Professional Documents

Culture Documents

Pacific Banking Corporation

Uploaded by

KDCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pacific Banking Corporation

Uploaded by

KDCopyright:

Available Formats

PACIFIC BANKING CORPORATION, petitioner, vs. COURT parties.

Petitioner did not only object to the introduction of

OF APPEALS and ORIENTAL ASSURANCE evidence but on the contrary, presented the very evidence that

CORPORATION, respondents. proved its existence.

Same; Same; Same; Same; Court can consider a fact

Insurance; Co-insurance; Fraud; Insured was guilty of which surfaced only after trial proper.—Be that as it may, it is

clear fraud for failure to reveal three other insurances.—It is not established that the Supreme Court has ample authority to go

disputed that the insured failed to reveal before the loss three beyond the pleadings where in the interest of justice and the

other insurances. As found by the Court of Appeals, by reason promotion of public policy, there is a need to make its own

of said unrevealed insurances, the insured had been guilty of a finding to support its conclusion. Otherwise stated, the Court can

false declaration; a clear misrepresentation and a vital one consider a fact which surfaced only after trial proper.

because where the insured had been asked to reveal but did

not, that was deception. Otherwise stated, had the insurer Same; Action; Cause of action accrues from the time the

known that there were many co-insurances, it could have insurer finally rejects the claim for payment.—Generally, the

hesitated or plainly desisted from entering into such contract. cause of action on the policy accrues when the loss occurs. But

Hence, the insured was guilty of clear fraud (Rollo, p. 25). when the policy provides that no action shall be brought unless

the claim is first presented extrajudicially in the manner provided

Same; Same; Same; Contention that the allegation of in the policy, the cause of action will accrue from the time the

fraud is but a mere inference or suspicion is untenable.— insurer finally rejects the claim for payment.

Petitioner’s contention that the allegation of fraud is but a mere

inference or suspicion is untenable. In fact, concrete evidence Same; Same; Same; Compliance with condition No. 11 is

of fraud or false declaration by the insured was furnished by the a requirement sine qua non to the right to maintain an action as

petitioner itself when the facts alleged in the policy under prior thereto no violation of petitioner’s right can be attributable

clauses “Co-Insurances Declared” and “Other Insurance to private respondent.—The evidence adduced shows that

Clause” are materially different from the actual number of co- twenty-four (24) days after the fire, petitioner merely wrote

insurances taken over the subject property. Consequently, “the letters to private respondent to serve as notice of loss,

whole foundation of the contract fails, the risk does not attach thereafter, the former did not furnish the latter whatever pertinent

and the policy never becomes a contract between the parties. documents were necessary to prove and estimate its loss.

Representations of facts are the foundation of the contract and Instead, petitioner shifted upon private respondent the burden of

if the foundation does not exist, the superstructure does not fishing out the necessary information to ascertain the particular

arise. Falsehood in such representations is not shown to vary or account of the articles destroyed by fire as well as the amount

add to the contract, or to terminate a contract which has once of loss. It is noteworthy that private respondent and its adjuster

been made, but to show that no contract has ever existed notified petitioner that insured had not yet filed a written claim

(Tolentino, Commercial Laws of the Philippines, p. 991, Vol. II, nor submitted the supporting documents in compliance with the

8th Ed.). A void or inexistent contract is one which has no force requirements set forth in the policy. Despite the notice, the latter

and effect from the very beginning, as if it had never been remained unheedful. Since the required claim by insured,

entered into, and which cannot be validated either by time or by together with the preliminary submittal of relevant documents

ratification (Tongoy v. C.A., 123 SCRA 99 [1983]; Avila v. C.A. had not been complied with, it follows that private respondent

145 SCRA [1986]). could not be deemed to have finally rejected petitioner’s claim

and therefore the latter’s cause of action had not yet arisen.

