Professional Documents

Culture Documents

Mahindra Aftermarket - MFCS Caselet - 19jul18 - RELEASE V1.0 - Cas - 811

Uploaded by

Aekansh JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mahindra Aftermarket - MFCS Caselet - 19jul18 - RELEASE V1.0 - Cas - 811

Uploaded by

Aekansh JainCopyright:

Available Formats

Mahindra War Room 2018 Aftermarket - MFCS Caselet

MAHINDRA AFTERMARKET - SERVICES BUSINESS CASELET

GOING BIG & BOLD INTO THE INDEPENDENT AFTERMARKET BUSINESS

India is the 4th largest automotive market in the world, and is part of the holy

triumvirate of China and USA as the world’s most important automotive markets.

About 3.2 million new cars were bought last year, growing about 9% over the

previous year. Most of the global automotive majors have set up shop in India,

with several of them opening large plants in various parts of the country. But a

large demand of 4 wheeled transport is also met by ‘Used’ cars - popularly

called “second hand" cars in the commonwealth countries and “aftermarket” or

“pre-owned” cars in the Americas. Over 60% of the entrants into the 4-wheeler

market prefer to buy a used car, to familiarize themselves with the vagaries of

driving, as well as to economize on the purchase. In the United States - the

cradle of automotive industry - about 3 used cars sell for every new car sold. In

Europe, 2 used cars sell for every new car. In India, last year, about 3.6 million

used cars were sold, representing 1.3 used cars for every used car. It is

expected that the used car market will grow significantly in the coming years,

moving the ratio of used to new cars closer to developed market averages, all

the more because of the large “feeder market” of two wheeler market. India is

now the largest two wheeler market in the world, overtaking China last year.

About 20 million two wheelers sold last year in India - that is 54,000 units every

day of last year. No wonder our roads seem more crowded everyday! Thus the

prospects of growth in the used car market in the coming years is indeed high!

Yet, the market was largely “unorganized” even till a decade ago. Sellers would

often palm off substandard products to buyers and disappear later, forcing a

large number of people to buy used cars within their social circle of family,

friends, acquaintances and references.

The Mahindra Group was among the first to spot the large opportunity in used

cars. In fact, Mahindra was slightly ahead of time while founding

‘AutomartIndia.com’ in 1998. The entity was restructured in 2007 as

‘FirstChoice’, with a mission to make the process of buying and selling used

cars as rewarding as a new car. Mahindra FirstChoice Wheels (MFCW) would

pursue the opportunity in multi-brand used-car retailing, while Mahindra First

Choice Services (MFCS) pursued the opportunity in servicing of both new and

Broadvision Perspectives Client Confidential 1 of 6

Mahindra War Room 2018 Aftermarket - MFCS Caselet

used cars. While MFCW opened a large used car superstore, MFCS pioneered

the concept of a 118-point quality check, offering warranty for used cars across

brands. MFCW soon expanded into over 1400 outlets across 700+ towns - both

company owned and franchise owned. MFCS has a footprint of over 34

warehouses servicing 353 Franchisees. Both businesses have a strong digital

footprint, spanning Indian Blue Book, AutoInspekt, Yard Management Solutions,

CarWorkz aggregator app of independent garages and so on. This caselet

pertains to the MFCS business - there is another independent caselet

pertaining to the MFCW business.

An Indian customer looking to service his or her car has a plethora of options

today - Original Equipment Manufacturer (OEM) Authorized Service Centers,

Independent Garages or Local Mechanics. The costs and benefits of servicing a

car vary depending on where one chooses to service the car. At one end of the

spectrum are “car mechanics” who offer a low cost but variable quality services.

Their use of genuine spare parts, and the standards of service offered vary wildly

unless the customer knows the mechanic or owner personally or has a history of

positive relationship. At the other end of the spectrum is the “Authorized Service

Centre”, often attached to the OEM’s dealership, where the cost of servicing is

significantly higher, but it comes with an assurance of greater standardization of

service and usage of genuine spares, as it is backed by a large brand.

