Professional Documents

Culture Documents

Absorption & Marginal Costing - Noor Alam (MC16-103) PDF

Uploaded by

Ahmed Ali KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Absorption & Marginal Costing - Noor Alam (MC16-103) PDF

Uploaded by

Ahmed Ali KhanCopyright:

Available Formats

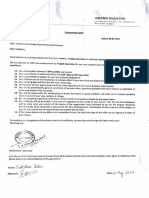

Absorption & Marginal Costing

Prepared BY : Noor Alam (MC16-103), 3rd Semester

Submitted To : Prof. Dr. Hafiz Zafar Ahmad

Hailey College of Commerce, University of The Punjab

Absorption & Marginal Costing 2017

Illustration # 1. Rayners Plc.

Rayners Plc. manufactures and sells electric blankets. The selling price is £12. Each blanket

has the following unit cost:

Direct material 2

Direct labour 1

Variable production overhead 2

Fixed production overhead 3

£8

Administration costs are incurred at the rate of £20 per annum.

The company achieved the following production and sales of blankets:

Years (1) (2) (3) (4)

Production 100 110 90 80

Sales 90 110 95 82

The following information is also relevant:

1) The overhead costs of £2 and £3 per unit have calculated on the basis of a budgeted

production volume of 90 units.

2) There was no inflation.

3) There was no opening stock.

4) There were no differences between actual and standard costs or selling prices.

Required:

a) Prepare a profit statement for each year using:

i. Marginal costing; and

ii. Absorption costing. (6 marks)

b) Explain why the profit figures reported under the two techniques disagree. (4 marks)

(Total 10 marks)

Illustration # 2.

A company manufactures a single product. The following budgeted information is available

for the period:

Direct materials £2.50 per unit

Direct labour £3.20per unit

Variable manufacturing overhead £1.00per unit

Variable selling overhead £1.40per unit

Fixed manufacturing costs £48,000

Fixed selling costs £18,000

Selling price £15.000per unit

Production 20,000units

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 2

Absorption & Marginal Costing 2017

Sales 15,000units

There were no opening stocks at the beginning of the period.

Actual costs incurred in the period were all as budgeted however actual sales and production

levels were 16,000 units 18,000 units respectively.

Required:

a) Prepare a trading and profit and loss account for the period using:

(i) Marginal costing;

(ii) Absorption costing. (5 marks)

b) Reconcile the difference in profits in (a). (2 marks)

c) Explain how and why profit reacts in response to fluctuations in stock levels under

each costing method. In particular, describe the effect on the profit with increasing

and decreasing stock levels. (3 marks)

(Total 10 marks)

Illustration # 3.

A company produces a single product with the following unit price and costs:

Selling price £12

Direct materials £3

Direct wages £1

Variable production overheads £3

Fixed production overheads £2

The fixed overheads were absorbed assuming that 10,000 units are produced each month:

During July 10,000 units were produced and sold. The opening stock in July was 1,000 units

the fixed production overheads incurred during July were £21,000.

a) Prepare a profit statement showing the profit for July using.

(i) Absorption costing principles and

(ii) Marginal costing principles (5 marks)

b) During August the production was 10,000 units but sales were only 8,000 units. Fixed

production overheads increased during august was £19,000. Prepare a profit statement

showing the profit for August using

(i) Absorption costing principles, and

(ii) Marginal costing principles (5 marks)

c) Reconcile the difference in profit between the two methods in August (5 marks)

(Total 15 marks)

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 3

Absorption & Marginal Costing 2017

Illustration # 4.

A company sells a single product at a price of &14 per unit. Variance manufacturing costs of

the product are £6.40 per unit. Fixed manufacturing overheads, which are absorbed into the

cost of production at a unit rate (based on normal activity of 20,000 units per period), are

£92,000 per period. Any over or under absorbed fixed manufacturing overhead balances are

transferred to the profit and loss account at the end of each period, in order to establish the

manufacturing profit. Sales and production (in units) for two periods are as follows:

Period 1 Period 2

Sales 15,000 22,000

Production 18,000 21,000

The manufacturing profit in period 1 was reported as £35,800

Required:

a) Prepare a trading statement to identify the manufacturing profit for period 2 using

the existing absorption costing method. (7 marks)

Determine the manufacturing profit that would be reported in period 2 if marginal

costing was used. (4 marks)

Explain, with supporting calculation

(i) The reason for the change in manufacturing profit between periods 1&2

where absorption costing is used in each period; (5 marks)

Why the manufacturing profit in (a) and (b) differs.

(Total 20 marks)

Illustration # 5. Surat

Surat is a small business which has the following budgeted marginal costing profit and loss

account for the month ended 31 December 2001

£’000 £’000

Sales 48

Cost of Sales:

Opening stock 3

Production costs 36

Closing stock (7)

(32)

Other variable costs: 16

Selling (3.2)

Contribution 12.8

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 4

Absorption & Marginal Costing 2017

Fixed costs:

Production overheads (4)

Administration (3.6)

Selling (1.2)

Net profit (4.0)

The standard cost per unit is:

Direct materials (1kg) 8

Direct labour (3 hours) 9

Variable overheads (3 hours) 3

20

Budgeted selling price per unit 30

The normal level of activity is 2,000 units per month. Fixed production cost and budgeted at

£4,000 per month and absorbed on the normal level of activity of units product.

