Professional Documents

Culture Documents

A Nano Car in Every Driveway

Uploaded by

ash147Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Nano Car in Every Driveway

Uploaded by

ash147Copyright:

Available Formats

Vertical View

A Nano Car in Every Driveway? How to

Succeed in the Ultra-Low-Cost Car Market

Henry Ford’s historic promise in 1908 to “build a car for the great multitude”

resulted in the production of more than 15 million Model Ts and created

unprecedented mobility for consumers everywhere. Will India’s Tata Motors

deliver on its equally bold promise to a new generation of consumers to bring

the Nano to market for the “great multitude” at a price of $2,500?

T o fulfill his promise “to build a car small

enough for the individual to run and care

for, [of ] the simplest designs that modern engi-

distribution methods. One hundred years later,

entrants into the ultra-low-cost car (ULCC)

market have the same agenda in their attempt

neering can devise, [and] low in price,” Henry to build a car with a price tag of $2,500 to

Ford exploited innovative product design, ven- $5,000, which is lower in comparable dollars

dor relationships, manufacturing techniques and than Henry Ford’s $850 Model T.

Vertical View

But this is not a history lesson that can Over the longer term, the emerging ultra-

be easily repeated. Today, all indicators point low-cost car market promises to create rich

to an automotive industry in recession, requir- opportunities—and risky challenges—for global

ing its leaders to balance the global economic auto industry participants that must decide if

crisis with future market demand. Industry they want to preserve and protect their current

consolidation and restructuring in global mar- positions or participate and prosper in the

kets will accelerate, propelled by the lack of new market. Manufacturers and suppliers must

availability to capital and consumer financing, be willing and able to partner and, more

high fuel costs and low consumer confidence. importantly, to change their traditional operat-

Undoubtedly, a new and improved automo- ing paradigms.

tive operating model will emerge from this

crisis, facilitated by innovation and low-cost

solutions to serve the demands of a broader

Preserve and Protect or

market of consumers. Perhaps the launch of Participate and Prosper?

the ultra-low-cost car marks the beginning of It is indisputable that the competitive landscape

a redefinition of the competitive landscape for has been altered dramatically and permanently

the entire industry. (see sidebar: The Market for Ultra-Low-Cost Cars).

The Market for Ultra-Low-Cost Cars

In emerging markets, there are at FIGURE: India and “rest of Asia” will make up more than half

least 10 models already selling for of sales in the low-cost car market by 20201

less than $6,000. India and the rest

17.5

of Asia (excluding China) represent 17.5 17.0

Vehicles sold per year — regular and ULCC (millions)

Rest of

the fastest growing regions. We world

15.0

project annual low-cost country 13.9 Africa

South

volumes to grow to approximately 12.5

America

17.5 million units globally by 2020 11.2

Rest of

Asia

(see figure). Although China and 10.0

8.5

India will continue to be the most 8.0

7.5 7.1

populous countries in 2020 with

5.4

1.4 billion and 1.3 billion people 5.0

India

4.0

respectively, their receptiveness 3.0 3.0 2.9

to low-cost vehicles differs. The 2.5 2.0

1.0 China

more rapid increase in disposable

0

income in China, combined with an

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

aging population and a historical

12007 estimates based on sales of regular low-cost cars and ultra-low-cost cars in the range of $3,100 to $7,800

preference for larger vehicles, lead (Nano + tax + distribution)

to the conclusion that India and the Sources: United Nations demographic studies; A.T. Kearney Global Business Policy Council population development,

infrastructure improvement and economic growth analyses

rest of Asia (excluding China) will be

the most promising ultra-low-cost that China should be neglected. The in overall vehicle production and,

car markets, accounting for perhaps size of the Chinese market in 2020, ultimately, to the profitable pro-

60 percent of the estimated global estimated at 2.6 million units, will duction of low-cost vehicles.

market potential. This is not to say contribute significantly to the rise

56 A nano car in every driveway?

Vertical View

FIGURE 1

Low-cost cars are selling in advanced and emerging markets

Low-cost car (LCC)

Advanced markets Emerging markets

Mini-car Regular low-cost car Ultra-low-cost car

Current vehicle Current vehicle Current vehicle

• Price: $7,801 to $12,000 • Price: $5,001 to $7,800 • Price: $2,500 to $5,000

• Market size: 2.5 to 3.7 million • Market size: 2.4 to 4.5 million • Market size: 2.3 to 3 million

