Professional Documents

Culture Documents

A Tesla in Every Garage

Uploaded by

nhatvpCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Tesla in Every Garage

Uploaded by

nhatvpCopyright:

Available Formats

Original photographs: Nikola tesla: Dickenson V.

Alley/wellcome images;Tesla parts: tesla motors

34 | FEB 2016 | north american | SPECTRUM.IEEE.ORG photo-illustration by Lincoln Agnew

02.Tesla.Strategy.NA [P].indd 34 1/15/16 3:18 PM

?

a Tesla

in Ev e ry

Garage?

$

Last summer, as I drove around the San Francisco Peninsula, I caught glimpses of How not

a sea change in American automobile culture. Plug-in electric vehicles and charging sta- to spark an

tions seemed to be everywhere. Near the entrance to Stanford University, I witnessed a electric-

three-car fender bender involving only electric cars. And perhaps most remarkable: the

prevalence of the Tesla Motors Model S, a luxury electric sedan that’s become the new

vehicle

status symbol among the tech-savvy. With more than 90,000 built to date, the Model S is revolution

now a common sight on Bay Area highways and byways. ¶ The Model S and Tesla’s newer

Model X sport-utility vehicle are unquestionably engineering marvels. And in the vision

By Matthew N. Eisler

of Tesla CEO Elon Musk, they are nothing less than agents of change. Rivaling the best-

performing internal-combustion automobiles, these green supercars are designed to reconcile comfort, power, and con-

venience with environmental sustainability, an ethos encapsulated in the current marketing slogan for the Model S: “Zero

Emissions. Zero Compromises.” ¶ Sales of the high-end models S and X—versions of which sell for well over US $100,000—are

supposed to provide the revenue needed to produce the Model 3, an affordable electric supercar for the masses, slated to

be unveiled in March and in production in 2017. Eventually, as they and other electric vehicles proliferate and get tied into

SPECTRUM.IEEE.ORG | north american | FEB 2016 | 35

02.Tesla.Strategy.NA [P].indd 35 1/15/16 3:18 PM

a s h o r t h i s t o r y of E V s

A combination of regulation and innovation has revived prospects for the electric car

1832–1839: 1900: Of 4,192 1901: Thomas 1920s–1930s: Most

Robert Anderson cars produced Edison patents electric vehicles

invents an electric in the United rechargeable vanish from U.S. roads,

carriage powered States, more batteries replaced by tens of

by nonrechargeable than a quarter made from millions of cheap

primary cells. are powered by nickel-zinc and internal combustion

electricity. nickel-iron. engine vehicles.

2003: Silicon Valley 2000: GM

engineers Martin begins recalling

Eberhard and Marc its EV-1s and

2006: Tesla unveils 2004: Elon Musk Tarpenning found destroys nearly 1997: Toyota introduces Prius

its Roadster, with invests in and Tesla Motors to all of them. hybrid electric vehicle, which

a base price becomes chairman produce high-end uses a NiMH battery and a

of US $98,000, of Tesla Motors. battery electric cars. gasoline engine.

equipped with a

battery pack using

repurposed lithium

cobalt oxide cells.

2008: China’s 2012: Tesla begins selling

BYD Auto Co. the Model S full-size luxury

releases the electric vehicle, equipped

F3DM, the with a battery pack using

world’s first 2009: Nissan unveils all-electric 2010: Chevrolet releases the Volt plug-in lithium nickel cobalt

commercial Leaf, equipped with a lithium hybrid, equipped with a lithium manga- aluminum cells produced

plug-in hybrid. manganese oxide battery pack. nese oxide battery pack from LG Chem. by Panasonic.

rooftop photovoltaic and energy storage systems, they will which led to the creation of the Zero Emission Vehicle (ZEV)

disrupt Rust Belt car manufacturing as well as the fossil-fuel mandate in 1990.

industry, accruing environmental benefits in the process. Promulgated by the California Air Resources Board (CARB),

As Musk sees it, Tesla Motors is not simply an automaker. It the state’s “clean air” agency, the mandate was the first such

is an “energy innovation company,” a critical element in its initiative in the world, and it had international repercussions.

broader quest for “zero emission power generation.” It compelled the seven major automakers then doing business

Skeptics in financial and environmental circles have ques- in California (Chrysler, Ford, General Motors, Honda, Mazda,

tioned the ability of the Bay Area startup to deliver this Nissan, and Toyota) to start producing vehicles that emit-

future, as well as the whole idea that the car market can be ted no harmful tail-pipe pollutants, with a rolling quota for

Clockwise from top: Smithsonian (2); Toyota; GM; Nissan; Tesla

substantially “greened.” I won’t rehash their arguments here. each manufacturer based on its market share of conventional

