Professional Documents

Culture Documents

2

Uploaded by

Magsaysay SouthCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2

Uploaded by

Magsaysay SouthCopyright:

Available Formats

Jorelle Company’s financial staff has been requested to review a proposed investment in new capital equipment.

Applicable financial data is presented below. There will be no salvage value at the end of the investment’s life and,

due to realistic depreciation practices, it is estimated that the salvage value and net book value are equal at the end of

each year. All cash flows are assumed to take place at the end of each year. For investment proposal, Jorelle uses a

12% after-tax target rate of return.

Investment Proposal

Purchase Cost Annual Net After-Tax Annual Net Income

Year and Book Value Cash Flows

0 $250,000 $ 0. $ 0.

1 168,000 120,000 35,000

2 100,000 108,000 39,000

3 50,000 96,000 43,000

4 18,000 84,000 47,000

5 0 72,000 51,000

Year P.V. of $1 Received P.V. of an Annuity of $1.00 Received

at the End of Each Period at the End of Each Period

1 0.89 0.89

2 0.80 1.69

3 0.71 2.40

4 0.64 3.04

5 0.57 3.61

6 0.51 4.12

169. The accounting rate of return for the investment proposal is

a. 12.0% c. 28.0%

b. 17.2% d. 34.4%

170. The net present value for the investment proposal is

a. $106,160 c. $356,160

b. $(97,970) d. $96,560

171. The traditional payback period for the investment proposal is

a. Over 5 years. c. 1.65 years.

b. 2.23 years. d. 2.83 years

Questions 86 through 88 are based on the following information. CIA 0593 IV-22 to 24

A company purchased a new machine to stamp the company logo on its products. The cost of the machine was

$250,000, and it has an estimated useful life of 5 years with an expected salvage value at the end of its useful life of

$50,000. The company uses the straight-line depreciation method.

The new machine is expected to save $125,000 annually in operating costs. The company’s tax rate is 40%, and it

uses a 10% discount rate to evaluate capital expenditure.

Year Present Value of $1 Present Value of an Ordinary Annuity of $1

1 .909 .909

2 .826 1.736

3 .751 2.487

4 .683 3.170

5 .621 3.791

You might also like

- CHAPTER 11 Without AnswerDocument3 pagesCHAPTER 11 Without Answerlenaka0% (1)

- Quiz#1 MaDocument5 pagesQuiz#1 Marayjoshua12No ratings yet

- RAMON MAGSAYSAY TECHNOLOGICAL UNIVERSITY MANAGEMENT ADVISORY SERVICESDocument4 pagesRAMON MAGSAYSAY TECHNOLOGICAL UNIVERSITY MANAGEMENT ADVISORY SERVICESPrincess Claris ArauctoNo ratings yet

- Multiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Document3 pagesMultiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Kimmy ShawwyNo ratings yet

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- CH BsaDocument1 pageCH BsaLovErsMaeBasergoNo ratings yet

- 10 Responsibility Accounting Live DiscussionDocument4 pages10 Responsibility Accounting Live DiscussionLee SuarezNo ratings yet

- Fitz Music Company Financial Accounting 2 ReviewDocument5 pagesFitz Music Company Financial Accounting 2 ReviewFitz Gerald BalbaNo ratings yet

- Toa 333-1Document1 pageToa 333-1CPANo ratings yet

- Notes Receivable Part 1Document2 pagesNotes Receivable Part 1Crisangel de LeonNo ratings yet

- Reviewer Incremental Analysis 1Document5 pagesReviewer Incremental Analysis 1Shaira Rehj RiveraNo ratings yet

- Cash flow questions on investments, convertible bonds, direct method, and statement preparationDocument5 pagesCash flow questions on investments, convertible bonds, direct method, and statement preparationAsif IqbalNo ratings yet

- Quiz 1 P2 FinmanDocument3 pagesQuiz 1 P2 FinmanRochelle Joyce CosmeNo ratings yet

- Working Capital Quiz - Optimize Cash and Reduce CostsDocument3 pagesWorking Capital Quiz - Optimize Cash and Reduce CostsVincent Larrie MoldezNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- Absorption vs Variable Costing Activity 2Document2 pagesAbsorption vs Variable Costing Activity 2Gill Riguera100% (1)

