Professional Documents

Culture Documents

Weekly Technical Report - 300718-201807300920227372611

Uploaded by

AM PMOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Technical Report - 300718-201807300920227372611

Uploaded by

AM PMCopyright:

Available Formats

30 Jul 2018

RETAIL RESEARCH

Weekly Technical Report

Weekly Technical Report

A chart speaks one thousand words

“1st Target Attained – Nifty Headed Higher”

Technical Research Analyst: Gajendra Prabu

E-Mail: (gajendra.prabu@hdfcsec.com)

RETAIL RESEARCH P age |1

RETAIL RESEARCH

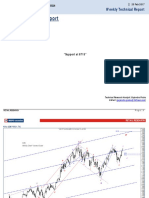

Nifty [CMP-11278.35]

RETAIL RESEARCH P age |2

RETAIL RESEARCH

Observations: [Earlier Indications are in Italics & All levels are in Nifty Spot/Cash]

Week’s action formed a strong bull candle post consolidation which indicates bulls are in strong positive momentum. This long bull candle could provide further

strength to bulls in coming week/s.

Index has surpassed the resistance of 11080 and provided a breakout post consolidation. As we had indicated earlier, on a rise above 11080 index headed to new life

high and 1st target of 11230 levels, high made was 11283 levels. The 2nd target of 11400 is yet to be attained in coming weeks/month. Unless index closes below

previous day’s low, index may attain the target in the current rising leg itself i.e. without providing meaningful downward retracement (fall). [After a sustained rally,

index is taking breather and consolidating at higher levels. Index could consolidate in narrow range between 10925 to 11080 levels; breakout or breakdown could

lead to further direction of the market for the next week. In bigger picture major “wave v” could develop for few more weeks/months for the target of 11230 –

11400 or above levels. In this span select Mid-Cap stocks could outperform to catch up after underperforming severely over the last few months. Overall maintain

bullish stance for the target on 11230 – 11400 in coming weeks. Medium term support is placed at 10700.]

Nifty has formed a new life high and is heading higher. As we had said Mid-Cap stocks are rebounding and gaining strong momentum, BSE Mid Cap index rose 4.6% in a

week’s span, still more room left on upside.

Index is rising in a channel setup which is a bullish development; there is more upside left to test the upper trendline of the channel.

However minimum requirement of this current rise has been done, so if any major selloff occurs (3-4% fall) within a week, then we can conclude a top has been made.

The higher tops and higher bottoms formation is continuing in all the degrees which is a bullish continuation structure and it could provide further strength to bulls to

head higher.

In bigger picture major “wave v” could continue to develop for few more weeks/month for the second target of 11400 or above levels.(1st target of 11230 attained)

Current rise is “wave c of v” so “wave d & e” are pending which means one falling leg and last rise. In case if we see any major selloff within a week then alternate count

will come into picture (less chance for this)(See next page)

Overall maintain bullish stance for the target of 11400 in coming weeks. Key support is placed at 11170. On any close below 11170 index could provide minor

correction to 11000 – 10950 levels (fall should not be sharp). Big picture positive bias will continue until we see any major weekly loss in Index. However we are in

major wave ’v’. Hence be watchful of possible reversal which can be the start of the correction of the entire rise from 6826.

As per our preferred wave count: Cycle degree “wave i” has started from 4531 level and ended at 6229. The “wave ii” has started from 6229 and ended at 5118. The

dynamic “wave iii” has started from 5118 and ended at 9119 with a couple of extensions. The larger fall from 9119 to 6825 was cycle degree “wave iv” down. Now we

are in cycle degree “wave v” which has tested our medium term target of 10000 Mark (We have been mentioning this target from Feb 04, 2017). The rise from 6825 to

8968 has five wave advance marked as major “wave i”, its internals can labelled as 1-2-3-4-5. The fall from 8968 to 7893 was double combination marked as major

“wave ii”, its internals are a-b-c-x-a-b-c. The rise from 7893 to 11171 was marked as major “wave iii”. The fall from 11171 to 9925 is “wave iv”. Currently “wave v” is in

progress from the low of 9952. Now major “wave v’s” internals are in development in which “wave a & b” has ended and “wave c, d & e” are pending. Overall the cycle

degree “wave v” is still in progress which could travel for few more month/s.

