Professional Documents

Culture Documents

MT 64 Great Bear Markets

Uploaded by

Garo OhanogluCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MT 64 Great Bear Markets

Uploaded by

Garo OhanogluCopyright:

Available Formats

26 Issue 64 – May 2009 MARKET TECHNICIAN

Great bear markets

By Peter Beuttell

There have been few Great Bear Markets (GBMs) in the last 100 Markets. It did not see losses greater than 60%, or last the 900-1,000

years if emerging indices are excluded. The first four listed below days of the others (it was down 48% in 663 days). Similarly the UK

were examined in articles that were published in the Market lost “only” 50% in the early 1930’s. The initial phase of the Dollar

Technician in 2001, 2002 and 2003 because of both the lengthy bear market of 1985-95 is worth a mention, however. Although the

advances and the investor psychology which preceded their tops. Dollar’s 42% loss through to 31st December 1987 does not qualify it

Whilst these original four did not comprise a great statistical either, the decline lasted 1,039 days (exactly as long as the 1929-32

sample, the contention of the analysis in 2001 was that these bear Crash), and it then effectively traded almost sideways for another

trends all had a fairly similar duration, and that might be useful in nine years. And for an Elliottician, one fascinating aspect to the

helping pin-point the eventual low of that bear trend. The table is the % declines – note their proximity to the Fibonacci ratios

proposition was not so much that it would turn out to be a Great of .854, .786, .7236, .666 and .618. (Barton Biggs actually went so far

Bear Market, or that a low would occur in a given time zone, but as to publish a paper entitled Is God a Mathematician?).

that if markets were still falling at

a particular point in time,

investors should be aware of

historical precedent and be

looking for signs that a low might

be occurring.

The table below sets out the extent

and duration of some of the 20th

Century’s worst bear markets. In

the case of two of them, Gold and

Japan, the “Great” section was

actually part of a larger secular

trend. This table includes only the

initial phase. To the original four,

we have added NASDAQ and the

DAX from their 2000 highs, the

latter because it lasted longer than

the expected 1,039 days. The CAC

from that period has been

included, because its duration

varied from the DAX’s.

Note that the severe US bear

market of 1973/74 does not

qualify as one of the Great Bear

Index Closing Closing % Decline High Date Low Date Duration

I-day Peak I-day Low in Days

1. S&P 500 31.86 4.41 86.1 3.9.29 8.7.32 1,039

2. UK All-Share 228.18 61.92 72.9 1.5.72 13.12.74 957

3. Gold 880 296 66.4 18.1.80 21.6.82 885

4. Topix 2,885 1,102 61.8 18.12.89 18.8.92 973

5. NASDAQ 5,133 1,108 78.4 10.3.00 10.10.02 945

6. DAX 30 8,136 2,189 73.1 7.3.00 12.3.03 1,102

7. CAC40 6,945 2,401 65.4 4.9.00 12.3.03 920

MARKET TECHNICIAN Issue 64 – May 2009 27

Using these time periods to project forward

from 24th March 2000 (MSCI World Index

high), the following emerged: + 885 days =

2nd September 2002; + 957 days = 6th

November 2002; + 973 days = 22nd

November 2002; + 1,039 days = 27th January

2003.

Clearly Autumn 2002, then a year out, was

the period to watch. The US indices

bottomed on 10th October. It later dawned

that, since the FT World Index, France, the UK

All Share Index and the NYSE Composite

peaked in early September 2000, that there

could be a second, later, bottoming period of

the last week of March through the first

week of April. The actual second low came

on 12th March, so despite having only a

small sample of 4 previous GBM’s to work

with, the technique did not do badly.

If the time durations for the seven Great Bear

Markets are now added to the 11th October

2007 high in the S&P 500, the time window

which results is broad – 14th March to 18th

October 2010, although the 3-cluster at 920-

957 days would suggest 18th April to 25th

May.

The charts on the front page and page 28 of

this issue illustrate all seven GBMs referred to

in the table and the S&P’s current position.

Because the S&P traded below all but one of

these profiles as of the March 2009 low, this

too could easily turn out to be a GBM. In

addition, my very long-term wave count

pairs this decade with 1929-32 in pattern

terms. Since that was the greatest GBM, it is

logical that its sibling could also produce

another one.

