Professional Documents

Culture Documents

Advanced Accounting Test Bank Chapter 07 Susan Hamlen

Uploaded by

Wilmar AbriolOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting Test Bank Chapter 07 Susan Hamlen

Uploaded by

Wilmar AbriolCopyright:

Available Formats

TEST BANK

CHAPTER 7

Foreign Currency Transactions and Hedging

MULTIPLE CHOICE

1. Topic: Valuation of forward contracts

LO 3

A U.S. company invests in a forward purchase contract for 100,000,000 yen with a

purchase price of $0.009/yen, for delivery in 45 days. The spot rate at the time the

contract is initiated is $0.0085/yen. At the end of the accounting year, the forward

contract is still outstanding. The year-end spot rate is $0.0088/yen. The year-end forward

rate for delivery at the contract date is $0.0092/yen. How is the forward contract

reported on the U.S. company’s balance sheet?

a. $20,000 asset

b. $20,000 liability

c. $30,000 asset

d. $30,000 liability

ANS: a

($0.0092 - $0.009) x 100,000,000 = $20,000

2. Topic: Cash flow hedge

LO 6

On August 1, a U.S. company enters into a forward contract, in which it agrees to buy

1,000,000 euros from a bank at a rate of $1.115 on December 1. Changes in the value of

the forward contract will be reported in other comprehensive income on the balance sheet

in which one of the following situations?

a. The U.S. company has receivables denominated in euros, with payment to be

received on December 1.

b. The U.S. company sold merchandise to a customer in Belgium on August 1, and

expects payment of 1,000,000 euros on December 1.

c. The U.S. company plans to sell merchandise to a customer in Belgium on August

1, with payment of 1,000,000 euros expected on December 1.

d. The U.S. company plans to purchase merchandise from a supplier in Belgium, with

payment of 1,000,000 euros expected to be paid on December 1.

ANS: d

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 1

Use the following information on the U.S. dollar value of the euro to answer questions 3 – 7

below:

Forward rate for

April 30, 2011

Spot rate delivery

October 30, 2010 $ 1.25 $ 1.30

December 31, 2010 1.28 1.32

April 30, 2011 1.26 1.26

On October 30, 2010, a company enters a forward contract to sell €100,000 on April 30, 2011.

The company’s accounting year ends December 31.

3. Topic: Hedge of export transaction

LO 4

The forward contract hedges an outstanding €100,000 account receivable due on April 30.

What is the net effect on income in 2010 and 2011?

2010 2011

a. $1,000 gain $4,000 gain

b. $1,000 loss $4,000 gain

c. $3,000 gain $6,000 gain

d. $2,000 loss $6,000 gain

ANS: a

2010: Gain on receivable, ($1.28 - $1.25) x €100,000 = $3,000

Loss on forward, ($1.32 - $1.30) x €100,000 = $2,000

Net gain $1,000

2011: Loss on receivable, ($1.28 - $1.26) x €100,000 = $2,000

Gain on forward, ($1.32 - $1.26) x €100,000 = $6,000

Net gain $4,000

©Cambridge Business Publishers, 2010

2 Advanced Accounting, 1st

Edition

4. Topic: Hedge of firm commitment

LO 5

The forward contract hedges a sales order for €100,000, received October 30. The sale

was made and the €100,000 collected on April 30, 2011. Sales revenue recorded on April

30 is:

a. $126,000

b. $122,000

c. $130,000

d. $124,000

ANS: c

(€100,000 x $1.26) + ($1.30 - $1.26) x €100,000 = $130,000

5. Topic: Hedge of firm commitment

LO 5

The forward contract hedges a sales order for €100,000, received October 30. The sale

was made and the €100,000 collected on April 30, 2011. The net effect on 2010 income

is:

a. No effect

b. $2,000 loss

c. $3,000 gain

d. $1,000 gain

ANS: a

The gain on the firm commitment and loss on the forward contract are ($1.32 - $1.30) x

€100,000 = $2,000, and they offset for a zero effect on 2010 income.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 3

6. Topic: Hedge of forecasted transaction

LO 6

The forward contract hedges a forecasted sale for €100,000, expected at the end of April

2011. The net effect on 2010 income is:

a. No effect

b. $2,000 loss

c. $3,000 gain

d. $1,000 gain

ANS: a

The loss on the forward contract is reported in other comprehensive income.

7. Topic: Hedge of forecasted transaction

LO 6

The forward contract hedges a forecasted sale for €100,000, expected at the end of April

2011. The sale takes place on April 30, 2011, €100,000 is collected, and the forward

contract is closed. Which statement is true, concerning the sale on April 30, 2011?

a. The $1,000 total loss on the forward contract is reclassified from other

comprehensive income as an adjustment to sales revenue.

b. The $4,000 total gain on the forward contract is reclassified from other

comprehensive income as an adjustment to sales revenue.

c. The 2011 $6,000 gain on the forward contract is recognized as a hedging gain on

the 2011 income statement.

d. The 2010 $2,000 loss on the forward contract is recognized as a hedging loss on

the 2010 income statement.

ANS: b

The total gain on the forward contract is ($1.30 - $1.26) x €100,000 = $4,000. Changes

in the value of the forward are reported in other comprehensive income until the hedged

forecasted transaction is reported in income. In this case, the forecasted transaction

results in sales revenue, reported in 2011.

©Cambridge Business Publishers, 2010

4 Advanced Accounting, 1st

Edition

8. Topic: Export transaction

LO 2

On May 20, 2012, when the spot rate is $1.30/€, a company sells merchandise to a

customer in Italy. The spot rate is $1.31/€ on June 30, the company’s year-end. Payment

of €100,000 is received on July 30, 2012, when the spot rate is $1.28/€. What is the effect

on fiscal 2012 and 2013 income?

Fiscal 2012 Fiscal 2013

a. $1,000 exchange loss $3,000 exchange gain

b. $1,000 exchange gain $3,000 exchange loss

c. No effect $2,000 exchange loss

d. No effect $2,000 exchange gain

ANS: b

Fiscal 2012 exchange gain = ($1.31 - $1.30) x €100,000 = $1,000

Fiscal 2013 exchange loss = ($1.31 - $1.28) x €100,000 = $3,000

9. Topic: Import transaction

LO 2

On May 20, 2012, when the spot rate is $1.30/€, a company purchases merchandise from

a supplier in Italy. The spot rate is $1.31/€ on June 30, the company’s year-end. Payment

of €100,000 is made on July 30, 2012, when the spot rate is $1.28/€. What is the effect on

fiscal 2012 and 2013 income?

Fiscal 2012 Fiscal 2013

a. $1,000 exchange loss $3,000 exchange gain

b. $1,000 exchange gain $3,000 exchange loss

c. No effect $2,000 exchange loss

d. No effect $2,000 exchange gain

ANS: a

Fiscal 2012 exchange loss = ($1.31 – $1.30) x €100,000 = $1,000

Fiscal 2013 exchange gain = ($1.31 – $1.28) x €100,000 = $3,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 5

Data for questions 10 and 11 are as follows:

On September 8, the Sealy Company purchased cotton at an invoice price of €20,000, when the

exchange rate was $1.32/€. Payment was to be made on November 8. On November 8, Sealy

purchased the €20,000 for $1.30/€, and paid the invoice.

10. Topic: Import transaction

LO 2

The cotton should be valued in Sealy's inventory at:

a. $20,000

b. $25,600

c. $26,000

d. $26,400

ANS: d

€20,000 x $1.32 = $26,400

11. Topic: Import transaction

LO 2

The exchange gain or loss recognized by Sealy as a result of this transaction is:

a. No gain or loss

b. $400 gain

c. $400 loss

d. $1,667 gain

ANS: b

€20,000 x ($1.32 - $1.30) = $400 gain

©Cambridge Business Publishers, 2010

6 Advanced Accounting, 1st

Edition

Data for questions 12 and 13 are as follows:

On June 5, Teneco Corporation sold merchandise at an invoice price of €100,000, when the

exchange rate was $1.36/€. Payment was to be received on August 16. On August 16, the

customer paid the €100,000. The exchange rate on that date was $1.39/€.

12. Topic: Export transaction

LO 2

The sale should be reported on Teneco's books at:

a. $136,000

b. $139,000

c. $ 73,530

d. $ 71,942

ANS: a

€100,000 x $1.36 = $136,000

13. Topic: Export transaction

LO 2

The exchange gain or loss recognized by Teneco as a result of this transaction is:

a. -0-

b. $3,000 gain

c. $3,000 loss

d. $3,919 loss

ANS: b

€100,000 x ($1.39 - 1.36) = $3,000 gain

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 7

14. Topic: Analysis of foreign currency risks

LO 3

A U.S. exporter has made a sale to a customer in another country. The customer is

obligated to remit payment in his local currency in 90 days. The direct spot rate is now

$1.54. The 90-day forward rate is $1.60. At which spot rate at the time the customer

remits payment would the company have been better off not hedging the export

transaction with a forward contract?

a. $1.52

b. $1.54

c. $1.59

d. $1.62

ANS: d

Any rate above $1.60 leads to higher U.S. dollar value of payment received than under the

forward contract.