I’m a historian of science and technology, and I do believe vehicles. The larger the share, the larger the ZEV quota. Spe-

that Tesla is making history, of a sort. I spent last summer cifically, CARB mandated that a carmaker’s California fleet

talking with electric vehicle owners about cars, class, and consist of “at least 2 percent ZEVs [in] each of the model years

politics. And what I learned suggests that the battery elec- from 1998 through 2000, 5 percent ZEVs in 2001 and 2002,

tric vehicle, or BEV, represents a more thorough upsetting and 10 percent ZEVs in 2003 and subsequent model years.”

of the existing order of things than Musk and his acolytes The board was forbidden from specifying the kinds of

might like to admit. technology that carmakers could use to achieve the desired

air-quality outcomes, but the only technology that then

Electric cars have been around as long as gasoline- met the ZEV criteria was the battery electric car. The car

powered ones. But their strong resurgence in recent decades industry, uninterested in shaking up existing product lines,

is due almost entirely to California’s air-quality politics, responded with something like this: Consumers want an

36 | FEB 2016 | north american | SPECTRUM.IEEE.ORG

02.Tesla.Strategy.NA [P].indd 36 1/15/16 3:18 PM

1959: Allis-Chalmers 1966: Britain’s

tests a fuel-cell Electricity Council

electric tractor, first 1964: General Motors tests the deploys the

vehicle of any kind Electrovair, a battery electric Enfield 8000, an

to employ such a concept vehicle. Later, it tests experimental battery

power source. the Electrovan fuel-cell EV equipped with lead-

concept vehicle. acid batteries.

1979: John B.

Goodenough

and a team at the

University of Oxford

invent lithium cobalt

oxide cathode.

1982: Stanford R.

Ovshinsky develops

1996: To satisfy ZEV quotas, GM 1994: Daimler-Benz unveils 1990: GM unveils the Impact, an nickel metal hydride

introduces all-electric EV-1, for the NECAR 1 hydrogen fuel-cell all-electric concept car; California’s (NiMH) battery

lease in California and Arizona. electric concept vehicle. Zero Emission Vehicle (ZEV) and founds Ovonic

mandate is implemented. Battery Co.

2014: Tesla selects First quarter March 2016:

site near Reno, Nev., 2015: Major Planned

for Gigafactory 1, car companies unveiling

where it will purchase of Tesla’s

produce lithium-ion $51 million in moderately

battery packs with 2015: Tesla begins selling ZEV credits priced Model 3

Panasonic. Model X crossover electric SUV. from Tesla. electric car.

automobile that does it all—one that is clean but also as fast, Hydrogen fuel-cell cars, by contrast, would emit no tail-pipe

long-ranged, stylish, and convenient as a good gasoline vehicle. pollutants. Ever since its invention in the mid-19th century,

Given the state of the art of electric vehicles, this is impossible. the fuel cell had impressed technologists as a kind of mira-

We will roll out advanced zero-emission technology eventually, cle engine that combined the best features of the battery and

but it will take time. the internal combustion motor. By electro-oxidizing gaseous

This was a straw argument. Automakers had never before let and liquid fuels stored in conventional tanks, fuel cells would

the quest for perfection get in the way of marketing a merely enable electric vehicles to use the vast and existing fossil-fuel

Clockwise from top: GM; Georgios Michael; Tesla (2); GM; Daimler; GM

good or just plain awful gasoline automobile. Nevertheless, infrastructure and drive farther than battery-powered EVs.

the argument worked: In 1996 CARB weakened the mandate, At least that was the theory. In fact, researchers were—and

?

eliminating the quotas for the years 1998 to 2002 (which it still are—struggling to make the technology practicable. Yet

later extended by a year). In return, the industry agreed to the promise of a fuel-cell super EV was enough for CARB to

deploy some BEVs ahead of schedule, but in very small num- further revise the mandate. In a series of increasingly com- ?

bers and only for lease. plex equivalence formulas, the board allowed automakers to

Even as the industry dragged its collective heels on the bat- gain ZEV credits through a mixture of battery, fuel-cell, and

tery EV, it continued to push for alternatives to satisfy the ZEV hybrid electric vehicles. It also allowed carmakers to trade

category—in particular, hybrid electric and fuel-cell electric ZEV credits and bank them.

vehicles, which the board agreed to recognize in 1998. The The ZEV mandate set the stage for General Motors’ EV-1. The

inclusion of hybrids enabled portions of an automaker’s ZEV company had unveiled an all-electric concept car called the

quota to run on gasoline. Eventually, CARB created the oxy- Impact at the January 1990 Los Angeles Auto Show. But the

moronic ZEV subcategory of “partial” zero-emission vehicles Impact had been commissioned by then CEO Roger Smith for

(PZEVs), which implied hybrid technology. internal political reasons rather than out of any serious desire

SPECTRUM.IEEE.ORG | north american | FEB 2016 | 37

02.Tesla.Strategy.NA [P].indd 37 1/15/16 3:18 PM

for large-scale production, according to Michael

hnayerson in his classic 1996 book, The Car

S

That Could: The Inside Story of GM’s Revolutionary

Electric Vehicle. Smith quickly realized he’d let

a genie out of a bottle and went into damage

control, publicly pointing out the limitations of

existing rechargeable batteries. But with ZEV

quotas to fulfill, GM introduced the Impact to

the market in 1996 as the EV-1, for lease in Cali-

fornia and Arizona.