- PRACTICAL ACCOUNTING 1 Part 2Document9 pagesPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNo ratings yet

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Document7 pagesRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNo ratings yet

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosNo ratings yet

- Quiz InvestmentsDocument2 pagesQuiz InvestmentsstillwinmsNo ratings yet

- STRATEGIC COST MANAGEMENT: RELEVANT COSTING DECISIONSDocument6 pagesSTRATEGIC COST MANAGEMENT: RELEVANT COSTING DECISIONSMon Ram0% (1)

- This Study Resource Was: Quiz On Receivable FinancingDocument3 pagesThis Study Resource Was: Quiz On Receivable FinancingKez MaxNo ratings yet

- MAS 7 Exercises For UploadDocument9 pagesMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNo ratings yet

- Shareholder'S Equity Multiple Choice QuestionsDocument7 pagesShareholder'S Equity Multiple Choice QuestionsRachel Rivera50% (2)

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Book 7Document2 pagesBook 7Actg SolmanNo ratings yet

- The Amount To Be Capitalized by Lessee To Right of Use AssetDocument1 pageThe Amount To Be Capitalized by Lessee To Right of Use Assetmax pNo ratings yet

- Intermediate Accounting Exam 2 ReviewDocument1 pageIntermediate Accounting Exam 2 ReviewBLACKPINKLisaRoseJisooJennieNo ratings yet

- Fa2prob3 1Document3 pagesFa2prob3 1jayNo ratings yet

- Cost AccountingDocument44 pagesCost Accountingarianas0% (1)

- Responsibility Accounting and Reporting: Multiple ChoiceDocument23 pagesResponsibility Accounting and Reporting: Multiple ChoiceARISNo ratings yet

- ToaDocument5 pagesToaGelyn CruzNo ratings yet

- P 1Document27 pagesP 1Mark Lorenz SarionNo ratings yet

- Fa 1 CompreDocument16 pagesFa 1 CompreTwainNo ratings yet

- Pre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersDocument10 pagesPre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersReve Joy Eco IsagaNo ratings yet

- Far Eastern University - Makati: Discussion ProblemsDocument2 pagesFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNo ratings yet

- N. Cruz-Course Material For Strategic Cost ManagementDocument134 pagesN. Cruz-Course Material For Strategic Cost ManagementEmmanuel VillafuerteNo ratings yet

- Investment in Associate Problems AnswersDocument9 pagesInvestment in Associate Problems AnswersMytha Isabel SalesNo ratings yet

- MODULE 2 CVP AnalysisDocument8 pagesMODULE 2 CVP Analysissharielles /No ratings yet

- Stock Edited PDFDocument29 pagesStock Edited PDFCzarina PanganibanNo ratings yet

- Vertical Analysis To Financial StatementsDocument8 pagesVertical Analysis To Financial StatementsumeshNo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- 208 BDocument10 pages208 BXulian ChanNo ratings yet

- CSI Inc's Investment Account AuditDocument4 pagesCSI Inc's Investment Account Auditandrei jude matullanoNo ratings yet

- Short-Term Budgeting: (Problem 1)Document18 pagesShort-Term Budgeting: (Problem 1)princess bubblegumNo ratings yet

- Group of 5: Key Accounting Rules for LeasesDocument3 pagesGroup of 5: Key Accounting Rules for LeasesGarp BarrocaNo ratings yet

- First Preboard FAR ReviewDocument26 pagesFirst Preboard FAR Reviewlois martinNo ratings yet

- COST ACCOUNTING 1 8 Final Allocation of Joint CostsDocument15 pagesCOST ACCOUNTING 1 8 Final Allocation of Joint CostsZoe MendozaNo ratings yet

- Prelim Exam - Special TopicsDocument9 pagesPrelim Exam - Special TopicsCaelah Jamie TubleNo ratings yet

- Current Liabilities and ProvisionsDocument12 pagesCurrent Liabilities and ProvisionsRinkashizu TokimimotakuNo ratings yet

