Professional Documents

Culture Documents

2017IJMIE

Uploaded by

Deepanshu ShakargayeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2017IJMIE

Uploaded by

Deepanshu ShakargayeCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/320487008

The Problem of Rising Non-performing Assets in Banking Sector in India:

Comparative Analysis of Public and Private Sector Banks

Article · July 2017

CITATIONS READS

0 761

2 authors, including:

Raj Kumar Mittal

Guru Gobind Singh Indraprastha University

102 PUBLICATIONS 173 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

RESEARCH View project

All content following this page was uploaded by Raj Kumar Mittal on 19 October 2017.

The user has requested enhancement of the downloaded file.

International Journal of Management, IT & Engineering

Vol. 7 Issue 7, July 2017,

ISSN: 2249-0558 Impact Factor: 7.119

Journal Homepage: http://www.ijmra.us, Email: editorijmie@gmail.com

Double-Blind Peer Reviewed Refereed Open Access International Journal - Included in the International Serial

Directories Indexed & Listed at: Ulrich's Periodicals Directory ©, U.S.A., Open J-Gage as well as in Cabell’s

Directories of Publishing Opportunities, U.S.A

The Problem of Rising Non- performing Assets in

Banking Sector in India: Comparative Analysis

of Public and Private Sector Banks

Dr. Raj Kumar Mittal

Ms. Deeksha Suneja

Abstract

The growth of the economy depends upon the efficiency and

stability of the banking sector. The most important factor

which measures the health of the banking industry is the size of

NPAs. Non-Performing assets have direct impact on the

financial performance of banks i.e. their profitability. It

Keywords:

denotes the efficiency with which a bank is optimizing its total

Bank; resources and therefore, serving an index to the degree of asset

Performance; utilization and managerial effectiveness.NPAs affects the

profitability of the banks in terms of rising cost of capital,

Efficiency; increasing risk perception thereby affecting liquidity position

Non-performing assets; of banks.This paper attempts to first examine the level of

NPAs in the banking sector in India and then analyze the

Profitability.

causes for increasing NPAs. In the final part of the

paper,measures which banks can take to reduce their NPAs

have been suggested. The study also compares the

performance of the public sector banks with the private sector

banks.The secondary data collected from different sources has

been used in the study. The study shows that the magnitude of

NPAs is increasing in public sector banks as compared to the

private sector banks. Therefore banks need to effectively

control their NPAs in order to increase their profitability and

efficiency.

University School of Management Studies, Guru Gobind Singh Indraprastha University, New

Delhi

Jagannath International Management School, New Delhi

384 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

1. Introduction

The banking system is the heart of the financial system. The major function of the financial

system is themobilisation of the public savings and its allocation in different sectors of the

economy as an investment. The conversion of financial savings in to investment is known as the

process of capital formation in the economy.How this process of financial intermediation (i.e.

collecting scattered savings and using it in to productive purposive) is carried out shall reflect the

efficiency of the financial institutions and their role in socio-economic transformation of the

nation.

The Narasimham Committee (1991) on “Financial System Reforms” introduced the concept of

non-performing assets.The status on non-performing assets constitutethe best indicator of

judging the health of the banking industry. The problem of NPAs is linked with the lending

procedure of banks as these are an inevitable burden on the banks.A bank gives out money

upfront and earns income over a time on the promise of a borrower to repay. When loans are not

repaid, the bank loses both its income stream, as well as its capital. Lending is always

accompanied by the credit risk arising out of the borrower’s default in repaying the money*.The

major problem today faced by all the commercial banks is the increasing risk of non-performing

assets, which poses challenge to their ultimate survival.

The NPAs have been classified under four categories:

(i) Standard Assets: A standard asset is a performing asset. Standard assets generate

continuous income and repayments as and when they fall due. Such assets carry a normal risk

and are not NPAs in the real sense.

(ii) Sub-standard Assets: All those assets which are considered as non-performing for a

period of 12 months.

(iii) Doubtful Assets: Those assets which are considered as non-performing for period of

more than 12 months.

(iv) Loss Assets: All those assets which cannot be recovered.

These assets are identified by the Central Bank or by the auditors.

