Professional Documents

Culture Documents

ATM Application Form

Uploaded by

arman chowdhury0 ratings0% found this document useful (0 votes)

882 views2 pagesATM

Original Title

ATM Application Form (2)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentATM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

882 views2 pagesATM Application Form

Uploaded by

arman chowdhuryATM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

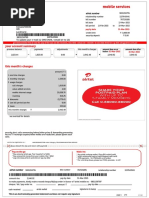

Please stick here your 1 copy

Passport size photograph

Don’t Staple

Branch

ATM/DEBIT Card Application Form

Account Number

Customer’s Signature - -

Personal Information: please fill in the form in capital letters and put tick mark ( √) in boxes where appropriate

Full Name: (Mr./Mrs./Ms.)

Put your name as you would like to see on your card(please use BLOCK letters and leave a blank space between each parts of your name)Do not use title or nick name

Date Birth: Religion: Nationality:

Gender: Male Female Marital Status: Single Married National ID No.:

Father’s Name:

Mother’s Name:

Spouse Name:

Occupation:

Name of the Company: Designation:

Address:

Phone: Fax No.: E-mail:

Mailing Address: (Please provide full details to ensure correct delivery of your Card, PIN and Statement)

City: Postal Code: Country:

Phone: Mobile: E-mail:

Permanent Address: (If different from mailing address)

City: Postal Code: Country:

Verified by Branch Authorized by Branch Date:

IT DIVISION (ATM Card Operation) USE ONLY .

Card No: 9 2 6 5 0 1

Date of Issue: D D M M Y Y Y Y Expiry Date D D M M Y Y Y Y

Input By (Signature & Date) Authorized By (Signature & Date)

ICT DIVISION (ATM Card Operation), Bahela Tower, 72 Gulshan Avenue, Gulshan-1,Dhaka 1212, Phone:+88-02-9859313 E-mail: atmcard@unionbank.com.bd, Web:www.unionbank.com.bd

Terms and Conditions (ATM/Debit Card)

1. Only account holders of Union Bank Ltd. Can apply for ATM/Debit Card.

2. a) All transactions initiated by the card, whether electronically or otherwise, using the Card will be debited from the

Designated Account of the Customer.

b) The Bank shall debit the designated Account for the amount withdrawn from any of the Banks Automated Teller Machine

(ATM) in Bangladesh by the use of the card. The Bank’s records generated electronically or otherwise, shall be deemed to

be conclusive proof of the correctness of the transaction notwithstanding the fact that there exists no debit voucher signed

by the Cardholder to support transactions through the ATM.

c) In consideration of issuing Card, the cardholder undertakes to indemnify the bank against all losses, claims, action,

proceeding, demands, costs and expenses incurred or sustained by the Bank of whatever nature and however arising out of

or in connection with the issuance or use of the card, provided only that the Bank acts in good faith.

3. The Bank reserves the right to limit the total cash withdrawal by the cardholder during a 24-hour period.

4. The card shall at all times, remains the property of the Bank may in its unfettered discretion and without giving any reason

to withdraw the Card or the services thereby offered or any part of such services at anytime without any prior notice

hereby the Cardholder will be responsible for returning the Card as per request from the Bank.

5. The Card and PIN are issued to the cardholder entirely at the Cardholder’s risk and the Bank shall bear no liability for any

loss, financial or otherwise, or damage caused from this issue. The Bank shall not be responsible for any losses or damages

or expenses arising directly or indirectly as a result of any transaction made with the Card and shall be indemnified by the

cardholder, against any such loss or damage.

6. The Cardholder shall not disclose the PIN. The Cardholder will be liable to the Bank for any and all transaction made by the

use of the card and hereby agrees to indemnify the Bank for any losses or damages caused by any unauthorized use of the

Card or PIN, unless the Bank has received notice in writing of any loss, damage or theft of the Card or disclosure of the PIN

prior to any unauthorized use of the Card or PIN for this purpose, use other Card by a person who obtained possession of

the card with the consent of the Cardholder constitutes authorized use of the card.

7. The Bank shall debit the Designated Account for all related charges with respect to the card and the use thereof and the

bank including charges for any replacement of the Card may announce charges, as from time to time by the Bank acquirer

as the case may be including charges for any replacement of the Card.

8. The Bank reserves the right to refuse an application of the issuance of a Card and to withdraw at anytime and at its sole

discretion all rights and privileges pertaining to the Card. The Bank shall not be responsible for any losses or damages or

expenses and arising whether directly or indirectly as a result of any malfunction of the Card of any of the Bank’s ATM, the

insufficiency of funds in such a machine or otherwise.