Now, CARB didn’t require GM or any other

carmaker to maintain its leased fleets of such

first-generation “compliance cars.” And so the

automakers didn’t, instead choosing to repos-

sess and decommission them. GM sent most of

its 1,117 EV-1s to the crusher, an event that out-

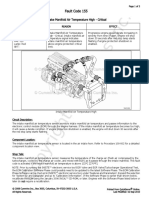

raged popular sentiment, as documented in the Big Battery Bet: The Gigafactory 1, now under construction near Reno, Nev., will

produce lithium-ion battery packs for Tesla Motors’ mass-market electric car, the

film Who Killed the Electric Car? Model 3, as well as Powerwalls, the company’s energy-storage units for the home.

It was as a direct response to this fiasco that

Silicon Valley engineers Martin Eberhard and

Marc Tarpenning founded Tesla Motors in 2003. In craft- and incremental slog. Battery lifetime in cellphones, tablets,

ing their business model, they embraced the auto industry’s and other portables is less of an issue because portable con-

rationale for not producing the BEV: that existing batteries sumer electronics are designed to last only a few years. Where

were inadequate and that consumers would not buy elec- electric vehicles are concerned, however, lifetime is crucial.

tric cars that did not deliver pulse-elevating performance. Evaluating the useful life span of a battery is an imperfect

Accordingly, they decided to produce a high-end sports car— science. The basic metric is the number of charge-discharge

the Roadster—equipped with a lithium-ion battery, the most cycles, which can mean very different things depending on

powerful available chemistry and also the most promising. how and where the battery is used. Designers of most con-

In this way, the green supercar myth, invented by the auto- temporary EVs favor lithium-ion chemistry, and in particular

making establishment to maintain the status quo, became the variants that are optimized for power and energy. Such

the basis of a business plan to undermine that establishment. batteries tend to have a relatively short shelf life, age rap-

idly when exposed to high temperature and voltage, and get

Joining Tesla Motors in 2004, Musk kept the supercar worked harder than the batteries in cellphones or laptops.

philosophy alive. As a business model, it made sense. For an Some types of lithium-ion batteries are also highly flamma-

upstart company trying to overthrow the status quo in an ble and require expensive control systems to be used safely.

industry with enormous barriers to entry, the hype associ- EV batteries are, of course, rigorously tested in the lab.

ated with supercars was and is essential to Tesla’s ability to But real-world driving presents a much more complex set

attract investment capital. of conditions, and assumptions about battery lifetimes are

In important ways, however, the supercar mythos has often disproved in the field. Some Nissan Leaf owners, for

obscured the technological and industrial implications of instance, were dismayed to learn that driving their cars a

battery-powered electric vehicles. Observers tend to focus lot caused the battery capacity to decline far more rapidly

$ on battery cost per kilowatt-hour as the most important fac- than they expected.

tor in commercializing the electric vehicle. Indeed, Tesla is What is certain is that even the best batteries will wear out

devoting a vast effort to drive costs from upwards of $400 long before the electric motors they serve. Which means

$

per kilowatt-hour to below $200. With plenty of help from that battery-powered EVs have hefty replacement costs that

the state of Nevada and in partnership with Panasonic, it is consumers may or may not even realize, let alone be willing

$ now building an enormous $5 billion battery-pack assembly to pay. Consider as well that carmakers typically do not pro-

David Calvert/Washington Post/Getty Images

plant (the so-called Gigafactory 1) near Reno. duce their own advanced battery cells (although a few, like

Large battery packs do represent a significant share of the Tesla and BMW, do assemble such cells into battery packs).

cost of an electric vehicle. In the highest-performance ver- Auto executives no doubt loathe the idea of creating an elec-

sions of the Model S, these packs account for up to 30 percent tric fleet whose chief component is made not by them but by

of the suggested retail price of $95,000 to $138,000. dedicated manufacturers like LG Chem or Panasonic. In the

But this obsession with cost per unit energy obscures the world of vertically disintegrated manufacturing, parts sup-

real challenge with EV batteries: battery aging. While increas- pliers get paid first.

