPlaceOfBirth <DtAndPlcOfBirth> [0..1]

9.1.27 Other <Othr> [0..n] R R R R

9.1.28 Identification <Id> [1..1] Text Max 35 R R R R

9.1.29 SchemeName <SchmeNm> [0..1] O O O O

9.1.30 Code <Cd> [1..1] Code R R R R

ARNU √ √ √ √

CCPT √ √ √ √

CUST √ √ √ √

DRLC √ √ √ √

EMPL √ √ √ √

NIDN √ √ √ √

SOSE √ √ √ √

TXID √ √ √ √

9.1.33 CountryOfResidence <CtryOfRes> [0..1] Code C C C Required for Japan

2.80 CreditorAccount <CdtrAcct> [0..1] R R Receiving party account R Receiving party account

1.1.0 Identification <Id> [1..1] R R Only one account number allowed. R Only one account number allowed.

1.1.1 IBAN <IBAN> [1..1] Identifier O O R The receiving party account for SEPA CT must be in the

IBAN format

1.1.2 Other <Othr> [1..1] O R Receiving party account number for non-Sepal

transactions

1.1.3 Identification <Id> [1..1] Text Max 34 R R This is mentioned as required here. What value should be displayed?

1.1.4 SchemeName <SchmeNm> [0..1] O O This is mentioned as required for SEPA. Should we include this?

1.1.5 Code <Cd> [1..1] Code R R How is the value decided for this tag if required?

BBAN √ √

CUID √ √

UPIC √ √

1.1.8 Type <Tp> [0..1] C C Required to US and JP

If not populated, default used for processing will be the

classification of a Checking/Demand Account type

(equivalent value of '2' for JP).

1.1.9 Code <Cd> [1..1] Code XOR XOR If <Cd> is populated, <Prtry> should not be populated.

Applicable to US; equivalent to Checking/Demand

CACC √ √

Account type

CASH √ √ Equivalent to Checking/Demand Account type

CHAR √ √ Equivalent to Checking/Demand Account type

CISH √ √ Equivalent to Checking/Demand Account type

COMM √ √ Equivalent to Checking/Demand Account type

LOAN √ √ Equivalent to Checking/Demand Account type

MGLD √ √ Equivalent to Checking/Demand Account type

MOMA √ √ Applicable to JP (equivalent value of '4')

NREX √ √ Equivalent to Checking/Demand Account type

ODFT √ √ Equivalent to Checking/Demand Account type

ONDP √ √ Equivalent to Checking/Demand Account type

SACC √ √ Equivalent to Checking/Demand Account type

SLRY √ √ Equivalent to Checking/Demand Account type

√ √ Applicable to US

SVGS Applicable to Japan (equivalent value of '1')

TAXE √ √ Equivalent to Checking/Demand Account type

TRAS √ √ Equivalent to Checking/Demand Account type

1.1.10 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR If <Prtry> is populated, <Cd> should not be populated.

Value of 'OTHER" - Applicable to Japan (equivalent

value of' '9')

1.1.12 Name <Nm> [0..1] Text Max 140 O O Name on the Account O

2.81 UltimateCreditor <UltmtCdtr> [0..1] C C C Receiving party-Only populate if 'Pay On Behalf' data C Receiving party-Only populate if 'Pay On Behalf' data Can we remove this set since it is mentioned as 'Receiving party-Only populate if 'Pay On Behalf' data applicable.'?

applicable. applicable.

9.1.0 Name <Nm> [0..1] Text Max 140 R R R Receiving party name R Receiving party name

Maximum of 70 characters for US Checks which will be

split into two name lines of 35 characters for check

printing.

Maximum of 70 Latin characters outside of US.

Maximum of 30 Local Language characters for China

Maximum of 35 Local Language characters for Japan

and Taiwan.

9.1.1 PostalAddress <PstlAdr> [0..1] O O O Receiving party address O Receiving party address

9.1.5 StreetName <StrtNm> [0..1] Text Max 70 If <StrtNm> and <BldgNb> are populated, the data O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1 the first address information used, followed by only 1

line of <AdrLine>. line of <AdrLine>.