Mahindra First Choice Services is positioned between the two, where one can

get the trusted high quality service experience of an OEM authorized service

centre, at a significantly lower price point, though the price will still be higher

than a local mechanic. MFCS adds significant value in customer service, such

as a one-stop, one-roof solution for servicing, accident repair and insurance,

pick-up and drop-off, towing services during breakdown or accident, on-line

appointments and transparent costing.

Over the last decade, both OEM Authorized Service Centers and MFCS have

not managed to attain full utilization of their capacities, though they have

expanded their networks significantly. A part of the reason is the cost of service

- a large number of automotive customers are still comfortable with the cost-

quality equation of their friendly neighborhood car mechanic whom they trust,

rather than an impersonal but professional authorized service centre. Promising

Broadvision Perspectives Client Confidential 2 of 6

Mahindra War Room 2018 Aftermarket - MFCS Caselet

upstarts such as CarNation and myTVS have practically shut down completely

or scaled down significantly. MFCS has stayed on with the strong backing of the

Mahindra Group and has proved its viability, though not entirely.

After dabbling with both company owned and franchisee owned models, MFCS

now operates 353 Franchisee Owned and Operated outlets across India, and a

further network of 34 warehouses which supply spare parts required by these

outlets. Franchisees are located between 50-200 kms from the warehouse, pay

cash and carry the spare parts they need from the warehouse. Delivering the

spare part asked on demand to the Franchisee is essential for MFCS to

succeed, as the Franchisee would find it difficult to keep the customer waiting

for his or her car to be serviced, while waiting for the spare part from MFCS. The

Franchisee may then source the spare part locally resulting in loss of business to

MFCS. At the same time, maintaining high inventory is a high cost option. Spare

Parts Management is thus very crucial for success in this business. About 70%

of spare parts used by value are specific while 30% are generic products (such

as oils, grease, filters etc.) With the large franchisee base, MFCS is now able to

realize economies of scale by accessing spare parts directly from

manufacturers, instead of intermediaries.

A Franchisee enrolls into MFCS by investing anywhere between INR. 65 Lacs to

INR. 1 crore, including a security deposit and monthly fee. All other costs are

borne by the Franchisee. The outlet where the Franchisee operates may be

owned or rented. MFCS adds value to the Franchisee through strong back-end

support, including technical know-how, equipment sourcing, set-up, process

training, SAP implementation, spare parts supply and business development.

During enrollment, Franchisees are generally confident of sourcing all the

business they need, but over time seek support from MFCS to generate

customer foot falls at their service centres.

Apart from managing Franchisees, MFCS also sources and supplies private-

label spare parts, and has developed CarWorkz as a potential platform

aggregator for the 70,000 independent garages in the country. MFCS is also

dabbling with Express Format servicing centre in petrol pumps and two wheeler

servicing, as potential areas of future growth.

Broadvision Perspectives Client Confidential 3 of 6

Mahindra War Room 2018 Aftermarket - MFCS Caselet

LIVE CHALLENGE: GOING BIG & BOLD INTO THE INDEPENDENT

AFTERMARKET BUSINESS

Estimated point to over 65 million vehicles plying the Indian roads today -

including cars, 2-wheelers, 3-wheelers and commercial vehicles. Collectively

their servicing needs is estimated at INR. 50,000 crores per annum. This

estimation is based on a broad definition that spans Service Centre revenues

including “cashless insurance claims” and Spare Part sales, across Cars, Two

Wheelers and Commercial Vehicles. Over the next 3 years, this is expected to

grow to INR. 65,000 crores. The OEM Authorized Service Centers are expected

to capture half of this pie, with the rest of the market remaining open for the

“Independent Aftermarket” segment. The Independent Aftermarket segment is

expected to grow to INR. 32,500 crores in the next 3 years, with the following

estimates:

