Professional Documents

Culture Documents

Short Term Budgeting Continued

Uploaded by

Big Rock Farm ResortCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Short Term Budgeting Continued

Uploaded by

Big Rock Farm ResortCopyright:

Available Formats

Short Term Budgeting continued…

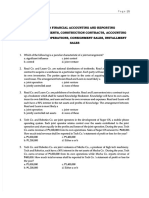

Sample Problem No. 4: Budgeted Income Statement

Consider the data and solutions in the previous sample problems. The standard costs of AJ Corporation are summarized below:

Units Rate Cost per unit

Direct Material 3 lbs. P 1.20 per lb. P 3.60

Direct Labor 0.25 hr. 0.20 per hr. 0.05

Variable Factory Overhead 0.25 hr. 5.00 per hr. 1.25

Foxed Factory Overhead 0.25 hr. 4.00 per hr. 1

Total P 5.90

The standard costs are the same from year 2019 to 2020. The work-in-process inventories are estimated at 10% of the current

production put into process. The work-in-process on December 31, 2019 is determined at P75,000.00.

Operating Expenses are budgeted at 20% of sales in a quarter. Non-cash operating expenses including accruals and prepayments are

estimated at 20% of sales. Other income from operations are projected at 5% of sales. The accrued and prepaid items are as follows:

2020

Q4, 2019

Q1 Q2 Q3 Q4

Accrued Expenses P 12,000.00 P 15,000.00 P 22,000.00 P 14,000.00 P 15,000.00

Prepaid Expenses 3,000.00 6,000.00 6,500.00 7,400.00 8,800.00

Accrued Income 4,400.00 900.00 3,500.00 7,900.00 8,600.00

Prepaid Income 2,100.00 3,300.00 4,400.00 9,700.00 8,200.00

The income tax rate is 40%.

Required:

a. Budgeted cost of goods manufactured and sold.

b. Budgeted income statement.

c. Budgeted cash payments to operating expenses.

d. Budgeted cash receipts from other revenues.

Financial Budget

Sample Problem No. 51: Cash Budget and Budgeted Cash Flows

Consider all the data and solutions in previous samples. Other cash transactions are:

Non-current assets are to be acquired in the second and third quarters of 2020 in the amounts of P200,000.00 and P145,000.00,

respectively. Some old non-current assets are to be sold at its book value for P174,000.00 in the third quarter.

Dividends are to be paid in February for P400,000.00 and July for P250,000.00.

The minimum cash balance is set at P400,000.00. In case of deficit, the corporation can avail a credit line in multiples of P25,000.00

from a financing institution at a rate of 14% per annum. Interest is paid quarterly based on the outstanding balance at the beginning of

the quarter. Payments to borrowings in multiples of P25,000.00 are made whenever cash is available determined at the beginning of the

quarter. The cash balance of January 1, 2020 is expected to equal the minimum cash balance.

Required:

a. Cash Budget.

b. Budgeted statement of cash flows.

You might also like

- This Study Resource Was: Saint Paul School of Business and LawDocument4 pagesThis Study Resource Was: Saint Paul School of Business and LawKim FloresNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Long Quiz. Strategy & The Master Budget Organizational Innovations - TQM & JIT - Attempt ReviewDocument30 pagesLong Quiz. Strategy & The Master Budget Organizational Innovations - TQM & JIT - Attempt ReviewCalix SuraoNo ratings yet

- PDF Advanced Accounting Solman CompressDocument91 pagesPDF Advanced Accounting Solman CompressLeah Mae NolascoNo ratings yet

- CVP - SolutionsDocument8 pagesCVP - SolutionsLaica MontefalcoNo ratings yet

- MAS Final Preboard Solutions B93Document5 pagesMAS Final Preboard Solutions B93813 cafeNo ratings yet

- Cost Behavior Analysis and ForecastingDocument2 pagesCost Behavior Analysis and ForecastingPotie RhymeszNo ratings yet

- Exercise 4 CashDocument4 pagesExercise 4 CashYeyebonl100% (1)