O O O

9.1.6 BuildingNumber <BldgNb> [0..1] Text Max 16 O O O O

9.1.7 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt O - Ctry

Dpdt

9.1.8 TownName <TwnNm> [0..1] Text Max 35 O O O O

9.1.9 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 C C C Required for US, Canada and Australia

9.1.10 Country <Ctry> [0..1] Code R R R Valid 2 character country code Valid 2 character country code

9.1.11 AddressLine <AdrLine> [0..7] Text Max 70 O O O Two address lines from <AdrLine> will be used if Two address lines from <AdrLine> will be used if

<StrtNm> and <BldgNb> are not populated O <StrtNm> and <BldgNb> are not populated

9.1.12 Identification <Id> [0..1] O O O O

9.1.13 OrganisationIdentification <OrgId> [1..1] XOR XOR XOR Either <OrgID> or <PrvtId> is required XOR

9.1.14 BICOrBEI <BICOrBEI> [0..1] Identifier O O O O

9.1.15 Other <Othr> [0..n] C C C O

9.1.16 Identification <Id> [1..1] Text Max 35 XOR XOR XOR Required for Global Advice; populated with Vendor Id XOR Required for Global Advice; populated with Vendor Id

Required to be populated with US and Canada check Required to be populated with US and Canada check

vendor number vendor number

9.1.17 SchemeName <SchmeNm> [0..1] O O O O

9.1.18 Code <Cd> [1..1] Code XOR XOR XOR R

BANK √ √ √ Use BANK to identify that the value in <Id> tag is a √ Use BANK to identify that the value in <Id> tag is a

Global Advice Vendor Id Global Advice Vendor Id

CUST √ √ √ Use CUST to identify that the valude in <Id> tag is a √

DUNS √ √ √ US and Canada Check vendor number √

EMPL √ √ √ √

GS1G √ √ √ √

TXID √ √ √ √

9.1.19 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR Value of EMBARGO when transaction in LATAM

9.1.21 PrivateIdentification <PrvtId> [1..1] XOR XOR XOR XOR Is this set required?

9.1.27 Other <Othr> [0..n] O O O O

9.1.28 Identification <Id> [1..1] Text Max 35 R R R R

9.1.29 SchemeName <SchmeNm> [0..1] O O O O

9.1.30 Code <Cd> [1..1] Code R R R R

Confidential 11/07/2018 Page 6 of 8

Customer Credit Transfer Initiation V3 pain.001.001.03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

ARNU √ √ √ √

CCPT √ √ √ √

CUST √ √ √ √

DRLC √ √ √ √

EMPL √ √ √ √

NIDN √ √ √ √

SOSE √ √ √ √

TXID √ √ √ √

9.1.33 CountryOfResidence <CtryOfRes> [0..1] Code C C C Required for Japan

2.82 InstructionForCreditorAgent <InstrForCdtrAgt> [0..n] O - Ctry Dpdt O - Ctry Dpdt Required fr transactions in Argentina

2.83 Code <Cd> [0..1] Code O O Can only be used for non-US transactions

CHQB √ √

HOLD √ √

PHOB √ √

TELB √ √

2.84 InstructionInformation <InstrInf> [0..1] Text Max 140 O O Reference number for US ACH batching may be

populated here; else <PmtInfId> will be used.

For US wires use for bank to creditor/beneficiary

information

Required to be populated with Creditor Phone Number

for Argentina transactions

All other intances will support information being sent to

Creditor Agent

2.85 InstructionForDebtorAgent <InstrForDbtrAgt> [0..1] Text Max 140 C Use to populate bank to bank wire information

Required for Brazil Boletto Bar Code: /BRTL/ + 11 digit

bar code

Required for Brazil Drawing Point Bank: /DTBC/ + Bank

Id

Required for Repetitive Wire reference: /RPWR/ + 8

digit template reference number

2.86 Purpose <Purp> [0..1] C C C Country transaction dependent O

2.87 Code <Cd> [1..1] Code XOR XOR XOR Refer to the External Purpose Code tab in this guide XOR Refer to the External Purpose Code tab in this guide Must be BECH for Child Support Payments.

Must be BECH for Child Support Payments.

2.88 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR BofAML supported Purpose Codes not contained in XOR BofAML supported Purpose Codes not contained in

External Code List External Code List

2.89 RegulatoryReporting <RgltryRptg> [0..10] BofAML supports reporting for Belgium, France, O - Ctry BofAML supports reporting for Belgium, France,