Same; Same; Same; Absence of notice of other Compliance with condition No. 11 is a requirement sine quo non

insurances nullifies the policy.—As the insurance policy against to the right to maintain an action as prior thereto no violation of

fire expressly required that notice should be given by the insured petitioner’s right can be attributable to private respondent. This

of other insurance upon the same property, the total absence of is so, as before such final rejection, there was no real necessity

such notice nullifies the policy. for bringing suit.

Same; Same; Same; Fraud or misrepresentation or arson Same; Contracts of insurance like other contracts are to

are exceptions to the general rule that insurance as to the be construed according to the sense and meaning of the terms

interest of the mortgagee cannot be invalidated.—The which the parties themselves have used.—While it is a cardinal

paragraph clearly states the exceptions to the general rule that principle of insurance law that a policy or contract of insurance

insurance as to the interest of the mortgagee, cannot be is to be construed liberally in favor of the insured and strictly as

invalidated; namely: fraud, or misrepresentation or arson. As against the insurer company yet, contracts of insurance, like

correctly found by the Court of Appeals, concealment of the other contracts, are to be construed according to the sense and

aforecited co-insurances can easily be fraud, or in the very least, meaning of the terms which the parties themselves have used.

misrepresentation (Rollo, p. 27). If such terms are clear and unambiguous, they must be taken

and understood in their plain, ordinary and popular sense.

Same; Same; Same; Same; Petitioner which is merely

claiming as indorsee of the insured cannot be entitled to the Same; Same; Insurance contracts are contracts of

proceeds.—Undoubtedly, it is but fair and just that where the indemnity and compliance of the insured with the terms of the

insured who is primarily entitled to receive the proceeds of the policy is a condition precedent to the right of recovery.—

policy has by its fraud and/or misrepresentation, forfeited said Contracts of insurance are contracts of indemnity upon the

right, with more reason, petitioner which is merely claiming as terms and conditions specified in the policy. The parties have a

indorsee of said insured, cannot be entitled to such proceeds. right to impose such reasonable conditions at the time of the

making of the contract as they may deem wise and necessary.

Same; Same; Same; The fact of fraud was tried by The agreement has the force of law between the parties. The

express or at least implied consent of the parties.—Petitioner terms of the policy constitute the measure of the insurer’s

further stressed that fraud which was not pleaded as a defense liability, and in order to recover, the insured must show himself

in private respondent’s answer or motion to dismiss, should be within those terms. The compliance of the insured with the terms

deemed to have been waived. It will be noted that the fact of of the policy is a condition precedent to the right of recovery.

fraud was tried by express or at least implied consent of the

You might also like

- CASESDocument16 pagesCASESKDNo ratings yet

- Second Division: Delito or Culpa Aquiliana, Under The Civil Code Has Been Fully andDocument2 pagesSecond Division: Delito or Culpa Aquiliana, Under The Civil Code Has Been Fully andKDNo ratings yet

- ARTICLE 261. Jurisdiction of Voluntary Arbitrators or Panel of VoluntaryDocument2 pagesARTICLE 261. Jurisdiction of Voluntary Arbitrators or Panel of VoluntaryKDNo ratings yet

- EdillonDocument2 pagesEdillonKDNo ratings yet

- ADR Compiled CASESDocument6 pagesADR Compiled CASESKDNo ratings yet

- Emerald, Philipps, Orlane, 246Document4 pagesEmerald, Philipps, Orlane, 246KDNo ratings yet

- TRANSFIELDDocument2 pagesTRANSFIELDKDNo ratings yet

- Prelims ReviewerDocument5 pagesPrelims ReviewerKDNo ratings yet

- TRANSFIELDDocument2 pagesTRANSFIELDKDNo ratings yet

- ARTICLE 261. Jurisdiction of Voluntary Arbitrators or Panel of VoluntaryDocument2 pagesARTICLE 261. Jurisdiction of Voluntary Arbitrators or Panel of VoluntaryKDNo ratings yet