15. Topic: Foreign currency options

LO 3

A company invests $200 in a foreign exchange option with the following terms: The

company may purchase 1,000,000 zloty at a price of $.25/zloty on December 20, 2014.

Which statement is true?

a. If the spot price for zloty is $.36 on December 20, the company will gain $359,800

on the option.

b. If the spot price for zloty is $.24 on December 20, the company will lose $200 on

the option.

c. If the spot price for zloty is $.27 on December 20, the company will lose $20,200

on the option.

d. If the spot price for zloty is $.30 on December 20, the company will gain $24,800

on the option.

ANS: b

The option gives the holder the option to buy 1,000,000 zloty for $250,000. At a spot

price of $.24/zloty, the option has no value and the holder loses its $200 investment.

©Cambridge Business Publishers, 2010

8 Advanced Accounting, 1st

Edition

16. Topic: Hedge of import transaction

LO 4

A U.S. import company purchases boomerangs from an Australian supplier on October 1,

2013 for 100,000 Australian dollars (A$), payable February 1, 2014. On October 1, 2013,

the company enters into a forward contract to hedge the foreign currency risk resulting

from this purchase. Exchange rates are as follows:

Forward

rate for 2/1

Spot rate delivery

October 1, 2013 $0.89 $0.85

December 31, 2013 0.88 0.84

February 1, 2014 0.82 0.82

For the import company, what is the income statement effect of the above information?

a. No effect in 2013, $4,000 gain in 2014

b. $1,000 gain in 2013, $6,000 gain in 2014

c. $1,000 loss in 2013, $6,000 loss in 2014

d. No effect in 2013, $4,000 loss in 2014

ANS: a

2013:

forward contract: ($.85 - $.84) x A$100,000 = $1,000 loss

payable: ($.89 - $.88) x A$100,000 = 1,000 gain

-0-

2014:

forward contract: ($.84 - $.82) x A$100,000 = $2,000 loss

payable: ($.88 - $.82) x A$100,000 = 6,000 gain

$4,000 gain

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 9

17. Topic: Hedge of firm commitment

LO 5

ABC Corporation issues a purchase order for 1,000,000 semiconductors to a foreign

supplier. The agreed upon total price is FC1,200,000, and the current spot rate is $1/FC.

Suppose a forward contract is taken out when the purchase order is issued, at a rate of

$0.95/FC, for delivery when the semiconductors are received. If the spot rate rises to

$1.05 when the semiconductors are received and paid for by ABC, at what value will the

semiconductors be reported on ABC’s books?

a. $1,020,000

b. $1,140,000

c. $1,200,000

d. $1,260,000

ANS: b

$1.05 x FC1,200,000 = $1,260,000

($1.05 - $.95) x FC1,200,000 = (120,000)

$1,140,000

Use the following information to answer questions 18 and 19 below.

A U.S. company purchases a 60-day certificate of deposit from an Italian bank on October 15.

The certificate has a face value of €1,000,000, costs $1,200,000 (the spot rate is $1.20/€), and

pays interest at an annual rate of 6 percent. On December 14, the certificate of deposit matures

and the company receives principal and interest of €1,010,000. The spot rate on December 14 is

$1.18/€. The average spot rate for the period October 15 – December 14 is $1.19/€.

18. Topic: Foreign currency lending

LO 2

The exchange gain or loss on this investment is:

a. $20,200 gain

b. $20,200 loss

c. $20,000 gain

d. $20,000 loss

ANS: d

€1,000,000 x ($1.20 - $1.18) = $20,000 loss

©Cambridge Business Publishers, 2010

10 Advanced Accounting, 1st

Edition

19. Topic: Foreign currency lending

LO 2

Interest income on the investment is reported at:

a. $0

b. $11,800

c. $11,900

d. $12,000

ANS: b

€10,000 x $1.18 = $11,800

Use the following information to answer questions 20 – 22 below:

A U.S. company anticipates that it will purchase merchandise for €10,000,000 at the end of July,

and pay for it at the end of September. On March 1, it enters a forward contract to buy

€10,000,000 on September 30. The forward contract qualifies as a cash flow hedge. The

company’s accounting year ends December 31. The company actually purchases the merchandise

on July 30 and closes the forward contract and pays for the merchandise on September 30. It still

holds the merchandise at the end of the year. Exchange rates are as follows:

Forward rate

for 9/30 delivery

Spot rate

March 1 $1.40 $1.41

July 30 1.42 1.415

September 30 1.43 1.43

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 11

20. Topic: Hedge of forecasted transaction

LO 6

The merchandise is reported on the year-end balance sheet at:

a. $14,100,000

b. $14,150,000

c. $14,200,000

d. $14,300,000

ANS: c

Changes in the value of the forward contract remain in other comprehensive income

until the merchandise is sold. The merchandise is reported at the spot rate at the date of

purchase, $1.42.

21. Topic: Hedge of forecasted transaction

LO 6

What is the net effect on income for the year?

a. No effect

b. $100 loss

c. $100 gain

d. $50 gain

ANS: a

Changes in the value of the forward are reported in other comprehensive income.

The $100 loss on the payable is exactly offset by a reclassification of $100 out of other

comprehensive income, so there is no net effect on income.

©Cambridge Business Publishers, 2010

12 Advanced Accounting, 1st

Edition

22. Topic: Hedge of forecasted transaction

LO 6

When the merchandise is sold, what amount is reported for cost of goods sold?

a. $14,100,000

b. $14,150,000

c. $14,200,000

d. $14,300,000

ANS: a

At the end of the year, other comprehensive income has a credit balance of $100. When

the merchandise is sold, it is reclassified as a reduction in cost of goods sold; $14,100,000

= $14,200,000 - $100,000.

Journal entries related to questions 20 – 22 (in thousands):

July 30

Inventory 14,200

Accounts payable 14,200

Investment in forward 50

Other comprehensive income 50

September 30

Exchange loss 100

Accounts payable 100

Investment in forward 150

Other comprehensive income 150

Other comprehensive income 100

Exchange gain 100

Accounts payable 14,300

Cash 14,100

Investment in forward 200

When merchandise is sold:

Cost of goods sold 14,100

Other comprehensive income 100

Inventory 14,200

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 13

Use the following information on the U.S. dollar value of the euro to answer questions 23 – 25:

Forward rate for

March 20, 2012

Spot rate delivery

November 30, 2011 $ 1.30 $ 1.29

December 31, 2011 1.33 1.31

March 20, 2012 1.35 1.35

23. Topic: Speculative forward purchase contract

LO 7

On November 30, 2011, a U.S. company, with a December 31 year-end, enters a forward

purchase contract for €100,000 to be delivered on March 20, 2012. The forward

contract does not qualify as a hedge. The company closes the contract at its expiration

date. Which statement is true?

a. No gain or loss is reported until the forward is closed on March 20

b. A gain of $2,000 is reported in 2012

c. A gain of $4,000 is reported in 2012

d. A gain of $6,000 is reported in 2012

ANS: c

The change in value of the forward is reported in income as the forward rate changes. For

2012, the gain is ($1.35 - $1.31) x €100,000 = $4,000.

24. Topic: Speculative forward sale contract

LO 7

On November 30, 2011, a U.S. company, with a December 31 year-end, enters a forward

sale contract for €100,000 to be delivered on March 20, 2012. The forward contract

does not qualify as a hedge. The company closes the forward contract on December 31.

Which statement is true?

a. No gain or loss is reported

b. A loss of $1,000 is reported in 2011

c. A loss of $3,000 is reported in 2011

d. A loss of $2,000 is reported in 2011

ANS: d

The change in value of the forward is reported in income as the forward rate changes. For

2011, the loss is ($1.31 - $1.29) x €100,000 = $2,000

©Cambridge Business Publishers, 2010

14 Advanced Accounting, 1st

Edition

25. Topic: IFRS for hedge of a forecasted purchase

LO 8

On November 30, 2011, a U.S. company, with a December 31 year-end, enters a forward

purchase contract for €100,000 to be delivered on March 20, 2012. The contract hedges

a forecasted purchase of equipment. The forward is closed and the equipment purchased

on March 20. If the company follows IFRS and reports gains and losses on hedges of

forecasted transactions as basis adjustments, total depreciation expense over the life of

the equipment is:

a. $129,000

b. $130,000

c. $131,000

d. $135,000

ANS: a

The equipment is recorded at the spot rate of $1.35 x €100,000 = $135,000, adjusted for

the $6,000 [= $1.35 - $1.29) x €100,000] gain on the forward contract.

