Professional Documents

Culture Documents

Statement of Cash Flows-Indirect Method

Uploaded by

Hossein ParvardehOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Cash Flows-Indirect Method

Uploaded by

Hossein ParvardehCopyright:

Available Formats

Statement of Cash Flows-Indirect Method

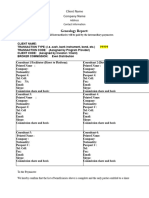

Cash flow from operating activities

Net Income

Adjustments to reconcile net income to

net cash provided by operating activities

Depreciation

Amortization of Intangibles

Depletion

Add Losses-Realized/Unrealized

Deduct Gains Realized/Unrealized

Change In Inventory

Change in Accounts Receivable/Gross vs Net as affected by Allowance

Change In Prepaid Assets/Expenses

Change in Accounts Payable

Change in Accrued Liabilities

Change in Unearned Revenue

Impact of Equity Method

Impact of Bond Amortization on Interest Expense

Impact of Bond Amortization on Interest Revenue

Change in Deferred Income Taxes

Net cash provided/used by Operating Activities

Cash flows from Investing Activities

Purchase/sale of land

Purchase/sale of equipment

Purchase/Sale of Investments

Loans to other companies/Repayments by other companies

Net cash provided/used by Investing Activities

Cash flows from Financing Activities

Purchase/Sale (Treasury Stock)

Sale of Stock-Preferred/Common

Proceeds from Bond Issuance

Redeemption of Bonds

Payment of dividends to shareholders

LOAN REPAYMENTS/BORROWED

Net cash provided/used by Financing Activities

Net increase/decrease in cash

Cash at beginning of period

Cash at end of period

Note: Interest revenue, interest expense and dividends as revenue are

part of operating activities. Payments of dividends to shareholders are part of

financing activities. Principal payments on debt are part of financing.

Direct Method: Referred to as the Income Statement Approach

This method is for use in the operating section of the Statement of Cash Flows

This method reports net cash flow from operating activities as major classes of cash receipts

and cash disbursements.

Cash Receipts

Cash Collected from Customers = Sales Revenue + Decrease in AR or - Increase in AR

+ Increase in Unearned Revenue or

- Decrease in Unearned Revenue

Cash received from Interest and Dividends

Cash Disbursements: Cash Paid to Suppliers = Cost of Goods Sold + Increase in Inventory

or - Decrease in Inventory

+ Decrease in Accounts Payable or

- Increase in Accounts Payable

Cash Paid for Operating Expenses = Operating Expenses + Increase

in Prepaid Expenses or - Decr

in Prepaid Expenses.

+Decrease in Accrued Expense

Payable or - Increase in Accrue

Expenses Payable

You will still consider depreciation, amortization, depletion

You might also like

- Direct and Indirect MethodDocument2 pagesDirect and Indirect MethodIan GolezNo ratings yet

- Financial Reporting Cash Flow AnalysisDocument4 pagesFinancial Reporting Cash Flow AnalysisKevin ChengNo ratings yet

- FAR Chapt. 7Document8 pagesFAR Chapt. 7Ryan GaniaNo ratings yet

- !!!!guide To Cash FlowsDocument3 pages!!!!guide To Cash Flowsws. cloverNo ratings yet

- Statement of Cash Flows (CA5106)Document17 pagesStatement of Cash Flows (CA5106)rhbqztqbzyNo ratings yet

- Basic Accounting Module Final TermDocument9 pagesBasic Accounting Module Final TermCharizmae MadridNo ratings yet

- IM - Updates in Financial Reporting Standards (ACCO 40023) - Cash To AccrualDocument13 pagesIM - Updates in Financial Reporting Standards (ACCO 40023) - Cash To AccrualJasmine100% (2)

- IAS - 7 Statement of Cash FlowsDocument29 pagesIAS - 7 Statement of Cash FlowsKəmalə AslanzadəNo ratings yet

- Fabm 2Document8 pagesFabm 2CAYABAN, RISHA MARIE DV.No ratings yet

- Understanding Liabilities in Under 40Document2 pagesUnderstanding Liabilities in Under 40Catherine Joy MoralesNo ratings yet

- Reconciliation of Cost & Financial AccountsDocument13 pagesReconciliation of Cost & Financial AccountsRahulNo ratings yet

- Statement of Cash Flows Ca5106Document57 pagesStatement of Cash Flows Ca5106Bon juric Jr.No ratings yet

- Cash Flow Statement ExplainedDocument13 pagesCash Flow Statement ExplainedZeet RoyNo ratings yet

- Financial Statement Analysis For Credit Decision Presented by Rabah ElmasriDocument5 pagesFinancial Statement Analysis For Credit Decision Presented by Rabah Elmasrinuwany2kNo ratings yet

- Notes Topic 4Document3 pagesNotes Topic 4Fatin Nur DiniNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesemonNo ratings yet

- Accounting Principles: Second Canadian EditionDocument38 pagesAccounting Principles: Second Canadian EditionErik Lorenz PalomaresNo ratings yet