• Also known as A-class vehicles • Uses technology and parts of mini- • Produced in high volumes with

• Achieves cost levels via cars sold in advanced markets basic trim

smaller size • Achieves cost levels via reduced • Achieves cost levels via reduced

content and by purchasing from size and content and by purchas-

local sources ing from local sources

Popular in Europe and Gaining popularity Attracting significant interest

Japan, with growing popularity in emerging markets from the automotive industry

in North America

Sources: J.D. Power and Associates; A.T. Kearney analysis

Moreover, the expansive potential of this market levels—will make hard-to-come-by profits easily

is commanding the attention of manufacturers susceptible to rising commodity prices, product

and vendors worldwide, with a number of global launch missteps and market economics.

players recently announcing strategies to enter The dynamic and powerful ultra-low-cost

or compete in the sector (see figure 1). General car market is forcing manufacturers and suppli-

Motors, which produces the mini-car, Spark, in ers to decide between two strategies. The first is

India, expects to introduce another low-cost car to preserve their brand and market positions

in 2009. Hyundai and Renault S.A.–Nissan and protect them against new market entrants,

have plans to produce a car for the low-cost car current competition and future price pressures.

market, and Škoda Auto, part of the Volkswagen Established suppliers opting for this stance risk

Group, is investing in product development falling into the “low-cost trap” between manu-

and plans to expand capacity in India. Fiat facturers and their new component standards

announced in August that it would market three and lower target prices. A new set of low-cost

models in China. competitors will emerge with the potential to

It is equally indisputable that using tradi- enter mature markets and capture market share

tional design, manufacturing and distribution from the domestic suppliers, forcing existing

approaches to achieve ultra-low-cost car entry participants to protect their positions.

prices below $3,500 will be a difficult task. The other choice for manufacturers and

A low price point and razor-thin margins — suppliers is to participate to capture share in the

estimated at around 3 percent at the base model fastest growing segment of the industry and

A.T. Kearney | EXECUTIVE AGENDA 57

Vertical View

Similar to Henry Ford’s apocryphally attributed “any - color - so -

long - as - it ’s - bl ack ” approach , the Nano offers consumers

few options, and only a fe w have any impact on the

manufacturing process .

prosper by being leaders in developing the Invent rather than adapt. Tata encouraged

market. We believe first movers will have the its design and manufacturing suppliers to be

opportunity to capture market share and build innovative—to redesign parts for a simple and

consumer loyalty. less capital-intensive manufacturing process, and

develop new ways to sell and distribute the Nano.

In fact, suppliers were forbidden to adapt carry-

Apply a Clean-Sheet Approach over parts from other Tata vehicles for use in the

Early movers on both the manufacturer and Nano, and in some manufacturing operations,

supplier sides have demonstrated that nothing such as welding, engineers opted for cheaper

less than a clean-sheet approach to product manual processes rather than automated ones.

development and manufacturing can produce Standardize at every stage of the value

a vehicle that sells for less than $3,500. Tata chain. Similar to Henry Ford’s apocryphally attri-

Motors, for example, used this approach to buted “any-color-so-long-as-it’s-black” approach,

develop the Nano, the world’s least expensive the Nano offers consumers few options, and

automobile, by adhering to four guidelines. only a few have any impact on the manufac-

Cooperate with suppliers. Tata began the turing process.

development process with 600 closely integrated The Nano’s distribution model reflects its

suppliers; only 100 remain. Independent suppli- innovative heritage, too. The company plans to

ers provide 80 percent of the Nano’s compo- mobilize large numbers of third parties to reach

nents, and 97 percent of the vehicle is sourced remote rural consumers, tailor the products and

in India. Suppliers such as Bosch worked with services to serve their needs, and add value to

Tata and employed Indian engineers with motor- the core product or service through ancillary

cycle, rather than automobile, design experience services. For example, one plant will produce

to craft innovative low-cost components. vehicle modules that are then sent to a number

Reduce the number and complexity of of strategically positioned satellite mini-factories,

parts. By focusing on the essentials and encour- where the Nano will be assembled and then

aging creativity in making components smaller, delivered to the buyer. A central warehouse will

lighter and cheaper, Tata avoided engineering stock spare parts and accessories.