ing the capacity and power of batteries has been relatively Why don’t automakers simply build their own EV batteries?

straightforward, making batteries last longer has proved a hard For one thing, established battery makers have economies

38 | FEB 2016 | north american | SPECTRUM.IEEE.ORG

02.Tesla.Strategy.NA [P].indd 38 1/15/16 3:18 PM

of scale, often in multiple lines of business; trying to catch the huge lot devoted to surplus supercars. It made me won-

up would require Herculean effort. Only Nissan has taken der: Why would a reasonably well-informed consumer pay

this route, and then only in collaboration with the Japanese $65,000 to $100,000 for a used Model S with a limited war-

electronics giant NEC. Even there, as demand for the Nissan ranty when she could plunk down a few thousand more for

Leaf has waned, the automaker has been looking to cut its a brand-new one with a full warranty?

costs by switching to South Korea’s LG Chem, which makes

the battery pack for the Chevrolet Volt plug-in hybrid electric. While battery-lifetime economics tends to be glossed

Indeed, most new EV users are choosing to lease rather over in public discussions of electric cars, the question of

than buy, in part because automakers are promising cheaper charging infrastructure is robustly engaged. Here, too, how-

and more capable batteries in future versions. But that tac- ever, confusion and paradoxes abound, in good measure

tic may backfire: Subsidizing the cost of battery aging in this because of the supercar ideology. Just like the assumption

way may keep consumers happy, but it will doubtless erode about EVs themselves, the assumption here is that users must

the carmakers’ ability to profit from EVs. have an experience that replicates the convenience of gas sta-

tions as much as possible. So charging means fast charging—

It’s no surprise, then, that most mainstream automakers the ability to replenish a battery to 80 percent of capacity in

have been reluctant to develop battery-powered all-electric 30 minutes or less. This is the approach embraced by Tesla,

vehicles. An alternative, less risky approach to EV technol- which has built a proprietary network of supercharging sta-

ogy is the hybrid, which combines a small internal combus- tions capable of adding 270 kilometers of range to a vehicle

tion engine with a small battery pack. in a half hour, for free.

The only major automaker thus far to bet big on hybrids Because the large-battery Model S and Model X are so long-

is Toyota. It selected a relatively small nickel metal hydride legged, this network is located primarily along intra- and inter-

battery, a reliable, safe, and reasonably powerful chemistry state corridors in the United States (plus a few in Canada). And

pioneered by the U.S. inventor Stanford R. Ovshinsky. In the because it can be used only by Tesla cars, EV boosters and

first-generation hybrids, the battery was used in a power-assist builders complain that it has stymied the popularization of

role; unlike the battery in an all-electric car, it was rarely if electric cars. Indeed, Tesla’s supercharging is one of three

ever deeply discharged, a practice that shortens battery life largely incompatible fast-charging standards in the United

span. A hybrid battery typically doesn’t last as long as the States (the others are CHAdeMO and SAE). Some critics have

automobile itself, but replacement costs average less than called out the federal government for its failure to support

$3,500 including labor. As a result, the original Prius, which fast charging while simultaneously subsidizing the produc-

Toyota introduced in 1997, had a life cycle resembling that of tion of electric vehicles.

a conventional gasoline automobile. Yet the fact is that all EV charging systems require changes

You can’t say the same for the battery-powered all-electric in consumer behavior. EV drivers have to learn to plug in their

car. Power packs for the Model S, which currently come in 70-, cars at home overnight or at other points of access during

85-, and 90-kilowatt-hour versions, are technological won- the day; they may also have to hire an electrician to recon-

ders, bolstered by an eight-year unlimited-mileage warranty. figure the receptacles in their garages. Even a high-amperage

The battery may indeed still work after eight years, but it will Supercharger requires the user to wait 30 minutes or more

do so at a significantly reduced capacity. Most drivers won’t for a “refueling.”

be too happy to have their driving range erode by 25 percent California currently has more nonresidential charging sta-

or more. And the sustainability of such warranties is also an tions than any U.S. state—more than 5,700 as of August 2014.

open question, given Tesla’s dependence on generous but But many of these stations are clustered at a few high-profile

temporary public subsidies. These include the $7,500 U.S. workplaces and are virtually nonexistent in apartment com-

federal tax credit to buyers (available for all makes of elec- plexes and commercial parking lots. This was a frequent

tric vehicles, up to 200,000 cumulative unit sales), a host of complaint among the EV owners I interviewed. Pacific Gas &

state subsidies, and the ability to earn cash by selling ZEV Electric Co., the major electric utility in northern California,

credits to its competitors. plans to install an additional 7,500 level 2 (that is, 240-volt

All this uncertainty over battery lifetimes has had an interest- AC) chargers, at a cost of $222 million to taxpayers.