RETAIL RESEARCH P age |3

RETAIL RESEARCH

Nifty – Internals

The daily chart of Nifty shows internal

count structure.

“Wave v of iii” has ended at the high

of 11171. The fall from 11171 to 9952

is “wave iv”.

Major “wave v” is in progress from

9952. Inside “wave v”: rise from 9952

to 10929 is “wave a”. From 10929 to

10604 is “wave b” with extreme

internals on a-b-c-d-e which is

contracting triangle.

Now “wave c” is in progress from

10604 levels and it is continuing.

On Friday index rose with up gap

(range 11210 to 11185) which could

be key support zone; so support level

could be 11170. As long as index

stays above the support the current

rise (wave c) could head higher.

Gradual fall and close below 11170

will indicate “wave c” has ended and

“wave d” has begun from highs which

could provide minor correction to

11000 – 10950 or little lower.

Orange colour labels are alternate

count; this will come into picture only

if a major weekly loss is seen soon.

RETAIL RESEARCH P age |4

RETAIL RESEARCH

Disclosure:

We /I, (GAJENDRA PRABU), (MBA Finance), authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities.

HSL has no material adverse disciplinary history as on the date of publication of this report. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or

view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its Associate may have beneficial ownership of

1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any

material conflict of interest.

Any holding in stock – No

HDFC Securities Limited (HSL) is a SEBI Registered Research Analyst having registration no. INH000002475.

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended

to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other jurisdiction

where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HSL or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or published

for any purposes without prior written approval of HSL.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HSL may from time to time solicit from, or perform broking, or other services for, any company mentioned in this mail and/or its

attachments.

HSL and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other

transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such

company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HSL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not

restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HSL and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or other deals in these

securities from time to time or may deal in other securities of the companies / organizations described in this report.

HSL or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

HSL or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from t date of this report for services in respect of managing or co-managing

public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HSL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HSL nor Research

Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

HSL may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the subject company or third party in connection with the Research Report.

This report is intended for non-Institutional Clients only. The views and opinions expressed in this report may at times be contrary to or not in consonance with those of Institutional Research or PCG Research teams of HDFC

Securities Ltd. and/or may have different time horizons.

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066

Compliance Officer: Binkle R. Oza Email: complianceofficer@hdfcsec.com Phone: (022) 3045 3600

HDFC Securities Limited, SEBI Reg. No.: NSE-INB/F/E 231109431, BSE-INB/F 011109437, AMFI Reg. No. ARN: 13549, PFRDA Reg. No. POP: 04102015, IRDA Corporate Agent License No.: HDF 2806925/HDF C000222657, SEBI

Research Analyst Reg. No.: INH000002475, CIN - U67120MH2000PLC152193

RETAIL RESEARCH P age |5

You might also like

- Crypto Data EntryDocument98 pagesCrypto Data EntryMicky S TilahunNo ratings yet

- Fibonacci Miracle: User's ManualDocument16 pagesFibonacci Miracle: User's ManualPasquale RutiglianoNo ratings yet

- Trader Guide To SuccessDocument68 pagesTrader Guide To SuccessFede Braca89% (9)

- Wicktator Trade MaterialDocument11 pagesWicktator Trade MaterialrontechtipsNo ratings yet

- Aoi TemplateDocument4 pagesAoi TemplateAm MartinNo ratings yet

- MoneyShow RomanBogomazov March17,+2015 Final PDFDocument16 pagesMoneyShow RomanBogomazov March17,+2015 Final PDFHazemSamir100% (2)

- Exploratory Trading HarvardDocument26 pagesExploratory Trading HarvardtomNo ratings yet

- Using Planetary Harmonics To Find Key Reversals The MarketDocument8 pagesUsing Planetary Harmonics To Find Key Reversals The Marketpankaj1981us100% (2)

