Professional Documents

Culture Documents

A Study On Profitability Analysis With Special Reference To Seshasayee Paper and Board LTD at Erode

Uploaded by

CHEIF EDITOROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Profitability Analysis With Special Reference To Seshasayee Paper and Board LTD at Erode

Uploaded by

CHEIF EDITORCopyright:

Available Formats

www.ijrream.in Impact Factor: 2.

9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

A Study on Profitability Analysis with Special Reference

to Seshasayee Paper and Board ltd at Erode

Prof .P.MURUGESAN, M.Com, MBA, M.Phil

Assistant professor

Department of Business Administration

Gnanesh College of Arts & science

Salem D.t Tamilnadu, India

Mobile No: 9698199746

ABSTRACT

The Profitability analysis is very important to all kind of organization or the business.

The companies also carefully maintain this Profitability analysis. The project having Seven

year balance sheets information’s. The research utilizes the “secondary data’s”. The

secondary data’s is the major sources of this project. The project has the details related to the

title and also statistical data and charts that clearly explain the researchers view and also

financial Profitability analysis.. All these research are based on balance sheets data. The SPB

Company has seen both profit and losses through out its financial period these earn more

profit and loss for various stages. This project finds the solution about the problems and helps

to change or modify the problem area. This study focuses on company’s Profitability analysis

on these seven years. This study also analyzes the Profitability Analysis of the company.

Tools of Profitability analysis have been used to analyze the Profitability analysis of the

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 47

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

company. This study also finds relationship between various components of the balance

sheet. This study also gives importance to analyze the profitability of the business.

Keywords: Profitability information, change or modify, relationship

CHAPTER I

1. INTRODUCTION OF THE STUDY

Profitability analysis generally states the profitable conditions of the firm. The

profitability analysis reviews the profits and declines of the company. Short term creditor will

be interested in the current financial position of the firm, while a long term creditor will pay

more attention to the solvency of the firm. The long term creditor will also be interested in

the profitability of the firm. The equity share holders are generally concerned with their

return and may bother about the firm’s financial conditions only when their earnings are

depressed. In fact, it has to be realized that the short and long term financial position and

profitability of the firm are must in every kind of financial analysis. But the emphasis would

differ.

AIMS OF PROFITABILITY FUNCTION:

The primary aim of finance function is to arrange as much funds for the business as

are required from time to time. This function has the following aims.

Acquiring sufficient funds:

The main aim of finance is to access the financial needs of an enterprise and the

finding out suitable sources for raising them.

Proper utilization of funds:

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 48

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

Through rising of funds is important but their effective utilization is more importune.

The funds should used in such a way that maximum benefit is derived from them.

Increasing Profitability:

The planning and control of finance function aims at increasing profitability of the

concern. It is true that money generates money. To increase profitability sufficient funds will

have to be invested.

Maximizing Firm’s value:

Finance function also aims at maximizing the value of the firm. It is generally said

that a concern’s value is liked with its profitability.

CHAPTER – II

2.1. OBJECTIVES OF THE STUDY

To study the profitability position of SPB Pvt. Ltd.

To analyze the income & expenditure pattern and its impact on the total profits of the

company.

To evaluate the overall value of the firm.

To find out the strengths and weakness of the company.

To compare the past performance of the company with the present performance.

2.2 SCOPE OF THE STUDY

The researcher had taken 7 years financial statement of the company.

The findings and suggestions given in this study may not suitable for other

organization.

The company official statement to give detailed financial data of the

company

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 49

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

2.3. LIMITATIONS OF THE STUDY

Profitability analysis of the organization is based entirely on the previous year’s

Balance sheet and Profit & Loss A/c statement.

Researcher taken 7 years data for analysis. The 7 years data many give a clear picture

about the overall performance.

There is always a possibility of window dressing of financial statements.

Chapter- III

3.1 RESEARCH METHODOLOGY

Research Methodology is a systematic way to solve a research problem; It includes

various steps that are generally adopted by a researcher in studying the problem along with

the logic behind them. The present study was conducted at the head office of “Seshasayee

paper and Board Limited Ltd.”, Anna nagar, Erode. The study depends mainly on the

secondary data namely the annual reports of the company. Five years annual reports had

been collected from the company. Data had also been collected from text books, journals,

newspapers, magazines and internet.

3.2. RESEARCH DESIGN

“A Research Design is the arrangement of conditions for collection and analysis of

data in a manner that aims to combine relevance to the research purpose with the economy in

procedure”. In fact, the research design is the conceptual structure with in which research is

conducted; it constitutes the blue print for the collection, measurement and analysis of data,

the research design utilized in this study is analytical research.

3.3. PERIOD OF STUDY

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 50

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

The duration taken by the researcher for the data collection and analysis regarding the

profitability analysis of SPB ERODE, Erode is three months. The data used are of last seven

years from 2013-09.

3.4. METHOD OF COLLECTION

The study basically uses primary and secondary data. Primary data means data which

is fresh collected data. Primary data mainly been collected through personal interviews,

surveys etc. Secondary data means the data that are already available. Generally speaking

secondary data is collected by some organizations or agencies which have already been

processed vlhen the researcher utilizes secondary data; he/she has to look into various sources

from where he can obtain them. The process of secondary data collection and analysis is

called desk research. Secondary data provides economy in time and cost. It is easily

available and unbiased. Secondary data mat either be published data or unpublished data.

3.5. SAMPLING TECHINIQUE

Analytical Research Design study is used. Usually for those research studies having the

computation of problems or application of formulae for computations analytical research

design technique is used.

3.6. TOOLS USED

Ratio Analysis

Comparative Income Statement Analysis

Common size Statement

CHAPTER – IV

ANALYSIS AND INTERPRETATION

4.1 RATIO ANALYSIS

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 51

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

Ratio is a relationship between two figures expressed mathematically. Profitability

ratio provides numerical relation between two relevant financial data. Financial ratios are

calculated from the Balance sheet and Profit & Loss A/c. The relationship can be either

expressed as a percent on as a quotient. Ratios summarize the data for easy understanding,

comparison and interpretation. The Ratio Analysis is the Profitability statement. It provides a

yardstick to measure the relationships between the variable of figures. In work the

Profitability analysis is necessary to know different angles. The term Ratio Analysis simply

means one number expressed in terms of another. It describes in mathematical term as the

quantitative relationship that exists between two numbers. Ration Analysis and interpretation

of Profitability Statements through ratio. Nowadays it is used by all business and industrial

concern in their profitability Analysis. Ratios are considered to be the best guide for different

efficient execution of basis managerial functions like planning, forecasting & control.

