Professional Documents

Culture Documents

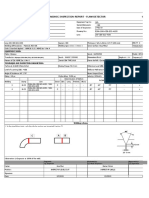

The Beige Book Flow Sheet

Uploaded by

moCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Beige Book Flow Sheet

Uploaded by

moCopyright:

Available Formats

The Beige Book

the Summary of Commentary on Current Economic Conditions

published by the United States Federal Reserve Board

How is the information used?

The anecdotal information collected in the Beige Book supplements the data and analysis used by Federal

Reserve economists and staff to assess economic conditions in the Federal Reserve Districts. This

information enables comparison of economic conditions in different parts of the country, which can be

helpful for assessing the outlook for the national economy. The Beige Book also serves as a regular

summary of the Federal Reserve System’s efforts to listen to businesses and community organizations.

The System serves commonwealths and territories as follows: the New York Bank serves the Commonwealth of

Puerto Rico and the U.S. Virgin Islands; the San Francisco Bank serves American Samoa, Guam, and the

Commonwealth of the Northern Mariana Islands.

-------------------------------------------------------------------------------------------------------------------------------

Boston A-1 First District Chicago G-1 Seventh District

New York B-1 Second District St. Louis H-1 Eighth District

Philadelphia C-1 Third District Minneapolis I-1 Ninth District

Cleveland D-1 Fourth District Kansas City J-1 Tenth District

Richmond E-1 Fifth District Dallas K-1 Eleventh District

Atlanta F-1 Sixth District San Francisco L-1 Twelfth District

-------------------------------------------------------------------------------------------------------------------------------

The Beige Book, more formally called the Summary of Commentary on Current Economic

Conditions, is a report published by the United States Federal Reserve Board eight times a year.

the Summary of Commentary is an analysis of economic activity and conditions, prepared

with the aid of reports from the district Federal Reserve Banks and issued by the central bank

of the Federal Reserve for its policy makers before a Federal Open Market Committee

meeting.

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve

System (the Fed), is charged under the United States law with overseeing the nation's open

market operations (e.g., the Fed's buying and selling of United States Treasury

securities).[1] This Federal Reserve committee makes key decisions about interest rates and

the growth of the United States money supply.

Each report is a gathering of "anecdotal information on current economic conditions" by

each Federal Reserve Bank in its district from "Bank and Branch directors and interviews

with key business contacts, economists, market experts, and others."

----------------------------------------------------------Definitions------------------------------------------------------------

Anecdotal evidence is evidence from anecdotes, i.e., evidence collected in a casual or informal

manner and relying heavily or entirely on personal testimony

* Anecdotal evidence is based on hearsay rather than hard facts.)

- an·ec·dote > a short, obscure historical or biographical account.

- bi·o·graph·i·cal > A biography, or simply bio, is a detailed description of a person's life

- dy·nam·ics > the forces or properties that stimulate growth, development, or change within a

system or process

- stim·u·late > encourage development of or increased activity in (a state or process)

- char·ac·ter·ize > describe the distinctive nature or features of.

- Supplement > to add something extra in order to improve something or make it bigger; To

include something or someone.

- sur·e·ty > a person who takes responsibility for another's performance of an undertaking, for

example their appearing in court or the payment of a debt.

- Surety bond > A surety bond or surety is a promise by a surety or guarantor to pay one

party a certain amount if a second party fails to meet some obligation, such as fulfilling the

terms of a contract. Wikipedia

-------------------------------------------------------------------------------------------------------------------------

Fact 1 All bank holding companies in the US are required to register with the Board of

Governors of the Federal Reserve System / The Federal Reserve Board of Governors in

Washington DC (https://www.federalreserve.gov/)

Fact 2

-------------------------------------------------------------------------------------------------------------------------

FDIC: Federal Deposit Insurance Corporation

https://www.fdic.gov/

- The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by

the U.S. Congress to maintain stability and public confidence in the nation's financial system

by insuring deposits, examining and supervising financial institutions for safety and

soundness and consumer protection, and managing

-------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------

You might also like

- The Federal Reserve Owns Your LifeDocument10 pagesThe Federal Reserve Owns Your Lifemo100% (2)

- A4v MethodsDocument2 pagesA4v Methodsambassadors100% (22)

