Professional Documents

Culture Documents

MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805

Uploaded by

Rainy GoodwillOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805

Uploaded by

Rainy GoodwillCopyright:

Available Formats

a

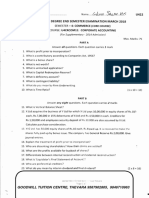

E L437 (Pages:4+3=7) Re g. No....(55.k.5....(,.......

Nam"..R*tlxn*

B.Com. DEGREE (C.B.C.S.S.) EXAMINATION, II{ARCH 2018

. Sixth Semester

.{ :.

Csre Course - APPLIED COST ACCOIJNTING

(Common for Co-operation, Finance and Taxation and Tlavel and Tourism)

[For Private Registration Candidates]

Time : Three Hours MuimumWeight: 25

Instruction s: This question paper contai1tstwo sectio ns. AnswerSection questions in the I

answer-book prbuid.ed. Section II Internal Examinationque,stions rnust be answered, in the

question paper itself. Follow the detailed instructions giuen under Section II.

Answers may be writteneither in English ot in Malayalarn.

Section I

Pem A

Answer all questions.

Each bunch of four questions carries a weight of L.

L Choose the correct answers :

(a) Output costing. (b) Job Costing. r

(c) Contract costing. ,d/"atch costing.

2. Terminal costing is also known as :

(a) Contract costing. ftXf"it costing.

@LAob costing. (d) Operating costing.

3. A product which has practically no salss or utility value is :

(a) Waste. (by'Scrap.

\

9 Spoilage. (d) Defectives.

4. Prod)rction cost under marginal costing include :

(a) cost only.

rPrime

$f Prime cost and variable overhead.

./

(D(rimb cost and fixed overhead.

(d) . Prime cost, variable overhead and fixed overhead.

II. Fill in the blanks :

5. Abnormal process losses should be transferred to F,yacrrr

aJL

6. In contract costing, the cost unit ir U]t}fu-k

Turn ove

a

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

E 143i,7

lj

,!

7. Under job costing, each job is known by its (' t t t"'t'

8. Pharmaceuticals Company adopt, J,{.@,l&t*sting.

m. State whether the following statements are True or False :

9. The cost'of abnormal process loss is not included in the cost of process. ,/

10. The allocdtion ofjoint costs to joint and by-products does not affect theiotal profit or loss^7

11. In absorption costing, the valuation of stock is higher than in marginal costing. +.

12. At break-even point, contribution is equal to fixed cost. /

fV. Match the followirrg :

13. Bicycle industry (a) Multiple costing.ry

L4. Cement (b) Operation costing.

15. Pharmaceuticals

.,(c) Output costir,9. i

16. Engineering industry (d) Process CostinS. \

Q

(e) Job costing.q) qr'

(O Batch costing, ,b

(g) Contract costing.t6,YA

(4x L=4)

Penr B

Answer any frve questions.

Each question carries a weight of L.

L7/ilhat is Job Costing?

LfiIrlhat is meant by work uncertified ?

19. What do you mean by key factor ?

20, What is budget manual?

2L. What do you mean by absorption costing?

2{ What is meant by Joint produ ct?

at is Abnormal gain ?

at do you mean by Joint Costs ?

(5x1=5)

Penr C

Answer any four questions.

Each questioru ca,rries a weight of 2.

25. Explain Cost Volume Profit Analysis.

26. Differentiate Work Certified and Work uncertified.

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

E 1437

:y" ExplatnZero base budgeting and performance budgeting.

2Y Acontractor has to supply 10,000 paper

__ cones per day

______ r__ __r to a textile unit. He finds that, when he

_,r_

'

( r_

. starts a production run he can produce 25,000 paper cones per day. The cost ofbuilding a

paper cone in stook for one year is 2 paise and the set up cost ofa production run is Rs. 18.

How frequently should production run be made?

rY-,

[z/. )me following data is given :

Fixed cost = Rs. 12,000

-" Selling pricir = Rs. 12 per unit t \O b

Variable cost Rs. 9 per unit

What will be the profit when sales is Rs. 60,000 ? What will be the amount of sales if it is

desired to earn a profit of Rs.6,000?

30l

,/ From the following particulars, prepare the cost sheet for Job No. 225 and find out the value

ofjob :

Direct materials used for the job Rs. 8,500.

Productive wages Rs. 12,100.

Direct expenses Rs. 760.

Charge of productive wages for factory overhead.s and

60Vo 2O%o of works cost for office

overheads. Profit to be earned on selling pice is 2OVo. i .