*

HarpreetKaur and Pasricha J.S.(2004) “Management of NPAs in Public Sector Banks”, The Indian Journal of

Commerce, Vol.57, No.2, p.14.

385 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

As compared to private sector banks, public sector banks have shown a better performance as far

as financial operations are concerned. The biggest problem however, in case of public sector

banks is the increasing level of non-performing assets year after year. NPAs hurts the

profitability of the banks as it results in non-recovery of loan installments along with the interest

amount due to which banks have to use more owned funds by way of increased capital and also

in the form of reserves and surplus to provide a cushion for the loss due to loan.

The efficiency of the banks is also reflected by the level of return on its assets which is

deteriorated by the presence of NPAs in the balance sheet of the banks. Therefore, this paper

examines the issue of NPAs in the context of scheduled commercialbanks in both public and

private sector. One of the drivers of growth and financial stability is the level of NPAs in the

banking sector.

In the year 1992, the Government of India introduced a number of reforms to deal with the

problem of growing NPAs in banking sector. The major steps includes; introduction of Debt

Recovery Tribunals, Securitization Act 2002, LokAdalats, Compromise Settlement Scheme and

introduction of Credit Information Bureau. The below data shows the amount of NPAs recovered

through various channels during the year 2015-16.

Table1: Recovery of NPAs through different channels

Recovery LokAdalats DRT’s SARFAESI Total

Channels Act

No. of cases 4456634 24537 173582 4654753

referred

Amount involved 720 693 801 2214

(in Rs.billion)

Amount 32 64 132 228

recovered (in Rs.

billion)

In the year 2015-16, 10.3 percent of the total amount referred to for recovery is recovered though

all the recovery channels. The above table shows that recovery through LokAdalats is 4.4%

while it was 9.2% through DRT’s as compared to 16.5% from SARFAESI Act.

386 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

Undoubtedly, strong banking sector is important for a flourishing economy. Various studies have

been conducted in the past to address the issue of NPA’s in the Indian bankingindustry. A brief

review of the different studies is given below:

Bhavani Prasad, G. and Veena, V.D (2011)in their paper titled “NPAs in Indian banking sector:

trends and issues,” found that public sector banks accounted for 78 percent of NPAs and is the

main reason for their falling revenues.

The RBI has also conducted a study to examine the factors contributing to the growth of NPA’s.

The study covered 800 top NPAs accounts in 33 banks (RBI Bulletin, July 1999). The study

showed that the proportion of problem loans in the banks has always been very high which was

at 17.91% of their gross advances on 31stMarch,1989. After the introduction of prudential norms

it came down to 17.44% as on 31st March,1999. The study also showed that the major factors

which result in NPA’s includes ; diversion of funds for modernization, expansion,

diversification, undertaking new projects etc.The report concluded that the reduction in non-

performing assets in the banking sector should be taken as a nation’s priority to make the

banking sector stronger.

KaminiRai(2012), in her study on “Performance of NPAs in Indian Commercial Banks” has

examined the main reasons for increasing NPA’s in banks in India.She pointed out that the

target-oriented approach, which results in ineffective supervision of loan accounts, lack of

managerial and technical expertise on part of the borrowers which ultimately deteriorates the

qualitative aspect of lending by banks, are the main reasons for the increasing NPAs in banks.

Mario Castelino (2005) in “Managing Non-Performing Assets” stated that in the recent past the

NPAs of the corporate sector have come down drastically, where as there is a concern over

increase in NPAs in the retail sector and increasing issue of frauds in mortgage loans.

Murali and Krishna (2006) observed that there has been a spurt in the lending activity of banks,

in the recent past. This is due to two factors, viz. availability of huge surplus funds with the

banks and the losses suffered by the banks in investment and treasury activities. While credit

387 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

growth is needed for survival, it is imperative to ensure that the credit growth does not result in

non-performing advances later. For this, banks have to resort to effective pre-disbursement as

well as post-disbursement monitoring. The authors concluded that negligence in monitoring a

loan was less excusable than an error at the appraisal stage.