Required:

a) Prepare a budgeted profit and loss account under absorption costing for the month

ended 31 December 2001. (6 marks)

b) Reconcile the profits under these two methods and explain why a business may prefer

to use marginal costing rather than absorption costing. (4 marks)

(Total 10 marks)

Illustration # 6. Oathall Limited

Oathall Limited, which manufacturer is a single product, is considering whether to use

marginal or absorption coasting to report its budgeted profit in its management accounts:

The following information is available:

£/ Unit

Direct materials 4

Direct labour 15

19

Selling price 50

Fixed production overheads are budgeted to be £300,000 per month and are absorbed on an

activity level of 100,000 units per month.

For the month in question, sales are expected to be 100,000 units although production units

will be 120,000 units.

Fixed selling costs of £150,000 per month will need to be included in the budget as will the

variable selling costs of £2 per unit.

There are no opening stocks.

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 5

Absorption & Marginal Costing 2017

Required:

a) Prepare the budgeted profit and loss account for a month for Oathall Limited using

absorption costing. Clearly show the valuation of any stock figures. (6 marks)

b) Prepare the budgeted profit and loss account for a month for Oathall Limited using

marginal costing. Clearly show the valuation of any stock figures. (4 marks)

(Total 10 marks)

Illustration # 7. Bailey Plc.

Bailey plc commenced business on 1 March making one product only, the standard cost of

which is as follows:

£

Direct labour 5

Direct material 8

Variable production overhead 2

Fixed production cost 5

Standard production cost. £20

The fixed production overhead figure has been calculated on the basic of budgeted normal

output of 36,000 units per annum. The fixed production overhead incurred in March and

April was £15,000 each month:

Selling, Distribution and administration expenses are:

Fixed £10,000 per month

Variable 15% of the sales value

The selling price per unit is £35 and the number of units production and sold were:

March (Units) April(Units)

Production 2,000 3,200

Sales 1,500 3,000

You are required to:

a) Prepare profit statements for each of the months of March and April using;

(i) Absorption and

(ii) Marginal (12 marks)

b) Present a reconciliation of the profit or loss figures given your answers to (a).

(3 marks)

(Total 15 marks)

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 6

Absorption & Marginal Costing 2017

Illustration # 8. Buhner

Buhner Limited makes and sells a single product called the Royal.

The cost card for one unit of Royal is shown below.

Direct materials £3

Direct labour £6

Variable production overhead £2

Fixed production overhead £4

Variable selling cost £5

The Sales price of one unit of Royal is £21

Budgeted fixed overheads are based on budgeted production of 5,000 units.

Stock of finished goods at the start of the period was 1,000 units. This had risen to 4,000 units

by the end of the period.

During the period 3,000 units were sold and actual fixed production overheads were £25,000.

Required:

a) Prepare profit statements for the period using:

(i) Marginal coasting (4 marks)

(ii) Absorption coasting. (4 marks)

b) Prepare a statement reconciling the two profits (2 marks)

(Total 10 marks)

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 7

Solutions

Prepared BY : Noor Alam (MC16-103), 3rd Semester

Submitted To : Prof. Dr. Hafiz Zafar Ahmad

Hailey College of Commerce, University of The Punjab

Absorption & Marginal Costing 2017

Illustration # 1. Solution:

(a) (i). Rayners Plc.

Profit and Loss Statement (Marginal Costing)

1 2 3

Cal. Val. (£) Cal. Val. (£) Cal. Val. (£)

Opening Stock --- --- 10x5 50 10x5 50

Add: Product Cost

Variable FOH Cost 100x5 500 110x5 550 90x5 450

Cost of Goods To Be Sold 500 600 500

Less: Closing Stock 10x5 (50) 10x5 (50) 5x5 (25)

Cost of Goods Sold 450 550 475

Sales 90x12 1080 110x12 1320 95x12 1140

Gross Contribution 630 770 665

Less: Variable Non Production Cost --- --- ---

Contribution 630 770 665

Less: Fixed Cost:

Fixed FOH (Actual) (270) (270) (270)

Fixed Admin Expenses (20) (20) (20)

Net Profit £ 340 £ 480 £ 375

(a) (ii). Rayners Plc.

Profit and Loss Statement (Absorption Costing)

1 2 3

Cal. Val. (£) Cal. Val. (£) Cal. Val. (£)

Opening Stock --- --- 10x8 80 10x8 80

Add: Product Cost

Variable FOH Cost 100x5 500 110x5 550 90x5 450

Fixed FOH Cost (Absorbed) 100x3 300 110x3 330 90x3 270

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 9

Absorption & Marginal Costing 2017

Cost Of Goods To Be Sold 800 960 800

Less: Closing Stock 10x8 (80) 10x8 (80) 5x8 (40)

Cost of Goods Sold (At Normal) 720 880 760

Under/Over Absorbed (Working-1) Over (30) Over (60) 0

Cost of Goods Sold (At Actual) 690 820 760

Sales 90x12 1080 110x12 1320 95x12 1140

Gross Profit 390 500 380

Less: Operating Expenses

Administration Cost (20) (20) (20)

Net Profit £ 370 £ 480 £ 360

(Working-1):

1 2 3

Absorbed FOH Cost 300 330 270

Actual FOH Cost 270 270 270

Difference £ 30 £ 60 ---

(b). Elaboration:

The profit under both techniques is disagree, because of Fixed FOH Cost. In Absorption

costing we take it as product cost so

It becomes the part of per unit cost

Use in stock valuation and

Charge in the time period in which sale of production occurs

The overall impact of these things increase the profit in Absorption costing while in Marginal

costing we simply take Fixed FOH Cost as Period Cost and charge it in the period it occurs.