- Declaration of Dianne-Michele: Carter El-Bey, A Living WomanDocument1 pageDeclaration of Dianne-Michele: Carter El-Bey, A Living WomanEmpressInINo ratings yet

- UCC Financing Statement ResetDocument6 pagesUCC Financing Statement Resetmo100% (1)

- Alarm Statutes 062014 ArkansasDocument26 pagesAlarm Statutes 062014 ArkansaslememefrogNo ratings yet

- Debt Truth 05Document1 pageDebt Truth 05Sue RhoadesNo ratings yet

- Discretionary TrustDocument21 pagesDiscretionary TrustmoNo ratings yet

- Tutorial 070Document20 pagesTutorial 070Jason HenryNo ratings yet

- 7 Points For An AffidavitDocument1 page7 Points For An AffidavitmoNo ratings yet

- Claim For Lost, Stolen, or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen, or Destroyed United States Savings BondsMr McBrideNo ratings yet

- Vehicle Bill of SaleDocument1 pageVehicle Bill of SaleBen EvadoNo ratings yet

- Tips For When To Employ Living Trusts - InvestopediaDocument4 pagesTips For When To Employ Living Trusts - InvestopediamoNo ratings yet

- Form of Protest Which May in Terms of Section Ninety-Eight ofDocument3 pagesForm of Protest Which May in Terms of Section Ninety-Eight ofJohn KronnickNo ratings yet

- Affidavit Police: Paul Andrew Mitchell Private Attorney General Mitchell v. AOL Time Warner, Inc. Et AlDocument3 pagesAffidavit Police: Paul Andrew Mitchell Private Attorney General Mitchell v. AOL Time Warner, Inc. Et AlmoNo ratings yet

- Purchase Agreement TemplateDocument9 pagesPurchase Agreement TemplateCarol MarieNo ratings yet

- These 15 Billionaires Own America's News Media CompaniesDocument6 pagesThese 15 Billionaires Own America's News Media CompaniesmoNo ratings yet

- These 15 Billionaires Own America's News Media CompaniesDocument6 pagesThese 15 Billionaires Own America's News Media CompaniesmoNo ratings yet

- 8 U.S. Code 1101 - 2 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDocument42 pages8 U.S. Code 1101 - 2 - Definitions - U.S. Code - US Law - LII - Legal Information InstitutemoNo ratings yet

- 8 U.S. Code 1101 - 2 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDocument42 pages8 U.S. Code 1101 - 2 - Definitions - U.S. Code - US Law - LII - Legal Information InstitutemoNo ratings yet

- Depositories Act 1996Document25 pagesDepositories Act 1996siddharthdileepkamatNo ratings yet

- CAUSE NUMBER: - State of Texas in The Municipal Court VS. City of Fort Worth Tarrant County, Texas Know All Men by These PresentsDocument1 pageCAUSE NUMBER: - State of Texas in The Municipal Court VS. City of Fort Worth Tarrant County, Texas Know All Men by These PresentsAngela WigleyNo ratings yet

- Belize Trust ChecklistDocument5 pagesBelize Trust ChecklistmoNo ratings yet

- Contract Formation: Offer, Acceptance & ValidityDocument1 pageContract Formation: Offer, Acceptance & ValidityKevin YomborNo ratings yet

- Today 10.lenderDocument9 pagesToday 10.lenderGamaya EmmanuelNo ratings yet

- 27four Tax Free Savings New Investment FormDocument8 pages27four Tax Free Savings New Investment FormLord OversightNo ratings yet

- 28 U.S. Code 2042 - Withdrawal - US Law - LII: Legal Information InstituteDocument4 pages28 U.S. Code 2042 - Withdrawal - US Law - LII: Legal Information InstituteBaqi-Khaliq BeyNo ratings yet

- W 9 PDFDocument1 pageW 9 PDFИринаNo ratings yet

- The Ancient Aliens - Annunaki - Creation of HumansDocument5 pagesThe Ancient Aliens - Annunaki - Creation of HumansmoNo ratings yet

- Rules Online Filing Ucc DocumentsDocument2 pagesRules Online Filing Ucc DocumentsmoNo ratings yet

- Writ in The Nature of Discovery: Moorish AmericansDocument1 pageWrit in The Nature of Discovery: Moorish AmericansAnonymous dCe1SVNo ratings yet