Ratio Analysis is a powerful tool of Profitability Analysis. A ratio is defined as “the

indicated quotient of two mathematical expression” and as “the relationship between two or

more things”. In financial Analysis ratio is used as used as a Benchmark for evaluating the

financial performance of the firm. The absolute accounting figures reported in a financial

statement do not provide a meaningful understating of the financial position of the firm; an

accounting figure conveys meaning when it is related to some other relevant information.

A. PROFITABILITY RATIOS

a) Gross Profit Margin Ratio

The gross profit margins reflect the efficient with which management produces each

unit of product.

Gross profit-sales

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 52

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

Gross profit margin = ------------------------------ x100

Sales

TABLE-1 SHOWING GROSS PROFIT MARGIN RATIO

Year Gross profit Sales Gross margin

2009 7526.60 31440 23.93%

2010 9646.77 33200 29.10%

2011 10250.7 34420.13 29.78%

2012 8141.27 35429.81 22.97%

2013 10369 38195.21 27.14%

2014 11484.61 41784.28 27.48%

2015 13778.88 45642.20 30.62%

Source: SPB annual report

Inference :The above tables indicate the gross margin ratio for the year 2015 was 30%.

b) PAT TO EBIT RATIO

The ratio expresses the percentage relationship of profit after tax to earnings before

interest tax.

PAT

PAT to EBIT RATIO = ----------------X100

EBIT

TABLE-2 SHOWING PAT TO EBIT RATIO

Year PAT EBIT PAT TO EBIT RATIO

2009 980.13 2800.20 35.00%

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 53

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

2010 1013.12 3200.30 31.49%

2011 1966.17 5565.34 35.32%

2012 658.44 2953.79 22.29%

2013 1791.30 4800.11 37.31%

2014 4140.17 6345.81 65.24%

2015 4579.03 8289.95 55.23%

Source: secondary data

Inference: The above table PAT to EBIT ratio shows a fluctuating trend and it has reached

its maximum in the year 2014 at 65.24%.

c).CURRENT RATIO

Current ratio is the most common ratio for measuring liquidity. The current ratio is the

ratio of total current assets to total current liabilities. Current ratio of affirm measures its term

solvency i.e. ability to meet short term obligations.

Current assets

Current assets = ------------------------------ X 100

Current liabilities

TABLE- 3 SHOWING CURRENT RATIO

Year Current assets Current liabilities Current ratio

2009 10110.13 9200.20 1.10%

2010 11520.13 9500.00 1.21%

2011 17919.42 10991.59 1.44%

2012 17170.84 12229.66 1.41%

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 54

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

2013 17250.9 12703.34 1.41%

2014 21512.29 14010.71 1.53%

2015 23534.64 16631.37 1.41%

Source: SPB annual report

INFERENC : Continuously for the seven years i.e. from 2015 the current ratio of the firm

showed and increasing trend, later in 2014 to 2015 the current ratio got declined because of

the increase in current liability.

d) SOLVENCY RATIO

Also known as dept ratio. So known generally refers to the capacity or ability of the

business to meet its short term and long term liabilities.

Total liabilities

Solvency ratio = --------------------------x100

Total assets

TABLE - 4 SHOWING SOLVENCY RATIO

Year Total liabilities Total assets solvency ratio

2009 23200.00 31826.10 72.91%

2010 24500.00 32500.00 75.38%

2011 25850.96 34881.65 75.18%

2012 21091.49 41049.73 50.78%

2013 31171.58 41100.42 74.62%

2014 43487.68 57596.02 75.50%

2015 56595.91 74811.8 75.65%

Source: SPB annual report

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 55

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

INFERENCE:Here, solvency ratio shows an increasing trend. This shows the company’s

capacity or ability of the business to meet its short term & long term obligations. If total

assets are far more then the external liability the company is treated as solvent.

e) RETURN ON INVESTMENT (BEFORE TAX)

The profitability of the firm is also measured in relation to investments. The term

investment may refer to total assets, capital or the owner’s equity.

EBIT

ROT (Before tax) = ----------------------------------------

Net assets/capital employed

TABLE - 5 SHOWING ROI (BEFORE TAX)

Year EBIT NET ASSETS RETURNON INVESTMENT RATIO

2009 2800.20 7540.80 37.13%

2010 3200.30 7920.73 40.40%

2011 5565.34 8530.69 36.95%

2012 2953.79 8958.24 12.95%

2013 4800.11 10928.84 26.10%

2014 6345.81 14113.34 97.10%

2015 8289.95 18210.89 33.22%

Source: SPB annual report

INFERENCE:The above table indicates the ROI shows the earning capacity of the company

in the year 2014 is maximum.

f). ADMINISTRATIVE EXPENSES RATIO

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 56

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

It enables as to find out a how far as the concern is able to save or is making over

expenditure I respect of administrative expenses. Thus this ratio reveals the relation

administrative expenses to net sales.

Administrative expenses

Administrative expenses ratio =------------------------------------------x100

Net sales

TABLE- 6 SHOWING ADMINISTRATIVE EXPENSES RATIO

Year Administrative expenses Net sales Administrative expenses ratio

2009 4660.20 30300.80 15.38%

2010 4850.3 32320.10 15.01%

2011 5020.4 34420.13 11.58%

2012 5379.79 35429.81 15.51%

2013 5912.23 38195.21 15.46%

2014 5637.59 41784.28 13.49%

2015 6115.48 45642.20 13.39%

Source: annual report

INFERENCE:The company has a very low administrative expenses ratio. In 2014 to 2013

later it god decreased. This is be caused of decreased in administrative expenses for the

improved performance of the company that result in increased sales.

g) RETURN ON EQUITY

ROE indicates how well the firm has used the resources of owners. The ratio of net

profit to owners reflects the extent to which the objective of achieving satisfactory return has

been accomplished.