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 10

Absorption & Marginal Costing 2017

Illustration # 2. Solution:

(a) (i).

Profit and Loss Statement (Marginal Costing)

Calculations Values. (£)

Opening Stock --- ---

Add: Product Cost

Variable FOH Cost 18,000x6.7 120,600

Cost of Goods To Be Sold 120,600

Less: Closing Stock 2,000x6.7 (13,400)

Cost of Goods Sold 107,200

Sales 16,000x15 240,000

Gross Contribution 132,800

Less: Variable Non Production Cost 16,000x1.4 (22,400)

Contribution 110,400

Less: Fixed Cost

Fixed FOH (Actual) (48,000)

Fixed Selling Cost (18,000)

Net Profit £ 44,400

(a)(ii).

Profit and Loss Statement (Absorption Costing)

Calculations Values

Opening Stock --- ---

Add: Product Cost

Variable FOH Cost 18,000x6.7 120,600

Fixed FOH Cost (Absorbed) 18,000x2.4 43,200

Cost of Goods To Be Sold 163,800

Less: Closing Stock 2,000x9.1 (18,200)

Cost of Goods Sold (At Normal) 145,600

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 11

Absorption & Marginal Costing 2017

Under/Over Absorbed (Working-1) Under 4,800

Cost of Goods Sold (At Actual) 150,400

Sales 16,000x15 240,000

Gross Profit 89,600

Less: Operating Expenses

Fixed Selling Cost (18,000)

Variable Selling Cost 16,000x1.4 (22,400)

Net Profit £ 49,200

(Working-1):

Absorbed FOH Cost £ 43,200

Actual FOH Cost £ 48,000

Difference £ 4,800

(b). Reconciliation:

Profit Reconciliation: (Difference in Profit due to Stock Valuation)

Absorption Costing £ 49,200

Marginal Costing £ 44,400

Difference £ 4,800

Stock Reconciliation: (Difference in Stock due to Fixed FOH)

Opening Stock ---

Closing Stock 2,000 Units

Difference 2,000

Absorption Rate x2.4

£ 4,800

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 12

Absorption & Marginal Costing 2017

(c). Elaboration:

Difference in Profit occurred due to Stock Valuation and difference in Stock occurred due to

Fixed FOH.

o In Marginal Costing the profit will be higher than that under the Absorption Costing

because sales exceed production (opening stock is more than closing stock). And,

o In Absorption Costing the profit will be higher than that under the Marginal Costing

because production exceeds sales (closing stock is more than opening stock).

Illustration # 3. Solution:

(a) & (b) (i).

Profit and Loss Statement (Absorption Costing)

July August

Cal. Val. (£) Cal. Val. (£)

Opening Stock 1,000x9 9,000 1,000x9 9,000

Add: Product Cost

Variable FOH Cost 10,000x7 70,000 10,000x7 70,000

Fixed FOH Cost (Absorbed) 10,000x2 20,000 10,000x2 20,000

Cost of goods to be sold 99,000 99,000

Less: Closing Stock 1,000x9 (9,000) 3,000x9 (27,000)

Cost of goods to be sold (At Normal) 90,000 72,000

Under/Over Absorbed (Working-1) Under 1,000 Over (1,000)

Cost of goods sold (At Actual) 91,000 71,000

Sales 10,000x12 120,000 8,000x12 96,000

Net Profit £ 29,000 £ 25,000

(Working-1):

July August

Absorbed FOH Cost 20,000 20,000

Actual FOH Cost 21,000 19,000

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 13

Absorption & Marginal Costing 2017

Difference £ 1,000 £ 1,000

(a) & (b) (ii).

Profit and Loss Statement (Marginal Costing)

July August

Cal. Val. (£) Cal. Val. (£)

Opening Stock 1,000x7 7,000 1,000x7 7,000

Add: Product Cost

Variable FOH Cost 10,000x7 70,000 10,000x7 70,000

Cost of Goods To Be Sold 77,000 77,000

Less: Closing Stock 1,000x7 (7,000) 3,000x7 (21,000)

Cost of Goods Sold 70,000 56,000

Sales 10,000x12 120,000 8,000x12 96,000

Gross Contribution 50,000 40,000

Less: Variable Non Production Cost --- ---

Contribution 50,000 40,000

Less: Fixed Cost:

Fixed FOH (Actual) (21,000) (19,000)

£ 29,00~

Net Profit £ 21,000

14 ~0

(c). Reconciliation:

Profit Reconciliation: (Difference in Profit due to Stock Valuation)

July August

Absorption Costing 29,000 25,000

Marginal Costing 29,000 21,000

Difference 0 £ 4,000

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 14

Absorption & Marginal Costing 2017

Stock Reconciliation: (Difference in Stock due to Fixed FOH)

July August

Opening Stock 1,000 Units 1,000 Units

Closing Stock 1,000 Units 3,000 Units

Difference 0 2,000

Absorption Rate x2 x2

0 £ 4,000

Illustration # 4. Solution:

(a).