- What Is A BondDocument2 pagesWhat Is A BondKau MilikkuNo ratings yet

- Fax Confirmation To Fraud Qween Elizabeth II Prima Facie Evidence of Indigenous StandingDocument26 pagesFax Confirmation To Fraud Qween Elizabeth II Prima Facie Evidence of Indigenous Standingmo100% (6)

- Surplus Cash Note: Note Must Be On or After The Maturity Date of The Note.)Document3 pagesSurplus Cash Note: Note Must Be On or After The Maturity Date of The Note.)PAW F McCOYNo ratings yet

- Land Patent Update Process ContractDocument3 pagesLand Patent Update Process ContractAnthonyHansenNo ratings yet

- ASTRO UserguideDocument1,054 pagesASTRO UserguideMarwan Ahmed100% (1)

- True Av4 Stamp Vs NonsenseDocument1 pageTrue Av4 Stamp Vs NonsensemoNo ratings yet

- Proof of Delivery COVER LETTERDocument1 pageProof of Delivery COVER LETTERBen Hill100% (1)

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- Dodd-Frank Act - Final and Proposed Rules Compliance Matrix and CalendarDocument1 pageDodd-Frank Act - Final and Proposed Rules Compliance Matrix and CalendarIQ3 Solutions GroupNo ratings yet

- Issuing SecuritiesDocument6 pagesIssuing SecuritiesKomal ShujaatNo ratings yet

- Consumer Credit Explained: Types, Sources and Demand FactorsDocument12 pagesConsumer Credit Explained: Types, Sources and Demand FactorsDrpranav SaraswatNo ratings yet

- Borrower-In-Custody Program GuidelinesDocument16 pagesBorrower-In-Custody Program GuidelinesMichael FociaNo ratings yet

- Beneficiary Designation: Policy InformationDocument2 pagesBeneficiary Designation: Policy Informationjaniceseto1No ratings yet

- FAR Mandatory DisclosureNEWDocument5 pagesFAR Mandatory DisclosureNEWMin Hotep Tzaddik BeyNo ratings yet

- V Ships Appln FormDocument6 pagesV Ships Appln Formkaushikbasu2010No ratings yet

- Securing Obligations Through Pledge and MortgageDocument4 pagesSecuring Obligations Through Pledge and MortgagePrincessAngelaDeLeon100% (1)

- Appellant Zaakera Stratman'sDocument11 pagesAppellant Zaakera Stratman'sb1525cNo ratings yet

- 18 U.S. Code 9 - Vessel of The United States Defined - U.S. Code - US Law - LII - Legal Information InstituteDocument3 pages18 U.S. Code 9 - Vessel of The United States Defined - U.S. Code - US Law - LII - Legal Information InstitutemoNo ratings yet

- PardonApp Pack PDFDocument8 pagesPardonApp Pack PDFCsc WatersNo ratings yet

- Recreational Flyer WashingtonDocument3 pagesRecreational Flyer Washingtonsolution4theinnocentNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- PRINT in BLACK INK. Ovals Must Be Filled in Completely.Document2 pagesPRINT in BLACK INK. Ovals Must Be Filled in Completely.mik2bgNo ratings yet

- Trust Services - Belize Offshore Services LTDDocument2 pagesTrust Services - Belize Offshore Services LTDmoNo ratings yet

- PQ of Vial Washer Ensures Removal of ContaminantsDocument25 pagesPQ of Vial Washer Ensures Removal of ContaminantsJuan DanielNo ratings yet

- Puerto Rico's Payday LoansDocument3 pagesPuerto Rico's Payday LoansRoosevelt Institute100% (3)

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsDocument2 pagesProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionNo ratings yet

- LeverageDocument38 pagesLeverageAnant MauryaNo ratings yet

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryFrom EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNo ratings yet

- Instructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument6 pagesInstructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- Interview Evaluation Form: Does The Applicant Make A Good Impression?Document2 pagesInterview Evaluation Form: Does The Applicant Make A Good Impression?Magdi Mawad MustafaNo ratings yet

- Statutory and Other RestrictionsDocument15 pagesStatutory and Other Restrictionsrgovindan123No ratings yet

- Winslow Township - Commerical Lien - Affidavit of ObligationDocument1 pageWinslow Township - Commerical Lien - Affidavit of ObligationJ. F. El - All Rights ReservedNo ratings yet

