Professional Documents

Culture Documents

BHEL Buyback View To Be or Not To Be

Uploaded by

SandipNanawareOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BHEL Buyback View To Be or Not To Be

Uploaded by

SandipNanawareCopyright:

Available Formats

For Information Purpose Only

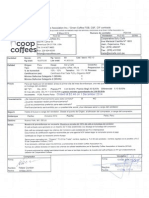

BUY BACK

BHEL

October 26, 2018

Kindly note that, the proposal to buyback not exceeding 18,93,36,645 (Eighteen Crore Ninety

Record Date : November 6, 2018

Three Lakh Thirty Six Thousand Six Hundred and Forty Five) equity shares of face value of Rs. 2

UPSIDE % = 25 % (difference between Buy- of the Company (representing 5.16% of the total number of equity shares in the paid-up share

Back price and CMP – Rs.68.80) capital of the Company) at a price of ~ 86 (Rupees Eighty Six only) per equity share payable in

cash for an aggregate consideration not exceeding Rs. 1628,29,51,470 (Rupees One Thousand

CMP = Rs. 68.80/- share

Six Hundred and Twenty Eight Crore Twenty Nine Lakh Fifty One Thousand Four Hundred and

MARKET CAP = Rs. 25,699.80 crore Seventy only), representing upto 5% of both the standalone and consolidated paid-up share

capital and free reserves as per the audited financial statements of the Company for the

*RECORD DATE: November 6, 2018*

financial year ended March 31, 2018, being less than 10% of the aggregate of the fully paid-up

*BUY – BACK Price = Rs.86 per share* equity share capital and free reserves as per the audited accounts of the Company for the

financial year ended March 31, 2018 (the last audited financial statements available as on the

Buy Back of Shares = 18,93,36,645 (Eighteen date of Board meeting recommending the proposal of the Buyback) from all the equity

Crore Ninety Three Lakh Thirty Six Thousand shareholders of the Company, as on the record date, on a proportionate basis through a "Tender

Six Hundred and Forty Five) equity shares of

Offer" route in accordance with the provisions contained in the Companies Act, 2013, the

face value of Rs. 2 of the Company

Companies (Management and Administration) Rules, 2014, the Securities and Exchange Board

(representing 5.16% of the total number of

equity shares in the paid-up share capital of India (Buy-back of Securities) Regulations, 2018 (the "Buyback"), subject to all other

applicable statutory approvals.

Route : Tender offer

In terms of Regulation 42 of Securities and Exchange Board of India (Listing Obligations and

Total Buyback size : Rs 1628.30 Crores Disclosure Requirements) Regulations, 2015, as amended and Regulation 9 (1) of SEBI (Buy-

back of Securities) Regulations, 2018 and other applicable provisions, we would like to inform

Promoter’s Holding = 63.06% = 167,183,056

you that the Board of Directors of the Company, at its meeting held on October 25, 2018, has

Equity Shares

fixed Tuesday, November 6, 2018, as the 'Record Date' to determine the entitlement and names

Public holding upto Rs.2Lacs = 4.24% = of the eligible shareholders/ beneficial owners who are eligible to participate and to whom the

15,55,36,808 Equity shares Letter of Offer and Tender Form will be delivered in relation to the Buyback of equity shares of

the Company.

https://beta.bseindia.com/xml-data/corpfiling/AttachLive/986d02c8-bc12-45b8-b6e8-5bab039f57b7.pdf

https://beta.bseindia.com/corporates/anndet_new.aspx?newsid=7224f1d7-6ed0-4e34-a891-429263737539

E-mail: smc.care@smcindiaonline.com

Corporate Office: Mumbai Office: Kolkata Office:

11/6B, Shanti Chamber, Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , 18, Rabindra Sarani, Poddar Court, Gate No-4,

Pusa Road, New Delhi - 110005 Graham Firth Steel Compound, Off Western 5th Floor, Kolkata - 700001