Profit and Loss Statement (Absorption Costing)

Period 1 Period 2

Cal. Val. (£) Cal. Val. (£)

Opening Stock --- --- 3,000x11 33,000

Add: Product Cost

Variable FOH Cost 18,000x6.4 115,200 21,000x6.4 134,400

Fixed FOH Cost (Absorbed) 18,000x4.6 82,800 21,000x4.6 96,600

Cost of Goods To Be Sold 198,000 264,000

Less: Closing Stock 3,000x11 (33,000) 2,000x11 (22,000)

Cost of Goods Sold (At Normal) 165,000 242,000

Under/Over Absorbed (Working-1) Under 9,200 Over (4,600)

Cost of Goods Sold (At Actual) 174,200 237,400

Sales 15,000x14 210,000 22,000x14 308,000

Net Profit £ 35,800 £ 70,600

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 15

Absorption & Marginal Costing 2017

(Working-1):

Period 1 Period 2

Absorbed FOH Cost 82,800 96,600

Actual FOH Cost 92,000 92,000

Difference £ 9,200 £ 4,600

(b).

Profit and Loss Statement (Marginal Costing)

Period 1 Period 2

Cal. Val. (£) Cal. Val. (£)

Opening Stock --- --- 3,000x6.4 19,200

Add: Product Cost

Variable FOH Cost 18,000x6.4 115,200 21,000x6.4 134,400

Cost of Goods To Be Sold 115,200 153,600

Less: Closing Stock 3000x6.4 19,200 2,000x6.4 12,800

Cost of Goods Sold 96,000 140,800

Sales 15,000x14 210,000 22,000x14 308,000

Gross Contribution 114,000 167,200

Less: Variable Non Production Cost --- --- --- ---

Contribution 114,000 167,200

Less: Fixed Cost:

Fixed FOH (Actual) (92,000) (92,000)

Net Profit 22,000 75,200

(c). Elaboration:

Profit Reconciliation: (Difference in Profit due to Stock Valuation)

Period 1 Period 2

Absorption Costing 35,800 70,600

Marginal Costing 22,000 75,200

Difference £ 13,800 £ 4,600

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 16

Absorption & Marginal Costing 2017

Stock Reconciliation: (Difference in Stock due to Fixed FOH)

Period 1 Period 2

Opening Stock --- 3,000 Units

Closing Stock 3,000 Units 2,000 Units

Difference 3,000 Units 1,000 Units

Absorption Rate x4.6 x4.6

£ 13,800 £ 4,600

(i) As, the closing stock of Period 1 became the part of opening stock of Period

2 Since, the change in manufacturing profit of Period 1 and 2 occurred where

absorption costing is used.

(ii) Difference in Manufacturing Profit in (a) and (b) occurred due to Stock

Valuation and difference in Stock occurred due to Fixed FOH. In Absorption

costing we take Fixed FOH as product cost so,

It becomes the part of per unit cost

Use in stock valuation and

Charge in the time period in which sale of production occurs

The overall impact of these things increase the manufacturing profit in

Absorption costing while in Marginal costing we simply take Fixed FOH Cost as

Period Cost and charge it in the period it occurs so it decreases the manufacturing

profit.

Illustration # 5. Solution:

(a). Surat

Profit and Loss Statement (Absorption Costing)

For the year ended Dec 31, 2001.

Calculations Values (£)

Opening Stock 150x22 3,300

Add: Product Cost

Variable FOH Cost 1,800x20 36,000

Fixed FOH Cost (Absorbed) 1800x2 3,600

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 17

Absorption & Marginal Costing 2017

Cost of Goods To Be Sold 42,900

Less: Closing Stock 350x22 7,700

Cost of Goods Sold (At Normal) 35,200

Under/Over Absorbed (Working-1) Under 400

Cost of Goods Sold (At Actual) 35,600

Sales 1,600x30 48,000

Gross Profit 12,400

Less: Operating Expenses

Variable Selling Cost (3,200)

Fixed Selling Cost (1,200)

Fixed Administration Cost (3,600)

Net Profit £ 4,400

(b). Reconciliation:

Profit Reconciliation: (Difference in Profit due to Stock Valuation)

Dec 31, 2001

Absorption Costing 4,400

Marginal Costing 4,000

Difference £ 400

Stock Reconciliation: (Difference in Stock due to Fixed FOH)

Dec 31, 2001

Opening Stock 150

Closing Stock 350

Difference 200 Units

Absorption Rate x2

£ 400

Marginal costing helps in decision making process when two potential investments

exist, but there are only enough available enough funds for one. By analyzing the associated

costs and benefits, it can be determined if one option will result in higher profits than another.

