Professional Documents

Culture Documents

47355bos37158iipc5mtp A

Uploaded by

Anshuman RoutOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

47355bos37158iipc5mtp A

Uploaded by

Anshuman RoutCopyright:

Available Formats

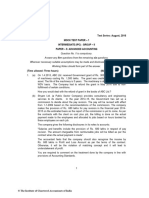

Test Series: October, 2017

MOCK TEST PAPER - 2

INTERMEDIATE (IPC): GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

SUGGESTED ANSWERS/HINTS

1. (a) (i) Interest for the period 2016-17

= US $ 10 lakhs x 4% × Rs. 62 per US$ = Rs. 24.80 lakhs

(ii) Increase in the liability towards the principal amount

= US $ 10 lakhs × Rs. (62 - 56) = Rs. 60 lakhs

(iii) Interest that would have resulted if the loan was taken in Indian currency

= US $ 10 lakhs × Rs. 56 x 10.5% = Rs. 58.80 lakhs

(iv) Difference between interest on local currency borrowing and foreign currency

borrowing = Rs. 58.80 lakhs - Rs. 24.80 lakhs = Rs. 34 lakhs.

Therefore, out of Rs. 60 lakhs increase in the liability towards principal amount, only Rs. 34

lakhs will be considered as the borrowing cost. Thus, total borrowing cost would be

Rs. 58.80 lakhs being the aggregate of interest of Rs. 24.80 lakhs on foreign currency

borrowings plus the exchange difference to the extent of difference between interest on local

currency borrowing and interest on foreign currency borrowing of Rs. 34 lakhs.

Hence, Rs. 58.80 lakhs would be considered as the borrowing cost to be accounted for as

per AS 16 and the remaining Rs. 26 lakhs (60 - 34) would be considered as the exchange

difference to be accounted for as per AS 11.

(b) Following will be the treatment in the given cases:

(i) When sales price of Rs. 50 lakhs is equal to fair value, A Ltd. should immediately

recognise the profit of Rs.10 lakhs (i.e. 50 – 40) in its books.

(ii) When fair value of leased machinery is Rs. 45 lakhs & sales price is Rs. 38 lakhs, then

loss of Rs. 2 lakhs (40 – 38) to be immediately recognised by A Ltd. in its books

provided loss is not compensated by future lease payment.

(iii) When fair value is Rs. 40 lakhs & sales price is Rs. 50 lakhs then, profit of Rs. 10 lakhs

is to be deferred and amortised over the lease period.

(iv) When fair value is Rs. 46 lakhs & sales price is Rs. 50 lakhs, profit of Rs. 6 lakhs

(46-40) to be immediately recognised in its books and balance profit of Rs. 4 lakhs

(50-46) is to be amortised/deferred over lease period.

(v) When fair value is Rs. 35 lakhs & sales price is Rs. 39 lakhs, then the loss of Rs. 5

lakhs (40-35) to be immediately recognised by A Ltd. in its books and profit of Rs. 4

lakhs (39-35) should be amortised/deferred over lease period.

(c) Computation of Basic Earnings per Share

Year 2015-16 Year 2016-17

(Rs.) (Rs.)

(i) EPS for the year 2015-16 as originally reported

= Net profit for the year attributable to equity

share holder / weighted average number of

equity shares outstanding during the year

© The Institute of Chartered Accountants of India

22,00,000

R 2.20

10,00,000 shares

(ii) EPS for the year 2015-16 restated for the right

issue 2.12

22,00,000

10,00,000 shares x 1.04

(iii) EPS for the year 2016-17 (including effect of right

issue) 2.62

30,00,000

(10,00,000 x 1.04 x 4/12) (12,00,000 x 8/12)

Working Notes:

1. Computation of theoretical ex-rights fair value per share =

Fair value of all outstanding shares immediately prior to exercise of rights+total amount received from exercise

Number of shares outstanding prior to exercise + number of shares issued in the exercise

Rs. 32 10,00,000 Rs. 25 2,00,000

= Rs. 30.83

10,00,000 2,00,000

2. Computation of adjustment factor

Fair value per share prior to exercise of rights

Theoretical ex-rights value per share

Rs. 32

= = Rs. 1.04 (approx.)

