Professional Documents

Culture Documents

Apr 2018 Ally Bank Statement

Uploaded by

Anonymous rFSoJmsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apr 2018 Ally Bank Statement

Uploaded by

Anonymous rFSoJmsCopyright:

Available Formats

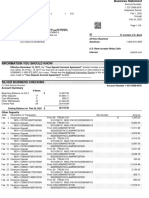

COMBINED CUST OMER ST AT EMENT

Ally Bank Statement Date

P.O. Box 2554 04/05/2018

Cranberry Twp, PA 16066 Page 1

275701-01-04

Customer Care Information

Toll Free 877-247-ALLY (2559)

www.ally.com

275701/903523//75701/0000/000000/303351 000 01 000000

RAFAEL E ARENAS

VILLA UNIVERSITARIA

83 CALLE RUM

AGUADILLA PR 00603-6786

CUSTOMER STATEMENT

Account Name Account Number Beginning Balance Ending Balance

Money Market Savings xxxxxx7583 $4,082.88 $5,467.18

Total Account Balances: $4,082.88 $5,467.18

If you only have a Certificate of Deposit(CD) account with us, you will receive a quarterly statement. If you have a

savings or checking account with us, then we will make your statement available for all of your accounts, including CDs,

monthly by mail or electronically. If you have a CD with electronic transfers, you will receive a monthly statement for any

month an electronic transfer occurs.

In honor of Financial Literacy Month, Ally is again organizing reading events at schools, libraries and businesses

nationally for its children's book Planet Zeee and the Money Tree. New for 2018, Ally created an interactive quiz game

based on the book, available at events and our site. Teach your kids about money by reading our book and playing the

game at allywalletwise.com/resources/childrensbook.

Ally Bank Member FDIC STMTCMB100 05/2013

275701/903523//75701/0000/000000/303351 000 01 000000 STMTCMB100

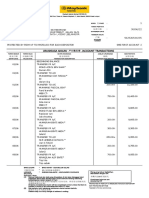

COMBINED CUST OMER ST AT EMENT

Statement Date

04/05/2018

Page 2

275701-02-04

Customer Care Information

Toll Free 877-247-ALLY (2559)

Money Market Savings www.ally.com

Summary For: Rafael E arenas

Account Number: xxxxxx7583 Open Date: 12/06/2017

Product: Money Market Savings Account Account Ownership: Single

Summary

Beginning Balance, as of 03/06/2018 $4,082.88 Days In Statement Period 31

Deposits and Other Credits $4,000.00 Annual Percentage Yield Earned 0.90%

Interest Paid This Period $3.63 Average Daily Balance This Period $4,774.74

ATM Fees Reimbursed $10.00 Interest Paid Year to Date $6.40

Withdrawals and Other Debits -$2,629.33

Ending Balance, as of 04/05/2018 $5,467.18

Overdraft Fee Summary This Period Year-to-Date

Overdraft Items Paid $0.00 $0.00

Overdraft Items Returned $0.00 $0.00

Activity

Date Description Credits Debits Balance

03/06/2018 Beginning Balance $4,082.88

03/06/2018 ATM Withdrawal $0.00 -$503.00 $3,579.88

BANCO POPULAR 639 AGUADILLA, PR

Transaction Fee: $ 3.00

03/07/2018 Check Card Purchase $0.00 -$29.23 $3,550.65

AMERICAN GASOLINE AGUA AGUADILLA,

PR

03/09/2018 Direct Deposit $1,500.00 -$0.00 $5,050.65

PAYPAL TRANSFER

TRANSFER

03/09/2018 Check Card Purchase $0.00 -$33.82 $5,016.83

CLARO SAN JUAN, PR

03/12/2018 Check Card Purchase $0.00 -$23.42 $4,993.41

UMA`S ISABELA, PR

03/12/2018 Check Card Purchase $0.00 -$40.68 $4,952.73

UMA`S ISABELA, PR

03/13/2018 Check Card Purchase $0.00 -$20.05 $4,932.68

CENTRO DE JUGUETES Y A AGUADILL,

PR

03/17/2018 Check Card Purchase $0.00 -$16.00 $4,916.68

PUMA MEGA STA AGUADILLA, PR

Ally Bank Member FDIC STMTCMB100 05/2013

275701/903523//75701/0000/000000/303352 000 02 STMTCMB100

COMBINED CUST OMER ST AT EMENT

Statement Date

04/05/2018

Page 3

275701-03-04

Customer Care Information

Toll Free 877-247-ALLY (2559)