The March low coincided with an increasingly

bullish configuration in terms of Elliott and the

standard array of indicators. Some of the same

early bull market signals which were visible 6

years ago have begun to appear again. Since

GBM analysis warns that there is still the risk

that the S&P could trade below 602 (a 61.8%

fall from the 1,576 high) at some point

between 14th March and 18th October 2010,

it will be interesting to watch the

development of this rally with that as a

backdrop. The wave patterns of the S&P 500,

NYSE Composite and NASDAQ during this

decade have all been different, and there are a

number of interesting parallels in the bond

and commodity markets, providing clues as to

whether this will indeed be another GBM, but

that will have to wait for greater clarity and

another article.

Peter Beuttell is the Director of MTS Research

Ltd

28 Issue 64 – May 2009 MARKET TECHNICIAN

You might also like

- Business Adventures: Twelve Classic Tales from the World of Wall StreetFrom EverandBusiness Adventures: Twelve Classic Tales from the World of Wall StreetNo ratings yet

- The Case for Long-Term Value Investing: A guide to the data and strategies that drive stock market successFrom EverandThe Case for Long-Term Value Investing: A guide to the data and strategies that drive stock market successNo ratings yet

- Elliott Wave Theorist September 2020Document13 pagesElliott Wave Theorist September 2020Nazerrul Hazwan KamarudinNo ratings yet

- Financial Forecast September 2020Document22 pagesFinancial Forecast September 2020Nazerrul Hazwan KamarudinNo ratings yet

- The Great Margin CallDocument33 pagesThe Great Margin CallJock WolfhardNo ratings yet

- Beringer Weinstock Group - TA SignalsDocument33 pagesBeringer Weinstock Group - TA SignalsYagnesh PatelNo ratings yet

- CIRSES 1987 Anita NikamDocument34 pagesCIRSES 1987 Anita Nikamhunalulu100% (2)

- Expiration-Day Effects of The All Ordinaries Share Price Index Futures: Empirical Evidence and Alternative Settlement ProceduresDocument36 pagesExpiration-Day Effects of The All Ordinaries Share Price Index Futures: Empirical Evidence and Alternative Settlement ProceduresVasantha NaikNo ratings yet

- Can The Bull Still Ride OnDocument2 pagesCan The Bull Still Ride OnJustin OnuekwusiNo ratings yet

- Stock Cycles Forecast: First Week in August, or September?Document14 pagesStock Cycles Forecast: First Week in August, or September?w_fib75% (4)

- 1987 Zero HedgeDocument9 pages1987 Zero Hedgeeliforu100% (1)

- KitchinDocument8 pagesKitchinsport.kacperNo ratings yet

- Stock Market Charts You Never Saw - SSRN-id3050736Document54 pagesStock Market Charts You Never Saw - SSRN-id3050736Alexis TocquevilleNo ratings yet

- Stock Market CrashDocument7 pagesStock Market CrashDorjee TseringNo ratings yet

- Equities Forecast: Q2 2020: Peter Hanks, Analyst Paul Robinson, StrategistDocument10 pagesEquities Forecast: Q2 2020: Peter Hanks, Analyst Paul Robinson, StrategistBob BlythNo ratings yet

- Á Trends For Long Time Frames, Trends For Medium Time FramesDocument56 pagesÁ Trends For Long Time Frames, Trends For Medium Time FramesOzina LopesNo ratings yet

- Charts Worth Saving For The Next 25-Years: Special ReportDocument12 pagesCharts Worth Saving For The Next 25-Years: Special Reportpangsai3000No ratings yet

- Hong Kong Feb 2003 FinalDocument11 pagesHong Kong Feb 2003 FinalDrago DragicNo ratings yet

- A Second Tech BubbleDocument14 pagesA Second Tech BubbleWuU2345100% (1)

- Cambria Tactical Asset AllocationDocument48 pagesCambria Tactical Asset Allocationemirav2No ratings yet

- Art 08Document24 pagesArt 08Karla LobatoNo ratings yet

- 2022 09GMPDocument61 pages2022 09GMPLuis MoscosoNo ratings yet

- August 022010 PostsDocument150 pagesAugust 022010 PostsAlbert L. PeiaNo ratings yet

- TASC CompoundPivotsDocument11 pagesTASC CompoundPivotsAnkit KabraNo ratings yet

- INSIIDETrack SRGrand Illusionexcerpt 1Document3 pagesINSIIDETrack SRGrand Illusionexcerpt 1Daniel SebastianNo ratings yet

- TS FORECASTS Quarter Didgest - Apr2020Document49 pagesTS FORECASTS Quarter Didgest - Apr2020Genesis TradingNo ratings yet

