Professional Documents

Culture Documents

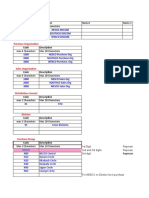

Asset Class Company Code Asset Description

Uploaded by

Jit GhoshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Class Company Code Asset Description

Uploaded by

Jit GhoshCopyright:

Available Formats

Asset Class Company Code Asset Description

The main criterion for The company code is an Enter a name for the asset in this

classifying fixed assets organizational unit within field.

according to legal and financial accounting

management requirements.

Enter Asset Class here. Refer to CC tab, and choose

Refer to Asset Class tab for the value from Company

possible values

CHAR 8 CHAR 4 CHAR 50

Mandatory Mandatory Mandatory

Z2400 3115 Taxi Meter 1

Additional Asset Description Asset main no. text Account Determination

Enter the additional description of the In this field, you can enter any Account Deterination is

asset if asset description is not desired name for an asset main generally defaulted here

enough number. The text is then used, for based on configuration

example, in reporting, and in the

display values transaction when

accessing totals per asset main

number.

CHAR 50 CHAR 50 CHAR 8

Optional Optional Defaulted

Taxi Meter 1 Taxi Meter 1

Serial Number Inventory Number Quantity

Enter the serial number of the Enter the Capex number of the Enter the quantity of the asset

asset here asset here here.

CHAR 18 CHAR 25 CHAR 13

Optional Optional Optional

10

Base Unit of Measure Capitalized On First Acquisition on

Enter the base unit of measure for Enter the capitalization date IF Enter the date of acquisition

asset. Refer to UoM tab for the the asset already capitalised

possible value on legacy system

CHAR 3 CHAR 8 CHAR 8

Optional Conditional Conditional

01.01.2012 01.01.2012

Vendor No. Acquisition Value (Pre Yr) Asset No.

Enter account number of Enter Acquisition Value Enter Asset no.

Vendor 01.04.2014

CHAR 10 CHAR 13 CHAR 12

Conditional Optional Mandatory

2000210 23000 30101100001

Cost Center Location Evaluation group 3

Enter the cost center for the Enter the location for the asset Enter the group of the asset.

asset. Refer to cost center tab in this field. Leave it blank for This field will be defaulted

for possible values Malaysia from asset class. Refer to

Evaluation Group 2 tab for the

full list.

This only use for taxi

equipment asset class

CHAR 10 CHAR 10 CHAR 4

Mandatory Optional Conditional

3115C10000 30100105 Taxi Meter

Original Asset Depreciation Key UseLife

Enter the original asset Enter the depreciation key. Enter the useful of the asset

number in legacy system Choose straight line method (in years). The useful life will

or "0000" if the asset not be defaulted by asset class.

subjected to depreciation Only change it when it is

different from defaulted useful

life.

CHAR 12 CHAR 4 CHAR 3

Optional Mandatory Conditional

Z001 10

Ordinary Depreciation Start Current Year Depreciation Accumulated Depreciation

Enter the Ordinary Enter the cuurent year Enter the amount if

Depreciation Calculation Start depreciation date accumulated depreciation

Date if the start should not 01.01.2015 to 31.03.2015 31.12.2014

follow acquisition posting date

CHAR 8 CHAR 9 CHAR 13

Optional Optional Optional

01.01.2012 575 4600

Asset Class Short Description Useful Life

Z1100 Land - Freehold

Z1200 Land - Leasehold

Z1300 Building 50

Z1400 Plant and Machinery 5

Z1500 Renovation 6

Z1600 Signboard 6

Z1700 Motor Vehicles 5

Z1800 Motor Vehicles for Rental 3

Z1900 Office Equipments 6

Z2000 Tools & Equipments 5

Z2100 Furniture and Fittings 6

Z2200 Computer 5

Z2300 Plantation expenditure

Z2400 Taxi Equipment 6

Z2500 Distribution right fee 6

Z7000 Low Value Asset

Z8000 Work in Progress

Company Code Company Name

BCPL

RML

RCL

OMPL

Location Name

Evaluation Group 3

Taxi Meter

Taxi Radio

NGV

Depreciation Key Depreciation Name Status Use

0000 For No Depreciation Charges Active Yes

Z001 Str.-line from rem. life to book value zero Active No

Z002 LVA 100 % Complete depreciation Active No

Z010 Str.-line from rem. life to book value zero - Naza Active Yes

Z020 LVA 100 % Complete depreciation Active No

You might also like

- SWI FT MT940 - Understanding FORMAT: Statement Date Bank Account Number Statement NumberDocument5 pagesSWI FT MT940 - Understanding FORMAT: Statement Date Bank Account Number Statement NumbersrinivasNo ratings yet