26. Topic: Exchange rates

LO 1

The value of the euro changes from $1.39 to $1.43. Which statement is true concerning

changes in the value of the euro in relation to the U.S. dollar?

a. Each U.S. dollar can be exchanged for more euros.

b. Each euro can be exchanged for fewer U.S. dollars.

c. The U.S. dollar has strengthened with respect to the euro.

d. A $10 product can be purchased with fewer euros.

ANS: d

27. Topic: Exchange rates

LO 1

Informal markets contracting for future delivery of foreign currencies are called:

a. Spot markets

b. Forward markets

c. Futures markets

d. Direct markets

ANS: b

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 15

28. Topic: Forward sale hedging foreign currency receivable

LO 4

A U.S. company has euro-denominated receivables that it hedges with a forward sale of

euros. The euro weakens against the U.S. dollar. Which statement is true?

a. The gain on the receivables and the loss on the forward are reported on the income

statement.

b. The gain on the receivables and the loss on the forward are reported in other

comprehensive income.

c. The loss on the receivables and the gain on the forward are reported on the income

statement.

d. The loss on the receivables and the gain on the forward are reported in other

comprehensive income.

ANS: c

29. Topic: Forward purchase hedging foreign currency payable

LO 4

A U.S. company has payables to suppliers denominated in euros, and hedges these

payables with foreign currency forward purchase contracts. The euro strengthens against

the U.S. dollar. Which statement is true?

a. The gain on the payables and the loss on the forward are reported on the income

statement.

b. The gain on the payables and the loss on the forward are reported in other

comprehensive income.

c. The loss on the payables and the gain on the forward are reported on the income

statement.

d. The loss on the payables and the gain on the forward are reported in other

comprehensive income.

ANS: c

©Cambridge Business Publishers, 2010

16 Advanced Accounting, 1st

Edition

30. Topic: Forward sale hedging forecasted transaction

LO 6

A U.S. company sells its products to customers in Japan, priced in yen. It hedges a

forecasted sale to a Japanese customer with a forward sale of yen. Changes in the value of

the hedge investment are:

a. Reported in other comprehensive income until the products are produced

b. Reported as adjustments to selling and administrative expenses when the products

are sold

c. Reported in income as the changes occur

d. Reported in other comprehensive income until the products are sold

ANS: d

31. Topic: Special hedge accounting, cash flow hedges

LO 3, 6

Changes in the market value of forward foreign currency contracts used to hedge

forecasted sales of merchandise to customers are:

a. Reported on the income statement if the forwards qualify for special hedge

accounting and in other comprehensive income if they don’t qualify.

b. Reported as a direct adjustment to retained earnings if they qualify for special

hedge accounting and on the income statement if they don’t qualify.

c. Reported in other comprehensive income if they qualify for special hedge

accounting and on the income statement if they don’t qualify.

d. Not reported if they qualify for special hedge accounting and reported on the

income statement if they don’t qualify.

ANS: c

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 17

32. Topic: Cash flow hedges

LO 3, 6

Which one of the following is a cash flow hedge for a U.S. company?

a. A hedge of euro-denominated receivables

b. A hedge of a planned purchase of inventory, denominated in pesos

c. A hedge of a sales order from a customer in the U.K., denominated in pounds

d. A hedge of payables denominated in U.S. dollars

ANS: b

33. Topic: Identification of hedge investments

LO 3

Which of the following is not a hedge investment?

a. A U.S. company issues a purchase order to a supplier in Mexico who requires

payment in pesos, and invests in a put option in pesos.

b. A U.S. company has debt denominated in euros, and invests in a forward purchase

of euros.

c. A U.S. company’s customers owe it several million pesos from credit sales, and the

company invests in a forward sale of pesos.

d. A U.S. company invests in corporate bonds denominated in euros and enters a put

option in euros.

ANS: a

34. Topic: Identification of hedge investments

LO 3

You are a U.S. investor and you expect that the value of the euro, in U.S. dollar terms,

will increase. Which of the following investments would you make?

a. Short position in euro futures.

b. Put option in euros.

c. Borrow from a bank in Italy, payment denominated in euros.

d. Forward purchase of euros.

ANS: d

©Cambridge Business Publishers, 2010

18 Advanced Accounting, 1st

Edition

35. Topic: Derivatives disclosures

LO 7

SFAS 161, effective at the end of 2008, provides that:

a. Hedges reported as assets be combined with hedges reported as liabilities.

b. All hedged items be carried at market value.

c. Additional footnote disclosures detail hedging gains and losses by hedge type.

d. Hedging gains and losses be separately displayed on the income statement and not

combined with other accounts.

ANS: c

36. Topic: Identification of hedge investments

LO 3

Which of the following is the real hedge?

a. A call option in euros, used to hedge a forecasted sale to a customer, denominated

in euros

b. A call option in euros, used to hedge an investment in securities, denominated in

euros

c. A put option in euros, used to hedge a receivable denominated in euros

d. A forward sale in euros, used to hedge debt denominated in euros

ANS: c

37. Topic: Hedge accounting

LO 3

On August 1, a U.S. company enters into a forward contract, in which it agrees to buy

1,000,000 euros from a bank at a rate of $1.45 on December 1. Changes in the value of

the forward contract will be reported on the income statement in which one of the

following situations?

a. The U.S. company uses the forward contract to hedge a loan denominated in

euros.

b. The U.S. company uses the forward contract to hedge a forecasted purchase of

merchandise from a French supplier.

c. The U.S. company uses the forward contract to hedge a planned purchase of

commodities from an Italian supplier.

d. The U.S. company uses the forward contract to hedge an expected acquisition of

commodities from a Belgian company.

ANS: a

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 19

38. Topic: Hedging financial risk

LO 1, 3

Which statement below best describes the process of hedging using financial derivatives?

a. You have inside information that the $/yen rate is going to rise, so you invest in a

financial derivative that allows you to gain if the $/yen rate rises.

b. You have inside information that the $/euro rate is going to fall, so you invest in a

financial derivative that allows you to gain if the $/euro rate falls.

c. As part of your normal business transactions, you are exposed to financial risk.

You invest in financial derivatives to increase potential gains from financial risk.

d. As part of your normal business transactions, you are exposed to financial risk.

You invest in financial derivatives to reduce that risk.

ANS: d

39. Topic: Hedging financial risk

LO 1, 3

A U.S. manufacturing company imports parts from a supplier in Germany. The company is

required to pay the supplier in euros. Which investment will hedge the manufacturing

company's foreign exchange risk?

a. Call option in euros

b. Short position in euros

c. Forward sale of euros

d. Borrowing from a German bank

ANS: a

40. Topic: Valuation of forward contracts

LO 3

How are investments in financial derivatives valued on the balance sheet?

a. Market value

b. Cost

c. Lower of cost or market value

d. Not reported

ANS: a

©Cambridge Business Publishers, 2010

20 Advanced Accounting, 1st

Edition

41. Topic: Valuation of forward contracts

LO 3

On December 1, a U.S. company agrees to buy euros on February 1 at a contract price of

$1.40. The company did not pay anything for this contract. The exchange rate for euros

declines to $1.38 (U.S. dollar strengthens) between December 1 and December 31, when

the company’s reporting year ends. How is this contract reported on the company’s year-

end balance sheet?

a. In the asset section

b. In the liability section

c. As a contra asset

d. The contract is not reported on the balance sheet

ANS: b

42. Topic: Hedges of firm commitments

LO 5

On July 10, 2012, a U.S. company with a December 31 year-end enters a forward contract

that locks in the selling price of won, for delivery on August 15. The forward contract

hedges a firm commitment to sell merchandise to a customer in Korea, with payment

denominated in won. The sale is made on August 1, 2012 and payment is received from

the customer on August 15. Where is the value of the firm commitment to sell reported in

the year-end financial statements for 2012?

a. Asset or liability on the balance sheet

b. Increase or decrease in other comprehensive income

c. Adjustment to sales revenue

d. Adjustment to cost of goods sold

ANS: c

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 21

43. Topic: Foreign currency borrowing

LO 2

The XYZ Company borrows 100,000,000 euros by issuing bonds to German investors

when the spot rate is $1.25/€. The interest rate is 10 percent per annum. When XYZ

accounts for this loan, which of the following will not be true?