Rs. 30.83

(d) As per para 8 of AS 5 “Net Profit or Loss for the Period, Prior Period Items and Changes in

Accounting Policies”, Extraordinary items should be disclosed in the statement of profit and

loss as a part of net profit or loss for the period. The nature and the amount of each

extraordinary item should be separately disclosed in the statement of profit and loss in a

manner that its impact on current profit or loss can be perceived. In the given case the

selling of land to tide over liquidation problems as well as fire in the Factory does not

constitute ordinary activities of the Company. These items are distinct from the ordinary

activities of the business. Both the events are material in nature and expected not to recur

frequently or regularly. Thus, these are Extraordinary Items.

Therefore, in the given case, disclosing net profits by setting off fire losses against profit

from sale of land is not correct. The profit on sale of land, and loss due to fire should be

disclosed separately in the statement of profit and loss.

2. Journal Entries

Rs. Rs.

Bank A/c Dr. 10,00,000

To Equity share capital A/c 10,00,000

(Being money on final call received)

Equity share capital (Rs. 50) A/c Dr. 75,00,000

To Equity share capital (Rs. 40) A/c 60,00,000

To Capital Reduction A/c 15,00,000

(Being conversion of equity share capital of Rs. 50 each into

Rs. 40 each as per reconstruction scheme)

© The Institute of Chartered Accountants of India

Bank A/c Dr. 12,50,000

To Equity Share Capital A/c 12,50,000

(Being new shares allotted at Rs. 40 each)

Trade payables A/c Dr. 12,40,000

To Equity share capital A/c 7,50,000

To Bank A/c (4,90,000 x 70%) 3,43,000

To Capital Reduction A/c 1,47,000

(Being payment made to trade payables in shares or cash to the

extent of 70% as per reconstruction scheme)

8% Debentures A/c Dr. 3,00,000

12% Debentures A/c Dr. 4,00,000

To A A/c 7,00,000

(Being cancellation of 8% and 12% debentures of A)

A A/c Dr. 8,00,000

To 15% Debentures A/c 6,00,000

To Capital Reduction A/c 2,00,000

(Being issuance of new 15% debentures and balance transferred

to capital reduction account as per reconstruction scheme)

Bank A/c Dr. 1,00,000

To A A/c 1,00,000

(Being new debentures subscribed by A)

8% Debentures A/c Dr. 1,00,000

12% Debentures A/c Dr. 2,00,000

To B A/c 3,00,000

(Being cancellation of 8% and 12% debentures of B)

B A/c Dr. 3,00,000

To 15% Debentures A/c 2,50,000

To Capital Reduction A/c 50,000

(Being issuance of new 15% debentures and balance transferred

to capital reduction account as per reconstruction scheme)

Land and Building Dr.

(51,84,000 – 42,70,000) 9,14,000

Inventories Dr. 30,000

To Capital Reduction A/c 9,44,000

(Being value of assets appreciated)

Outstanding expenses A/c Dr. 10,60,000

To Bank A/c 10,60,000

(Being outstanding expenses paid in cash)

Capital Reduction A/c Dr. 33,41,000

To Machinery A/c 1,30,000

To Computers A/c 1,20,000

To Trade receivables A/c 1,09,000

To Profit and Loss A/c 29,82,000

(Being amount of Capital Reduction utilized in writing off P & L A/c

(Dr.) balance and downfall in value of other assets)

Capital Reserve A/c Dr. 5,00,000

3

© The Institute of Chartered Accountants of India

To Capital Reduction A/c 5,00,000

(Being debit balance of capital reduction account adjusted

against capital reserve)

Balance Sheet of Xylem Ltd. (as reduced) as on 31.3.2017

Particulars Notes Rs.

Equity and Liabilities

1 Shareholders' funds

a Share capital 1 80,00,000

2 Non-current liabilities

a Long-term borrowings 2 8,50,000

Total 88,50,000

Assets

1 Non-current assets

a Fixed assets

Tangible assets 3 63,04,000

2 Current assets

a Inventories 3,50,000

b Trade receivables 9,81,000

c Cash and cash equivalents 12,15,000

Total 88,50,000

Notes to accounts

Rs.