- User Manual FI03: Title: Module NameDocument35 pagesUser Manual FI03: Title: Module Namesksk1911No ratings yet

- Section 1: Document Information: SCM Report Master Data ZMM - Mat - VenDocument3 pagesSection 1: Document Information: SCM Report Master Data ZMM - Mat - VenRicky リキNo ratings yet

- G1nti Itc1 Bs12 R N D Project v0.2rDocument13 pagesG1nti Itc1 Bs12 R N D Project v0.2rBurzes BatliwallaNo ratings yet

- FTDS SD E 227 Add Warrior Customer Number To The Customer MasterDocument25 pagesFTDS SD E 227 Add Warrior Customer Number To The Customer MasterDeepakNo ratings yet

- HowTo PrintLayouts PLD 88Document61 pagesHowTo PrintLayouts PLD 88Ricardo CANo ratings yet

- Development Specification DocumentDocument8 pagesDevelopment Specification DocumentKenny Junior Mercedes RojasNo ratings yet

- Redbook EntriesDocument15 pagesRedbook EntriesJit GhoshNo ratings yet

- FIBK BankReconciliatiaonReport FS FinalDocument10 pagesFIBK BankReconciliatiaonReport FS FinalAMIT SAWANTNo ratings yet

- Aged AR by Aging Bucket Report 0.1 PDFDocument14 pagesAged AR by Aging Bucket Report 0.1 PDFShanthi SottagariNo ratings yet

- SAS-T-9 Enhance Invoice VerificationDocument7 pagesSAS-T-9 Enhance Invoice VerificationRoshanNo ratings yet

- KPMG Demo - Obyc GL MappedDocument3 pagesKPMG Demo - Obyc GL MappedJit GhoshNo ratings yet

- Overdue customer line item alert notificationDocument8 pagesOverdue customer line item alert notificationMine SapNo ratings yet

- Transaction Code CESU Business Process Master List - FICODocument4 pagesTransaction Code CESU Business Process Master List - FICOJit GhoshNo ratings yet

- AIS Sap Business OneDocument16 pagesAIS Sap Business OneMarcos MedinaNo ratings yet

- Unit Test Script: Test Scenario No. Re-Posting of CostsDocument2 pagesUnit Test Script: Test Scenario No. Re-Posting of CostsjsphdvdNo ratings yet

- Table Sap b1Document25 pagesTable Sap b1shmilyou100% (2)

- Incoming Payments & Customer Correspondences Package for SF02 ScenarioDocument5 pagesIncoming Payments & Customer Correspondences Package for SF02 ScenarioBurzes BatliwallaNo ratings yet

- B1 ICO BranchDocument47 pagesB1 ICO BranchdabrandNo ratings yet

- Functional Specification: FS - FI - VAT - Profit Center Jan - 18Document7 pagesFunctional Specification: FS - FI - VAT - Profit Center Jan - 18Anonymous 0SLsR9No ratings yet

- SAP Foreign Currency Revaluation Q & ADocument9 pagesSAP Foreign Currency Revaluation Q & Aprasad tatikondaNo ratings yet

- MMFIDocument3 pagesMMFImayoorNo ratings yet

- WBS MPM KT Doc-1Document22 pagesWBS MPM KT Doc-1Himanshu KapoorNo ratings yet

- Week - End Holiday Quarter Comp-Of Reason Total Working Hours For The Day ApproverDocument4 pagesWeek - End Holiday Quarter Comp-Of Reason Total Working Hours For The Day ApprovermayoorNo ratings yet

- Parallel Currencies Asset AccountingDocument7 pagesParallel Currencies Asset AccountingsapeinsNo ratings yet

- Technical SpecsDocument19 pagesTechnical SpecsPritismanNo ratings yet

- Automatic Payment Program (App)Document168 pagesAutomatic Payment Program (App)Pavan UlkNo ratings yet