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Far 17 Investment PropertyDocument12 pagesFar 17 Investment PropertyTeresaNo ratings yet

- Weighted Average Method Process Costing CalculationDocument2 pagesWeighted Average Method Process Costing CalculationLouise0% (2)

- Problem No. 1: QuestionsDocument3 pagesProblem No. 1: QuestionsPamela Ledesma SusonNo ratings yet

- A5 PPE Lapsing ScheduleDocument21 pagesA5 PPE Lapsing ScheduleMa. BeatriceNo ratings yet

- Relevant Costing Quiz 1Document4 pagesRelevant Costing Quiz 1Joe P PokaranNo ratings yet

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- PFS: Financial Aspect - Investment CostsDocument11 pagesPFS: Financial Aspect - Investment CostsSheena Cadiz FortinNo ratings yet

- BDO Unibank 2020 Annual Report Financial SupplementsDocument236 pagesBDO Unibank 2020 Annual Report Financial SupplementsDanNo ratings yet

- AP 5905Q InventoriesDocument3 pagesAP 5905Q Inventoriesaldrin elsisuraNo ratings yet

- Activity 3-Cae06: 1. The Bookkeeper of Latsch Company, Which Has An Accounting Year EndingDocument3 pagesActivity 3-Cae06: 1. The Bookkeeper of Latsch Company, Which Has An Accounting Year EndingMarian Gerangaya07No ratings yet

- Integrated Topic 1 (Far-004a)Document4 pagesIntegrated Topic 1 (Far-004a)lyndon delfinNo ratings yet

- Advanced Financial Accounting TopicsDocument16 pagesAdvanced Financial Accounting TopicsNhel AlvaroNo ratings yet

- University of Perpetual Help System Dalta Calamba Campus, Brgy. Panciano Rizal, Calamba City College of AccountancyDocument16 pagesUniversity of Perpetual Help System Dalta Calamba Campus, Brgy. Panciano Rizal, Calamba City College of AccountancyChristine Jane AbangNo ratings yet

- Audit of Shareholders EquityDocument10 pagesAudit of Shareholders Equityaira nialaNo ratings yet

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocument6 pagesInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacNo ratings yet

- Management Advisory Services Activity Cost and CVP Analysis MSQDocument9 pagesManagement Advisory Services Activity Cost and CVP Analysis MSQMa Teresa B. CerezoNo ratings yet

- 01 CashandCashEquivalentsNotesDocument7 pages01 CashandCashEquivalentsNotesVeroNo ratings yet

- Acctg Ats1Document2 pagesAcctg Ats1Christian N MagsinoNo ratings yet

- 11 Just in Time Backflush CostingDocument3 pages11 Just in Time Backflush CostingIrish Gracielle Dela CruzNo ratings yet

- ACCTG 013 - Module 6Document33 pagesACCTG 013 - Module 6Andrea Lyn Salonga CacayNo ratings yet

- Relevant Costing Simulated Exam Ans KeyDocument5 pagesRelevant Costing Simulated Exam Ans KeySarah BalisacanNo ratings yet

- CBA Corporation Cash Budget AnalysisDocument16 pagesCBA Corporation Cash Budget AnalysisLysss EpssssNo ratings yet

- Chapter 16 AnsDocument7 pagesChapter 16 AnsDave Manalo100% (5)

- 9201 - Partnership FormationDocument4 pages9201 - Partnership FormationBrian Dave OrtizNo ratings yet

- Partnership and Corporation AccountingDocument2 pagesPartnership and Corporation AccountingEmman S NeriNo ratings yet

- Chapter 11: Allocation of Joint Costs and Accounting For By-ProductsDocument100 pagesChapter 11: Allocation of Joint Costs and Accounting For By-Productsmoncarla lagonNo ratings yet

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- This Study Resource Was: Quiz On Receivable FinancingDocument3 pagesThis Study Resource Was: Quiz On Receivable FinancingKez MaxNo ratings yet