Kumar (2006) in his research book titled, "Banking Sector Efficiency in Globalized Economy,"

highlighted that the performance of the banks both in the public and private sectors has become

more market driven with growing emphasis on better performance. Author has examinedthe

broad structure of banking system in India, analyzed the overall efficiency of the system in terms

of financial parameters into two components: technical efficiency and allocation efficiency. He

concluded that the much-publicized fact that public sector banks are inefficient is based on a

piecemeal analysis in the form of a simple, static, partial and isolated ratios having some hidden

and often misconceived assumptions about the structure. The study concluded that there is an

urgent need of the time to go in for this kind of system wide analysis to explore the intricacies of

the complex system.

Bhatia (2007) in his research paper entitled, “Non-performingassets of Indian public, private and

foreign sectorbanks: An empiricalassessment”, explored theapplication of an empirical approach

to the analysis of NPAs. The NPAs are considered as an important parameter to judge the

performance and financial health of banks. The level of NPAs is one of the drivers of financial

stability and growth of the banking sector. This paper attempts to find out the fundamental

factors which impact the level of NPAs of banks in India . A framework consisting of two types

of factors, viz., macroeconomic and bank-specific parameters, is developed and the behavior of

NPAs of the three categories of banks has beenanalysed.

Siraj and Pillai (2011) investigated the performance of Indian scheduled commercialbanks

(SCBs) before and after the global financial crisis (2007-2009). The study wasconducted using

data available for the period from 1999-2000 to 2010-2011. It wasfound that from year 2007-

2008 to year 2010-2011 the provisions and contingencies that included provisions towards NPAs

grewconsiderably for all bank groups. Thefresh additions to NPAs grew at a higher rate after the

global financial crisis. The mostaffected bank groups were foreign banks and nationalised banks.

388 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

Financial crises leadto higher NPAs and force banks to invest in less risky investment

portfolios.Consequently, a reduction in the CDR was observed after 2007 across all bank groups

except at the State Bank of India and its associated banks.

Ali Shingjergji (2013) in “The impact of macro-economicvariables on the non –

performingloansin the Albanian Banking System (2005 – 2012)” examined the impact of main

macroeconomic variables on the non performing loans’. This study is motivated by the

hypothesis that macroeconomic variables have an effect on the non- performing loans. The paper

examined the relationship between non -performing loans and variables like GDP, inflation rate,

exchange rate, and base interest rate by using a simple regression model. In fact the level of non

- performing loans in the Albanian banking system reachedup to 23.1 percent of the total loans.

The study concluded that there is a positive relationship between the base interest rate of four

quarters lag and NPLs ratio in time.

Asha Singh (2013) in “Performance of Non-Performing Assets in Indian commercialbanks”

observed that the NPAs of the public sector banks are increasing year by year. On the contrary,

the non-performing assets of private sector banks have been decreasing regularly year by year

except in some years. Generally reduction in NPAs shows that banks have strengthened their

credit appraisal processes over the years and increased in NPAs shows the necessity of

provisions, which brings down the overall profitability of banks.

Gerlach, S., Peng, W.&Shu, C. (2005) in “Macroeconomic conditions and banking performance

in Hong Kong SAR: A panel data study” concluded that NPAs ratio increases with number of

bankruptcies and nominal interest rate but decreases with inflation (CPI and property prices) and

economic growth.

The existing studies generally focused on analyzing NPAs till the end of the year 2015. This

paper attempts to examine the trend in NPAs from the year 2005 till 2016 which primarily

focused on analyzing the growth rate in non-performing assets in public sector and private sector

banks. The paper also attempts to identify possible causes which drive loans to become bad

along with its impact on the future performance of banks. The study also providesuggestions

banks can take to minimize the problem.

389 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

2. Research Method

The study is primarily analytical and descriptive based on secondary data collected from RBI

publications, journals, reports and websites of public and private sector banks in India. The time

period covered for the study is from 2005 to 2016.

To analyse the growth in NPAs among public sector banks and private sector banks, different

statistical tools like figures, bar graphs have been used. Compound annual growth rate(CAGR)

has been calculated to identify the percentage increase in NPAs over the selected period under

study.

