Professional Documents

Culture Documents

General Journal

Uploaded by

Syed Ali HaiderCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Journal

Uploaded by

Syed Ali HaiderCopyright:

Available Formats

General Journal

The word “Journal” derived from “Jour” a French word means “Day”. So General Journal or

simply a Journal is a book of first entry in which we record daily transactions. Based on dual

aspect concept of accounting debit and credit aspect of every transaction is to be recorded in

Journal chronologically with short explanation. All the transactions are recorded at first in this

book so it is also called book of First or prime or original entry. On the basis of journal, the

ledger accounts are to be prepared so it is also referred to as an “Assistant of Ledger”.

Entry:

Recording of any transaction in relevant heads of account in a particular book is called entry. If

the transaction is recorded in journal then it is called journal entry and if the transaction is

recorded in ledger then it is called ledger entry.

Simple Entry:

The entry in which one Heads of Account is to be Debited and Credited is called “Simple

Entry.”

Compound Entry:

The entry in which more than one Heads of Account are Debited or Credited is called

“Compound Entry.”

Journalizing:

The process of recording transactions in journal is called journalizing.

Narration:

A short explanation written with each entry in journal is called narration and the journal entry is

considered incomplete without narration.

Ledger Folio (L/F):

It is a page/account/reference number of particular account where the particular account is to be

prepared. It helps for locating the concerned account from ledger.

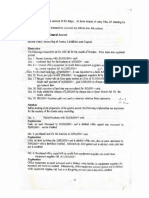

Specimen of General Journal

It is given in next page with understanding hints

Account to Amount to

be debited be debited

General Journal

Page # ------

Debit Credit

Date Description/Detail L/F

(Currency Sign) (Currency Sign)

xxx XXX 1 XXX

To XXX 3 XXX

(---------------------)

XXX XXX

Narration

Date of Account to Amount to

transaction be credited be credited

Total

Practice Question

Journalize the following transactions.

Date Transactions Rs.

2016

Feb 01 Mr. Aslam started his business with cash 500,000

„‟ 02 Purchased merchandises 100,000

„‟ 03 Goods bought from Mr. Akbar on credit basis 80,000

„‟ 05 Machinery bought 300,000

„‟ 05 Merchandises sold 200,000

„‟ 08 Sold goods on credit basis to Mr. Rahit 150,000

„‟ 13 Received commission 3,000

„‟ 19 Returned goods to Mr. Akbar 20,000

„‟ 20 Goods returned by Mr. Rahit 15,000

„‟ 26 Mr. Aslam withdrew cash from business for his private use 25,000

„‟ 28 Borrowed from Mr. Akram 50,000

„‟ 29 Paid Rent for the month 10,000

Solution

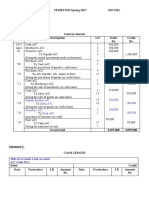

General Journal

Page # 01

Debit Credit

Date Description L/F

Rs. Rs.

2016

Feb 01 Cash A/c 1 500,000

To Capital A/c 2 500,000

( Initial Investment made in business)

„‟ 02 Purchases A/c 3 100,000

To Cash A/c 1 100,000

( being the purchases of goods on cash basis)

„‟ 03 Purchases A/c 3 80,000

To Accounts Payable- Mr. Akbar 4 80,000

( Being the purchase of goods on credit basis)

„‟ 05 Machinery A/c 5 300,000

To Cash A/c 1 300,000

( Being the purchase of machinery on cash

basis)

„‟ 05 Cash A/c 1 200,000

To Sales A/c 6 200,000

( Being the sales of goods on cash basis)

„‟ 08 Accounts Receivable- Mr. Rahit 7 150,000

To Sales A/c 8 150,000

( Being the sale of goods on credit basis)

Total C/F 1330,000 1330,000

Page # 02

Debit Credit

Date Description L/F

Rs. Rs.