non-functional, non-essential parts. Bosch, for As demonstrated with the Nano, the

example, adapted a smaller and lighter motor- clean-sheet approach offers another signifi-

cycle starter for use in the Nano. And the car’s cant advantage: innovation in product design,

wheels are attached with only three lug nuts manufacturing and distribution. As innovative

to reduce cost. product designs make their way down the

58 A nano car in every driveway?

Vertical View

segment tiers, manufacturing innovations will As powerful a tool as the clean-sheet

make their way up the same tiers. For example, approach is, however, it does not assure success

anti-lock braking systems and airbags will find in the marketplace. A product designed to

their way into low-cost cars while efficiency minimums will be vulnerable to sharp increases

measures and cost improvements are transferred in commodity prices that slow the creation of

into more expensive vehicles. new parts and threaten margins. The challenge

A ULCC on Europe’s Roads? Probably.

On North America’s Roads? Probably Not.

It’s an obvious question: Will the FIGURE: Price of ultra-low-cost cars can rise

ULCC segment target consumers in developed markets

in the world’s two most affluent

Higher-end cars (ultra-low-cost or low-cost)

markets, Europe and North America? $515 $9,107

$244 $210 $8,591

The answer—two answers, actu- $1,000 $388

$750

ally—is not so obvious. We believe $1,000

$5,000

European consumers can expect to

see an ultra-low-cost car entry, but

not soon. North American consum-

ers will probably not see any. The

costs of regulatory compliance and

distribution could drive the sale Tata Nano base model $228 $4,034

$105 $108 $93 $3,806

$125

price up 60 to 90 percent. $500

$375

Three overarching factors will $2,500

shape the ultra-low-cost car’s future

in both markets:

Emission standards. Western

Europe, Japan and North America Base Conver- Logistics Market- Manu- Dealer- Import Expected Sales Total

price sion cost ing facturer ship tariffs1 MSRP2 tax cost

established emissions standards profit profit

more than a decade ago. Emerging 1For countries with normal trade relation status

2Manufacturer suggested retail price

markets such as China and India

Sources: Automotive News Data Center; Global Auto Insider; U.S. Department of Transportation Federal Motor

are adopting European standards, Vehicle Safety Standards; A.T. Kearney analysis

but with a five- to seven-year lag.

Autos in the lightweight low-cost car ter few, if any difficulties, in meeting to meet government regulations.

segment, with their small engines those standards. As European and With logistics, marketing and pro-

and modest fuel consumption, will North American governments con- motions, manufacturer-dealer prof-

meet current emissions standards. tinue to establish higher standards, its, tariffs, account destination fees,

Safety regulations. North there will be compliance issues. and taxes bumping the final cost up

America and Europe have similar Distribution. Bringing a even further. Applying the same per-

government-developed safety regu- ULCC to the North American or centage increases to an ultra-low-

lations with respect to seat belts, European market will result in a sig- cost car at the highest price point

rollover and rear-, side- and frontal- nificant price increase (see figure). in the category—$5,000—results

protection standards. In developing The $2,500 target base price of the in a North American or European

countries, the standards are lower, Nano, for example, could jump to sales price of more than $9,000.

and ultra-low-cost cars will encoun- more than $4,000, with conversions

A.T. Kearney | EXECUTIVE AGENDA 59

Vertical View

will be to further reduce the cost of a product makes it impossible to develop radical new and

when there is very little wiggle room to do so. innovative thinking.

Success will be volume dependent, with In addition to Tata’s clean-sheet approach,

margins held to the low single-digit range. we believe success in the ultra-low-cost car seg-

And that presents the inevitable question: ment requires the following (see figure 2):

Will ultra-low-cost car manufacturers enter the Create entrance and growth strategies.

European and North American markets in an So far, most entrance and growth strategies have

effort to increase volume? We believe the been similar as a multitude of manufacturers

answer is yes to Europe and no to North rush to gain first-mover advantage in the rap-

America—but not soon and not at the ULCC idly growing Indian market. India, the default

price (see sidebar: A ULCC on Europe’s Roads? build-and-sell location, has the greatest pro-

Probably. On North America’s Roads? Probably Not jected market growth in the Asia-Pacific region.

on page 59). Now, manufacturers are developing plans to

expand their production footprints beyond

India, with Thailand as one of the early target

The Strategy: What Works? locations. Southeast Asia will remain the pri-

What Doesn’t? mary export market for new models, and the

Tata’s model is a case study in what to do right Middle Eastern and African markets are in line

and stands in vivid contrast to less effective for subsequent growth.

