Professional Documents

Culture Documents

Republic of The Philippines Palawan State University College of Business and Accountancy Puerto Princesa City

Uploaded by

baneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Republic of The Philippines Palawan State University College of Business and Accountancy Puerto Princesa City

Uploaded by

baneCopyright:

Available Formats

Republic of the Philippines

PALAWAN STATE UNIVERSITY

College of Business and Accountancy

Puerto Princesa City

P412─INVESTMENT PORTFOLIO MANAGEMET

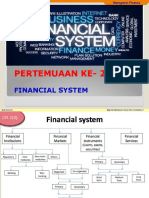

CHAPTER 3—THE FINANCIAL MARKET

1.) BANKS

A. FINANCIAL INSTRUMENTS

Financial instruments are assets that can be traded. Banks participate in the capital market and money

They can also be seen as packages of capital that market. Within the capital market, banks take active

may be traded. Most type of financial instruments part in the bond markets. Banks may invest in equity

provide an efficient flow and transfer of capital all and mutual funds as a part of their fund

throughout the worlds investors. management. Banks take active trading interest in

the bond market and have certain exposures to the

TYPES AND FUNCTIONS equity market also. Banks also participate in the

SHARES market as the clearing houses.

A unit of ownership interest in the 2.) PRIMARY DEALERS (PD’s)

corporation or financial asset. While owning shares

PD’s deal in government securities both in

in a business does not mean that the shareholder has

direct control over the business’s day-to-day primary and secondary markets. Their basic

operations, being shareholder does entitle the responsibility is to provide two-way quotes and

processor to an equal distribution in any profits, if act as market makers for government securities

any declared in the form of dividends. The two main and strengthen the government securities

types of shares are common shares and preferred market.

shares.

3.) FINANCIAL INSTITUTIONS (FI’s)

BONDS

FI’s provide/lend long term funds for

A debt investment in which investment

industry and agriculture. FI’s raise their

loans money to an entity (corporate or

resources through long-term bonds from

governmental) that borrows the funds for a defined

period of time at a fixed interest rate. Bonds are used financial system and borrowings from

by companies, municipalities, states and U.S and international financial institutions like

foreign governments to finance a variety of projects International Finance Corporation (IFC), Asian

and activities Development Bank (ADB), International

Development Association (IDA), International

DERIVATIVES

Bank for Reconstruction and Development

A security whose price is dependent upon or (IBRD), etc.

derived from one or more underlying assets. The

derivatives itself is merely contract between two or 4.) STOCK EXCHANGES

more parties. Its value determined by fluctuation in

Stock exchange is duly approved by the

the underlying assets. The most common underlying

assets include stocks, bonds, commodities, Regulators to provide sale and purchase of

currencies, interest rates and market indexes. securities by “open cry” or “on line” on behalf

of investors through brokers. The stock

FUTURES exchanges provide clearing house facilities for

A financial contract obligating the buyer to netting of payments and securities delivery.

purchase an asset (or the seller to sell an asset), such Securities traded in stock exchanges include

as physical commodity or a financial instrument, at a equities, debt and derivatives.

predetermined future date and time. Future contracts

detail the quality and quantity of the underlying 5. BROKERS

asset; they are standardized to facilitate trading on a Only brokers approved by

futures exchange some future contracts may call for

Capital Market Regulator can operate on stock

physical delivery of asset, while others are settled in

exchange. Brokers perform job for

cash.

intermediating between buyers and seller of

B. THE FINANCIAL PARTICIPANTS AND securities. They help build up order book, price

THEIR FUNCTIONS discovery, and are responsible for a contract

being honoured. For their services, broker earn a

fee known as brokerage.

6.) INVESTMENT BANKERS (Merchant 3.) ALLOCATION OF RISK

Bankers) Virtually all real assets involve some risk

These are agencies/organizations regulated and When Ford builds its auto plants. for example, it

licensed by SEBI, the capital market regulator. They cannot know for sure what cash flows those plants

arrange raising of funds through equity and debt will generate.

route and assist companies in completing various This allocation of risk also benefits the firms that

formalities like filling of the prescribed document need to raise capital to finance their investments.

and other compliances with the regulators. When investors are able to select security types with

the risk-return characteristics that best suit their

7. FOREIGN INSTITUTIONAL INVESTOR

preferences, each security can be sold for the best

(FII’s) possible price.

