Professional Documents

Culture Documents

Carbide Chemical Company-Replacement of Old Machines-Discounting of Cashflows

Uploaded by

Rajib DahalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carbide Chemical Company-Replacement of Old Machines-Discounting of Cashflows

Uploaded by

Rajib DahalCopyright:

Available Formats

2.

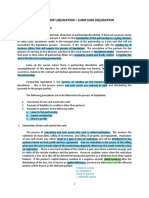

Carbide Chemical Company is considering the replacement of two old machines

with a new more efficient machine, The old machine could be sold for $70,000 in the

secondary market. The depreciated book value is $120,000 with a remaining useful and

depreciable life of 8 years. Straight-line depreciation is used on these machines. The

new machine can be purchased and installed for $480,000. It has useful life of 8 years,

and at the end of which a salvage value of $40,000 is expected. The machine falls in 5-year

property class for accelerated cost recovery (depreciation) purposes. Due to its greater

efficiency , the machine is expected to result in incremental annual saving of $120,000.

The company's corporate tax rate is 34 percent, and if a loss occurs in any year on the project,

it is assumed that company will get a tax credit of 34 percent for such class. 2.a) What are the incremental cash flows

over the eight years and what is the incremental cash This Model is prepared by Rajib Dahal. If you need

flow at time 0? 2.b) What is the project's net present value If the require date of return is 14 percent? excelsheet calculation, please contact me at my email at

rajib.dahal@nu.edu.kz/rajib.dahal@gmail.com

Assumptions

Depreciated Book Value of Old Machine 120,000 Depreciation Schedule forfive-year property class

Current Salvage Value of old machine 70,000 Years Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Capex for new machine 480000 Depreciation rate 20.00% 32.00% 19.20% 11.52% 11.52% 5.76%

Annual Depreciation-

Salvage Value of new machine 40,000 New Machine 96,000 153,600 92,160 55,296 55,296 27,648

Annual reduction in labour and maintenance cost 120,000

Discount Rate 0.14

Tax Rate 0.34

Discounted Cash Flow Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Years 0 1 2 3 4 5 6 7 8

Cash savings from new machine 120,000 120,000 120,000 120,000 120,000 120,000 120,000 120,000

Gain from Salvage Value of Old machine (50,000)

D&A(New Machine) 96,000 153,600 92,160 55,296 55,296 27,648 0 0

D&A(Old Machine) 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000

Increase in D&A 81,000 138,600 77,160 40,296 40,296 12,648 (15,000) (15,000)

Gain from Salvage Value of new machine 40,000

Cash savings before taxation (50,000) 39,000 (18,600) 42,840 79,704 79,704 107,352 135,000 175,000

Taxation (17,000) 13,260 (6,324) 14,566 27,099 27,099 36,500 45,900 59,500

Cash flows after taxation 25,740 (12,276) 28,274 52,605 52,605 70,852 89,100 115,500

Add: D&A (Increment) 0 81,000 138,600 77,160 40,296 40,296 12,648 (15,000) (15,000)

Add: Capex (480,000)

Transaction Cash flows (393,000) 106,740 126,324 105,434 92,901 92,901 83,500 74,100 100,500

Discount factor 1.000 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351

Discounted Cash flow (393,000) 93,632 97,202 71,165 55,005 48,250 38,042 29,613 35,231

NPV 75,139

You might also like

- Lesson 4 Expenditure Cycle PDFDocument19 pagesLesson 4 Expenditure Cycle PDFJoshua JunsayNo ratings yet

- 1364002Document3 pages1364002Pulkit MahajanNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Chapter 15-Financial Planning: Multiple ChoiceDocument22 pagesChapter 15-Financial Planning: Multiple ChoiceadssdasdsadNo ratings yet

- New LeveragesDocument16 pagesNew Leveragesmackm87No ratings yet

- Fin Man Case Study On Fs AnalysisDocument6 pagesFin Man Case Study On Fs AnalysisRechelleNo ratings yet

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyNo ratings yet

- Chapter 7 Materials Controlling and CostingDocument43 pagesChapter 7 Materials Controlling and CostingNabiha Awan100% (1)

- This Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)Document8 pagesThis Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)NCT100% (1)

- Job Order and Process CostingDocument4 pagesJob Order and Process CostingJade TanNo ratings yet

- ASSIGNMENT 2.1 CASH FLOWS StudentDocument4 pagesASSIGNMENT 2.1 CASH FLOWS StudentMichael Angelo CatubigNo ratings yet

- AFAR ReviewDocument11 pagesAFAR ReviewPaupauNo ratings yet

- Standard Unmodified Auditor ReportDocument3 pagesStandard Unmodified Auditor ReportRiz WanNo ratings yet

- Chapter OneDocument5 pagesChapter OneHazraphine LinsoNo ratings yet

- Mas-07: Responsibility Accounting & Transfer PricingDocument7 pagesMas-07: Responsibility Accounting & Transfer PricingClint AbenojaNo ratings yet