- Final Exam Questions on Financial ManagementDocument3 pagesFinal Exam Questions on Financial ManagementAnaSolitoNo ratings yet

- Afar QuizDocument18 pagesAfar QuizCpa Cheap review materialsNo ratings yet

- Fedillaga Case13Document19 pagesFedillaga Case13Luke Ysmael FedillagaNo ratings yet

- Variable Costing SeatworkDocument5 pagesVariable Costing SeatworkPortgas D. AceNo ratings yet

- Instructional Material - Sustainability Audit 2020Document99 pagesInstructional Material - Sustainability Audit 2020Robin de CastroNo ratings yet

- Module 8 AgricultureDocument9 pagesModule 8 AgricultureTrine De LeonNo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- Management Science Chapter 10Document44 pagesManagement Science Chapter 10Myuran SivarajahNo ratings yet

- Chapter 16 - Consol. Fs Part 1Document17 pagesChapter 16 - Consol. Fs Part 1PutmehudgJasdNo ratings yet

- STDM Sample QuestionsDocument6 pagesSTDM Sample QuestionsAyra PelenioNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- AMIS 525 Pop Quiz - Chapters 22 and 23Document5 pagesAMIS 525 Pop Quiz - Chapters 22 and 23ssregens82No ratings yet

- MAS-07: RESPONSIBILITY ACCOUNTING & TRANSFER PRICINGDocument7 pagesMAS-07: RESPONSIBILITY ACCOUNTING & TRANSFER PRICINGClint AbenojaNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Assets: Pedro Castro Statement of Financial Position October 1, 2016Document2 pagesAssets: Pedro Castro Statement of Financial Position October 1, 2016Mandy Bloom0% (1)

- Performing Preliminary Engagement ActivitiesDocument9 pagesPerforming Preliminary Engagement ActivitiesMarnelli CatalanNo ratings yet

- Intermediate Accounting I Investment in Associate Part 2Document3 pagesIntermediate Accounting I Investment in Associate Part 2Fery AnnNo ratings yet

- Audit of Current LiabilitiesDocument4 pagesAudit of Current LiabilitiesMark Anthony TibuleNo ratings yet

- Differential Cost AnalysisDocument7 pagesDifferential Cost AnalysisSalman AzeemNo ratings yet

- 02 MAS Final Preboard 2018 2019 WITH ANSWER 2 PDFDocument13 pages02 MAS Final Preboard 2018 2019 WITH ANSWER 2 PDFAshNor RandyNo ratings yet

- Comprehensive Accounting Final Preboard ReviewDocument13 pagesComprehensive Accounting Final Preboard ReviewJims Leñar CezarNo ratings yet

- BUSINESS FINANCE PROBLEMSDocument3 pagesBUSINESS FINANCE PROBLEMSAndré MendozaNo ratings yet

- TWO-WAY FOH VARIANCE QUIZDocument7 pagesTWO-WAY FOH VARIANCE QUIZBig Rock Farm ResortNo ratings yet

- Other Percentage Tax RatesDocument11 pagesOther Percentage Tax RatesmavslastimozaNo ratings yet

- Other Percentage Tax RatesDocument11 pagesOther Percentage Tax RatesmavslastimozaNo ratings yet

- Two-Way ANOVA Exercises Answers: F MS MSE DF DFDocument5 pagesTwo-Way ANOVA Exercises Answers: F MS MSE DF DFBig Rock Farm ResortNo ratings yet

- ReadmeDocument1 pageReadmeBig Rock Farm ResortNo ratings yet

- UrcDocument15 pagesUrcKarlo PradoNo ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument15 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global EditionNuu 'No ratings yet

- CMA Question August-2013 PDFDocument58 pagesCMA Question August-2013 PDFBarna PaulNo ratings yet

- Lesson 1 Analyzing Recording TransactionsDocument6 pagesLesson 1 Analyzing Recording TransactionsklipordNo ratings yet