- Market Report 3-9-2009Document3 pagesMarket Report 3-9-2009cmdwightNo ratings yet

- Dow Jones 30Document42 pagesDow Jones 30Kavitha ReddyNo ratings yet

- The Special K: Trends, Triggers, and ReversalsDocument5 pagesThe Special K: Trends, Triggers, and ReversalsVishvanath JawaleNo ratings yet

- Leuthold Group - From August 2015Document10 pagesLeuthold Group - From August 2015ZerohedgeNo ratings yet

- WEEK 43 - October 26 To 29, 2010Document2 pagesWEEK 43 - October 26 To 29, 2010JC CalaycayNo ratings yet

- Thesun 2009-08-26 Page15 Market SummaryDocument1 pageThesun 2009-08-26 Page15 Market SummaryImpulsive collectorNo ratings yet

- CME Group Equity Index Futures Quarterly Roll Summary: Exhibit 1Document3 pagesCME Group Equity Index Futures Quarterly Roll Summary: Exhibit 1Jose CarlosNo ratings yet

- 2008 Bear Market Analysis Inv Perp 1969-2007Document5 pages2008 Bear Market Analysis Inv Perp 1969-2007arfwayarryNo ratings yet

- JUL 02 DanskeDailyDocument4 pagesJUL 02 DanskeDailyMiir ViirNo ratings yet

- CME Group Report On The Flash CrashDocument6 pagesCME Group Report On The Flash CrashDealBook100% (1)

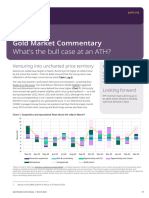

- Gold Market Commentary March 2024Document6 pagesGold Market Commentary March 2024LinzerdNo ratings yet

- The Performance of Japanese Seasoned Equity Offerings, 1971-1992Document31 pagesThe Performance of Japanese Seasoned Equity Offerings, 1971-1992gogayin869No ratings yet

- Bubble Bubble: Root RootDocument2 pagesBubble Bubble: Root RootAnonymous Q7FbhF5ZGpNo ratings yet

- State of Currency Derivatives Trading in India: Futures Vs ForwardsDocument7 pagesState of Currency Derivatives Trading in India: Futures Vs ForwardsanjanigolchhaNo ratings yet

- The Great Depression is-LM ModelDocument4 pagesThe Great Depression is-LM ModelRuhaan RajputNo ratings yet

- Lesson From 1930 2Document33 pagesLesson From 1930 2Wendy GarcíaNo ratings yet

- 2020 07GMPb PDFDocument43 pages2020 07GMPb PDFImre GamsNo ratings yet

- SP500 February 24thDocument11 pagesSP500 February 24thJohn doNo ratings yet

- Stock Market Crashes in 2007-2009: Were We Able To Predict Them?Document35 pagesStock Market Crashes in 2007-2009: Were We Able To Predict Them?rtfirefly168No ratings yet

- PHP Zo IpfzDocument5 pagesPHP Zo Ipfzfred607No ratings yet

- Resilience Three Lessons From The Financial Crisis Speech by Dave RamsdenDocument13 pagesResilience Three Lessons From The Financial Crisis Speech by Dave RamsdenHao WangNo ratings yet

- Financial Markets Predict Armageddon.Document16 pagesFinancial Markets Predict Armageddon.alemis9No ratings yet

- Knut Mork (1994)Document26 pagesKnut Mork (1994)zati azizNo ratings yet

- Whither The Secular Trend of Equities?: What Is A Secular Peak?Document5 pagesWhither The Secular Trend of Equities?: What Is A Secular Peak?Vishal PatilNo ratings yet

- EC0 463 International Monetary Relations Professor Malamud BEH 502 895 - 3294 Email: WebsiteDocument13 pagesEC0 463 International Monetary Relations Professor Malamud BEH 502 895 - 3294 Email: WebsitekkanirajNo ratings yet

- Dow Jones Industrial Average Brochure PDFDocument4 pagesDow Jones Industrial Average Brochure PDFsofia goicocheaNo ratings yet

- The Early History of Stock Market IndicesDocument29 pagesThe Early History of Stock Market IndicesTôThànhPhongNo ratings yet

- IFR Magazine March 31 2018Document92 pagesIFR Magazine March 31 2018santoshcal3183No ratings yet

- The Truth About TimingDocument2 pagesThe Truth About TimingEvandro PinhoNo ratings yet

- General Market Update - July 2019Document7 pagesGeneral Market Update - July 2019Anonymous kOLTDa6No ratings yet