The specific objectives of the present study are:

1. To find out the quantum of NPAs in public sector and private sector banks in India.

2. Toanalyze the impact of NPAs on banks’ performance.

3. To analyze the reasons for mounting NPAs in banks in India.

4. To suggest ways to reduce the level of NPAs in banks in India.

3. Results and Analysis

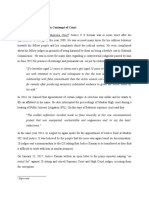

3.1 The figure 1 shows the Gross NPAs to Gross Advances Ratio of public and

privatesectorbanks during the year 2005 – 2016.

Figure 1: Gross NPAs to Gross Advances Ratio of Public and Private Sector Banks

12.00

10.00

8.00

Public Sector

6.00 Banks

4.00 Private Banks

2.00

0.00

200520072009201120132015

(Source: Database on Indian Economy, Reserve Bank of India, 2005-2016)

390 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

The above graph shows the trend of Gross NPAs to Gross Advances Ratio of public and private

sector banks for the period of 10 years starting from 2005 to 2016. The x-axis represent the

years, whereas y-axis represent the ratio. We can observe here that the Gross NPAs to Gross

Advances Ratio of public sector banks is showing a downward trend from year 2005 till 2008 but

since the year 2009 it has started increasing. One of the reasons is the global financial turmoil of

2008. Private sector banks havealso shown almost the same trend but we can see that the trend is

considerably increasing for public sector banks.

Table 2: Gross NPAs to gross advances ratio of public and private sector banks

(Amount in Rs. Crores)

Public

Private

Year Sector

Banks

Banks

2005 5.36 3.83

2006 3.81 2.41

2007 2.69 2.19

2008 2.06 2.47

2009 1.75 2.92

2010 2.03 2.99

2011 1.97 2.48

2012 2.67 2.09

2013 3.24 1.77

2014 4.09 1.78

2015 5.26 2.1

2016 10.69 2.83

From Table 2, it can beseen that there is a compound annual increase of 6 percent in gross NPAs

to gross advances ratio of public sector banks but with respect to private sector banks, there is a

negative increase of 3 percent which means that the ratio of gross NPAs to gross advances

have improved considerably over the years.

391 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

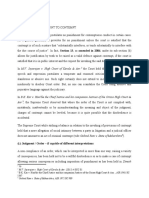

The following figure represents the movement of Net NPAs of public and private sectorbanks

for the time period under study.

Figure 2:Movement of Net NPAs of Public Sector and Private Sector Banks

Movement of Net NPAs

3000000

2500000

2000000

Public SectorBanks

1500000

1000000

Private Sector

500000 Banks

0

(Source: Database on Indian Economy, Reserve Bank of India, 2005-2016)

We can observe here that the net non- performing assets of both public and private sector banks

are increasing over the years but as there is a huge difference between the quantum of NPAs

between them. The share of public sector banks in NPAs is considerably far more compared to

private sector banks.

Table 3: Rising NPAs in public and private sector banks in India.

(Amount in Rs. Crores)

Private Sector

Year Public Sector Banks

Banks

2005 105407 42116

2006 84934 31703

2007 89657 40282

2008 93275 56469

2009 102863 74120

2010 168131 65060

2011 212640 44322

392 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

2012 389686 44012

2013 618509 59944

2014 885464 88615

2015 1226734 141283

2016 2514814 266774

From Table 3, as shown in , it is found that CAGR in NPAs for public sector banks is 33

percent as compared to 18 percent for private sector banks which shows a mounting increase

over the period under study.

Table 4: Classification of Loan Assets of Public Sector Banks

(Amount in Rs. Crores)

Standard Sub-Standard Doubtful

Year Advances Advances Advances Loss Advances

Amount Percent Amount Percent Amount Percent Amount Percent

2005 8379 94.6 110 1.2 308 3.5 59 0.7

2006 10926 96.4 113 1.0 246 2.2 55 0.5

2007 14262 97.4 143 1.0 198 1.4 48 0.3

2008 17786 97.8 173 1.0 192 1.1 40 0.2

2009 22378 98.0 203 0.9 206 0.9 41 0.2

2010 26735 97.8 288 1.1 254 0.9 58 0.2

2011 32718 97.8 350 1.1 332 1.0 65 0.2

2012 38255 97.0 623 1.6 490 1.2 60 0.2

2013 43957 96.4 815 1.8 761 1.7 68 0.2

2014 49887 95.6 958 1.8 1216 2.3 99 0.2

2015 53382 95.0 1054 1.9 1630 2.9 100 0.2

2016 52875 90.7 2005 3.4 3232 5.5 163 0.3

(Source: Database on Indian Economy, Reserve Bank of India, 2005-2016)

The above table shows the classification of loan assets of publicsectorbanks. Over the years,

there is a fluctuation of NPAs among the banks. Standard advances and doubtful advances have

shown both increasing and decreasing trend. Sub-standard advances are gradually increasing

over the years. Loss advances are more of constant during the period under study.