FII’s are foreign based funds authorized by Capital 4.) SEPARATION OF OWNERSHIP AND

Market Regulator to invest in countries equity and MANAGEMENT

debt market through stock exchanges. They are

allowed to repatriate sale proceeds of their holdings, Businesses are owned and managed by the same

provided sales have been made through an individual. This simple organization is well suited to

authorized stock exchange and taxes have been paid. small businesses and, the most common form of

FII’s enjoy de-facto capital account convertibility. business

organization before the Industrial revolution.

8. CUSTODIANS

D. FINANCIAL MARKET PARTICIPANTS

Custodians are organization which are allowed to

hold securities on behalf of costumers and carry out There are two basic financial market participant

operations on their behalf. They handle both funds categories: Investor vs. Speculator and

and securities of Qualified Institutional Borrowers Institutional vs. Retail

(QIBs) including FII’s. They are supervised by the

Action in financial markets by central banks is

Capital Market regulator.

usually regarded as intervention rather than

9. DEPOSITORIES participation.

Depositories hold securities in demat (electronic) INVESTOR VS. SPECULATOR

form, maintain accounts of depository participants

who, in turn, maintain accounts of their costumers. Investor

On instruction of stock exchange clearing house, An investor is any party that makes an

supported by documentations, a depository transfers Investment. The term has taken on a specific

securities from buyers to sellers’ account in meaning in finance to describe the particular

electronic form. types of people and companies that regularly

purchase equity or debt securities for financial

C. THE FINANCIAL MARKET AND gain in exchange for funding an expanding

ECONOMY company. Less frequently the term is applied to

parties who purchase real estate, currency,

1.) THE INFORMATIONAL ROLE OF commodity derivatives, personal property, or

FINANCIAL MARKETS other assets.

Stock prices reflect investors’ collective Speculation

assessment of a firm’s current performance and

Speculation

future prospects. When the market is more

In the narrow sense of financial speculation,

optimistic about the firm, its share price will

involves the buying, holding, selling, and short-

rise. Higher price makes it easier for the firm to

selling of stocks, bonds, commodities,

raise capital and therefore encourages investment.

currencies, collectibles, real estate, derivatives

2.) CONSUMPTION TIMING or any valuable financial instrument to profit

an economy are earning more than they currently

from fluctuations in its price as opposed to

wish to spend.

buying it for use or for income via methods such

for example, retirees, spend more than they as dividends or interest. Speculation represents

currently earn. one of three market roles in western financial

The One way is to “store” your wealth in financial markets, distinct from hedging, long term

assets. In high-earnings periods, you can invest your investing and arbitrage. Speculators in an asset

savings in financial assets such as stocks and bonds. may have no intention to have long term

In low-earnings periods, you can sell these assets to exposure to that asset.

provide funds for your consumption needs.

INSTITUTIONAL VS. RETAIL

Institutional investor

An institutional investor is an investor, such as a

bank, insurance company, retirement fund, hedge

fund, or mutual fund, that is financially sophisticated

and makes large investments, often held in very

large portfolios of investments. Because of their

sophistication, institutional investors may often

participate in private placements of securities, in

which certain aspects of the securities laws may be

inapplicable.

Retail

A retail investor is an individual investor

possessing shares of a given security. Retail

investors can be further divided into two categories

of share ownership.

1.) A Beneficial Shareholder is a retail investor who

holds shares of their securities in the account of a

bank or broker, also known as “in Street Name.” The

broker is in possession of the securities on behalf of

the underlying shareholder.

2.) Registered Shareholder is a retail investor who

holds shares of their securities directly through the

issuer or its transfer agent. Many registered

shareholders have physical copies of their stock

certificates.

In the United States, as of 2005 about 57 million

households owned stocks, and in total, individual

investors owned 26% of equities.

You might also like

- Chapter 1 - An Overview of Financial Managemen: ReviewerDocument3 pagesChapter 1 - An Overview of Financial Managemen: ReviewerChristian Mozo Oliva67% (3)

- MNGT M2Document3 pagesMNGT M2Melody MadarraNo ratings yet

- NAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsDocument2 pagesNAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsRoss John JimenezNo ratings yet

- Financial MarketsDocument4 pagesFinancial MarketsFlorina LuminitaNo ratings yet

- MKT, INST & INSTRUMENTSDocument58 pagesMKT, INST & INSTRUMENTSDaniela MercadoNo ratings yet

- Ia. Financial Markets: ObjectivesDocument4 pagesIa. Financial Markets: ObjectivesCosulschi NicolaeNo ratings yet