(4 x 2 = 8)

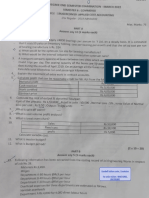

Pem D

Answer any loivo questinns.

Each question carries a weight of 4.

31. Explain the various methods and techniques of Costing.

32. In the course of manufacture of the main product'P', by products'A' and'B'also emerge. The

joint expenses. of manufacture amount to Rs. 1,19,550. All the three products are processed

further after separation and sold as per details given below :

%

Main Product By-products

.P' ,A' ,B'

Sales Rs.90,000 60,000 40,000

\ ,ff- Cost incurred after separation 6,000 5,000 4,000

*rrofit

'%rofit as percentase of sales 25 20 15

h.[o

^^

[q, [,8^^n ^4,

^frh[,"

IAE. oftotal cost ofsales which are apportioned to the three

^: Total fixed selling expenses are 10Vo

fraWV

products in the ratio of 20 :40 :4A. Prepare a statement showing the apportionment ofjoint

costs to the main product and trvo by-products.

Turn over

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

33. The budgeted cost of a factory specializing in the production of a single product at the optimum

capac.rty of _6-,19units per annum ry""ffi,f,s. 176,048 as detailed below :

ffi:,,:'::,,,, >r

20'688

Power 1,440 W'Y*

Repairs 1,700

k Miscellaneous 540

Direct material 49,280

Direct labour

,r

wr 1 ,02,400

- 1,55,360

L,76,049

Having regard to possible impact on sales turnover by market trends the company decided to

have a flexible budget with a production target qtg€90-""d 4,800 units (the actual quantity

proposed to be produced being left to a later date before commencement of the budget period).

Prepare a flexible budget for production levels at SOVo and, TS%o.capacity.

Assume selling price per unit is maintained at Rs. 40 as at present, indicate the effeet on

net profit. I

Administration, selling and distribution expenses continue at Rs. 3,600.

(2 x 4 = 8)

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

You might also like

- 2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Document4 pages2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- 2017 March B.com 5th Semester Special Accounting Question Paper MG University Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2017 March B.com 5th Semester Special Accounting Question Paper MG University Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy Goodwill50% (2)

- ACCT 6011 Assignment #2 Template W21Document5 pagesACCT 6011 Assignment #2 Template W21patel avaniNo ratings yet

- As Part of The Requirements of Her University Entrepreneurship ProgramDocument1 pageAs Part of The Requirements of Her University Entrepreneurship ProgramMiroslav GegoskiNo ratings yet

- Investment Decision Rules: © 2019 Pearson Education LTDDocument22 pagesInvestment Decision Rules: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- This Study Resource Was: Price 52Document3 pagesThis Study Resource Was: Price 52rashiNo ratings yet

- Chapter 13Document85 pagesChapter 13AdelaideNo ratings yet

- ACCT 6011 Assignment #1 TemplateDocument8 pagesACCT 6011 Assignment #1 Templatepatel avaniNo ratings yet

- FTCP Seminar 5 Answers (6) XSXSXSXDocument5 pagesFTCP Seminar 5 Answers (6) XSXSXSXLewis FergusonNo ratings yet

- FTCP - Sxsxsxsxeminar 6 - 2015 - AnswersDocument4 pagesFTCP - Sxsxsxsxeminar 6 - 2015 - AnswersLewis FergusonNo ratings yet

- Financial&managerial Accounting - 15e Williamshakabettner Chap 9Document17 pagesFinancial&managerial Accounting - 15e Williamshakabettner Chap 9mzqaceNo ratings yet

- Exercises: CS1B-15: EBCT - ExercisesDocument4 pagesExercises: CS1B-15: EBCT - ExercisesTaruna BajajNo ratings yet

- Cost Accounting SEM VI - A7a647e3 3463 45a2 Aeda 9b11352ea07cDocument11 pagesCost Accounting SEM VI - A7a647e3 3463 45a2 Aeda 9b11352ea07csimran KeswaniNo ratings yet

- QuestionsDocument14 pagesQuestionsojasvi3350No ratings yet

- Core 3-Cost Accounting (SBC)Document4 pagesCore 3-Cost Accounting (SBC)swainananta336No ratings yet

- Cost AccountingDocument12 pagesCost Accountingdivyayella024No ratings yet

- 5-Fundamentals of CostingDocument7 pages5-Fundamentals of CostingNasa UsaNo ratings yet