- 1908GMPb PDFDocument41 pages1908GMPb PDFKirillNo ratings yet

- The Relationship Between Price in Futures Markets: VariabilityDocument14 pagesThe Relationship Between Price in Futures Markets: VariabilityGeorge máximoNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- The Wizards of Wall Street: Business Adventures, Once in Golconda, and The Go-Go YearsFrom EverandThe Wizards of Wall Street: Business Adventures, Once in Golconda, and The Go-Go YearsNo ratings yet

- GANN WD - (1931) The Human BodyDocument1 pageGANN WD - (1931) The Human BodyAjay KukrejaNo ratings yet

- How To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersDocument279 pagesHow To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersAnuj Saxena87% (99)

- SNP 101619Document36 pagesSNP 101619Garo Ohanoglu100% (1)

- WINNER: Trading Software $1000 WINNER: Trading Software $500Document11 pagesWINNER: Trading Software $1000 WINNER: Trading Software $500Garo OhanogluNo ratings yet

- SPX Ffact SheetDocument2 pagesSPX Ffact SheetGaro OhanogluNo ratings yet

- 14 Welcome To The United States A Guide For New Immigrants m-618Document116 pages14 Welcome To The United States A Guide For New Immigrants m-618api-309082881No ratings yet

- Super Trader Tactics For TRIPLE-DIGIT RETURNSDocument22 pagesSuper Trader Tactics For TRIPLE-DIGIT RETURNSjdalvaran85% (20)

- The VXX Trading SystemDocument19 pagesThe VXX Trading SystemobrocofNo ratings yet

- DT Ebook Futures-OptionsStrategyGuide PDFDocument69 pagesDT Ebook Futures-OptionsStrategyGuide PDFGaro OhanogluNo ratings yet

- HarfordDocument13 pagesHarfordGaro OhanogluNo ratings yet

- Irregular Verb ListDocument5 pagesIrregular Verb ListDaniella DanaNo ratings yet

- Pitchfork Primer ManualDocument110 pagesPitchfork Primer Manualpaparock3475% (4)

- 004-Japanese Candlestick Sakata MethodDocument15 pages004-Japanese Candlestick Sakata MethodMohd LuqmanulHakim Bin Rosli100% (2)

- Big Banks Strategy PDFDocument18 pagesBig Banks Strategy PDFGaro Ohanoglu100% (1)

- Newsletter-Oct 201224182 PDFDocument4 pagesNewsletter-Oct 201224182 PDFGaro OhanogluNo ratings yet

- Profiting With Pivot Based MasDocument50 pagesProfiting With Pivot Based Masbebehui100% (13)

- Weekly Options Digital Guide PDFDocument48 pagesWeekly Options Digital Guide PDFGaro Ohanoglu100% (4)

- The Basics: Introduction To Options Part I of IIIDocument28 pagesThe Basics: Introduction To Options Part I of IIIGaro OhanogluNo ratings yet

- ROI Report Feb 2014 PDFDocument12 pagesROI Report Feb 2014 PDFGaro OhanogluNo ratings yet

- Language in Use Beginner Tests PDFDocument31 pagesLanguage in Use Beginner Tests PDFRosa Beatriz Cantero DominguezNo ratings yet

- Introduction To Elliott Wave Fibonacci Spread TradingDocument164 pagesIntroduction To Elliott Wave Fibonacci Spread Tradingscribbug100% (2)

- When To Exit GuideDocument24 pagesWhen To Exit GuideGaro OhanogluNo ratings yet

- Performance Analysis of CBOE S&P 500 Options Selling IndicesDocument23 pagesPerformance Analysis of CBOE S&P 500 Options Selling IndicesGaro OhanogluNo ratings yet

- 61 - 2004 Winter-Spring PDFDocument25 pages61 - 2004 Winter-Spring PDFGaro Ohanoglu100% (1)

- FSC From Paper To Virtual and Symposium Series Enhanced FullDocument46 pagesFSC From Paper To Virtual and Symposium Series Enhanced FullGaro OhanogluNo ratings yet

- Performance Analysis of CBOE S&P 500 Options Selling IndicesDocument23 pagesPerformance Analysis of CBOE S&P 500 Options Selling IndicesGaro OhanogluNo ratings yet

- McMaster, Gavin - Volatility Trading Made Easy - Effective Strategies To Survive Severe Market Swings 2013Document37 pagesMcMaster, Gavin - Volatility Trading Made Easy - Effective Strategies To Survive Severe Market Swings 2013Mark Holfeltz100% (3)