393 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

Table 5: Classification of Loan Assets of Private Sector Banks

(Amount in Rs. Crores)

Standard Sub-Standard Doubtful

Loss Advances

Year Advances Advances Advances

Amount Percent Amount Percent Amount Percent Amount Percent

2005 2172 96.1 22 1.0 56 2.5 9 0.4

2006 3099 97.6 24 0.8 44 1.4 9 0.3

2007 4109 97.8 44 1.0 39 0.9 9 0.2

2008 5129 97.5 73 1.4 45 0.9 12 0.2

2009 5681 97.1 106 1.8 50 0.9 13 0.2

2010 6265 97.3 89 1.4 66 1.0 22 0.3

2011 7936 97.8 45 0.6 108 1.3 29 0.4

2012 9629 98.1 52 0.5 104 1.1 29 0.3

2013 11384 98.2 64 0.6 112 1.0 32 0.3

2014 13371 98.2 86 0.6 114 0.8 42 0.3

2015 15750 97.9 108 0.7 176 1.1 52 0.3

2016 19184 97.2 186 0.9 311 1.6 62 0.3

(Source: Database on Indian Economy, Reserve Bank of India, 2005-2016)

The above table shows the classification of loan assets of privatesectorbanks. There has been a

constant rise in standard advances over the years except for the years 2015 and 2016 when can

see a decline. There is a fluctuation in sub-standard advances and doubtful advances over the

years. After year 2011, loss advances remained constant over the years.

As compared to private sector banks, public sector banks have more sub-standard and doubtful

advances but the standard advances of private sector banks remains high against public sector

banks which shows a better performance of private sector banks.

3.2 Causes for NPAs

A robust banking sector is the backbone of the economy, therefore to improve the health of the

banking system we must look into account all the likely causes which can hinder its smooth

performance. No doubt, NPAs are a menace to the efficient working of the overall banking

industry. In order to reduce the problem of NPAs that banks can work efficiently, we must first

394 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

be aware of all the reasons which cause problem of bad loans.The causes are divided into three

categories, one related with respect to the internal functioning of banks, second are the causes

accountable to borrowers. It has been observed that the large borrowers are the biggest defaulters

in the bank. The top 30 NPAs of PSBs were found to account for 40.2 percent of their

GNPAs[2]Apart from these, there are some macro-economic causes which affect the whole

industry and cause changes in NPAs.

Table6: Causes for rising NPAs in banks in India

Causes accountable to Causes accountable to

Other causes

banks borrower

Poor credit appraisal

Longer gestation time Fast changing technology

mechanism

Wrong selection of

Mis-management of funds Political warfare

borrowers

Lack of trained staff Wrong selection of projects Taxation laws

Inflexible attitude Diversion of funds Credit policies

No delegation of authority Lack of quality control Government policies

Lack of proper follow-up by

Rising expenses Increase in factor cost

the banks

Weakpost- credit appraisal Changes in consumer tastes

Poor choice of location

system and preferences

Inefficient management of Inadequate attention to research

Recession in the market

lending facilities and development

3.3 Impact of NPAs on banks

NPAs directly affect the profitability of the banks. Below mentioned are the ways through which

banks profitability is affected:

(i) Liquidity position:NPAs affects the liquidity position of the banks, thereby creating a

mis-match between assets and liability and force the banks to raise resources at high cost.

(ii) Undermine bank’s image: High level of NPAs shadows the image of banks both in

domestic and global markets. This ultimately leads to lower profitability.

395 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

(iii) Effect on funding: Increasing level of NPAs in banks results in scarcity of funds in the

Indian capital market as there will be only few banking institutions who will lend money.