1. Share Capital

2,00,000 Equity shares of Rs. 40 80,00,000

2. Long-term borrowings

Secured

15% Debentures (assumed to be secured) 8,50,000

3. Tangible assets

Land & Building 51,84,000

Machinery 7,20,000

Computers 4,00,000 63,04,000

Working Notes:

1. Cash at Bank Account

Particulars Rs. Particulars Rs.

To Balance b/d 2,68,000 By Trade payables A/c 3,43,000

To Equity Share capital A/c 10,00,000 By Outstanding expenses A/c 10,60,000

To Equity Share Capital A/c 12,50,000 By Balance c/d (bal. fig.) 12,15,000

To A A/c 1,00,000

26,18,000 26,18,000

© The Institute of Chartered Accountants of India

2. Capital Reduction Account

Particulars Rs. Particulars Rs.

To Machinery A/c 1,30,000 By Equity Share Capital A/c 15,00,000

To Computers A/c 1,20,000 By Trade payables A/c 1,47,000

To Trade receivables A/c 1,09,000 By A A/c 2,00,000

To Profit and Loss A/c 29,82,000 By B A/c 50,000

By Land & Building 9,14,000

By Inventories 30,000

By Capital Reserve A/c 5,00,000

33,41,000 33,41,000

3 (a) Number of Shares to be issued to Partners

Rs.

Assets: Machinery Rs. 1,40,000 + Inventory Rs. 1,37,400 + Trade 5,01,400

Receivable Rs.1,24,000 + Bank Rs. 1,00,000

Less: Liabilities taken over (1,69,400)

Net Assets taken over (Purchase Consideration) 3,32,000

Classes of Shares to be issued: M N O Total

10% Preference Shares of Rs. 10 each 1,36,000 90,000 46,000 2,72,000

(to retain rights as to Interest on Capital)

Balance in Equity Shares of Rs. 10 each 30,000 18,000 12,000 60,000

(3,32,000 -2,72,000) (issued in profit

sharing ratio)

1,66,000 1,08,000 58,000 3,32,000

(b) Partners’ Capital Accounts

Particulars M N O Particulars M N O

To Drawings 50,000 46,000 34,000 By balance b/d 1,36,000 90,000 46,000

To 10% Preference 1,36,000 90,000 46,000 By Interest on 13,600 9,000 4,600

share capital Capital

To Equity Shares 30,000 18,000 12,000 By profit for the 1,10,700 66,420 44,280

year 5:3:2

(W.N. 1)

To Bank –Additional 54,300 17,420 6,880 By Machinery* A/c 10,000 6,000 4,000

drawings (W.N. 2)

Total 2,70,300 1,71,420 98,880 2,70,300 1,71,420 98,880

* Gain on Transfer of Machinery = Rs. 1,40,000 – (Rs. 2,00,000-Rs. 80,000) = Rs. 20,000 in

5:3:2 ratio.

(c) Balance sheet of MNO Ltd. as on 31 st March, 2017 (after Takeover of Firm)

Note no. Rs.

I Equity and Liabilities:

(1) Shareholders Funds

Share Capital 1 3,32,000

(2) Current Liabilities

Trade Payables 1,69,400

5

© The Institute of Chartered Accountants of India

Total 5,01,400

II Assets

(1) Non-Current Assets

Fixed Assets

Tangible Assets- Machinery 1,40,000

(2) Current Assets:

(a) Inventories 1,37,400

(b) Trade Receivables 1,24,000

(c) Cash and Cash Equivalents 1,00,000

Total 5,01,400

Notes to Accounts

Particulars Rs.

1. Share capital

Authorized shares capital 20,00,000

Issued, Subscribed & paid up

6,000 Equity Shares of Rs. 10 each 60,000

27,200 10% Preference Shares capital of Rs. 10 each 2,72,000

(All above shares issued for consideration other than cash, in 3,32,000

takeover of partnership firm)

Working Notes:

1. Profit & Loss Appropriation Account for the year ended 31 st March, 2017

Particulars Rs. Rs. Particulars Rs.