O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt

Germany, Italy and Spain Dpdt Germany, Italy and Spain

11.1.0 DebitCreditReportingIndicator <DbtCdtRptgInd> [0..1] Code

11.1.1 Authority <Authrty> [0..1]

11.1.4 Details <Dtls> [0..n] O O O O

11.1.8 Code < Cd> [0..1] Text Max 10 O O O O

11.1.10 Information <Inf> [0..n] Text Max 140 O O O O

2.90 Tax <Tax> [0..1] C C C Supported only for US Tax payments

13.1.0 Creditor <Cdtr> [0..1] O O O

13.1.3 TaxType <TaxTp> [0..1] Text Max 35 O O O Equivalent to TXP.02, Tax Payment Type Code

13.1.4 Debtor <Dbtr> [0..1] O O O

13.1.5 TaxIdentification <TaxId> [0..1] Text Max 35 O O O Equivalent to TXP.10, Taxpayer Verification

13.1.18 Record <Rcrd> [0..n] O O O

13.1.20 Category <Ctgy> [0..1] Text Max 35 O O O 1st occurrence of <Rcrd>equivalent to TXP.04, Tax

Information Id

2nd occurrence of <Rcrd>equivalent to TXP.06, Tax

Information Id

3rd occurrence of <Rcrd>equivalent to TXP.08, Tax

Information Id

13.1.23 CertificateIdentification <CertId> [0..1] Text Max 35 O O O Equivalent to TXP.01, Tax Identification Number

13.1.31 TaxAmount <TaxAmt> [0..1] O O O

13.1.34 TotalAmount <TtlAmt Ccy="AAA"> [0..1] Amount O O O 1st occurrence of <Rcrd>equivalent to TXP.05, Tax

Amount

2nd occurrence of <Rcrd>equivalent to TXP.07, Tax

Amount

3rd occurrence of <Rcrd>equivalent to TXP.09, Tax

Amount

2.91 RelatedRemittanceInformation <RltdRmtInf> [0..10] O O O Supports Remittance Advice Split Remittance services O

2.92 RemittanceIdentification <RmtId> [0..1] Text Max 35 O O O May be utilized for remittance reassociation O Can be utilized for remittance reassociation

2.93 RemittanceLocationMethod <RmtLctnMtd> [0..1] Code O O O Supports Remittance Advice delivery services O Supports Remittance Advice delivery services

EDIC √ √ √ Required for EDI Format delivery of remittance advice √

EMAL √ √ √ Required for Email delivery of remittance advice √

FAXI √ √ √ Required for Fax delivery of remittance advice √

POST √ √ √ Required for Postal Mail delivery of remittance advice √

URID √ √ √ Required for Global Advice Services √ Global Advice Services

2.94 RemittanceLocationElectronicAddress <RmtLctnElctrncAdr> [0..1] Text Max 2048 O O O Populate with email address or fax number. Use ";" to O Populate with email address or fax number. Use ";" to

separate multiple email addresses. separate multiple email addresses.

2.95 RemittanceLocationPostalAddress <RmtLctnPstlAdr> [0..1] O O O O Information required for email delivery of Remittance

Advice

2.96 Name <Nm> [1..1] Text Max 140 R R R Required for Fax or Email delivery of remittance advice R Required for Fax or Email delivery of remittance advice

2.97 Address <Adr> [1..1] R R R Required if a remittance advise is mailed to an address R Required if a remittance advise is mailed to an address

different than the Creditor or Ultimate Creditor Postal different than the Creditor or Ultimate Creditor Postal

Address. Address.

10.1.0 AddressType <AdrTp> [0..1] Code O

ADDR

BIZZ

DLVY

HOME

MLTO

PBOX

10.1.3 StreetName <StrtNm> [0..1] Text Max 70 O O O If <StrtNm> and <BldgNb> are populated, the data O If <StrtNm> and <BldgNb> are populated, the data

should not be repeated in <AdrLine>. It will also be should not be repeated in <AdrLine>. It will also be

the first address information used, followed by only 1 the first address information used, followed by only 1

line of <AdrLine>. line of <AdrLine>.

10.1.4 BuildingNumber <BldgNb> [0..1] Text Max 16 O O O O

10.1.5 PostCode <PstCd> [0..1] Text Max 16 O - Ctry Dpdt O - Ctry Dpdt O - Ctry Dpdt O - Ctry

Dpdt

10.1.6 TownName <TwnNm> [0..1] Text Max 35 O O O O

10.1.7 CountrySubDivision <CtrySubDvsn> [0..1] Text Max 35 C C C Required for US, Canada and Australia

10.1.8 Country <Ctry> [0..1] Code R R R Valid 2 character country code R Valid 2 character country code

10.1.9 AddressLine <AdrLine> [0..7] Text Max 70 O O O Two address lines from <AdrLine> will be used if O Two address lines from <AdrLine> will be used if

<StrtNm> and <BldgNb> are not populated <StrtNm> and <BldgNb> are not populated

2.98 RemittanceInformation <RmtInf> [0..1] O O O Remittance Information delivered is dependent upon O - either Remittance Information delivered is dependent upon

clearing system limitations. Ustrd or clearing system limitations.