- CM Notes PrelimDocument21 pagesCM Notes PrelimSimon BacsalNo ratings yet

- Chapter 7-10Document8 pagesChapter 7-10Jolina T. OrongNo ratings yet

- Capital Market Instruments and Types in 40 CharactersDocument5 pagesCapital Market Instruments and Types in 40 CharactersMuhammad AbdullahNo ratings yet

- Financial EnvironmentDocument30 pagesFinancial EnvironmentIan TattaoNo ratings yet

- Banking Chapter 1Document7 pagesBanking Chapter 1Shasharu Fei-fei LimNo ratings yet

- BU - 5th - semFIM Unit-2Document11 pagesBU - 5th - semFIM Unit-2max90binNo ratings yet

- Financial Markets and Institutions OverviewDocument31 pagesFinancial Markets and Institutions OverviewBUBOYNo ratings yet

- Capital Market Midterm Reviewer 1Document13 pagesCapital Market Midterm Reviewer 1geverachristinemaeNo ratings yet

- FM415 Week1Document8 pagesFM415 Week1joahn.rocreo1234No ratings yet

- Combined CRs and QuizzesDocument2 pagesCombined CRs and QuizzesKryzzel Anne JonNo ratings yet

- Financial Markets GuideDocument5 pagesFinancial Markets GuideMeng DanNo ratings yet

- Capital MarketDocument14 pagesCapital MarketVishaka KarandeNo ratings yet

- Financial Market ReviewerDocument9 pagesFinancial Market ReviewerBryan NograNo ratings yet

- Purple Gradient 3D Bold Modern Investing Tips PresentationDocument47 pagesPurple Gradient 3D Bold Modern Investing Tips PresentationJana Beni Carolyn R. SabadoNo ratings yet

- Financial Markets ExplainedDocument11 pagesFinancial Markets Explainedsonal2901No ratings yet

- W I AS ?: HAT S EcurityDocument6 pagesW I AS ?: HAT S EcurityMuhammad SaadullahNo ratings yet

- Abm 4 Module 2Document3 pagesAbm 4 Module 2Argene AbellanosaNo ratings yet

- Valuation of Long Term Securities and Sources of FinanceDocument110 pagesValuation of Long Term Securities and Sources of FinanceLuckmore ChivandireNo ratings yet

- Ch01 Solutions Manual An Overview of FM and The Financial Management and The FinancialDocument4 pagesCh01 Solutions Manual An Overview of FM and The Financial Management and The FinancialAM FMNo ratings yet

- Financial Markets and IntermediariesDocument3 pagesFinancial Markets and IntermediariesAnonymous tiMNO7VNo ratings yet

- 1 Lesson 2 Financial Institutions, Instrument and MarketDocument20 pages1 Lesson 2 Financial Institutions, Instrument and MarketRoi Vincent MontenegroNo ratings yet

- Chapter 1-Financial MarketsDocument18 pagesChapter 1-Financial Marketskim cheNo ratings yet

- Role of financial markets and institutions lectureDocument13 pagesRole of financial markets and institutions lectureJohanna Nina UyNo ratings yet

- Three Main Components of the Financial SystemDocument6 pagesThree Main Components of the Financial SystemCheska TuazonNo ratings yet

- 098 Fmbo-1Document9 pages098 Fmbo-1KetakiNo ratings yet

- Global Finance - Chapter 2Document3 pagesGlobal Finance - Chapter 2Gwen AgrimorNo ratings yet

- Security Analysis & Portfolio ManagementDocument20 pagesSecurity Analysis & Portfolio ManagementKaneNo ratings yet

- Security Analysis & Portfolio ManagementDocument25 pagesSecurity Analysis & Portfolio ManagementKaneNo ratings yet

- BSAIS2 (Pena) (Ashlie Nicol)Document24 pagesBSAIS2 (Pena) (Ashlie Nicol)Ashlie PenaNo ratings yet

- Financial Markets Chapter Explains Key ConceptsDocument4 pagesFinancial Markets Chapter Explains Key ConceptsKelrina D'silvaNo ratings yet

- Finman Report Chapter 8Document17 pagesFinman Report Chapter 8Markbenson MarananNo ratings yet

- Investment and Portfolio Management - PrelimDocument6 pagesInvestment and Portfolio Management - PrelimTrisha TarucNo ratings yet

- FINANCIAL MARKETS Notes PDFDocument11 pagesFINANCIAL MARKETS Notes PDFDivyansh MishraNo ratings yet