www.ally.com

Activity

Date Description Credits Debits Balance

03/18/2018 ATM Withdrawal $0.00 -$505.00 $4,411.68

FBPR AGUADILLA DI AGUADILLA, PR

Transaction Fee: $ 5.00

03/23/2018 Direct Deposit $700.00 -$0.00 $5,111.68

PAYPAL TRANSFER~ Future Amount: 700 ~

Tran: DDIR

TRANSFER

03/24/2018 ATM Withdrawal $0.00 -$303.00 $4,808.68

BANCO POPULAR 639 AGUADILLA, PR

Transaction Fee: $ 3.00

03/25/2018 Check Card Purchase $0.00 -$65.31 $4,743.37

DENNYS AGUADILLA AGUADILLA, PR

03/25/2018 Service Fee $0.00 -$10.00 $4,733.37

Excessive Transactions Fee

03/28/2018 Direct Deposit $1,200.00 -$0.00 $5,933.37

PAYPAL TRANSFER

TRANSFER

03/28/2018 ATM Withdrawal $0.00 -$503.00 $5,430.37

BANCO POPULAR 639 AGUADILLA, PR

Transaction Fee: $ 3.00

03/28/2018 ATM Withdrawal $0.00 -$503.00 $4,927.37

BANCO POPULAR 639 AGUADILLA, PR

Transaction Fee: $ 3.00

03/30/2018 Check Card Purchase $0.00 -$20.00 $4,907.37

AMERICAN GASOLINE AGUA AGUADILLA,

PR

03/30/2018 Service Fee $0.00 -$10.00 $4,897.37

Excessive Transactions Fee

04/02/2018 Direct Deposit $600.00 -$0.00 $5,497.37

PAYPAL TRANSFER

TRANSFER

04/05/2018 Check Card Purchase $0.00 -$33.82 $5,463.55

CLARO SAN JUAN, PR

04/05/2018 Service Fee $0.00 -$10.00 $5,453.55

Excessive Transactions Fee

04/05/2018 ATM Fee Reimbursement $10.00 -$0.00 $5,463.55

04/05/2018 Interest Paid $3.63 -$0.00 $5,467.18

04/05/2018 Ending Balance $5,467.18

Ally Bank Member FDIC STMTCMB100 05/2013

275701/903523//75701/0000/000000/303353 000 03 STMTCMB100

COMBINED CUST OMER ST AT EMENT

Send Correspondence to: Send Deposit to:

Ally Bank Ally Bank

P.O. Box 951 P.O. Box 13625 Statement Date

Horsham, PA 19044 Philadelphia, PA 19101-3625

04/05/2018

Page 4

To receive prompt credit of your deposit, please mail to the Deposit

275701-04-04

Customer Care Information

address listed above. Checks which are not made payable to Ally Bank

Toll Free 877-247-ALLY (2559)

should be properly endorsed. Deposits received at any other address

www.ally.com

may be subject to delays. Do not send correspondence with your deposit(s).

Regulatory Requirement:

In Case of Errors or Questions about Your Electronic Transfers:

For recurring transactions and

other inquiries, please call

• Telephone us at: Ally Bank Customer Care, 1-877-247-ALLY (2559)

the phone number above.

Or

• Write us at: Ally Bank Customer Care, P.O. Box 2554, Cranberry Twp, PA 16066

Contact us as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on

the statement or receipt. We must hear from you no later than 60 days after we send you or make available to you the FIRST statement

on which the problem or error appeared.

Tell us the following information:

• Your name and account number

• The dollar amount of the suspected error

• Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe there is an error or

why you need more information

If you tell us orally, we may require you send us your complaint or questions in writing within ten (10) Business Days.

We will determine whether an error occurred within ten (10) Business Days after we hear from you and will correct any error promptly. If

we need more time, however, we may take up to forty-five (45) days to investigate your complaint or question. If we decide to do this,

we will credit your account within ten (10) Business Days for the amount you think is in error, so that you will have the use of the money

during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive

it within 10 Business Days, we may not credit your account.