a. A decrease in the exchange rate will generate an exchange gain on the bonds

payable

b. If the spot rate rises to $1.35/€ one year hence, when the interest payment is

accrued, the interest expense will be recorded at $13,500,000

c. If XYZ desires to hedge these bonds, it will have to purchase euros forward

d. The bonds payable will be carried at $125,000,000 until they mature

ANS: d

44. Topic: Foreign currency borrowing

LO 2

Interest expense on a loan denominated in another currency is translated at:

a. The average spot rate for the period the interest covers

b. The spot rate when the loan was made

c. The spot rate when the interest is recorded

d. The forward rate for delivery when the interest must be paid

ANS: c

45. Topic: Hedging strategy

LO 3

U.S. manufacturers that sell to customers in other countries, priced in the currency of the

customer’s country, often adjust their hedging strategy depending on which way they

believe foreign currency rates are headed. Which statement best represents the adjustment

they make, if the U.S. dollar is expected to weaken?

a. Reduce the percentage of receivables hedged

b. Reduce the percentage of payables hedged

c. Increase the percentage of receivables hedged

d. Increase the percentage of payables hedged

ANS: a

©Cambridge Business Publishers, 2010

22 Advanced Accounting, 1st

Edition

46. Topic: Hedge accounting

LO 3

Two major goals of SFAS 133 are:

a. Disclose the fair values of derivatives investments in the footnotes of the financial

statements, and report hedged assets and liabilities at fair value on the balance

sheet.

b. Report the fair values of derivatives investments on the balance sheet, and report

hedged assets and liabilities at fair value on the balance sheet.

c. Report the fair values of derivatives investments on the balance sheet, and match

gains and losses on hedge investments and hedged assets and liabilities on the same

income statement.

d. Report hedged assets and liabilities at fair value on the balance sheet, and match

gains and losses on hedge investments and hedged assets and liabilities on the same

income statement.

ANS: c

47. Topic: Hedge of forecasted transaction

LO 6

A U.S. company hedges an anticipated sale of merchandise to a foreign customer. When

are gains and losses on the hedge investment reported on the income statement?

a. When the customer pays for the merchandise

b. When the anticipated sale becomes a firm commitment

c. When the hedge investment is determined to be an effective hedge

d. When the merchandise is sold

ANS: d

48. Topic: Speculative investments

LO 7

A U.S. company enters a forward purchase contract that does not qualify as a hedge

investment. When are gains and losses on the hedge investment reported on the income

statement?

a. When the forward contract changes in market value

b. When the forward contract is closed

c. When the forward contract is determined to be an effective hedge

d. When the merchandise is sold

ANS: a

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 23

49. Topic: Hedge of foreign-currency-denominated payable

LO 4

A U.S. company has entered into a forward purchase contract to hedge a reported foreign

currency obligation. If the U.S. dollar weakens against the foreign currency:

a. The forward contract appears as a current asset on the company’s balance sheet.

b. The forward contract’s reported value exactly offsets the reported foreign currency

obligation, with no net balance sheet disclosure.

c. The gain on the forward contract adds to other comprehensive income.

d. The gain on the foreign currency obligation adds to other comprehensive income.

ANS: a

50. Topic: IFRS for foreign currency hedging

LO 8

IFRS allows which reporting practice, not allowed under U.S. GAAP?

a. Reporting foreign currency derivative positions at cost rather than at market value

b. Reporting gains and losses on cash flow hedges as adjustments to the carrying

value of related asset acquisitions

c. Reporting gains and losses on firm commitment hedges as adjustments to the

carrying value of related asset acquisitions

d. Reporting foreign currency derivative positions at market rather than at cost

ANS: b

©Cambridge Business Publishers, 2010

24 Advanced Accounting, 1st

Edition

PROBLEMS

1. Topic: Fair value hedge of receivables and payables, cash flow hedge of

forecasted transaction

LO 4, 6

Use the following exchange rates for the Canadian dollar to answer the three questions

below concerning a U.S. company’s foreign exchange activities. The company’s

accounting year ends December 31.

Forward rate for

Spot rate March 31, 2011 delivery

October 31, 2010 $ 0.82 $ 0.81

December 31, 2010 0.85 0.86

March 31, 2011 0.83 0.83

Required

Answer the following questions.

a. The company sells merchandise to a Canadian customer for C$100,000 on October

31, 2010, and receives payment from the customer, in Canadian dollars, on March

31, 2011. What are the following balances?

i. Sales revenue for 2010

ii. Accounts receivable, December 31, 2010

iii. Exchange gain or loss for 2011

b. The company sells merchandise to a Canadian customer for C$100,000 on October

31, 2010, and receives payment from the customer, in Canadian dollars, on March

31, 2011. On October 31, 2010 it enters a forward contract to lock in the selling

price of Canadian dollars, for March 31, 2011 delivery. On March 31, 2011, it

delivers the Canadian dollars and closes the forward contract. What are the

balances?

i. Investment in forward , December 31, 2010

ii. Amount of U.S. dollars received March 31, 2011

c. The company enters a forward contract on October 31, 2010 to hedge a forecasted

purchase of merchandise for C$100,000 on March 31, 2011. On March 31 it takes

delivery of the merchandise, closes the forward and pays for the merchandise. It

sells the merchandise in May. What are the balances?

i. Investment in forward, December 31, 2010

ii. Cost of goods sold on May sale

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 25

ANS:

a. i. C$100,000 x $.82 = $82,000

ii. C$100,000 x $.85 = $85,000

iii. C$100,000 x ($.85 - $.83) = $2,000 loss

b. i. C$100,000 x ($.81 - $.86) = $5,000 liability

ii. C$100,000 x $.81 = $81,000

c. i. C$100,000 x ($.81 - $.86) = $5,000 asset

ii. $83,000 – ($.83 - $.81)(C$100,000) = $81,000

2. Topic: Unhedged foreign currency transactions, hedges of firm commitments

LO 2, 4, 5

A U.S. company buys merchandise from suppliers in the U.K., and pays for the

merchandise in pounds sterling. Its accounting year ends December 31. Use the following

information on $/£ to answer the questions below.

Forward rate for delivery

Spot rate March 1, 2013

October 1, 2012 $1.29 $1.28

November 1, 2012 1.30 1.32

December 31, 2012 1.35 1.34

March 1, 2013 1.37 1.37

Required

Answer the following questions:

a. The U.S. company takes delivery of merchandise costing £1,000,000 on November

1, 2012. The company pays for the merchandise, in pounds, on March 1, 2013.

No hedging is involved. The company sells the merchandise on June 1, 2013.

What amounts will appear on the financial statements of the U.S. company for:

i. Accounts payable, December 31, 2012 balance sheet

ii. Exchange gain or loss, 2012 income statement

iii. Cost of goods sold, 2013 income statement

b. Assume the same facts as in a. above, but the U.S. company issues a purchase

order on October 1, 2012 before taking delivery on November 1. On October 1

the company also enters a forward contract to hedge its FX risk, for delivery of

pounds on March 1, 2013. What amounts will appear on the financial statements

of the U.S. company for:

i. Investment in forward contract, December 31, 2012 balance sheet

ii. Cost of goods sold, 2013 income statement

©Cambridge Business Publishers, 2010

26 Advanced Accounting, 1st

Edition

ANS:

a. i. £1,000,000 x $1.35 = $1,350,000

ii. £1,000,000 x ($1.30 - $1.35) = $50,000 loss

iii. £1,000,000 x $1.30 = $1,300,000

b. i. £1,000,000 x ($1.28 - $1.34) = $60,000 asset

ii. £1,000,000 x $1.30 – [£1,000,000 x ($1.28 - $1.32)] = $1,260,000

3. Topic: Unhedged foreign currency transactions, hedges of import and

forecasted transactions

LO 2, 4, 6

Following are exchange rates for the euro (U.S. $/€) . Import Express is a U.S. company

whose accounting year ends on December 31.

Forward rate for

May 31, 2011

Spot rate delivery

November 30, 2010 $ 1.25 $ 1.30

December 31, 2010 1.28 1.32

May 31, 2011 1.26 1.26

Required

Answer the following questions.

a. On November 30, 2010, Import Express takes delivery of merchandise on credit

from an Italian supplier for €1,000. It pays for the merchandise on May 31, 2011.

