Professional Documents

Culture Documents

Jollibee Foods Corporation Financial Data (2017)

Uploaded by

Sheila Mae Araman0 ratings0% found this document useful (0 votes)

148 views10 pagesfinancial data

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinancial data

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

148 views10 pagesJollibee Foods Corporation Financial Data (2017)

Uploaded by

Sheila Mae Aramanfinancial data

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

Jollibee Foods Corporation Financial Data

Company name: Jollibee Foods Corp Status: Active

End of fiscal year: December 31 2017 ISIN PHY4466S1007

Auditor: SyCip Gorres Velayo & Co. Year established: 1978

Company sector Consumer Cyclical Trading currency: PHP

name:

Industry name: Restaurants Place of Philippines (PH)

incorporation:

Industry group name Restaurants Doing business in: Philippines (PH)

Address Number 10 F. Ortigas Junior Tel.: +63 26341111

avenue

10th Floor, Jollibee Plaza Building,

1600

City/Country: Pasig, Philippines Web address: http://www.jollibee.com.ph

Company description: Jollibee Foods Corp is engaged in the development, operation and franchising of

quick service restaurants. The company is also engaged in manufacturing and

property leasing in support of the quick service restaurant systems and other business

activities.

Price Price change Bid Offer Open High Low Volume

[%]

287.40 -2.80[-0.96%] 286.20 290.00 288.80 291.00 286.00 687,570

Market Cap. Shares In Beta EPS DPS PE Ratio Yield 52-Wks-Range

[m] Issue [m]

313557.870945 1086.935531 - 6.58 2.18 44.10 0.75 236.00 - 305.40

JFC KEY FIGURES (at previous day's close)

Yesterday's Close 290.20

PE Ratio 44.103343465

Market Capitalisation 313.56B

Latest Shares Outstanding 1.09B

Earnings pS (EPS) 6.58

Dividend pS (DPS) 2.18

Dividend Yield 0.75%

Sales per Employee 10.69M

Effective Tax Rate -

Foreign Sales -

Domestic Sales -

Selling, General & Adm/tive 5.24%

(SG...

Research & Devlopment (R&D) 0.00%

as ...

Gross Profit Margin 18.18%

EBITDA Margin 10.25%

JFC KEY FIGURES (at previous day's close)

Pre-Tax Profit Margin 6.34%

Assets Turnover 0.68%

Return on Assets (ROA) 0.09%

Return on Equity (ROE) 0.19%

Return on Capital Invested 0.14%

(ROC...

Current Ratio 1.39

Leverage Ratio (Assets/Equity) 2.20%

Interest Cover 33.24

Total Debt/Equity (Gearing 0.40%

Rati...

LT Debt/Total Capital 0.27%

Working Capital pS 58.39

Cash pS 19.54

Book-Value pS 68.54

Tangible Book-Value pS 34.16

Cash Flow pS 11.89

Free Cash Flow pS 3.58

Spread 3.80

Gross gearing 0.00%

Net Debt -21.11B

JFC Balance Sheet Chart (December 31 2017)

Period † High Low

1 Week 294.00 273.60

1 Month 294.00 262.80

3 Months 294.00 245.00

6 Months 305.40 245.00

1 Year 305.40 236.00

3 Years 305.40 182.00

5 Years 305.40 150.80

Share price performance previous 3 years

Period † High Low

Share price performance intraday

Period † Open Open Avg. VWAP Min Max Avg. Change %

Vol Vol Daily

Vol

[m]

1 Week 275.00 289.30 289.64 583k 2M 1M 12.40 4.51%

1 Month 270.00 276.71 280.02 243k 2M 675k 17.40 6.44%

3 Months 281.00 267.71 269.28 143k 2M 702k 6.40 2.28%

6 Months 295.00 278.39 279.07 143k 3M 750k -7.60 -2.58%

1 Year 238.60 267.95 268.19 124k 4M 770k 48.80 20.45%

3 Years 186.00 235.05 235.15 105k 4M 749k 101.40 54.52%

5 Years 162.00 216.81 218.37 200 4M 733k 125.40 77.41%

JFC Growth Ratios (December 31 2017)

