Professional Documents

Culture Documents

India Income Tax Calculator

Uploaded by

Pankaj BatraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Income Tax Calculator

Uploaded by

Pankaj BatraCopyright:

Available Formats

http://www.PankajBatra.

com

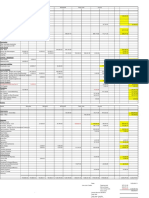

Tax Calculator F.Y. 2008-09

Sex (for male - 1, for female - 0) 1

Place of Residence(For Metro

cities-0,For Non Metro cities-1) 1

Number of children 0

Salary Breakup Investment & April May June July August September October November December January February March Total

Bills Details

Basic -

HRA -

Transport Allowance -

Child Education -

Grade/Special Allowance -

Arrears -

LTA -

Leave Encashment -

Performance Incentive -

Medical Reimbursement -

Food Coupons\Periodical Journals -

Telephone Reimbursements -

Car Reimbursement -

Internet Expense -

Driver Salary -

TOTAL SALARY - - - - - - - - - - - - -

Less : Exemptions

Actual Rent paid as per rent receipts -

HRA Exemption - - - - - - - - - - - - -

EPF Employer Contribution -

Child Education Allowance - -

Medical Reimbursement - -

Transport Allowance - -

LTA -

Food Coupons - -

Telephone Reimbursement - -

Car Expenses Reimbursement - -

Internet expense - -

Driver Salary - -

Other Reimbursement - -

Balance Salary -

Professional Tax -

Net Taxable Salary -

Loss from House Property (interest component) -

Any other Income - -

Gross Total Income -

Deductions under chapter VIA

80C + 80CCC(Pension Fund): Amt. Invested

LIC Premium

Employee's contribution to PF

PPF

ELSS

Others -

Tution Fees paid -

Housing Loan Principal repayment -

Infrastructure Bonds -

Fixed Deposit for 5 yrs. or more -

Others -

Total of Section 80C -

Pension Fund (80 CCC)

Total Deduction under Section 80C & 80CCC - -

80D (Medical insurance premium) -

80E (Interest on Loan for Higher Education) - -

80U (Handicapped person) - -

Total Income -

Total Income rounded off -

Tax on Total Income -

Surcharge -

Tax Payable -

Education Cess @ 3% -

Balance -

TDS -

Net Tax Payable -

Monthly Deductions from salary April May June July August September October November December January February March

TDS -

Professional Tax -

Employee's PF Contribution -

Others

Employer's PF Contribution -

In Hand 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

ADVANCE TAX SCHEDULE

Total Tax as per Consolidation Sheet: -

PARTICULARS % PAYABLE PAID DIFFERENCE

Payable upto 15th June, 2008 15% - - -

Payable upto 15th September, 2008 30% - - -

Payable upto 15th December, 2008 60% - - -

Payable upto 15th March, 2009 100% - - -

You might also like

- IT CalculatorDocument3 pagesIT Calculatorramkrishna0071No ratings yet

- Cashflow Projection TemplateDocument1 pageCashflow Projection TemplatePAMAJANo ratings yet

- Income Tax CalculatorDocument2 pagesIncome Tax CalculatormanikandanpalanisamyNo ratings yet

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsEyob SNo ratings yet

- Business Budget 12monthsDocument4 pagesBusiness Budget 12monthsSadia RahmanNo ratings yet

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsSRININo ratings yet

- Business-Budget 12monthsDocument6 pagesBusiness-Budget 12monthsReza KurniaNo ratings yet

- Business Budget 12monthsDocument4 pagesBusiness Budget 12monthsArie KristionoNo ratings yet

- Income Tax CalculatorDocument6 pagesIncome Tax Calculatorrash2winNo ratings yet

- Total Income: Have A Question? Ask It Here: HTTP://WWW - Socialfinance.InDocument6 pagesTotal Income: Have A Question? Ask It Here: HTTP://WWW - Socialfinance.InsheetalNo ratings yet

- Company Operating Cash Flow Report 2021Document6 pagesCompany Operating Cash Flow Report 2021Gomv ConsNo ratings yet

- Weekly Expense ReportDocument1 pageWeekly Expense ReportJessica KlingNo ratings yet

- Weekly Expense ReportDocument2 pagesWeekly Expense ReportmrbroNo ratings yet

- Weekly Expense Report (Company Name / Logo) : Employee Name: Email: Phone: Manager Name: Purpose: Department: LocationDocument2 pagesWeekly Expense Report (Company Name / Logo) : Employee Name: Email: Phone: Manager Name: Purpose: Department: LocationTaufik RohmanNo ratings yet