Tel: +91-11-30111000 Express Highway, Jay Coach Signal, Goreagon Tel.: 033 6612 7000/033 4058 7000

www.smcindiaonline.com (East) Mumbai - 400063 Fax: 033 6612 7004/033 4058 7004

Tel: 91-22-67341600, Fax: 91-22-67341697

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is licensed to carry on the business of broking, depository services and related

activities. SMC is a registered member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited, MSEI (Metropolitan Stock Exchange of India Ltd) and M/s SMC Comtrade Ltd is a registered

member of National Commodity and Derivative Exchange Limited and Multi Commodity Exchanges of India and other commodity exchanges in India. SMC is also registered as a Depository Participant with CDSL

and NSDL. SMC’s other associates are registered as Merchant Bankers, Portfolio Managers, NBFC with SEBI and Reserve Bank of India. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in

securities market. SMC or its associates or its Research Analyst or his relatives do not hold any financial interest in the subject company interest at the time of publication of this Report. SMC or its associates or its

Research Analyst or his relatives do not hold any actual/beneficial ownership of more than 1% (one percent) in the subject company, at the end of the month immediately preceding the date of publication of this

Report. SMC or its associates its Research Analyst or his relatives does not have any material conflict of interest at the time of publication of this Report.

SMC or its associates/analyst has not received any compensation from the subject company covered by the Research Analyst during the past twelve months. The subject company has not been a client of SMC

during the past twelve months. SMC or its associates has not received any compensation or other benefits from the subject company covered by analyst or third party in connection with the present Research Report.

The Research Analyst has not served as an officer, director or employee of the subject company covered by him/her and SMC has not been engaged in the market making activity for the subject company covered by

the Research Analyst in this report.

The views expressed by the Research Analyst in this Report are based solely on information available publicly available/internal data/ other reliable sources believed to be true. SMC does not represent/ provide any

warranty expressly or impliedly to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

The research analysts who have prepared this Report hereby certify that the views /opinions expressed in this Report are their personal independent views/opinions in respect of the subject company.

Disclaimer: This Research Report is for the personal information of the authorized recipient and doesn't construe to be any investment, legal or taxation advice to the investor. It is only for private circulation and use.

The Research Report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. No action is solicited on the basis of the

contents of this Research Report. The Research Report should not be reproduced or redistributed to any other person(s)in any form without prior written permission of the SMC. The contents of this material are

general and are neither comprehensive nor inclusive. Neither SMC nor any of its affiliates, associates, representatives, directors or employees shall be responsible for any loss or damage that may arise to any person

due to any action taken on the basis of this Research Report. It does not constitute personal recommendations or take into account the particular investment objectives, financial situations or needs of an individual

client or a corporate/s or any entity/s. All investments involve risk and past performance doesn't guarantee future results. The value of, and income from investments may vary because of the changes in the macro and

micro factors given at a certain period of time. The person should use his/her own judgment while taking investment decisions. Please note that SMC its affiliates, Research Analyst, officers, directors, and employees,

including persons involved in the preparation or issuance if this Research Report: (a) from time to time, may have long or short positions in, and buy or sell the securities thereof, of the subject company(ies) mentioned

here in; or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company(ies) discussed

herein or may perform or seek to perform investment banking services for such company(ies) or act as advisor or lender/borrower to such subject company(ies); or (c) may have any other potential conflict of interest

with respect to any recommendation and related information and opinions.