Data will be truncated if clearing system limitations Strd Data will be truncated if limitations exceeded.

exceeded.

2.99 Unstructured <Ustrd> [0..n] Text Max 140 O O O SEPA Credit Transfer only supports 1 occurrence of We are currently displaying this value and is a concatenation of Document reference number, Document date, Document Amount and Payment Amount. Is this correct?

O <Ustrd> limited to 140 characters

2.100 Structured <Strd> [0..n] O O O Best practice for minimum usage: invoice number and For SEPA Transfers,RfrdDocInf and RfrdDocAmt

remitted amount or credit note amount with currency O information will be passed up to a max of 140

characters.

2.101 ReferredDocumentInformation <RfrdDocInf> [0..n] O O O

2.102 Type <Tp> [0..1] O O O

2.103 CodeOrProprietary <CdOrPrtry> [1..1] R R R

2.104 Code <Cd> [1..1] Code XOR XOR XOR If <Cd> is populated, <Prtry> should not be populated. XOR If <Cd> is populated, <Prtry> should not be populated.

CINV √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

CNFA √ √ √ Remittance amounts will be negative amounts √ Remittance amounts will be negative amounts

CONT √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

CREN √ √ √ Remittance amounts will be negative amounts √ Remittance amounts will be negative amounts

DEBN √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

DNFA √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

DISP √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

HIRI √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

INVS √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

MSIN √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

PROF √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

PUOR √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

QUOT √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

Confidential 11/07/2018 Page 7 of 8

Customer Credit Transfer Initiation V3 pain.001.001.03 ISO Published: April 2009

ISO Published: April 2009

Common Industry Agreement: As of November 30, 2009

ISO Message Item Tag Name ISO 20022 ISO 20022 Type ACH - Wires - Cheques/ BofAML Non-SEPA CT Values or Usage Rules SEPA BofAML SEPA CT Values or Usage Rules Customer Notes Comments/Questions

Index Occurrence and Domestic & Domestic & Drafts Customer

No. Code Values Int'l Int'l to Bank

ONLY

SBIN √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

SPRR √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

TISH √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

USAR √ √ √ Remittance amounts will be positive amounts √ Remittance amounts will be positive amounts

2.105 Proprietary <Prtry> [1..1] Text Max 35 XOR XOR XOR If <Prtry> is populated, <Cd> should not be populated. XOR If <Prtry> is populated, <Cd> should not be populated.

CS √ √ √ Required for Child Support payments √ Required for Child Support payments

ITEM √ √ √ Required for Card payments √ Required for Card payments

2.107 Number <Nb> [0..1] Text Max 35 R R R Invoice or Credit Memo number required if R

<RfrdDocInf> is used

Reference Identification for Child Support Payments Invoice or Credit Memo number required if Reference Identification for Child Support Payments should be populated

should be populated here. <RfrdDocInf> is used here.

2.108 RelatedDate <RltdDt> [0..1] DateTime O O O Date on Invoice or Credit Memo O Date on Invoice or Credit Memo

2.109 ReferredDocumentAmount <RfrdDocAmt> [0..1] O O O O

2.110 DuePayableAmount <DuePyblAmt Ccy="AAA"> [0..1] Amount O O O Amount due as stated on invoice or other referred O Amount due as stated on invoice or other referred

document type document type

2.111 DiscountAppliedAmount <DscntApldAmt [0..1] Amount O O O Discount amount applied against amount on invoice or O Discount amount applied against amount on invoice or

Ccy="AAA"> other referred document type other referred document type

2.112 CreditNoteAmount <CdtNoteAmt Ccy="AAA"> [0..1] Amount O O O Credit amount of a credit note or credit memo O Credit amount of a credit note or credit memo

2.113 TaxAmount <TaxAmt Ccy="AAA"> [0..1] Amount O O O Tax amount on any referred document O Tax amount on any referred document

2.114 AdjustmentAmountAndReason <AdjstmntAmtAndRsn> [0..n] O O O Adjustment amount and reason applicable to any O Adjustment amount and reason applicable to any

referred document referred document

2.115 Amount <Amt Ccy="AAA"> [1..1] Amount R R R R

2.116 CreditDebitIndicator <CdtDbtInd> [0..1] Code O O O If no indicator is provided, the bank will default the O If no indicator is provided, the bank will default the

indicator as DBIT indicator as DBIT

CRDT √ √ √ √

DBIT √ √ √ √

2.117 Reason <Rsn> [0..1] Text Max 4 O O O O

2.118 AdditionalInformation <AddtlInf> [0..1] Text Max 140 O O O Limited to 2 occurrence O Limited to 2 occurrence

First occurrence is limited to 80 characters First occurrence is limited to 80 characters