- Lecture 007 Premium DiscountDocument19 pagesLecture 007 Premium Discountvivekpandey65No ratings yet

- Extreme Reversals Part 2Document29 pagesExtreme Reversals Part 2mohamed hamdallah100% (1)

- Volatility Index 75 Macfibonacci Trading StrategyDocument5 pagesVolatility Index 75 Macfibonacci Trading StrategyRàví nikezim 100No ratings yet

- XJW 8 Q Uo O2 NX Tjlud C9 Oe 1597653088Document16 pagesXJW 8 Q Uo O2 NX Tjlud C9 Oe 1597653088mohd solihin bin mohd hasanNo ratings yet

- Head and Shoulders Pattern: Stock Chart Patterns AnalysisDocument9 pagesHead and Shoulders Pattern: Stock Chart Patterns AnalysisMOHD TARMIZINo ratings yet

- Forex - Chasers GideDocument13 pagesForex - Chasers GidecarrieNo ratings yet

- 5-0 Harmonic PatternDocument5 pages5-0 Harmonic PatternknsmadnessNo ratings yet

- CaseDocument3 pagesCaseAileean Irish100% (1)

- Sacred Algo - Full PDFDocument34 pagesSacred Algo - Full PDFTokyo bowyug100% (1)

- My MM TradingNotesDocument5 pagesMy MM TradingNotesnyagweyaNo ratings yet

- The Growth of Venture Capital-2003Document351 pagesThe Growth of Venture Capital-2003ahmadNo ratings yet

- Elliott Wave Trade SetupsDocument6 pagesElliott Wave Trade SetupsJack XuanNo ratings yet

- A Regarder Obligatoirement Boom&Crash Strategies (90 - Accuracy)Document51 pagesA Regarder Obligatoirement Boom&Crash Strategies (90 - Accuracy)lamine banceNo ratings yet

- Average True Range (ATR) Formula, What It Means, and How To Use ItDocument10 pagesAverage True Range (ATR) Formula, What It Means, and How To Use ItAbdulaziz AlshakraNo ratings yet

- PFX Forex Scalper EA - (Cost $1490) - For FREE - ForexCrackedDocument15 pagesPFX Forex Scalper EA - (Cost $1490) - For FREE - ForexCrackedOscar MorenoNo ratings yet

- BANKING INDUSTRY-Fundamental AnalysisDocument19 pagesBANKING INDUSTRY-Fundamental AnalysisGopi Krishnan.nNo ratings yet

- Lesson-4 World Trading HoursDocument14 pagesLesson-4 World Trading HoursKARTHIK P JAYSWAL 2123321No ratings yet

- Emperorbtc Trading ManualDocument188 pagesEmperorbtc Trading ManualChecker Nicolas100% (1)

- 3 Step Guide To ICT Rejection Block - ICTDocument3 pages3 Step Guide To ICT Rejection Block - ICTchadleruo099No ratings yet

- Forex VolatilityDocument25 pagesForex VolatilityNoufal AnsariNo ratings yet

- Transfer of Right of SharesDocument3 pagesTransfer of Right of Sharessaut pakpahan100% (1)

- 1002 MaddenDocument55 pages1002 MaddenAM PM100% (1)

- 4 PivotReversalScalpDocument20 pages4 PivotReversalScalpUnix 01No ratings yet

- ICT IdeasDocument4 pagesICT IdeasLloyd BolencesNo ratings yet

- High-Frequency Trading Should VVVVVVVVDocument31 pagesHigh-Frequency Trading Should VVVVVVVVSrinu BonuNo ratings yet

- Elliott Wave in The 21st Century: by Matt Blackman With Mike GreenDocument26 pagesElliott Wave in The 21st Century: by Matt Blackman With Mike GreennetcrazymNo ratings yet

- Trading Setup: 200 SMA Forex Day Trading StrategyDocument4 pagesTrading Setup: 200 SMA Forex Day Trading Strategycosming80No ratings yet

- Support and Resistance (The Holygrail)Document11 pagesSupport and Resistance (The Holygrail)Nmabuchi GeofferyNo ratings yet

