Professional Documents

Culture Documents

Determine Applicable Tax Rates For

Uploaded by

Kenneth Bryan Tegerero TegioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Determine Applicable Tax Rates For

Uploaded by

Kenneth Bryan Tegerero TegioCopyright:

Available Formats

Determine applicable tax rates for:

1. Interest Income

2. Interest Income from promissory notes

3. Interest Income from peso deposit

4. Interest Income from dollar deposit

5. Interest Income from dollar deposit earned by NRA-ETB

6. Interest Income from long term deposit by corporations

7. Interest Income from a pre-terminated deposit after 3 and a half years

8. Dividend income earned by RC

9. Dividend income earned by NRC

10. Dividend income earned by RA

11. Dividend income earned by NRA-ETB

12. Dividend income earned by NRA-NETB

13. Dividend income earned by DC

14. Dividend income earned by RFC

15. Dividend income earned by NRFC

16. Dividend income earned by NRFC with tax sparring rule

17. Dividend income declared by Resident Corporation to Resident Citizen

18. Gain from sale of personal car

19. Gain from sale of family home

20. Gain from sale of company car

21. Gain from sale of corporate idle capital machineries

22. Gain from sale of corporate office

23. Gain from sale of corporate other capital assets

You might also like

- J.K. Lasser's Your Income Tax 2023: Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2023: Professional EditionNo ratings yet

- IncomeTax Banggawan2019 CH3Document13 pagesIncomeTax Banggawan2019 CH3Noreen Ledda50% (4)

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Income Taxation Finals Quiz 2Document7 pagesIncome Taxation Finals Quiz 2Jericho DupayaNo ratings yet

- Comprehensive Income Taxation Somera (4!29!14)Document200 pagesComprehensive Income Taxation Somera (4!29!14)Moi Warhead0% (1)

- Final Income Tax RulesDocument8 pagesFinal Income Tax RulesJade Ivy GarciaNo ratings yet

- Learn key income reporting principlesDocument15 pagesLearn key income reporting principlesRoligen Rose PachicoyNo ratings yet

- Income Tax Banggawan2019 Ch9Document13 pagesIncome Tax Banggawan2019 Ch9Noreen Ledda83% (6)

- SCRC 3 CorporationDocument18 pagesSCRC 3 CorporationChristine Yedda Marie AlbaNo ratings yet

- CHAPTER5Document16 pagesCHAPTER5Bisag Asa86% (7)

- Chapter5-Self-Test ExercisesDocument10 pagesChapter5-Self-Test ExercisesNeighvestNo ratings yet

- 2023-Exercises Law 1Document9 pages2023-Exercises Law 1abelonalysa0No ratings yet

- Final Tax PDFDocument50 pagesFinal Tax PDFMicol Villaflor Ü100% (1)

- CIC Midterm Exam Tax 1 BSADocument4 pagesCIC Midterm Exam Tax 1 BSARommel CruzNo ratings yet

- CRS Chapter 9 RIT Inclusions To Gross IncomeDocument60 pagesCRS Chapter 9 RIT Inclusions To Gross Incomesheryl ann dizonNo ratings yet

- Final Income Tax Rates and RulesDocument26 pagesFinal Income Tax Rates and RulesJason MablesNo ratings yet

- Activity 1 TAX1Document2 pagesActivity 1 TAX1Lovely Jane Raut CabiltoNo ratings yet

- Improperly Accumulated Earnings TaxDocument4 pagesImproperly Accumulated Earnings TaxSophia OñateNo ratings yet

- CPA Quizzer v.1 by Themahatma (CPAR 2016)Document9 pagesCPA Quizzer v.1 by Themahatma (CPAR 2016)John Mahatma Agripa100% (1)

- Tax ReviewDocument6 pagesTax ReviewAlbert Delos SantosNo ratings yet

- Final Income Tax RulesDocument5 pagesFinal Income Tax RulesPanda CocoNo ratings yet

- TAX-Chap 2-3 Question and AnswerDocument9 pagesTAX-Chap 2-3 Question and AnswerPoison Ivy0% (1)