Second occurrence is limited to 60 characters Second occurrence is limited to 60 characters

2.119 RemittedAmount <RmtdAmt Ccy="AAA"> [0..1] Amount O O O O

2.120 CreditorReferenceInformation <CdtrRefInf> [0..1] O O O O

2.121 Type <Tp> [0..1] O O O O

2.122 CodeOrProprietary <CdOrPrtry> [1..1] R R R R

2.123 Code <Cd> [1..1] Code O O O If <Cd> is populated, <Prtry> should not be populated O

DISP √ √ √

FXDR √ √ √

PUOR √ √ √

RADM √ √ √

RPIN √ √ √

SCOR √ √ √ √ SEPA Credit Transfer supports SCOR only

2.124 Proprietary <Prtry> [1..1] Text Max 35 O O O If <Prtry> is populated, <Cd> should not be populated.

Value of "GL" required for ePayables card transaction

up to 10 occurences of <RmtInf/Strd>

2.126 Reference <Ref> [0..1] Text Max 35 R R R Would contain GL reference for ePayables card R

transactions

2.127 Invoicer <Invcr> [0..1] O O O Party who issued the referred document O Party who issued the referred document

9.1.0 Name <Nm> [0..1] Text Max 140 R R R O

9.1.12 Identification <Id> [0..1] O O O O

9.1.13 OrganisationIdentification <OrgId> [1..1] R R R R

9.1.15 Other <Othr> [0..n] R R R R

9.1.16 Identification <Id> [1..1] Text Max 35 R R R R

9.1.17 SchemeName <SchmeNm> [0..1] O O O O

9.1.18 Code <Cd> [1..1] Code R R R R

BANK √ √ √ √

CUST √ √ √ √

DUNS √ √ √ √

EMPL √ √ √ √

GS1G √ √ √ √

TXID √ √ √ √

2.128 Invoicee <Invcee> [0..1] O O O Party who is issued the referred document O Party who is issued the referred document

9.1.0 Name <Nm> [0..1] Text Max 140 R R R Child Support Payments - Absent parent name. O Child Support Payments - Absent parent name.

9.1.12 Identification <Id> [0..1] O O O O

9.1.13 OrganisationIdentification <OrgId> [1..1] R R R R

9.1.15 Other <Othr> [0..n] R R R R

9.1.16 Identification <Id> [1..1] Text Max 35 R R R R

9.1.17 SchemeName <SchmeNm> [0..1] O O O O

9.1.18 Code <Cd> [1..1] Code R R R R

BANK √ √ √ √

CUST √ √ √ √

DUNS √ √ √ √

EMPL √ √ √ √

GS1G √ √ √ √

TXID √ √ √ √

9.1.19 Proprietary <Prtry> [1..1] Text Max 35

9.1.20 Issuer <Issr> [0..1] Text Max 35

9.1.21 PrivateIdentification <PrvtId> [1..1]

9.1.22 DateAndPlaceOfBirth <DtAndPlcOfBirth> [0..1]

9.1.23 BirthDate <BirthDt> [1..1] DateTime

9.1.24 ProvinceOfBirth <PrvcOfBirth> [0..1] Text Max 35

9.1.25 CityOfBirth <CityOfBirth> [1..1] Text Max 35

9.1.26 CountryOfBirth <CtryOfBirth> [1..1] Code

9.1.27 Other <Othr> [0..n] Child Support Payments - SSN of Absent Parent Child Support Payments - SSN of Absent Parent

9.1.28 Identification <Id> [1..1] Text Max 35 One instance for SSN another for imployment indicator One instance for SSN another for imployment indicator

9.1.29 SchemeName <SchmeNm> [0..1]

9.1.30 Code <Cd> [1..1] Code

9.1.31 Proprietary <Prtry> [1..1] Text Max 35

9.1.32 Issuer <Issr> [0..1] Text Max 35

9.1.33 CountryOfResidence <CtryOfRes> [0..1] Code

9.1.34 ContactDetails <CtctDtls> [0..1]

9.1.35 NamePrefix <NmPrfx> [0..1] Code

9.1.36 Name <Nm> [0..1] Text Max 140

9.1.37 PhoneNumber <PhneNb> [0..1] PhoneNumber

9.1.38 MobileNumber <MobNb> [0..1] PhoneNumber

9.1.39 FaxNumber <FaxNb> [0..1] PhoneNumber

9.1.40 EmailAddress <EmailAdr> [0..1] Text Max 2048

9.1.41 Other <Othr> [0..1] Text Max 35

2.129 AdditionalRemittanceInformation <AddtlRmtInf> [0..3] Text Max 140 O O O Free-form text will be included with referrred document O Free-form text will be included with referrred document Child Support Payments - MEDY (yes) or MEDN (no) indicates medical

data. data. insurance.