SEGMENT SHARE ESTIMATED SIZE

2-WHEELERS 40% ~ INR. 13,000 CRORES

CARS 35% ~ INR. 11,500 CRORES

COMMERCIAL VEHICLES (INCL. 3W) 25% ~ INR. 8,000 CRORES

TOTAL REVENUES ~ INR. 32,500 CRORES

Thus far, MFCS was pursuing a vision to reach the #3 position in Car Servicing,

focused on Out of Warranty cars, but this is not amounting to the financial scale

aspired. Hence, MFCS has revised its vision to attain #1 position in the entire

Independent Aftermarket, estimated at INR. 32,500 crores as described

above, over the next 5 years. This is no doubt a lofty vision, and requires

action across one or more of 3 levers:

Lever 1: A historical challenge for MFCS has been increasing footfall of

customers into the Franchisee Service Centres across the board. Studies show

that while over 80% of cars are technically in need of some type of service or

repair, only 52% of car owners choose to service their cars seasonally. Many

owners are not interested in doing preventive maintenance beyond fluid checks

and tyres, expecting their automobiles to be maintenance-free. The growth of

Broadvision Perspectives Client Confidential 4 of 6

Mahindra War Room 2018 Aftermarket - MFCS Caselet

app-driven shared economy also compounds the situation - on the one hand it

diminishes automotive sales and therefore the need for service; on the other, it

increases the need for servicing as the aggregator cars are more intensively

used! Last year, MFCS ran a campaign called ‘Free Ke Baad First Choice’ to lure

customers into the Service Centres after their free service from the OEM is

exhausted, with some success. But MFCS is looking for a disruptor here. Can

MFCS expand its service offerings into 2-Wheelers, 3-Wheelers and

Commercial Vehicles? Is this feasible technically? Does it require additional

investments and if so how much? What is the current pattern of behavior of

servicing among 2-wheelers, 3-wheelers and commercial vehicle

customers? Can MFCS expand the pie dramatically by opening up to these

vehicle categories?

Lever 2: Selling private label spare parts into the “Bazaar Channel” - which

comprises wholesalers, distributors and retailers who buy from aftermarket

companies and sell into the “car mechanics” or independent garages - is

another significantly large opportunity. Last year, about INR. 15,000 crores worth

of independent after market spare parts is sold by companies such as Bosch,

Anand Group, Minda, Valeo, TVS group etc. Bosch is the leader here with

revenues of INR. 2500 crores with the distant No.2 estimated at INR. 400-700

crores. MFCS has developed its own brand of spare parts called “MFC Parts”

and has developed a network of 75 distributors with a unique business model

that is doing reasonably well. Since MFCS does not manufacture these parts,

they face the “cost vs quality” conundrum in developing sources aggressively

and expanding the range of products. While the sales to the network of

Franchisees can expedite the economies of scale in sourcing, what

strategy should MFCS adopt in sourcing, logistics, sales & marketing, to

scale the Bazaar Channel sales substantially? Can it compete with the likes

of Bosch and carve out a market share of say 15% in the next 5 years?

Lever 3: In developed markets such as the United States, Service Centres have

a strong “preferred partner” tie-up with Insurance companies, which divert the

large volume of accident repair businesses directly to the preferred partners.

Such tie ups help the Insurance companies to reduce their claim costs, by

consolidating their volume with their preferred partners. In India, such tie ups are

Broadvision Perspectives Client Confidential 5 of 6

Mahindra War Room 2018 Aftermarket - MFCS Caselet

in a nascent form of “cashless” accidental repair, where in the customer can

repair their vehicle at a Service Centre who would then bill and collect from the

Insurance company. But the direct tie up with the Insurance Companies and

benefiting from the large volume of diverted accidental repair business is yet to

be realized. Can Mahindra sell this value proposition and become the

preferred partner to Insurance companies? What is the landscape of these

insurance companies today? What would it take for them to offer a

preferred status to MFCS?

Given this backdrop, evolve a strategy for Mahindra First Choice Services

to attain the #1 Position in the Independent Aftermarket within the next 5

years, by pursuing one or more of the above 3 levers.