- Tax by DimaampaoDocument90 pagesTax by Dimaampaoamun din100% (5)

- Tax ReviewerDocument62 pagesTax ReviewerFelixberto Jr. BaisNo ratings yet

- Gross IncomeDocument24 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Inclusion in Gross IncomeDocument3 pagesInclusion in Gross IncomeHi HelloNo ratings yet

- Banggawan ExercisesDocument100 pagesBanggawan ExercisesPeter Piper100% (1)

- Tax NotesDocument6 pagesTax NotesDeloria DelsaNo ratings yet

- Hapter: Income TaxesDocument40 pagesHapter: Income TaxesGray JavierNo ratings yet

- Chapter 11 - International TaxationDocument11 pagesChapter 11 - International TaxationlinaelinaaaNo ratings yet

- Ch12 LeasesDocument6 pagesCh12 LeasesralphalonzoNo ratings yet

- Unit 5 (A) - Financing DecisionDocument28 pagesUnit 5 (A) - Financing Decision2154 taibakhatunNo ratings yet

- 15statement of Cash FlowsDocument26 pages15statement of Cash FlowsLily DaniaNo ratings yet

- HQ04 - Final Income TaxationDocument5 pagesHQ04 - Final Income TaxationJimmyChaoNo ratings yet

- Midterm Tax Exam GuideDocument4 pagesMidterm Tax Exam GuideErwin Labayog Medina0% (1)

- 02 Corporate Income TaxDocument10 pages02 Corporate Income TaxbajujuNo ratings yet

- Tax For Rental Income in The PhilippinesDocument3 pagesTax For Rental Income in The PhilippinesRESIE GALANGNo ratings yet

- Passive IncomeDocument31 pagesPassive IncomeE.D.J100% (1)

- True or FalseDocument76 pagesTrue or FalsepangytpangytNo ratings yet

- Individual Income Tax GuideDocument15 pagesIndividual Income Tax GuideChristelle JosonNo ratings yet

- Tax ReviewerDocument10 pagesTax Revieweraira nialaNo ratings yet

- Chapter 5 Final TaxDocument2 pagesChapter 5 Final Taxcherry blossomNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- Final Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Document109 pagesFinal Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Bien Bowie A. CortezNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- Afghanistan Tax Card FinalDocument17 pagesAfghanistan Tax Card FinalSalman XrNo ratings yet

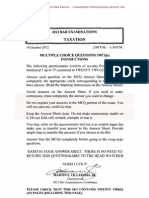

- 2012 Bar Examinations On TaxationDocument19 pages2012 Bar Examinations On Taxationjamaica_maglinteNo ratings yet

- RMO No. 27-2016Document5 pagesRMO No. 27-2016Romer LesondatoNo ratings yet

- Corporation and Estate Taxation - Sample ProblemDocument5 pagesCorporation and Estate Taxation - Sample Problemwind snip3r reojaNo ratings yet

- Real Estate Tax PlanningDocument4 pagesReal Estate Tax PlanningSuman SethNo ratings yet

- TAX 1 ReviewerDocument3 pagesTAX 1 ReviewerMarrielDeTorresNo ratings yet

- Taxation Law: ChanroblesvirtualawlibraryDocument7 pagesTaxation Law: ChanroblesvirtualawlibraryJms SapNo ratings yet

- Percentage Tax Rates and Requirements Review QuestionsDocument23 pagesPercentage Tax Rates and Requirements Review QuestionsDanzen Bueno Imus0% (1)

- Final Quiz and SeatworkDocument3 pagesFinal Quiz and SeatworkMikaela SungaNo ratings yet

- 2015 VC Report LetterDocument20 pages2015 VC Report Lettermanny42No ratings yet

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoNo ratings yet

- Final Income TaxationDocument44 pagesFinal Income TaxationKimberly Ann Romero100% (2)

- Income Taxation Lesson 3Document6 pagesIncome Taxation Lesson 3DYLANNo ratings yet

- RPC 2 - CasesDocument2 pagesRPC 2 - CasesKenneth Bryan Tegerero TegioNo ratings yet