(iv) Higher cost of capital: It shall result in increasing the cost of capital as banks will now

have to keep aside more funds for the smooth working of its operations.

(v) High risk: NPAs will affect the risk-bearing capacity of the banks.

(vi) Effect on income: NPAs will reduce the net interest income of the banks as interest is

not charged to these accounts.

(vii) Declining productivity: It will also cost in terms of time, money and manpower which

will ultimately results in declining profitability, since the staff is primarily engaged with

preparing papers for filing law cases to recover principal amount and interest rather than

devoting time for planningmobilization of funds.

(viii) Effect on ROI and profitability: It reduces the earning capacity of the assets thereby

negatively affect the ROI.All NPAs need to be prudentially provided for which shall have a

direct impact on the profitability of the banks.

(ix) Ultimate burden on society: It will ultimately affect the consumers who now will have

to fetch out more money for paying higher interest.

3.4 Suggestions to reduce NPAs in banks

(i) Revision of existing credit appraisal and monitoring systems by RBI

(ii) Regular follow-up of customers by the banks to ensure that there is no diversion of funds.

(iii) Review of all loan accounts at fixed interval.

(iv) Proper training to bank employees and staff to overcome the weakness of credit appraisal

and credit monitoring.

(v) Banks may resort to one-time settlement scheme or compromise settlement scheme.

Recovery through Debt Recovery Tribunals and LokAdalats are other ways. Banks these days

are resorting to SARFAESIAct for the management of NPAs.

(vi) Establishing a rigorous screening process before granting credit.

(vii) The bank should rephrase or reschedule the account for reasons that are beyond the

borrower’ control.

396 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

4. Conclusion

Non-performing assets have always been a problem for the Indian bankingsector as it is having a

direct impact on the profitability of the banks. The failure of the banking sector may have an

adverse impact on other sectors. Thus, there is a need to ensure that the banks take proper steps

to resolve it, thereby ensuring fair and efficient recovery of loans so that banking sector continue

to function without stress. The study reveals that the extent of NPAs is comparatively more in

public sector banks as compared to private sector banks. The government is taking many steps to

reduce the problem of NPAs but banks should also have to be more proactive to adopt a

structured NPAs policy to prevent the non-performing assets and should follow stringent

measures for its recovery. Bankers should also consider the ROI on a proposed project and

provide loans to customers who have better credit worthiness as prevention is always better than

cure.

References

[1] Ali Shingjergji, “The Impact of Macroeconomic Variables on the Non Performing Loans

in the Albanian Banking System During 2005 – 2012” Academic Journal of Interdisciplinary

Studies, Vol. 2, No. 9, October 2013

[2] Bhatia, “Non-Performing Assets of Indian Public, Private and Foreign Sector Banks: An

Empirical Assessment “,ICFAI, Journal of Bank Management, Vol. 6, No. 3, pp. 7-28, 2007

[3] Bhavani Prasad, G. and Veena, V.D., “NPAs in Indian banking sector -trends and

issues,” Journal of Banking Financial Services and Insurance Research, Volume No. 1, Issue 9,

2011, Pp 67-84, 2011

[4] Gerlach, S., Peng, W., &Shu, C., “Macroeconomic conditions and banking performance

in Hong Kong SAR: A panel data study.” BIS Papers, Bank for International Settlements, Basel,

(No. 22), 2005

[5] KaminiRai, “Study on Performance of NPAs of Indian Commercial Banks” Asian

Journal of Research Banking and Finance, Volume 2, Issue 12, December 2012

[6] Mario Castelino, Managing Non-Performing Assets, Chartered Financial Analyst,

Mumbai, 2005

[7] Murali S, ParshadKPS, “Ensuring Qualitative Credit Growth through Effective

Monitoring of Advances.” Indian Bankers February, 2006; 19-24.

397 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

ISSN: 2249-0558 Impact Factor: 7.119

[8] RBI, “Report on Trend and Progress of Banking in India, various issues.”

[9] Singh Asha, “Performance of Non-Performing Assets in Indian Commercial Banks”

published in International Journal of Marketing, Financial Services &Research Management”

vol. 2, issue 9 2013, pp. 86-94

[10] Siraj, K. and Pillai, P., “Asset quality and profitability of Indian scheduled commercial

banksduring global financial crisis”, International Research Journal of Finance and Economics

2011, No. 80,pp. 55-65.