Total B/F 1,330,000 1,330,000

„‟ 13 Cash A/c 1 3,000

To Commission A/c 9 3,000

( Being the receipt of commission)

„‟ 19 Accounts Payable- Mr. Akbar 4 20,000

To Return outwards A/c 10 20,000

( Being the goods returned to supplier)

„‟ 20 Return inwards A/c 11 15,000

To Accounts Receivable- Mr. Rahit 7 15,000

( Being the goods returned from customers)

„‟ 26 Drawings A/c 12 25,000

To Cash A/c 1 25,000

( Being the amount withdrawn by the owner for

his personal use)

„‟ 28 Cash A/c 1 50,000

To Loan - Mr. Akram 13 50,000

( Being the loan taken)

„‟ 29 Rent A/c 14 10,000

To Cash A/c 1 10,000

( Being the payment of rent)

Grand Total 1,453,000 1,453,000

Muhammad Shafiq Kaleem

Lecturer – Accounting & Finance

Virtual University of Pakistan

Note: Please consult recommended books mentioned in “books” Tab of

VU-LMS for more practice.

You might also like

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Spring 2017 - MGT101 - 1Document11 pagesSpring 2017 - MGT101 - 1jaydee1000No ratings yet

- Book Keeping ProcessDocument8 pagesBook Keeping ProcessNagarathna KulkarniNo ratings yet

- Journal Entries RemarksDocument5 pagesJournal Entries RemarksAl Shane Lara CabreraNo ratings yet

- AccountingDocument5 pagesAccountingAl Shane Lara CabreraNo ratings yet

- 5 Basic AccountingDocument31 pages5 Basic Accounting2205611No ratings yet

- Ledger Account Accounting Workbooks Zaheer SwatiDocument10 pagesLedger Account Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Basic Accounting Excercise (Goods)Document4 pagesBasic Accounting Excercise (Goods)Zubair JuttNo ratings yet

- TUTORIAL AccDocument12 pagesTUTORIAL Accizzat ikramNo ratings yet

- Assignment No. 01 SEMESTER Spring 2017 MGT101: 280,000 280,000 Farhan Brother A/C Sales A/C Furniture A/C Cash A/CDocument2 pagesAssignment No. 01 SEMESTER Spring 2017 MGT101: 280,000 280,000 Farhan Brother A/C Sales A/C Furniture A/C Cash A/CHalima SaadiaNo ratings yet

- Solution 742381Document13 pagesSolution 742381GREATER HEIGHTS PUBLIC SCHOOLNo ratings yet

- Acc - Chapter 15 AmroDocument12 pagesAcc - Chapter 15 AmroWassim AlwanNo ratings yet

- Topic 3 Accounting ProcessDocument49 pagesTopic 3 Accounting ProcessNurul AfiqahNo ratings yet

- Admas ColledgeDocument20 pagesAdmas Colledgeyonas fitaNo ratings yet

- Account CHP 4Document9 pagesAccount CHP 4LOW YAN QINNo ratings yet

- Tugas 2. Proses PencatatanDocument5 pagesTugas 2. Proses Pencatatantheresia betveneNo ratings yet

- Accounts AnswersDocument12 pagesAccounts AnswersRafiya95z MynirNo ratings yet

- Case - 1 UnitDocument2 pagesCase - 1 UnitSowmya Vijaykumar SirsaliNo ratings yet

- Preparation of The General: JournalDocument3 pagesPreparation of The General: JournalWamema joshuaNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Class 11 Accountancy Chapter-3 Revision NotesDocument11 pagesClass 11 Accountancy Chapter-3 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Journal EntriesDocument5 pagesJournal Entriesjul123456No ratings yet

- Journal EntryDocument5 pagesJournal EntryABM-AKRISTINE DELA CRUZNo ratings yet

- AC114M3 Part 2Document13 pagesAC114M3 Part 2Penny TratiaNo ratings yet

- Presentation ON General Ledger & Trail BalanceDocument14 pagesPresentation ON General Ledger & Trail BalanceNumanNo ratings yet

- Fin Acc Presentation (MR - Rupesh Dahake)Document24 pagesFin Acc Presentation (MR - Rupesh Dahake)rupeshdahake100% (3)

- Steps in The Accounting Process: Ans:1 Definition of Accounting. 1: The System of Recording and SummarizingDocument9 pagesSteps in The Accounting Process: Ans:1 Definition of Accounting. 1: The System of Recording and SummarizingshamagondalNo ratings yet

- Class - 4 TransactionDocument8 pagesClass - 4 TransactionAkshay SinghNo ratings yet

- Assignment, ANdallo, Ransey Ace DDocument3 pagesAssignment, ANdallo, Ransey Ace DRansey Ace AndalloNo ratings yet