For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to ninety (90) days to investigate your

complaint or question. For new accounts, we may take up to twenty (20) Business Days to credit your account for the amount you think

is in error.

We will tell you the results within three (3) Business Days after completing our investigation. If we decide there was no error, we will

send you a written explanation. You may ask for copies of the documents that we used in our investigation.

CHECKS OUTSTANDING TO BALANCE YOUR ACCOUNT

Check Number Amount 1. Enter Ending balance from this

statement:

2. Add deposits recorded in your

checkbook but not shown on this

statement. Enter the interest earned

deposit into your checkbook.

3. Total (1 and 2 above)

4. Enter "Checks Outstanding" Total

Balance: (3 less 4 should equal your

Total checkbook balance)

Ally Bank Member FDIC Equal Housing Lender , NMLS ID 181005 STMTCMB100 05/2013

275701/903523//75701/0000/000000/303354 000 04

You might also like

- Suntrust Statement Template PDFDocument2 pagesSuntrust Statement Template PDFJustin Mason54% (13)

- 111 Data User 0 Com - Woodforest Files WNBStatementDocument3 pages111 Data User 0 Com - Woodforest Files WNBStatementAnonymous GRvpej582% (11)

- Huntington Bank Checking and Savings Account SummaryDocument7 pagesHuntington Bank Checking and Savings Account SummaryEmannuel Ontario74% (35)

- Bank of The West BNP Paribas2 StatementDocument4 pagesBank of The West BNP Paribas2 StatementЮлия П0% (1)

- Sample Bank Statement PDFDocument4 pagesSample Bank Statement PDFSinchai Jones57% (7)

- Green Dot StatementDocument2 pagesGreen Dot Statementalex0312031292% (26)

- Chase Bank SteatmentDocument5 pagesChase Bank SteatmentMasRockey71% (7)

- July 23, 2009 Through August 24, 2009 JPMorgan Chase BankDocument4 pagesJuly 23, 2009 Through August 24, 2009 JPMorgan Chase BankMaria Blackburn33% (3)

- Chime Spending Statement August 2019Document2 pagesChime Spending Statement August 2019Henry Bosquez88% (8)

- Huntington Statement 2021Document3 pagesHuntington Statement 2021Mdot ParaNo ratings yet

- JPMorgan Chase Bank statement summaryDocument6 pagesJPMorgan Chase Bank statement summaryNelson Lanyuy67% (3)

- Your Consolidated Statement: Contact UsDocument5 pagesYour Consolidated Statement: Contact UsSAM50% (2)

- TD Business Convenience Plus: Account SummaryDocument4 pagesTD Business Convenience Plus: Account SummaryMarleny AriasNo ratings yet

- Card Statement PDFDocument6 pagesCard Statement PDFBrraghavan Raghavan0% (1)

- Wells Fargo Everyday CheckingDocument6 pagesWells Fargo Everyday CheckingDavid Dali Rojas Huamanchau100% (1)

- Chase 2010:ikea BestbuyDocument4 pagesChase 2010:ikea BestbuyBurak Tatar100% (3)

- USAA Home Equity Line of Credit Statement SummaryDocument3 pagesUSAA Home Equity Line of Credit Statement SummaryЮлия ПNo ratings yet

- Key BankDocument4 pagesKey BankKelley33% (3)

- August 2017 Wells Fargo StatementDocument11 pagesAugust 2017 Wells Fargo StatementAnonymous qQaGsVkFNo ratings yet

- Gary L Carroll Cindy M Krider 41041 Community RD Magnolia TX 77354 2051660063Document2 pagesGary L Carroll Cindy M Krider 41041 Community RD Magnolia TX 77354 2051660063Daniel Smart Odogwu0% (1)

- SunTrust TemplateDocument1 pageSunTrust TemplateJustin Mason100% (2)

- KPMG Entrance Intern Test I. Multiple Choice QuestionDocument5 pagesKPMG Entrance Intern Test I. Multiple Choice QuestionNam Nguyễn Tiến100% (1)

- Statement PDFDocument8 pagesStatement PDFklymsolutions100% (4)

- Deposit Account StatementDocument3 pagesDeposit Account Statementsaid Obnika100% (1)

- Statement 23-DEC-22 AC 50679917 25042632 PDFDocument3 pagesStatement 23-DEC-22 AC 50679917 25042632 PDFRoxana ChinceaNo ratings yet