- Weekly Expense ReportDocument2 pagesWeekly Expense ReportA Wahid KemalNo ratings yet

- Emami Fashion 2015 ETBDocument85 pagesEmami Fashion 2015 ETBAnanda Satyam MaheswarnathNo ratings yet

- Business Review TemplateDocument24 pagesBusiness Review TemplateAllen LucañasNo ratings yet

- Have A Question? Ask It Here: HTTP://WWW - Socialfinance.In: SuccessDocument6 pagesHave A Question? Ask It Here: HTTP://WWW - Socialfinance.In: SuccessShiva RungtaNo ratings yet

- Maintenance Report: 68 NO. Unit Type BPN Control (BPN) HM Start Down Problem Progres /comment Est - Cost Last ActionDocument1 pageMaintenance Report: 68 NO. Unit Type BPN Control (BPN) HM Start Down Problem Progres /comment Est - Cost Last ActionMulyadiNo ratings yet

- Fuel Plus DailyDocument19 pagesFuel Plus DailyDr.Muhammad UmerNo ratings yet

- Budgeting and Forecasting: and The Impact On ProfitabilityDocument33 pagesBudgeting and Forecasting: and The Impact On ProfitabilityHassan AzizNo ratings yet

- Total Income: Have A Question? Ask It Here: HTTP://WWW - Socialfinance.InDocument6 pagesTotal Income: Have A Question? Ask It Here: HTTP://WWW - Socialfinance.InNikhil DhamapurkarNo ratings yet

- Income Tax Calculator FY 2023 24Document1 pageIncome Tax Calculator FY 2023 24Balamurali KirankumarNo ratings yet

- Coxs Bazar Railway Station, ChattogarmDocument3 pagesCoxs Bazar Railway Station, ChattogarmsayemNo ratings yet

- Timesheet - SabbirDocument8 pagesTimesheet - SabbirMd. Asif Sikder ShohagNo ratings yet

- Tax Calculator (Salary Format)Document2 pagesTax Calculator (Salary Format)Muhammed Abul Kalam AcmaNo ratings yet

- Annual Budget Forecast TemplateDocument2 pagesAnnual Budget Forecast Templaterowena balaguerNo ratings yet

- Mobil Financing PackageDocument1 pageMobil Financing PackageHendraNo ratings yet

- Wer Form Formatasterzen Blank Copy BDocument1 pageWer Form Formatasterzen Blank Copy BJunpyo ArkinNo ratings yet

- Cash FlowDocument1 pageCash FlowadsakljfnmdsklNo ratings yet

- Travel expense report for Ethiopia trip from Mar 24 to Apr 1Document4 pagesTravel expense report for Ethiopia trip from Mar 24 to Apr 1sleshiNo ratings yet

- Cashflow Analysis BreakdownDocument5 pagesCashflow Analysis BreakdownRommel A. RosalesNo ratings yet

- Travel Expenses Reimbursement Form W.e.f-1.11.2020Document2 pagesTravel Expenses Reimbursement Form W.e.f-1.11.2020dineshNo ratings yet

- Payslip NowDocument1 pagePayslip NowAllan LopezNo ratings yet

- Full & Final Payment Statement: (A) PaymentsDocument2 pagesFull & Final Payment Statement: (A) PaymentsAkash KumarNo ratings yet

- IT Department Budget TemplateDocument5 pagesIT Department Budget Templatenaufalafra50No ratings yet

- Household Budget PlannerDocument8 pagesHousehold Budget PlannersumithNo ratings yet

- Provisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation SexDocument3 pagesProvisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation Sexdivyesh_desaiNo ratings yet

- Billing Status NTDCDocument1 pageBilling Status NTDCMuhammad BilalNo ratings yet

- Friday, February 5, 2021: Description QTY Unit Price (MMK) Total (MMK) RemarkDocument1 pageFriday, February 5, 2021: Description QTY Unit Price (MMK) Total (MMK) RemarkCukar GcNo ratings yet

- BPO Employee's Monthly Budget and Savings GoalDocument6 pagesBPO Employee's Monthly Budget and Savings GoalageNo ratings yet

- Expense Claim Form: March 2018-Feb 2019Document1 pageExpense Claim Form: March 2018-Feb 2019Varun SirohiNo ratings yet

- Nigerian PAYE Calculator 4.0Document2 pagesNigerian PAYE Calculator 4.0obumuyaemesi100% (1)

- Employee Payroll RegisterDocument4 pagesEmployee Payroll RegisterJohnmarkNo ratings yet

- Brand Digital Econet Shop Teller Transactions & Cash Position ReportDocument18 pagesBrand Digital Econet Shop Teller Transactions & Cash Position ReportTapiwa MapfumoNo ratings yet