It sells the inventory to a U.S. customer during 2011. What are the correct

amounts that will appear on Import Express’ financial statements for each of the

following items?

i. Accounts payable, December 31, 2010 balance sheet

ii. Cost of goods sold, 2011 income statement

iii. Foreign exchange loss, 2010 income statement

b. On November 30, 2010, Import Express takes delivery of merchandise on credit

from an Italian supplier for €1,000. On the same day, it agrees to buy €1,000

(forward purchase) for delivery on May 31, 2011. Import Express closes the

forward on May 31 and pays for the merchandise. It sells the inventory to a U.S.

customer during 2011. What are the correct amounts that will appear on Import

Express’ financial statements for each of the following items?

i. Investment in forward contract, December 31, 2010 (asset)

ii. Loss on forward contract, 2011

Gain on accounts payable, 2011

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 27

c. On November 30, 2010, Import Express forecasts that it will need to buy

merchandise for €1,000 from an Italian supplier at the end of May, 2011. It plans

to pay for the merchandise as soon as it is delivered. On November 30, 2010,

Import Express agrees to buy €1,000 (forward purchase) for delivery on May 31,

2011. The forward contract qualifies as a cash flow hedge of the forecasted

purchase of merchandise. The merchandise is actually delivered on May 31, 2011.

Import Express closes the forward and immediately pays the supplier. The

merchandise is subsequently sold to a U.S. customer later in 2011. Make the

journal entries necessary to record these events:

i. December 31, 2010: Adjust the investment in forward contract.

ii. May 31, 2011:

(1) Adjust the investment in forward contract.

(2) Close out the forward contract.

(3) Take delivery of the merchandise and pay for it.

iii. Record cost of sales for 2011.

ANS:

a. Entries (not required):

11/30

Inventory 1,250

Accounts payable 1,250

12/31

Exchange loss 30

Accounts payable 30

5/31

Accounts payable 20

Exchange gain 20

Accounts payable 1,260

Cash 1,260

i. Accounts payable, December 31, 2010 balance sheet $1,280

ii. Cost of goods sold, 2011 income statement $1,250

ii. Exchange loss, 2010 income statement $ 30

©Cambridge Business Publishers, 2010

28 Advanced Accounting, 1st

Edition

b. Entries (not required):

11/30

Inventory 1,250

Accounts payable 1,250

12/31

Exchange loss 30

Accounts payable 30

Investment in forward 20

Exchange gain 20

5/31

Accounts payable 20

Exchange gain 20

Exchange loss 60

Investment in forward 60

Foreign currency 1,260

Investment in forward 40

Cash 1,300

Accounts payable 1,260

Foreign currency 1,260

i. Investment in forward contract, December 31, 2010 (asset) $20

ii. Loss on forward contract, 2011 $60

Gain on accounts payable, 2011 $20

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 29

c. i.

Investment in forward 20

Other comprehensive income 20

ii. (1)

Other comprehensive income 60

Investment in forward 60

(2)

Foreign currency 1,260

Investment in forward 40

Cash 1,300

(3)

Inventory 1,260

Foreign currency 1,260

iii.

Cost of goods sold 1,300

Other comprehensive income 40

Inventory 1,260

©Cambridge Business Publishers, 2010

30 Advanced Accounting, 1st

Edition

4. Topic: Forward purchase, cash flow hedge that becomes a fair value hedge

LO 4, 5, 6

Use the following information on exchange rates for the euro to answer the question

below.

Forward

rate for

Spot 4/30/12

rate delivery

October 1, 2011 $1.45 $1.48

December 31, 2011 1.50 1.53

January 31, 2012 1.52 1.55

March 31, 2012 1.56 1.58

April 30, 2012 1.60 1.60

On October 1, 2011, a U.S. company forecasts that it will take delivery of merchandise

from a supplier in Portugal for €10,000,000 around the end of March, 2012, with payment

expected to be made, in euros, about one month later. The company closes its books on

December 31. The following events occur:

1. October 1, 2011: The company enters a forward purchase agreement for delivery

of €10,000,000 on April 30, 2012. This position qualifies as a hedge of the

forecasted transaction described above. No initial investment is required.

2. December 31, 2011: The company closes its books.

3. January 31, 2012: The company issues a purchase order to the supplier for

€10,000,000 in merchandise, to be delivered March 31, 2012.

4. March 31, 2012: The company takes delivery of the merchandise.

5. April 30, 2012: The company closes the forward contract and pays the supplier

€10,000,000.

6. May 15, 2012: The company sells the merchandise to a U.S. customer for

$22,500,000.

Required

Prepare the journal entries to record the above events on the indicated dates.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 31

ANS:

December 31, 2011: End of year adjusting entry:

Investment in forward 500,000

Other comprehensive

income 500,000

January 31, 2012: Adjust the investment:

Investment in forward 200,000

Other comprehensive

income 200,000

March 31, 2012: Adjust for the period January 31 - March 31, and take delivery of

the merchandise.

Investment in forward 300,000

Other comprehensive

income 300,000

Exchange loss 300,000

Firm commitment 300,000

Other comprehensive income 300,000

Exchange gain 300,000

Inventory 15,300,000

Firm commitment 300,000

Accounts payable 15,600,000

©Cambridge Business Publishers, 2010

32 Advanced Accounting, 1st

Edition

April 30, 2012: Adjust for the period March 31 to April 30, close the forward

contract and pay the supplier.

Investment in forward 200,000

Other comprehensive

income 200,000

Exchange loss 400,000

Accounts payable 400,000

Other comprehensive income 400,000

Exchange gain 400,000

Foreign currency 16,000,000

Investment in forward 1,200,000

Cash 14,800,000

Accounts payable 16,000,000

Foreign currency 16,000,000

Cost of goods sold 14,800,000

Other comprehensive income 500,000

Inventory 15,300,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 33

5. Topic: Hedge of firm commitment

LO 5

Following is information on $/€ exchange rates:

Forward rate for delivery

Spot rate August 15, 2012

March 1, 2012 $1.50 $1.55

June 30, 2012 1.60 1.62

August 15, 2012 1.65 1.65

A U.S. company buys from suppliers in Germany, and pays the suppliers in euros. The

U.S. company’s accounting year ends June 30. On March 1, 2012, the company sends a

purchase order to a German supplier for €1,000,000 in merchandise, payable in euros,

delivery to take place August 15, 2012. On the same day the company enters into a

forward contract for delivery of €1,000,000 on August 15. The forward qualifies as a

hedge of a firm commitment. On August 15, the company closes the forward contract,

takes delivery of the merchandise, and pays the supplier. The company sells the

merchandise to its customers on August 31, 2012.

Required

What amounts will appear on the financial statements of the U.S. company for:

a. Investment in forward contract, June 30, 2012 balance sheet

b. Cost of goods sold, fiscal 2013 income statement

ANS:

a. €1,000,000 x ($1.62 - $1.55) = $70,000

b. Value of firm commitment = €1,000,000 x ($1.65 - $1.55) = $100,000 credit

Currency paid = $1,650,000 - firm commitment offset $100,000 = $1,550,000

©Cambridge Business Publishers, 2010

34 Advanced Accounting, 1st

Edition

6. Topic: Hedge of firm commitment

LO 5

On November 1, 2012, a U.S. company issues a purchase order to buy merchandise for

€1,000,000. The company expects to take delivery of the merchandise on January 10,

2008, and will pay the supplier on March 1, 2013. To hedge its FX risk, on November 1,

2012 the company invests in a forward contract for delivery of €1,000,000 on March 1,

2013. The company sells the merchandise to a U.S. customer for $2,000,000 in cash on

April 1, 2013. Assume the forward contract qualifies as a fair value hedge of the firm

commitment to buy merchandise.

Exchange rates for the euro ($/€) are below.

Forward rate for

Spot rate March 1, 2013 delivery

November 1, 2012 $ 1.40 $1.42

December 31, 2012 1.41 1.43

January 10, 2013 1.44 1.435

March 1, 2013 1.45 1.45

Required

For each date below, prepare the necessary journal entries to record the events and/or

adjustments needed.

a. December 31, 2012 (end of year closing)

b. January 10, 2013 (takes delivery of merchandise)

c. March 1, 2013 (closes the forward and pays the bill)

d. April 1, 2013 (sells the merchandise to a U.S. customer). Assume the company

uses the perpetual inventory method.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 35

ANS:

a. December 31, 2012

Investment in forward 10,000

Exchange gain 10,000

Exchange loss 10,000

Firm commitment 10,000

Rate changes from $1.42 to $1.43.

b. January 10, 2013

Investment in forward 5,000

Exchange gain 5,000

Exchange loss 5,000

Firm commitment 5,000

Rate changes from $1.43 to $1.435.

Inventory 1,425,000

Firm commitment 15,000

Accounts payable 1,440,000

c. March 1, 2013

Exchange loss 10,000

Accounts payable 10,000

Rate changes from $1.44 to $1.45.

Investment in forward 15,000

Exchange gain 15,000

Rate changes from $1.435 to $1.45.