- Strategy DetailDocument23 pagesStrategy DetailAlex MartínezNo ratings yet

- Momo 100 Forex Trading StrategyDocument8 pagesMomo 100 Forex Trading Strategythilaga_santhoshNo ratings yet

- Introduction To Big DataDocument11 pagesIntroduction To Big DatamokeNo ratings yet

- Introduction To Big DataDocument11 pagesIntroduction To Big DatamokeNo ratings yet

- The Double Shot Fibonacci StrategyDocument11 pagesThe Double Shot Fibonacci StrategyGio GameloNo ratings yet

- Value Chart + Fibos + Regression ChannelDocument14 pagesValue Chart + Fibos + Regression ChannelDavid EscaleiraNo ratings yet

- Jamess Scalp ModelDocument17 pagesJamess Scalp Modelbach jayNo ratings yet

- Supply & Demand PDFDocument19 pagesSupply & Demand PDFJoel SepeNo ratings yet

- Risk Entries: 1st Pattern (Sell)Document17 pagesRisk Entries: 1st Pattern (Sell)Arya WibawaNo ratings yet

- Summer Intership Project Bajaj FinservDocument51 pagesSummer Intership Project Bajaj FinservAMBIYA JAGIRDAR50% (2)

- Google Merchant CenterDocument3 pagesGoogle Merchant Centersakib sadmanNo ratings yet

- Lotk Trading: Lotktrading 1Document22 pagesLotk Trading: Lotktrading 1jorge perez100% (1)

- Rugged Liquidity Lock.Document24 pagesRugged Liquidity Lock.Joshua MosesNo ratings yet

- Strategy Overview - Fallen Angel and Rising DevilDocument4 pagesStrategy Overview - Fallen Angel and Rising DevilPaul DilimoțNo ratings yet

- 4.1 Forex Foundation Trading Course (2 Slides Per Page) PDFDocument35 pages4.1 Forex Foundation Trading Course (2 Slides Per Page) PDFARYOS 101No ratings yet

- Master Sheet - BootcampDocument144 pagesMaster Sheet - BootcampJeniffer RayenNo ratings yet

- Time Spent Trading 1-2 Hours/DayDocument10 pagesTime Spent Trading 1-2 Hours/DayStephanie JainarNo ratings yet

- Aliff AwangDocument50 pagesAliff AwangKrishnamohan YerrabilliNo ratings yet

- Ripster EMA Cloud SystemDocument4 pagesRipster EMA Cloud SystembambisylNo ratings yet

- KISS FOREX HOW TO TRADE ICHIMOKU SYSTEMS PROFITABLE SIGNALS - Part4Document20 pagesKISS FOREX HOW TO TRADE ICHIMOKU SYSTEMS PROFITABLE SIGNALS - Part4malick komlanNo ratings yet

- Backtesting Potential Reversal Zone With Harmonic Pattern Plus PDFDocument11 pagesBacktesting Potential Reversal Zone With Harmonic Pattern Plus PDFRaimundo MotaNo ratings yet

- Algo Trading Presentation PDFDocument18 pagesAlgo Trading Presentation PDFRavi ParikhNo ratings yet

- The Fingerprint of GodDocument8 pagesThe Fingerprint of GodMuranka BringalNo ratings yet

- CCI - Technical AnalysisDocument20 pagesCCI - Technical AnalysisqzcNo ratings yet

- v75 100Document6 pagesv75 100thirapaiahNo ratings yet

- 5 0 Supply Demand in Control, Definition and What It ImpliesDocument5 pages5 0 Supply Demand in Control, Definition and What It Impliesmikestar_tarNo ratings yet

- Basics of Candlesticks PDFDocument9 pagesBasics of Candlesticks PDFNguyen hoangNo ratings yet

- Trading JournalsDocument19 pagesTrading JournalsVijeshcNo ratings yet

- WWE 2k19 Tipps and TricksDocument72 pagesWWE 2k19 Tipps and TricksSome OneNo ratings yet

- COT Indicator Manual PDFDocument6 pagesCOT Indicator Manual PDFmajidyNo ratings yet