1 year 3 years 5 years 10 years

Diluted EPS growth 0.15 0.09 0.13 0.11

Diluted continuous EPS growth 0.15 0.09 0.13 0.11

Dividend growth 0.17 0.10 0.13 0.11

Equity per share growth 0.19 0.13 0.14 0.12

Revenue growth 0.16 0.13 0.13 0.13

Operating income growth -0.00 0.02 0.08 0.08

Net income growth 0.15 0.10 0.14 0.12

JFC Growth Ratios (December 31 2017)

1 year 3 years 5 years 10 years

Net income cont growth 0.15 0.10 0.14 0.12

CFO growth -0.13 0.65 0.09 0.12

FCF growth -0.52 - -0.03 0.06

Operating revenue growth 0.16 0.13 0.13 0.13

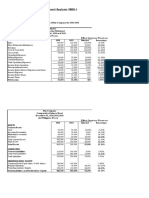

JFC Income Statement December 31 2017 (PHP)

Total Revenue 131576.551

Operating Revenue 131576.551

Cost of Revenue 107658.14

Gross Profit 23918.411

Operating Expenses 17470.613

Selling,General and Administr... 6897.373

General and Administrative Ex... 3484.18

Rent and Landing Fees 516.717

Selling and Marketing Expense 3413.193

Depreciation and Amortization 437.345

Depreciation 437.345

Other Operating Expenses 2346.516

Operating Income 6447.798

Interest Income/Expense,Net-N... -146.253

Interest Income-Non Operating 259.567

Interest Expense-Non Operatin... 405.82

Special Income/Charges -919.995

Impairment of Capital Assets 429.828

Write Off 199.45

Other Special Charges 290.717

Other Non-Operating Income/Ex... 1873.742

Pretax Income 8339.51

Provision for Income Tax 1666.928

Net Income Available to Commo... 7109.12

Net Income 7109.12

Net Income Including Noncontr... 6672.582

Net Income from Continuing Op... 6672.582

Minority Interest 436.538

Other under Preferred Stock D... 0.00

DilutedNIAvailtoComStockholde... 7109.12

Basic EPS 6.58

Basic EPS from Continuing Ope... 6.58

Diluted EPS 6.49

Diluted EPS from Continuing O... 6.49

JFC Growth Ratios (December 31 2017)

1 year 3 years 5 years 10 years

Basic Weighted Average Shares... 1080.488873

Diluted Weighted Average Shar... 1094.674664

Dividend Per Share 2.18

RentExpenseSupplemental 10236.613

Total Expenses 125128.753

Net Income from Continuing an... 7109.12

Normalized Income 6885.59377177

Basic EPS,Continuing and Disc... 6.58

Diluted EPS,Continuing and Di... 6.49

Interest and Dividend Income 259.567

Interest Expense 405.82

Net Interest Income -146.253

Earning Before Interest and T... 8745.33

Earning Before Interest Tax D... 13490.496

Cost of Revenue,Reconciled 107658.14

Depreciation,Reconciled 4745.166

Net Income from Continuing Op... 7109.12

TotalUnusualItemsExcludingGoo... 279.367

TotalUnusualItems 279.367

Normalized Basic EPS 6.37

Normalized Diluted EPS 6.29

Tax rate for calculations 0.20

JFC Efficency Ratios (December 31 2017)

Days in sales 9.10

Days in inventory 21.74

Days in payment 35.30

Cash conversion cycle -4.46

Receivable turnover 40.09

Inventory turnover 16.79

Payable turnover 10.34

Fixed assets turnover 7.01

Assets turnover 1.62

ROE 0.19

ROA 0.09

ROIC 0.14

FCF sales ratio 0.03

FCF net income ratio 0.54

Capital expenditure sales ratio 0.07

JFC Financial Health Ratios (December 31 2017)

JFC Efficency Ratios (December 31 2017)

Current ratio 1.39

Quick ratio 0.99

Debt total capital ratio 0.27

Debt equity ratio 0.37

Financial leverage 2.20

Total debt to equity 0.40

JFC Avearge Growth Ratios Over 5 Years

(December 31 2017)