To Interest on Capital: By Net Profit 2,48,600

M [Rs. 1,36,000 x 10%] 13,600 (given)

N [Rs. 90,000 x 10%] 9,000

O [Rs. 46,000 x 10%] 4,600 27,200

To Profits transferred to

Capital in profit sharing

ratio 5:3:2

M 1,10,700

N 66,420

O 44,280 2,21,400

2,48,600 2,48,600

2. Statement showing Additional Drawings in Cash

(a) Funds available for Drawings

Total Drawing of Partners (given) 1,30,000

Add: Further Funds available for Drawings (1,78,600-1,00,000) 78,600

2,08,600

Less: Interest on Capital (27,200)

Amount available for Additional Drawings 1,81,400

© The Institute of Chartered Accountants of India

(b) Ascertainment of Additional Drawings

Particulars M N O

As per above statement Rs. 1,81,400 90,700 54,420 36,280

(in profit sharing ratio)

Add: Interest 13,600 9,000 4,600

1,04,300 63,420 40,880

Less: Already drawn (50,000) (46,000) (34,000)

Additional Drawings 54,300 17,420 6,880

4. (a) (i) Calculation of Rebate on bills discounted (not due) on 31.3.2017

S. No. Amount Due date Unexpired Rate of Rebate on bill

(Rs.) 2017 portion discount discounted (Rs.)

(i) 7,50,000 April 8 8 days 12% 1,972

(ii) 3,00,000 May 5 35 days 14% 4,028

(iii) 4,40,000 June 12 73 days 14% 12,320

(iv) 9,60,000 July 15 106 days 15% 4,1820

60,140

(ii) Amount of discount to be credited to the Profit and Loss Account

Rs.

Transfer from Rebate on bills discount as on 31 st March, 2016 66,400

Add: Discount received during the year ended 31 st March, 2017 3,00,000

3,66,400

Less: Rebate on bills discounted as on 31 st March, 2017 60,140

Discount credited to the Profit and Loss Account 3,06,260

(b) Modern Insurance Company (Abstract showing the Amount of claims)

Net Claims incurred

Rs.

Claims paid on direct business (7,06,000 + 7,600 + 8,400) 7,22,000

Add: Re-insurance 1,64,000

Add: Outstanding as on 31.3.2017 17,400

Less: Outstanding as on 1.4.2016 (11,600) 1,69,800

8,91,800

Less: Claims received from re-insurance 64,000

Add: Outstanding as on 31.3.2017 28,400

Less: Outstanding as on 1.4.2016 (17,000) (75,400)

8,16,400

Add: Outstanding direct claims at the end of the year 1,75,000

9,91,400

Less: Outstanding claims at the beginning of the year (1,64,600)

Net claims incurred 8,26,800

© The Institute of Chartered Accountants of India

(c) The event is a non-adjusting event with reference to the provisions of AS 4 “Contingencies

and Events Occurring After the Balance Sheet Date” since it occurred after the year-end and

does not relate to the conditions existing at the year-end. However, the event would appear

to be of such significance as to require a disclosure in the report of the approving authority

to enable users of the financial statements to make proper evaluation and decision, hence,

such disclosure is recommended.

5. (a) Step 1: Calculation of Deficiency

Branch stock account (at invoice price)

Particulars Rs. Particulars Rs.

To Opening Stock (Rs. 74,736 + 1/3 By Sales 3,61,280

of Rs. 74,736) 99,648

To Goods sent to Branch A/c By Closing Stock 1,23,328

(Rs. 2,89,680 + 1/3 of Rs. 2,89,680) 3,86,240

By Deficiency at sale

price [Balancing figure] 1,280

4,85,888 4,85,888

Step 2: Calculation of Net Profit before Commission

Branch account

Particulars Rs. Particulars Rs.

To Opening [Rs. 74,736 + 1/3 of 99,648 By Sales 3,61,280

Rs. 74,736]

To Gross sent to Branch A/c 3,86,240 By Closing Stock 1,23,328

(Rs. 2,89,680 + 1/3 of Rs. 2,89,680)

To Expenses 49,120 By Stock Reserve A/c 24,912

To Stock Reserve A/c (Rs. 1,23,328 x 30,832 By goods sent to 96,560

25/100] Branch A/c

To Net Profit – subject to manager’s

commission 40,240

6,06,080 6,06,080

Step 3: Calculation of Commission still due to manager

Rs.

A Calculation at 10% profit before charging his commission

[Rs. 40,240 x 10/100] 4,024

B Less: 25% of cost of deficiency in stock (25% of (75% of Rs. 1,280) (240)

C Commission for the year [A-B] 3,784

D Less: Paid on account (2,400)

E Balance due (C-D) 1,384

(b) Calculation of unrealized profit of each department and total unrealized profit

Dept. A Dept. B Dept. C Total

Rs. Rs. Rs. Rs.