ing effect on the used EV market. Lower-end models depreciate But the reality is that in some places, charging infrastruc-

faster than gasoline vehicles and are now available at bargain ture for the masses is hiding in plain sight. Back before direct-

prices. A 2012 Nissan Leaf that sold for around $36,000 retail ignition and fuel-injection devices improved the starting

was worth a little over $8,000 on average in 2015. capabilities of gasoline engines, drivers in colder climates

The Model S, on the other hand, is retaining most of its often had to warm the engine blocks of their cars. As a result,

value, thanks to Tesla’s resale guarantee, which encourages 120-volt AC sockets were widely installed in public parking

customers to trade in after three years. The success of this lots in places like Alaska, Canada, and Scandinavia. Much of

approach has had the unintended consequence of generating this Frostbelt infrastructure still exists, and similar plug-in

a large number of very expensive used EVs. When I visited spots could be built quickly and cheaply elsewhere as a cost-

the Tesla plant in Fremont, Calif., last June, I was struck by effective way of stimulating affordable | co nti n u e d o n pag e 5 4

SPECTRUM.IEEE.ORG | north american | FEB 2016 | 39

02.Tesla.Strategy.NA [P].indd 39 1/15/16 3:18 PM

a tesla in every garage? the company was able to buy its Fremont plant, which had

co nti n u e d f ro m pag e 39 been built for the Nummi partnership between GM and Toy-

ota, for the rock-bottom price of $42 million.

short-range battery electric fleets. And yet such a system is not The answer is that in various ways the major car companies

being considered seriously in California or anywhere else in saw the Bay Area startup as a means of hedging their risk dur-

the Sunbelt, which speaks to the pervasive influence of big- ing a period of forced technological change. For them, produc-

battery, supercar thinking in current EV planning. ing small numbers of unprofitable compliance cars was, and

continues to be, a short-term annoyance and also raises the

Given the highly competitive nature of the auto industry, disconcerting possibility that these all-electric vehicles will

why did Tesla receive so much support from other automak- eventually become popular.

ers? For example, Daimler and Toyota invested $50 million But with Tesla, they had an easy way out: The establishment

apiece in Tesla in 2009 and 2010, respectively. And in 2010, players purchased ZEV credits from Tesla, thereby decreasing

the number of compliance cars they had

to produce. Such sales raised $51 million

for Tesla in the first quarter of 2015.

NEW VERSION! Daimler and Toyota also contracted

with Tesla to supply power trains and

battery packs for their compliance cars,

notably the Mercedes-Benz B-class hatch-

back and the RAV4 sport-utility vehicle.

Besides outsourcing their ZEV responsi-

bilities, the auto giants were likely moti-

vated by the opportunity to learn what

the startup was doing, in the same way

that the Nummi partnership allowed

GM to learn about Toyota’s lean manu-

facturing. With all of this industry and

government assistance, Tesla’s stock sky-

rocketed, from around $26 per share in

2010 to more than $250 in mid-2015. In

October 2014, amid plummeting oil prices,

Daimler and Toyota cashed out, report-

edly at a tidy profit. Analysts offered vary-

ing opinions as to why, but I think it’s

likely that by then their experience with

Tesla had proved beyond a doubt that in

a world of cheap gasoline, BEVs made no

economic sense once the federal rebate

money ran out.

And for Toyota, the hybrid is the elec-

tric automobile of the future. In a speech

in 2013, Takeshi Uchiyamada, team leader

of the original Prius project and the cur-

rent chair of Toyota, dismissed the idea

Over 100 new features & Over 500,000 registered users that hybrids are just an interim solution

improvements in Origin 2016! worldwide in: on the way to an all-electric vehicle, add-

◾ 6,000+ Companies including ing that his company saw the technology

FOR A FREE 60-DAY EVALUATION, 120+ Fortune Global 500 as a “long bridge and a very sturdy one.”

GO TO ORIGINLAB.COM/DEMO ◾ 6,500+ Colleges & Universities

AND ENTER CODE: 8547 ◾ 3,000+ Government Agencies Nobody should write off Musk and

& Research Labs

Tesla just yet. The fundamental condi-

tions that gave rise to the company persist.

Blessed with a mild and dry but fragile

ecology as well as rich engineering and

20+ years serving the scientific

& engineering community capital resources, California has an eco-

friendly entrepreneurial culture. It was

the ideal setting for Eberhard, Tarpen-

54 | FEB 2016 | north american | SPECTRUM.IEEE.ORG

02.Tesla.Strategy.NA [P].indd 54 1/15/16 3:18 PM

ning, and Musk to cultivate their electric supercar ideology.

Nowhere else does the belief in better living through advanced

technology run as deep.