Growth ann capital spending 0.19

Growth ann gross profit 0.14

Avg gross margin 0.18

Avg post tax margin 0.05

Avg pre tax marginr 0.07

Avg net profit 0.05

Avg ret commonr 0.20

Avg ret assets 0.09

Avg ret invested capital 0.15

JFC Profitability Ratios (December 31 2017)

Gross margin 0.18

Operating margin 0.05

EBT margin 0.06

Tax rate 0.20

Net margin 0.05

Sales per employee 10,689,459.01

EBIT margin 0.07

EBITDA margin 0.10

Normalized net profit margin 0.05

Interest coverage 21.55

Inc per employee tot ops 577,554.63

JFC Valuation Ratios (December 29 2017)

Sales per share 115.60

Growth ann sales per share 5 ye... 0.12

Book value per share 35.60

CF per share 12.35

Price to EPS 40.16

Ratio PE 5 year high 41.26

Ratio PE 5 year low 16.19

Price to book 7.11

Price to sales 2.19

Price to cash flow 20.49

JFC Valuation Ratios (December 29 2017)

Price to free cash flow 54.95

Div rate 2.18

Dividend yield 0.01

Div payout tot ops 0.34

Div payout 5 year 0.34

Payout ratio 0.32

Sustainable growth rate 0.13

Cash return 0.02

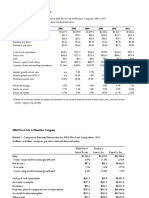

JFC Balance Sheet December 31 2017 (PHP)

Total Assets 89783.895

Current Assets 37141.016

Cash,Cash Equivalents,and Sho... 22520.874

Cash and Cash Equivalents 21107.474

Cash 15465.934

Cash Equivalents 5641.54

Short Term Investments 1413.4

Accounts Receivable 3534.862

Accounts Receivable,Gross 4224.981

Allowance for Doubtful Accoun... -690.119

Other Receivables 482.611

Inventories 6835.514

Raw Materials 6812.955

Other Inventories 22.559

Prepaid Assets and Others 3655.777

Other Current Assets 111.378

Total Non-Current Assets 52642.879

Net Property,Plant,and Equipm... 20893.814

Gross Property,Plant,and Equi... 47143.323

Properties 0.00

Land and Improvements 673.514

Buildings and Improvements 20461.846

Machinery,Furniture/Equipment 23637.11

Construction in Progress 2370.853

Accumulated Depreciation -26249.509

Goodwill and Other Intangible... 15730.239

Goodwill 9050.223

Other Intangible Assets 6680.016

Investment Properties 848.974

Long term equity investment 7492.771

Investment in Financial Asset... 29.862

JFC Valuation Ratios (December 29 2017)

Available-for-Sale Securities 29.862

Derivative Assets,Non-Current 11.948

Deferred Non-Current Assets 98.657

Deferred Taxes,Non-Current As... 3908.813

Prepaid Assets,Non-Current 3054.144

Other Non-Current Assets 387.657

Total Liabilities 47201.916

Current Liabilities 26694.605

Payables 13179.804

Accounts Payable 10877.674

Taxes Payable 2162.96

Dividends Payable 56.053

Other Payable 83.117

Current Debt and Capital Leas... 1216.219

Current Debt 1216.219

Other Current Liabilities 1134.096

Total Non-Current Liabilities 20507.311

Provisions,Long Term 825.109

Long Term Debt and Capital Le... 14901.052

Long Term Debt 14901.052

Deferred Taxes,Non-Current Li... 1188.995

Pension and Other Postretirem... 1489.546

Derivative Liabilities 51.042

Other Non-Current Liabilities 2051.567

Total Equity 42581.979

Stockholder's Equity 40782.635

Capital Stock 1084.478

Common Stock 1084.478

Additional Paid in Capital 7520.383

Retained Earnings 16413.14

Treasury Stock 180.511

Other Equity Interest -2595.223

Minority Interest 1799.344

Total Capitalization 55683.687

Common Stock Equity 40782.635

Net Tangible Assets 25052.396

Working Capital 10446.411

Invested Capital 56899.906

Tangible Book Value 25052.396

Total Debt 16117.271

JFC Valuation Ratios (December 29 2017)

Ordinary Shares Number 1085.3234

Treasury Shares Number 16.44734

JFC Cash Flow December 31 2017 (PHP)