- ME - Tutorial Evaluation 3: Name: - Er - No.: - 1 2 3 4 5 6 7 8 9Document1 pageME - Tutorial Evaluation 3: Name: - Er - No.: - 1 2 3 4 5 6 7 8 9Tamanna SinghNo ratings yet

- Cost Accounting Answer Key for MTP_Intermediate_Syl2016_June2017_Set 2Document17 pagesCost Accounting Answer Key for MTP_Intermediate_Syl2016_June2017_Set 2Sagul HameedNo ratings yet

- Quiz 1 BDocument8 pagesQuiz 1 BTahseenNo ratings yet

- General Economics Paper-IDocument7 pagesGeneral Economics Paper-ISarthak MishraNo ratings yet

- Midterm Examination Iii Intermediate MicroeconomicsDocument5 pagesMidterm Examination Iii Intermediate MicroeconomicsOng Wei LingNo ratings yet

- Eco2003f Exam 2010 PDFDocument10 pagesEco2003f Exam 2010 PDFSiphoNo ratings yet

- Microeconomic Theory I QP2Document3 pagesMicroeconomic Theory I QP2Anand KoleNo ratings yet

- P8 Syl2012 Set1Document24 pagesP8 Syl2012 Set110Jyoti KumariNo ratings yet

- CAPE Accounting 2009 U2 P1Document11 pagesCAPE Accounting 2009 U2 P1Lauren EstwickNo ratings yet

- Hellman Midterm2 AnswersDocument26 pagesHellman Midterm2 Answersmahirahmed51No ratings yet

- Study of Cost Accounting and AnalysisDocument410 pagesStudy of Cost Accounting and AnalysisloknathNo ratings yet

- P8 PDFDocument18 pagesP8 PDFA22BBD65No ratings yet

- CAPE Management of Business 2008 U2 P1Document8 pagesCAPE Management of Business 2008 U2 P1Unknown userNo ratings yet

- Instructions:: Question Paper Booklet NoDocument16 pagesInstructions:: Question Paper Booklet NoArpita ChawlaNo ratings yet

- Paper 8Document40 pagesPaper 8rvee kalraNo ratings yet

- CMA Test Paper June 2018Document210 pagesCMA Test Paper June 2018gouravbhatia200189100% (1)

- Problem Set 6: ECON 301, Professor HogendornDocument9 pagesProblem Set 6: ECON 301, Professor HogendornSukayna AmeenNo ratings yet

- Midterm Examination Iii Intermediate MicroeconomicsDocument5 pagesMidterm Examination Iii Intermediate MicroeconomicsAhmed LakhaniNo ratings yet

- Public Investment CriteriaDocument21 pagesPublic Investment Criteriabalwant_negi7520No ratings yet

- Paper8 SolutionDocument14 pagesPaper8 SolutionHarsh TanejaNo ratings yet

- University of Santo Tomas: Alfredo M. Velayo College of AccountancyDocument7 pagesUniversity of Santo Tomas: Alfredo M. Velayo College of AccountancyPrincess Jay NacorNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- MGT236-Examples and Problems, Feb.,2021Document10 pagesMGT236-Examples and Problems, Feb.,2021Faisal KhanNo ratings yet

- Inventory Control Models: EPL ModelDocument25 pagesInventory Control Models: EPL ModeldarmianaNo ratings yet

- Tybcaf Sem-VDocument29 pagesTybcaf Sem-Vkatejagruti3No ratings yet

- Test Bank For Economics 4th Edition N Gregory Mankiw Mark P TaylorDocument13 pagesTest Bank For Economics 4th Edition N Gregory Mankiw Mark P Taylorderekwhitereqtxmjcba100% (27)

- Chapter 5Document5 pagesChapter 5Anh Thu VuNo ratings yet

- 4 2006 Dec QDocument9 pages4 2006 Dec Qapi-19836745No ratings yet

- Chapter 8 Short - Run Costs and Output DecisionsDocument74 pagesChapter 8 Short - Run Costs and Output DecisionsasimNo ratings yet

- Industrial Engineering by S K Mondal.0002Document70 pagesIndustrial Engineering by S K Mondal.0002basavaraj mittalakattechikkappaNo ratings yet

- Chapter 1Document4 pagesChapter 1sadsadsa100% (1)

- 1st Sem 2013 BcomDocument52 pages1st Sem 2013 BcompiqueNo ratings yet

- General Comments: The Chartered Institute of Management AccountantsDocument27 pagesGeneral Comments: The Chartered Institute of Management AccountantsZic ZacNo ratings yet