strategies. Some manufacturers, for example, A consistent design strategy is emerging

introduce older models into the market to based on a clean-sheet approach rather than

take advantage of their fully paid-up base of pulling from reusable vehicle architectures or

equipment and tools. The Buick Regal was pre-populated product shelves.

among the first entrants in China. While this Entry into this market segment will not

approach provides rapid entry into a new come without risk, however. It will require shift-

market, it does so at a cost: The cars often do ing paradigms from the traditional global pro-

not meet specific customer needs and are at cesses to thinking creatively and meeting target

a competitive disadvantage in relation to locally market vehicle specifications and prices. The

tailored products. market must be sized accurately to capture ade-

Other car manufacturers streamline existing quate volume and thus recover investments.

models to fit low-cost prerequisites or redesign What’s more, all strategies and tactics focus

select parts to meet specific market require- on avoiding cannibalization of current market

ments. While this provides an opportunity to portfolios, deploying already scarce resources,

offer some customization, it limits the potential establishing robust supplier partnerships (design-

for cost reduction. to-cost targets, truly collaborative engineering,

Finally, some manufacturers design a “new” volume commitments and lifetime contracts,

car within a design-to-cost framework, but for example), and building manufacturing foot-

reuse a significant number of existing parts. prints that can scale-up quickly with minimum

This minimizes engineering costs and maxi- capital outlays.

mizes economies of scale, but makes it difficult Establish targets and make trade-off

to eliminate designed and built-in functional- decisions. Manufacturers will focus their devel-

ities, along with their built-in costs. It also opment efforts around design-to-cost targets—

60 A nano car in every driveway?

Vertical View

FIGURE 2

Five key operating dimensions for the ultra-low-cost car market

Compare manufacturers within the low- Determine strategies for market entry,

cost car industry and analyze relevant export, product development, branding,

products outside the industry, to discover sales channels and distribution.

innovative ideas in products, services and

warranties. Knowledge transfer is key. Benchmarking Entrance and

and cost analysis development

strategies

ULCC

Preservation Cost and pricing

Defend market position against targets and Develop new cost-cutting approaches

emerging low-cost manufacturers and and protection for manufacturing, distribution and

trade-off

suppliers that are targeting established decisions procuring components; create pricing

markets. policies to address margin erosion,

dealer margins and inventory.

Cross-functional

alignment and

collaboration

Form internal cross-functional teams and join

Source: A.T. Kearney with suppliers and distributors to reduce costs.

collaborating with key suppliers to redesign The only way for the ultra-low-cost car manu-

interfacing components and sub-systems to facturer to accomplish this is by:

keep costs low while also meeting mass-market • Forming new organizations dedicated to the

production targets. A variety of trade-off deci- creation of an ultra-low-cost car

sions must be made: • Redesigning processes and policies so the

• Engineering. Should it be X or Y? Redesign entire team works toward common goals

or reuse components? Define new technical • Revamping incentive structures to manage

specifications for materials and performance? conflicts and balance trade-off decisions

• Manufacturing. Where and what type of • Expanding supplier-selection criteria to include

site? What production processes? What degree innovation and product diversification

of automation? • Partnering with suppliers early in the design,

• Sourcing. How much local content versus manufacturing, engineering and assembly

how much imported? processes

• Pricing. Lower price and higher volume? Protect and preserve market position

Higher prices for export units? What is the and profits. Success in this market will require

best approach to pricing and bundling manufacturers and suppliers to employ their

optional accessories? know-how in the higher-cost vehicle seg-

Align across functions and collaborate ments, including vast experience in emerging

with suppliers. To deliver a car priced between markets, product innovations and cost struc-

$2,500 and $3,500 and to meet local market tures. Those that decide not to participate

specifications, emissions and safety standards in the ultra-low-cost car segment must protect

will force use of fewer carry-over parts, which and preserve their current brands, market

will necessitate major new product innovations. positions and profit margins. Real risks will

A.T. Kearney | EXECUTIVE AGENDA 61

Vertical View

emerge if any of the following scenarios occurs: competitors’ products) must go beyond compar-

• In the next two to five years, safety and emis- ing innovative ideas in the low-cost car industry

sion standards are met and ultra-low-cost to evaluating innovations in adjacent industries.

cars are exported and distributed to mature In these markets, why not analyze the manu-

markets facturers of scooters and rickshaws? Focus on

• Manufacturers adopt a new set of target prices identifying innovative ideas and employ a sys-

from ultra-low-cost car product innovations tematic approach to conduct the tear-down,

and expect competing suppliers to comply capture insights and inject knowledge at appro-