Cash Flow from Operating Acti... 12843.628

Net Income from Continuing Op... 8339.51

Gain/Loss on Sale of Business 116.207

Gain/Loss on Sale of Property... 174.51

Net Foreign Currency Exchange... -6.913

Gain/Loss on Investment Secur... -1430.398

Pension and Employee Benefit ... 37.84

Depreciation and Amortization 4745.166

Depreciation 4745.166

Provision and Write-Off of As... 794.609

Stock-Based Compensation 227.483

Other Non-Cash Items 406.157

Changes in Working Capital 698.409

Change in Receivables -532.69

Change in Inventories -715.127

Change in Payables 2176.062

Change in Other Current Asset... -229.836

Interest Received, CFO 225.314

Taxes Refund/Paid -2396.189

Cash Flow from Investing Acti... -10544.4

Purchase/Sale of Property,Pla... -8542.508

Purchase of Property,Plant an... -8904.796

Sale of Property,Plant,and Eq... 362.288

Purchase/Sale of Intangibles,... -69.634

Purchase of Intangibles -69.634

Purchase/Sale of Business,Net -1147.722

Purchase/Acquisition of Busin... -1590.933

Sale of Business 443.211

NetInvestmentPropertiesPurcha... 365.49

SaleOfInvestmentProperties 365.49

Purchase/Sale of Investments,... -687.848

Purchase of Investments -687.848

Dividends Received, CFI 20.037

Other Investing Changes,Net -482.215

Cash Flow from Financing Acti... 2077.341

Issuance/Payments of Debt,Net 3909.658

Issuance/Payments of Long Ter... 3909.658

JFC Cash Flow December 31 2017 (PHP)

Proceeds or Issuance of Long ... 5517.281

Payments to Settle Long Term ... -1607.623

Issuance/Payments of Short Te... 0.00

Proceeds or Issuance of Short... 0.00

Payments to Settle Short Term... 0.00

Issuance/Payments of Common S... 861.125

Proceeds or Issuance of Commo... 861.125

Cash Dividends Paid -2347.164

Common Stock Dividends Paid -2347.164

Interest Paid, CFF -360.856

Other Financing Changes, Net 14.578

Cash and Cash Equivalents,End... 21107.474

Change in Cash 4376.569

Effect of Exchange Rate Chang... -2.441

Cash and Cash Equivalents,Beg... 16733.346

Capital Expenditure -8974.43

Issuance of Capital Stock 861.125

Issuance of Debt 5517.281

Repayment of Debt -1607.623

Free Cash Flow 3869.198

Your Recent History

You might also like

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Pepsico: Visual Financials (BETA)Document4 pagesPepsico: Visual Financials (BETA)gyanadasNo ratings yet

- Financial Analysis of P & GDocument25 pagesFinancial Analysis of P & Ghitesh_mahajan_3No ratings yet

- Pepsico, Inc. (Nasdaqgs:Pep) Financials Key StatsDocument28 pagesPepsico, Inc. (Nasdaqgs:Pep) Financials Key StatsJulio CesarNo ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- Wipro, Ltd. WIT Azim H. Premji 119,491 AD Development, Infrastructure Outsourcing and Business Consulting ServicesDocument4 pagesWipro, Ltd. WIT Azim H. Premji 119,491 AD Development, Infrastructure Outsourcing and Business Consulting ServicespalsarajNo ratings yet

- Aapl +0 08 $195 99Document1 pageAapl +0 08 $195 99Gisnelly LucianoNo ratings yet

- Jollibee Foods Corporation Financial Data: JFC KEY FIGURES (At Previous Day's Close)Document10 pagesJollibee Foods Corporation Financial Data: JFC KEY FIGURES (At Previous Day's Close)King NeilNo ratings yet

- Techne Corporation (TECH) - Good Risk/Reward PropositionDocument8 pagesTechne Corporation (TECH) - Good Risk/Reward Propositionsommer_ronald5741No ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- Big Lots, Inc.: Price, Consensus & SurpriseDocument1 pageBig Lots, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Reliance Industries Ratios and AnalyticsDocument6 pagesReliance Industries Ratios and AnalyticsTI678No ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Exxon Mobil CorpDocument2 pagesExxon Mobil CorpBhubaneshwari Roy MNo ratings yet

