Professional Documents

Culture Documents

CF Memo On Pension Reform

Uploaded by

Commonwealth FoundationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CF Memo On Pension Reform

Uploaded by

Commonwealth FoundationCopyright:

Available Formats

MEMORANDUM

TO: Members of the Pennsylvania Senate

FROM: Matthew J. Brouillette, Commonwealth Foundation

CC: Members of the Media

DATE: October 5, 2010

RE: Public Pension Reform

As the 2009-10 legislative session winds down and the announcement of the death of HB 2497 may have

been premature, I would like to reaffirm the need for sustainable and comprehensive public pension

reform.

This five-step approach to pension reform is based upon the indisputable need to remove politics from the

public pension system. While the current economic downturn has dramatically increased the unfunded

liabilities in PSERS, SERS, and thousands of other public pension plans, it is the political nature of

defined-benefit pension plans that puts Pennsylvanians in serious financial jeopardy.

The experience in the private sector shows that defined-contribution plans are the only means by which

Pennsylvania can remove politics from the public pension system while ensuring that taxpayer costs are

“current” (paid for as earned), predictable (in the future) and affordable (not exceeding 7% of payroll

after any required employee contributions).

In short, true pension reform must consider the long-term effects and all people (such as SB 566), not

simply short-term effects and a few people (such as HB 2497).

Attached is a summary of what true pension reform looks like, followed by a contrast with “non-reform”

reforms that have failed in both the private and public sectors. These “non-reforms” represent an easier

political solution in an attempt to mollify public employee labor unions, but they create unsustainable

risks and liabilities leading to “Generational Theft.”

Fortunately, the people of Pennsylvania support true pension reform. According to an April 2010 poll by

Susquehanna Polling and Research Company, voters—Democrats, Republicans, and Independents

alike—favor legislation that would place all new government hires in a 401(k)-type retirement plan (such

as SB 566), rather than the defined-benefit pension plans in which government workers are currently

enrolled.

Q: Most government employees - including teachers, state workers, judges, and legislators - receive a pension plan which provides

a guaranteed annual payment upon retirement. There is legislation to move all new government employees to a 401(k) type plan,

similar to what many employees in the private sector receive. Generally speaking, do you favor or oppose this legislation?

Total Favor Total Oppose Undecided/Refused

All Voters 54% 34% 12%

Republican 58% 33% 9%

Democrat 50% 36% 14%

Independent 60% 29% 11%

If you would like additional information or would like to further discuss pension reform with me or Rick

Dreyfuss, our pension expert and actuary, please contact me at 717.671.1901 or at

mjb@commonwealthfoundation.org or Rick Dreyfuss at rcd@commonwealthfoundation.org.

You might also like

- Memo in Support of DOC and PBPP MergerDocument2 pagesMemo in Support of DOC and PBPP MergerCommonwealth FoundationNo ratings yet

- Calpine RGGI LawsuitDocument208 pagesCalpine RGGI LawsuitCommonwealth FoundationNo ratings yet

- Constitutional and Legal Requirements of A Balanced Budget in PennsylvaniaDocument1 pageConstitutional and Legal Requirements of A Balanced Budget in PennsylvaniaCommonwealth FoundationNo ratings yet

- UFCW 1776 LetterDocument1 pageUFCW 1776 LetterCommonwealth FoundationNo ratings yet

- Pennsylvania Government Flow ChartDocument1 pagePennsylvania Government Flow ChartCommonwealth FoundationNo ratings yet

- Commonwealth Foundation Testimony On RGGI 10.28.19Document3 pagesCommonwealth Foundation Testimony On RGGI 10.28.19Commonwealth FoundationNo ratings yet

- Pennsylvanians Flee From High TaxesDocument4 pagesPennsylvanians Flee From High TaxesCommonwealth FoundationNo ratings yet

- Charter Testimony October 2016Document6 pagesCharter Testimony October 2016Commonwealth FoundationNo ratings yet

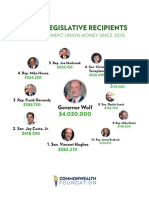

- Top 10 Legislative Recipients of Union Political MoneyDocument1 pageTop 10 Legislative Recipients of Union Political MoneyCommonwealth FoundationNo ratings yet