- International Financial Market and International Monetary SystemDocument6 pagesInternational Financial Market and International Monetary SystemRohainamae aliNo ratings yet

- CHAPTER 2: An Overview of The Financial SystemDocument6 pagesCHAPTER 2: An Overview of The Financial SystemAmalia Kusuma DewiNo ratings yet

- Assignment - Financial MarketsDocument9 pagesAssignment - Financial MarketsTaruntej Singh100% (3)

- Project Work On Capital Market Instruments: Submitted BY Ankit Agrawal 4 BBM D 1011331Document9 pagesProject Work On Capital Market Instruments: Submitted BY Ankit Agrawal 4 BBM D 1011331Savinder SachdevNo ratings yet

- 12 Business Studies CH 10 Financial MarketsDocument11 pages12 Business Studies CH 10 Financial MarketsRiyasat khanNo ratings yet

- Chapter 5 Acctg235Document21 pagesChapter 5 Acctg235Ronnel Villaceran SaysonNo ratings yet

- FE - Financial Assets and SecuritiesDocument7 pagesFE - Financial Assets and SecuritiesJUAN BERMUDEZNo ratings yet

- MBFS Question Bank & AnswersDocument17 pagesMBFS Question Bank & AnswersArunkumar JwNo ratings yet

- NISM RA - Chap 2Document14 pagesNISM RA - Chap 2rex031162No ratings yet

- Mutual FundsDocument15 pagesMutual FundsMirchi RiyazNo ratings yet

- Finmar 1 5Document11 pagesFinmar 1 5Bhosx KimNo ratings yet

- Overview of Indian Financial MarketDocument22 pagesOverview of Indian Financial MarketPrinky SweetiepieNo ratings yet

- FIN - 605 - Lecture NotesDocument195 pagesFIN - 605 - Lecture NotesDebendra Nath PanigrahiNo ratings yet

- The Role of The Financial MarketsDocument6 pagesThe Role of The Financial Marketsrosalyn mauricioNo ratings yet

- Jamila Mufazzal - Chapter002.pptx (BF)Document49 pagesJamila Mufazzal - Chapter002.pptx (BF)jamila mufazzalNo ratings yet

- Financial Instruments, Financial Market and Financial InstitutionsDocument21 pagesFinancial Instruments, Financial Market and Financial InstitutionsLlorito VinceNo ratings yet

- Chapter 1Document13 pagesChapter 1mark sanadNo ratings yet

- Managerial Finance: An Overview of Financial Systems and MarketsDocument116 pagesManagerial Finance: An Overview of Financial Systems and MarketsJaja SutejaNo ratings yet

- Financial Markets Midterm ReviewerDocument2 pagesFinancial Markets Midterm Reviewerjonah mae magdadaroNo ratings yet

- Exchange Traded Funds Sovereign Wealth Funds, Transfer Pricing, & Cyber Crimes: Sovereign Wealth Funds, Transfer Pricing, & Cyber CrimesFrom EverandExchange Traded Funds Sovereign Wealth Funds, Transfer Pricing, & Cyber Crimes: Sovereign Wealth Funds, Transfer Pricing, & Cyber CrimesNo ratings yet

- HBVHB B HBGVGHBDocument9 pagesHBVHB B HBGVGHBbaneNo ratings yet

- DSKJDSKADJKNMNCDocument1 pageDSKJDSKADJKNMNCbaneNo ratings yet

- The Cell Cycle: How Cells Divide and GrowDocument6 pagesThe Cell Cycle: How Cells Divide and GrowbaneNo ratings yet

- Republic of The Philippines Palawan State University College of Business and Accountancy Puerto Princesa CityDocument3 pagesRepublic of The Philippines Palawan State University College of Business and Accountancy Puerto Princesa CitybaneNo ratings yet

- Document 12345Document1 pageDocument 12345baneNo ratings yet

- Pls DLDocument1 pagePls DLbaneNo ratings yet

- Derbes, Program of Giotto's ArenaDocument19 pagesDerbes, Program of Giotto's ArenaMarka Tomic DjuricNo ratings yet

- 5.17.18 FIRST STEP ActDocument28 pages5.17.18 FIRST STEP ActSenator Cory BookerNo ratings yet

- Abm 1-W6.M2.T1.L2Document5 pagesAbm 1-W6.M2.T1.L2mbiloloNo ratings yet

- Characteristics Literature of Restoration PeriodDocument4 pagesCharacteristics Literature of Restoration PeriodIksan AjaNo ratings yet

