Professional Documents

Culture Documents

Indian Treasury

Uploaded by

vipinkosa3805Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Treasury

Uploaded by

vipinkosa3805Copyright:

Available Formats

Indian 'Treasury Stock'

Published on Sat, Oct 25 17:09, Updated at Mon, Oct 27 at 16:18

Source: CNBC-TV18

Well let's move on to the next story - which came to us 2 weeks ago, when we were discussing

Reliance's decision to reclassify some treasury stock, from the promoter and persons acting in

concert category to the public category. That transaction is still an enigma, but then so is the

concept of treasury stock in India. Reliance has it, M&M has it, and ICICI bank had it and now so

does the King of Good Times. Yet legally, treasury stock is not allowed here.

What is treasury stock? It's a company owning it's own stock - either by way of a merger or a

buyback. The company can reissue the stock on a future date. But in India as per company law, a

company or its subsidiaries cannot hold it's own shares. So how come all these Indian companies

have treasury stock? Isha Dalal travels back in time to understand how India’s own home grown

version of treasury stock came to be.

Delhi High Court, 1996

Shardul Shroff, partner in India’s leading law firm Amarchand Mangaldas was on the verge of

making corporate history.

Client, telecom Solutions Company Himachal Futuristic or HFCL had merged with Himachal

Telematics through a court approved merger scheme

But what the court approved, the Department of Company Affairs did not!

Post merger, HFCL wound up in possession of a subsidiary that held HFCL shares. That was a

violation of Section 42 of the Companies Act, and DCA was crying foul. But HFCL’s lawyers had

a case to make.

Shardul Shroff, Partner, Amarchand Mangaldas

Suppose you have purchased shares in the market or purchased it in a bid, the cost of acquisition

gets frozen in your schedule of investments. But the market cap or market value may be higher. If

those shares were put to sale, the shareholders will benefit. And that is the logic that courts

accept by asking a company to create an independent trust for the purposes of holding those

shares temporarily and liquidating them over time so realization value is accruing to benefit of

shareholders

And that's how the desi version of 'treasury stock' was born. In the last 10 years there have been

2 formats of holding this treasury stock that have been legitimised. Each with an accompany set

of rules on how the stock is held, how it's classified, how it votes and when it's sold.

Type 1, is the HFCL type

Wherein HFCL's subsidiary Trade Invest ended up with 30 lakh shares of HFCL because of the

merger. As per court directions Trade Invest then became trustee of those shares for the benefit

of HFCL shareholders. The shares had to be held for 8 years , after which they could be sold and

the proceeds shared by HFCL's shareholders. And while they shares were held in trust, they had

no voting power.

Shardul Shroff, Partner, Amarchand Mangaldas

They suspend the right to vote because of the bar in law that you cannot use a subsidiary’s rights

in a holding company and vote on them. Because you are in control of that subsidiary. So you are

voting as a company on your own shares. And that is not permissible

Type 2 is the ICICI Bank case. In 2002 when ICICI merged with it's subsidiary ICICI Bank, the

merged entity ended up with its own stock. Almost 16% of it. All held by a Trust, specially created

for the purpose. Because of the ownership separation, these shares retained their full voting

rights

Amrish Shah, Executive Director, PwC

These shares have full voting rights, full dividends, right to participate in meetings. Treated like a

normal shares. Because in India these are not held by the company- so like any other registered

shareholder

But Type 2 comes with a twist. Is the Trust's shareholding classified as 'public' or 'promoter &

persons acting in concert'.

That depends on who controls the trust ? For instance in the case of the United Spirits - Shaw

Wallace merger of 2006. A USL Benefit Trust was created to hold 2.28% of United Spirits stock.

The trust was run independently, that is it could vote as it pleased in shareholder meetings.

Which is why it was classified as public shareholding and not promoter and persons acting in

concert.

Shardul Shroff, Partner, Amarchand Mangaldas

if you’re an independent trustee, then you’re not dependent upon or acting in concert unless the

trust itself embeds a principal that you’ll vote with us or vote with the promoters or vote in

accordance with decision of the board. That would normally not be put because people don’t want

insider angle to come into play

Yet that does exist for some companies - such as Reliance, where the Petroleum Trust holds a

7.2% stake in Reliance. The trust was created when Reliance Petroleum merged into it's parent

company Reliance. And the trustees of Reliance have an agreement to vote along with the

promoter group. Which is why the Trust is classified under the 'Promoter and persons acting in

concert' category

Lawyers say in the spirit of corporate governance it's best to have an independent trust. But that's

just about which way the trust votes. What about how long it lives? Well trusts cannot go on

indefinitely and the so called ‘treasury stock’ too can be held only for a defined period.

Amrish Shah, Executive Director, PwC

it needs to be a definite period you cant have an undefined term for a trust under the Indian trust

act. They generally keep a reasonable period of 3-5 years

Ajay Bahl, Partner, AZB & Partner

It is at the end of the day a mandate given to trustees as to how they must operate. If the deed

say that all stock must be sold in seven years and proceeds distributed, so be it. If it provides that

income must accrue and be distributed periodically that would be the case

Eventually shareholders stand to gain more from the sale of treasury stock over a period of time

than it's extinguishment at the time of merger. For companies too, this can come in

handy...especially in tough times like these...when any other kind of share sale is difficult.