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 57

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

PAT

ROE = -----------------

Net worth

TABLE-7 SHOWING ROE

Year PAT Net worth Return on Equity ratio

2009 1200.09 7232.30 16.59%

2010 952.13 6520.38 14.60%

2011 1966.17 8530.69 23.09%

2012 658.44 8958.24 7.35%

2013 1791.30 10928.84 17.17%

2014 4140.17 14113.34 29.34%

2015 4579.03 18210.89 25.14%

Source: SPB annual report

INFERENCE: The above table indicates the ROE available to the shareholders is low in the

year 2011.

h) RETURN ON ASSET

Profitability can be measured in terms of relationship between net profits assets. This

ratio also known as profit to asset ratio. It measures the profitability of investments can be

known.

Net profit

ROA = --------------------------- x100

Total assets

TABLE -8 SHOWING ROA

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 58

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

Year Net profit Total assets Return on assets ratio

2009 980.13 31000.20 3.21%

2010 1013.12 32001.30 3.11%

2011 1966.17 34381.65 5.71%

2012 658.44 41049.73 1.62%

2013 1791.30 41100.42 4.35%

2014 4140.17 57596.02 7.18%

2015 4579.03 74811.8 6.12%

Source: SPB annual report

INFERENCE:The above data indicates that the ROA is low in the year 2011 because of the

reason that there is low PAT the company.

I).RETURN ON CAPITAL EMPLOYED

A comparison of this ratio with that of other units in the industry will indicate have

efficiency the funds of the business have been employed. The higher the ratio, the more

efficiency.

Net profit

Return on capital employed = --------------------------x100

Capital employed

TABLE-9 SHOWING RRETURN ON CAPITAL EMPLOYED

Year Net profit Capital employed Return on assets ratio

2009 980.13 7900.00 12.40%

2010 1013.12 8230.30 12.25%

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 59

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

2011 1966.17 8530.69 23.09%

2012 658. 44 8958.24 7.35%

2013 1791.30 10928.84 17.17%

2014 4140.17 14113.34 29.34%

2015 4579.03 18210.89 25.14%

Source: SPB annual report

INFERENCE:Since the company has suffered low profit in the year 2010 there is low return

on capital employed for the company and has got a maximum ROUE in the years 2013.

j) OPERATING PROFIT RATIO

The ratio that measures the relationship between a firms operation net profit to net sales

of the company.

Operating net profit

Operating profit ratio = ----------------------------- x100

Net sales

TABLE-10 SHOWING OPERATING PROFIT RATIO

Year Net profit Capital employed Return on assets ratio

2009 980.13 30300 3.23%

2010 1013.12 32320 3.12%

2011 1966.17 34420.13 5.71%

2012 658.44 35429.81 1.85%

2013 1791.30 38195.21 4.68%

2014 4140.17 41784.28 9.90%

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 60

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

2015 4579.03 45642.20 10.03%

Source: SPB annual report

INFERENCE: In the year 2011 there is very low operating profit ratio. Since because of the

reason there is very low net profit for those years.

k) RESERVE TO EQUITY SHARE CAPITAL RATIO

A very high indicates a conservative dividend policy and increase plugging back of

profits. Higher the ratio better will be the position.

Revenue reserves

Reserves to equity capital ratio =-------------------------------x100

Equity capital

TABLE-11 SHOWING RESERVE TO EQUITY S. CAPITAL RATIO

Reserve to equity share

Year Revenue reserves Equity capital

capital ratio

2009 7500.10 1125 6.67%

2010 8200.12 1125 7.29%

2011 9303.84 1125 8.27%

2012 5667.97 1125 5.03%

2013 7410.69 1125 6.58%

2014 12983.34 1125 1.54%

2015 17135.89 1125 15.18%

Source: SPB annual report

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 61

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

INFERENCE:The company maintains a relative same trend in its reserve to equity capital

ratio compared to 2011-2012; the company maintained a high ratio in 2012&2013 the higher

the ratio better will be the position.

COMPARATIVE FINANCIAL STATEMENTS

Comparative financial statement is prepared in a way so as to provide time perspective

to the consideration of various elements of financial position embodied in such statements.

This is done to make the financial data more meaningful. the statements of two or more years

are prepared to show absolute data in value and in terms of percentages comparative

statement can be prepared for both income statement as well as Balance sheet. The

preparation of comparative financial and operating statement is an important device of

horizontal financial analysis. Comparative financial statements are statements of position of a

business so designed as to provide time perspective to the consideration of various elements

of financial position embodied in such a statement. Generally balance sheet and income

statement is which alone are prepared in a comparative because they are the most important

statements of financial position.

Comparative income statement discloses the net profit or net loss resulting from the

operations of the business such statement shows the operating results for a number of

accounting periods so that changes in absolute data from one period to another period may

be stated in terms of absolute change or in terms of percentage comparative balance sheet is

prepared on two are more different dates can be used for comparing assets and liabilities and

to find out any increase in these terms this facilitates the comparison of figures of two or

more periods and provides necessary information which maybe useful in forming an opinion

regarding the financial conditions as well as progressive outlook of the concern.

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 62

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

SHOWING CONSOLIDATED COMPARATIVE INCOME STATEMENT

(Amounts in Rs.)

Particulars 2009- 2010- 2011- 2012- 2013- 2014-

2010 2011 2012 2013 2014 2015

INCOME 7.83 2.23 2.93 7.80 9.39 9.25

Sales (93.46) (89.46) 47.01 100.38 73.00 (16.35)

Other income 7.33 8.56 2.80 7.92 9.55 9.13

EXPENDITURE 12.33 13.62 13.32 7.99 12.86 6.41

Materials consumed 3.50 4.32 1.85 (13.23) 3.70 2.54

Power and fuel 11.68 11.56 10.66 7.89 6.85 17.94

Employees cost

Repairs and maintenance 22.32 24.34 1.66 28.88 11.97 16.71

Other expenses 9.26 7.84 5.22 (1.33) (6.12) (21.67)

Decrease/(increase) in

stock process 100.79 44.87 49.35 140.36 14.9 (33.92)

PROFIT BEFORE 6.20 5.40 12.36 2.97 6.30 5.3

INTEREST AND

DEPRECIATION

Interest and financing 52.30

cost (22.16) 42.38 46.90 62.50 32.20 38.47

Depreciation 7.36 (18.26) (48.89) (6.01) 24.03 0.93

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 63

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

24.70 1.51 28.75 2.13 17.40

PROFIT BEFORE

TAX 7.36

Transfer to differed tax (72.63) 56.34 63.18 134.63 60.48 38.47

Provision current tax - (95.34) (56.90) 98.54 (55.86) (118.5)

Provision for fringe - - - - 54.95 15.39

benefit tax - - 66.51 3.77 17.64

PROFIT AFTER TAX 78.53

68.34 66.51 172 131.12 10.60

INFERENCE

From the above comparative income statement it is inferred that sales shows its

increase in cash year and maximum in the year 2011-12 at 9.29 other income shows a crease

in the year 09-10 and 12-13 but it marked its greatest increase in 2010-11. Material

consumption shows a through out increase and decrease the years and in year.