- Tutang Sinampay:: Jerzon Senador Probably Wants To Be Famous and Show The World How Naughty He Is by Hanging HisDocument2 pagesTutang Sinampay:: Jerzon Senador Probably Wants To Be Famous and Show The World How Naughty He Is by Hanging HisClaire Anne BernardoNo ratings yet

- Safety Residential WarrantyDocument1 pageSafety Residential WarrantyJanan AhmadNo ratings yet

- GoguryeoDocument29 pagesGoguryeoEneaGjonajNo ratings yet

- The Grand Duchy of Karameikos: Players Guide v1.0Document29 pagesThe Grand Duchy of Karameikos: Players Guide v1.0Fabiano RodriguesNo ratings yet

- Removal of Directors or Trustees: by The SEC - After Notice and Hearing and Only OnDocument2 pagesRemoval of Directors or Trustees: by The SEC - After Notice and Hearing and Only OnApple Ke-eNo ratings yet

- Oracle Applications EBS - Accounting EntriesDocument43 pagesOracle Applications EBS - Accounting EntriesUdayraj SinghNo ratings yet

- Korea Technologies Co, Ltd. v. LermaDocument1 pageKorea Technologies Co, Ltd. v. Lermadwight yuNo ratings yet

- Dyslexia and The BrainDocument5 pagesDyslexia and The BrainDebbie KlippNo ratings yet

- Jabatan Bomba Dan Penyelamat MalaysiaDocument2 pagesJabatan Bomba Dan Penyelamat MalaysiaVe Ronise100% (1)

- VDS 2095 Guidelines For Automatic Fire Detection and Fire Alarm Systems - Planning and InstallationDocument76 pagesVDS 2095 Guidelines For Automatic Fire Detection and Fire Alarm Systems - Planning and Installationjavikimi7901No ratings yet

- HR Project Background Screening & AnalysisDocument86 pagesHR Project Background Screening & AnalysisDamu_Prashanth_5848No ratings yet

- AGAG v. Alpha FinancingDocument5 pagesAGAG v. Alpha Financinghermione_granger10No ratings yet

- Legal Due Diligence Report for PT Olam IndonesiaDocument65 pagesLegal Due Diligence Report for PT Olam IndonesiaHubertus SetiawanNo ratings yet

- (Defamation) Cassidy V Daily Mirror NewspapersDocument4 pages(Defamation) Cassidy V Daily Mirror NewspapersHoey Lee100% (4)

- 10th Parliament BookDocument86 pages10th Parliament BookLilian JumaNo ratings yet

- PFR CompiledDocument91 pagesPFR CompiledLyn Dela Cruz DumoNo ratings yet

- Motion For Leave Demurrer) MelgarDocument11 pagesMotion For Leave Demurrer) MelgarRichard Conrad Foronda Salango100% (2)

- LAW OF EVIDENCEDocument7 pagesLAW OF EVIDENCERajithha KassiNo ratings yet

- Seminarski Rad - My Favourite FilmDocument11 pagesSeminarski Rad - My Favourite FilmMartin StarčevićNo ratings yet

- BatStateU-FO-NSTP-03 - Parent's, Guardian's Consent For NSTP - Rev. 01Document2 pagesBatStateU-FO-NSTP-03 - Parent's, Guardian's Consent For NSTP - Rev. 01Gleizuly VaughnNo ratings yet

- 17Mb221 Industrial Relations and Labour LawsDocument2 pages17Mb221 Industrial Relations and Labour LawsshubhamNo ratings yet

- Declaration - 13th Melaka International Youth DialogueDocument6 pagesDeclaration - 13th Melaka International Youth DialogueBojan GrebenarNo ratings yet

- Antiquera v. PeopleDocument4 pagesAntiquera v. PeopleIan TaduranNo ratings yet

- 01 PartnershipDocument6 pages01 Partnershipdom baldemorNo ratings yet

- Zweber v. Credit River Township, No. A14-0893 (Mn. July 27, 2016)Document26 pagesZweber v. Credit River Township, No. A14-0893 (Mn. July 27, 2016)RHTNo ratings yet

- Ambit Good & Clean Midcap Portfolio September 2020: Asset ManagementDocument20 pagesAmbit Good & Clean Midcap Portfolio September 2020: Asset ManagementVinay T MNo ratings yet