• A manufacturer or supplier enters the market priate stages in the development cycle.

but cannibalizes its existing portfolio

• The competition generates “know-how” that

gives them an early-mover advantage in the

A Measure of Cooperation,

market Creativity and Innovation

Regardless of which scenario plays out, or We believe success in the ultra-low-cost car

if they all do, the risks will be considerable. market can be achieved and will be measured by

The mantra will be to identify competitors— cooperation, creativity and innovation. There is

their capabilities, product plans, partnerships a certain and unknown amount of risk, but

and target costs. Equally important is to have this market is destined to change the industry

a flawless launch cycle and sustain volumes to landscape, much like the Model T changed

maximize returns. It is essential to know how auto manufacturing and the world’s sense of

much time is left before emerging-market com- mobility. While ultra-low-cost cars may not be

petitors re-engineer or adapt their products and available on every continent, the innovative

pose a credible threat in mature markets. ideas and techniques generated for this market

Benchmark the competition. Benchmark- will have a long-lasting impact on the entire

ing and competitive tear-downs (cost analyses of automotive industry.

Consulting Authors

Dan Oxyer is a partner based in the Southfield office. He can be reached

at dan.oxyer@atkearney.com.

Graeme Deans is a partner based in the Toronto office. He can be reached

at graeme.deans@atkearney.com.

Shiv Shivaraman is a principal based in the Southfield office. He can be reached

at shiv.shivaraman@atkearney.com.

Sudipta Ghosh is a manager based in the Southfield office. He can be reached

at sudipta.ghosh@atkearney.com.

Ruediger Pleines is a manager based in the Munich office. He can be reached

at ruediger.pleines@atkearney.com.

62 A nano car in every driveway?

You might also like

- A Nano Car in Every Driveway PDFDocument8 pagesA Nano Car in Every Driveway PDFAshwani MattooNo ratings yet

- TACC613 M&A: Analysis of AP Eagers' Acquisition of Automotive Holding GroupDocument6 pagesTACC613 M&A: Analysis of AP Eagers' Acquisition of Automotive Holding GroupKarma SherpaNo ratings yet

- Marketing AssignmentDocument7 pagesMarketing AssignmentMamuni PandaNo ratings yet

- A Nano Car in Every DrivewayDocument13 pagesA Nano Car in Every DrivewayRajendra PetheNo ratings yet

- Final ProjectDocument15 pagesFinal Projecttrisanka banikNo ratings yet

- Tata Motors-SC2122Document3 pagesTata Motors-SC2122Tien Nguyen VanNo ratings yet

- Global OEM Parts SupplierDocument1 pageGlobal OEM Parts SupplierReshma GhadiNo ratings yet

- Suzuki Samurai - Case StudyDocument11 pagesSuzuki Samurai - Case StudyNitish Raj SubarnoNo ratings yet

- Globalization Within The Auto IndustryDocument12 pagesGlobalization Within The Auto Industrymatze946No ratings yet

- Chevrolet Cruze AnalysisDocument10 pagesChevrolet Cruze AnalysisShaan SinghNo ratings yet

- Global-Automobile-Report - Group-4 AVADocument9 pagesGlobal-Automobile-Report - Group-4 AVAALVIN APURONo ratings yet

- 20UHCMD111 3rd Sem ProjectDocument47 pages20UHCMD111 3rd Sem ProjectPooja GoyalNo ratings yet

- Challenges Facing The Global Automotive IndustryDocument8 pagesChallenges Facing The Global Automotive IndustryDK Premium100% (1)

- Media 30may21 FiDocument7 pagesMedia 30may21 FianupamNo ratings yet

- 20UHCMD111 3rd Sem ProjectDocument47 pages20UHCMD111 3rd Sem ProjectPooja GoyalNo ratings yet

- Blue Ocean Strategy: Group 5: 1. Vũ Thị Phương Thanh 2. Kiều Thị Thu Trang 3. Nguyễn Thị Thu Trang 4. Mai Thị HoàDocument32 pagesBlue Ocean Strategy: Group 5: 1. Vũ Thị Phương Thanh 2. Kiều Thị Thu Trang 3. Nguyễn Thị Thu Trang 4. Mai Thị HoàThanh VũNo ratings yet