- Fundamental AnalysisDocument4 pagesFundamental AnalysisBindu GaireNo ratings yet

- PFE Financials As On 08-09-2023Document38 pagesPFE Financials As On 08-09-2023Asim MalikNo ratings yet

- Singapore Exchange Limited: Firing On All CylindersDocument6 pagesSingapore Exchange Limited: Firing On All CylindersCalebNo ratings yet

- Bank of China Limited SEHK 3988 FinancialsDocument47 pagesBank of China Limited SEHK 3988 FinancialsJaime Vara De ReyNo ratings yet

- Fatima FertilizersDocument18 pagesFatima FertilizersBarira AkhtarNo ratings yet

- Financial Projections Template 08Document26 pagesFinancial Projections Template 08Clyde SakuradaNo ratings yet

- Jollibee Foods Corporation PSE JFC FinancialsDocument38 pagesJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniNo ratings yet

- 34209002-Keren Wijaya-Manajemen Keuangan I - Eksekutif AkuntansiDocument4 pages34209002-Keren Wijaya-Manajemen Keuangan I - Eksekutif AkuntansiKEREN WIJAYANo ratings yet

- BetterInvesting Weekly Stock Screen 2-5-18Document1 pageBetterInvesting Weekly Stock Screen 2-5-18BetterInvestingNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- Industrial and Commercial Bank of China Limited SEHK 1398 FinancialsDocument49 pagesIndustrial and Commercial Bank of China Limited SEHK 1398 FinancialsJaime Vara De ReyNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- The Warren Buffett Spreadsheet Final-Version - PreviewDocument335 pagesThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNo ratings yet

- Financial Model - Customize ItDocument46 pagesFinancial Model - Customize ItShujat AliNo ratings yet

- IDEA One PagerDocument6 pagesIDEA One PagerdidwaniasNo ratings yet

- GME Stock ValuationDocument1 pageGME Stock ValuationOld School ValueNo ratings yet

- Jubilant FoodsDocument24 pagesJubilant FoodsMagical MakeoversNo ratings yet

- CF Report Fall 2018Document24 pagesCF Report Fall 2018Tamal GhoshNo ratings yet

- ANSWERS For Horizontal Analysis Application-CBA CorporationDocument4 pagesANSWERS For Horizontal Analysis Application-CBA CorporationYhadNo ratings yet

- Value Investing ExperimentDocument14 pagesValue Investing ExperimentimbetbmNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- 3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsDocument3 pages3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsQudsiya KalhoroNo ratings yet

- Bank of AmericaDocument21 pagesBank of AmericaRavish SrivastavaNo ratings yet

- WorldCom Bond IssuanceDocument9 pagesWorldCom Bond IssuanceAniket DubeyNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Enil 06 08Document1 pageEnil 06 08surbhiNo ratings yet

- Explain (Simply and in Your Own Words) What The Company DoesDocument8 pagesExplain (Simply and in Your Own Words) What The Company DoesShreyas LakshminarayanNo ratings yet

- Mayes 8e CH03 SolutionsDocument37 pagesMayes 8e CH03 SolutionsKHANJNo ratings yet

- Top 5 MidcapDocument20 pagesTop 5 MidcapABHISHEK YADAVNo ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- KR Valuation 28 Sept 2019Document54 pagesKR Valuation 28 Sept 2019ket careNo ratings yet

- Exhibit 1: Income StatementDocument16 pagesExhibit 1: Income StatementAbhishek GuptaNo ratings yet

- Financial Analysis: Nestle India Ltd. ACC LTDDocument20 pagesFinancial Analysis: Nestle India Ltd. ACC LTDrahil0786No ratings yet

- Corporate Factbook Altria - MODocument9 pagesCorporate Factbook Altria - MOTom RobertsNo ratings yet

- Corporate ValuationDocument32 pagesCorporate ValuationNishant DhakalNo ratings yet

- BetterInvesting Weekly Stock Screen 11-6-17.xlxsDocument1 pageBetterInvesting Weekly Stock Screen 11-6-17.xlxsBetterInvesting100% (1)