- SAT Scores by State 2015Document2 pagesSAT Scores by State 2015Commonwealth FoundationNo ratings yet

- Vape Tax VictimsDocument2 pagesVape Tax VictimsCommonwealth FoundationNo ratings yet

- Social Impacts of Liquor PrivatizationDocument6 pagesSocial Impacts of Liquor PrivatizationCommonwealth FoundationNo ratings yet

- Obamacare Has Harmed Pennsylvania FamiliesDocument2 pagesObamacare Has Harmed Pennsylvania FamiliesCommonwealth FoundationNo ratings yet

- Pennsylvania Sat 1986-2011 (Intern's Conflicted Copy 2016-06-16)Document13 pagesPennsylvania Sat 1986-2011 (Intern's Conflicted Copy 2016-06-16)Commonwealth FoundationNo ratings yet

- What Is Paycheck Protection?Document1 pageWhat Is Paycheck Protection?Commonwealth FoundationNo ratings yet

- How Workers Are Forced To Fund Attack AdsDocument2 pagesHow Workers Are Forced To Fund Attack AdsCommonwealth FoundationNo ratings yet

- Mary Isenhour Letter To PERCDocument2 pagesMary Isenhour Letter To PERCCommonwealth FoundationNo ratings yet

- DPW Welfare Waste, Fraud & Abuse SavingsDocument2 pagesDPW Welfare Waste, Fraud & Abuse SavingsCommonwealth FoundationNo ratings yet

- PA Pension ReformDocument31 pagesPA Pension ReformCommonwealth FoundationNo ratings yet

- AFSCME Local 2528 PAC SolicitationDocument3 pagesAFSCME Local 2528 PAC SolicitationCommonwealth FoundationNo ratings yet

- Patient-Centered Medicaid Reform ActDocument14 pagesPatient-Centered Medicaid Reform ActCommonwealth FoundationNo ratings yet

- Public Pensions: Past, Present and FutureDocument2 pagesPublic Pensions: Past, Present and FutureCommonwealth FoundationNo ratings yet

- Pennsylvania's Pension Crisis: Facts and MythsDocument2 pagesPennsylvania's Pension Crisis: Facts and MythsCommonwealth FoundationNo ratings yet

- Commonwealth Foundation RTKDocument10 pagesCommonwealth Foundation RTKCommonwealth FoundationNo ratings yet

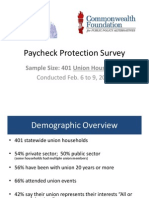

- Paycheck Protection Survey: Sample Size: 401 Union HouseholdsDocument7 pagesPaycheck Protection Survey: Sample Size: 401 Union HouseholdsCommonwealth FoundationNo ratings yet

- Unsinkable: The True Story of Pennsylvania's Sinking Pension SystemDocument1 pageUnsinkable: The True Story of Pennsylvania's Sinking Pension SystemCommonwealth FoundationNo ratings yet

- Liquor Privatization Facts and MythsDocument2 pagesLiquor Privatization Facts and MythsCommonwealth FoundationNo ratings yet

- Comparison ChartDocument1 pageComparison ChartCommonwealth FoundationNo ratings yet

- FM3 Privatization PollDocument15 pagesFM3 Privatization PollCommonwealth FoundationNo ratings yet

- Letter To Corbett: Reject Medicaid ExpansionDocument4 pagesLetter To Corbett: Reject Medicaid ExpansionCommonwealth FoundationNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Estrada Vs ArroyoDocument2 pagesEstrada Vs ArroyoPhoebe M. PascuaNo ratings yet

- W.O. Douglas - Stare DecisisDocument25 pagesW.O. Douglas - Stare DecisisArnOmkarNo ratings yet

- Modern History Amy R Conflict in EuropeDocument37 pagesModern History Amy R Conflict in EuropeBryan Ngo100% (1)

- Espinosa v. OmanaDocument2 pagesEspinosa v. OmanaMarie Titular100% (3)

- Article Property and ProjectionDocument72 pagesArticle Property and ProjectionSergio Rodriguez de la HozNo ratings yet

- In The High Court of Delhi at New DelhiDocument12 pagesIn The High Court of Delhi at New DelhiJappreet SinghNo ratings yet

- Republic Act No. 1425Document11 pagesRepublic Act No. 1425jappkill90% (31)