All disputes shall be subject to the exclusive jurisdiction of Delhi High court.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToDocument1 pageSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemNo ratings yet

- Case Study - Swiss ArmyDocument16 pagesCase Study - Swiss Armydineshmaan50% (2)

- Erection, Commissioning, Operation AND Maintenance Manual FOR Transformers & ReactorsDocument176 pagesErection, Commissioning, Operation AND Maintenance Manual FOR Transformers & ReactorsSandipNanawareNo ratings yet

- eASR User Manual Guide to View Maharashtra Land RatesDocument11 pageseASR User Manual Guide to View Maharashtra Land RatesPrafulNo ratings yet

- Monthly Outage List Approved in WRLDC OCCM For The Month of June' 2021Document13 pagesMonthly Outage List Approved in WRLDC OCCM For The Month of June' 2021SandipNanawareNo ratings yet

- Threatened Plants of MaharashtraDocument5 pagesThreatened Plants of MaharashtraSandipNanawareNo ratings yet

- Premium Payment Options: A. Autopay/E-MandateDocument1 pagePremium Payment Options: A. Autopay/E-MandateSandipNanawareNo ratings yet

- Part Name Warranty Period Warranty Covered Not CoveredDocument1 pagePart Name Warranty Period Warranty Covered Not CoveredSandipNanawareNo ratings yet

- Loan Repayment ScheduleDocument2 pagesLoan Repayment ScheduleSandipNanawareNo ratings yet

- The Norms Set For Discharge of Its Function: Manual 4Document30 pagesThe Norms Set For Discharge of Its Function: Manual 4SandipNanawareNo ratings yet

- Part Name Warranty Period Warranty Covered Not CoveredDocument1 pagePart Name Warranty Period Warranty Covered Not CoveredSandipNanawareNo ratings yet

- CEA Safety Requirements For TPP EleDocument34 pagesCEA Safety Requirements For TPP ElesrinivasgillalaNo ratings yet

- Nagzira WLSDocument17 pagesNagzira WLSSandipNanawareNo ratings yet

- Monthly Outage List Approved in WRLDC OCCM For The Month of July' 2021Document14 pagesMonthly Outage List Approved in WRLDC OCCM For The Month of July' 2021SandipNanawareNo ratings yet

- Brochure Bajaj LongLifeDocument22 pagesBrochure Bajaj LongLifezoomtoamitNo ratings yet

- Base SchemeDocument19 pagesBase SchemeSandipNanawareNo ratings yet

- GETCO Tender for Height Raising 66kV VALIA-NETRANG LineDocument70 pagesGETCO Tender for Height Raising 66kV VALIA-NETRANG LineSandipNanawareNo ratings yet

- EHV Catalogue PDFDocument29 pagesEHV Catalogue PDFvineets058No ratings yet

- Paripatrak 2 June 2018Document2 pagesParipatrak 2 June 2018SandipNanawareNo ratings yet

- Moisture in Transformer Solid Insulation Sparling-April 08Document70 pagesMoisture in Transformer Solid Insulation Sparling-April 08BaSant Kohli100% (1)

- ENERGY CHARGING PERMISSIONDocument16 pagesENERGY CHARGING PERMISSIONSandipNanawareNo ratings yet

- Mr. Vimal Kejriwal - CII Policy WatchDocument2 pagesMr. Vimal Kejriwal - CII Policy WatchSandipNanawareNo ratings yet

- 11 - Chapter 3 PDFDocument28 pages11 - Chapter 3 PDFRainielNo ratings yet

- 52 Technical Specification of CVT Coupling Capacitor StructureDocument12 pages52 Technical Specification of CVT Coupling Capacitor StructureSandipNanawareNo ratings yet

- Flow Chart For Procedure For Grant of Grid Connectivity ToDocument1 pageFlow Chart For Procedure For Grant of Grid Connectivity ToSandipNanawareNo ratings yet

- Transmission Line AnalyzerDocument2 pagesTransmission Line AnalyzerSandipNanawareNo ratings yet

- 1st Quarter Financial Results 2017 18Document5 pages1st Quarter Financial Results 2017 18SandipNanawareNo ratings yet

- Application Form ExtensionDocument3 pagesApplication Form ExtensionSandipNanawareNo ratings yet