- How To Purchase A Foreclosure Property From PASDocument3 pagesHow To Purchase A Foreclosure Property From PASsin2begin2No ratings yet

- Application For Corporate Net BankingDocument9 pagesApplication For Corporate Net BankingGosswin Gnanam G100% (1)

- Torren Colcord's "Promissary Note"Document6 pagesTorren Colcord's "Promissary Note"RickyRescueNo ratings yet

- Norman F. Dacey and Norman F. Dacey, Doing Business As National Estate Planning Council v. New York County Lawyers' Association, 423 F.2d 188, 2d Cir. (1970)Document18 pagesNorman F. Dacey and Norman F. Dacey, Doing Business As National Estate Planning Council v. New York County Lawyers' Association, 423 F.2d 188, 2d Cir. (1970)Scribd Government DocsNo ratings yet

- Deed of SurrenderDocument10 pagesDeed of SurrenderGhanshyam mishraNo ratings yet

- Chicago Offering DocumentsDocument280 pagesChicago Offering DocumentsThe Daily LineNo ratings yet

- How Much Should You InvestDocument3 pagesHow Much Should You InvestKurian PunnooseNo ratings yet

- Regn. No.: The Employees' Deposit Linked Insurance Scheme 1976Document2 pagesRegn. No.: The Employees' Deposit Linked Insurance Scheme 1976Tilak RajNo ratings yet

- TDCAA DWI Caselaw Update 120621Document206 pagesTDCAA DWI Caselaw Update 120621Charles SullivanNo ratings yet

- Chapter 3 - LDS Inc.Document7 pagesChapter 3 - LDS Inc.Brad LevinNo ratings yet

- Small Estate Affidavit (Blank)Document2 pagesSmall Estate Affidavit (Blank)Denise Corder HallNo ratings yet

- Treasury Secretary Steve Mnuchin Asks Congress To Raise Debt LimitDocument1 pageTreasury Secretary Steve Mnuchin Asks Congress To Raise Debt LimitCNBC.comNo ratings yet

- Official Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineDocument3 pagesOfficial Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineCarloe Perez100% (1)

- Mount Holyoke College travel waiver and release formDocument1 pageMount Holyoke College travel waiver and release formidkthisusernameNo ratings yet

- Shopoff Land PPM - 9!6!07Document188 pagesShopoff Land PPM - 9!6!07tower8No ratings yet

- Southern Florida: United States Bankruptcy CourtDocument38 pagesSouthern Florida: United States Bankruptcy CourtMy-Acts Of-SeditionNo ratings yet

- 55 - Gov - Uscourts.ord.124749.55.0Document4 pages55 - Gov - Uscourts.ord.124749.55.0Freeman LawyerNo ratings yet

- 21 Templates that Run Your World: Keys to Unlocking Your Success in Business, Love and MoneyFrom Everand21 Templates that Run Your World: Keys to Unlocking Your Success in Business, Love and MoneyNo ratings yet

- WESS 2017 ch2Document26 pagesWESS 2017 ch2Muzamil SajjadNo ratings yet

- The Legacy of Doctor MoreauDocument1 pageThe Legacy of Doctor MoreaumoNo ratings yet

- The CIA's Mockingbird Media ExposedDocument3 pagesThe CIA's Mockingbird Media ExposedmoNo ratings yet

- 28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDocument4 pages28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstitutemoNo ratings yet

- Individuality in Religion-Study guied-MTE-ConsultantingDocument122 pagesIndividuality in Religion-Study guied-MTE-ConsultantingmoNo ratings yet

- 20180831172446139Document10 pages20180831172446139moNo ratings yet

- Intent To VacateDocument1 pageIntent To VacatemoNo ratings yet

- Temporary changes to content during election periodDocument2 pagesTemporary changes to content during election periodmoNo ratings yet

- "Speci Al Ty Adverti Si NG": Cbe/ Sbe/ Ldbe/ Mbe/ WBEDocument1 page"Speci Al Ty Adverti Si NG": Cbe/ Sbe/ Ldbe/ Mbe/ WBEmoNo ratings yet