Unrealized

Profit of:

Department A 45,000 x 50/150 = 15,000 42,000 x 20/120 = 7,000 22,000

© The Institute of Chartered Accountants of India

Department B 40,000 x .25 = 72,000 x .15= 10,800 20,800

10,000

Department C 39,000 x 42,000 x 40/140 = 12,000

30/130 = 9,000 21,000

63,800

Total unrealized profit is Rs. 63,800.

(c)

Particulars Financial Capital Maintenance at

Historical Cost (Rs.)

Closing equity

18,00,000 represented by cash

(Rs. 30 x 60,000 units)

Opening equity 60,000 units x Rs. 20 = 12,00,000

Permissible drawings to keep Capital intact 6,00,000 (18,00,000 – 12,00,000)

6. (Rs. in lakhs)

Date Particulars Debit Credit

01.04.20X1 9% Redeemable preference share capital A/c Dr. 20.00

Premium on redemption of preference shares A/c Dr. 2.00

To Preference shareholders A/c 22.00

(Being preference share capital transferred to

shareholders account)

01.04.20X1 Preference shareholders A/c Dr. 22.00

To Bank A/c 22.00

(Being payment made to shareholders)

01.04.20X1 Equity shares buy back A/c Dr. 90.00

To Bank A/c 90.00

(Being 3 lakhs equity shares of Rs. 10 each bought

back @ Rs.30 per share)

01.04.20X1 Equity share capital A/c Dr. 30.00

Securities premium A/c Dr. 60.00

To Equity Shares buy back A/c 90.00

(Being cancellation of shares bought back)

01.04.20X1 Revenue reserve A/c Dr. 50.00

To Capital redemption reserve A/c 50.00

(Being creation of capital redemption reserve

account to the extent of the face value of

preference shares redeemed and equity shares

bought back as per the law)

01.04.20X1 10% Debentures A/c Dr. 2.20

To Investment (own debentures) A/c 2.00

To Profit on cancellation of own debentures A/c 0.20

(Being cancellation of own debentures costing

Rs. 2 lakhs, face value being Rs. 2.20 lakhs and the

balance being profit on cancellation of debentures)

1.04.20X1 Profit on cancellation of debentures A/c Dr. 0.20

9

© The Institute of Chartered Accountants of India

To Capital reserve A/c 0.20

(Being profit on cancellation of debentures

transferred to capital reserve account)

01.04.20X1 Bank A/c Dr. 10.00

Employees stock option outstanding (Current

liabilities) A/c Dr. 5.00

To Equity share capital A/c 5.00

To Securities premium A/c 10.00

(Being the allotment to employees, of 50,000

shares of Rs. 10 each at a premium of 20 per

share in exercise of stock options by employees)

01.04.20X1 Securities premium A/c Dr. 2.00

To Premium on redemption of preference 2.00

shares A/c

(Being premium on redemption of preference

shares adjusted through securities premium)

Balance Sheet of Extra Ltd. as on 01.04.20X1

Particulars Note No (Rs. in lakhs)

I. Equity and Liabilities

(1) Shareholder's Funds

(a) Share Capital 1 75.00

(b) Reserves and Surplus 2 66.20

(2) Non-current Liabilities

(a) Long term borrowings 3 1.80

(3) Current Liabilities 65.00

Total 208.00

II. Assets

(1) Non-current assets

(a) Fixed assets 50.00

(b) Non-current investments at cost 118.00

(2) Current assets 4 40.00

Total 208.00

Notes to Accounts

Rs. in lakhs

1 Share Capital

Equity share capital

Opening balance 100.00

Less : Cancellation of bought back shares (30.00)

Add : Shares issued against ESOP 5.00 75.00

2 Reserves and Surplus

Capital Reserve

Opening balance 8.00

10

© The Institute of Chartered Accountants of India

Add: Profit on cancellation of debentures 0.20 8.20

Revenue reserves

Opening balance 50.00

Less: Creation of Capital Redemption Reserve (50.00) -

Securities Premium

Opening balance 60.00

Less : Adjustment for cancellation of equity shares (60.00)