- When To Exit GuideDocument24 pagesWhen To Exit GuideGaro OhanogluNo ratings yet

- The Basics: Introduction To Options Part I of IIIDocument28 pagesThe Basics: Introduction To Options Part I of IIIGaro OhanogluNo ratings yet

- Special Update 2018 02 06 I Am in Wall Street LTD PDFDocument8 pagesSpecial Update 2018 02 06 I Am in Wall Street LTD PDFGaro OhanogluNo ratings yet

- Executive Shirt CompanyDocument9 pagesExecutive Shirt CompanyAshish Adike0% (1)

- Klyde Warren Park, Dallas, TX: Urban Design Literature Study by Suren Mahant 10008Document24 pagesKlyde Warren Park, Dallas, TX: Urban Design Literature Study by Suren Mahant 10008coolNo ratings yet

- 1022 2021Document15 pages1022 2021nfk roeNo ratings yet

- Path BrochureDocument2 pagesPath Brochures.chabot4130No ratings yet

- Company Profile PT BTR 2022 - 220611 - 085254 - 220707 - 113639Document20 pagesCompany Profile PT BTR 2022 - 220611 - 085254 - 220707 - 11363902171513No ratings yet

- Municipality Province Quezon Calabarzon Philippines Manila LucenaDocument6 pagesMunicipality Province Quezon Calabarzon Philippines Manila LucenaJensen Ryan LimNo ratings yet

- Haier CompanyDocument11 pagesHaier CompanyPriyanka Kaveria0% (1)

- A Critical Analysis On The Role of The Chinese in The Development of Philippine EconomyDocument5 pagesA Critical Analysis On The Role of The Chinese in The Development of Philippine EconomyAlexis0% (1)

- Network HospitalDocument2,271 pagesNetwork HospitalNamanNo ratings yet

- André Gorz Autonomy and Equity in The Post-Industrial AgeDocument14 pagesAndré Gorz Autonomy and Equity in The Post-Industrial Ageademirpolat5168No ratings yet

- PT SejahteraDocument2 pagesPT Sejahtera202010415109 ADITYA FIRNANDONo ratings yet

- Lucky - Financial InclusionDocument128 pagesLucky - Financial InclusionDinesh Nayak100% (1)

- Saturn in LibraDocument13 pagesSaturn in Librasands109No ratings yet

- Chenglong Motor Dongfeng Liuzhou Co LTD User ManualDocument280 pagesChenglong Motor Dongfeng Liuzhou Co LTD User ManualalindNo ratings yet

- Case C-132/88 Commission V GreeceDocument7 pagesCase C-132/88 Commission V GreeceJane Chan Ee NinNo ratings yet

- BillDocument1 pageBillZeeshan Haider RizviNo ratings yet

- Full Paper PDFDocument10 pagesFull Paper PDFSuhasini DurveNo ratings yet

- The History of The Spanish EmpireDocument2 pagesThe History of The Spanish Empireapi-227795658No ratings yet

- Global Finance Graduate Programme, Novo NordiskDocument1 pageGlobal Finance Graduate Programme, Novo NordiskMylinh VuNo ratings yet

- LISTDocument1 pageLISTHannahLaneGarciaNo ratings yet

- Planning and Economic DevelopmentDocument9 pagesPlanning and Economic DevelopmentGurleen KaurNo ratings yet

- Unclaimed Balances LawDocument17 pagesUnclaimed Balances LawFritchel Mae QuicosNo ratings yet

- A Research Report ON "Perception of Consumer Towards Online Food Delivery App"Document43 pagesA Research Report ON "Perception of Consumer Towards Online Food Delivery App"DEEPAKNo ratings yet

- Jarandeshwar Sugar 31120Document1 pageJarandeshwar Sugar 31120chief engineer CommercialNo ratings yet

- BudgetingDocument5 pagesBudgetingKevin James Sedurifa Oledan100% (1)

- FactoringDocument36 pagesFactoringmaninder1419699No ratings yet

- Trade Cycles - Meaning and PhasesDocument11 pagesTrade Cycles - Meaning and Phasesprof_akvchary56% (9)

- DebtDocument68 pagesDebttalupurumNo ratings yet

- Microfinance Sector in GhanaDocument20 pagesMicrofinance Sector in GhanaSandeep YadNo ratings yet

- Money Matters VocabularyDocument16 pagesMoney Matters VocabularySvetlana TselishchevaNo ratings yet