Tesla cars, and modern BEVs in general, have largely been

shaped within this unique context and are now being exported

to the world. But when the technology has been transferred to

other contexts, things have not always proceeded smoothly:

Recall New York Times reporter John M. Broder’s abortive test

drive of a Model S, in which he tried to go from Delaware to

Connecticut. He became stranded after he exhausted the The brightest minds discussing the biggest topics.

battery in cold weather.

The ensuing row between him and Musk (who accused Earn PDHs by attending a Webinar!

Broder of sabotage) overshadowed the fact that Broder acted

precisely as Tesla implied its users should. That is, he took at

face value the suggestion that the all-electric vehicle requires New Webinar in February

no changes in consumer behavior or expectations. Doubt-

less Broder would have been better off researching how cold

as well as hot weather can detract from BEV performance.

12 Feb Non Linear Magnetic Materials

Several inconvenient truths thus come into focus. The first with COMSOL Multiphysics®

is obvious but nevertheless bears repeating: Tesla sloganeer- This webinar will show demonstrations and

ing aside, electric vehicles are significantly unlike internal tips and tricks on how to build high-fidelity

combustion vehicles in fundamental ways. Most important, finite element models of devices that include

they age in ways that are not yet fully understood and that saturation and hysteresis effects using

have huge implications for ownership and manufacturing. COMSOL Multiphysics®.

Less obvious but equally pertinent is that the user’s experi-

ence of an electric vehicle will vary significantly depending http://spectrum.ieee.org/webinar/

on climate, culture, and class. Many people identify strongly non-linear-magnetic-materials-with-

with their gasoline-fueled vehicles. To them, a silent, clean, comsol-multiphysics

superefficient EV is just not a car.

With the Model 3, expected next month, Musk will be tar-

geting not his loyal and wealthy fans but rather the non–true

believers: drivers socialized to the very high levels of cost-

effectiveness, convenience, and sophistication of modern

On-Demand Webinars

gasoline-engine technology. Musk wants the Model 3 to com-

pete with BMW’s 3 Series, but the kind of people who are con- Grid Resiliency and Stability

sidering a BMW are unlikely to be awed by electric supercar with Siemens Transformers

mythology. And on a practical level, there’s the problem of Tune in to learn about the right strategies to

how to profitably build and market the Model 3 in large vol- prevent your business from harm and secure grid

umes, especially outside California. A recent Morgan S tanley resiliency and stability. http://spectrum.ieee.

analysis forecasts an average cost that’s nearly double the org/webinar/grid-resiliency-and-stability-with-

Model 3’s planned $35,000 retail price. siemens-transformers

The reality is that an affordable electric vehicle for the masses

already exists in the form of the hybrid electric car. Toyota Signal Integrity: VNA Applications

has sold more than 8 million of them to date, mostly Priuses, We will discuss de-embedding and look at a case

an order of magnitude greater than the cumulative sales of study of channel measurements on two different

all BEVs. Hybrid electrics are a formidable market segment VNA structures. http://spectrum.ieee.org/

that will prove difficult to challenge, especially as more data webinar/signal-integrity-vna-applications

on the economics of large EV batteries come to light.

No doubt the technology of BEVs is here to stay in one form or

another, and for that alone, Tesla has accomplished something

significant. But we can’t ignore the fact that the technology Sponsors

inevitably demands enormous changes in the ways automo-

biles are manufactured, used, and maintained. The question

is not whether the battery electric vehicle can be made to

adapt to society but whether society is willing to adapt to it. n

Sign up today!

post your comments at http://spectrum.ieee.org/teslastrategy0216 www.spectrum.ieee.org/webinar

02.Tesla.Strategy.NA [P].indd 55 1/15/16 3:18 PM

You might also like

- How Perceptions of Training Impact Employee Performance: Evidence From Two Chinese Manufacturing FirmsDocument21 pagesHow Perceptions of Training Impact Employee Performance: Evidence From Two Chinese Manufacturing FirmsPutu Nilam SariNo ratings yet

- Demolition E2004 (HK)Document180 pagesDemolition E2004 (HK)Daniel YongNo ratings yet

- l5 Digital Comm IIDocument57 pagesl5 Digital Comm IIHsjsjsjsjNo ratings yet

- Eia-485 SpecificacionDocument10 pagesEia-485 Specificacionandres fernando carvajal lozanoNo ratings yet

- Comparative Study On Wireless Mobile Technology 1G, 2G, 3G, 4G and 5GDocument5 pagesComparative Study On Wireless Mobile Technology 1G, 2G, 3G, 4G and 5GnhatvpNo ratings yet

- Arcing-Test - IEC 61641 - TEST HỒ QUANG ĐIỆNDocument18 pagesArcing-Test - IEC 61641 - TEST HỒ QUANG ĐIỆNnhatvpNo ratings yet