- A Lawyer Shall Not Engage in Unlawful, Dishonest, Immoral and Deceitful ConductDocument2 pagesA Lawyer Shall Not Engage in Unlawful, Dishonest, Immoral and Deceitful ConductKDNo ratings yet

- Ui Vs BonifacioDocument4 pagesUi Vs BonifacioKD100% (1)

- Defense of Petitioners: Revolved Mainly in TheDocument2 pagesDefense of Petitioners: Revolved Mainly in TheKDNo ratings yet

- Indeterminate Sentence LawDocument2 pagesIndeterminate Sentence LawKDNo ratings yet

- AbcDocument11 pagesAbcKDNo ratings yet

- 1) British Airways V. Court of Appeals G.R. NO. 92288, 09 February 1993, SECOND DIVISION (Nocon, J.)Document15 pages1) British Airways V. Court of Appeals G.R. NO. 92288, 09 February 1993, SECOND DIVISION (Nocon, J.)KDNo ratings yet

- Busorg Digests (2S, 2012)Document56 pagesBusorg Digests (2S, 2012)Gabby PundavelaNo ratings yet

- OÑADocument2 pagesOÑAKDNo ratings yet

- Canon Kabushiki Kaisha Vs CADocument2 pagesCanon Kabushiki Kaisha Vs CAKDNo ratings yet

- Scanned With CamscannerDocument5 pagesScanned With CamscannerKDNo ratings yet

- PSALM V CIRDocument4 pagesPSALM V CIRKD100% (1)

- 2B Civil Procedure Syllabus PDFDocument18 pages2B Civil Procedure Syllabus PDFKDNo ratings yet

- Review of Anti-Voyeurism, Illegal Gambling, and Dangerous Drugs ActsDocument7 pagesReview of Anti-Voyeurism, Illegal Gambling, and Dangerous Drugs ActsKDNo ratings yet

- 21-23 SPL RevDocument8 pages21-23 SPL RevKDNo ratings yet

- Solidbank Corporation VDocument4 pagesSolidbank Corporation VKDNo ratings yet

- Chapter 12 13 PilDocument10 pagesChapter 12 13 PilKDNo ratings yet

- Ilocos TourDocument1 pageIlocos TourKDNo ratings yet

- Banco de Oro Savings and Mortgage Bank VDocument4 pagesBanco de Oro Savings and Mortgage Bank VKDNo ratings yet

- Garcia v. VillarDocument3 pagesGarcia v. VillarKDNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Comparison of Civil Capacity in China and The PhilippinesDocument6 pagesComparison of Civil Capacity in China and The Philippinesjinx1147No ratings yet

- Palileo v. CosioDocument4 pagesPalileo v. CosioHency TanbengcoNo ratings yet

- Irrevocable Special Power of AttorneyDocument2 pagesIrrevocable Special Power of AttorneyEppie Severino100% (2)

- Rojales v. DimeDocument1 pageRojales v. DimeAdrian KitNo ratings yet

- James Robert Stull, A Minor, by His Mother, Julie Stull MacLeod and His Stepfather George Stuart MacLeod v. School Board of The Western Beaver Junior-Senior High School, 459 F.2d 339, 3rd Cir. (1972)Document12 pagesJames Robert Stull, A Minor, by His Mother, Julie Stull MacLeod and His Stepfather George Stuart MacLeod v. School Board of The Western Beaver Junior-Senior High School, 459 F.2d 339, 3rd Cir. (1972)Scribd Government DocsNo ratings yet

- United States v. Martorano, Raymond, A/K/A Lon John, 709 F.2d 863, 3rd Cir. (1983)Document16 pagesUnited States v. Martorano, Raymond, A/K/A Lon John, 709 F.2d 863, 3rd Cir. (1983)Scribd Government DocsNo ratings yet

- Copyright Transfer AgreementDocument1 pageCopyright Transfer AgreementMoh heri KurniawanNo ratings yet