Child Support Payments - MEDY (yes) or MEDN (no)

indicates medical insurance.

Confidential 11/07/2018 Page 8 of 8

You might also like

- Scripted ISO 20022 PPT Long Version v55Document48 pagesScripted ISO 20022 PPT Long Version v55fsdafNo ratings yet

- Electronic Bank StatementDocument6 pagesElectronic Bank StatementMukesh Sharma100% (1)

- AP Human Geography Chapter 6 NotesDocument20 pagesAP Human Geography Chapter 6 NotesSeth Adler93% (74)

- View payroll reports and paystubsDocument9 pagesView payroll reports and paystubsAdnan DiampuanNo ratings yet

- Book Agadir to Rabat flight with Air ArabiaDocument2 pagesBook Agadir to Rabat flight with Air ArabiaCubecraft GamesNo ratings yet

- 2012 Ontario Tax FormDocument2 pages2012 Ontario Tax FormHassan MhNo ratings yet

- 2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917Document2 pages2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917BindhuNo ratings yet

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Document2 pagesAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNo ratings yet

- 1964 10 20 Kamala Devi Harris Birth Cert Mother Goplan Shyamala Indian Age 26 Father Donald Jasper Harris Age 26 Jamaican Oakland Alameda CA File No 64 295984 Oct 20 1964Document2 pages1964 10 20 Kamala Devi Harris Birth Cert Mother Goplan Shyamala Indian Age 26 Father Donald Jasper Harris Age 26 Jamaican Oakland Alameda CA File No 64 295984 Oct 20 1964Jan LishmamNo ratings yet

- A DETAILED LESSON PLAN IN TLE DraftingDocument16 pagesA DETAILED LESSON PLAN IN TLE DraftingJude PellerinNo ratings yet

- Cheque ManagementDocument13 pagesCheque ManagementsapchevronNo ratings yet

- Accounts Payable SSOn ReportDocument26 pagesAccounts Payable SSOn ReportMuhammad FaysalNo ratings yet

- Igt - Boot Os List Rev B 10-28-2015Document5 pagesIgt - Boot Os List Rev B 10-28-2015Hector VillarrealNo ratings yet

- Outgoing Payments Iso 20022 Application GuidelineDocument54 pagesOutgoing Payments Iso 20022 Application Guidelinesri_vas4uNo ratings yet

- Deutsche Bank Outlines New Payment System Going Around The US DollarDocument28 pagesDeutsche Bank Outlines New Payment System Going Around The US DollarAnthony Allen Anderson100% (4)

- SCM NotesDocument29 pagesSCM NotesNisha Pradeepa100% (2)

- AP Human Geography 2012 Scoring Guidelines: Part A (1 Point)Document11 pagesAP Human Geography 2012 Scoring Guidelines: Part A (1 Point)Rajendra PilludaNo ratings yet

- Superannuation and Retirement Planning AdviceDocument16 pagesSuperannuation and Retirement Planning Adviceapi-337581948No ratings yet

- Study apparel export order processDocument44 pagesStudy apparel export order processSHRUTI CHUGH100% (1)

- AMERICAN EXPRESS CORPORATE CARD MITCDocument17 pagesAMERICAN EXPRESS CORPORATE CARD MITCKrisNo ratings yet

- Unit 8 Risk in The WorkplaceDocument11 pagesUnit 8 Risk in The WorkplaceAnonymous WalvB8No ratings yet

- Connectivity endpoint and typeDocument4 pagesConnectivity endpoint and typeLokeshNo ratings yet

- Wellsfargo Business Choice Checking FeesDocument3 pagesWellsfargo Business Choice Checking FeesMike HartNo ratings yet

- CSSSamantha GermanSLA201406Document117 pagesCSSSamantha GermanSLA201406rpillz100% (1)

- EIA GuidelineDocument224 pagesEIA GuidelineAjlaa RahimNo ratings yet

- E TradeDocument6 pagesE TradeImran AzizNo ratings yet

- Dau Terminal AnalysisDocument49 pagesDau Terminal AnalysisMila Zulueta100% (2)