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Hing Yiap Group Berhad Buy: Results Report SJ Securities Sdn. BHDDocument4 pagesHing Yiap Group Berhad Buy: Results Report SJ Securities Sdn. BHDlimml63No ratings yet

- Alembic Chemicals LTD P& L Statement For Year Ended On 31st December2019Document8 pagesAlembic Chemicals LTD P& L Statement For Year Ended On 31st December2019SANKET SAHOONo ratings yet

- 1.1 - Whatif &PTDocument28 pages1.1 - Whatif &PTSalman AhmadNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionNo ratings yet

- Or Bad Genes? (Book by David Raup, W.W. Norton, Co.)Document4 pagesOr Bad Genes? (Book by David Raup, W.W. Norton, Co.)Sheila Mae AramanNo ratings yet

- Chemical Bonding: Lewis Dot Carbon Hydrogen OxygenDocument17 pagesChemical Bonding: Lewis Dot Carbon Hydrogen OxygenSheila Mae AramanNo ratings yet

- Comparing and C-WPS OfficeDocument5 pagesComparing and C-WPS OfficeSheila Mae AramanNo ratings yet

- Factual Recount-WPS OfficeDocument4 pagesFactual Recount-WPS OfficeSheila Mae AramanNo ratings yet

- Activity Based-WPS OfficeDocument6 pagesActivity Based-WPS OfficeSheila Mae AramanNo ratings yet

- Immersing into-WPS OfficeDocument6 pagesImmersing into-WPS OfficeSheila Mae AramanNo ratings yet

- Concept Map - CARBODocument1 pageConcept Map - CARBOSheila Mae AramanNo ratings yet

- When Does A Team Rotate?Document3 pagesWhen Does A Team Rotate?Sheila Mae AramanNo ratings yet

- Compounds (Noxious Compounds Produced by The Plant) Determined The Usage ofDocument25 pagesCompounds (Noxious Compounds Produced by The Plant) Determined The Usage ofSheila Mae AramanNo ratings yet

- Article Review - The Problem of Adaptation in The Study of Human BehaviorDocument1 pageArticle Review - The Problem of Adaptation in The Study of Human BehaviorSheila Mae AramanNo ratings yet

- Literature Is i-WPS OfficeDocument2 pagesLiterature Is i-WPS OfficeSheila Mae AramanNo ratings yet

- Plants (Desiccation Resistant), Marine Organisms (Fusiform Body), Cryptic Insects AllDocument23 pagesPlants (Desiccation Resistant), Marine Organisms (Fusiform Body), Cryptic Insects AllSheila Mae AramanNo ratings yet

- Concept Map - CARBODocument1 pageConcept Map - CARBOSheila Mae AramanNo ratings yet

- Jimboy ProbabilityDocument7 pagesJimboy ProbabilitySheila Mae AramanNo ratings yet

- c19WPS OfficeDocument3 pagesc19WPS OfficeSheila Mae AramanNo ratings yet

- PrecipitationDocument1 pagePrecipitationSheila Mae AramanNo ratings yet

- Similarities of Philippines and ThailandDocument2 pagesSimilarities of Philippines and ThailandSheila Mae Araman100% (1)

- Lessons of Covid19Document1 pageLessons of Covid19Sheila Mae AramanNo ratings yet

- Impact of COVID19 To CommunityDocument3 pagesImpact of COVID19 To CommunitySheila Mae AramanNo ratings yet

- The coronavirus-WPS OfficeDocument8 pagesThe coronavirus-WPS OfficeSheila Mae AramanNo ratings yet

- Additional PartDocument1 pageAdditional PartSheila Mae AramanNo ratings yet

- ) P (1-U) + Q (V) - The First Part On The Right Is Accounts For Alleles NotDocument14 pages) P (1-U) + Q (V) - The First Part On The Right Is Accounts For Alleles NotSheila Mae AramanNo ratings yet

- MACROEVOLUTIONDocument7 pagesMACROEVOLUTIONSheila Mae AramanNo ratings yet

- Cash TransferDocument2 pagesCash TransferSheila Mae AramanNo ratings yet

- Cut SentencesDocument4 pagesCut SentencesSheila Mae AramanNo ratings yet

- Web DeveloperceDocument2 pagesWeb DeveloperceSheila Mae AramanNo ratings yet

- Phylogenetic AnalysisDocument6 pagesPhylogenetic AnalysisSheila Mae AramanNo ratings yet