- Brochure ERS1Document2 pagesBrochure ERS1SandipNanawareNo ratings yet

- SilDocument3 pagesSilSandipNanawareNo ratings yet

- Procedure IPP ConnectivityDocument1 pageProcedure IPP ConnectivitySandipNanawareNo ratings yet

- Financial Ratio Analysis and Working Capital ManagementDocument26 pagesFinancial Ratio Analysis and Working Capital Managementlucky420024No ratings yet

- ERP at BPCL SummaryDocument3 pagesERP at BPCL SummaryMuneek ShahNo ratings yet

- PEA144Document4 pagesPEA144coffeepathNo ratings yet

- ME-6501Computer Aided Design (CAD) WITH QB - by Civildatas - Com 12Document78 pagesME-6501Computer Aided Design (CAD) WITH QB - by Civildatas - Com 12Charan KumarNo ratings yet

- 03-F05 Critical Task Analysis - DAMMAMDocument1 page03-F05 Critical Task Analysis - DAMMAMjawad khanNo ratings yet

- Internal Quality Audit Report TemplateDocument3 pagesInternal Quality Audit Report TemplateGVS RaoNo ratings yet

- Customs RA ManualDocument10 pagesCustoms RA ManualJitendra VernekarNo ratings yet

- Analyzing Transactions and Double Entry LectureDocument40 pagesAnalyzing Transactions and Double Entry LectureSuba ChaluNo ratings yet

- Case Study 1Document9 pagesCase Study 1kalpana0210No ratings yet

- PositioningDocument2 pagesPositioningKishan AndureNo ratings yet

- Group 2Document54 pagesGroup 2Vikas Sharma100% (2)

- Session 5Document2 pagesSession 5Angelia SimbolonNo ratings yet

- Hire PurchaseDocument16 pagesHire PurchaseNaseer Sap0% (1)

- A Dissertation Project Report On Social Media Marketing in IndiaDocument62 pagesA Dissertation Project Report On Social Media Marketing in IndiashaikhfaisalNo ratings yet

- AMUL Market AnalysisDocument59 pagesAMUL Market AnalysisHacking Master NeerajNo ratings yet

- Child-Friendly Integrated Public Space (Ruang Publik Terpadu Ramah Anak / RPTRA)Document14 pagesChild-Friendly Integrated Public Space (Ruang Publik Terpadu Ramah Anak / RPTRA)oswar mungkasaNo ratings yet

- MM Case Study FinalDocument22 pagesMM Case Study FinalPrasanjeet DebNo ratings yet

- Bms Index Numbers GROUP 1Document69 pagesBms Index Numbers GROUP 1SIRISHA N 2010285No ratings yet

- Βιογραφικά ΟμιλητώνDocument33 pagesΒιογραφικά ΟμιλητώνANDREASNo ratings yet

- Parked Tank LayoutDocument1 pageParked Tank LayoutAZreen A. ZAwawiNo ratings yet

- Human Right Note For BCADocument2 pagesHuman Right Note For BCANitish Gurung100% (1)

- Oracle ACE WPDocument23 pagesOracle ACE WPSyed Fahad KhanNo ratings yet

- Suzuki Project NewDocument98 pagesSuzuki Project NewRohan Somanna67% (3)

- Prince2 - Sample Paper 1Document16 pagesPrince2 - Sample Paper 1ikrudisNo ratings yet

- Fundamentals of Accounting 3- Segment Reporting and Responsibility AccountingDocument25 pagesFundamentals of Accounting 3- Segment Reporting and Responsibility AccountingAndrew MirandaNo ratings yet

- Appointment and Authority of AgentsDocument18 pagesAppointment and Authority of AgentsRaghav Randar0% (1)

- Griffin Chap 11Document34 pagesGriffin Chap 11Spil_vv_IJmuidenNo ratings yet

- The Theory of Interest Second EditionDocument43 pagesThe Theory of Interest Second EditionVineet GuptaNo ratings yet