- COT Indicator Manual PDFDocument6 pagesCOT Indicator Manual PDFmajidyNo ratings yet

- Guide To Elliott Wave Analysis - RecogniaDocument5 pagesGuide To Elliott Wave Analysis - RecogniaIvonne TorrellasNo ratings yet

- Adfadfa DfadfadDocument58 pagesAdfadfa DfadfadAdamNo ratings yet

- Setting SL & TP in Harmonic TradingDocument1 pageSetting SL & TP in Harmonic TradingBiantoroKunarto0% (1)

- ReportDocument5 pagesReportDinesh ChoudharyNo ratings yet

- ReportDocument5 pagesReportDinesh ChoudharyNo ratings yet

- CML43575Document8 pagesCML43575AM PMNo ratings yet

- CML43569Document2 pagesCML43569AM PMNo ratings yet

- Wealth ManagerDocument2 pagesWealth ManagerAM PMNo ratings yet

- NISM Series IX Merchant BankingDocument174 pagesNISM Series IX Merchant Bankingcprabhash2186No ratings yet

- NISM Series IX Merchant BankingDocument174 pagesNISM Series IX Merchant Bankingcprabhash2186No ratings yet

- National Securities Clearing Corporation Limited: Department: Futures & Options SegmentDocument2 pagesNational Securities Clearing Corporation Limited: Department: Futures & Options SegmentAM PMNo ratings yet

- Annexure CDocument6 pagesAnnexure CAM PMNo ratings yet

- Weekly Technical Report - 110618-201806110944029221562Document5 pagesWeekly Technical Report - 110618-201806110944029221562AM PMNo ratings yet

- National Securities Clearing Corporation Limited: Department: Securities Lending & Borrowing Scheme (SLBS)Document4 pagesNational Securities Clearing Corporation Limited: Department: Securities Lending & Borrowing Scheme (SLBS)AM PMNo ratings yet

- National Securities Clearing Corporation Limited: Department: Futures & Options SegmentDocument2 pagesNational Securities Clearing Corporation Limited: Department: Futures & Options SegmentAM PMNo ratings yet

- National Securities Clearing Corporation LimitedDocument1 pageNational Securities Clearing Corporation LimitedAM PMNo ratings yet

- National Securities Clearing Corporation Limited: Department: Capital Market SegmentDocument2 pagesNational Securities Clearing Corporation Limited: Department: Capital Market SegmentAM PMNo ratings yet

- 5356 DC NotesDocument1 page5356 DC NotesAM PMNo ratings yet

- National Securities Clearing Corporation LimitedDocument1 pageNational Securities Clearing Corporation LimitedAM PMNo ratings yet

- Nsfud Deksfmvh Fjiksvz (Esvy, Oa, Uthz) Nsfud Deksfmvh Fjiksvz (Esvy, Oa, Uthz) Vrajk"V H CKTKJ Vrajk"V H CKTKJ Vrajk"V H CKTKJDocument3 pagesNsfud Deksfmvh Fjiksvz (Esvy, Oa, Uthz) Nsfud Deksfmvh Fjiksvz (Esvy, Oa, Uthz) Vrajk"V H CKTKJ Vrajk"V H CKTKJ Vrajk"V H CKTKJAM PMNo ratings yet

- Waves 11, Kona Hawai'I: Modeling of The 2011 Tohoku - Oki Tsunami and It ' S Impacts To HawaiiDocument21 pagesWaves 11, Kona Hawai'I: Modeling of The 2011 Tohoku - Oki Tsunami and It ' S Impacts To HawaiiAM PMNo ratings yet

- Regd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 2Document2 pagesRegd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 2AM PMNo ratings yet

- Commodities Daily: Close %CHGDocument5 pagesCommodities Daily: Close %CHGAM PMNo ratings yet

- Technical Recommendation:: Commodity Contract S2 S1 Close R1 R2 RecommendationsDocument2 pagesTechnical Recommendation:: Commodity Contract S2 S1 Close R1 R2 RecommendationsAM PMNo ratings yet