- JPMCStatementDocument4 pagesJPMCStatementJoe Whitelaw50% (2)

- StatementDocument4 pagesStatementAaron Montoya100% (1)

- My Bank Account StatementDocument4 pagesMy Bank Account StatementIseayNo ratings yet

- Statement 1Document4 pagesStatement 1donaldlinkous100% (1)

- Sept Bank - NewDocument9 pagesSept Bank - NewLisa HesterNo ratings yet

- 05312010Document7 pages05312010bkwaku50% (2)

- JpmcstatementDocument6 pagesJpmcstatementxcygonNo ratings yet

- Estmt - 2014 01 15Document6 pagesEstmt - 2014 01 15Leonyd Gonzalez Nistal100% (2)

- Liska PaystubDocument1 pageLiska PaystubCreative Puppy100% (1)

- Michael March StatmentDocument11 pagesMichael March StatmentMucho Facerape100% (1)

- Citizens Bank 2020Document2 pagesCitizens Bank 2020SAM100% (1)

- 2018 - 01 Chase Checking PDFDocument12 pages2018 - 01 Chase Checking PDFAtul PandeyNo ratings yet

- Corporate Card Statement of AccountDocument3 pagesCorporate Card Statement of AccountJaram Johnson100% (1)

- Earnings Statement PAY STUBDocument1 pageEarnings Statement PAY STUBAtonye Nyingifa100% (1)

- BOA Statement ARTURO INFANTEDocument10 pagesBOA Statement ARTURO INFANTEJaram Johnson0% (2)

- Save with Capital One 360 Bank in JanuaryDocument5 pagesSave with Capital One 360 Bank in JanuaryAluvya AdamsNo ratings yet

- Jennifer Baer Feb PersonalDocument4 pagesJennifer Baer Feb Personaldarcywoodham67% (3)

- Chase B Statement-MarDocument4 pagesChase B Statement-MarЮлия ПNo ratings yet

- Chase Bank StatementDocument1 pageChase Bank StatementMiles PrevitireNo ratings yet

- Customer Relationship - Axis Bank DeepanshuDocument101 pagesCustomer Relationship - Axis Bank Deepanshudeepak Gupta100% (1)

- Account Summary Portfolio AllocationDocument4 pagesAccount Summary Portfolio AllocationLoydNo ratings yet

- Nov STM MP Prime PDFDocument2 pagesNov STM MP Prime PDFMarija Difrancesco100% (1)

- Police Circular On Sexual Offences Mumbai Aug 30 2013Document4 pagesPolice Circular On Sexual Offences Mumbai Aug 30 2013Kimberly WrightNo ratings yet

- View PDFDocument6 pagesView PDFfabrikfashions171No ratings yet

- Document SOS1Document5 pagesDocument SOS1Mickie FieldsNo ratings yet

- Estmt - 2016 08 31 PDFDocument4 pagesEstmt - 2016 08 31 PDFAnonymous dVQ61xYNo ratings yet

- October 2021Document6 pagesOctober 2021Adriana JohnsonNo ratings yet

- Customer StatementDocument4 pagesCustomer Statementkeller kyle100% (1)

- Ally-Bank-Statement - Helen ZhaoDocument4 pagesAlly-Bank-Statement - Helen ZhaoJonathan Seagull Livingston100% (1)

- Aug Bank - NewDocument7 pagesAug Bank - NewLisa Hester100% (2)

- June 2017 Revitalize Bank Statement PDFDocument10 pagesJune 2017 Revitalize Bank Statement PDFTiffanyNo ratings yet

- Us Bank Bus 2Document10 pagesUs Bank Bus 2Madison Black100% (1)

- Summary of Your Banking Relationship: Savings & InvestmentsDocument4 pagesSummary of Your Banking Relationship: Savings & InvestmentsJeffreyNo ratings yet

- AccountExtract PDFDocument3 pagesAccountExtract PDFD Ann HoppieNo ratings yet

- Jan2019Document2 pagesJan2019SaeviNo ratings yet

- Griffin p2Document4 pagesGriffin p2bootybethathangNo ratings yet

- Customer Statement: Ally Bank P.O. Box 70377 Philadelphia, PA 19176-0377Document4 pagesCustomer Statement: Ally Bank P.O. Box 70377 Philadelphia, PA 19176-0377garrettloehrNo ratings yet