Less: Adjustment for premium on redemption of preference (2.00)

shares

Add: Shares issued against ESOP at premium 10.00 8.00

Capital Redemption Reserve 50.00

66.20

3 Long term borrowings

Secured

10% Debentures (4-2.20) 1.80

Working Notes:

(Rs. in lakhs)

1. 10% Debentures

Opening balance 4.00

Less: Cancellation of own debentures (2.20)

1.80

2. Current liabilities

Opening balance 70.00

Less: Adjustment for ESOP outstanding (5.00)

65.00

3. Investments at cost

Opening balance 120.00

Less: Investment in own debentures (2.00)

118.00

4. Current assets

Opening balance 142.00

Less: Payment to preference shareholders (22.00)

Less: Payment to equity shareholders (90.00)

Add: Share price received against ESOP 10.00

40.00

7. (a) From the fixed assets account given in the question, it is inferred that the Company follows

Reduction Method for accounting of Government Grants. Accordingly, out of the

Rs.16,00,000 that has been received, Rs.8,00,000 (being the balance in Machinery A/c)

should be credited to the machinery A/c. The balance Rs. 8,00,000 may be credited to P&L

A/c, since already the cost of the asset to the tune of Rs.12,00,000 had been debited to P&L

A/c in the earlier years by way of depreciation charge, and Rs. 8,00,000 transferred to P&L

11

© The Institute of Chartered Accountants of India

A/c now would be partial recovery of that cost. There is no need to provide depreciation for

2015-16 or 2016-17 as the depreciable amount is now Nil.

(b) Calculation of Total Remuneration payable to Liquidator

Amount in Rs.

2% on Assets realised (45,00,000 x 2%) 90,000

3% on payment made to Preferential creditors 1,25,000 x 3% 3,750

3% on payment made to Unsecured creditors

(Refer W.N) 79,551

Total Remuneration payable to Liquidator 1,73,301

Working Note:

Liquidator’s remuneration on payment to unsecured creditors =

Cash available for unsecured creditors after all payments including liquidation expenses,

payment to secured creditors, preferential creditors & liquidator’s remuneration

= Rs. 45,00,000 – Rs. 50,000 – Rs. 15,00,000 – Rs. 1,25,000 – Rs. 90,000 – Rs. 3,750

= Rs. 27,31,250

Liquidator’s remuneration on payment to unsecured creditors = 3/103 x Rs. 27,31,250 =

Rs. 79,551.

(c) As per AS 26 ‘Intangible Assets’, the depreciable amount of an intangible asset should be

allocated on a systematic basis over its useful life. Also there is a rebuttable presumption

that the useful life of an intangible asset will not exceed 10 years from the date it is available

for use. The amortization should commence when the asset is available for use. As per AS

26, if there has been a significant change in the expected pattern of economic benefits from

the asset, the amortisation method should be changed to reflect the changed pattern.

The company has been following a policy of amortization over a period of 8 years. As on

01-4-2017, 5 years have passed and the carrying amount stands at Rs. 30 lakhs. If the same

treatment were to be continued, this would have been amortized over the next 3 years. But

the revised estimate of remaining useful life would extend the period by another 5 years to

amortize the carrying amount, the Company would be advised to amortise the carrying value

over the next 5 years. Thus after revision in estimated useful life, the amount of Rs. 30 lakhs

would be amortised over next 5 years.

(d) AS 29 “Provisions, Contingent Liabilities and Contingent Assets” provides that when an

enterprise has a present obligation, as a result of past events, that probably requires an

outflow of resources and a reliable estimate can be made of the amount of obligation, a

provision should be recognised. Sun Ltd. has the obligation to deliver the goods within the

scheduled time as per the contract. It is probable that Sun Ltd. will fail to deliver the goods

within the schedule and it is also possible to estimate the amount of compensation.

Therefore, Sun Ltd. should provide for the contingency amounting Rs. 1.5 crores as per

AS 29.

(e) Journal Entries

Particulars Dr. Cr.

Rs. Rs.