- Cash Flow Worksheet New VersionDocument1 pageCash Flow Worksheet New VersionAnh Ha ThaoNo ratings yet

- Personal Monthly Budget: IncomeDocument20 pagesPersonal Monthly Budget: Incomehuhah303No ratings yet

- Bookings Step 2 CICARDocument1 pageBookings Step 2 CICARjoej20375No ratings yet

- Fire Pro - 1Document1 pageFire Pro - 1Jasper MoqueteNo ratings yet

- Fire Pro - 1Document1 pageFire Pro - 1Jasper MoqueteNo ratings yet

- Local Travel Conveyance: Date: 04/09/2019 Company: AcellpDocument4 pagesLocal Travel Conveyance: Date: 04/09/2019 Company: Acellpsvd arunexcelloNo ratings yet

- General Feb 2023 Condensed NotesDocument10 pagesGeneral Feb 2023 Condensed NotesAvneet SinghNo ratings yet

- KOKOON HOTEL SURABAYA BUDGET 2020 SUMMARYDocument79 pagesKOKOON HOTEL SURABAYA BUDGET 2020 SUMMARYsigitNo ratings yet

- Weekly Cost ProfDocument1 pageWeekly Cost ProfFrankieNo ratings yet

- E1Document1 pageE1HERNANDEZ JOSHUA ELIZ P.No ratings yet

- Payslip detailsDocument2 pagesPayslip detailsSuyash RaulNo ratings yet

- Little Book of LegacyDocument20 pagesLittle Book of Legacyrhythems84No ratings yet

- Income Tax Calculator F.Y. 2016-17 (AY 2017-18Document2 pagesIncome Tax Calculator F.Y. 2016-17 (AY 2017-18Pankaj BatraNo ratings yet

- Snapdeal Has Some Good NewsDocument4 pagesSnapdeal Has Some Good NewsPankaj BatraNo ratings yet

- India Income Tax CalculatorDocument1 pageIndia Income Tax CalculatorPankaj Batra100% (24)

- Map of SingaporeDocument1 pageMap of SingaporePankaj Batra100% (2)

- India Income Tax CalculatorDocument1 pageIndia Income Tax CalculatorPankaj Batra100% (24)

- NPS Subscriber Registration FormDocument6 pagesNPS Subscriber Registration FormPankaj Batra100% (1)

- Singapore City MapDocument1 pageSingapore City MapPankaj Batra100% (1)

- KYC - New Individual FormDocument2 pagesKYC - New Individual FormRoshan MalhotraNo ratings yet

- Night Safari MapDocument1 pageNight Safari MapPankaj BatraNo ratings yet

- Singapore Metro RoutemapDocument1 pageSingapore Metro RoutemapPankaj Batra100% (1)

- Singapore Visa Travel Agent List IndiaDocument2 pagesSingapore Visa Travel Agent List IndiaPankaj Batra100% (7)

- IFSC India Bank Codes For NEFT RGTSDocument146 pagesIFSC India Bank Codes For NEFT RGTSPankaj Batra100% (2)

- Kotak Securities Nomination Update FormDocument1 pageKotak Securities Nomination Update FormPankaj BatraNo ratings yet

- Kotak Securities Address Update FormDocument2 pagesKotak Securities Address Update FormPankaj Batra100% (1)

- ICICI MF Update Details FormDocument2 pagesICICI MF Update Details FormPankaj Batra100% (1)

- Epfo Social Security NumberDocument2 pagesEpfo Social Security Numberrana1979100% (8)

- Sundaram Mutual Fund PIN Generation FormDocument4 pagesSundaram Mutual Fund PIN Generation FormPankaj BatraNo ratings yet

- IFSC India Bank Codes For NEFT RGTSDocument1,436 pagesIFSC India Bank Codes For NEFT RGTSPankaj Batra100% (2)

- Kotak Mutual Fund PIN Generation FormDocument2 pagesKotak Mutual Fund PIN Generation FormPankaj Batra100% (1)

- HDFC Mutual Fund PIN Generation FormDocument2 pagesHDFC Mutual Fund PIN Generation FormPankaj Batra100% (2)

- UTI Mutual Fund PIN Generation FormDocument2 pagesUTI Mutual Fund PIN Generation FormPankaj Batra100% (2)

- State Bank Mutual Fund PIN Generation FormDocument4 pagesState Bank Mutual Fund PIN Generation FormPankaj BatraNo ratings yet

- Principal PNB Mutual Fund PIN Generation FormDocument1 pagePrincipal PNB Mutual Fund PIN Generation FormPankaj BatraNo ratings yet