- Lecture 03Document108 pagesLecture 03Masood AliNo ratings yet

- Tutorial 6Document4 pagesTutorial 6Muntasir AhmmedNo ratings yet

- Adobe Scan Mar 16, 2023Document20 pagesAdobe Scan Mar 16, 2023Renalyn Ps MewagNo ratings yet

- Reading of Ledger AccountDocument18 pagesReading of Ledger Accountneeru79200050% (2)

- Ledger and Trial BalanceDocument42 pagesLedger and Trial BalanceAmruthaprashanth100% (1)

- Journal EntriesDocument5 pagesJournal Entriesjul123456No ratings yet

- Chapter (13) : Accounting For PartnershipDocument12 pagesChapter (13) : Accounting For Partnershipmagdy kamel100% (1)

- Sol DissolutionDocument40 pagesSol DissolutionBlastik FalconNo ratings yet

- CH3 Accounting EquationDocument43 pagesCH3 Accounting EquationAmr HassanNo ratings yet

- Accountancy-Books of Prime EntryDocument8 pagesAccountancy-Books of Prime EntryGedie Rocamora100% (1)

- Sample Worksheet K204050266 P3.5Document16 pagesSample Worksheet K204050266 P3.5Trâm Mai Thị ThùyNo ratings yet

- Dissolution + Single EntryDocument18 pagesDissolution + Single EntryOm JainNo ratings yet

- FM 211 Preparation of Journal EntriesDocument9 pagesFM 211 Preparation of Journal EntriesJuvy Jane DuarteNo ratings yet

- Recording Business Transactions: Student Name Student ID Course ID DateDocument8 pagesRecording Business Transactions: Student Name Student ID Course ID DateSami Ur RehmanNo ratings yet

- TUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Document24 pagesTUGAS DASAR AKUNTANSI 4 - Samuel S Purba - 141200193Samuel PurbaNo ratings yet

- FinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFDocument10 pagesFinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFSherona ReidNo ratings yet

- Partnership Final Accounts: Tar EtDocument40 pagesPartnership Final Accounts: Tar EtVenkatesh Ramchandra100% (3)

- Incomplete RecordsDocument27 pagesIncomplete RecordsSteven Raintung0% (1)

- Format: The Format/specimen of A Double Column Cash Book Is Given BelowDocument7 pagesFormat: The Format/specimen of A Double Column Cash Book Is Given Belowjoshua stevenNo ratings yet

- Financial Accounting and Cost Management and Management Control Paper MBADocument8 pagesFinancial Accounting and Cost Management and Management Control Paper MBAPriyank SaxenaNo ratings yet

- Let Us Now Analyse The Transaction One by OneDocument5 pagesLet Us Now Analyse The Transaction One by OneKamakshi BakshiNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- PC3 29Document12 pagesPC3 29ScribdTranslationsNo ratings yet

- Lembar Jawaban BlankDocument17 pagesLembar Jawaban Blankmaisaroh dwi oktavianingtyasNo ratings yet

- Smart LaundryDocument21 pagesSmart Laundryfriskila dewiNo ratings yet

- Omar Muhktar Abusama Nov 19Document34 pagesOmar Muhktar Abusama Nov 19Garpt Kudasai100% (1)

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- Good Shepherd International School, Ooty: Winter Holiday HomeworkDocument12 pagesGood Shepherd International School, Ooty: Winter Holiday Homework6969 RithvikNo ratings yet

- Journal Entries & Correction of ErrorsDocument33 pagesJournal Entries & Correction of ErrorsSteven RaintungNo ratings yet

- UNIT7 Literature From Around The WorldDocument21 pagesUNIT7 Literature From Around The WorldSyed Ali HaiderNo ratings yet

- Arif CVDocument4 pagesArif CVSyed Ali HaiderNo ratings yet

- IdiomsDocument5 pagesIdiomsSyed Ali HaiderNo ratings yet

- Words Meanings SentencesDocument6 pagesWords Meanings SentencesSyed Ali HaiderNo ratings yet

- ICT Ethics and SecurityDocument4 pagesICT Ethics and SecuritySyed Ali HaiderNo ratings yet