398 International journal of Management, IT and Engineering

http://www.ijmra.us, Email: editorijmie@gmail.com

View publication stats

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Narayan v. Babasaheb, (2016) 6 SCC 725Document9 pagesNarayan v. Babasaheb, (2016) 6 SCC 725Deepanshu ShakargayeNo ratings yet

- Answer 2-: Inventive Step and Capable of Industrial Application'Document4 pagesAnswer 2-: Inventive Step and Capable of Industrial Application'Deepanshu ShakargayeNo ratings yet

- Health Law Final Exam AnswersDocument22 pagesHealth Law Final Exam AnswersDeepanshu ShakargayeNo ratings yet

- Judicial Pronouncement On Contempt of Court: Supra NoteDocument12 pagesJudicial Pronouncement On Contempt of Court: Supra NoteDeepanshu ShakargayeNo ratings yet

- Chapter 1,2,3Document60 pagesChapter 1,2,3Deepanshu ShakargayeNo ratings yet

- Summary ProceedingDocument4 pagesSummary ProceedingDeepanshu ShakargayeNo ratings yet

- IPR Ans 1Document5 pagesIPR Ans 1Deepanshu ShakargayeNo ratings yet

- Section 13 of The Act 1971 Postulates No Punishment For Contemptuous Conduct in Certain CasesDocument4 pagesSection 13 of The Act 1971 Postulates No Punishment For Contemptuous Conduct in Certain CasesDeepanshu ShakargayeNo ratings yet

- AbstractDocument3 pagesAbstractDeepanshu ShakargayeNo ratings yet

- CPC Notes MisslDocument178 pagesCPC Notes MisslDeepanshu ShakargayeNo ratings yet

- Arrest Dr. Mohd. Asad Malik: Roshan Beevi v. Joint Secy. To The Govt. of Tamil NaduDocument22 pagesArrest Dr. Mohd. Asad Malik: Roshan Beevi v. Joint Secy. To The Govt. of Tamil NaduDeepanshu ShakargayeNo ratings yet

- Cryopreservation and Ivf: What Can Be Stored?Document2 pagesCryopreservation and Ivf: What Can Be Stored?Deepanshu ShakargayeNo ratings yet

- Law of Limitation Act in India: M.Pradeep KumarDocument12 pagesLaw of Limitation Act in India: M.Pradeep KumarDeepanshu ShakargayeNo ratings yet

- Infertility and ItDocument3 pagesInfertility and ItDeepanshu ShakargayeNo ratings yet

- Warrant Dr. Mohd. Asad MalikDocument10 pagesWarrant Dr. Mohd. Asad MalikDeepanshu ShakargayeNo ratings yet

- Formatted ReportDocument93 pagesFormatted ReportDeepanshu ShakargayeNo ratings yet

- Ovarian Cyst: Causes, Symptoms, and TreatmentDocument2 pagesOvarian Cyst: Causes, Symptoms, and TreatmentDeepanshu ShakargayeNo ratings yet

- Proclamation and Attachment Dr. Mohd. Asad MalikDocument9 pagesProclamation and Attachment Dr. Mohd. Asad MalikDeepanshu ShakargayeNo ratings yet

- 1801200610371st Asad MalikDocument8 pages1801200610371st Asad MalikDeepanshu ShakargayeNo ratings yet

- Rights of Arrested Person Dr. Mohd. Asad MalikDocument10 pagesRights of Arrested Person Dr. Mohd. Asad MalikDeepanshu ShakargayeNo ratings yet

- SummonDocument4 pagesSummonDeepanshu ShakargayeNo ratings yet

- Assignment 6Document3 pagesAssignment 6Deepanshu ShakargayeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shaheed Suhrawardy Medical College HospitalDocument3 pagesShaheed Suhrawardy Medical College HospitalDr. Mohammad Nazrul IslamNo ratings yet

- Siemens 6SL31622AA000AA0 CatalogDocument20 pagesSiemens 6SL31622AA000AA0 CatalogIrfan NurdiansyahNo ratings yet