Foreign currency 1,450,000

Cash 1,420,000

Investment in forward 30,000

Accounts payable 1,450,000

Foreign currency 1,450,000

d. April 1, 2013

Cash 2,000,000

Sales revenue 2,000,000

Cost of goods sold 1,425,000

Inventory 1,425,000

©Cambridge Business Publishers, 2010

36 Advanced Accounting, 1st

Edition

7. Topic: Import and export transactions

LO 2

Following is information on $/€ exchange rates:

Spot rate

November 1, 2013 $1.42

December 31, 2013 1.38

February 15, 2014 1.36

March 1, 2014 1.35

Required

Answer the following questions:

a. A U.S. company sells merchandise to customers in euro countries, with payment to

be received in euros. Sales totaling €1,000,000 occur on November 1, 2013.

Payment is made on March 1, 2014. The U.S. company’s accounting year ends

December 31. What amounts will appear on the financial statements of the U.S.

company for:

i. Sales revenue, 2013 income statement

ii. Accounts receivable, 12/31/13 balance sheet

iii. Exchange gain or loss, 2013 income statement

b. A U.S. company buys merchandise from suppliers in euro countries, payable in

euros. Purchases of €1,000,000 are made on November 1, 2013. The U.S.

company pays the suppliers on February 15, 2014. The U.S. company sells the

merchandise to its customers on March 1, 2014. The U.S. company’s accounting

year ends December 31. What amounts will appear on the financial statements of

the U.S. company for:

i. Accounts payable, 12/31/13 balance sheet

ii. Exchange gain or loss, 2014 income statement

iii. Cost of goods sold, 2014 income statement

ANS:

a. i. €1,000,000 x $1.42 = $1,420,000

ii. €1,000,000 x $1.38 = $1,380,000

iii. €1,000,000 x ($1.38 - $1.42) = $40,000 loss

b. i. €1,000,000 x $1.38 = $1,380,000

ii. €1,000,000 x ($1.38 - $1.36) = $20,000 gain

iii. €1,000,000 x $1.42 = $1,420,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 37

8. Topic: Hedges of export transactions

LO 4

A U.S. company sells merchandise to a Greek customer on February 1, 2010 for

€1,000,000. The customer pays the bill on May 1, 2010. To hedge foreign exchange risk,

on February 1, 2010 the U.S. company enters a forward sale contract for €1,000,000 with

a May 1 delivery date. On May 1 the company collects the €1,000,000 from the customer

and closes the forward contract. Relevant rates are as follows:

Spot 5/1 Forward

February 1, 2010 $1.345 $1.348

May 1, 2010 1.330 1.330

Required

Make the journal entries to record the following transactions, including appropriate

adjusting entries:

a. February 1 sale to the Greek customer.

b. May 1 collection of the receivable and closing of the contract.

ANS:

a.

Accounts receivable 1,345,000

Sales revenue 1,345,000

b.

Exchange loss 15,000

Accounts receivable 15,000

Investment in forward 18,000

Exchange gain 18,000

Foreign currency 1,330,000

Accounts receivable 1,330,000

Cash 1,348,000

Investment in forward 18,000

Foreign currency 1,330,000

©Cambridge Business Publishers, 2010

38 Advanced Accounting, 1st

Edition

9. Topic: Hedge of firm commitment

LO 5

On February 1, 2010, a U.S. company issues a purchase order to buy merchandise from a

Greek supplier for €1,000,000. On February 1, 2010 the U.S. company enters a forward

purchase contract for €1,000,000 with a July 1 delivery date. The forward qualifies as a

hedge of the firm commitment to buy the merchandise. On May 1, 2010, the company

takes delivery of the merchandise. On July 1, 2010, the company closes the forward and

pays the bill. Relevant exchange rates are as follows:

7/1 forward

Spot rate rate

February 1, 2010 $1.345 $1.350

May 1, 2010 1.340 1.344

July 1, 2010 1.330 1.330

Required

a. Make the journal entries to record the following transactions, including

appropriate adjusting entries:

i. May 1 delivery of merchandise.

ii. July 1 closing of forward contract and payment of bill.

b. Assume the U.S. company sells the merchandise to a U.S. customer for

$1,600,000. What is the reported gross margin (sales revenue minus cost of goods

sold) on the sale?

ANS:

a. i.

Exchange loss 6,000

Investment in forward 6,000

Firm commitment 6,000

Exchange gain 6,000

Inventory 1,346,000

Firm commitment 6,000

Accounts payable 1,340,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 39

ii.

Exchange loss 14,000

Investment in forward 14,000

Accounts payable 10,000

Exchange gain 10,000

Foreign currency 1,330,000

Investment in forward 20,000

Cash 1,350,000

Accounts payable 1,330,000

Foreign currency 1,330,000

b. $1,600,000 - $1,346,000 = $254,000

10. Topic: Hedge of forecasted transaction

LO 6

A U.S. corporation purchases merchandise from a German supplier on a regular basis. On

November 8, 2012, the corporation purchased €100,000 for delivery on March 8, 2013,

in anticipation of an expected purchase of merchandise for €100,000 at the beginning of

March. The forward contract qualifies as a hedge of a forecasted transaction. The

corporation took delivery of the merchandise, settled the forward contract, and paid the

German supplier €100,000 on March 8, 2013. The merchandise was subsequently sold on

April 10, 2013 to a U.S. customer for $200,000. The corporation’s accounting year ends

on December 31. Relevant exchange rates are as follows:

Forward rate for delivery

Spot rate March 8, 2013

November 8, 2012 1.25 1.26

December 31, 2012 1.27 1.28

March 8, 2013 1.24 1.24

April 10, 2013 1.23 N/A

Required

a. Prepare the adjusting entry necessary to update the investment in forward at

December 31, 2012.

b. Prepare the entries necessary to take delivery of the merchandise and close the

forward on March 8, 2013.

c. Prepare the entry necessary to record cost of goods sold on April 10, 2013.

©Cambridge Business Publishers, 2010

40 Advanced Accounting, 1st

Edition

ANS:

a.

Investment in forward 2,000

Other comprehensive income 2,000

b.

Other comprehensive income 4,000

Investment in forward 4,000

Foreign currency 124,000

Investment in forward 2,000

Cash 126,000

Inventory 124,000

Foreign currency 124,000

c.

Cost of goods sold 126,000

Inventory 124,000

Other comprehensive income 2,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 41

11. Topic: Valuation of forward contracts, hedging entries

LO 3, 4, 6

A U.S. company enters into the following forward contracts on October 15, 2011:

1. Agreement to sell 100,000,000 yen on January 15, 2012 at $0.0088

2. Agreement to buy 1,000,000 new shekels on February 15, 2012 at $0.221

Forward and spot rates for yen and shekels are as follows:

Forward rate

Forward rate Spot rate for 2/15/12

Spot rate for 1/15/12 for new delivery of new

for yen delivery of yen shekels shekels

October 15, 2011 $ .0086 $ .0088 $.220 $ .221

December 31,2011 .0084 .0085 .222 .219

The company’s accounting year ends December 31.

Required

a. How are the forward contracts valued on the company’s December 31, 2011

balance sheet? For each contract, specify the amount and whether it is a current

asset or a current liability.

b. Assume that the forward contract to sell yen is an effective hedge of a 100,000,000

yen forecasted sale to customers in Japan. Make the adjusting entry for this

contract at December 31, 2011.

c. Assume the forward contract to buy new shekels is an effective hedge of a

1,000,000 new shekel obligation currently on the company’s books. Make the

adjusting entry for this contract at December 31, 2011.

ANS:

a. Forward sale in yen: ($.0088 - $.0085) x 100,000,000 = $30,000 current asset

Forward purchase in new shekels: ($.221 - $.219) x 1,000,000 = $2,000 current

liability

b.

Investment in forward 30,000

Other comprehensive income 30,000

c.

Exchange loss 2,000

Investment in forward 2,000

©Cambridge Business Publishers, 2010

42 Advanced Accounting, 1st

Edition

12. Topic: Hedge of firm commitment

LO 5

On March 1, 2011, a U.S. company issued a purchase order to a supplier in the Cayman

Islands for goods with a price of KYD 5,000,000. The goods will be delivered July 1,

2011, and payment will be made on September 1, 2011. On March 1, 2011, the company

purchased KYD 5,000,000 for delivery September 1, 2011. The forward contract is an

effective hedge of the firm commitment to purchase goods from the Cayman Islands. The

goods are delivered as expected on July 1, and the company follows through on the

forward contract and makes the payment to the supplier on September 1. The company’s

accounting year ends on December 31.