Material consumption shows a through out increase or decrease of the every year and

in the year 2009-10 got increase of 13.32 power and fuel shows decline in the year 10-11 and

later it goes on increasing. The employee cost show decline in every year 2011-2012. And

later it goes on increasing other expenses shows decline in year 2010-2013

An interest and financial change shows its decline from 2009-10 to 2010-11 and

2012-13. Depreciation shows its decline for 2009-10 and 2011-12 and it later increasing. In

the case of loan funds, secured loan showed its declining trend from the year 10-11 which

ranges from (21.89) and later in the year 2011-12 it marked its increase at 113.11 unsecured

loan got sudden later increase in year 2009-10 later it showed a declassing trend and later in

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 64

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

the year 2012-13 there is very low unsacred loan to the company. It shows the ability of the

company to raise loan from external as well as internal sources.

In the case fixed asset shows its decline in year 10-11 at (-0.51) and later increasing in

the year 11-12 at 5715C.A showed its decline in year 10-11 at 3.87 and later increase in the

year 11-12 at 20.10 C.L showed it increase or decrease for every year.

COMMON SIZE STATEMENTS

The common size balance sheet shows the percentage of each asset item to the total

asset and each liability item to the total liabilities. Similarly a common size of income

statement shows each item expense as a percentage of net sales. With common size

statements comparison can be made between two different size firms belonging to the same

industry.The common size analysis of current asset and current liability can be used to

measure the relationship of various elements of currents assets and current liability to it total.

An attempt has been made for the common size analysis of current asset and current liability.

From this analysis it can be inferred that shareholders fund ands were considered to be

the major element in the source of fund of the company over the study period where as fixed

asset, current asset and & advances as well as investment were treated as the major

application of funds. In this study the income statements & balance sheet of the company for

the past five years has been analyzed.

COMMON SIZE BALANCE SHEET OF SPB FROM 2007-2013

Particulars 2007 2008 2009 2010 2011 2012 2013

SOURCE OF

FUNDS 1.50 1.95 2.73 2.77 3.27 4.10 4.22

Shares

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 65

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

Reserve and 22.80 22.54 22.63 19.31 21.53 20.21 20.30

surpluses 45.55 42.32 30.43 36.30 32.37 32.10 31.33

Loan funds 7.87 8.85 13.28 11.44 12.30 12.20 11.33

Deferred tax

Current liability and 22.23 24.32 30.90 30.16 30.15 31.22 32.82

provisions 100 100 100 100 100 100 100

Total

APPLICATION OF

FUNDS 67.45 61.22 54.58 55.64 53.60 52.38 51.90

Fixed assets 1.13 1.41 1.81 1.81 2.27 1.96 1.82

Investment

Current assets, loan 31.46 37.35 43.59 42.54 45.96 45.66 46.28

advances 100 100 100 100 100 100 100

Total

Inference

Common size statement indicates the relationship of various items with some common

item. From the above common size balance sheet we can see that reserve and surplus as well

as loan finds forms the major items source of finds for company. Fixed asset forms a major

part of the application of finds of the company followed by current assets, loan a advance.

Out of current assets, inventories forms a major element followed by sin dry debtors and cash

and bank. Provision form an insignificant position out of current liabilities.

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 66

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

COMMON SIZE INCOME STATEMENT OF SPB FROM 2008-2014

particulars 2008 2009 2010 2011 2012 2013 2014

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 67

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

NCOME

Materials consumed 55.39 56.32 55.13 55.09 49.98 48.13 48.17

Power and fuel 13.76 15.28 17.54 21.88 20.10 22.76 22.80

Employees cost 7.28 6.68 7.92 7.92 7.36 7.23 7.42

Repairs and maintenance 3.49 3.23 3.19 2.67 2.70 2.74 2.90

Other expenses 2.27 3.13 3.70 4.10 3.96 3.80 4.33

Interest and financing cost 1.13 1.16 1.63 1.87 3.77 3.98 3.82

Depreciation 3.80 3.50 3.79 3.17 3.77 3.75 3.82

Provision tax 3.21 1.39 2.43 1.41 3.21 3.82 3.92

Net profit 10 9.79 4.67 1.85 2.7 2.90 2.82

100 100 100 100 100 100 100

EXPENDITURE

Sales 99.70 98.76 99.75 99.86 99.74 97.82 96.80

Other income 0.30 0.38 0.25 0.13 0.26 0.13 0.21

Transfer to deferred tax - 0.58 - - - - -

100 100 100 100 100 100 100

INFERENCE

The above common size income statement shows the percentage of various element of

income and expenditure to the net sale made by the company. It helps the research to find out

how mach each and every term forms part of the sales. From the analysis it can be inferred

that material consumption from the major part of expenditure in relation to sales. By analysis

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 68

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

the PAT of the company in years 2010 and 2009 there is very low profit company and in

20117,12,11 PAT is there to the company and marked if maximum in the year 2013 and it

forms to the extent of 10%.

CHAPTER – V

5`1.FINDINGS

GMR shows the gross profit earned by the company. Here the company has a

positive GPR and later it shows an increasing trend and finally in the year 2013 it

reached a cross margin Ratio of 30.62%.

In the year 2010 and 2011 the company showed a low Net Profit margin. In the year

2013 it showed the highest net profit margin.

Company’s PAT to EBIT ratio shows a fluctuating trend and it has reached its

maximum in the year 2014 i.e. 65.24%.

ROI shows the revenue earning capacity of the company in the year 2011 since the

EBIT was low there is ROI of the company and it showed it maximum in the year

2013.