- 2400 8560 PR 8010 - A1 HSE Management PlanDocument34 pages2400 8560 PR 8010 - A1 HSE Management PlanMohd Musa HashimNo ratings yet

- Heroic Tales Core Rules 1.1.0Document33 pagesHeroic Tales Core Rules 1.1.0Melobajoya MelobajoyaNo ratings yet

- HimediaDocument2 pagesHimediaWiwit MarianaNo ratings yet

- 6 1 Maxima and MinimaDocument10 pages6 1 Maxima and MinimaSebastian GarciaNo ratings yet

- Rubber Stamp BusinessDocument4 pagesRubber Stamp BusinessvasantsunerkarNo ratings yet

- Asia Pacific SAR Plan V2.0Document38 pagesAsia Pacific SAR Plan V2.0Joci SimõesNo ratings yet

- Plasterboard FyrchekDocument4 pagesPlasterboard FyrchekAlex ZecevicNo ratings yet

- Pursanova IXC ManualDocument16 pagesPursanova IXC ManualHector Serrano MagañaNo ratings yet

- A3 Report Template Checklist - SafetyCultureDocument4 pagesA3 Report Template Checklist - SafetyCulturewarriorninNo ratings yet

- Mechatronics MaterialDocument86 pagesMechatronics MaterialKota Tarun ReddyNo ratings yet

- Moodle2Word Word Template: Startup Menu: Supported Question TypesDocument6 pagesMoodle2Word Word Template: Startup Menu: Supported Question TypesinamNo ratings yet

- Introduction To Entrepreneurship: Bruce R. Barringer R. Duane IrelandDocument29 pagesIntroduction To Entrepreneurship: Bruce R. Barringer R. Duane IrelandAnonymous Yp8H9QwNo ratings yet

- Module 8 - Facilitating Learner - Centered TeachingDocument4 pagesModule 8 - Facilitating Learner - Centered TeachingSheila Mae Paltep100% (3)

- Useful C Library FunctionDocument31 pagesUseful C Library FunctionraviNo ratings yet

- Vivekananda'S Conception of Normative Ethics and Resolution Ethical Problems in BusinessDocument8 pagesVivekananda'S Conception of Normative Ethics and Resolution Ethical Problems in BusinessYajat BhargavNo ratings yet

- Reading Comprehension Lesson Plan FinalDocument9 pagesReading Comprehension Lesson Plan Finalapi-254917183No ratings yet

- Infoblatt Skischulen Trends Port eDocument18 pagesInfoblatt Skischulen Trends Port eAustrian National Tourism BoardNo ratings yet

- PriceDoxy 09 September 2011Document56 pagesPriceDoxy 09 September 2011Elena OltuNo ratings yet

- Omran WalidDocument196 pagesOmran WalidDébora AmougouNo ratings yet

- Contingency Measures and ProceduresDocument25 pagesContingency Measures and ProceduresKaren Villapando LatNo ratings yet

- Calculations: M 0 M 1 c1 c1 0 c2 c2 1 2Document6 pagesCalculations: M 0 M 1 c1 c1 0 c2 c2 1 2shadab521100% (1)

- FinancialAccountingTally PDFDocument1 pageFinancialAccountingTally PDFGurjot Singh RihalNo ratings yet

- Five Star Env Audit Specification Amp Pre Audit ChecklistDocument20 pagesFive Star Env Audit Specification Amp Pre Audit ChecklistMazhar ShaikhNo ratings yet

- Unit 2 Talents: Phrasal Verbs: TurnDocument5 pagesUnit 2 Talents: Phrasal Verbs: TurnwhysignupagainNo ratings yet

- Vallen AE AccesoriesDocument11 pagesVallen AE AccesoriesSebastian RozoNo ratings yet

- 0 - Danica Joy v. RallecaDocument2 pages0 - Danica Joy v. RallecaRandy Jake Calizo BaluscangNo ratings yet

- Manual en TC1 TD4 Curr 2018-07-16Document39 pagesManual en TC1 TD4 Curr 2018-07-16Daniel Peña100% (1)

- A Review of Automatic License Plate Recognition System in Mobile-Based PlatformDocument6 pagesA Review of Automatic License Plate Recognition System in Mobile-Based PlatformadiaNo ratings yet