- Cash Flow Statement (BBA)Document43 pagesCash Flow Statement (BBA)shrestha.aryxnNo ratings yet

- Pas 7Document3 pagesPas 7Sacedon, Trishia Mae C.No ratings yet

- Accruals and PrepaymentsDocument7 pagesAccruals and PrepaymentsRakiya ZainabNo ratings yet

- Receivables Reporting and ValuationDocument11 pagesReceivables Reporting and ValuationMichaella PurgananNo ratings yet

- Property, Plant & EquipmentDocument19 pagesProperty, Plant & EquipmentErika Mae LegaspiNo ratings yet

- Fundamentals of Accounting and Business Management 2: Statement of Financial Position Account FormDocument6 pagesFundamentals of Accounting and Business Management 2: Statement of Financial Position Account Formmarcjann dialinoNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementanuhyaextraNo ratings yet

- TLE - Business Math-1Document11 pagesTLE - Business Math-1lesllyhabulan84No ratings yet

- ABO ReviewerDocument3 pagesABO ReviewerJulianne Hazel EpeNo ratings yet

- Accounting For Non Accountants 2019Document39 pagesAccounting For Non Accountants 2019gina100% (1)

- Cash Receipts and PaymentsDocument5 pagesCash Receipts and Paymentsmh bachooNo ratings yet

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- acc questions PDFDocument4 pagesacc questions PDFneharajt06061No ratings yet

- Conceptual Framework Module 9Document5 pagesConceptual Framework Module 9Jaime LaronaNo ratings yet

- Cash Flow Statement-ShortDocument27 pagesCash Flow Statement-ShortdaisyNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- Acctg Chap 5-7 PDFDocument16 pagesAcctg Chap 5-7 PDFAlexis B. BERTOLDONo ratings yet

- Far 2402 - ReceivablesDocument5 pagesFar 2402 - ReceivablesVangieNo ratings yet

- FARreviewerDocument5 pagesFARreviewerKimNo ratings yet

- 02 Accounting 3 Statements Linking GuideDocument2 pages02 Accounting 3 Statements Linking GuideGus MarNo ratings yet

- 1-Cash FlowsDocument1 page1-Cash Flowsahmedfouad0712No ratings yet

- Understanging Cash FlowDocument2 pagesUnderstanging Cash FlowAnna Roszkowska-KochNo ratings yet

- Review Session - NUS ACC1002 2020 SpringDocument50 pagesReview Session - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- Measurement of Income 2Document26 pagesMeasurement of Income 2Abinash MishraNo ratings yet

- Pointers To Review: FABM 2: Recording Phase: Answer KeyDocument9 pagesPointers To Review: FABM 2: Recording Phase: Answer KeyMaria Janelle BlanzaNo ratings yet

- CASH FLOW STATEMENT ANALYSISDocument16 pagesCASH FLOW STATEMENT ANALYSISKalidindi Vamsi Krishna VarmaNo ratings yet

- Income Statement and Balance Sheet AnalysisDocument3 pagesIncome Statement and Balance Sheet AnalysisDGNo ratings yet

- Statement of Cash Flows: By: Riaz Hussain Ansari Lecturer Department of Business Administration University of SahiwalDocument28 pagesStatement of Cash Flows: By: Riaz Hussain Ansari Lecturer Department of Business Administration University of SahiwalAli JuttNo ratings yet

- Chapter 2 The Accounting Equation and The Double-Entry SystemDocument24 pagesChapter 2 The Accounting Equation and The Double-Entry SystemMarriel Fate Cullano0% (1)

- Cash Flow statement-AFMDocument27 pagesCash Flow statement-AFMRishad kNo ratings yet

- Batch 8-Accounting StudyDocument30 pagesBatch 8-Accounting StudyDaryl Gomez TimatimNo ratings yet

- Accounting Slides Topic 6Document21 pagesAccounting Slides Topic 6Edouard Rivet-BonjeanNo ratings yet

- 3 the Accounting EquationDocument26 pages3 the Accounting EquationJohn Alfred CastinoNo ratings yet

- Unit I - Accounting EquationDocument6 pagesUnit I - Accounting EquationAnime LoverNo ratings yet

- Cash Flow Statement-ShortDocument27 pagesCash Flow Statement-ShortSam ONiNo ratings yet

- Dividends and Retained EarningsDocument1 pageDividends and Retained EarningsxxxNo ratings yet

- Cash Flow Statement-Short1Document27 pagesCash Flow Statement-Short1saqlain aliNo ratings yet

- Cash Flow Statement-ShortDocument33 pagesCash Flow Statement-Shortadam jamesNo ratings yet

- T 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementDocument45 pagesT 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementthukrishivNo ratings yet

- 1 LiabilitiesDocument39 pages1 LiabilitiesDiana Faith TaycoNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Ch23 StatementofCashFlowExamples Zeke and ZoeDocument4 pagesCh23 StatementofCashFlowExamples Zeke and ZoeHossein ParvardehNo ratings yet