- U.S. Bank: Customercredittransferinitiationv03 Pain.001.001.03Document14 pagesU.S. Bank: Customercredittransferinitiationv03 Pain.001.001.03Jean-FrançoisLogezNo ratings yet

- USD STMT Aug To Oct 2020 For KOMDocument3 pagesUSD STMT Aug To Oct 2020 For KOMsimple footballNo ratings yet

- Navig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFDocument2 pagesNavig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFAnonymous MoQ28DEBPNo ratings yet

- Emergency Replacement Parts for Grove RT 760E CraneDocument1 pageEmergency Replacement Parts for Grove RT 760E CraneraulNo ratings yet

- Gyaan All in OneDocument41 pagesGyaan All in OneHEMANT SARVANKARNo ratings yet

- Pain 001 001 09Document23 pagesPain 001 001 09Anoop KesharwaniNo ratings yet

- JPMACCESS FundsTransferImportDocument42 pagesJPMACCESS FundsTransferImportManu K BhagavathNo ratings yet

- Sage Data ImportDocument81 pagesSage Data ImportIan McNair100% (1)

- PLL Nov Expo01 19 PI Fiseha Gebreegziabher GebrehiwotDocument1 pagePLL Nov Expo01 19 PI Fiseha Gebreegziabher GebrehiwotOfficial WebNo ratings yet

- Non Federal Direct Deposit Enrollment Request Form EnglishDocument1 pageNon Federal Direct Deposit Enrollment Request Form EnglishtobyNo ratings yet

- BMO World Elite Mastercard Benefits Guide enDocument11 pagesBMO World Elite Mastercard Benefits Guide enTonyNo ratings yet

- Application No.:: SEBI / IRDA Registration NO.Document24 pagesApplication No.:: SEBI / IRDA Registration NO.Mohd MizanNo ratings yet

- EBAY INC 10-K (Annual Reports) 2009-02-20Document126 pagesEBAY INC 10-K (Annual Reports) 2009-02-20http://secwatch.comNo ratings yet

- Who We AreDocument568 pagesWho We AreProgressivesUnitedNo ratings yet

- ISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2Document287 pagesISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2kafihNo ratings yet

- COMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24Document350 pagesCOMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24http://secwatch.comNo ratings yet

- MSN BalacesheetsDocument16 pagesMSN BalacesheetsnawazNo ratings yet

- Aaron Berg w2Document2 pagesAaron Berg w2kevin kuhnNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Central District of CaliforniaDocument65 pagesUnited States Bankruptcy Court Voluntary Petition: Central District of California11CV00233No ratings yet

- Tutorial 1 PDFDocument2 pagesTutorial 1 PDFchirag chhabraNo ratings yet

- Lucky Tiger Casino Card Authentication: XX XXXXDocument1 pageLucky Tiger Casino Card Authentication: XX XXXXบ่จัก ดอกNo ratings yet

- Inter Company Invoicing ProcessDocument1 pageInter Company Invoicing Processaj9055537No ratings yet

- Keep your hotel smiling with integrated property managementDocument8 pagesKeep your hotel smiling with integrated property managementseenubhaiNo ratings yet

- IBAN Payment InformationDocument2 pagesIBAN Payment InformationJillyin James100% (1)

- Sheila McCorriston WithdrawalDocument14 pagesSheila McCorriston WithdrawalAnonymous BmFjIMShq9100% (1)

- Total Statement SummaryDocument4 pagesTotal Statement SummaryIia AdvertisementsNo ratings yet

- FIN.2.2.1 - Bank Transactions: General Ledger - Journals - General JournalDocument3 pagesFIN.2.2.1 - Bank Transactions: General Ledger - Journals - General JournalIslam SultanNo ratings yet

- Anexa 5 Amex CenturionDocument1 pageAnexa 5 Amex CenturionRaluca AndreeaNo ratings yet

- Roger Smith Military Records - 0001Document33 pagesRoger Smith Military Records - 0001Samuel PerezNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Asia CSV Format Description for Global Integration PaymentsDocument72 pagesAsia CSV Format Description for Global Integration PaymentsitmuesNo ratings yet

- Credit Card Statement SummaryDocument2 pagesCredit Card Statement SummaryGerson ChirinosNo ratings yet

- WorldRemit Payment Receipt Sent FundsDocument1 pageWorldRemit Payment Receipt Sent FundsEzekiel EgwenikeNo ratings yet