9. The bank does not warrant and will not be responsible for the card not being honoured for any reason.

10. In the event of replacement of a card (in case of lost/stolen) Bank will levy a charge set by the Bank’s management.

11. In the event of resetting PIN, Bank will levy a charge set by the Bank’s management.

12. The Card shall cease to be valid and the Bank shall be entitled to the immediate return of the Card in the event of

a) Closure of the Designated Account.

b) Death of the Cardholder.

c) The Cardholder’s authority to operate the Designated Account is terminated.

d) The Cardholder ceases to be a customer of the Bank.

e) The Bank request for its return.

13. All notification and/or questions concerning the use of the Card should be directed to the ICT Division (ATM Card

Operation) of the Bank at Head Office or the Cardholder’s branch.

14. All rules and regulations governing the operations of current/savings accounts will prevail.

15. The Bank may at anytime change the Terms and Conditions without prior notice to the Cardholder.

16. These Terms and Conditions will stand amended if law, government regulations or instructions issued by the Bangladesh

Bank necessitates such amendments.

17. The Bank shall have the right to charge the Customer any fees for issuance and use of the card on a yearly basis.

18. Cardholder will not use the card for any illegal transaction or anything unlawful, under the laws of Bangladesh.

19. Cardholder may terminate this agreement by serving 60 days’ prior notice to the Bank before it expiry.

20. ATM Debit Card of Union Bank can be used in all Q-cash network.

Applicant’s Signature Date:

You might also like

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeFrom EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeNo ratings yet

- Baroda Pioneer Transaction FormDocument2 pagesBaroda Pioneer Transaction FormAjith MosesNo ratings yet

- Letter - Noor BankDocument1 pageLetter - Noor Bankrajkamal_eNo ratings yet

- IFCI Long Term Infra Bonds Application FormDocument2 pagesIFCI Long Term Infra Bonds Application FormPrajna CapitalNo ratings yet

- ATV of AccountDocument1 pageATV of AccountLella ElaaNo ratings yet

- Air India Ticket AuthorizationDocument2 pagesAir India Ticket AuthorizationAnurag ShrivastavNo ratings yet

- IR - Subscription - Form - (Post Paid) - & - Auto - Bill - Pay - Form - CompressedDocument2 pagesIR - Subscription - Form - (Post Paid) - & - Auto - Bill - Pay - Form - Compressedshahid2opuNo ratings yet

- NPS Withdrawal FormsDocument12 pagesNPS Withdrawal FormsHimanshu ButalaNo ratings yet

- Mobile Banking Statement for ABDUL QAYOOM from HBLDocument1 pageMobile Banking Statement for ABDUL QAYOOM from HBLmuhammad asim shaikhNo ratings yet

- Zhang Liang inDocument7 pagesZhang Liang inNaing linn AungNo ratings yet

- CAMSDocument39 pagesCAMSSterling FincapNo ratings yet

- Cisf Welfare Funds Manual 2017Document62 pagesCisf Welfare Funds Manual 2017GROUP HQRNo ratings yet

- CPF Withdrawal ApplicationDocument4 pagesCPF Withdrawal ApplicationkyinekyineNo ratings yet

- SMS Internet Banking FormDocument4 pagesSMS Internet Banking FormSayed InsanNo ratings yet

- Form A PDFDocument2 pagesForm A PDFSundar SethNo ratings yet

- UTI - Change of Bank FormDocument2 pagesUTI - Change of Bank FormSameer apteNo ratings yet

- Test Doc 2Document3 pagesTest Doc 2Kor KortNo ratings yet

- Meaning of Money: Types and Uses of Plastic MoneyDocument24 pagesMeaning of Money: Types and Uses of Plastic MoneySeema ManghnaniNo ratings yet

- RTGS Funds Transfer Application FormDocument2 pagesRTGS Funds Transfer Application Formpayal26No ratings yet

- VISADocument74 pagesVISAዝምታ ተሻለNo ratings yet

- Kerala Financial Enterprises receipt for Rs. 2500 UPI payment to Adarsh Udayan chittyDocument1 pageKerala Financial Enterprises receipt for Rs. 2500 UPI payment to Adarsh Udayan chittyAdarsh. UdayanNo ratings yet

- Metrobank Vs Asb HoldingsDocument7 pagesMetrobank Vs Asb HoldingsAlex Viray LucinarioNo ratings yet

- Contactless Cards WorkingDocument4 pagesContactless Cards WorkingdineshNo ratings yet