- SAP FI Master Records SetupDocument36 pagesSAP FI Master Records SetupishtiaqNo ratings yet

- BBP New Format Vendor MasterDocument21 pagesBBP New Format Vendor Mastersowndarya vangalaNo ratings yet

- FIGL - GL Voucher Print - FSDocument7 pagesFIGL - GL Voucher Print - FSAMIT SAWANTNo ratings yet

- UTP - Technical Spec - DD - Work Stream - StatusDocument119 pagesUTP - Technical Spec - DD - Work Stream - StatusKalikinkar LahiriNo ratings yet

- 224 Integrated PeriodEnd Closing Activities en CNDocument17 pages224 Integrated PeriodEnd Closing Activities en CNkunjan2165No ratings yet

- Bidcoro - Fi - BBP - V1 0 - 23.05.16Document73 pagesBidcoro - Fi - BBP - V1 0 - 23.05.16Srinivas YakkalaNo ratings yet

- Sap Fi 10Document96 pagesSap Fi 10krishna_1238No ratings yet

- Fertis ASIS r2Document52 pagesFertis ASIS r2Veera ManiNo ratings yet

- Request ID and Subject TrackingDocument1,486 pagesRequest ID and Subject TrackingDeepakNo ratings yet

- Pre Migration Activities:: 1. Rasfin - Migr - PrecheckDocument16 pagesPre Migration Activities:: 1. Rasfin - Migr - PrecheckgayatriscribdNo ratings yet

- SAP Business One Solution Model: Customer SupplierDocument11 pagesSAP Business One Solution Model: Customer SupplierMalu FlorendoNo ratings yet

- RMP Everymonth Closing Activities: S.No. English Desciption Wave V SAPDocument11 pagesRMP Everymonth Closing Activities: S.No. English Desciption Wave V SAPSyed Zain Ul AbdinNo ratings yet

- SE91 transaction message class configurationDocument4 pagesSE91 transaction message class configurationmayoorNo ratings yet

- Incidentrequest Closed Monthly JunDocument250 pagesIncidentrequest Closed Monthly Junأحمد أبوعرفهNo ratings yet

- FS - FI F 013 Dunning Letter 1Document8 pagesFS - FI F 013 Dunning Letter 1Mine SapNo ratings yet

- 20 Tips Ficoaa DOC-71682Document5 pages20 Tips Ficoaa DOC-71682Suraj MohapatraNo ratings yet

- SAP Business One ERP OverviewDocument25 pagesSAP Business One ERP OverviewVeera ManiNo ratings yet

- Functional Specification - Enhancement: Enhancement ID: Enhancement NameDocument7 pagesFunctional Specification - Enhancement: Enhancement ID: Enhancement NamesapeinsNo ratings yet

- Fertis ASIS r2Document52 pagesFertis ASIS r2Veera ManiNo ratings yet

- Functional forms and objects for FI moduleDocument3 pagesFunctional forms and objects for FI moduletituseapenNo ratings yet

- Fi GL AuthorizationDocument12 pagesFi GL AuthorizationpysulNo ratings yet

- Practitioner Portal - Payment Advice Run Email Functionality To Multiple Party and No Email Error HandlingDocument14 pagesPractitioner Portal - Payment Advice Run Email Functionality To Multiple Party and No Email Error HandlingJoseNo ratings yet

- SAP Implementation Tools Overview: Version 1.0 Page 1/32Document32 pagesSAP Implementation Tools Overview: Version 1.0 Page 1/32SultanNo ratings yet

- SAP Business One user license comparisonDocument39 pagesSAP Business One user license comparisonAndroNo ratings yet

- Mondelez Minute of Meeting 160729Document4 pagesMondelez Minute of Meeting 160729vinhnpaNo ratings yet

- Profitability ManagementDocument1 pageProfitability ManagementIvica999No ratings yet

- 01 - SAP System ArchitectureDocument56 pages01 - SAP System ArchitectureDinbandhu TripathiNo ratings yet

- Dunning Objects ListsDocument1 pageDunning Objects ListsSachin SinghNo ratings yet