- Financial Management For Decision Makers 8th Edition Edition Atrill Solutions ManualDocument22 pagesFinancial Management For Decision Makers 8th Edition Edition Atrill Solutions ManualRayane M Raba'a0% (1)

- Accounts Gibson Keller Debit CreditDocument4 pagesAccounts Gibson Keller Debit CreditMcKenzie WNo ratings yet

- BD ppt19Document84 pagesBD ppt19Steven GalfordNo ratings yet

- Chapter 2. Understanding The Income Statement A. QuestionsDocument2 pagesChapter 2. Understanding The Income Statement A. QuestionsThị Kim TrầnNo ratings yet

- Analysis of WCMDocument47 pagesAnalysis of WCMRATNA KUMARNo ratings yet

- Business Plan For Solar CarDocument73 pagesBusiness Plan For Solar CarbadrNo ratings yet

- 07 - Capital - Structure ProblemsDocument5 pages07 - Capital - Structure ProblemsRohit KumarNo ratings yet

- Midterm Exam Attempt Review PDFDocument18 pagesMidterm Exam Attempt Review PDFKRIS ANNE SAMUDIONo ratings yet

- Ias 27 PDFDocument14 pagesIas 27 PDFRandy PaderesNo ratings yet

- Nama: Destria Ayu Atikah NPK: 11190000098 Tugas: Workshop Akuntansi Keuangan Lanjutan (TM 4) Abesn: 13Document3 pagesNama: Destria Ayu Atikah NPK: 11190000098 Tugas: Workshop Akuntansi Keuangan Lanjutan (TM 4) Abesn: 13destria ayu atikahNo ratings yet

- FIN081 - P2 - Q2 - Receivable Management - AnswersDocument7 pagesFIN081 - P2 - Q2 - Receivable Management - AnswersShane QuintoNo ratings yet

- Revenue and Profit Maximization of A Competitive Firm: Module - 8Document12 pagesRevenue and Profit Maximization of A Competitive Firm: Module - 8Debarshi GhoshNo ratings yet

- 2 Home, SA, Branch ProblemsDocument7 pages2 Home, SA, Branch ProblemsthatfuturecpaNo ratings yet

- Based On PSA 700 Revised - The Independent Auditor's Report On A Complete Set of General Purpose Financial StatementsDocument12 pagesBased On PSA 700 Revised - The Independent Auditor's Report On A Complete Set of General Purpose Financial Statementsbobo kaNo ratings yet

- Inventory and Cost of Goods Sold (Practice Quiz)Document4 pagesInventory and Cost of Goods Sold (Practice Quiz)Monique100% (1)

- Philippine School of Business Administration Accounting 309: Accounting For Business CombinationDocument35 pagesPhilippine School of Business Administration Accounting 309: Accounting For Business CombinationLorraineMartinNo ratings yet

- Survey of Accounting 5th Edition Edmonds Solutions ManualDocument25 pagesSurvey of Accounting 5th Edition Edmonds Solutions ManualAlexisScottcmr100% (40)

- Lecture # 6 Cost Estimation IIDocument33 pagesLecture # 6 Cost Estimation IIBich Lien Pham100% (1)

- Break-Even Analysis Administración de la producciónDocument3 pagesBreak-Even Analysis Administración de la producciónFryda GarciaNo ratings yet

- C 03Document52 pagesC 03Lạc LốiNo ratings yet

- Cost and Management AccountingDocument6 pagesCost and Management AccountingAli HaiderNo ratings yet

- Managerial Accounting Midterm ExamDocument9 pagesManagerial Accounting Midterm ExamElaine ChiaNo ratings yet

- Ceat Balance SheetDocument2 pagesCeat Balance Sheetkcr kc100% (2)

- Assignment Help Guide SheetDocument11 pagesAssignment Help Guide SheetShakil KhanNo ratings yet

- Financial Statement Analysis of BHELDocument137 pagesFinancial Statement Analysis of BHELMahesh Papisetty66% (38)

- Bec 225 AssignmentDocument4 pagesBec 225 Assignmentstanely ndlovuNo ratings yet