Professional Documents

Culture Documents

10E - Build A Spreadsheet 02-28

Uploaded by

MISRET 2018 IEI JSCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10E - Build A Spreadsheet 02-28

Uploaded by

MISRET 2018 IEI JSCCopyright:

Available Formats

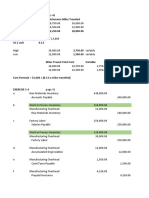

DATA INPUT

Inventory Classification January 1, 20x1 December 31, 20x1

Raw material $ 55,000 $ 75,000

Work in process 110,000 125,000

Finished goods 160,000 155,000

Raw materials purchased 240,000

Direct labor expenses 420,000

Manufacturer overhead costs

Indirect material $ 12,000

Indirect labor 22,000

Depreciation 110,000

Utilities 23,000

Other 35,000

Sales revenue 1,210,000

Selling & Administrative 105,000

Tax rate 35%

SOLUTION

1. Schedule of Cost of Goods Manufactured

Direct Material:

Raw-material inventory $ 55,000

Add: Purchases of raw material 240,000

Raw material available for use $ 295,000

Deduct: Raw-material inventory, December 31 75,000

Raw material used $220,000

Direct labor 420,000

Manufacturing overhead:

Indirect material $ 12,000

Indirect labor 22,000

Depreciation on plant and equipment 110,000

Utilities 23,000

Other 35,000

Total manufacturing overhead 202,000

Total manufacturing costs $842,000

Add: Work-in-process inventory, January 1 110,000

Subtotal $952,000

Deduct: Work-in-process inventory, December 31 125,000

Cost of goods manufactured $827,000

2. Schedule of Cost of Goods Sold

Finished-goods inventory, January 1 $ 160,000

Add: Cost of goods available for sale 827,000

Deduct: Finished-goods inventory, December 31 $ 987,000

Cost of goods sold 155,000

$ 832,000

3. Income Statement

Sales revenue $1,210,000

Less: Cost of goods sold 832,000

Gross margin $ 378,000

Selling and administration expenses 105,000

Income before taxes $ 273,000

Income tax expense 95,550

Net income $ 177,450

You might also like

- Quality Management and Practises in Automobile SectorDocument57 pagesQuality Management and Practises in Automobile Sectorshivi73100% (16)

- Long Term Career GoalsDocument3 pagesLong Term Career GoalsXylinNo ratings yet

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Chapter 6Document24 pagesChapter 6jake doinog88% (16)

- Case Study AnalysisDocument4 pagesCase Study AnalysisZohaib Ahmed JamilNo ratings yet

- Innovation All ChapterDocument94 pagesInnovation All Chapterbereket amareNo ratings yet

- Reimagining HR For 2025Document10 pagesReimagining HR For 2025Sasi KumarNo ratings yet

- Ra 6657 As Amended 31 Jan 11, 1317 HrsDocument59 pagesRa 6657 As Amended 31 Jan 11, 1317 HrsCharm Divina LascotaNo ratings yet

- Quiz 1 - Cost Terms, Inventory - PrintableDocument8 pagesQuiz 1 - Cost Terms, Inventory - PrintableEdward Prima KurniawanNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Case Study - Destin Brass Products CoDocument6 pagesCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNo ratings yet

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- Procurement Manual of WapdaDocument170 pagesProcurement Manual of WapdaWaqar Ali Rana69% (13)

- Kalamazoo ZooDocument4 pagesKalamazoo ZooMISRET 2018 IEI JSC100% (1)

- Translation and Globalization-Routledge (2003)Document209 pagesTranslation and Globalization-Routledge (2003)mmaissNo ratings yet

- Module 1. Math InvestmentDocument43 pagesModule 1. Math InvestmentManuel FranciscoNo ratings yet

- Business Finance Assignment 2Document6 pagesBusiness Finance Assignment 2Muhammad Ali KhanNo ratings yet

- 10E - Build A Spreadsheet 02-44Document2 pages10E - Build A Spreadsheet 02-44MISRET 2018 IEI JSCNo ratings yet

- 10E - Build A Spreadsheet 02-43Document2 pages10E - Build A Spreadsheet 02-43MISRET 2018 IEI JSCNo ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- Shelsa Nabila - 027031801017 - LabAkbiDocument6 pagesShelsa Nabila - 027031801017 - LabAkbiShelsa NabilaNo ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (25)

- Cost Accounting de Leon Chapter 3 SolutionsDocument9 pagesCost Accounting de Leon Chapter 3 SolutionsRichelle SangatananNo ratings yet