Since ROE is the part of profit i.e. Available to the shareholders, it must be distributed

to the shareholders as per the dividend rate. Since 2010 it shows a low PAT and ROE

those years.

The company has ROA in the year 2014 and in the year 2010 there is low ROA

because of the reason that there is low PAT for the company.

Since the Company has suffered low profit in the year 2011 there is low return on

capital employed for the company and has got a maximum ROUE in the year 2013.

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 69

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

In the year 2011 there is very low operating profit Ratio. Because there was very low

net profit in those years.

The company maintains a relative same trend in its Reserve to equity capital ratio

compared to 2011-2012. The company maintained a high ratio in 2013 & 2014. The

higher the ratio the position will be the better.

5.2 SUGGESTIONS

Company should make efforts to improve the profitability condition of the business

through increased sales since the company showed a low profit balance in PAT in the

years 2011 and 2012.

Company should undergo in efforts to cut down the operating expenses because the

increased operating expenses is not favorable the Company. The company should

reduce all so it’s of expenses related to the day to day operations of the company such

as printing and stationary transportation expenses etc.

Company should be able to maintain a safe position of current ratio as 2:1. But in

none of the years the company is not able to achieve the target and by reducing the

current liabilities it is possible for the company to maintain a better liquidity position

and this in turn helps the company for its efficient performance.

Company should introduce a better policy for the Reserves maintained by the

company. If the company is able to maintain an improved level of reserve it helps the

company to phase the future contingencies of losses modernization expansion of the

business. Here the company maintained a satisfactory level of Reserves.

Company should introduce measures to cut down the administrative expenses of the

company. But at the same time it should be possible for the company to withhold the

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 70

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

experienced and skilled employees by providing them attractive remuneration. The

joining of qualified professionals with the company will improve the productivity of

the business.

5.3 CONCLUSION

Analysis of Profitability performance is the vital part of Financial Management of any

business like SBP Pvt. Ltd. The liquidity position of the current financial performance of the

Company has to be examined regularly for the effective functioning. This study helps the

“SBP” to control over the financial areas and the smooth functioning of the business. This

study and analysis of financial statement gives a thorough insight to the research and he

Company about the Profitability performance of the SBP and how the financial statements

should be analyzed which will help in the improvement of profitability and liquidity of the

business. From the development history of the “SBP” it is clear that it call achieve more

heights in the future years. By considering the above suggestions there is no doubt that the

Company will be bagged with number of rewards for the better management of finance in

near future.

BIBLIOGRAPHY

MC Graw K Khan P.K&Jain M Hill Publications, Management Accounting.

Sharma R.K&Gupta Shash.K, Management Accounting Principles &practices.

Dr.Maheswari. S.N., Management Accounting, Sultan Chand and Sons, New Delhi.

Dr. Pandey.I.M., Financial management, Vikash Publication new Delhi.

K.GUPTA – Financial Management, Kitab Mahal R.K.Sharma Allahabad.

WEBSITES

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 71

www.ijrream.in Impact Factor: 2.9463

INTERNATIONAL JOURNAL OF RESEARCH REVIEW IN

ENGINEERING AND MANAGEMENT (IJRREM)

Tamilnadu-636121, India

Indexed by

Scribd impact Factor: 4.7317, Academia Impact Factor: 1.1610

ISSN NO (online) : Application No : 19702 RNI –Application No 2017103794

www.travcements.com

www.NetMBA.com

FINANCIAL MANAGEMENT 6th edition

WWW.SPB LTD.COM

International Journal of Research Review in Engineering and Management

(IJRREM),Volume -2,Issue-7,July-2018,Page No:47-71,Impact Factor: 2.9463, Scribd

Impact Factor :4.7317, academia Impact Factor : 1.1610 Page 72

You might also like

- A Study On Forcasting Planning in Dynaspede Intergrated System - HosurDocument25 pagesA Study On Forcasting Planning in Dynaspede Intergrated System - HosurCHEIF EDITORNo ratings yet

- A Study On Working Capital Management With Special Reference To Steel Authority of India Limited, SalemDocument19 pagesA Study On Working Capital Management With Special Reference To Steel Authority of India Limited, SalemCHEIF EDITORNo ratings yet

- A Study On Job Enrichment With Special Reference To ELGI Electric and Industries Limited, CoimbatoreDocument17 pagesA Study On Job Enrichment With Special Reference To ELGI Electric and Industries Limited, CoimbatoreCHEIF EDITORNo ratings yet

- A Study of Financial Performance of Samsung Electronics Pvt. Ltd.Document11 pagesA Study of Financial Performance of Samsung Electronics Pvt. Ltd.dipawali randiveNo ratings yet

- Irfan Project BabuDocument5 pagesIrfan Project BabuDhanrajKumbhareNo ratings yet

- Financial Analysis of GMR Infrastructure 2014-18Document10 pagesFinancial Analysis of GMR Infrastructure 2014-18krishna bajaitNo ratings yet

- A Study on Efficiency Analysis of Portfolio Creation by Considering Risk Factor in India Infoline Ltd with special reference to Cochin.Document12 pagesA Study on Efficiency Analysis of Portfolio Creation by Considering Risk Factor in India Infoline Ltd with special reference to Cochin.murugesanNo ratings yet

- Financial Performance Analysis of TNPL KarurDocument25 pagesFinancial Performance Analysis of TNPL KarurVenkatram PrabhuNo ratings yet

- A Study On Customers Satisfaction Towards Allwin Pipes Private Limited, PerundurDocument27 pagesA Study On Customers Satisfaction Towards Allwin Pipes Private Limited, PerundurCHEIF EDITORNo ratings yet

- JETIR2308535Document9 pagesJETIR2308535miteshbhoi712No ratings yet

- Evaluating The Effect of Employee Stock Option Plans On The Financial Performance of Indian Construction & Infrastructure CompaniesDocument8 pagesEvaluating The Effect of Employee Stock Option Plans On The Financial Performance of Indian Construction & Infrastructure CompaniesIJEMR JournalNo ratings yet

- A Study On Financial Reengineering in Ashok Leyland Ltd.,hosurDocument8 pagesA Study On Financial Reengineering in Ashok Leyland Ltd.,hosurIJERDNo ratings yet