- Reliance Mutual Fund PIN Generation Form India Personal FinanceDocument2 pagesReliance Mutual Fund PIN Generation Form India Personal FinancePankaj Batra100% (2)

- Franklin Mutual Fund PIN Generation FormDocument1 pageFranklin Mutual Fund PIN Generation FormPankaj BatraNo ratings yet

- Birla MF Update Details FormDocument1 pageBirla MF Update Details FormPankaj BatraNo ratings yet

- DSP ML Mutual Fund PIN Generation FormDocument1 pageDSP ML Mutual Fund PIN Generation FormPankaj Batra100% (2)

- Midterm Exam 1 Practice - SolutionDocument6 pagesMidterm Exam 1 Practice - SolutionbobtanlaNo ratings yet

- Factors Affecting Cost of Construction in NigeriaDocument44 pagesFactors Affecting Cost of Construction in NigeriaGeomanjeri100% (1)

- Microeconomics II Chapter on MonopolyDocument16 pagesMicroeconomics II Chapter on Monopolyvillaarbaminch0% (1)

- Capital Budgeting TheoriesDocument4 pagesCapital Budgeting TheoriesAbraham ChinNo ratings yet

- Required:: Page 1 of 3Document62 pagesRequired:: Page 1 of 3binary78650% (2)

- ADXDocument7 pagesADXsathish bethriNo ratings yet

- PRICING EXERCISES FOR B2B (5 Probs)Document4 pagesPRICING EXERCISES FOR B2B (5 Probs)Pravish KhareNo ratings yet

- 09marketstructure Past PaperDocument21 pages09marketstructure Past PaperJacquelyn ChungNo ratings yet

- Ic 34Document37 pagesIc 34PankajaNo ratings yet

- Case 05 JohnsonDocument19 pagesCase 05 JohnsonKad Saad100% (3)

- Reliance Industries LimitedDocument15 pagesReliance Industries LimitedBhavNeet SidhuNo ratings yet

- Item Rate Boq: Sac Code Basic Price (RS.) Rate of GST (In %)Document1 pageItem Rate Boq: Sac Code Basic Price (RS.) Rate of GST (In %)sachinsaklani23No ratings yet

- Pricing strategies to maximize revenue and salesDocument13 pagesPricing strategies to maximize revenue and salesgraceNo ratings yet

- Week 10 - Leasing (Part 1)Document1 pageWeek 10 - Leasing (Part 1)Vidya IntaniNo ratings yet

- Impact of Organized RetailDocument6 pagesImpact of Organized RetailPushpak Singh0% (1)

- Lesson 1 Revisiting Economics As A Social ScienceDocument2 pagesLesson 1 Revisiting Economics As A Social ScienceJay92% (26)

- The Dinkum Index - Q211Document13 pagesThe Dinkum Index - Q211economicdelusionNo ratings yet

- CCP602Document35 pagesCCP602api-3849444No ratings yet

- Positioning Services in Competitive MarketsDocument13 pagesPositioning Services in Competitive MarketsWilson D AranjoNo ratings yet

- Brokers' Perceptions of Derivative Trading in Indian Stock MarketsDocument14 pagesBrokers' Perceptions of Derivative Trading in Indian Stock MarketsJagannath G EswaranNo ratings yet

- IGCSE Accounting O Level p1 Answers PDFDocument17 pagesIGCSE Accounting O Level p1 Answers PDFNusaibah AssyifaNo ratings yet

- Encyclopedia of Small Silver Coins (2008)Document601 pagesEncyclopedia of Small Silver Coins (2008)José Augusto CorreaNo ratings yet

- Degnis CoDocument3 pagesDegnis CoPubg DonNo ratings yet

- Transcript of Warren Buffett Interview With FCICDocument23 pagesTranscript of Warren Buffett Interview With FCICSantangel's ReviewNo ratings yet

- ECO1003 Microeconomics Case Study QuestionsDocument7 pagesECO1003 Microeconomics Case Study Questionsnouman faraz khan100% (1)

- Suggestions Buying A New CarDocument3 pagesSuggestions Buying A New CarGottliebWren1No ratings yet

- Evaluate SAP AG's capital structure and acquisition opportunityDocument3 pagesEvaluate SAP AG's capital structure and acquisition opportunitySajjad AhmadNo ratings yet

- ExerciseDocument3 pagesExerciseK61CA Cao Nguyễn Hạnh ChâuNo ratings yet

- How monetary policy impacts Pakistan's economic growthDocument10 pagesHow monetary policy impacts Pakistan's economic growthSamsam RaufNo ratings yet