- Auditing AssignmentDocument17 pagesAuditing Assignmentihsan278No ratings yet

- PR Advance 1 Problem 10-7 Statement of AffairsDocument4 pagesPR Advance 1 Problem 10-7 Statement of AffairsReynaldi100% (1)

- Inventories ATs Garcia CristineJoy G BSA-1BDocument4 pagesInventories ATs Garcia CristineJoy G BSA-1BCj GarciaNo ratings yet

- Intercompany Sale of Merchandise - AdditionalDocument4 pagesIntercompany Sale of Merchandise - AdditionalJaimell LimNo ratings yet

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsDocument32 pagesQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsYou're WelcomeNo ratings yet

- Kuis AklDocument6 pagesKuis AklArista Yuliana SariNo ratings yet

- 118.2 - Illustrative Example - Hedge Accounting: FV HedgeDocument2 pages118.2 - Illustrative Example - Hedge Accounting: FV HedgeStephen GarciaNo ratings yet

- Tom Schriber A Director of Personnel at Management Resources Inc Is in The Process of Designing A Program That Its Customers Can Use in TheDocument1 pageTom Schriber A Director of Personnel at Management Resources Inc Is in The Process of Designing A Program That Its Customers Can Use in TheDoreenNo ratings yet

- HW On Operating Segments BDocument3 pagesHW On Operating Segments BJazehl Joy ValdezNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- 2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDocument1 page2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib DahalNo ratings yet

- Management Science Chapter 10Document44 pagesManagement Science Chapter 10Myuran SivarajahNo ratings yet

- Acc 11 HandoutDocument5 pagesAcc 11 HandoutRenalyn MadeloNo ratings yet

- SCM Chap 3 Probs 1-3Document4 pagesSCM Chap 3 Probs 1-3aj dumpNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199No ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- Cash FlowDocument3 pagesCash FlowMark IlanoNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Performance Measurement SolmanDocument55 pagesPerformance Measurement SolmanJoseph Deo CañeteNo ratings yet

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- Standard Costing - Chapter 18 23122020 124146pmDocument12 pagesStandard Costing - Chapter 18 23122020 124146pmZeerak Ali100% (1)

- SC PracticeDocument6 pagesSC Practicefatima airis aradais100% (1)

- SEATWORKDocument4 pagesSEATWORKMarc MagbalonNo ratings yet

- COST ALLOCATION and ACTIVITY-BASED COSTINGDocument5 pagesCOST ALLOCATION and ACTIVITY-BASED COSTINGBeverly Claire Lescano-MacagalingNo ratings yet

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument4 pagesEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- CVP - WWW - Ffqacca.co - CCDocument7 pagesCVP - WWW - Ffqacca.co - CCxxxfarahxxx100% (1)

- Gross Profit AnalysisDocument5 pagesGross Profit AnalysisInayat Ur RehmanNo ratings yet

- Problem I Cost ModelDocument76 pagesProblem I Cost ModelSia DLSLNo ratings yet

- International Accounting Standards: IAS 29 "Financial Reporting in Hyperinflationary Economies"Document29 pagesInternational Accounting Standards: IAS 29 "Financial Reporting in Hyperinflationary Economies"Phebieon MukwenhaNo ratings yet

- Solution Chapter 5 Rev FinalDocument84 pagesSolution Chapter 5 Rev FinalMiya Crizxen RevibesNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- 1 - p.3 7 8 Week 5 Financial AnalysisDocument4 pages1 - p.3 7 8 Week 5 Financial AnalysisTamoor BaigNo ratings yet

- Practice Questions - Financial Statement AnalysisDocument6 pagesPractice Questions - Financial Statement Analysisluliga.loulouNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Finman Midterms Part 1Document7 pagesFinman Midterms Part 1JerichoNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Assignment On SC and VADocument12 pagesAssignment On SC and VAVixen Aaron EnriquezNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- PAS 41 SummaryDocument2 pagesPAS 41 SummaryCharles BarcelaNo ratings yet

- 10 Responsibility Accounting Live DiscussionDocument4 pages10 Responsibility Accounting Live DiscussionLee SuarezNo ratings yet

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Document1 pageStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- Solution Problem On Project EvaluationDocument5 pagesSolution Problem On Project EvaluationHasanNo ratings yet

- Customs Duties On Imports of Books-Nepal-Recent ChangesDocument4 pagesCustoms Duties On Imports of Books-Nepal-Recent ChangesRajib DahalNo ratings yet

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Document1 pageStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- As The Capital Budgeting Director of Union Mills Inc.-Dcf ANALYSIS-DISCOUNTED CASH FLOWDocument1 pageAs The Capital Budgeting Director of Union Mills Inc.-Dcf ANALYSIS-DISCOUNTED CASH FLOWRajib Dahal100% (1)

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocument1 pageMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNo ratings yet

- Appendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Document1 pageAppendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Rajib Dahal100% (2)