- Cost Accounting Hilton 14Document13 pagesCost Accounting Hilton 14Vin TenNo ratings yet

- Cost CH 4 Cost System 2019Document19 pagesCost CH 4 Cost System 2019KPP Madya Dua Jakarta PusatNo ratings yet

- Question 2-Practice Question: Canseco CompanyDocument2 pagesQuestion 2-Practice Question: Canseco CompanyLordy AdanzaNo ratings yet

- Homework Chapter 2 - Phuong AnhDocument5 pagesHomework Chapter 2 - Phuong AnhNguyễn Ánh NgọcNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

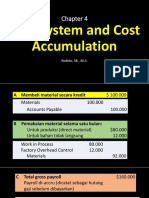

- Cost System and Cost Accumulation: Kodirin, Ak., M.ADocument19 pagesCost System and Cost Accumulation: Kodirin, Ak., M.AShofiyyatul MaulaNo ratings yet

- Document 9Document2 pagesDocument 9mohammedbudul18No ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Banitog, Brigitte C. BSA 211Document8 pagesBanitog, Brigitte C. BSA 211MyunimintNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Part A: Schedules of Cost of Goods Manufactured and Cost of Goods Sold Income StatementDocument2 pagesPart A: Schedules of Cost of Goods Manufactured and Cost of Goods Sold Income StatementaksNo ratings yet

- Chapter 1 Question Review - 102Document5 pagesChapter 1 Question Review - 102Mark Joseph CanoNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Chapter 6 Exercise Activity With AnswersDocument25 pagesChapter 6 Exercise Activity With Answers乙คckคrψ YTNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Muhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamDocument8 pagesMuhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamKashif RaheemNo ratings yet

- Chapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inDocument20 pagesChapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inPratyush GoelNo ratings yet

- Tugas Akuntansi BiayaDocument6 pagesTugas Akuntansi Biayacathy pisaNo ratings yet

- Chapter 04Document4 pagesChapter 04Nouman BaigNo ratings yet

- Answer Sheet Practice Wiley Question Exam 2 M04-M07 Fall 2020Document2 pagesAnswer Sheet Practice Wiley Question Exam 2 M04-M07 Fall 2020bryan.canarisNo ratings yet

- Horngren's Cost Accounting. A Managerial Emphasis 17ed ch2 Problem For Self-StudyDocument3 pagesHorngren's Cost Accounting. A Managerial Emphasis 17ed ch2 Problem For Self-StudyIrakli AmbroladzeNo ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Q3Document11 pagesQ3anik022No ratings yet

- Problem 1-20: 1 JGG Manufacturing Company Manufacturing CostDocument9 pagesProblem 1-20: 1 JGG Manufacturing Company Manufacturing CostMackenzie Heart Obien0% (1)

- Job Costing - ExcercisesDocument31 pagesJob Costing - Excercisesგიორგი კაციაშვილიNo ratings yet

- UntitledDocument13 pagesUntitledPiands FernandsNo ratings yet

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- Quiz 1 SDocument4 pagesQuiz 1 SAmmu SandhuNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Lecture 5.2-General Cost Classifications (Problem 2)Document2 pagesLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon80% (5)

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- Proj CostDocument64 pagesProj CostCarlisle ChuaNo ratings yet

- Three Formal SchedulesDocument5 pagesThree Formal SchedulesKimberly ToraldeNo ratings yet

- CFAS - Asynchronus ActivityDocument10 pagesCFAS - Asynchronus ActivityAira Santos VibarNo ratings yet

- Particulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Document7 pagesParticulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Jhoanne Marie TederaNo ratings yet

- The Seabright Manufacturing Company, Inc.Document11 pagesThe Seabright Manufacturing Company, Inc.Iqbal RosyidinNo ratings yet

- - Nguyễn Thị Trúc - Individual Exercises Session 8Document5 pages- Nguyễn Thị Trúc - Individual Exercises Session 8Thanh Trúc NguyễnNo ratings yet

- Statement of Comprehensive Income - PROBLEMSDocument20 pagesStatement of Comprehensive Income - PROBLEMSSarah GNo ratings yet

- Tugas Managerial AccountinDocument3 pagesTugas Managerial Accountinlaurentinus fikaNo ratings yet

- Managerial Accounting - ExercisesDocument60 pagesManagerial Accounting - ExercisesNúmero CuatroNo ratings yet