- Brgy Sudlon IDocument2 pagesBrgy Sudlon Ijeremie nunezNo ratings yet

- HIS103 Lec 11 11-Point Movement & Mass Upsurge 1969Document13 pagesHIS103 Lec 11 11-Point Movement & Mass Upsurge 1969Taufiqur AnikNo ratings yet

- Ma. Hazelina Tujan Militante vs. Ana Kari Carmencita Nustad G.R. No. 209518Document2 pagesMa. Hazelina Tujan Militante vs. Ana Kari Carmencita Nustad G.R. No. 209518Nicasio Alvarez IIINo ratings yet

- US Internal Revenue Service: f56f AccessibleDocument2 pagesUS Internal Revenue Service: f56f AccessibleIRS100% (1)

- Newspaper Index: A Monthly Publication of Newspaper's ArticlesDocument32 pagesNewspaper Index: A Monthly Publication of Newspaper's Articlesasifali juttNo ratings yet

- Constitutional Law I Outline 2013Document29 pagesConstitutional Law I Outline 2013The Lotus Eater100% (2)

- Andrés David Montenegro, Locating Work in Santiago Sierra's Artistic Practice, Ephemera 13, 2013Document17 pagesAndrés David Montenegro, Locating Work in Santiago Sierra's Artistic Practice, Ephemera 13, 2013Santiago SierraNo ratings yet

- Basic Features of The Constitution - PrepLadderDocument9 pagesBasic Features of The Constitution - PrepLaddernavam singhNo ratings yet

- Three Tiers Do Not Fit All: The Constitutional Deficiencies of Sex Offender Super-Registration Schemes - Sarah GadDocument27 pagesThree Tiers Do Not Fit All: The Constitutional Deficiencies of Sex Offender Super-Registration Schemes - Sarah GadSarah_GadNo ratings yet

- 27-08-2017 - The Hindu - Shashi Thakur - Link 2Document41 pages27-08-2017 - The Hindu - Shashi Thakur - Link 2AKshita LaNiNo ratings yet

- Contractual Obligations - Legal AspectsDocument20 pagesContractual Obligations - Legal AspectsGeramer Vere DuratoNo ratings yet

- Voluntary Service in Germany: Voluntary Social Year - Freiwilliges Soziales Jahr (FSJ)Document3 pagesVoluntary Service in Germany: Voluntary Social Year - Freiwilliges Soziales Jahr (FSJ)Джейла ГусейноваNo ratings yet

- 8 Zulueta V MarianoDocument2 pages8 Zulueta V MarianoFritz SaponNo ratings yet

- Sangguniang Panlungsod NG Baguio City v. Jadewell Parking Systems Corporation G.R. No. 160025, April 23, 2014 Sereno, CJ. FactsDocument2 pagesSangguniang Panlungsod NG Baguio City v. Jadewell Parking Systems Corporation G.R. No. 160025, April 23, 2014 Sereno, CJ. FactsMichael Vincent BautistaNo ratings yet

- Stout v. Jefferson County (Alabama) - Doc 1001 - AttachmentsDocument385 pagesStout v. Jefferson County (Alabama) - Doc 1001 - AttachmentsTrisha Powell CrainNo ratings yet

- Final Report Criminal Justice Report Executive Summary and Parts I To IIDocument628 pagesFinal Report Criminal Justice Report Executive Summary and Parts I To IIsofiabloemNo ratings yet

- Taxation and Agrarian ReformDocument19 pagesTaxation and Agrarian ReformChelsweetNo ratings yet

- Badillo V CADocument5 pagesBadillo V CAjcb180% (1)

- Sworn Affidavit: Thousand Pesos (PHP 350,000.00) From The Companies, Fullwon Philippines EnterprisesDocument2 pagesSworn Affidavit: Thousand Pesos (PHP 350,000.00) From The Companies, Fullwon Philippines Enterprisesmicaella judelleNo ratings yet

- American HistoryDocument4 pagesAmerican HistorySamuel MwangiNo ratings yet

- Multi Party System Pol SCDocument20 pagesMulti Party System Pol SCKanchan VermaNo ratings yet

- Faqs DisciplineDocument2 pagesFaqs DisciplineDEEKSHALNo ratings yet

- Industrial Employment Act 1946Document26 pagesIndustrial Employment Act 1946samNo ratings yet