Broadvision Perspectives Client Confidential 6 of 6

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 275-0468 Caja As-Transmission - FrontDocument2 pages275-0468 Caja As-Transmission - FrontLit Rut Morocho VillaltaNo ratings yet

- 8.king Pin Kit List (English) - NamYang - UpdatedDocument3 pages8.king Pin Kit List (English) - NamYang - UpdatedTommy CamposNo ratings yet

- Cadic Catalogue 2018 PDFDocument27 pagesCadic Catalogue 2018 PDFChiito Vidal100% (1)

- CDM816DSpare Parts Manual (Pilot Control) 2Document55 pagesCDM816DSpare Parts Manual (Pilot Control) 2Mohammadazmy Sobursyakur100% (1)

- Body Repair: SectionDocument11 pagesBody Repair: SectionTony RojasNo ratings yet

- The Big Loom Thread - Information For Loom Types & Conversion WiringDocument5 pagesThe Big Loom Thread - Information For Loom Types & Conversion WiringniposomtecnicaNo ratings yet

- DesignofSteeringSystem DraftDocument11 pagesDesignofSteeringSystem DraftAndy ChangNo ratings yet

- LanternaDocument7 pagesLanternaCristi StefanNo ratings yet

- Dealer Code Customer Name Phone Number Enq Number Enq DateDocument5 pagesDealer Code Customer Name Phone Number Enq Number Enq DateAbhi SharmaNo ratings yet

- Catalogo WixDocument39 pagesCatalogo WixFILTROSNo ratings yet

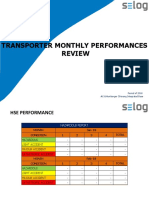

- Performance Review Jan - Feb 2018 SELOGDocument10 pagesPerformance Review Jan - Feb 2018 SELOGApriandi SetiawanNo ratings yet

- 5 SPEED RWD (Electronic Control)Document4 pages5 SPEED RWD (Electronic Control)Marcos_mfa100% (1)

- Predective Powertrain ControlDocument10 pagesPredective Powertrain ControlFrancisco ArroyoNo ratings yet

- The New Volkswagen Taigun: Hustle Mode OnDocument11 pagesThe New Volkswagen Taigun: Hustle Mode OngauravNo ratings yet

- Error Log Passat B6Document13 pagesError Log Passat B6Daniel NastaseNo ratings yet

- Electronic Stability ProgramDocument23 pagesElectronic Stability ProgramdwiudNo ratings yet

- Vehicle LayoutsDocument7 pagesVehicle LayoutscecilchifticaNo ratings yet

- Lesson 8 Car Safety and Newtons LawsDocument17 pagesLesson 8 Car Safety and Newtons Lawsyuno nAHNo ratings yet

- Para Transit System in India - A Case Study of Chennai - Madhu S - MindTEXTDocument3 pagesPara Transit System in India - A Case Study of Chennai - Madhu S - MindTEXTROHIT GUPTANo ratings yet

- Cezary EssayDocument2 pagesCezary EssaydonNo ratings yet

- 2015 Honda Civic Coupe Owner's ManualDocument441 pages2015 Honda Civic Coupe Owner's Manualred eagle winsNo ratings yet

- Brake: Application GuideDocument16 pagesBrake: Application GuideellenNo ratings yet

- Vehicle Registration Numbers and Number PlatesDocument12 pagesVehicle Registration Numbers and Number PlatesSam HarrisonNo ratings yet

- Caterpillar 769DDocument3 pagesCaterpillar 769DMargaretha Frida PrayudithaNo ratings yet

- U-Series Transaxles: Section 2Document20 pagesU-Series Transaxles: Section 2raghu7862No ratings yet

- Car AssignmentDocument80 pagesCar AssignmentVineet SharmaNo ratings yet

- Каталог Ремкомплектов Для СуппортовDocument156 pagesКаталог Ремкомплектов Для СуппортовДмитрий ГоринNo ratings yet

- Theoritical Driving Course 123Document46 pagesTheoritical Driving Course 123Patrick P. ParconNo ratings yet

- Hyundai Motor India Limited Industrial ReportDocument10 pagesHyundai Motor India Limited Industrial ReportSudheer KumarNo ratings yet

- Ford Ecosport Trend 1.5L Ti-VCT Owners ManualDocument236 pagesFord Ecosport Trend 1.5L Ti-VCT Owners ManualJoeDabid100% (1)