- The Dauten Toy Corporation-Appendix 11B-1-Replacement Project Analysis - Capital Budgeting - Cashflow Analysis-DCF-Discounted CashflowDocument1 pageThe Dauten Toy Corporation-Appendix 11B-1-Replacement Project Analysis - Capital Budgeting - Cashflow Analysis-DCF-Discounted CashflowRajib Dahal67% (3)

- Thoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Document3 pagesThoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Rajib Dahal75% (8)

- 3.the Acme Blivert Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDocument1 page3.the Acme Blivert Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib Dahal100% (1)

- 2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDocument1 page2.carbide Chemical Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib DahalNo ratings yet

- Fundamentals of Financial Management-1.Briarcliff Stove Company-13 Capital Budgeting TechniquesDocument1 pageFundamentals of Financial Management-1.Briarcliff Stove Company-13 Capital Budgeting TechniquesRajib Dahal83% (6)

- 3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczDocument1 page3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczRajib Dahal50% (2)

- Esno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pageEsno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib DahalNo ratings yet

- Pilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pagePilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib Dahal50% (2)

- Prospectus - 2021 07 15Document284 pagesProspectus - 2021 07 15Uddeshya NigamNo ratings yet

- Dwnload Full Cfin 2 2nd Edition Besley Test Bank PDFDocument35 pagesDwnload Full Cfin 2 2nd Edition Besley Test Bank PDFbrandihansenjoqll2100% (13)

- BM 204 2020 Module Investment ApprochesDocument36 pagesBM 204 2020 Module Investment ApprochesPhebieon MukwenhaNo ratings yet

- Corporate FailureDocument44 pagesCorporate FailureChamunorwa MunemoNo ratings yet

- Business: Pearson Edexcel International GCSEDocument15 pagesBusiness: Pearson Edexcel International GCSEHan Thi Win KoNo ratings yet

- Quizesfm 2Document2 pagesQuizesfm 2Prince MalabaNo ratings yet

- SPV1Document37 pagesSPV1ritu_gnimsNo ratings yet

- Chapter 7 Internal Control Over CashDocument39 pagesChapter 7 Internal Control Over Cashtrangalc123No ratings yet

- CE - Taxation and Law 2Document34 pagesCE - Taxation and Law 2rylNo ratings yet

- Practical Accounting 1 Theory of AccountsDocument5 pagesPractical Accounting 1 Theory of AccountsHerald SisanteNo ratings yet

- Business Strategy: Section A Q1Document9 pagesBusiness Strategy: Section A Q1Flash PartiesNo ratings yet

- IM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesDocument16 pagesIM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesAisea Juliana VillanuevaNo ratings yet

- FinancialStatement 2020 (Q3)Document307 pagesFinancialStatement 2020 (Q3)Tonga ProjectNo ratings yet

- MULLES & LUCENA - JournalDocument2 pagesMULLES & LUCENA - JournalKri BanayNo ratings yet

- Hammer Group SeptDec 2023Document5 pagesHammer Group SeptDec 2023Adilah AzamNo ratings yet

- Chapter 6 - Using Discounted Cash Flow Analysis To Make Investment DecisionsDocument14 pagesChapter 6 - Using Discounted Cash Flow Analysis To Make Investment DecisionsSheena Rhei Del RosarioNo ratings yet

- Chapter 3 GoDocument8 pagesChapter 3 GoPiertotum LocomotorNo ratings yet

- Intrinsic Value CalculatorDocument11 pagesIntrinsic Value CalculatorKrishnamoorthy SubramaniamNo ratings yet

- Ratio Analysis (Buet)Document13 pagesRatio Analysis (Buet)Tahsinul Haque TasifNo ratings yet

- Changes 2018-2023 SyllabusDocument19 pagesChanges 2018-2023 Syllabusaonabbasabro786No ratings yet

- Issue and Redemption of Shares 2Document3 pagesIssue and Redemption of Shares 2Prince TshepoNo ratings yet

- Financial Accounting BBA MUDocument19 pagesFinancial Accounting BBA MUbhimNo ratings yet

- Trends in Dividend PolicyDocument4 pagesTrends in Dividend Policynishan_patel_3No ratings yet

- Poa ExcelDocument4 pagesPoa Excelahm_sarahNo ratings yet

- In Philippine PesoDocument4 pagesIn Philippine PesoAitanna Sophia LagunaNo ratings yet

- SPB Case DigestDocument9 pagesSPB Case DigestAnny YanongNo ratings yet

- Dividend, Acc & Audit Summary by Swapnil Patni SirDocument7 pagesDividend, Acc & Audit Summary by Swapnil Patni Sirsamsungkalra01No ratings yet

- Module 6 DepreciationDocument9 pagesModule 6 DepreciationGreg GarciaNo ratings yet

- FIN 515 Midterm ExamDocument4 pagesFIN 515 Midterm ExamDeVryHelpNo ratings yet

- Analis Rencana Pendirian ABC LaundryDocument216 pagesAnalis Rencana Pendirian ABC Laundrypocaries100% (1)