- Bar Bulletin 7Document20 pagesBar Bulletin 7Alimozaman DiamlaNo ratings yet

- Project BCDocument1 pageProject BCKenneth Bryan Tegerero TegioNo ratings yet

- Bv&eps ToaDocument2 pagesBv&eps ToaKenneth Bryan Tegerero TegioNo ratings yet

- CPA Review - BMBE Notes - 2019Document1 pageCPA Review - BMBE Notes - 2019Kenneth Bryan Tegerero TegioNo ratings yet

- Representation - Concealment - Q and A - For DistributionDocument3 pagesRepresentation - Concealment - Q and A - For DistributionKenneth Bryan Tegerero TegioNo ratings yet

- DAM - Special ProceedingsDocument41 pagesDAM - Special ProceedingsKenneth Bryan Tegerero TegioNo ratings yet

- Bernas - Conflict of Laws Syllabus (Reading List) Nov 2008 To 2009 FinalDocument7 pagesBernas - Conflict of Laws Syllabus (Reading List) Nov 2008 To 2009 Finallex libertadore100% (1)

- Donor's Tax Ruling AppealDocument11 pagesDonor's Tax Ruling AppealKenneth Bryan Tegerero Tegio100% (1)

- CPA Review - VAT Quizzer - 2019Document11 pagesCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- Exam - Tax - 2019 - KeyDocument2 pagesExam - Tax - 2019 - KeyKenneth Bryan Tegerero Tegio0% (1)

- Actrev 4 2019Document2 pagesActrev 4 2019Kenneth Bryan Tegerero TegioNo ratings yet

- Lesson PlanDocument2 pagesLesson PlanKenneth Bryan Tegerero TegioNo ratings yet

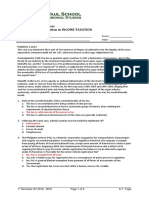

- Accountancy Department Preliminary Examination in INCOME TAXATIONDocument6 pagesAccountancy Department Preliminary Examination in INCOME TAXATIONKenneth Bryan Tegerero TegioNo ratings yet

- Chapter 27 Forensics MCQbarbosaDocument4 pagesChapter 27 Forensics MCQbarbosaKenneth Bryan Tegerero TegioNo ratings yet

- Obe Course Syllabus: BlawregDocument3 pagesObe Course Syllabus: BlawregKenneth Bryan Tegerero TegioNo ratings yet

- General provisions on insurable interestDocument5 pagesGeneral provisions on insurable interestKenneth Bryan Tegerero TegioNo ratings yet

- Law On Evidence PointersDocument6 pagesLaw On Evidence PointersKenneth Bryan Tegerero TegioNo ratings yet

- Special Exam TaxDocument11 pagesSpecial Exam TaxKenneth Bryan Tegerero TegioNo ratings yet

- Taxation - Review - BSA - LGC, OIC - 2018NDocument9 pagesTaxation - Review - BSA - LGC, OIC - 2018NKenneth Bryan Tegerero TegioNo ratings yet

- Answer Key - Conflict of Laws - TegioDocument1 pageAnswer Key - Conflict of Laws - TegioKenneth Bryan Tegerero TegioNo ratings yet

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Special Exam TaxDocument1 pageSpecial Exam TaxKenneth Bryan Tegerero TegioNo ratings yet

- Special Exam TaxDocument11 pagesSpecial Exam TaxKenneth Bryan Tegerero TegioNo ratings yet

- Chapter 1 - FS AnalysisDocument40 pagesChapter 1 - FS AnalysisKenneth Bryan Tegerero Tegio100% (2)

- Special Exam TaxDocument11 pagesSpecial Exam TaxKenneth Bryan Tegerero TegioNo ratings yet

- Actrev2 - InvestmentsDocument19 pagesActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- AsapDocument3 pagesAsapKenneth Bryan Tegerero TegioNo ratings yet

- AccountStatement 17 NOV 2023 To 17 DEC 2023Document3 pagesAccountStatement 17 NOV 2023 To 17 DEC 2023yoxavex125No ratings yet