- Analyze Financial StatementsDocument33 pagesAnalyze Financial StatementsJi WonNo ratings yet

- Logos Are Special. They Are Not Just A Combination of Shapes, Text, and Graphics. They Tell Stories.Document3 pagesLogos Are Special. They Are Not Just A Combination of Shapes, Text, and Graphics. They Tell Stories.Donnalyn TablacNo ratings yet

- Homework on investment property analysisDocument2 pagesHomework on investment property analysisCharles TuazonNo ratings yet

- MAS Handout-Relevant Costing PDFDocument5 pagesMAS Handout-Relevant Costing PDFDivine VictoriaNo ratings yet

- MS03 09 Capital Budgeting Part 2 EncryptedDocument6 pagesMS03 09 Capital Budgeting Part 2 EncryptedKate Crystel reyesNo ratings yet

- Peer Mentoring PostTestDocument7 pagesPeer Mentoring PostTestronnelNo ratings yet

- Calculate payback period, IRR, and NPV for stamping machine investmentDocument1 pageCalculate payback period, IRR, and NPV for stamping machine investmentMagsaysay SouthNo ratings yet

- 8Document1 page8Magsaysay SouthNo ratings yet

- Payback Period Calculation for $400K Machine InvestmentDocument1 pagePayback Period Calculation for $400K Machine InvestmentMagsaysay SouthNo ratings yet

- 25Document1 page25Magsaysay SouthNo ratings yet

- 24Document1 page24Magsaysay SouthNo ratings yet

- Marsh Company investment project analysisDocument1 pageMarsh Company investment project analysisMagsaysay SouthNo ratings yet

- With Excess CapacityDocument1 pageWith Excess CapacityMagsaysay SouthNo ratings yet

- 16Document1 page16Magsaysay SouthNo ratings yet

- 20Document1 page20Magsaysay SouthNo ratings yet

- 19Document1 page19Magsaysay SouthNo ratings yet

- 23Document1 page23Magsaysay SouthNo ratings yet

- Davy Division Minimum Transfer PriceDocument1 pageDavy Division Minimum Transfer PriceMagsaysay SouthNo ratings yet

- 18Document1 page18Magsaysay SouthNo ratings yet

- 15Document1 page15Magsaysay SouthNo ratings yet

- 14Document1 page14Magsaysay SouthNo ratings yet

- 19Document1 page19Magsaysay SouthNo ratings yet

- 17Document1 page17Magsaysay SouthNo ratings yet

- 18Document1 page18Magsaysay SouthNo ratings yet

- 12Document1 page12Magsaysay SouthNo ratings yet

- 9Document1 page9Magsaysay SouthNo ratings yet

- 13Document1 page13Magsaysay South100% (1)

- Payback Period Calculation for $400K Machine InvestmentDocument1 pagePayback Period Calculation for $400K Machine InvestmentMagsaysay SouthNo ratings yet

- 6Document1 page6Magsaysay SouthNo ratings yet

- 7Document1 page7Magsaysay SouthNo ratings yet

- 8Document1 page8Magsaysay SouthNo ratings yet

- 5Document1 page5Magsaysay SouthNo ratings yet

- 6Document1 page6Magsaysay SouthNo ratings yet

- Revenue CycleDocument3 pagesRevenue CycleMagsaysay SouthNo ratings yet

- Expenditure CycleDocument12 pagesExpenditure CycleMagsaysay SouthNo ratings yet

- Calculate payback period, IRR, and NPV for stamping machine investmentDocument1 pageCalculate payback period, IRR, and NPV for stamping machine investmentMagsaysay SouthNo ratings yet

- 1Document1 page1Magsaysay SouthNo ratings yet

- Revenue CycleDocument8 pagesRevenue CycleMagsaysay SouthNo ratings yet

- Financial Management: Page 1 of 7Document7 pagesFinancial Management: Page 1 of 7cima2k15No ratings yet

- Consumer Preference and Perception of Online Shopping for Branded ClothesDocument70 pagesConsumer Preference and Perception of Online Shopping for Branded ClothesABHISHEK SINGHNo ratings yet