- Business Blueprint Document FI03-01 - Customer / Vendor Account GroupsDocument8 pagesBusiness Blueprint Document FI03-01 - Customer / Vendor Account GroupsDinbandhu TripathiNo ratings yet

- Manage cash transactionsDocument31 pagesManage cash transactionsbiswajit6864No ratings yet

- S/4 HANA Production PlanningDocument15 pagesS/4 HANA Production PlanningVeera ManiNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- 2020 2nd Quarter Supplies2Document159 pages2020 2nd Quarter Supplies2ceNo ratings yet

- S5 - RA T CodesDocument5 pagesS5 - RA T CodesJit GhoshNo ratings yet

- SAP RAR Period End Processing and Accounting EntriesDocument16 pagesSAP RAR Period End Processing and Accounting EntriesJit GhoshNo ratings yet

- COPA Activate Account BasedDocument2 pagesCOPA Activate Account BasedJit GhoshNo ratings yet

- Transaction Code CESU Business Process Master List - FICODocument4 pagesTransaction Code CESU Business Process Master List - FICOJit GhoshNo ratings yet

- CESU Approval of Revised SAP Asset Management BBPDocument2 pagesCESU Approval of Revised SAP Asset Management BBPJit GhoshNo ratings yet

- Voyager - S4HANA Conversion ProjectDocument4 pagesVoyager - S4HANA Conversion ProjectJit GhoshNo ratings yet

- XK99 Mass Vendor ChangeDocument4 pagesXK99 Mass Vendor ChangeJit GhoshNo ratings yet

- R-APDRP Project Business BlueprintDocument2 pagesR-APDRP Project Business BlueprintJit GhoshNo ratings yet

- Concur Discovery Questions: Topic Item Country/Business UnitsDocument12 pagesConcur Discovery Questions: Topic Item Country/Business UnitsJit GhoshNo ratings yet

- Concur Customer Discovery QuestionnaireDocument17 pagesConcur Customer Discovery QuestionnaireJit GhoshNo ratings yet

- Streamline Travel & Expense with ConcurDocument13 pagesStreamline Travel & Expense with ConcurJit GhoshNo ratings yet

- CESU - RAPDRP - FICO - CC Master DataDocument2 pagesCESU - RAPDRP - FICO - CC Master DataJit GhoshNo ratings yet

- Asset Legacy Transfer Error - Accumulated Values For Activation Date Not Allowed in Transfer YearDocument2 pagesAsset Legacy Transfer Error - Accumulated Values For Activation Date Not Allowed in Transfer YearJit GhoshNo ratings yet

- Busness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Document10 pagesBusness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Jit GhoshNo ratings yet

- Transaction Code CESU Business Process Master List - FICODocument4 pagesTransaction Code CESU Business Process Master List - FICOJit GhoshNo ratings yet

- CESU Material Management and Plant Maintenance ProcessesDocument19 pagesCESU Material Management and Plant Maintenance ProcessesJit GhoshNo ratings yet

- S. No. Module Dev ID Development Type Frequency Explanation of Requirements Standard SAP Solution Input OutputDocument1 pageS. No. Module Dev ID Development Type Frequency Explanation of Requirements Standard SAP Solution Input OutputJit GhoshNo ratings yet

- GL - Master Chart Of Accounts DataDocument49 pagesGL - Master Chart Of Accounts DataJit GhoshNo ratings yet

- Miel Development List Abap Bi BoDocument5 pagesMiel Development List Abap Bi BoJit GhoshNo ratings yet

- SGR - ID - Wtihholding TaxDocument13 pagesSGR - ID - Wtihholding TaxJit GhoshNo ratings yet

- S4hana CopaDocument10 pagesS4hana CopaGhosh2No ratings yet

- L2 Training Guide for Flexible Real Estate ManagementDocument49 pagesL2 Training Guide for Flexible Real Estate Managementgagan3y83% (6)

- Sap PC NTSDocument2 pagesSap PC NTSJit GhoshNo ratings yet

- 6b. CESU - RAPDRP - FICO - RICEFW - Flow ChartDocument3 pages6b. CESU - RAPDRP - FICO - RICEFW - Flow ChartJit GhoshNo ratings yet

- Incorrect WTH TAN Calculation For DP and Invoice ProcessingDocument2 pagesIncorrect WTH TAN Calculation For DP and Invoice ProcessingJit GhoshNo ratings yet