- MB - 301 (2009)Document11 pagesMB - 301 (2009)pranabroyNo ratings yet

- T4 June 07 QuesDocument10 pagesT4 June 07 QuessmhgilaniNo ratings yet

- SKEMA PSPM 18-19 AA025Document10 pagesSKEMA PSPM 18-19 AA025Dehey KNo ratings yet

- Microeconomic Theory Basic Principles and Extensions 11th Edition Nicholson Test BankDocument8 pagesMicroeconomic Theory Basic Principles and Extensions 11th Edition Nicholson Test Bankmagnusngah7aaz100% (30)

- B.Com 6th Semester 2023 QuestionsDocument10 pagesB.Com 6th Semester 2023 Questionsswainananta336No ratings yet

- CV6216 2123 S2 TPwwf3-Retirement & ReplacementDocument22 pagesCV6216 2123 S2 TPwwf3-Retirement & ReplacementZJ XNo ratings yet

- Prelim Exam PDFDocument6 pagesPrelim Exam PDFPaw VerdilloNo ratings yet

- Income Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Document4 pagesIncome Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Rainy GoodwillNo ratings yet

- Second Semester October 2022 Financial Accounting 2 Question Paper MGUDocument5 pagesSecond Semester October 2022 Financial Accounting 2 Question Paper MGURainy GoodwillNo ratings yet

- MGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Document4 pagesMGU CBCSS Sixth Sem Applied Cost Accounting Question Paper March 2018 Free Download Goodwill Tuition Centre For Accountancy 9846710963 9567902805Rainy GoodwillNo ratings yet

- Accounting For Management SCMS Question PapersDocument7 pagesAccounting For Management SCMS Question PapersRainy GoodwillNo ratings yet

- Income Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGUDocument3 pagesIncome Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGURainy GoodwillNo ratings yet

- Calicut Sreelaxmi QP 2022 March 23Document4 pagesCalicut Sreelaxmi QP 2022 March 23Rainy GoodwillNo ratings yet

- Degree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityDocument4 pagesDegree (CBCSS) Examination - Model Question Paper 2016 Applied Costing MG UniversityRainy GoodwillNo ratings yet

- October 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperDocument4 pagesOctober 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperRainy GoodwillNo ratings yet

- Agriculture Income - Income TaxDocument5 pagesAgriculture Income - Income TaxRainy GoodwillNo ratings yet

- Cost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssDocument4 pagesCost Accounting 5th Sem October 2018 Goodwill Tuition Centre Thevara Question Paper CbcssRainy GoodwillNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNo ratings yet

- MGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryDocument6 pagesMGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryRainy GoodwillNo ratings yet

- Goodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Document4 pagesGoodwill Tuition Centre, Ernakulam For Online Tuition: 9846710963, 9567902805Rainy GoodwillNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- Cusat Question Paper Mba Accounting For Managers 2022 MarchDocument3 pagesCusat Question Paper Mba Accounting For Managers 2022 MarchRainy GoodwillNo ratings yet

- Final Accounts AdjustmentsDocument7 pagesFinal Accounts AdjustmentsRainy GoodwillNo ratings yet

- MGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Rainy GoodwillNo ratings yet

- IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Document4 pagesIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Rainy GoodwillNo ratings yet

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocument62 pagesMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNo ratings yet

- Defence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustDocument10 pagesDefence Accounts Department SAS Examination Question Paper Accountancy 2016 AugustRainy GoodwillNo ratings yet

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocument62 pagesMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNo ratings yet

- 2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Document4 pages2018 March B.com Special Accounting Question Paper 4th Smester SH College Autonomous Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNo ratings yet

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Document7 pagesAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillNo ratings yet

- IFRS B.com SH College Model Question Paper 2017 March 2Document2 pagesIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- Impact of Covid-19 On Two - Wheeler Market in IndiaDocument4 pagesImpact of Covid-19 On Two - Wheeler Market in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Peserta Sosialisasi PP Batch IIDocument2 pagesPeserta Sosialisasi PP Batch IIDhuhri DelMarNo ratings yet

- Linear Programing (Problem Formulation)Document13 pagesLinear Programing (Problem Formulation)HafsaparkerNo ratings yet

- 0 - Aditya MNC Assignment PDFDocument22 pages0 - Aditya MNC Assignment PDFAshish pariharNo ratings yet

- Quote For - DMIAGRP For Projector & Accessories August 2020Document1 pageQuote For - DMIAGRP For Projector & Accessories August 2020raviezsoftNo ratings yet

- Making tractor markets work for smallholder farmers in NigeriaDocument24 pagesMaking tractor markets work for smallholder farmers in NigeriaMazen BackupNo ratings yet