15thMarch Bank A/c (9,500 x 40) Dr. 3,80,000

20X2 to Employee compensation expense A/c

[9,500 x (130-40) Dr. 8,55,000

12

© The Institute of Chartered Accountants of India

31st March To Equity share capital A/c (9,500 x 10) 95,000

20X2 To Securities premium A/c [9,500 x (130-10)] 11,40,000

(Being allotment to employees of 9,500 equity shares of

Rs. 10 each at a premium of Rs. 120 per share in exercise

of stock options by employees)

31st Profit and Loss A/c Dr. 8,55,000

March To Employee compensation expense A/c 8,55,000

20X2 (Being transfer of employee compensation expense to

profit and loss account)

13

© The Institute of Chartered Accountants of India

You might also like

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BDocument15 pages7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraNo ratings yet

- Mock Test QuestionsDocument36 pagesMock Test QuestionsKish VNo ratings yet

- Answer Paper 2 SFM May 17Document22 pagesAnswer Paper 2 SFM May 17Ekta Saraswat VigNo ratings yet

- Jaya College of Arts and Science Department of ManagDocument4 pagesJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- Xii Acc Worksheetss-30-55Document26 pagesXii Acc Worksheetss-30-55Unknown patelNo ratings yet

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- Solution Series 1Document14 pagesSolution Series 1BKLMMDFKLFBNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerSushmanth ReddyNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Series 1 PDFDocument8 pagesSeries 1 PDFBKLMMDFKLFBNo ratings yet

- Adv. Accounting M.Test Answer 24.07.2022Document12 pagesAdv. Accounting M.Test Answer 24.07.2022Planet ZoomNo ratings yet

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalNo ratings yet

- MTP Oct. 2018 FM and Eco QuestionDocument6 pagesMTP Oct. 2018 FM and Eco QuestionAisha MalhotraNo ratings yet

- Nov 16 AccountsDocument25 pagesNov 16 AccountsAmit RanaNo ratings yet

- Adv AnsDocument13 pagesAdv AnsOcto ManNo ratings yet

- © The Institute of Chartered Accountants of India: Rs. RsDocument12 pages© The Institute of Chartered Accountants of India: Rs. RsHarsh KumarNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Paper18 SolutionDocument26 pagesPaper18 SolutionVisvesh MNo ratings yet

- Paper14 Strategic Financial ManagementDocument34 pagesPaper14 Strategic Financial ManagementKumar SAPNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaHarsh KumarNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- Mergers and AcquisitionsDocument34 pagesMergers and Acquisitionsmeet daftaryNo ratings yet

- Paper18b PDFDocument47 pagesPaper18b PDFAnonymous SgD5u8R100% (1)

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document11 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)12345 678910No ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument3 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiasolomonNo ratings yet

- Business RiskDocument4 pagesBusiness Risksneharsh2370No ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingDocument16 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingPraveen Reddy DevanapalleNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Leverage & Risk AnalysisDocument11 pagesLeverage & Risk AnalysisAnkush ChoudharyNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument34 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Inp 2111 - Accounts - Suggested AnswerDocument14 pagesInp 2111 - Accounts - Suggested AnswerSachin ChourasiyaNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034Harish KapoorNo ratings yet

- Accounts Paper Answer 22.08.2022Document12 pagesAccounts Paper Answer 22.08.2022Karan SinghNo ratings yet

- PAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaDocument7 pagesPAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaAnmol JajuNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- FR (Old) MTP Compiler Past 8Document122 pagesFR (Old) MTP Compiler Past 8Pooja GuptaNo ratings yet

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Name - Anshuman RoutDocument8 pagesName - Anshuman RoutAnshuman RoutNo ratings yet

- Amity University Kolkata: Industry Interaction CellDocument1 pageAmity University Kolkata: Industry Interaction CellAnshuman RoutNo ratings yet

- The Credit Risk and Its Measurement, Hedging and Monitoring: SciencedirectDocument7 pagesThe Credit Risk and Its Measurement, Hedging and Monitoring: SciencedirectAnshuman RoutNo ratings yet

- Directors': Maithan Alloys LimitedDocument9 pagesDirectors': Maithan Alloys LimitedAnshuman RoutNo ratings yet

- 6 - 7 - Facility Location and LayoutDocument14 pages6 - 7 - Facility Location and LayoutAnshuman RoutNo ratings yet

- 11 - Introduction To Supply ChainDocument12 pages11 - Introduction To Supply ChainAnshuman RoutNo ratings yet

