Professional Documents

Culture Documents

A Seasonal Trade in Australian Dollar Futures

Uploaded by

kaddour7108Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Seasonal Trade in Australian Dollar Futures

Uploaded by

kaddour7108Copyright:

Available Formats

A seasonal trade in Australian dollar futures

By Ernest P. Chan, Ph.D.

April 15, 2007

I ususally don't discuss trades that I don't understand. But this time I will make an exception because

the historical patterns is so consistent -- but still, I will urge the reader to be cautious. Here is the

trade: buy the CME/Globex June Australian dollar futures (ticker AD) at the close of April 28, and sell it

at the close of May 4. Just like the gasoline futures trade that I mentioned in my last article, historically

we would have realized a profit on this trade every year since 1995. Here is the annual P/L and

maximum drawdown (measured from day 1, the entry point) experienced by this position:

Year P/L Maximum Drawdown

1995 $1300 $0

1996 $1000 -$60

1997 $330 $0

1998 $140 $0

1999 $590 $0

2000 $730 -$220

2001 $750 $0

2002 $70 -$290

2003 $1210 $0

2004 $860 -$30

2005 $280 -$500

2006 $1240 $0

The average P/L of this trade is $708, the maximum P/L is $1,300, the minimum P/L is $70, while the

maximum drawdown is -$500. The initial margin is $1,148 and the maintainence margin is $850, which

means that at the maximum drawdown your investment is $1,350 (per contract). The holding period is

about 5 trading days only.

Acknowledgement

Once again, this research has been inspired by the monthly seasonal trades that Mr. Paul Kavanaugh at

PFG publishes.

Disclaimer

This research is for informational purposes only, and is not a recommendation to buy or sell any

securities mentioned. As always, past performance is no guarantee of future results!

Dr. Ernest P. Chan is a quantitative consultant who helps his clients implement automated, statistical

trading strategies using Matlab. His office is located in Toronto and can be reached through

www.epchan.com.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- FXCM Activetrader: User Guide To The Activetrader PlatformDocument51 pagesFXCM Activetrader: User Guide To The Activetrader Platformkaddour7108No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Echorouk 02 Apr 09 PDFDocument30 pagesEchorouk 02 Apr 09 PDFkaddour7108No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- High Frequency FX Trading:: Technology, Techniques and DataDocument4 pagesHigh Frequency FX Trading:: Technology, Techniques and Datakaddour7108No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- AC Notes2013 PDFDocument13 pagesAC Notes2013 PDFkaddour7108No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 040 Nancy MinshewDocument6 pages040 Nancy Minshewkaddour7108No ratings yet

- GEA Quick Reference GuideDocument2 pagesGEA Quick Reference Guidekaddour7108No ratings yet

- The Index Trading Course - FontanillsDocument432 pagesThe Index Trading Course - Fontanillskaddour7108100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Introduction To Algorithmic Trading Strategies: Pairs Trading by CointegrationDocument42 pagesIntroduction To Algorithmic Trading Strategies: Pairs Trading by Cointegrationkaddour7108No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Var PresDocument51 pagesVar Preskaddour7108No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Estimating A VAR - GretlDocument9 pagesEstimating A VAR - Gretlkaddour7108No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Spurious Regressions: RW y y V RW X X VDocument3 pagesSpurious Regressions: RW y y V RW X X Vkaddour7108No ratings yet

- A Whale in The Waters of Negative YieldsDocument2 pagesA Whale in The Waters of Negative Yieldskaddour7108No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 10 Reasons State Lotteries RuinDocument3 pages10 Reasons State Lotteries Ruinkaddour7108No ratings yet

- Tesla v. JohnsonDocument6 pagesTesla v. JohnsonDoctor ConspiracyNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Scenario Planning ToolDocument24 pagesScenario Planning Toolmohamed.khalidNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Case Studies On The Letters of CreditDocument3 pagesCase Studies On The Letters of Creditomi0855100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Introduction For UPSDocument19 pagesIntroduction For UPSteju_690% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Faulty Workmanship and Ensuing LossDocument4 pagesFaulty Workmanship and Ensuing Lossmichelle_b_griffinNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Dear Customer Welcome To JS Bank E-Statement !Document3 pagesDear Customer Welcome To JS Bank E-Statement !Murtaza AhmedNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Zambia in FiguresDocument24 pagesZambia in FiguresChola Mukanga100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- EntrepreneurshipDocument191 pagesEntrepreneurshipWacks Venzon50% (2)

- LoanDocument1 pageLoansuriya bhaiNo ratings yet

- Business Plan Pizza ShopDocument11 pagesBusiness Plan Pizza ShopPaulaBrinzeaNo ratings yet

- Chapter 7 Correction of Errors (II) TestDocument6 pagesChapter 7 Correction of Errors (II) Test陳韋佳No ratings yet

- Lecture 33434434313545Document10 pagesLecture 33434434313545Christelle Marie Aquino Beroña100% (3)

- CDR Mechanical Engineer 1 No SummaryDocument24 pagesCDR Mechanical Engineer 1 No SummaryZizo Awad100% (1)

- Management AccountingDocument304 pagesManagement AccountingRomi Anton100% (2)

- Grovy Alcove, JVC Dubai +971 4553 8725Document19 pagesGrovy Alcove, JVC Dubai +971 4553 8725SandeepNo ratings yet

- Stock Market Portfolio ProjectDocument3 pagesStock Market Portfolio ProjectTaquee MahmoodNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Sem-1 Syllabus Distribution 2021Document2 pagesSem-1 Syllabus Distribution 2021Kishan JhaNo ratings yet

- Tutorial - Ex20.2, 20.3 and 20.6 - SolutionsDocument2 pagesTutorial - Ex20.2, 20.3 and 20.6 - SolutionsCarson WongNo ratings yet

- CBOK 2015 Stakeholder Overview For Institutes - June 2014Document10 pagesCBOK 2015 Stakeholder Overview For Institutes - June 2014danielaNo ratings yet

- Leave Travel Concession (LTC) Rules: Office MemorandumDocument2 pagesLeave Travel Concession (LTC) Rules: Office Memorandumchintu_scribdNo ratings yet

- SBI ProjectDocument82 pagesSBI Projectchandan sharmaNo ratings yet

- CM CH 2 Product Costing SystemsDocument43 pagesCM CH 2 Product Costing SystemsAkuntansi Internasional 2016100% (1)

- Island Cruise Reflective PaperDocument4 pagesIsland Cruise Reflective PaperCarlos Carranza100% (1)

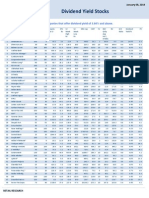

- High Dividend Yield StocksDocument3 pagesHigh Dividend Yield StockskaizenlifeNo ratings yet

- Introduction To Engro PakistanDocument15 pagesIntroduction To Engro Pakistanasfand yar waliNo ratings yet

- CHECKLISTDocument3 pagesCHECKLISTKalepu SridharNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Oneott Intertainment LTD.: Comments Date DeclarationDocument1 pageOneott Intertainment LTD.: Comments Date Declarationrajrajeshwari kulkarniNo ratings yet

- ADF BootCamp1Document407 pagesADF BootCamp1SivanagakrishnaNo ratings yet

- Booking Holidays Online: BBC Learning English 6 Minute EnglishDocument6 pagesBooking Holidays Online: BBC Learning English 6 Minute EnglishMonica. RicardoNo ratings yet

- Approved Employers - LahoreDocument15 pagesApproved Employers - Lahoreraheel97No ratings yet