- Note: Posted Transactions Until The Last Working Day Are ShownDocument13 pagesNote: Posted Transactions Until The Last Working Day Are ShownSheraz azamNo ratings yet

- Capitec Payment NotificationDocument1 pageCapitec Payment NotificationChequeNo ratings yet

- Patria Bank S.A: Extras de Cont / Account StatementDocument3 pagesPatria Bank S.A: Extras de Cont / Account StatementRommel FrumuseluNo ratings yet

- Note: Posted Transactions Until The Last Working Day Are ShownDocument1 pageNote: Posted Transactions Until The Last Working Day Are ShownM Abdullah ChaudhryNo ratings yet

- Credit Card Statement SummaryDocument2 pagesCredit Card Statement SummaryGerson ChirinosNo ratings yet

- EPOnlineSvcAccessApplnForm CompileDocument11 pagesEPOnlineSvcAccessApplnForm CompileRia ArguellesNo ratings yet

- LOIDocument1 pageLOImzlwinNo ratings yet

- Paid Up Letter1111Document1 pagePaid Up Letter1111Vee-kay Vicky KatekaniNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document6 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Prashant SinghNo ratings yet

- Vendor Registration Form GuideDocument7 pagesVendor Registration Form GuideGautam NegiNo ratings yet

- Bank@Campus Account - ICICI Bank LTDDocument1 pageBank@Campus Account - ICICI Bank LTDKumar RanjanNo ratings yet

- FilesDocument3 pagesFilesJacqueline Burgy FutrellNo ratings yet

- CIMB CashRebate CalculationDocument5 pagesCIMB CashRebate CalculationLindaNo ratings yet

- ECOBANK - Payment Method (En)Document3 pagesECOBANK - Payment Method (En)University of East London OnlineNo ratings yet

- 2020-21 156b Radhika HothiDocument9 pages2020-21 156b Radhika Hothianchal dhimanhikevisaNo ratings yet

- Sungai Kayan Plantation Company No 47 Jalan Ajibah Abol 93400 KUCHINGDocument1 pageSungai Kayan Plantation Company No 47 Jalan Ajibah Abol 93400 KUCHING林本No ratings yet

- Customer AgreementDocument17 pagesCustomer Agreementluis miguel ReyesNo ratings yet

- ECS Mandate Form For StudentsDocument1 pageECS Mandate Form For StudentsrakeshagrawalNo ratings yet

- Servcorp Virtual Office Service Agreement: 12 Month CommitmentDocument2 pagesServcorp Virtual Office Service Agreement: 12 Month CommitmentCrest CapitalNo ratings yet

- 5062 Policy Payout FormDocument2 pages5062 Policy Payout Formbpd21No ratings yet

- Do's & Don'Ts EngDocument1 pageDo's & Don'Ts EngRAJIKUL ISLAMNo ratings yet

- Application For A Social Insurance Number Information Guide For ApplicantsDocument7 pagesApplication For A Social Insurance Number Information Guide For ApplicantsTHEBOSS09480No ratings yet

- DMP Payment Procedure Automated Teller MachiDocument16 pagesDMP Payment Procedure Automated Teller MachiNavinkumar G.KunarathinamNo ratings yet

- Mövenpick - Secure Authorization Form SampleDocument1 pageMövenpick - Secure Authorization Form Samplebadai_utmNo ratings yet

- Reliance Bill Details for Ashish NaikDocument4 pagesReliance Bill Details for Ashish NaikAshish NaikNo ratings yet

- Airtel mobile bill detailsDocument3 pagesAirtel mobile bill detailssubham duttaNo ratings yet

- Transaction Details Amount in PKR Closing Balance DateDocument2 pagesTransaction Details Amount in PKR Closing Balance DateShahzad CHNo ratings yet

- Premium Payment Instruction For Credit Card DeductionDocument2 pagesPremium Payment Instruction For Credit Card DeductioninabansNo ratings yet

- UNFCU External Transfer Agreement - Terms of UseDocument3 pagesUNFCU External Transfer Agreement - Terms of UseAnusionwu Stanley ObinnaNo ratings yet

- ProfitMart CommoditiesDocument16 pagesProfitMart CommoditiesProfit CircleNo ratings yet

- AMERICAN EXPRESS CardNetDocument1 pageAMERICAN EXPRESS CardNetCHANDANNo ratings yet

- AIOS Membership FormDocument2 pagesAIOS Membership FormiAdrivNo ratings yet

- Unit Trust Account Opening Form 13.12.2019 1Document4 pagesUnit Trust Account Opening Form 13.12.2019 1henrykibe01No ratings yet