Spot and forward rates are as follows ($/KYD):

Forward rate for delivery

Spot Rate on September 1, 2011

March 1, 2011 $1.22 $1.21

July 1, 2011 1.21 1.20

September 1, 2011 1.19 1.19

Required

Answer the following questions regarding how the above information is reported on the

company’s financial statements:

a. What is the net hedging gain or loss for 2011?

b. Suppose the goods purchased from the Cayman Islands are sold to a U.S.

customer for $8,000,000. What is the gross margin (sales revenue less cost of

goods sold) on the sale? Show calculations clearly.

ANS:

a. Loss on forward: ($1.21 - $1.19) x 5,000,000 = $100,000 loss

Gain on firm commitment: ($1.21 - $1.20) x 5,000,000 = 50,000 gain

Gain on accounts payable: ($1.21 - $1.19) x 5,000,000 = 100,000 gain

Net $ 50,000 gain

b. Inventory is recorded as follows when the goods are delivered on July 1:

Inventory 6,100,000

Firm commitment 50,000

Accounts payable 6,050,000

The gross margin on the sale is:

Sales $8,000,000

Cost of goods sold 6,100,000

Gross margin $1,900,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 43

13. Topic: Forward purchase, cash flow hedge that becomes a fair value hedge

LO 4, 5, 6

A U.S. company purchases merchandise from a Hong Kong supplier on a regular basis.

The following events occur:

October 1, 2012: The company purchased $H1,000,000 for delivery on May 1,

2013, in anticipation of an expected payment of $H for a forecasted merchandise

purchase.

December 1, 2012: The company issued a purchase order for $H1,000,000 in

merchandise from the supplier.

March 1, 2013: The company took delivery of the merchandise.

May 1, 2013: The company closed the forward contract and paid the supplier.

May 31, 2013: The company sold the merchandise to a U.S. customer for

$200,000.

The company’s accounting year ends December 31.

Exchange rates ($/H) are as follows:

Forward rate for

Spot rate delivery 5/1/13

October 1, 2012 $0.125 $0.127

December 1, 2012 0.127 0.129

December 31, 2012 0.128 0.131

March 1, 2013 0.131 0.1315

May 1, 2013 0.132 0.132

Required

Prepare the journal entries to record the above transactions, including necessary adjusting

entries. Assume the hedge qualifies for special hedge accounting.

©Cambridge Business Publishers, 2010

44 Advanced Accounting, 1st

Edition

ANS:

Adjusting entries at December 31, 2012:

Investment in forward 4,000

Other comprehensive income 4,000

To record increase in value of forward contract ($.127 to $.131)

Exchange loss 2,000

Firm commitment 2,000

To record loss on firm commitment ($.129 to $.131)

Other comprehensive income 2,000

Exchange gain 2,000

To reclassify other comprehensive income to income to match against loss on firm

commitment.

March 1, 2013

Investment in forward 500

Other comprehensive income 500

To mark the forward to market ($.131 to $.1315)

Exchange loss 500

Firm commitment 500

To mark the firm commitment to market ($.131 to $.1315)

Other comprehensive income 500

Exchange gain 500

To reclassify other comprehensive income to income to match against firm commitment

loss.

Inventory 128,500

Firm commitment 2,500

Accounts payable 131,000

To record delivery of merchandise, adjusted for firm commitment balance.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 45

May 1, 2013

Investment in forward 500

Other comprehensive income 500

To mark the forward to market ($.1315 to $.132)

Exchange loss 1,000

Accounts payable 1,000

To mark accounts payable to market ($.131 to $.132)

Other comprehensive income 1,000

Exchange gain 1,000

To reclassify other comprehensive income to income to match against accounts payable

loss.

Foreign currency 132,000

Investment in forward 5,000

Cash 127,000

To close forward contract.

Accounts payable 132,000

Foreign currency 132,000

To pay the supplier.

May 31, 2013

Cost of goods sold 127,000

Other comprehensive income 1,500

Inventory 128,500

Note: Remaining other comprehensive income balance is $4,000 - $2,000 + $500 - $500 +

$500 - $1,000 = $1,500 gain.

©Cambridge Business Publishers, 2010

46 Advanced Accounting, 1st

Edition

14. Topic: Cash flow hedge accounting versus regular accounting

LO 3, 6

Following is information on exchange rates for the euro:

Spot rate Forward rate for 4/30/12 delivery

October 1, 2011 $1.45 $1.48

December 31, 2011 1.50 1.53

January 31, 2012 1.52 1.55

March 31, 2012 1.56 1.58

April 30, 2012 1.60 1.60

On October 1, 2011, a U.S. company forecasts that it will buy merchandise from a

supplier in Portugal for €10,000,000 around the end of March, 2012, with payment

expected to be made, in euros, about one month later. The company closes its books on

December 31. The following events occur:

1. October 1, 2011: The company enters a forward purchase agreement for delivery

of €10,000,000 on April 30, 2012. No initial investment is required.

2. December 31, 2011: The company closes its books.

3. January 31, 2012: The company issues a purchase order to the supplier for

€10,000,000 in merchandise, to be delivered March 31, 2012.

4. March 31, 2012: The company takes delivery of the merchandise.

5. April 30, 2012: The company closes the forward contract and pays the supplier

€10,000,000.

6. May 15, 2012: The company sells the merchandise to a U.S. customer for

$22,500,000.

Required

Fill in the schedule below, showing the amounts related to the above events that will be

reported in the company’s annual reports for 2011 and 2012. Show related journal entries

in the next schedule. Show liabilities and gains in parenthesis.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 47

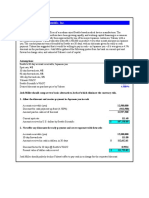

ANS:

Forward contract qualifies as a

hedge of the forecasted The forward contract does not

Account title transaction qualify as a hedge

2011 2012 2011 2012

Investment in forward $ 500,000 -- $ 500,000 --

(balance sheet)

Other comprehensive (500,000) -- -- --

income (Balance sheet)

(Gains) and losses (income -- -- (500,000) $ (200,000)

statement) (300,000)

(200,000)

400,000

$ (300,000)

Cost of goods sold (income -- $14,800,000 -- $15,600,000

statement)

©Cambridge Business Publishers, 2010

48 Advanced Accounting, 1st

Edition

Forward contract is a qualified hedge Forward contract is not a qualified hedge

December 31

Investment in forward 500,000 Investment in forward 500,000

OCI 500,000 Exchange gain 500,000

January 31

Investment in forward 200,000 Investment in forward 200,000

OCI 200,000 Exchange gain 200,000

March 31

Investment in forward 300,000 Investment in forward 300,000

OCI 300,000 Exchange gain 300,000

Exchange loss 300,000 --

Firm commitment 300,000

OCI 300,000 --

Gain 300,000

Inventory 15,300,000 Inventory 15,600,000

Firm commitment 300,000 A/P

A/P 15,600,000 15,600,000

April 30

Investment in forward 200,000

OCI 200,000 Investment in forward 200,000

Exchange loss 400,000 Exchange gain

A/P 400,000 200,000

OCI 400,000 Exchange loss 400,000

Exchange gain 400,000 A/P

Foreign currency 16,000,000 400,000

Cash 14,800,000 --

Investment in for. 1,200,000

A/P 16,000,000 Foreign currency 16,000,000

Foreign currency 16,000,000 Cash

14,800,000

May 15 Investment in for. 1,200,000

CGS 14,800,000 A/P 16,000,000

OCI 500,000 Foreign currency 16,000,000

Inventory 15,300,000

CGS 15,600,000

Inventory

15,600,000

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 49

15. Topic: Cash flow hedge accounting versus regular accounting

LO 3, 6

Following are exchange rates for the Canadian dollar.

Forward rate for March 31,

Spot rate 2012 delivery

October 31, 2011 $ 0.80 $ 0.81

December 31, 2011 0.84 0.86

March 31, 2012 0.82 0.82

A U.S. company enters a forward contract on October 31, 2011 to hedge a forecasted

purchase of merchandise for C$1,000,000 on March 31, 2012. On March 31 it takes

delivery of the merchandise, closes the forward and pays for the merchandise. It sells the

merchandise in May. The company’s accounting year ends December 31.

Required

What are the balances for the following accounts, assuming the forward contract qualifies

as a hedge of the forecasted transaction for the period October 31, 2011 to March 31,

2012, and also if the forward contract does not qualify as a hedge?

a. Other comprehensive income balance, December 31, 2011

b. Gain/loss on forward contract, 2011 income statement

c. Gain/loss on forward contract, 2012 income statement

d. 2012 cost of goods sold

ANS:

Qualifies as hedge Does not qualify

Other comprehensive income, December

31, 2011 (gain) $ 50,000 $ 0

2011 income statement

gain on forward contract 0 50,000

2012 income statement

loss on forward contract 0 40,000

2012 cost of goods sold 810,000 820,000

©Cambridge Business Publishers, 2010

50 Advanced Accounting, 1st

Edition

16. Topic: Hedge of firm commitment, import transaction, speculation

LO 2, 5, 7

Electronic Importers, a U.S. company, has the following outstanding balances as of

December 31, 2011, its accounting year-end.