- CultureDocument3 pagesCultureSyed Ali HaiderNo ratings yet

- ch1 Computer6thDocument3 pagesch1 Computer6thSyed Ali HaiderNo ratings yet

- GeographyDocument7 pagesGeographySyed Ali HaiderNo ratings yet

- IdiomsDocument5 pagesIdiomsSyed Ali HaiderNo ratings yet

- RL Reco Fund Tracker 181214Document5 pagesRL Reco Fund Tracker 181214techkasambaNo ratings yet

- NRI Deposit Accounts RBI GUIDLINES 2016Document28 pagesNRI Deposit Accounts RBI GUIDLINES 2016samNo ratings yet

- Project Report On IpoDocument50 pagesProject Report On IpoNeeraj Soni77% (26)

- Chapter 23Document24 pagesChapter 23Nguyên BảoNo ratings yet

- FN1584 1622Document445 pagesFN1584 16224207west59thNo ratings yet

- Answers BSBFIM501Document13 pagesAnswers BSBFIM501Gurpreet Kaur80% (5)

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi ali100% (1)

- Topic 63 Country Risk Determinants, Measures and ImplicationsDocument2 pagesTopic 63 Country Risk Determinants, Measures and ImplicationsSoumava PalNo ratings yet

- Maintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial StabilityDocument54 pagesMaintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial Stabilityfrancis reddyNo ratings yet

- Value A Guide To Managers and Investors, Who Is Regarded As Father of Share Holder Value, The FollowingDocument2 pagesValue A Guide To Managers and Investors, Who Is Regarded As Father of Share Holder Value, The FollowingJubit Johnson100% (1)

- Onex I 230956Document2 pagesOnex I 230956chunduharikrishnaNo ratings yet

- 2nd Quarter Reviewer SessionDocument12 pages2nd Quarter Reviewer SessionshairaNo ratings yet

- Tutorial 5Document1 pageTutorial 5easoncho29No ratings yet

- 1T6 S4hana2022 BPD en AeDocument121 pages1T6 S4hana2022 BPD en AeVinay KumarNo ratings yet

- Artbitzs - Reloadable CardDocument10 pagesArtbitzs - Reloadable CardSwapnil PNo ratings yet

- C1 Free Problem Solving Session Nov 2019 - Set 5Document6 pagesC1 Free Problem Solving Session Nov 2019 - Set 5JMwaipNo ratings yet

- Statutory Compliance RCM 2022-2023Document1 pageStatutory Compliance RCM 2022-2023Aman ParchaniNo ratings yet

- Koehl's Doll ShopDocument3 pagesKoehl's Doll Shopmobinil1No ratings yet

- Finlatics Sector Project - 1Document2 pagesFinlatics Sector Project - 1Aditya ChitaliyaNo ratings yet

- Financial Markets and Institutions 7th Edition Mishkin Test BankDocument36 pagesFinancial Markets and Institutions 7th Edition Mishkin Test Bankrosiegarzamel6100% (21)

- Money AffirmationsDocument9 pagesMoney AffirmationsMotherboard Mmuso100% (1)

- Perpetual Help: Calculate Future Value and Present Value of Money andDocument8 pagesPerpetual Help: Calculate Future Value and Present Value of Money andDennis AlbisoNo ratings yet

- Comparison Report On HIL, Everest and Visaka IndustriesDocument4 pagesComparison Report On HIL, Everest and Visaka IndustriesHItesh priyhianiNo ratings yet

- Chapter 1: Introduction To Accounting: Activity 1: A Chapter DiscussionDocument9 pagesChapter 1: Introduction To Accounting: Activity 1: A Chapter DiscussionFaith ClaireNo ratings yet

- Stripe Tax Invoice 3H6ZFA4U-2021-07Document1 pageStripe Tax Invoice 3H6ZFA4U-2021-07Rafa CNo ratings yet

- NOC SBI DocDocument2 pagesNOC SBI DocSupratim Majumdar0% (1)

- Real Estate InvestingDocument6 pagesReal Estate Investingkrossi9183No ratings yet

- Non Shopee & Lazada - Promo Mechanics (September Promo)Document5 pagesNon Shopee & Lazada - Promo Mechanics (September Promo)Ma Joyce ImperialNo ratings yet

- Bpi Savings: Mai, Michelle ADocument21 pagesBpi Savings: Mai, Michelle AMimiNo ratings yet

- Mahusay Bsa-315major-Output-1Document3 pagesMahusay Bsa-315major-Output-1Jeth MahusayNo ratings yet