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 18

Absorption & Marginal Costing 2017

Illustration # 6. Solution:

(a). Oathall Limited

Profit and Loss Statement (Absorption Costing)

Calculations Values (£)

Opening Stock --- ---

Add: Product Cost

Variable FOH Cost 120,000x19 2,280,000

Fixed FOH Cost (Absorbed) 120,000x3 360,000

Cost of goods to be sold 2,640,000

Less: Closing Stock 20,000x22 (440,000)

Cost of goods to be sold (At Normal) 2,200,000

Under/Over Absorbed (Working-1) Over (60,000)

Cost of goods sold (At Actual) 2,140,000

Sales 100,000x50 5,000,000

Gross Profit 2,860,000

Less: Operating Expenses

Fixed Selling Cost (150,000)

Variable Selling Cost 100,000x2 (200,000)

Net Profit £ 2,510,000

(Working-1):

Absorbed FOH Cost 360,000

Actual FOH Cost 300,000

Difference £ 60,000

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 19

Absorption & Marginal Costing 2017

(b).

Profit and Loss Statement (Marginal Costing)

Calculations Values (£)

Opening Stock --- ---

Add: Product Cost

Variable FOH Cost 120,000x19 2,280,000

Cost of Goods To Be Sold 2,280,000

Less: Closing Stock 20,000x19 (380,000)

Cost of Goods Sold 1,900,000

Sales 100,000x50 5,000,000

Gross Contribution 3,100,000

Less: Variable Non Production Cost (200,000)

Contribution 2,900,000

Less: Fixed Cost

Fixed FOH (Actual) (300,000)

Fixed Selling Cost (150,000)

Net Profit £ 2,450,000

Illustration # 7. Solution:

(a) (i). Bailey Plc.

Profit and Loss Statement (Absorption Costing)

March April

Cal. Val. (£) Cal. Val. (£)

Opening Stock --- --- 500x20 10,000

Add: Product Cost

Variable FOH Cost 2,000x15 30,000 3,200x15 48,000

Fixed FOH Cost (Absorbed) 2,000x5 10,000 3,200x5 16,000

Cost of goods to be sold 40,000 74,000

Less: Closing Stock 500x20 (10,000) 700x20 (14,000)

Cost of goods to be sold (At Normal) 30,000 60,000

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 20

Absorption & Marginal Costing 2017

Under/Over Absorbed (Working-1) Under 5,000 Over (1,000)

Cost of goods sold (At Actual) 35,000 59,000

Sales 1,500x35 52,500 3,000x35 105,000

Gross Profit 17,500 46,000

Less: Operating Expenses

(Selling, Distribution, Administration)

Fixed (10,000) (10,000)

Variable (7,875) (15,750)

Net Loss £ (375) Profit £ 20,250

(Working-1):

March April

Absorbed FOH Cost 10,000 16,000

Actual FOH Cost 15,000 15,000

Difference £ 5,000 £ 1,000

(a) (ii). Bailey Plc.

Profit and Loss Statement (Marginal Costing)

March April

Cal. Val. (£) Cal. Val. (£)

Opening Stock --- --- 500x15 7,500

Add: Product Cost

Variable FOH Cost 2,000x15 30,000 3,200x15 48,000

Cost of Goods To Be Sold 30,000 55,500

Less: Closing Stock 500x15 (7,500) 700x15 (10,500)

Cost of Goods Sold 22,500 45,000

Sales 1,500x35 52,500 3,000x35 105,000

Gross Contribution 30,000 60,000

Less: Variable Non Production Cost (7,875) (15,750)

Contribution 22,125 44,250

Less: Fixed Cost:

Fixed FOH (Actual) (15,000) (15,000)

Fixed Non Productive Cost (10,000) (10,000)

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 21

Absorption & Marginal Costing 2017

Net Loss £ (2,875) Profit £ 19,250

(b). Reconciliation:

Profit Reconciliation: (Difference in Profit due to Stock Valuation)

March April

Absorption Costing (375) 20,250

Marginal Costing (2,875) 19,250

Difference £ 2,500 £ 1,000

Stock Reconciliation: (Difference in Stock due to Fixed FOH)

March April

Opening Stock --- 500 Units

Closing Stock 500 Units 700 Units

Difference 500 Units 200 Units

Absorption Rate x5 x5

£ 2,500 £ 1,000

Illustration # 8. Solution:

(a) (i).

Profit and Loss Statement (Marginal Costing)

Calculations Values (£)

Opening Stock 1,000x11 11,000

Add: Product Cost

Variable FOH Cost 6,000x11 66,000

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 22

Absorption & Marginal Costing 2017

Cost of Goods To Be Sold 77,000

Less: Closing Stock 4,000x11 44,000

Cost of Goods Sold 33,000

Sales 3,000x21 63,000

Gross Contribution 30,000

Less: Variable Non Production Cost 3,000x5 (15,000)

Contribution 15,000

Less: Fixed Cost:

Fixed FOH (Actual) 25,000

Net Loss £ (10,000)

(a)(ii). Bailey Plc.