- A Study On Work Life Balance of Employees in Agni Steels Private Limited, IngurDocument36 pagesA Study On Work Life Balance of Employees in Agni Steels Private Limited, IngurCHEIF EDITORNo ratings yet

- A Minor Project Report ON "Financial Ratio Analysis of Havells"Document14 pagesA Minor Project Report ON "Financial Ratio Analysis of Havells"Sandeep DhupalNo ratings yet

- Fin Irjmets1684895781Document5 pagesFin Irjmets1684895781Mani kandan.GNo ratings yet

- A Study On Employee Compensation in Watch Production Company With Special Reference To Company - Hosur Talukls, TamilnaduDocument20 pagesA Study On Employee Compensation in Watch Production Company With Special Reference To Company - Hosur Talukls, TamilnaduCHEIF EDITOR100% (1)

- A Study On Liquidity and Profitability Analysis of Selected It CompaniesDocument8 pagesA Study On Liquidity and Profitability Analysis of Selected It CompaniessscNo ratings yet

- Faheem Ratio AnalysisDocument59 pagesFaheem Ratio AnalysisFab ZaydNo ratings yet

- Case Study ICICIDocument51 pagesCase Study ICICIvarunNo ratings yet

- JisnaDocument45 pagesJisnaSarin SayalNo ratings yet

- A Study On Profitability Ratio Analysis of The Sundaram Finance LTD in ChennaiDocument3 pagesA Study On Profitability Ratio Analysis of The Sundaram Finance LTD in ChennaiInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Ankita Synopsis OnDocument13 pagesA Ankita Synopsis OnChaudharies Creativity MindNo ratings yet

- 1118pm - 2.EPRA JOURNALS 9997Document6 pages1118pm - 2.EPRA JOURNALS 9997Mani kandan.GNo ratings yet

- Study On Working CapitalDocument76 pagesStudy On Working CapitalAslam AhamedNo ratings yet

- Financial AnalysisDocument108 pagesFinancial Analysisnaseebahamad100% (5)

- Research MethodologyDocument11 pagesResearch Methodologyamuliya v.sNo ratings yet

- A Study On Banking Services of HDFC BankDocument9 pagesA Study On Banking Services of HDFC BankNageshwar SinghNo ratings yet

- A Study On Quality Circle in Harita Seating Systems Limited at Hosur, Krishnagiri DistrictDocument21 pagesA Study On Quality Circle in Harita Seating Systems Limited at Hosur, Krishnagiri DistrictCHEIF EDITORNo ratings yet

- Ratio Analysis 1012Document74 pagesRatio Analysis 1012Sakhamuri Ram'sNo ratings yet

- Financial Reporting Analysis ProjectDocument39 pagesFinancial Reporting Analysis ProjectSunny Sharma100% (1)

- Financial Analysis of Reliance JioDocument47 pagesFinancial Analysis of Reliance JioKAJAL TIWARINo ratings yet

- CHAPTER 3 Research DesignDocument7 pagesCHAPTER 3 Research DesignManoj shettyNo ratings yet

- 830pm 50.epra Journals-5705Document7 pages830pm 50.epra Journals-5705DedipyaNo ratings yet

- Financial Performance of Sunfresh AgroDocument56 pagesFinancial Performance of Sunfresh Agropachpind jayeshNo ratings yet

- Harish Mba ProjectDocument72 pagesHarish Mba ProjectchaluvadiinNo ratings yet

- Ratio Analysis of Dhruv Cotex Cotton IndustriesDocument57 pagesRatio Analysis of Dhruv Cotex Cotton IndustriesAditya KadamNo ratings yet

- 31 PDFDocument6 pages31 PDFRajashekar NayakNo ratings yet

- Synopsis - Vanipally Purushotham ReddyDocument6 pagesSynopsis - Vanipally Purushotham Reddypurushotham reddy vanipallyNo ratings yet

- Manish Manral - A COMPARATIVE STUDY OF FINANCIAL PERFORMANCE OF SELECTED AUTOMOBILE COMPANIES WITH ASHOKA LEYLAND LTD. (PANTNAGAR)Document90 pagesManish Manral - A COMPARATIVE STUDY OF FINANCIAL PERFORMANCE OF SELECTED AUTOMOBILE COMPANIES WITH ASHOKA LEYLAND LTD. (PANTNAGAR)Ankit TiwariNo ratings yet

- Project Reoprt On SIDCO 2010 - 2013Document105 pagesProject Reoprt On SIDCO 2010 - 2013Ananthu GokulNo ratings yet

- Trend Analysis Final Project by ArjitDocument37 pagesTrend Analysis Final Project by Arjitsandeepkaur1131992No ratings yet

- Manage-Working Capital Management of Paper Mills-K MadhaviDocument10 pagesManage-Working Capital Management of Paper Mills-K MadhaviImpact JournalsNo ratings yet

- 3 Research MethodologyDocument5 pages3 Research MethodologypoovarasnNo ratings yet

- InfosysDocument44 pagesInfosysSubhendu GhoshNo ratings yet

- TUSHAR's Report On Financial Statement AnalysisDocument30 pagesTUSHAR's Report On Financial Statement AnalysisIgnas MaliNo ratings yet

- Gnimt (Model Town)Document4 pagesGnimt (Model Town)Abhishek SharmaNo ratings yet

- A Study To Analyze The Financial PerformanceDocument11 pagesA Study To Analyze The Financial PerformanceRaghav AryaNo ratings yet

- Total Performance Analysis of The Company Uses Prism Performance at PT Perkebunannusantara II, Tanjung Garbus Estate, North Sumatra, IndonesiaDocument13 pagesTotal Performance Analysis of The Company Uses Prism Performance at PT Perkebunannusantara II, Tanjung Garbus Estate, North Sumatra, IndonesiaaijbmNo ratings yet

- Project On Ratio AnalysisDocument18 pagesProject On Ratio AnalysisSAIsanker DAivAMNo ratings yet

- A Synopsis Report ON A Study On Capital Budgeting AT L&TDocument19 pagesA Synopsis Report ON A Study On Capital Budgeting AT L&TMohmmedKhayyum100% (1)

- IJCRT1704210Document9 pagesIJCRT1704210A.K.Praveen kumarNo ratings yet

- Equity Research: Fundamental Analysis For Long Term InvestmentDocument5 pagesEquity Research: Fundamental Analysis For Long Term Investmentharish kumarNo ratings yet

- Assessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanDocument5 pagesAssessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanSunita MishraNo ratings yet

- Quantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesDocument6 pagesQuantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesPoonam KilaniyaNo ratings yet

- Financial Performence of KesoramDocument97 pagesFinancial Performence of KesoramBasinepalli Sathish ReddyNo ratings yet

- Effectiveness in Project Portfolio ManagementFrom EverandEffectiveness in Project Portfolio ManagementRating: 5 out of 5 stars5/5 (1)

- Training Effectiveness Measurement for Large Scale Programs: Demystified!From EverandTraining Effectiveness Measurement for Large Scale Programs: Demystified!No ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- A Study On Work Life Balance of Employees in Agni Steels Private Limited, IngurDocument36 pagesA Study On Work Life Balance of Employees in Agni Steels Private Limited, IngurCHEIF EDITORNo ratings yet

- A Study On Service Quality of Grand Royal Tours Private Limited, Salem.Document35 pagesA Study On Service Quality of Grand Royal Tours Private Limited, Salem.CHEIF EDITORNo ratings yet

- Simulation Modeling of Inverter Controlled BLDC Drive Using Four SwitchDocument18 pagesSimulation Modeling of Inverter Controlled BLDC Drive Using Four SwitchCHEIF EDITORNo ratings yet

- A Study On Impact of Stress Factors On Employees Performance With Special Reference To Erode District.Document19 pagesA Study On Impact of Stress Factors On Employees Performance With Special Reference To Erode District.CHEIF EDITORNo ratings yet

- Light Weight Aggregates Characteristic Study and Its Application in Concrete Filled Steel TubesDocument20 pagesLight Weight Aggregates Characteristic Study and Its Application in Concrete Filled Steel TubesCHEIF EDITORNo ratings yet

- Device Free Occupant Activity Sensing Using Internet of Things For Security PurposeDocument28 pagesDevice Free Occupant Activity Sensing Using Internet of Things For Security PurposeCHEIF EDITORNo ratings yet

- Investigation of Groundwater Potential Zones Using RS & GIS in Western Part of Krishnagiri DistrictDocument25 pagesInvestigation of Groundwater Potential Zones Using RS & GIS in Western Part of Krishnagiri DistrictCHEIF EDITORNo ratings yet

- A Study On Employees Stress Management in Dixcy Scott Private Limited, TirupurDocument30 pagesA Study On Employees Stress Management in Dixcy Scott Private Limited, TirupurCHEIF EDITORNo ratings yet

- A Study On Customers Satisfaction Towards Allwin Pipes Private Limited, PerundurDocument27 pagesA Study On Customers Satisfaction Towards Allwin Pipes Private Limited, PerundurCHEIF EDITORNo ratings yet

- A Centralized Power Management Control Scheme For AC and DC Buses PV Battery-Based Hybrid Micro GridsDocument20 pagesA Centralized Power Management Control Scheme For AC and DC Buses PV Battery-Based Hybrid Micro GridsCHEIF EDITORNo ratings yet

- Experimental Investigation of Steel Fibre Reinforced ConcreteDocument17 pagesExperimental Investigation of Steel Fibre Reinforced ConcreteCHEIF EDITORNo ratings yet

- A Study On Customer Perception in Modern Food Retail Out Lets With Special Reference To BangaloreDocument27 pagesA Study On Customer Perception in Modern Food Retail Out Lets With Special Reference To BangaloreCHEIF EDITORNo ratings yet

- A Study On Routine Assessment With Special Reference To Coimbatore IndustryDocument10 pagesA Study On Routine Assessment With Special Reference To Coimbatore IndustryCHEIF EDITORNo ratings yet

- Experimental Investigation of Geopolymer Concrete With HyposludgeDocument11 pagesExperimental Investigation of Geopolymer Concrete With HyposludgeCHEIF EDITORNo ratings yet

- A Fuzzy Model Based MPPT Control For PV SystemsDocument23 pagesA Fuzzy Model Based MPPT Control For PV SystemsCHEIF EDITORNo ratings yet

- Analysis of Hybrid Load Management SystemDocument30 pagesAnalysis of Hybrid Load Management SystemCHEIF EDITORNo ratings yet

- Fuzzy Based Image Forgery Localization Using Blocking ArtifactsDocument37 pagesFuzzy Based Image Forgery Localization Using Blocking ArtifactsCHEIF EDITORNo ratings yet

- Analysis of Three Phase Fly Back Full Bridge PFC Boost Converters With Control of Switching CyclesDocument30 pagesAnalysis of Three Phase Fly Back Full Bridge PFC Boost Converters With Control of Switching CyclesCHEIF EDITORNo ratings yet

- ,A Study On Effectiveness Training After Employment With Special Reference To Bimetal Bearing Limited Hosur, Krishnagiri DistrictDocument22 pages,A Study On Effectiveness Training After Employment With Special Reference To Bimetal Bearing Limited Hosur, Krishnagiri DistrictCHEIF EDITORNo ratings yet

- A Study On Inventory Management With Special Reference To Motion Technologies in BangaloreDocument28 pagesA Study On Inventory Management With Special Reference To Motion Technologies in BangaloreCHEIF EDITORNo ratings yet

- A Study On Employee Safety With Special Reference To Ashok Leyland PVT LTD, Hosur, Krishnagiri DistrictDocument19 pagesA Study On Employee Safety With Special Reference To Ashok Leyland PVT LTD, Hosur, Krishnagiri DistrictCHEIF EDITORNo ratings yet

- A Novel Approach On Reinforcement Learning and Deep LearningDocument10 pagesA Novel Approach On Reinforcement Learning and Deep LearningCHEIF EDITORNo ratings yet

- A Study On Effectiveness of Portfolio Management On Various Sectors in Stock MarketDocument25 pagesA Study On Effectiveness of Portfolio Management On Various Sectors in Stock MarketCHEIF EDITORNo ratings yet

- A Study On Consumer Behavior With Special Reference TVS Motor Company - Hosur, Krishnagiri DistrictDocument7 pagesA Study On Consumer Behavior With Special Reference TVS Motor Company - Hosur, Krishnagiri DistrictCHEIF EDITORNo ratings yet