- 1000 Nesco Discom 2000 Southco Discom 3000 Wesco Discom: Code DescriptionDocument58 pages1000 Nesco Discom 2000 Southco Discom 3000 Wesco Discom: Code DescriptionGhosh2No ratings yet

- Busness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Document10 pagesBusness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Jit GhoshNo ratings yet

- SPPL March 2018 Document with Repeating EntriesDocument8 pagesSPPL March 2018 Document with Repeating EntriesGhosh2No ratings yet

- Reply-Wesco - FICO AMDocument165 pagesReply-Wesco - FICO AMJit GhoshNo ratings yet

- HSBCnet - MY MT940 File SpecificationDocument8 pagesHSBCnet - MY MT940 File SpecificationGhosh2No ratings yet

- ALFM Money Market FundDocument47 pagesALFM Money Market FundLemuel VillanuevaNo ratings yet

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- Richard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCDocument4 pagesRichard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCNick HuronNo ratings yet

- FADocument46 pagesFANishant JainNo ratings yet

- Financial Planning, Tools EtcDocument31 pagesFinancial Planning, Tools EtcEowyn DianaNo ratings yet

- Ily Abella Surveyors Income StatementDocument6 pagesIly Abella Surveyors Income StatementJoy Santos33% (3)

- Capitalized Cost Eng Econo As1Document8 pagesCapitalized Cost Eng Econo As1Francis Valdez LopezNo ratings yet

- Marketing of Financial ServicesDocument10 pagesMarketing of Financial ServicesRohit SoniNo ratings yet

- Unit I Introduction To Marketing FinanceDocument3 pagesUnit I Introduction To Marketing Financerajesh laddhaNo ratings yet

- Negotiable Instruments Act-1881Document37 pagesNegotiable Instruments Act-1881Md ToufikuzzamanNo ratings yet

- G.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsDocument3 pagesG.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsOnana100% (2)

- C 1044Document28 pagesC 1044Maya Julieta Catacutan-EstabilloNo ratings yet

- Assignment On:: Financial AnalysisDocument5 pagesAssignment On:: Financial AnalysisMd. Mustafezur Rahaman BhuiyanNo ratings yet

- Choose Letter of The Correct Answer.Document3 pagesChoose Letter of The Correct Answer.Peng GuinNo ratings yet

- Learn compound interest formulas and calculationsDocument30 pagesLearn compound interest formulas and calculationsShyla Patrice DantesNo ratings yet

- BRM v3-1 Taxonomy 20130615Document52 pagesBRM v3-1 Taxonomy 20130615kevinzhang2022No ratings yet

- Kartik - Double EnteryDocument17 pagesKartik - Double EnterySathya SeelanNo ratings yet

- Pricing Products and Services True/False QuestionsDocument49 pagesPricing Products and Services True/False QuestionsKimyongseongNo ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsPriya MadanaNo ratings yet

- Housing Loan ApplicationformDocument0 pagesHousing Loan Applicationformangel gryeNo ratings yet

- Hudson Law of Finance 2e 2013 Syndicated Loans ch.33Document16 pagesHudson Law of Finance 2e 2013 Syndicated Loans ch.33tracy.jiang0908No ratings yet

- Simulates Midterm Exam. IntAcc1 PDFDocument11 pagesSimulates Midterm Exam. IntAcc1 PDFA NuelaNo ratings yet

- Best Respondent Memorial PDFDocument38 pagesBest Respondent Memorial PDFPriyanka PriyadarshiniNo ratings yet

- Analysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Document35 pagesAnalysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Husban Ahmed Chowdhury100% (2)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurucpe plNo ratings yet

- Cost Sheet of AmulDocument7 pagesCost Sheet of AmulKhushi DaveNo ratings yet

- Easypaisa-All Pricing and CommissioningDocument17 pagesEasypaisa-All Pricing and Commissioningqaisar_murtaza50% (4)

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocument3 pagesBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNo ratings yet

- Leibowitz - Franchise Value PDFDocument512 pagesLeibowitz - Franchise Value PDFDavidNo ratings yet

- 21933mtp Cptvolu1 Part1Document208 pages21933mtp Cptvolu1 Part1arshNo ratings yet