- Maruti Udyog LimitedDocument125 pagesMaruti Udyog LimitedSainiJaspreetkaurNo ratings yet

- How Manufacturers Can Move Downstream to Capture More Profitable Post-Sale OpportunitiesDocument11 pagesHow Manufacturers Can Move Downstream to Capture More Profitable Post-Sale OpportunitiesGangadhar BituNo ratings yet

- Challenge 2-The Connected Car: Industry Evolution or TransformationDocument4 pagesChallenge 2-The Connected Car: Industry Evolution or TransformationSagar BhardwajNo ratings yet

- 2012 Automotive Industry Perspective2012Document5 pages2012 Automotive Industry Perspective2012Brazil offshore jobsNo ratings yet

- 2011 Automotive Industry PerspectiveDocument6 pages2011 Automotive Industry Perspectivebc9hzNo ratings yet

- Tata Motors AssignmentDocument7 pagesTata Motors AssignmentUINo ratings yet

- Roland Berger Car As A Service ExtractDocument24 pagesRoland Berger Car As A Service ExtractPrekelNo ratings yet

- The Indian Automobile Industry: Speeding Into The Future ?: Actes Du GERPISA N° 28 35Document14 pagesThe Indian Automobile Industry: Speeding Into The Future ?: Actes Du GERPISA N° 28 35abcNo ratings yet

- Literature Review Automotive IndustryDocument4 pagesLiterature Review Automotive Industryf1gisofykyt3100% (1)

- Session 1Document1 pageSession 1Sreekanth SattirajuNo ratings yet

- Future Trends Report For FordDocument18 pagesFuture Trends Report For FordSamana ZaynabNo ratings yet

- Advancing Mobility - The Next Frontier in Smarter TransportationDocument24 pagesAdvancing Mobility - The Next Frontier in Smarter TransportationJack MasonNo ratings yet

- Financial Re Engineering Newppt 100920023921 Phpapp02Document23 pagesFinancial Re Engineering Newppt 100920023921 Phpapp02Stephen JosephNo ratings yet

- Exhibit 4Document5 pagesExhibit 4MJNo ratings yet

- RenaultNissan Case StudyB Lamarsaude PDFDocument10 pagesRenaultNissan Case StudyB Lamarsaude PDFBhoomika MithraNo ratings yet

- Automotive Industry: Developing An Indian Model For ExcellenceDocument4 pagesAutomotive Industry: Developing An Indian Model For Excellencevaragg24No ratings yet

- Pfeffer 2005 AME Producing Sustainable Competitive Advantage Through PeopleDocument13 pagesPfeffer 2005 AME Producing Sustainable Competitive Advantage Through PeopleFarhan1561No ratings yet

- Strategic Management in Auto Mobile IndustryDocument10 pagesStrategic Management in Auto Mobile IndustryVikramaditya ReddyNo ratings yet

- Project Marketing Strategy of Maruti SuzukiDocument38 pagesProject Marketing Strategy of Maruti SuzukiJalesh mehta100% (1)

- 20UHCMD111 Plagarism (Check 1)Document31 pages20UHCMD111 Plagarism (Check 1)Pooja GoyalNo ratings yet

- Auto Component Sector Report: Driving Out of Uncertain TimesDocument24 pagesAuto Component Sector Report: Driving Out of Uncertain TimesAshwani PasrichaNo ratings yet

- Airbus A3XX Development Plan/TITLEDocument31 pagesAirbus A3XX Development Plan/TITLEHarsh AgrawalNo ratings yet

- Airbus A3XX PowerpointDocument31 pagesAirbus A3XX PowerpointRashidNo ratings yet

- Capacity Planning DemoDocument21 pagesCapacity Planning DemoSantosh JadhavNo ratings yet

- TOP 100 Suppliers 2017Document16 pagesTOP 100 Suppliers 2017JNNo ratings yet

- Porter's Five Forces Analysis of Automobile Industry: 1.1 EntryDocument9 pagesPorter's Five Forces Analysis of Automobile Industry: 1.1 EntryvigneshsampathNo ratings yet

- 20UHCMD111 Plagarism (Check 1)Document31 pages20UHCMD111 Plagarism (Check 1)Pooja GoyalNo ratings yet

- Great Wall Motors-: Greenfield Vs Acquisition Strategic Alliance Case StudyDocument6 pagesGreat Wall Motors-: Greenfield Vs Acquisition Strategic Alliance Case StudyNandu Krishnan UNo ratings yet