Forward purchase contract dated December 1, 2011 for 20,000,000 yen to hedge a firm

commitment to purchase computer hardware for 20,000,000 yen in 90 days ending on

March 1, 2012.

Account payable for 70,000,000 yen for unpaid merchandise acquired on December 16,

2011 and due on January 15, 2012.

Forward sale contract dated December 16, 2011 for 30,000,000 yen to speculate in

exchange rate changes and due on January 15, 2012.

Exchange rates quoted in the U.S. for Japanese yen are:

12/1/11 12/16/11 12/31/11 1/15/12 3/1/12

Spot rate $.00620 $.00610 $.00600 $.00593 $.00580

90-day forward .00630 .00620 .00610 .00600 .00590

60-day forward .00620 .00610 .00603 .00590 .00580

30-day forward .00610 .00600 .00590 .00580 .00570

15-day forward .00615 .00605 .00595 .00585 .00575

Required

a. Calculate the gain or loss on Electronic Importers' 2011 income statement due to

the above items. Specify the amount and whether it is a gain or loss.

b. Calculate the balances at which the forward purchase contract and the forward sale

contract would be reported in the December 31, 2011 balance sheet.

c. At what amount (U.S. dollars) should the computer hardware be valued on March

1, 2012?

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 51

ANS:

a. Forward purchase contract: no income effect due to offsetting gain and loss on

contract and firm commitment.

Accounts payable 70,000,000 x ($.00610 - $.00600) = $7,000 gain

Forward sale 30,000,000 x ($.00600 - $.00595) = 1,500 gain

$8,500 gain

b. Forward purchase contract:

($.0063 - $.00603) x 20,000,000 = $5,400 current liability

Forward sale contract:

($.006 - $.00595) x 30,000,000 = $1,500 current asset

c.

($.0058 x 20,000,000) = $116,000

Plus firm commitment balance:

($.0063 - $.0058) x 20,000,000 10,000

Hardware balance, 3/1/12 $126,000

©Cambridge Business Publishers, 2010

52 Advanced Accounting, 1st

Edition

17. Topic: Import transactions, hedge of firm commitment, hedge of forecasted

transaction, speculation

LO 2, 5, 6, 7

Each of the following situations is independent of the others. Acme Importers is a U.S.

company with a December 31 year-end. Use the following information on exchange rates

(US$/$Canadian) to answer each question.

Forward rate

for delivery on

Spot rate 2/1/13

September 1, 2012 $.80 $.82

October 1, 2012 .78 .79

December 31, 2012 .75 .74

February 1, 2013 .69 .69

Required

For each situation, (1) make the journal entries necessary to record the events, including

year-end adjustments, and (2) calculate the effect on Acme's income in the year 2012, and

in the year 2013. Show the amounts and whether they are gains or losses.

a. On September 1, 2012 Acme Importers agrees to buy merchandise from Montreal

Suppliers. Delivery will take place on October 1, 2012, and Acme will pay

Montreal Suppliers C$5,000 on February 1, 2013.

b. On September 1, 2012, Acme Importers makes a firm commitment to buy

merchandise from Montreal Suppliers. Delivery will take place on October 1,

2012, and Acme will pay Montreal Suppliers C$5,000 on February 1, 2013. On

October 1, 2012, Acme enters into a forward purchase contract with ABC

Exchange Dealers for the purchase of C$5,000, to be delivered February 1, 2013.

c. On September 1, 2012, Acme Importers makes a firm commitment to buy

merchandise from Montreal Suppliers. Delivery will take place on October 1,

2012, and Acme will pay Montreal Suppliers C$5,000 on February 1, 2013. On

September 1, 2012, Acme enters into a forward purchase contract with ABC

Exchange Dealers for the purchase of C$5,000, to be delivered February 1, 2013.

The merchandise remains in Acme's inventory as of December 31, 2013.

d. The CFO at Acme Importers believes that the U.S. dollar will continue to

strengthen with respect to the Canadian dollar. On October 1, 2012, he enters into

a speculative forward sale contract with ABC Exchange Dealers for delivery of

C$5,000 on February 1, 2013.

e. On September 1, 2012, Acme Importers forecasts that it will buy merchandise

from a Canadian supplier. Delivery and payment of C$5,000 is expected to take

place on October 1, 2012. On September 1, 2012, Acme enters into a forward

purchase contract with ABC Exchange Dealers for the purchase of C$5,000 for

$0.76, to be delivered October 1, 2012. The merchandise purchase occurs as

forecasted, and the merchandise remains in Acme’s inventory as of December 31,

2013.

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 53

ANS:

1a.

10/1 Merchandise 3,900

Accounts payable 3,900

(5,000 x $.78)

12/31 Accounts payable 150

10/1

Exchange gain 150

[($.78 - $.75) x 5,000]

2/1 Accounts payable 300

Exchange gain 300

[($.75 - $.69) x 5,000]

2/1 Accounts payable 3,450

Cash 3,450

(5,000 x $.69)

b.

10/1 Merchandise 3,900

Accounts payable 3,900

12/31 Accounts payable 150

Exchange gain 150

12/31 Exchange loss 250

Investment in forward 250

[($.79 - $.74) x 5,000]

2/1 Accounts payable 300

Exchange gain 300

2/1 Exchange loss 250

Investment in forward 250

[($.74 - $.69) x 5,000]

2/1 Foreign currency 3,450

Investment in forward 500

Cash 3,950

2/1 Accounts payable 3,450

Foreign currency 3,450

©Cambridge Business Publishers, 2010

54 Advanced Accounting, 1st

Edition

c.

10/1 Exchange loss 150

Investment in forward 150

[($.82 - $.79) x 5,000]

10/1 Firm commitment 150

Exchange gain 150

10/1 Merchandise 3,900

Accounts payable 3,900

10/1 Merchandise 150

Firm commitment 150

12/31 Exchange loss 250

Investment in forward 250

12/31 Accounts payable 150

Exchange gain 150

2/1 Exchange loss 250

Investment in forward 250

Accounts payable 300

2/1

Exchange gain 300

2/1 Foreign currency 3,450

2/1

Investment in forward 500

Cash 3,950

Accounts payable 3,450

2/1

Foreign currency 3,450

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 55

d.

12/31 Investment in forward 250

Exchange gain 250

[($.79 - $.74) x 5,000]

2/1 Investment in forward 250

Exchange gain 250

[($.74 - $.69) x 5,000]

2/1 Foreign currency 3,450

Cash 3,450

Cash 3,950

2/1

Foreign currency 3,450

Investment in forward 500

e.

10/1 Investment in forward 100

Other comprehensive

income 100

[($.78-.76) x 5,000]

10/1 Foreign currency 3,900

Investment in forward 100

Cash 3,800

Merchandise 3,900

10/1

Foreign currency 3,900

2. Income effects:

2012 2013

(a) $150 gain $300 gain

(b) 100 loss 50 gain

(c) 100 loss 50 gain

(d) 250 gain 250 gain

(e) -0- -0-

©Cambridge Business Publishers, 2010

56 Advanced Accounting, 1st

Edition

18. Topic: Borrowing in foreign currency

LO 2

A U.S. company purchases a 60-day certificate of deposit from a German bank on October

15. The certificate has a face value of €10,000,000, costs $13,800,000 (the spot rate is

$1.38/€ on October 15), and pays interest at an annual rate of 8 percent. On December

14, the certificate of deposit matures and the company receives principal and interest due

to it. The spot rate on December 14 is $1.40/€. The average spot rate for the period

October 15 - December 14 is $1.39/€.

Required

Prepare all necessary journal entries to record the above events on the U.S. company's

books.

ANS:

10/15

Temporary investments 13,800,000

Cash 13,800,000

12/14

Temporary investments 200,000

Exchange gain 200,000

$200,000 = ($1.40 - $1.38) x €10,000,000.

Foreign currency 14,186,667

Temporary

investments 14,000,000

Interest income 186,667

$186,667 = (10,000,000 x 8% x 2/12) x $1.40

©Cambridge Business Publishers, 2010

Test Bank, Chapter 7 57

19. Topic: Speculation in forward contracts

LO 7

On November 1, 2013, a U.S. company thinks the exchange rate for the euro will fall, so it

enters into a forward contract in the amount of €1,000,000, for delivery on March 15,