- Sales Management NotesDocument8 pagesSales Management NotesDisha MathurNo ratings yet

- Internship Report of M.Shahzad PDFDocument64 pagesInternship Report of M.Shahzad PDFinzamamalam515No ratings yet

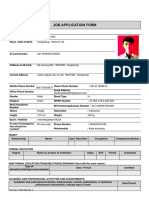

- Job Application FormDocument3 pagesJob Application Formdodi maulanaNo ratings yet

- The Metrocentre Partnership Report and Financial Statements For The Year Ended 31 December 2019Document37 pagesThe Metrocentre Partnership Report and Financial Statements For The Year Ended 31 December 2019Roshan PriyadarshiNo ratings yet

- Integrated Approach of Material ManagementDocument14 pagesIntegrated Approach of Material ManagementShashidhar KasturiNo ratings yet

- Blockchain's Smart Contracts: Driving The Next Wave of Innovation Across Manufacturing Value ChainsDocument10 pagesBlockchain's Smart Contracts: Driving The Next Wave of Innovation Across Manufacturing Value ChainsCognizant50% (2)

- Vino Resume BIM Manager NDocument3 pagesVino Resume BIM Manager NvinoratheeshNo ratings yet

- Case Pantene FinalDocument6 pagesCase Pantene Finalapi-241899000100% (1)

- Mock PDFDocument26 pagesMock PDFCamiNo ratings yet

- Types of Business Organizations (Principles of Management)Document5 pagesTypes of Business Organizations (Principles of Management)Mushima Tours & TransfersNo ratings yet

- Session 1Document44 pagesSession 1Rajveer deepNo ratings yet

- IMS PolicyDocument1 pageIMS PolicySandeep MazumdarNo ratings yet

- General Purchasing ProcedureDocument20 pagesGeneral Purchasing ProcedureHARIKRISHNAN VENUGOPALANNo ratings yet

- Jde Iot Orchestrator 2889921 PDFDocument3 pagesJde Iot Orchestrator 2889921 PDFkcmkcmNo ratings yet

- Analysis ReportDocument5 pagesAnalysis ReportAsif AliNo ratings yet

- Chief Value Officer BrochureDocument1 pageChief Value Officer Brochuremadhu pilaiNo ratings yet

- BabaempDocument91 pagesBabaempshravan AnvekarNo ratings yet

- Fortune 500 ListDocument38 pagesFortune 500 ListSrinivas Shivanathuni33% (3)

- Organisational Study of Hyundai Motors" (Desk Reserach During Covid-19 Pandemic)Document60 pagesOrganisational Study of Hyundai Motors" (Desk Reserach During Covid-19 Pandemic)Nischal PrasannaNo ratings yet

- Profit Maximization Using Total Cost and Total ... - Chegg - Com6Document3 pagesProfit Maximization Using Total Cost and Total ... - Chegg - Com6BLESSEDNo ratings yet

- Project Management PolicyDocument4 pagesProject Management PolicyCarlos Andres Espinosa PerezNo ratings yet

- Result Analysis For Revenue ProjectsDocument12 pagesResult Analysis For Revenue ProjectssudharpNo ratings yet

- 06.06.2023 Duzenlendi MT-103 - 202Document2 pages06.06.2023 Duzenlendi MT-103 - 202Murat BıçakNo ratings yet

- This Study Resource Was: Biological Assets Question 21-1 Multiple Choice (PAS 41)Document6 pagesThis Study Resource Was: Biological Assets Question 21-1 Multiple Choice (PAS 41)Alexandra Nicole IsaacNo ratings yet

- Pooja KukrejaDocument97 pagesPooja Kukrejachandershekhar0% (1)

- Just in Time Manufacturing in The Indian Automobile IndustryDocument7 pagesJust in Time Manufacturing in The Indian Automobile IndustryVinod Kumar Vundela100% (1)

- Marketing PlanDocument30 pagesMarketing PlanMinhas Khan100% (1)

- Auto Cash Rule SetDocument4 pagesAuto Cash Rule SetSingh Anish K.No ratings yet