- Analysis of Priority and Non-Priority Sector Npas of Indian Public Sectors BanksDocument6 pagesAnalysis of Priority and Non-Priority Sector Npas of Indian Public Sectors BanksAnshuman RoutNo ratings yet

- AbstractDocument89 pagesAbstractAnshuman RoutNo ratings yet

- Hostel ExpenseDocument2 pagesHostel ExpenseAnshuman RoutNo ratings yet

- 2022 Gr11 Mathematical Literacy WRKBK ENGDocument20 pages2022 Gr11 Mathematical Literacy WRKBK ENGmanganyeNo ratings yet

- National Income AccountsDocument13 pagesNational Income AccountsPlatonicNo ratings yet

- AccountingDocument336 pagesAccountingVenkat GV100% (2)

- Cash Management - BeginnerDocument40 pagesCash Management - BeginnerYelmi MarianiNo ratings yet

- Automatic Accounting Instructions For DistributionDocument7 pagesAutomatic Accounting Instructions For DistributionmlnfNo ratings yet

- R12 FunctionalityDocument87 pagesR12 FunctionalityKanika Sharma100% (1)

- BASIC ACCO Simulated MidtermDocument10 pagesBASIC ACCO Simulated MidtermistepNo ratings yet

- Job Contract & Batch CostingDocument37 pagesJob Contract & Batch CostingthilaganadarNo ratings yet

- Unit 3 Accounting Process BBA 2nd Sem Theory Formats With Illustrations 2079Document63 pagesUnit 3 Accounting Process BBA 2nd Sem Theory Formats With Illustrations 2079Ujwal SuwalNo ratings yet

- JPMCStatementDocument4 pagesJPMCStatementhealthymassagecs50% (2)

- Trial BalanceDocument12 pagesTrial BalanceMarieNo ratings yet

- Assignment 1Document13 pagesAssignment 1Elin EkströmNo ratings yet

- Corporate Accounting AssignmentDocument6 pagesCorporate Accounting AssignmentKarthikacauraNo ratings yet

- 06 TaskPerformance PartnershipDocument3 pages06 TaskPerformance PartnershipBae MaxZNo ratings yet

- Sap Fico BeginnersDocument710 pagesSap Fico Beginnersprincereddy100% (3)

- Merits and Demerits of Plastic Money Based On Experiences of PeoplesDocument13 pagesMerits and Demerits of Plastic Money Based On Experiences of PeoplesSOHEL BANGI84% (25)

- Chithambara College Past Students Association AccountsDocument61 pagesChithambara College Past Students Association Accountsapi-140426513No ratings yet

- Requirement 1 2 3: ACCT500: Course ProjectDocument18 pagesRequirement 1 2 3: ACCT500: Course Projectsuruth242No ratings yet

- Final AccountsDocument43 pagesFinal AccountsJincy Geevarghese100% (1)

- MCQs Problems For Merchandising Business - For UploadDocument8 pagesMCQs Problems For Merchandising Business - For UploadIrish Trisha PerezNo ratings yet

- e-StatementBRImo 385201001647508 Nov2023 20231117 133133Document2 pagese-StatementBRImo 385201001647508 Nov2023 20231117 133133yazidfadillah2019No ratings yet

- Topic 4 Double EntryDocument31 pagesTopic 4 Double Entry2023401088No ratings yet

- SAP FI OverviewDocument118 pagesSAP FI OverviewMian IrfanNo ratings yet

- Quiz 3 and 4Document11 pagesQuiz 3 and 4Irish AnnNo ratings yet

- Lembar Jawaban (PRINT) - UD WIRASTRIDocument34 pagesLembar Jawaban (PRINT) - UD WIRASTRInafitNo ratings yet

- Sage Accpac FR User GuideDocument206 pagesSage Accpac FR User GuideMichael Piaca GonzalesNo ratings yet

- Bank of America Statement Nov 2023 1Document9 pagesBank of America Statement Nov 2023 1raheemtimo1No ratings yet

- Fa - I Chapter 6Document13 pagesFa - I Chapter 6Hussen AbdulkadirNo ratings yet

- Journal Posting TempletDocument7 pagesJournal Posting TempletbiniyamNo ratings yet

- Ias 16Document26 pagesIas 16Niharika MishraNo ratings yet