- Standard Costing and Variance AnalysisDocument2 pagesStandard Costing and Variance AnalysisMISRET 2018 IEI JSCNo ratings yet

- Activity Based Costing: Samit Paul IIM, RanchiDocument21 pagesActivity Based Costing: Samit Paul IIM, RanchiMISRET 2018 IEI JSCNo ratings yet

- Process Costing: Samit Paul IIM, RanchiDocument17 pagesProcess Costing: Samit Paul IIM, RanchiMISRET 2018 IEI JSCNo ratings yet

- Problem - Chapter 02Document1 pageProblem - Chapter 02MISRET 2018 IEI JSCNo ratings yet

- Chapter 23Document7 pagesChapter 23MISRET 2018 IEI JSCNo ratings yet

- Chapter 7 PDFDocument4 pagesChapter 7 PDFMISRET 2018 IEI JSCNo ratings yet

- Problem - Chapter 02Document1 pageProblem - Chapter 02MISRET 2018 IEI JSCNo ratings yet

- 02 02 Assignment Problem (SC)Document1 page02 02 Assignment Problem (SC)MISRET 2018 IEI JSCNo ratings yet

- TBApp IIIDocument18 pagesTBApp IIIMISRET 2018 IEI JSCNo ratings yet

- Chapter 1Document4 pagesChapter 1MISRET 2018 IEI JSCNo ratings yet

- Web QuizDocument4 pagesWeb QuizMISRET 2018 IEI JSCNo ratings yet

- Strategy MangmtDocument23 pagesStrategy MangmtMISRET 2018 IEI JSCNo ratings yet

- Micro Economics Quiz OneDocument3 pagesMicro Economics Quiz OneMISRET 2018 IEI JSCNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- Toolkit Materiality Assessment 2022 - FINALDocument36 pagesToolkit Materiality Assessment 2022 - FINALtrader123No ratings yet

- WORKSHOP ON Business AnalyticsDocument2 pagesWORKSHOP ON Business AnalyticssubramonianNo ratings yet

- Micro Tutorial 8 - 2017Document2 pagesMicro Tutorial 8 - 2017AndyNo ratings yet

- Managerial Economics Presentation On Gulf AirlinesDocument16 pagesManagerial Economics Presentation On Gulf AirlinesSaquib SiddiqNo ratings yet

- MAC CH 12 Money Supply CC PDFDocument20 pagesMAC CH 12 Money Supply CC PDFBerkshire Hathway coldNo ratings yet

- Challenges and Opportunities Facing Brand Management - An IntroducDocument12 pagesChallenges and Opportunities Facing Brand Management - An IntroducLeyds GalvezNo ratings yet

- Gilaninia and MousavianDocument9 pagesGilaninia and Mousavianpradeep110No ratings yet

- Mock Test (Only Writing Session) : Deadline: 6th December 2021 ( 5pm )Document3 pagesMock Test (Only Writing Session) : Deadline: 6th December 2021 ( 5pm )Thu HàNo ratings yet

- Bs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)Document9 pagesBs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)JANISCHAJEAN RECTONo ratings yet

- Lead - Talent Management & ODDocument2 pagesLead - Talent Management & ODanshatNo ratings yet

- Job Description Community CoordinatorDocument4 pagesJob Description Community CoordinatorJay ChandraNo ratings yet

- Tck-In Day 9Document3 pagesTck-In Day 9Julieth RiañoNo ratings yet

- Efqm Excellence Model: December 2013Document15 pagesEfqm Excellence Model: December 2013thelearner16No ratings yet

- AutogptDocument3 pagesAutogptKelvin ChenNo ratings yet

- Department of Business Administration, Faculty of Management, Maharaja Krishnakumarsinhji Bhavnagar University, BhavnagarDocument31 pagesDepartment of Business Administration, Faculty of Management, Maharaja Krishnakumarsinhji Bhavnagar University, BhavnagarChaitali Suvagiya SolankiNo ratings yet

- Abbott Laboratories Pakistan LimitedDocument15 pagesAbbott Laboratories Pakistan LimitedHibaNo ratings yet

- EU Compendium of Spatial PlanningDocument176 pagesEU Compendium of Spatial PlanningVincent NadinNo ratings yet

- E TaxDocument1 pageE TaxTemesgenNo ratings yet

- Structure and Composition of Foreign Exchange Management SystemDocument28 pagesStructure and Composition of Foreign Exchange Management SystemParthadeep SharmaNo ratings yet

- Expand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcDocument18 pagesExpand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcserradajaviNo ratings yet