Profit and Loss Statement (Absorption Costing)

Calculations Values (£)

Opening Stock 1,000x15 15,000

Add: Product Cost

Variable FOH Cost 6,000x11 66,000

Fixed FOH Cost (Absorbed) 6,000x4 24,000

Cost of goods to be sold 105,000

Less: Closing Stock 4,000x15 60,000

Cost of goods to be sold (At Normal) 45,000

Under/Over Absorbed (Working-1) Under 1,000

Cost of goods sold (At Actual) 46,000

Sales 3,000x21 63,000

Gross Profit 17,000

Less: Operating Expenses

Variable Selling Cost 3,000x5 (15,000)

Net Profit £ 2,000

(Working-1):

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 23

Absorption & Marginal Costing 2017

Absorbed FOH Cost 24,000

Actual FOH Cost 25,000

Difference £ 1,000

(b). Reconciliation:

Profit Reconciliation: (Difference in Profit due to Stock Valuation)

Absorption Costing 2,000

Marginal Costing (10,000)

Difference £ 12,000

Stock Reconciliation: (Difference in Stock due to Fixed FOH)

Opening Stock 1,000

Closing Stock 4,000

Difference 3,000

Absorption Rate x4

£ 12,000

Note:

1) If production exceeds sales (closing stock is more than opening stock),

the profit under Absorption Costing will be higher than that under the

Marginal Costing.

2) If sales exceeds production (opening stock is more than closing stock),

the profit under Marginal Costing will be higher than that under the

Absorption Costing.

3) If production and sales are same (Closing stock and opening stock are

equal), the profit under both two costing techniques will same.

Submitted To: Prof. Dr. Hafiz Zafar Ahmad 24

You might also like

- Marginal - Absorption Costing - Practice Questions With SolutionsDocument11 pagesMarginal - Absorption Costing - Practice Questions With Solutionsaishabadar88% (17)

- CH 5 - Limiting Factor Questions & SolutionDocument26 pagesCH 5 - Limiting Factor Questions & SolutionMuhammad Azam75% (8)

- IUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Document9 pagesIUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Muhammad ZubairNo ratings yet

- Capital Budgeting Problems SolutionsDocument22 pagesCapital Budgeting Problems SolutionsChander Santos Monteiro100% (3)

- Marginal & Absorption CostingDocument6 pagesMarginal & Absorption CostingEman Mirza100% (4)

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- Questions For Make or BuyDocument42 pagesQuestions For Make or BuyTaha Madni67% (3)

- Cost QB PDFDocument300 pagesCost QB PDFHuzaifa Muhammad75% (4)

- Lesson 3 - Materials That Undergo DecayDocument14 pagesLesson 3 - Materials That Undergo DecayFUMIKO SOPHIA67% (6)

- Marginal Costing vs Absorption Costing Profit ReconciliationDocument4 pagesMarginal Costing vs Absorption Costing Profit ReconciliationFareha Riaz100% (3)

- Marginal and Absorption Costing Techniques ComparedDocument9 pagesMarginal and Absorption Costing Techniques ComparedRida JunejoNo ratings yet

- CH 4 - Relevant Costing Principles ICAP Questions and SolutionDocument35 pagesCH 4 - Relevant Costing Principles ICAP Questions and SolutionMuhammad AzamNo ratings yet

- Calculate Learning Curve CostsDocument8 pagesCalculate Learning Curve Costszoyashaikh20No ratings yet

- Absorption & Marginal CostingDocument17 pagesAbsorption & Marginal CostingAhmed Ali KhanNo ratings yet

- Inventory Valuation-ProblemsDocument3 pagesInventory Valuation-ProblemsKaran100% (1)

- 4 5931788210203003021Document139 pages4 5931788210203003021Issa Boy100% (1)

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- Problems On Accept or Reject Special of Er DecisionDocument9 pagesProblems On Accept or Reject Special of Er DecisionJBNo ratings yet

- Activity Based Costing Boosts Building Firm's CompetitivenessDocument20 pagesActivity Based Costing Boosts Building Firm's CompetitivenessMazni HanisahNo ratings yet

- Absorption & Marginal CostingDocument17 pagesAbsorption & Marginal CostingAhmed Ali KhanNo ratings yet

- NVH Analysis in AutomobilesDocument30 pagesNVH Analysis in AutomobilesTrishti RastogiNo ratings yet

- Duty Entitlement Pass BookDocument3 pagesDuty Entitlement Pass BookSunail HussainNo ratings yet

- Formal 17 12 04 PDFDocument184 pagesFormal 17 12 04 PDFJose LaraNo ratings yet

- Functional BudgetsDocument12 pagesFunctional Budgetsarjun sachdev100% (1)

- Chapter 9 Accounting For Branches Including Foreign Branches PMDocument48 pagesChapter 9 Accounting For Branches Including Foreign Branches PMviji88mba60% (5)

- Absorption and Marginal Costing - Additional Question With AnswersDocument14 pagesAbsorption and Marginal Costing - Additional Question With Answersunique gadtaulaNo ratings yet

- Khurasan University Faculty of Economics (BBA) : Cost AccountingDocument47 pagesKhurasan University Faculty of Economics (BBA) : Cost AccountingTalaqa Sam Sha100% (2)