- EEL 7 SpeakingDocument20 pagesEEL 7 SpeakingSathish KumarNo ratings yet

- Bullion Gold Silver Copper Zinc Lead Aluminium Nickel Energy Crude Oil Natural Gas Agro JeeraDocument8 pagesBullion Gold Silver Copper Zinc Lead Aluminium Nickel Energy Crude Oil Natural Gas Agro JeeraAM PMNo ratings yet

- Metals Insight: Base Metals: Technical RecommendationsDocument4 pagesMetals Insight: Base Metals: Technical RecommendationsAM PMNo ratings yet

- Review:: Oil and Oilseeds InsightDocument2 pagesReview:: Oil and Oilseeds InsightAM PMNo ratings yet

- A Daily Report On Natural RubberDocument6 pagesA Daily Report On Natural RubberAM PMNo ratings yet

- Shivangi Digant ShahDocument10 pagesShivangi Digant ShahSabari Nathan MariappanNo ratings yet

- REL Fact Sheet 03-18Document2 pagesREL Fact Sheet 03-18Hannes Sternbeck FryxellNo ratings yet

- Intercorporate Investments PDFDocument1 pageIntercorporate Investments PDFMohaiminul Islam ShuvraNo ratings yet

- Answers To Mcqs CH 10, CHAPTER 10 FINANCIAL MARKETS CBSE XIIDocument82 pagesAnswers To Mcqs CH 10, CHAPTER 10 FINANCIAL MARKETS CBSE XIIPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- ICICI Direct - Research ReportDocument4 pagesICICI Direct - Research ReportMudit KediaNo ratings yet

- NOTES On Statement of Financial PositionDocument13 pagesNOTES On Statement of Financial PositionJenevic D. MariscalNo ratings yet

- Oracle Fixed Assets Interview Questions in R12 - 1: 1. What Are The Different Ways of Adding Assets in FA?Document35 pagesOracle Fixed Assets Interview Questions in R12 - 1: 1. What Are The Different Ways of Adding Assets in FA?Mukesh DagarNo ratings yet

- Solutions Shreve Chapter 5Document6 pagesSolutions Shreve Chapter 5SemenCollectorNo ratings yet

- Opening Day Balance SheetDocument2 pagesOpening Day Balance Sheetapi-3809857No ratings yet

- Ejercicios PE (Resueltos)Document14 pagesEjercicios PE (Resueltos)Monserrat50% (4)

- 17Q June 2016Document95 pages17Q June 2016Juliana ChengNo ratings yet

- Lateritic Ore Capability ProfileDocument4 pagesLateritic Ore Capability Profileفردوس سليمانNo ratings yet

- OI Report Betting On World AgricultureDocument82 pagesOI Report Betting On World AgriculturemcampuzaNo ratings yet

- GRE Fee Reduction Request FormDocument3 pagesGRE Fee Reduction Request FormgihijiNo ratings yet

- Banner Year For 2 Multi-Manager Stalwarts: JANUARY 20, 2021Document9 pagesBanner Year For 2 Multi-Manager Stalwarts: JANUARY 20, 2021Sendhil RevuluriNo ratings yet

- Crilw Part I Book PDFDocument432 pagesCrilw Part I Book PDFPavlov Kumar HandiqueNo ratings yet

- Appendix 11 Fee ScheduleDocument10 pagesAppendix 11 Fee ScheduleHamzaNo ratings yet

- Question: How Can A Person Recover The Bank Deposits Left by The Deceased?Document2 pagesQuestion: How Can A Person Recover The Bank Deposits Left by The Deceased?Cirila TatlongarawNo ratings yet

- Proproom Recaps 2017Document10 pagesProproom Recaps 2017FitzNo ratings yet

- CDC - Central Depository Company of PakistanDocument1 pageCDC - Central Depository Company of Pakistanaraza_962307No ratings yet

- Cir MemoW&MDocument2 pagesCir MemoW&Mnmsusarla9990% (1)

- BXE Presentation Aug 2016Document38 pagesBXE Presentation Aug 2016HunterNo ratings yet