- Credit Scoring, Statistical Techniques and Evaluation Criteria: A Review of The LiteratureDocument41 pagesCredit Scoring, Statistical Techniques and Evaluation Criteria: A Review of The LiteratureAnonymous 0sxQqwAIMBNo ratings yet

- GSIS eBilling Collection SummaryDocument2 pagesGSIS eBilling Collection SummaryDom Minix del RosarioNo ratings yet

- DME ACH Processing in SAP - ExcelDocument3 pagesDME ACH Processing in SAP - ExcelNaveen KumarNo ratings yet

- Manual ManualDocument2 pagesManual ManualBobNo ratings yet

- Small Business Bureau Registration Form OfficialDocument4 pagesSmall Business Bureau Registration Form OfficialNisherrie HoopsNo ratings yet

- Student loan interest statementDocument2 pagesStudent loan interest statementMaikeru ShogunnateMusa MNo ratings yet

- FedGlobal ACH PaymentsDocument2 pagesFedGlobal ACH PaymentscrazytrainNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- SEB-ISO-20022 Specification ENDocument76 pagesSEB-ISO-20022 Specification ENPerla GonzalezNo ratings yet

- C++ Chapter 2 Basic of C++Document14 pagesC++ Chapter 2 Basic of C++Hanan FuadNo ratings yet

- CmaterialDocument38 pagesCmaterialLakshmi SarvaniNo ratings yet

- Coordinate Geometry Solutions Class 10 SSC: Exercise 7.1Document42 pagesCoordinate Geometry Solutions Class 10 SSC: Exercise 7.1Rajendra PilludaNo ratings yet

- Possible Frqs For Chapter 10 and Chapter 11 ExamDocument3 pagesPossible Frqs For Chapter 10 and Chapter 11 ExamRajendra PilludaNo ratings yet

- AP HuG Chapter 7 2014Document5 pagesAP HuG Chapter 7 2014Rajendra PilludaNo ratings yet

- About Microfinance: Microfinance - Also Called Microcredit, Microlending, or MicroloansDocument2 pagesAbout Microfinance: Microfinance - Also Called Microcredit, Microlending, or MicroloansRajendra PilludaNo ratings yet

- About Microfinance: Microfinance - Also Called Microcredit, Microlending, or MicroloansDocument2 pagesAbout Microfinance: Microfinance - Also Called Microcredit, Microlending, or MicroloansRajendra PilludaNo ratings yet

- AP Human Geography FRQs on Urbanization, Models and TransportationDocument6 pagesAP Human Geography FRQs on Urbanization, Models and TransportationRajendra PilludaNo ratings yet

- About Microfinance: Microfinance - Also Called Microcredit, Microlending, or MicroloansDocument2 pagesAbout Microfinance: Microfinance - Also Called Microcredit, Microlending, or MicroloansRajendra PilludaNo ratings yet

- ch.9 Test BankDocument32 pagesch.9 Test BankRajendra PilludaNo ratings yet

- Vi Cheat SheetDocument2 pagesVi Cheat Sheetvaaz205No ratings yet

- Ap14 FRQ Human GeographyDocument3 pagesAp14 FRQ Human Geographyapi-314084641No ratings yet

- ch.9 Test BankDocument32 pagesch.9 Test BankRajendra PilludaNo ratings yet

- P2P Life Cycle PDFDocument72 pagesP2P Life Cycle PDFRajendra PilludaNo ratings yet

- Received Amount Not EqualDocument2 pagesReceived Amount Not EqualRajendra PilludaNo ratings yet

- CH 9-10 Outline and Test ReviewDocument12 pagesCH 9-10 Outline and Test ReviewRajendra PilludaNo ratings yet

- Drilldown Diagnostics ScriptDocument1 pageDrilldown Diagnostics ScriptRajendra PilludaNo ratings yet

- Ap Human Geography Course Outline: I. Geography: Its Nature and Perspectives (5-10% of The AP Exam)Document7 pagesAp Human Geography Course Outline: I. Geography: Its Nature and Perspectives (5-10% of The AP Exam)Rajendra PilludaNo ratings yet

- How To Create A Service Request PDFDocument6 pagesHow To Create A Service Request PDFRajendra PilludaNo ratings yet

- CH 07Document48 pagesCH 07Rajendra PilludaNo ratings yet

- CH 07Document48 pagesCH 07Rajendra PilludaNo ratings yet

- MJE ManualDocument32 pagesMJE ManualSonaliNo ratings yet

- APHG CHPT 4 PDFDocument16 pagesAPHG CHPT 4 PDFRajendra PilludaNo ratings yet