- Correspondence Constable Joel DonnyDocument6 pagesCorrespondence Constable Joel Donnyapi-314465116No ratings yet

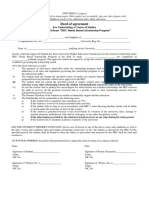

- Deed of Agreement: For Undertaking A Course of Studies Under The Scheme "HEC "Document2 pagesDeed of Agreement: For Undertaking A Course of Studies Under The Scheme "HEC "MuhammadMansoorGoharNo ratings yet

- G.R. No. 154705Document4 pagesG.R. No. 154705Weddanever CornelNo ratings yet

- Letter To Assia Re - Resuing InforDocument1 pageLetter To Assia Re - Resuing InforMichaelNo ratings yet

- Dolot vs. PajeDocument18 pagesDolot vs. PajeKKCDIALNo ratings yet

- Salary Adjustment Due To PromotionDocument3 pagesSalary Adjustment Due To PromotionDany TorresNo ratings yet

- Republic of The Philippines Quezon City: Court of Tax AppealsDocument7 pagesRepublic of The Philippines Quezon City: Court of Tax AppealsfrsfwtetNo ratings yet

- Company Law Lesson On Promoters (Autosaved)Document21 pagesCompany Law Lesson On Promoters (Autosaved)William MushongaNo ratings yet

- People v Glenn Hatton: Identification of accused and failure to positively ID in court is fatal to prosecutionDocument8 pagesPeople v Glenn Hatton: Identification of accused and failure to positively ID in court is fatal to prosecutionShiena Lou B. Amodia-RabacalNo ratings yet

- India Bank Appeal DismissedDocument2 pagesIndia Bank Appeal DismissedUKNo ratings yet

- Amla To Ra 10586Document34 pagesAmla To Ra 10586Parubrub-Yere TinaNo ratings yet

- Asian Terminals V RicafortDocument1 pageAsian Terminals V RicafortIan AuroNo ratings yet

- Illinois Manufacturers', Illinois Retail Merchants vs. Illinois Workers' Compensation CommissionDocument3 pagesIllinois Manufacturers', Illinois Retail Merchants vs. Illinois Workers' Compensation CommissionCrainsChicagoBusinessNo ratings yet

- Advocates Act, 1961, Sections 24 (1) (E), 28 (2) (D) and 49Document16 pagesAdvocates Act, 1961, Sections 24 (1) (E), 28 (2) (D) and 49SmartNo ratings yet

- Domingo Versus Rayala, DigestedDocument2 pagesDomingo Versus Rayala, DigestedHannah Garcia IbanezNo ratings yet

- Golez Vs CamaraDocument11 pagesGolez Vs CamaraDaryl Noel TejanoNo ratings yet

- DTC Agreement Between United Kingdom and Gambia, TheDocument36 pagesDTC Agreement Between United Kingdom and Gambia, TheOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Ichong Vs Hernandez DigestDocument6 pagesIchong Vs Hernandez DigestFennyNuñalaNo ratings yet

- Transpacific Battery Corp vs Security Bank & Trust CoDocument2 pagesTranspacific Battery Corp vs Security Bank & Trust Copiptipayb100% (2)

- Types Right To StrikeDocument17 pagesTypes Right To StrikeMishika Pandita100% (1)

- Fermin V. People FACTS: On Complaint of Spouses Annabelle Rama Gutierrez and Eduardo Gutierrez, Two CriminalDocument1 pageFermin V. People FACTS: On Complaint of Spouses Annabelle Rama Gutierrez and Eduardo Gutierrez, Two CriminalBaphomet JuniorNo ratings yet

- Court Case Over Inherited Land Dispute Among RelativesDocument8 pagesCourt Case Over Inherited Land Dispute Among Relativesp95No ratings yet

- Implied trust vs express trustDocument3 pagesImplied trust vs express trustJunelyn T. EllaNo ratings yet