- Visa Application Form Kingdom of The Netherlands in The CaribbeanDocument9 pagesVisa Application Form Kingdom of The Netherlands in The CaribbeanUtkarsh Choudhary100% (1)

- Payment NotificationDocument1 pagePayment NotificationThulo TsimiNo ratings yet

- Written ConfirmationDocument2 pagesWritten ConfirmationJacqueline Burgy FutrellNo ratings yet

- ChannelApplicationform PDFDocument2 pagesChannelApplicationform PDFKishan BhowmikNo ratings yet

- Professional Report Writing SkillsDocument1 pageProfessional Report Writing Skillsarman chowdhuryNo ratings yet

- Thank You For Helping Us Measure The Internet.: Home Arts Business Science OtherDocument6 pagesThank You For Helping Us Measure The Internet.: Home Arts Business Science Otherarman chowdhuryNo ratings yet

- Project Cycle Management (PCM)Document1 pageProject Cycle Management (PCM)arman chowdhuryNo ratings yet

- How To Be Excellent in Corporate SalesDocument1 pageHow To Be Excellent in Corporate Salesarman chowdhuryNo ratings yet

- Human Resource ManagementDocument2 pagesHuman Resource Managementarman chowdhuryNo ratings yet

- Microsoft Excel - Learner To ProfessionalDocument1 pageMicrosoft Excel - Learner To Professionalarman chowdhuryNo ratings yet

- Pharmaceutical Sales Leadership ExcellenceDocument1 pagePharmaceutical Sales Leadership Excellencearman chowdhuryNo ratings yet

- Procurement, Logistics, Inventory, Transportation and WarehousingDocument1 pageProcurement, Logistics, Inventory, Transportation and Warehousingarman chowdhuryNo ratings yet

- Practical Accounting For Non-Accounting ProfessionalsDocument1 pagePractical Accounting For Non-Accounting Professionalsarman chowdhuryNo ratings yet

- Certificate Course On Effective Business CommunicationDocument1 pageCertificate Course On Effective Business Communicationarman chowdhuryNo ratings yet

- Office ManagementDocument1 pageOffice Managementarman chowdhuryNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Public ProcurementDocument1 pagePublic Procurementarman chowdhuryNo ratings yet

- Software and IT Service MarketingDocument1 pageSoftware and IT Service Marketingarman chowdhuryNo ratings yet

- Result Based MonitoringDocument1 pageResult Based Monitoringarman chowdhuryNo ratings yet

- Key Account ManagementDocument12 pagesKey Account Managementarman chowdhuryNo ratings yet

- SINOPEC PartnersEngDocument42 pagesSINOPEC PartnersEngHamed GeramiNo ratings yet

- Corporate Key Account Management TrainingDocument9 pagesCorporate Key Account Management Trainingarman chowdhuryNo ratings yet

- 1106a 70tag4 PDFDocument5 pages1106a 70tag4 PDFbest100% (1)

- OilDocument17 pagesOilCharlie BrownNo ratings yet

- BIZOL Product Sheet 1230Document1 pageBIZOL Product Sheet 1230arman chowdhuryNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Jenbacher Type 3: Efficient, Durable, Reliable Reference InstallationsDocument2 pagesJenbacher Type 3: Efficient, Durable, Reliable Reference InstallationsMUHAMMAD EHSAN-UL-HAQUE L1F17MSME0003No ratings yet

- Shell Mysella S5N40 TDSDocument2 pagesShell Mysella S5N40 TDSLaiq100% (1)

- Latest Mobile Phone in India 2020 With Prices, New Phones From Samsung, NokiaDocument9 pagesLatest Mobile Phone in India 2020 With Prices, New Phones From Samsung, Nokiaarman chowdhuryNo ratings yet

- 3 Sinopec Tulux T600 15W 40Document3 pages3 Sinopec Tulux T600 15W 40arman chowdhuryNo ratings yet

- The Best Phone To Buy For 2020 - CNETDocument12 pagesThe Best Phone To Buy For 2020 - CNETarman chowdhuryNo ratings yet

- Top 10 Best Mobile Phones in India With Price & Specs (21 October 2020) - Digit - inDocument8 pagesTop 10 Best Mobile Phones in India With Price & Specs (21 October 2020) - Digit - inarman chowdhuryNo ratings yet

- Top 10 Mobile Phones in India With Price, Best Mobiles in India 2020Document12 pagesTop 10 Mobile Phones in India With Price, Best Mobiles in India 2020arman chowdhuryNo ratings yet