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- COST SHEET TITLEDocument6 pagesCOST SHEET TITLEmeenagoyal995650% (2)

- Chapter 17 Standard Costing Setting Standards and Analyzing VariancesDocument23 pagesChapter 17 Standard Costing Setting Standards and Analyzing VariancesHashir AliNo ratings yet

- Review QsDocument92 pagesReview Qsfaiztheme67% (3)

- LIMITING FACTOR DECISIONDocument4 pagesLIMITING FACTOR DECISIONMuhammad Azam0% (1)

- 35 Resource 11Document16 pages35 Resource 11Anonymous bf1cFDuepPNo ratings yet

- Process & Operation Costing ExplainedDocument71 pagesProcess & Operation Costing ExplainedMansi IndurkarNo ratings yet

- Cost Sheet Exercise 1Document3 pagesCost Sheet Exercise 1Phaniraj LenkalapallyNo ratings yet

- Planning and Operational VariancesDocument4 pagesPlanning and Operational Varianceskevior2100% (1)

- Key Factors: Q-1 Key-Factor Product Mix Decision - Minimum Production Condition - Additional CostDocument11 pagesKey Factors: Q-1 Key-Factor Product Mix Decision - Minimum Production Condition - Additional CostPRABESH GAJURELNo ratings yet

- Problems and SolutionsDocument7 pagesProblems and SolutionsMohitAhujaNo ratings yet

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- 1 Eoq PDFDocument12 pages1 Eoq PDFLyber PereiraNo ratings yet

- Transfer Pricing Ex - QuestionsDocument2 pagesTransfer Pricing Ex - QuestionsKaruna Chakinala100% (1)

- Problems From Unit - 5Document8 pagesProblems From Unit - 5jeganrajrajNo ratings yet

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774No ratings yet

- Functional BudgetsDocument12 pagesFunctional BudgetsAyush100% (1)

- Flexible Budget Formula and Performance ReportDocument7 pagesFlexible Budget Formula and Performance Reportsafwanhossain100% (2)

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- Cost Accounting by Usry Chapter 6 Exercise 1Document4 pagesCost Accounting by Usry Chapter 6 Exercise 1Saadia Saeed100% (2)

- Limiting Factors QuestionsDocument8 pagesLimiting Factors QuestionsAnonymous YkMptv9jNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- Chapter 8: Leverage and EBIT–EPS AnalysisDocument51 pagesChapter 8: Leverage and EBIT–EPS AnalysisNikita AggarwalNo ratings yet

- Standard CostingDocument24 pagesStandard Costingharsh100% (1)

- Marginal CostingDocument10 pagesMarginal Costinganon_672065362No ratings yet

- CH 16Document4 pagesCH 16Riya Desai100% (5)

- Property, Plant & Equipment: Measurement After RecognitionDocument49 pagesProperty, Plant & Equipment: Measurement After RecognitionPapa Ekow ArmahNo ratings yet

- Pof AFS SundayDocument32 pagesPof AFS SundayAsad AhmedNo ratings yet

- Aafr Ifrs 16 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 16 Icap Past Papers With SolutionAqib SheikhNo ratings yet

- MEA AssignmentDocument13 pagesMEA Assignmentankit07777100% (1)

- Cost SheetDocument29 pagesCost Sheetnidhisanjeet0% (1)

- IAS 2 Summary-MergedDocument19 pagesIAS 2 Summary-MergedShameel IrshadNo ratings yet

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsDocument107 pagesNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Absorption CostingDocument10 pagesAbsorption Costingberyl_hst100% (1)

- Costing Series 2-2009Q6Document2 pagesCosting Series 2-2009Q6May CcmNo ratings yet

- MANAGEMENT INFORMATION DOCUMENTDocument2 pagesMANAGEMENT INFORMATION DOCUMENTMahediNo ratings yet

- Lecture 3-4 Marginal Vs Absoption CostingDocument16 pagesLecture 3-4 Marginal Vs Absoption CostingAfzal AhmedNo ratings yet

- Chapter 15 Important QuestionsDocument1 pageChapter 15 Important QuestionsAhmed Ali KhanNo ratings yet

- Chapter 16 Important QuestionsDocument1 pageChapter 16 Important QuestionsAhmed Ali KhanNo ratings yet

- IMPORTANT QUEST-WPS OfficeDocument1 pageIMPORTANT QUEST-WPS OfficeAhmed Ali KhanNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- FpseDocument1 pageFpseAhmed Ali KhanNo ratings yet

- Advertisement No 10 2019Document1 pageAdvertisement No 10 2019Muhammad Usman AnsariNo ratings yet

- Chapter 7 Important QuestionsDocument1 pageChapter 7 Important QuestionsAhmed Ali KhanNo ratings yet

- Chapter 6 Important QuestionsDocument1 pageChapter 6 Important QuestionsAhmed Ali KhanNo ratings yet

- Chapter Chapter 5 Important QuestionsDocument1 pageChapter Chapter 5 Important QuestionsAhmed Ali KhanNo ratings yet