- Financial Indicators - Automotive PDFDocument2 pagesFinancial Indicators - Automotive PDFminh hùngNo ratings yet

- Managing supply-demand risk through flexible global production networksDocument11 pagesManaging supply-demand risk through flexible global production networksAnonymous vGOtuxeNo ratings yet

- Strategic Brand Management: Automobile IndustryDocument5 pagesStrategic Brand Management: Automobile Industryhanishgurnani 2k20umba12No ratings yet

- Daimler Chrysler MergerDocument49 pagesDaimler Chrysler MergerSamir Saffari100% (1)

- Us CP Fleet Leasing and Management in North AmericaDocument60 pagesUs CP Fleet Leasing and Management in North AmericaDeepak SamavedamNo ratings yet

- Fiat Group Automobiles Situation AnalysisDocument6 pagesFiat Group Automobiles Situation AnalysisCristobalColon888100% (1)

- Product 1Document12 pagesProduct 1Luis CarrilloNo ratings yet

- Ford Automobile Industry Case StudyDocument10 pagesFord Automobile Industry Case StudyUpendra SharmaNo ratings yet

- Test Bank For Strategic Management 4th Edition Frank RothaermelDocument36 pagesTest Bank For Strategic Management 4th Edition Frank Rothaermelfluiditytrenail7c8j100% (36)

- HyundaiDocument15 pagesHyundaiasli_balciNo ratings yet

- THE RENAULT KWID Indian Market StrategyDocument9 pagesTHE RENAULT KWID Indian Market StrategyAkshat BansalNo ratings yet

- Porter's Five Forces Analysis of the Indian Passenger Car IndustryDocument11 pagesPorter's Five Forces Analysis of the Indian Passenger Car IndustryVivekNo ratings yet

- M&M Valuation Report Highlights Strong R&D and Market LeadershipDocument5 pagesM&M Valuation Report Highlights Strong R&D and Market LeadershipCorpValue IncNo ratings yet

- Changes in GST IGST 10-11-2017Document24 pagesChanges in GST IGST 10-11-2017ganeshbabucgNo ratings yet

- Changes in GST IGST 10-11-2017Document24 pagesChanges in GST IGST 10-11-2017ganeshbabucgNo ratings yet

- GST E Book PDFDocument63 pagesGST E Book PDFnaveen chaudharyNo ratings yet

- Ashok Leyland Q1 2013 Earnings Call 26 Jul'12: OperatorDocument16 pagesAshok Leyland Q1 2013 Earnings Call 26 Jul'12: Operatorash147No ratings yet

- AgFlake - Conductive PigmentsDocument2 pagesAgFlake - Conductive Pigmentsash147No ratings yet

- Ashok Leyland Conference Call Transcript Q2 2013Document13 pagesAshok Leyland Conference Call Transcript Q2 2013ash147No ratings yet

- CNL - Hurrytop PresentationDocument15 pagesCNL - Hurrytop Presentationash147No ratings yet

- EIA MaharshtraDocument15 pagesEIA Maharshtraash147No ratings yet

- Invest Wisely To Make Your Dreams Come True: July, 2010Document28 pagesInvest Wisely To Make Your Dreams Come True: July, 2010ash147No ratings yet

- VIBROTEST 60: More than just a vibration analyserDocument12 pagesVIBROTEST 60: More than just a vibration analyserash147No ratings yet

- Indian Income Tax Act 2008Document1,065 pagesIndian Income Tax Act 2008ananthca100% (2)

- Mge Galaxy 3500 UpsDocument4 pagesMge Galaxy 3500 Upsash147No ratings yet

- VIBROTEST 60: More than just a vibration analyserDocument12 pagesVIBROTEST 60: More than just a vibration analyserash147No ratings yet

- Maxima CutDocument20 pagesMaxima Cutash147No ratings yet

- Variable Geometry Turbocharger Technologies For Exhaust Energy Recovery and Boosting A ReviewDocument17 pagesVariable Geometry Turbocharger Technologies For Exhaust Energy Recovery and Boosting A ReviewMomen Al-Himony100% (1)

- Sixty Years of Research On Ship Rudders Effects of Design Choices On Rudder Performance PDFDocument19 pagesSixty Years of Research On Ship Rudders Effects of Design Choices On Rudder Performance PDFSunil100% (1)

- Annual Report 2014 2015 OnlineDocument210 pagesAnnual Report 2014 2015 OnlinedarkniightNo ratings yet