- Chapter 3Document6 pagesChapter 3Sheila Mae AramanNo ratings yet

- mitosis-WPS OfficeDocument5 pagesmitosis-WPS OfficeSheila Mae AramanNo ratings yet

- Risk management-WPS OfficeDocument6 pagesRisk management-WPS OfficeSheila Mae AramanNo ratings yet

- Wild Wood Case StudyDocument6 pagesWild Wood Case Studyaudrey gadayNo ratings yet

- F11340000120144004Insurance ContractDocument71 pagesF11340000120144004Insurance ContractmuglersaurusNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Group 3 WilmarDocument20 pagesGroup 3 WilmarTrlz AlNo ratings yet

- Accounting and Auditing StandardDocument16 pagesAccounting and Auditing StandardErica NicolasuraNo ratings yet

- 858 Accounts QPDocument11 pages858 Accounts QPRudra SahaNo ratings yet

- Business Finance Q2 Week 3Document8 pagesBusiness Finance Q2 Week 3JustineNo ratings yet

- Chuong 2Document27 pagesChuong 2Huỳnh Hồng HanhNo ratings yet

- Financial Statement Analysis Project ON Lowe'SDocument7 pagesFinancial Statement Analysis Project ON Lowe'SShruti MathurNo ratings yet

- Chapter 3 - RevenueDocument4 pagesChapter 3 - RevenuejasonNo ratings yet

- Sage50 Introductory PDFDocument110 pagesSage50 Introductory PDFrosauraNo ratings yet

- CA Inter Accounts Q MTP 2 Nov 2022Document6 pagesCA Inter Accounts Q MTP 2 Nov 2022smartshivenduNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Ankit Patel 107550592024Document96 pagesAnkit Patel 107550592024Ankit PatelNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- Ia3 AssignmentDocument8 pagesIa3 AssignmentRed VelvetNo ratings yet

- Chapter 5 - Dayag - MCSDocument2 pagesChapter 5 - Dayag - MCSMazikeen DeckerNo ratings yet

- Games Language People Play 11 To 40Document30 pagesGames Language People Play 11 To 40(FPTU Cần Thơ) Đinh Cao TườngNo ratings yet

- TQ in Financial Management (Pre-Final)Document8 pagesTQ in Financial Management (Pre-Final)Christine LealNo ratings yet

- Bilans Stanja - BALANCE SHEETDocument2 pagesBilans Stanja - BALANCE SHEETLorimer01080% (10)

- Quiz 1 Answers BUSICOMBIDocument14 pagesQuiz 1 Answers BUSICOMBIfoxtrotNo ratings yet

- AFAR 1.4 - Installment SalesDocument7 pagesAFAR 1.4 - Installment SalesKile Rien MonsadaNo ratings yet

- Finance-Accounting Nam 3 CNTH11Document65 pagesFinance-Accounting Nam 3 CNTH11Nongstan Jie Jie ĐỗNo ratings yet

- Monmouth Student Template UpdatedDocument14 pagesMonmouth Student Template Updatedhao pengNo ratings yet

- 17Q DMPL FS Q3 Fy22Document90 pages17Q DMPL FS Q3 Fy22mac macNo ratings yet

- There Are Some Major Key Performance Indicators For Chemical Industry: 1. FinancialDocument2 pagesThere Are Some Major Key Performance Indicators For Chemical Industry: 1. FinancialsonuNo ratings yet

- The Proprietary Theory and The Entity Theory of Corporate Enterpr PDFDocument242 pagesThe Proprietary Theory and The Entity Theory of Corporate Enterpr PDFAnusha GowdaNo ratings yet

- BSA REVIEW Cash TheoriesDocument4 pagesBSA REVIEW Cash TheorieschristineNo ratings yet

- Asignacion - 3 FinancialDocument4 pagesAsignacion - 3 FinancialLeslie Leah0% (1)

- APC PreparationDocument28 pagesAPC PreparationDesign GroupNo ratings yet