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- First DraftDocument6 pagesFirst DraftHossein ParvardehNo ratings yet

- Forging A NationDocument3 pagesForging A NationHossein ParvardehNo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- European Urban and Regional Studies 2010 Lindkvist 31 43Document13 pagesEuropean Urban and Regional Studies 2010 Lindkvist 31 43Hossein ParvardehNo ratings yet

- Apple - Think DiffrentDocument5 pagesApple - Think DiffrentHossein ParvardehNo ratings yet

- 1Document4 pages1Hossein ParvardehNo ratings yet

- O o o O: Still, Ecological Sustainability Is The Foundation Upon Which Other Elements of Sustainability StandDocument15 pagesO o o O: Still, Ecological Sustainability Is The Foundation Upon Which Other Elements of Sustainability StandHossein ParvardehNo ratings yet

- Amul Issues To AddressDocument1 pageAmul Issues To AddressHossein ParvardehNo ratings yet

- Warehouse Line Operations: Titan Lenders CorpDocument13 pagesWarehouse Line Operations: Titan Lenders CorpNye LavalleNo ratings yet

- PMGT WhitepaperDocument56 pagesPMGT WhitepapermbidNo ratings yet

- Analyze Profitability Ratios of Digi and MaxisDocument5 pagesAnalyze Profitability Ratios of Digi and MaxisMuhammad KharusaniNo ratings yet

- Additional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionDocument36 pagesAdditional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionAiiny Nurul 'sinepot'No ratings yet

- Sage X3 - User Guide - Setting Up Fixed AssetsDocument7 pagesSage X3 - User Guide - Setting Up Fixed AssetscaplusincNo ratings yet

- Chief Information OfficerDocument3 pagesChief Information Officerapi-77974318No ratings yet

- Easypaisa-All Pricing and CommissioningDocument17 pagesEasypaisa-All Pricing and Commissioningqaisar_murtaza50% (4)

- 2 Acknowledgement, Abstract, ContentDocument5 pages2 Acknowledgement, Abstract, ContentHema MaliniNo ratings yet

- Module 2Document47 pagesModule 2Manuel ErmitaNo ratings yet

- ISO 9001:2000 Goat Production Profitability AnalysisDocument38 pagesISO 9001:2000 Goat Production Profitability AnalysisJay AdonesNo ratings yet

- Best Respondent Memorial PDFDocument38 pagesBest Respondent Memorial PDFPriyanka PriyadarshiniNo ratings yet

- Paper 3 1 1Document7 pagesPaper 3 1 1api-593075882No ratings yet

- Valuation Report: Wilanow One ProjectDocument87 pagesValuation Report: Wilanow One ProjectVNNo ratings yet

- Marcellus Little-Champs Presentation DIRECTDocument19 pagesMarcellus Little-Champs Presentation DIRECTBijoy RaghavanNo ratings yet

- Chapter Three: Interest Rates and Security ValuationDocument40 pagesChapter Three: Interest Rates and Security ValuationOwncoebdiefNo ratings yet

- Stamp Duty Rules ExplainedDocument3 pagesStamp Duty Rules ExplainedSausan SaniaNo ratings yet

- Credit Rating Agencies PDFDocument17 pagesCredit Rating Agencies PDFAkash SinghNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPshamiNo ratings yet

- Midterm MCQ 1-5Document83 pagesMidterm MCQ 1-5AngeloNo ratings yet

- Genealogy ReportDocument2 pagesGenealogy Reportzhaodonghk3No ratings yet

- EBRDDocument17 pagesEBRDDana Cristina VerdesNo ratings yet

- TerraPower Case PDFDocument7 pagesTerraPower Case PDFKaustav DeyNo ratings yet

- Principal and Agent: Joseph E. StiglitzDocument13 pagesPrincipal and Agent: Joseph E. StiglitzRamiro EnriquezNo ratings yet

- Ratio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilityDocument6 pagesRatio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilitysolomonNo ratings yet

- L.3 (Indemnity & Guarantee, Bailment & Pledge)Document16 pagesL.3 (Indemnity & Guarantee, Bailment & Pledge)nomanashrafNo ratings yet

- ABM - Specialized Subject: Fundamentals of Accountancy, Business and Management 1Document14 pagesABM - Specialized Subject: Fundamentals of Accountancy, Business and Management 1Jupiter Whiteside100% (6)

- Soal Dan JWBN Siklus DGGDocument17 pagesSoal Dan JWBN Siklus DGGGhina Risty RihhadatulaisyNo ratings yet

- Mr. Radhakrishnan's business transactionsDocument11 pagesMr. Radhakrishnan's business transactionsPriyasNo ratings yet

- Rta - Price List Agro July 2023Document9 pagesRta - Price List Agro July 2023Saniya ShaikhNo ratings yet

- CPA Licensure Exam Syllabus for Management Advisory ServicesDocument16 pagesCPA Licensure Exam Syllabus for Management Advisory ServiceskaderderkaNo ratings yet