- "COMPANY NAME" Business Plan: (Tagline or Philosophy) Add A Photo or Personal Design (Optional)Document12 pages"COMPANY NAME" Business Plan: (Tagline or Philosophy) Add A Photo or Personal Design (Optional)moNo ratings yet

- Interest Rates and Interest ChargesDocument4 pagesInterest Rates and Interest ChargesmoNo ratings yet

- Rapid ECG Interpretation Skills ChallengeDocument91 pagesRapid ECG Interpretation Skills ChallengeMiguel LizarragaNo ratings yet

- Test Engleza 8Document6 pagesTest Engleza 8Adriana SanduNo ratings yet

- Future War in Cities Alice Hills PDFDocument5 pagesFuture War in Cities Alice Hills PDFazardarioNo ratings yet

- KEC115/6/7x: Ac Generator Short Circuit and Over Current GuardDocument4 pagesKEC115/6/7x: Ac Generator Short Circuit and Over Current GuardRN NNo ratings yet

- On-Chip ESD Protection Design For IcsDocument14 pagesOn-Chip ESD Protection Design For IcsMK BricksNo ratings yet

- Construction Internship ReportDocument8 pagesConstruction Internship ReportDreaminnNo ratings yet

- Ted Hughes's Crow - An Alternative Theological ParadigmDocument16 pagesTed Hughes's Crow - An Alternative Theological Paradigmsa46851No ratings yet

- Nigerian Romance ScamDocument10 pagesNigerian Romance ScamAnonymous Pb39klJNo ratings yet

- Mechanical Function of The HeartDocument28 pagesMechanical Function of The HeartKarmilahNNo ratings yet

- 09 Bloom Gardner Matrix Example 2009Document2 pages09 Bloom Gardner Matrix Example 2009Ellen Jaye BensonNo ratings yet

- Brief Cop27 Outcomes and Cop28 EngDocument24 pagesBrief Cop27 Outcomes and Cop28 EngVasundhara SaxenaNo ratings yet

- Generic Strategies: Lessons From Crown Cork & Seal and Matching DellDocument16 pagesGeneric Strategies: Lessons From Crown Cork & Seal and Matching DellavaNo ratings yet

- Securifire 1000-ExtractedDocument2 pagesSecurifire 1000-ExtractedWilkeey EstrellanesNo ratings yet

- Simple Present 60991Document17 pagesSimple Present 60991Ketua EE 2021 AndrianoNo ratings yet

- Chapter 9 Lease DecisionsDocument51 pagesChapter 9 Lease Decisionsceoji25% (4)

- Ut ProcedureDocument2 pagesUt ProcedureJJ WeldingNo ratings yet

- GF26.10-S-0002S Manual Transmission (MT), Function 9.7.03 Transmission 716.6 in MODEL 639.601 /603 /605 /701 /703 /705 /711 /713 /811 /813 /815Document2 pagesGF26.10-S-0002S Manual Transmission (MT), Function 9.7.03 Transmission 716.6 in MODEL 639.601 /603 /605 /701 /703 /705 /711 /713 /811 /813 /815Sven GoshcNo ratings yet

- LinkedIn Learning - Workplace Learning Report 2021 EN 1Document65 pagesLinkedIn Learning - Workplace Learning Report 2021 EN 1Ronald FriasNo ratings yet

- JE Creation Using F0911MBFDocument10 pagesJE Creation Using F0911MBFShekar RoyalNo ratings yet

- All Paramedical CoursesDocument23 pagesAll Paramedical CoursesdeepikaNo ratings yet

- MCS Adopts Milyli Software Redaction Tool BlackoutDocument3 pagesMCS Adopts Milyli Software Redaction Tool BlackoutPR.comNo ratings yet

- Dice Resume CV Narendhar ReddyDocument5 pagesDice Resume CV Narendhar ReddyjaniNo ratings yet

- ms360c Manual PDFDocument130 pagesms360c Manual PDFEdgardoCadaganNo ratings yet

- Blackmagic RAW Speed TestDocument67 pagesBlackmagic RAW Speed TestLeonardo Terra CravoNo ratings yet

- Supply Chain Management of VodafoneDocument8 pagesSupply Chain Management of VodafoneAnamika MisraNo ratings yet

- M Audio bx10s Manuel Utilisateur en 27417Document8 pagesM Audio bx10s Manuel Utilisateur en 27417TokioNo ratings yet