- IIFL - Rollover Action - Feb-21 T Expiry DayDocument6 pagesIIFL - Rollover Action - Feb-21 T Expiry DayRomelu MartialNo ratings yet

- Palm Oil Business Plan (001-025)Document25 pagesPalm Oil Business Plan (001-025)Jevenal KoffiNo ratings yet

- A Framework For Traceability and Transparency in The Dairy Supply Chain NetworksDocument10 pagesA Framework For Traceability and Transparency in The Dairy Supply Chain NetworksDragana IlijevskaNo ratings yet

- My - Companies Source Vcsdata - Com - 2024 03 02 - 05 00Document2 pagesMy - Companies Source Vcsdata - Com - 2024 03 02 - 05 00pankhuri.singhNo ratings yet

- Lesson 2 Basic Osah, General Provisions, Safety Rules..Document30 pagesLesson 2 Basic Osah, General Provisions, Safety Rules..GM VispoNo ratings yet

- Changodar GIDC Company List PDFDocument4 pagesChangodar GIDC Company List PDFemersionNo ratings yet

- Bain Report - FaaS PDFDocument38 pagesBain Report - FaaS PDFVaishnaviRaviNo ratings yet

- B. Lingkungan Internal Bisnis 1. Critical Success Factor PT - Indofood Sukses Makmur TBKDocument2 pagesB. Lingkungan Internal Bisnis 1. Critical Success Factor PT - Indofood Sukses Makmur TBKRANIA ABDUL AZIZ BARABANo ratings yet

- Brij Glass Industries PVT - Ltd. Rohini-4, Shulihwa, Chipagadh, Bhariahawa, Nepal Raw Materials Stock As OnDocument4 pagesBrij Glass Industries PVT - Ltd. Rohini-4, Shulihwa, Chipagadh, Bhariahawa, Nepal Raw Materials Stock As OnSunil PalNo ratings yet

- Industrial Pattern Changes During India's Five Year PlansDocument8 pagesIndustrial Pattern Changes During India's Five Year PlansSAJAHAN MOLLANo ratings yet

- Ticket & Receipt: Your Travel InformationDocument4 pagesTicket & Receipt: Your Travel InformationMozart Luiz Mattoso Pinheiro BarbosaNo ratings yet

- 2424 Fort Worth Star-Telegram 1908-02-16 5Document1 page2424 Fort Worth Star-Telegram 1908-02-16 5Richard TonsingNo ratings yet

- My Personal Goals: Name: Terso P. Gregorio Jr. Section: Bsfinance 2BDocument5 pagesMy Personal Goals: Name: Terso P. Gregorio Jr. Section: Bsfinance 2BTerso GregorioNo ratings yet

- Oil Market Outlook: Equities & CommoditiesDocument25 pagesOil Market Outlook: Equities & CommoditiesCynric HuangNo ratings yet

- BPI Q Form No. 10eDocument1 pageBPI Q Form No. 10eEXPORT SECTION NPQSDNo ratings yet

- Group 4: Cathrine Hengebøl, Eline Guern, Luca Hangarter, Florian Garbaccio, Thanh Duy HaDocument10 pagesGroup 4: Cathrine Hengebøl, Eline Guern, Luca Hangarter, Florian Garbaccio, Thanh Duy HaHà Duy Thành100% (1)

- Bachelor of Business Administration (Hons) Finance (BM242/BA242)Document3 pagesBachelor of Business Administration (Hons) Finance (BM242/BA242)nur fatinNo ratings yet

- Nippon India Small CapDocument17 pagesNippon India Small CapArmstrong CapitalNo ratings yet

- A Study of Outlook Money Magazine and Its Impact On Investment Behavior (Responses)Document40 pagesA Study of Outlook Money Magazine and Its Impact On Investment Behavior (Responses)Vivek PatelNo ratings yet

- BT Chương 3 - EnquiriesDocument5 pagesBT Chương 3 - EnquiriesNguyen Thuc QuyenNo ratings yet

- Eco 1Document8 pagesEco 1Tanishq KambojNo ratings yet

- How the Division of Labor and Comparative Advantage Increase Productivity and Living StandardsDocument2 pagesHow the Division of Labor and Comparative Advantage Increase Productivity and Living StandardsAnna M SylvesterNo ratings yet

- Bsa2 1 1Document2 pagesBsa2 1 1Shannen OrtegaNo ratings yet

- 33727-Article Text-165012-1-10-20220211Document10 pages33727-Article Text-165012-1-10-20220211uliyaNo ratings yet