Amrish Shah, Executive Director, PwC

if they have a stock in a trust, it is freely priced. In a preferential allotment you have to follow at

least the 2 weeks or 26 weeks average price. And in today’s market if I have to follow a 26 week

average, I might not be able to get anyone to put in the funds. Because even 26 weeks is too

high. But I might be able to use the stock.

Use the stock to realize a higher value for the company's shareholders. And that's the only reason why the Delhi

High Court allowed for this desi version of treasury stock to be created in 1996. In Mumbai Isha Dalal.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TBchap 014Document96 pagesTBchap 014DemianNo ratings yet

- Act 6J03 - Comp2 - 1stsem05-06Document12 pagesAct 6J03 - Comp2 - 1stsem05-06ROMAR A. PIGANo ratings yet

- (DIGEST) CIR v. ManningDocument2 pages(DIGEST) CIR v. ManningSamantha Nicole100% (2)

- San Miguel Corp vs. Sandiganbayan BBBBBBBBDocument3 pagesSan Miguel Corp vs. Sandiganbayan BBBBBBBBMonikka100% (1)

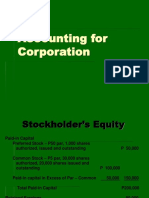

- Accounting For CorporationDocument11 pagesAccounting For CorporationMaricar D. VillarazaNo ratings yet

- Home Assignment 3Document3 pagesHome Assignment 3AUNo ratings yet

- Compilation of Raw Data - LBOBGDT Group 9Document165 pagesCompilation of Raw Data - LBOBGDT Group 9Romm SamsonNo ratings yet

- Final Exam Audapp2 2020Document5 pagesFinal Exam Audapp2 2020HisokaNo ratings yet

- Shareholders Equity - PDF - Treasury Stock - Capital SurplusDocument15 pagesShareholders Equity - PDF - Treasury Stock - Capital SurplusRazel MhinNo ratings yet

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RINo ratings yet

- Sec 7 To 13 RCCDocument2 pagesSec 7 To 13 RCCAldous Francis SisonNo ratings yet

- Commissioner V ManningDocument20 pagesCommissioner V ManningMiakaNo ratings yet

- Accountancy and Auditing 2-2011Document7 pagesAccountancy and Auditing 2-2011Muhammad BilalNo ratings yet

- ACC 221 - Second ExaminationDocument4 pagesACC 221 - Second ExaminationCharlesNo ratings yet

- CH 13Document85 pagesCH 13Michael Fine100% (3)

- BMR PresentationDocument20 pagesBMR PresentationHimanshu NazkaniNo ratings yet

- Far 7 Flashcards - QuizletDocument31 pagesFar 7 Flashcards - QuizletnikoladjonajNo ratings yet

- Activity: Basic Earnings Per ShareDocument2 pagesActivity: Basic Earnings Per Sharebi23450% (1)

- Shareholders' Equity: Intermediate Accounting 3Document22 pagesShareholders' Equity: Intermediate Accounting 3Aga Mathew Mayuga100% (1)

- Chapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelDocument3 pagesChapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelJedediah Samuel Marato0% (1)

- Balance Sheet Current LiabilitiesDocument3 pagesBalance Sheet Current LiabilitiesamirNo ratings yet

- Acen-Sec17-Q-Q3 2020Document99 pagesAcen-Sec17-Q-Q3 2020Jullian Paul GregorioNo ratings yet

- Financial Accounting and Reporting 2 Corporation: Universal College of Paranaque IncDocument20 pagesFinancial Accounting and Reporting 2 Corporation: Universal College of Paranaque IncLLYOD FRANCIS LAYLAYNo ratings yet

- Chapter 7 Angel Ann E. Orola Bsba HR1 1Document90 pagesChapter 7 Angel Ann E. Orola Bsba HR1 1Gwen Stefani DaugdaugNo ratings yet

- Topic No. 4 Retained Earnings Appropriation and Quasi ReorganizationDocument29 pagesTopic No. 4 Retained Earnings Appropriation and Quasi ReorganizationGale KnowsNo ratings yet

- Mcgraw Hill Chapter 11 SolutionsDocument4 pagesMcgraw Hill Chapter 11 SolutionspareenNo ratings yet

- Serial System LTD Annual Report 2013Document176 pagesSerial System LTD Annual Report 2013WeR1 Consultants Pte LtdNo ratings yet

- TLV 20221111164418 2022-Q3-ReportDocument84 pagesTLV 20221111164418 2022-Q3-Reportafrodita99977No ratings yet

- The Boeing Company: FORM 10-QDocument105 pagesThe Boeing Company: FORM 10-Qparv salechaNo ratings yet

- Stock Dividend: Date of PaymentDocument6 pagesStock Dividend: Date of PaymentmercyvienhoNo ratings yet