- Mdpe Yellow Gas: ApplicationsDocument2 pagesMdpe Yellow Gas: ApplicationsPrateek GijjannavarNo ratings yet

- CABLE SCHEDULE CHECKLISTDocument3 pagesCABLE SCHEDULE CHECKLISTIsd BambNo ratings yet

- A) Use of Abbreviations:: Tips To Follow 1. Avoid Prepositions (As Much As Possible), Conjunctions and ArticlesDocument5 pagesA) Use of Abbreviations:: Tips To Follow 1. Avoid Prepositions (As Much As Possible), Conjunctions and ArticlesManoj KumarNo ratings yet

- Management of Information SystemsDocument16 pagesManagement of Information SystemsAle Ortiz100% (1)

- 4.C.4 Solidary Liability PNCC Vs CADocument2 pages4.C.4 Solidary Liability PNCC Vs CANoelle Therese Gotidoc VedadNo ratings yet

- Procedure For Working in Live TrafficDocument20 pagesProcedure For Working in Live TrafficGian Carlo MiguelNo ratings yet

- Hydraulic DynamometerDocument26 pagesHydraulic DynamometerhelderlpNo ratings yet

- North West London Night 071016Document1 pageNorth West London Night 071016Daniel PaiusNo ratings yet

- CFM International CFM56: HistoryDocument24 pagesCFM International CFM56: HistoryĐoàn Hồng NgọcNo ratings yet

- Stainless Steel Evaporator Engineering ManualDocument52 pagesStainless Steel Evaporator Engineering ManualGerber GarciaNo ratings yet

- PC 1-3 Wheel-Rail Interaction Fundamentals WRI 2017 - 20170604Document109 pagesPC 1-3 Wheel-Rail Interaction Fundamentals WRI 2017 - 20170604Hà Tiến ĐôngNo ratings yet

- 1967 Honda p50 Service Manual PDFDocument98 pages1967 Honda p50 Service Manual PDFpacemajaNo ratings yet

- United States Bankruptcy Court District of NevadaDocument4 pagesUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNo ratings yet

- Service Instructions 2Document1 pageService Instructions 2Marcio BatistaNo ratings yet

- An Experimental Study On Partial Replacement of Aggregate by E Waste For Flexible PavementDocument3 pagesAn Experimental Study On Partial Replacement of Aggregate by E Waste For Flexible PavementEditor IJTSRDNo ratings yet

- Reflection On The Movie 5 Centimeters Per SecondDocument4 pagesReflection On The Movie 5 Centimeters Per SecondJeanoRusticoCruzNo ratings yet

- Sailor's Working Day On BoardDocument5 pagesSailor's Working Day On BoardОльга ЕфименкоNo ratings yet

- Forward Lighting Systems: General InformationDocument31 pagesForward Lighting Systems: General InformationGus SalazarNo ratings yet

- HTW 8-3-4-Add.1 - Draft Revised Model Course 3.27 On Security Awareness Training For All Seafarers (Secretariat)Document62 pagesHTW 8-3-4-Add.1 - Draft Revised Model Course 3.27 On Security Awareness Training For All Seafarers (Secretariat)El Mariner PeterNo ratings yet

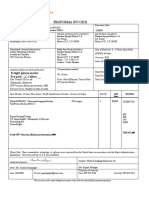

- Proforma Invoice Example 1Document2 pagesProforma Invoice Example 1Sahil KhattarNo ratings yet

- P94-1589 Diagrama Eléctrico KWDocument2 pagesP94-1589 Diagrama Eléctrico KWOswaldoNo ratings yet

- AASHTO Design MethodDocument50 pagesAASHTO Design Methodzavlei100% (1)

- Pace (India) Threading and Grooving Price ListDocument12 pagesPace (India) Threading and Grooving Price ListSandip JawalkarNo ratings yet

- Hoists: Genuine OEM Parts ForDocument12 pagesHoists: Genuine OEM Parts ForDavid Ortuño LunaNo ratings yet

- Transportation and Traffic TheoryDocument21 pagesTransportation and Traffic TheorysaobracajniNo ratings yet

- Pipeline Shore Approach Design Case Study PDFDocument10 pagesPipeline Shore Approach Design Case Study PDFJohn RajNo ratings yet

- 2000 Nissan Frontier VG33E ELDocument232 pages2000 Nissan Frontier VG33E ELDavid CervantesNo ratings yet