- (自练) Telco startup market expansion - Lucy - 20210731Document10 pages(自练) Telco startup market expansion - Lucy - 20210731VictoriaNo ratings yet

- Rbse Class 12 Accountancy Question Paper 2020Document10 pagesRbse Class 12 Accountancy Question Paper 2020rajwanikajal24No ratings yet

- Public Notice of MMCS Ownership Stake in Manono Lithium RightsDocument2 pagesPublic Notice of MMCS Ownership Stake in Manono Lithium RightsRobert AmsterdamNo ratings yet

- Sale of Goods Act 1930Document27 pagesSale of Goods Act 1930urvashi bansalNo ratings yet

- Taco 02Document1 pageTaco 02Koushik RoyNo ratings yet

- Reorder Point (Rop) Methods in X Pharmacy, District WenangDocument6 pagesReorder Point (Rop) Methods in X Pharmacy, District WenangMiftahThariqNo ratings yet

- Business-Model-Canvas - 2 - XenithDocument2 pagesBusiness-Model-Canvas - 2 - XenithSwarup PottaNo ratings yet

- Annex Table 26. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2008Document3 pagesAnnex Table 26. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2008Ramona PalaghianuNo ratings yet

- Service Marketing - Singapore Airline - Group 6Document7 pagesService Marketing - Singapore Airline - Group 6Chiku JainNo ratings yet

- Inventory and MRP problemsDocument4 pagesInventory and MRP problemsKhiren MenonNo ratings yet

- Managerial Economics and Business Finance MCQDocument5 pagesManagerial Economics and Business Finance MCQShaik Mohammad MujeebNo ratings yet

- Proformarechnung 11479 PDFDocument2 pagesProformarechnung 11479 PDFNicolae HincuNo ratings yet

- Chapter 5 - Accounting EquationDocument17 pagesChapter 5 - Accounting EquationRiya AggarwalNo ratings yet

- Textbook On International Trade and Business LawDocument25 pagesTextbook On International Trade and Business LawLyra Joy CalayanNo ratings yet

- BBA CAM 5th Semester Service Marketing Model Question PaperDocument4 pagesBBA CAM 5th Semester Service Marketing Model Question PaperShipra BhutaniNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummarymerrwonNo ratings yet

- Bank Statement 2Document6 pagesBank Statement 2Iseay100% (1)

- Chapter 10 Cycle InventoryDocument32 pagesChapter 10 Cycle InventoryTeklay TesfayNo ratings yet

- Reading 25 Non-Current (Long-Term) LiabilitiesDocument18 pagesReading 25 Non-Current (Long-Term) LiabilitiesARPIT ARYANo ratings yet

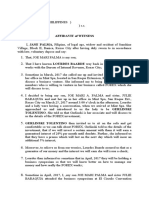

- Witness Affidavit on 400k Forex Investment ScamDocument2 pagesWitness Affidavit on 400k Forex Investment ScamAn-ja Burio VillalobosNo ratings yet

- Workflow v1.06 EnglishDocument2 pagesWorkflow v1.06 Englishfake.mNo ratings yet

- PowerPoint PresentationDocument221 pagesPowerPoint PresentationPutri jayantiNo ratings yet

- Financial Statement and Cash Flow AnalysisDocument31 pagesFinancial Statement and Cash Flow AnalysismialossNo ratings yet

- Legal Forms Assign 2Document41 pagesLegal Forms Assign 2Alyssa joy TorioNo ratings yet

- Procter and GambleDocument36 pagesProcter and Gambleamnaarshad100% (1)

- Week 2 National Income-2Document41 pagesWeek 2 National Income-2elijah thonNo ratings yet

- Google InvoiceDocument1 pageGoogle Invoicevetal.perov93No ratings yet

- Application For Registration As An Australian Company: 1 State/territory of RegistrationDocument10 pagesApplication For Registration As An Australian Company: 1 State/territory of Registrationquaz4No ratings yet

- Chapter 3 Assignment 2Document5 pagesChapter 3 Assignment 2Jatin MittalNo ratings yet