- Bank Statement Template 20Document4 pagesBank Statement Template 20衡治洲No ratings yet

- Bank Statement - 2023-05-25Document4 pagesBank Statement - 2023-05-25ozmaedith633No ratings yet

- CBQ - Tariff of ChargesDocument9 pagesCBQ - Tariff of Chargesanwarali1975No ratings yet

- Jibfl 2018 Vol33 Issue3 Mar pp158-161 PDFDocument4 pagesJibfl 2018 Vol33 Issue3 Mar pp158-161 PDFsackNo ratings yet

- Berkshire Partners' New Drug Breakthrough and Funding OptionsDocument90 pagesBerkshire Partners' New Drug Breakthrough and Funding OptionsCharuka KarunarathneNo ratings yet

- IDFCFIRSTBankstatement 10068100037 163706819Document1 pageIDFCFIRSTBankstatement 10068100037 163706819Rajanala Vignesh NaiduNo ratings yet

- MBBcurrent 562526534235 2022-06-30 PDFDocument6 pagesMBBcurrent 562526534235 2022-06-30 PDFmuhamad faidzalNo ratings yet

- ACH manages electronic cheque clearing between banksDocument2 pagesACH manages electronic cheque clearing between bankspapson rukundoNo ratings yet

- Pricing 2021 highlights key bank chargesDocument14 pagesPricing 2021 highlights key bank chargesKamalNo ratings yet

- Bank-Reconciliation-Statement-Notes Class 11Document21 pagesBank-Reconciliation-Statement-Notes Class 11DhruvNo ratings yet

- Silverlake Symmetri: Core BankingDocument15 pagesSilverlake Symmetri: Core BankingĐặng Thanh HiềnNo ratings yet

- Banking Procedure 1-1-2Document63 pagesBanking Procedure 1-1-2MichaelNo ratings yet

- A Project On Analysis of "HDFC BANK & ICICI BANK"Document38 pagesA Project On Analysis of "HDFC BANK & ICICI BANK"vikas_rathour01No ratings yet

- 11 PaperDocument2 pages11 PaperSomesh DhingraNo ratings yet

- PFR Week TwoDocument203 pagesPFR Week TwoMarian's PreloveNo ratings yet

- Polytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsDocument15 pagesPolytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsYassi CurtisNo ratings yet

- Super Care Pharma Bank Statement-May-2021Document4 pagesSuper Care Pharma Bank Statement-May-2021AKM Anwar SadatNo ratings yet

- Functions of Banking Institution: by Resham Raj RegmiDocument49 pagesFunctions of Banking Institution: by Resham Raj Regmibibek bNo ratings yet

- InstaBIZ 1Document14 pagesInstaBIZ 1Sacjin mandalNo ratings yet

- Ca Foundation Accounts Paper Dec23Document11 pagesCa Foundation Accounts Paper Dec23aagarwal786riteshNo ratings yet

- Internship ReportDocument55 pagesInternship Reportreshmamaharjan11No ratings yet

- First Texas Savings Association, and First Gibraltar Savings Association, FSB, Intervening v. Reliance Insurance Co., 950 F.2d 1171, 1st Cir. (1992)Document13 pagesFirst Texas Savings Association, and First Gibraltar Savings Association, FSB, Intervening v. Reliance Insurance Co., 950 F.2d 1171, 1st Cir. (1992)Scribd Government DocsNo ratings yet

- Commercial Banks Loans OverviewDocument10 pagesCommercial Banks Loans OverviewHuỳnh Lữ Thị NhưNo ratings yet

- Well FargoDocument2 pagesWell FargoHola PreNo ratings yet

- Kwekwe Polytechnic: Engineering DivisionDocument3 pagesKwekwe Polytechnic: Engineering DivisionSimbarashe MakanyireNo ratings yet

- Fabian Bortz Feb 2020 StatementDocument4 pagesFabian Bortz Feb 2020 StatementChamp HillaryNo ratings yet

- What Is BankDocument19 pagesWhat Is BankSunayana BasuNo ratings yet

- Financial Analysis of HondaDocument71 pagesFinancial Analysis of HondaKajal YadavNo ratings yet