- A Study On Cash Management in Standard Polymers Private Limited at Pondicherry"Document14 pagesA Study On Cash Management in Standard Polymers Private Limited at Pondicherry"CHEIF EDITORNo ratings yet

- A Comparative Study and An Optimized Solution For Detecting Faults in Induction Motor DrivesDocument35 pagesA Comparative Study and An Optimized Solution For Detecting Faults in Induction Motor DrivesCHEIF EDITORNo ratings yet

- A Study On Employees Job Clarity With Special Reference To Whirlpool of India Private Limited PondicherryDocument19 pagesA Study On Employees Job Clarity With Special Reference To Whirlpool of India Private Limited PondicherryCHEIF EDITORNo ratings yet

- A Study On Employee Personality in Nature Capsules Ltd. in PondicherryDocument19 pagesA Study On Employee Personality in Nature Capsules Ltd. in PondicherryCHEIF EDITORNo ratings yet

- A Study To Learn The Decision-Making Civilization and Its Impact On Employee PerformanceDocument21 pagesA Study To Learn The Decision-Making Civilization and Its Impact On Employee PerformanceCHEIF EDITORNo ratings yet

- Rotor Position Estimation and Control of Switched Reluctance Motor Drives Using Neuro-Fuzzy TopologyDocument28 pagesRotor Position Estimation and Control of Switched Reluctance Motor Drives Using Neuro-Fuzzy TopologyCHEIF EDITORNo ratings yet

- Sample Journal Research PaperDocument5 pagesSample Journal Research Paperjhwmemrhf100% (1)

- I J M E R: Problems of Street Vendors in Pondicherry K DhamodharanDocument10 pagesI J M E R: Problems of Street Vendors in Pondicherry K DhamodharanDR K DHAMODHARANNo ratings yet

- Environmental Scientist CVDocument6 pagesEnvironmental Scientist CVVasimNo ratings yet

- How Change Management Impacts Corporate GoalsDocument8 pagesHow Change Management Impacts Corporate GoalsAngga PratamaNo ratings yet

- ACADEMIC PERFORMANCE INDICATORSDocument11 pagesACADEMIC PERFORMANCE INDICATORSMk ManoharanNo ratings yet

- Library Science Ugc Net Question and AnswersDocument115 pagesLibrary Science Ugc Net Question and Answersselva_brid6053100% (4)

- Role of Architects in The Rural IndiaDocument9 pagesRole of Architects in The Rural Indiaa_j_sanyal259No ratings yet

- Where Can A Surgeon PublishDocument12 pagesWhere Can A Surgeon PublishSiddharth DorairajanNo ratings yet

- ART20171405Document4 pagesART20171405Rus MiniNo ratings yet

- Maintenance Framework Implementation A Case Study of Automobile Ancillary SMEsDocument15 pagesMaintenance Framework Implementation A Case Study of Automobile Ancillary SMEsIJRASETPublicationsNo ratings yet

- The History and Meaning of The Journal Impact FactorDocument4 pagesThe History and Meaning of The Journal Impact FactorLida Gómez P.No ratings yet

- How To Get Published in The Best Entrepreneurship Journals A Guide To Steer Your Academic Career - Fayolle & WrightDocument284 pagesHow To Get Published in The Best Entrepreneurship Journals A Guide To Steer Your Academic Career - Fayolle & WrightNur Putri HidayatiNo ratings yet

- Worldwide Research On Circular Economy and EnvironDocument14 pagesWorldwide Research On Circular Economy and EnvironOviya VihaNo ratings yet

- Impact Factor: A Measure of Journal Importance and InfluenceDocument8 pagesImpact Factor: A Measure of Journal Importance and InfluenceMd AzimNo ratings yet

- RPG and Story-Based Game in Game DevelopmentDocument9 pagesRPG and Story-Based Game in Game DevelopmentIJRASETPublicationsNo ratings yet

- DR - Vikas.CV 17.03.2020Document7 pagesDR - Vikas.CV 17.03.2020Vikas ShrivastavaNo ratings yet

- Anna University Ug Thesis SampleDocument6 pagesAnna University Ug Thesis Samplek1lod0zolog3100% (1)

- HistoryDocument12 pagesHistoryananthalaxmiNo ratings yet

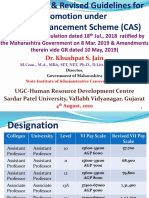

- UGC CAS TITLEDocument75 pagesUGC CAS TITLExc123544No ratings yet

- A Study On Consumer Satisfaction Towards Good Day Biscuits With Special Reference To Coimbatore CityDocument4 pagesA Study On Consumer Satisfaction Towards Good Day Biscuits With Special Reference To Coimbatore Cityshivam pratap singhNo ratings yet

- Impact of Reality Shows On Delhi-NCR YouthDocument10 pagesImpact of Reality Shows On Delhi-NCR YouthIJRASETPublicationsNo ratings yet

- CV Analysis Using Machine LearningDocument9 pagesCV Analysis Using Machine LearningIJRASETPublicationsNo ratings yet

- Bank DiversityDocument8 pagesBank DiversityGetachewNo ratings yet

- Top 25 Most Prestigious Medical JournalsDocument11 pagesTop 25 Most Prestigious Medical JournalsDr. Karen VieiraNo ratings yet

- A Study On Work Stress of Employees in Textiles at ErodeDocument15 pagesA Study On Work Stress of Employees in Textiles at ErodeCHEIF EDITORNo ratings yet

- How To Write A Successful Paper IJPDDocument27 pagesHow To Write A Successful Paper IJPDbaridinoNo ratings yet

- High Impact Factor Journal - International Journal of Advanced Research in Basic Engineering Sciences and TechnologyDocument6 pagesHigh Impact Factor Journal - International Journal of Advanced Research in Basic Engineering Sciences and TechnologyIJARBESTNo ratings yet

- Environments - Digital Livro Humboldt PDFDocument278 pagesEnvironments - Digital Livro Humboldt PDFhcukiermanNo ratings yet

- Volume3 Issue8 (4) 2014Document342 pagesVolume3 Issue8 (4) 2014iaetsdiaetsdNo ratings yet

- Journal Metrics 2017Document2 pagesJournal Metrics 2017yagebu88No ratings yet