- Important Quest-Wps OfficeDocument1 pageImportant Quest-Wps OfficeAhmed Ali KhanNo ratings yet

- Logic and Critical ThinkingDocument24 pagesLogic and Critical ThinkingAhmed Ali Khan100% (1)

- Absorption & Marginal Costing - Noor Alam (MC16-103)Document24 pagesAbsorption & Marginal Costing - Noor Alam (MC16-103)Ahmed Ali Khan100% (1)

- 300 Most Repeated QuestionsDocument12 pages300 Most Repeated Questionsmoazam tariqNo ratings yet

- 300 Most Repeated QuestionsDocument12 pages300 Most Repeated Questionsmoazam tariqNo ratings yet

- Jang and The Nation on 11-11-2018Document1 pageJang and The Nation on 11-11-2018salman jabbarNo ratings yet

- 17 - Marginal and Absoption Costing - E PDFDocument70 pages17 - Marginal and Absoption Costing - E PDFAhmed Ali KhanNo ratings yet

- Advertisement No 34-2018Document1 pageAdvertisement No 34-2018Tauseef GillaniNo ratings yet

- Breakeven AnalysisDocument20 pagesBreakeven AnalysisMaimoona AsadNo ratings yet

- Harvesting Clender 0Document5 pagesHarvesting Clender 0Dr-Ahmad Ali AwanNo ratings yet

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Colin Drury Cost AccountingDocument29 pagesColin Drury Cost AccountingAhmed Ali KhanNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- Absorption & Marginal Costing - Noor Alam (MC16-103)Document24 pagesAbsorption & Marginal Costing - Noor Alam (MC16-103)Ahmed Ali Khan100% (1)

- Wordbank Restaurants 15Document2 pagesWordbank Restaurants 15Obed AvelarNo ratings yet

- Data SheetDocument14 pagesData SheetAnonymous R8ZXABkNo ratings yet

- Verificare Bujii IncandescenteDocument1 pageVerificare Bujii IncandescentemihaimartonNo ratings yet

- BUSN7054 Take Home Final Exam S1 2020Document14 pagesBUSN7054 Take Home Final Exam S1 2020Li XiangNo ratings yet

- Chapter 1 - Introduction To Computer NetworksDocument32 pagesChapter 1 - Introduction To Computer NetworksHuluNo ratings yet

- Statement of PurposeDocument2 pagesStatement of Purposearmaan kaurNo ratings yet

- 272 Concept Class Mansoura University DR Rev 2Document8 pages272 Concept Class Mansoura University DR Rev 2Gazzara WorldNo ratings yet

- Bolsas Transfer FKDocument7 pagesBolsas Transfer FKBelèn Caridad Nelly Pajuelo YaipènNo ratings yet

- Mechanical PropertiesDocument30 pagesMechanical PropertiesChristopher Traifalgar CainglesNo ratings yet

- Illustrator CourseDocument101 pagesIllustrator CourseGreivanNo ratings yet

- fr1177e-MOTOR CUMMINS 195HPDocument2 pagesfr1177e-MOTOR CUMMINS 195HPwilfredo rodriguezNo ratings yet

- DOLE AEP Rule 2017Document2 pagesDOLE AEP Rule 2017unhoopterenceNo ratings yet

- Sound Wave Interference and DiffractionDocument79 pagesSound Wave Interference and DiffractionMuhammad QawiemNo ratings yet

- Cagayan Electric Company v. CIRDocument2 pagesCagayan Electric Company v. CIRCocoyPangilinanNo ratings yet

- DSP Lab Record Convolution ExperimentsDocument25 pagesDSP Lab Record Convolution ExperimentsVishwanand ThombareNo ratings yet

- RF Power Measurements Basic PrinciplesDocument27 pagesRF Power Measurements Basic PrinciplesHector Velasco100% (1)

- ApudDocument53 pagesApudlatifahNo ratings yet

- Master StationDocument138 pagesMaster StationWilmer Quishpe AndradeNo ratings yet

- Iqvia PDFDocument1 pageIqvia PDFSaksham DabasNo ratings yet

- Current Affairs Q&A PDF June 9 2023 by Affairscloud 1Document21 pagesCurrent Affairs Q&A PDF June 9 2023 by Affairscloud 1Yashika GuptaNo ratings yet

- Telangana Budget 2014-2015 Full TextDocument28 pagesTelangana Budget 2014-2015 Full TextRavi Krishna MettaNo ratings yet

- English 8-Q3-M3Document18 pagesEnglish 8-Q3-M3Eldon Julao0% (1)

- Numark MixTrack Pro II Traktor ProDocument3 pagesNumark MixTrack Pro II Traktor ProSantiCai100% (1)

- Pass Issuance Receipt: Now You Can Also Buy This Pass On Paytm AppDocument1 pagePass Issuance Receipt: Now You Can Also Buy This Pass On Paytm AppAnoop SharmaNo ratings yet

- High Uric CidDocument3 pagesHigh Uric Cidsarup007No ratings yet

- Exam Venue For Monday Sep 25, 2023 - 12-00 To 01-00Document7 pagesExam Venue For Monday Sep 25, 2023 - 12-00 To 01-00naveed hassanNo ratings yet