- IEC - Panel RegulationDocument20 pagesIEC - Panel RegulationAsith SavindaNo ratings yet

- Fiber Optic Communications Fiber Optic Communications: EE4367 Telecom. Switching & TransmissionDocument25 pagesFiber Optic Communications Fiber Optic Communications: EE4367 Telecom. Switching & TransmissionnhatvpNo ratings yet

- App.A - Technical Data ELEC - REFER AURECONDocument10 pagesApp.A - Technical Data ELEC - REFER AURECONnhatvpNo ratings yet

- Guidelines To The Construction of A Low-Voltage Assembly Complying With The Standards IEC 61439 Part 1 and Part 2Document84 pagesGuidelines To The Construction of A Low-Voltage Assembly Complying With The Standards IEC 61439 Part 1 and Part 2smpasaneNo ratings yet

- IEC-614391-1 &2 - For Switchgears - GMA-US - LRDocument12 pagesIEC-614391-1 &2 - For Switchgears - GMA-US - LRKapil GalwaniNo ratings yet

- Merlin Gerin Modbus GuideDocument94 pagesMerlin Gerin Modbus Guidezisis81No ratings yet

- Harmonic 1 PDFDocument24 pagesHarmonic 1 PDFnhatvpNo ratings yet

- Profibus Technical DescriptionDocument36 pagesProfibus Technical DescriptionFelipe A. PérezNo ratings yet

- 1G, 2G, 3G, 4G, 5G: By: Simon JohansenDocument15 pages1G, 2G, 3G, 4G, 5G: By: Simon JohansenMuhammad Nandya100% (1)

- Robust MPC for Discrete-Time MJLSs With Operation Mode DisorderingDocument13 pagesRobust MPC for Discrete-Time MJLSs With Operation Mode DisorderingnhatvpNo ratings yet

- WP - Power Over Ethernet (PoE) IEEE 802.3af - Original - 15240Document8 pagesWP - Power Over Ethernet (PoE) IEEE 802.3af - Original - 15240aashray bNo ratings yet

- Communication Networks: Technical InformationDocument32 pagesCommunication Networks: Technical Informationrdavid@hotmail.itNo ratings yet

- Electrical Vehicle Path Tracking Based Model Predictive Control With A Laguerre Function and Exponential WeightDocument16 pagesElectrical Vehicle Path Tracking Based Model Predictive Control With A Laguerre Function and Exponential WeightnhatvpNo ratings yet

- 612 Fundamentals of Electromagnetic CompatibilityDocument20 pages612 Fundamentals of Electromagnetic Compatibilityharshasasidharan007No ratings yet

- Context Deep Neural Network Model For Predicting Depression Risk Using Multiple RegressionDocument11 pagesContext Deep Neural Network Model For Predicting Depression Risk Using Multiple RegressionnhatvpNo ratings yet

- Critical Review On The Battery State of Charge Estimation MethodsDocument12 pagesCritical Review On The Battery State of Charge Estimation MethodsnhatvpNo ratings yet

- Hybrid Prediction Model For The Interindustry Carbon Emissions Transfer Network Based On The Grey Model and General Vector MachineDocument12 pagesHybrid Prediction Model For The Interindustry Carbon Emissions Transfer Network Based On The Grey Model and General Vector MachinenhatvpNo ratings yet

- Run-Time Efficiency of Bilinear Model Predictive Control Using Variational Methods, With Applications To Hydronic CoolingDocument11 pagesRun-Time Efficiency of Bilinear Model Predictive Control Using Variational Methods, With Applications To Hydronic CoolingnhatvpNo ratings yet

- FPGA Implementation of Model Predictive Control With Constant Switching Frequency For PMSM DrivesDocument9 pagesFPGA Implementation of Model Predictive Control With Constant Switching Frequency For PMSM DrivesnhatvpNo ratings yet

- Predictive ACC Using Customized ECUDocument13 pagesPredictive ACC Using Customized ECUnhatvpNo ratings yet

- IEEE ACcess PaperDocument11 pagesIEEE ACcess Paperziafat shehzadNo ratings yet

- A Cost-Effective and Low-Complexity Predictive Control For Matrix Converters Under Unbalanced Grid Voltage ConditionsDocument11 pagesA Cost-Effective and Low-Complexity Predictive Control For Matrix Converters Under Unbalanced Grid Voltage ConditionsnhatvpNo ratings yet

- Learning To Guide: Guidance Law Based On Deep Meta-Learning and Model Predictive Path Integral ControlDocument13 pagesLearning To Guide: Guidance Law Based On Deep Meta-Learning and Model Predictive Path Integral ControlnhatvpNo ratings yet