- Best Mobile Phones in India (October, 2020) - Latest & New Smartphones PriceDocument49 pagesBest Mobile Phones in India (October, 2020) - Latest & New Smartphones Pricearman chowdhuryNo ratings yet

- Dumps With Pin Cashout Tutorials. PDFDocument10 pagesDumps With Pin Cashout Tutorials. PDFDiego Eduardo Rivera Paz100% (8)

- E Banking Chapter 3Document19 pagesE Banking Chapter 3Philip K BugaNo ratings yet

- Strategic Error ProofingDocument154 pagesStrategic Error Proofingbertrussell56No ratings yet

- High Tech VS High TouchDocument10 pagesHigh Tech VS High Touchartha wibawaNo ratings yet

- Karate1boletin 2023 Karate 1 Premier League Fukuoka 001Document31 pagesKarate1boletin 2023 Karate 1 Premier League Fukuoka 001ACHMAD IRVANNo ratings yet

- P MLZ 2 WDWMZ 3 KDIMUDocument7 pagesP MLZ 2 WDWMZ 3 KDIMUDaniel CookNo ratings yet

- Computers in Everyday Life: Grade 9 by Mr. ChisengaDocument13 pagesComputers in Everyday Life: Grade 9 by Mr. Chisengamanasseh simpasaNo ratings yet

- MX8600Document2 pagesMX8600MariyappanSubhash50% (2)

- View monthly bank statementDocument5 pagesView monthly bank statementHari HaranNo ratings yet

- Payment OptionsDocument2 pagesPayment OptionsDanson Githinji ENo ratings yet

- Axis Bank account statement for Gattu Surya Surendar Amarnath GoudaDocument3 pagesAxis Bank account statement for Gattu Surya Surendar Amarnath GoudaGandra KiranraoNo ratings yet

- Blackbook ProjectDocument78 pagesBlackbook ProjectKriti Somani71% (28)

- Internet SlangDocument95 pagesInternet SlangDanang WibisanaNo ratings yet

- A STUDY of NPA ProjectDocument74 pagesA STUDY of NPA ProjectAman RajakNo ratings yet

- Account Opening Form NR IndividualDocument2 pagesAccount Opening Form NR IndividualGraham EvansNo ratings yet

- 4aa1 6651enwDocument4 pages4aa1 6651enwHelena DamjanovićNo ratings yet

- 2013 KPMG Nigeria Banking Industry Customer Satisfaction Survey FinalDocument36 pages2013 KPMG Nigeria Banking Industry Customer Satisfaction Survey FinalViswa Keerthi100% (1)

- ATM Simulation Full DoCumEntary With CodeDocument141 pagesATM Simulation Full DoCumEntary With Codevaishnavi kadambariNo ratings yet

- Axis Bank account statement for Partha Sarathi DasDocument2 pagesAxis Bank account statement for Partha Sarathi DasPartha sarathi dasNo ratings yet

- Deposit Insurance ExplainedDocument13 pagesDeposit Insurance ExplainedRachelle CasimiroNo ratings yet

- ATM Seminar Report on Automated Teller MachinesDocument11 pagesATM Seminar Report on Automated Teller MachinesSimon YohannesNo ratings yet

- Unit Iii: Part BDocument56 pagesUnit Iii: Part BSumathy JayaramNo ratings yet

- TransactionSummary 130722084614Document7 pagesTransactionSummary 130722084614kogila arunprabuNo ratings yet

- RBI Notice For Depositing Counterfeit NotesDocument24 pagesRBI Notice For Depositing Counterfeit NotesaaannnnniiiiiiiiNo ratings yet

- Claims reimbursement form submission guideDocument2 pagesClaims reimbursement form submission guideJoyce HerreraNo ratings yet

- AtmDocument33 pagesAtmShayani BatabyalNo ratings yet

- Lean and Green Banking in India 2012Document20 pagesLean and Green Banking in India 2012Prof Dr Chowdari Prasad100% (2)

- RoleOf It Technology in Banking SectorDocument70 pagesRoleOf It Technology in Banking SectorRads Datta86% (21)

- BRD - Mobile Wallet 7.0 - Accounting ManualDocument252 pagesBRD - Mobile Wallet 7.0 - Accounting Manualaya100% (1)

- PetroRetailMixElementsAStudyofIndianMarket PDFDocument14 pagesPetroRetailMixElementsAStudyofIndianMarket PDFMadan MohanNo ratings yet