- A Probabilistic Algorithm For Predictive Control With Full-Complexity Models in Non-Residential BuildingsDocument18 pagesA Probabilistic Algorithm For Predictive Control With Full-Complexity Models in Non-Residential BuildingsnhatvpNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Inakyd 3623-X-70Document2 pagesInakyd 3623-X-70roybombomNo ratings yet

- Mahindra Powertrain - Market StrategyDocument4 pagesMahindra Powertrain - Market StrategyEshan KapoorNo ratings yet

- Craniosacral Therapy For The Treatment of Chronic.10Document9 pagesCraniosacral Therapy For The Treatment of Chronic.10Marcus Dos SantosNo ratings yet

- Regular Manual Cleaning: Mimaki Printer Maintenance and Long-Term Storage OptionsDocument3 pagesRegular Manual Cleaning: Mimaki Printer Maintenance and Long-Term Storage OptionshumbyxNo ratings yet

- BBO 2011 ROUND 2 QUESTIONSDocument16 pagesBBO 2011 ROUND 2 QUESTIONSMalvina YuanNo ratings yet

- Diesel HatchbackDocument14 pagesDiesel HatchbackloganathprasannaNo ratings yet

- Assignment #1: 1 HgjyygbykvrfDocument1 pageAssignment #1: 1 HgjyygbykvrfJuan Sebastian ArangoNo ratings yet

- M. Valerio Assignment 6.1Document1 pageM. Valerio Assignment 6.1Mark Kristian ValerioNo ratings yet

- 11 F.Y.B.Sc - Chemistry PDFDocument22 pages11 F.Y.B.Sc - Chemistry PDFmalini PatilNo ratings yet

- Operator Manual T2100-ST2 - ST1Document50 pagesOperator Manual T2100-ST2 - ST1Nurul FathiaNo ratings yet

- Engineering Mechanics Lectures PDFDocument83 pagesEngineering Mechanics Lectures PDFluay adnanNo ratings yet

- Ped 201 Toddler Observation LabDocument6 pagesPed 201 Toddler Observation Labapi-477856901No ratings yet

- Wyoming County Fair (2022)Document20 pagesWyoming County Fair (2022)Watertown Daily TimesNo ratings yet

- Comparison Study of Conventional Hot-Water and Microwave Blanching at Different Timetemperaturepower Combinations On The Quality of Potatoes.Document72 pagesComparison Study of Conventional Hot-Water and Microwave Blanching at Different Timetemperaturepower Combinations On The Quality of Potatoes.DavldSmith100% (1)

- Artikel Ilmiah FikriDocument6 pagesArtikel Ilmiah FikriViola Mei DamayantiNo ratings yet

- อัตราภาษีของไทยที่ลดให้เปรูDocument124 pagesอัตราภาษีของไทยที่ลดให้เปรูDante FilhoNo ratings yet

- Margot's Cafe MenuDocument1 pageMargot's Cafe Menumichael_burns_24No ratings yet

- Proceedings of National Conference on Landslides held in LudhianaDocument8 pagesProceedings of National Conference on Landslides held in LudhianaAniket PawarNo ratings yet

- Fault Code 155: Intake Manifold Air Temperature High - CriticalDocument3 pagesFault Code 155: Intake Manifold Air Temperature High - Criticalhamilton miranda100% (1)

- 2 History of OrthodonticsDocument11 pages2 History of OrthodonticsMeiz JaleelNo ratings yet

- MACRO-ETCHING SOLUTIONS FOR ALUMINIUM ALLOYSDocument1 pageMACRO-ETCHING SOLUTIONS FOR ALUMINIUM ALLOYSsensoham03No ratings yet

- Dod EngDocument2 pagesDod Engvk4415003No ratings yet

- Exile 3 Hint BookDocument21 pagesExile 3 Hint BookLaura RoseNo ratings yet

- Hyundai Elevator Manual Helmon 2000 InstructionDocument27 pagesHyundai Elevator Manual Helmon 2000 InstructionReynold Suarez100% (1)

- PCS PADDLE SHIFTER INSTALL GUIDEDocument21 pagesPCS PADDLE SHIFTER INSTALL GUIDEAndreas T P ManurungNo ratings yet

- Limbah PabrikDocument2 pagesLimbah Pabrikindar dewaNo ratings yet

- Astrological Terms A-ZDocument63 pagesAstrological Terms A-Zmahadp08100% (1)

- Pd3c CV Swa (22kv)Document2 pagesPd3c CV Swa (22kv)เต่า วีไอNo ratings yet

- Ex Ophtalmo Eng 1Document4 pagesEx Ophtalmo Eng 1Roxana PascalNo ratings yet

- Clay ShonkwilerDocument9 pagesClay ShonkwilerJeoff Libo-onNo ratings yet