Professional Documents

Culture Documents

Swift Standards Infographiciso20022

Uploaded by

Hemant Sudhir WavhalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Swift Standards Infographiciso20022

Uploaded by

Hemant Sudhir WavhalCopyright:

Available Formats

Welcome to ISO 20022

Key Benefits

A single standardisation approach (methodology,

process, repository) to be used by all financial

standards initiatives. Provides a foundation for Open standard

efficient communication between industry players Open to everyone, not

controlled by a single interest

End-to-end automation

Single standard covering all

business domains and

end-to-end processes

Global standard to meet local needs

A rich, structured standard that supports

the definition of formal market practice

ISO 20022 Content

Facilitates communication between business

partners as well as internal enterprise Modern and future-proof

communication technology

• Business model and data dictionary • Uses modern,well-supported

• Catalogue of messages covers all financial technology (XML) that facilitates

business areas: efficient integration

- 20 business areas • Adaptable to new technologies as

- 365 registered ISO 20022 messages they emerge

(since 2004)

- More than 25 submitting organisations

(since 2004) ISO 20022 means business

& facilitates new services

Covers new flows, functionalities,

business segments, regulatory

ISO 20022 Registration Authority (RA)

requirements and structured data

• Safeguards the quality of the Financial

Repository

• Ensures compliance to the standard

• Maintains the ISO 20022 website

(www.iso20022.org)

Additional actors include the

Registration Management Group (RMG),

the Standards Evaluation Groups (SEGs)

and the Technical Support Group (TSG).

ISO 20022 is taking off around the world

Close to 200 initiatives under discussion, planned or live

Majority are driven by market infrastructures which adopt ISO 20022 to:

• Comply with regulation that mandates ISO 20022;

• Renew legacy technology;

• Improve market efficiency and reduce cost;

• Facilitate regional integration or internationalise domestic services;

• Harmonise legacy domestic standards;

• Realise efficient end-to-end business processes.

Initiatives per region: Initiatives across business areas:

10% 20% 70% 1% 1% 43% 55%

Americas Asia Europe, FX Trade Payments Securities

Pacific Middle East

and Africa

You might also like

- Swift Mystandards Translator FactsheetDocument2 pagesSwift Mystandards Translator Factsheetrathorenitin87No ratings yet

- Decoding Payments Message Standards: October 2019Document19 pagesDecoding Payments Message Standards: October 2019osirazNo ratings yet

- TQM AIBA Qustion PDFDocument13 pagesTQM AIBA Qustion PDFMasrur TonmoyNo ratings yet

- Swift Iso20022 Fintech Discussion PaperDocument8 pagesSwift Iso20022 Fintech Discussion PaperMiLady La RainNo ratings yet

- Swift Iso20022 New Adoption Overview 2020 Slides En01Document62 pagesSwift Iso20022 New Adoption Overview 2020 Slides En01Vishnupriya Narayan100% (1)

- Ds Netsuite OneworldDocument4 pagesDs Netsuite OneworldvkumaransgaiNo ratings yet

- Budget PDFDocument29 pagesBudget PDFviswanath_manjula100% (1)

- BAS For Manufacturing Sector - Operating Management Feb 2012Document155 pagesBAS For Manufacturing Sector - Operating Management Feb 2012EswarNo ratings yet

- Interoperability and Standardization Globally - The European ViewDocument10 pagesInteroperability and Standardization Globally - The European Viewvishal samundreNo ratings yet

- Case Study - HFMDocument2 pagesCase Study - HFMabhishek SinghNo ratings yet

- Scripted ISO 20022 PPT Long Version v55Document48 pagesScripted ISO 20022 PPT Long Version v55fsdafNo ratings yet

- Infosys Helps Outotec: Case StudyDocument4 pagesInfosys Helps Outotec: Case StudyShivamNo ratings yet

- Infosys - Enhance-Customer-Satisfaction PDFDocument4 pagesInfosys - Enhance-Customer-Satisfaction PDFShivamNo ratings yet

- The Banker Cash Management Guide July2018Document11 pagesThe Banker Cash Management Guide July2018IPmanNo ratings yet

- Industry Setting and Problem The New Approach: Management of Multicloud Estate - Transform, Deliver and OperateDocument1 pageIndustry Setting and Problem The New Approach: Management of Multicloud Estate - Transform, Deliver and Operatesriram tennetiNo ratings yet

- Supporting You in Your Adoption Journey: Expertise, Tailored To Your NeedsDocument2 pagesSupporting You in Your Adoption Journey: Expertise, Tailored To Your NeedsEllerNo ratings yet

- Application ModernizationDocument2 pagesApplication ModernizationLászló DianNo ratings yet

- Enhanced Telecom Operations Map: The Business Process FrameworkDocument46 pagesEnhanced Telecom Operations Map: The Business Process Frameworkhearttiger100% (1)

- Alcatel-Lucent Services Achieving Competitive Advantage2010Document2 pagesAlcatel-Lucent Services Achieving Competitive Advantage2010amit_vatsaNo ratings yet

- KIZAD - The Integrated Trade, Logistics and Industrial Hub of Abu Dhabi (Brochure)Document17 pagesKIZAD - The Integrated Trade, Logistics and Industrial Hub of Abu Dhabi (Brochure)Jaqueline SilvaNo ratings yet

- Nokia TelecommunicationsDocument6 pagesNokia TelecommunicationsRakesh rajNo ratings yet

- ITis OnePager EngeDocument1 pageITis OnePager EngeNexio Technologies Inc.No ratings yet

- Lifesciences Regulatory Submission PlatformDocument2 pagesLifesciences Regulatory Submission PlatformVarshith SureshNo ratings yet

- Mobideo - Brochure - General - May 2020Document4 pagesMobideo - Brochure - General - May 2020Snehal SakhareNo ratings yet

- SWIFT Global Vendor Webinar 202201Document37 pagesSWIFT Global Vendor Webinar 202201Abdulwahab AhmedNo ratings yet

- Iso 28000 and Iso 20000Document9 pagesIso 28000 and Iso 20000AkashDeepGuptaNo ratings yet

- Transforming Procure To Pay - UnileverDocument20 pagesTransforming Procure To Pay - UnileverLokesh KNo ratings yet

- Massimo-Vanetti-SBS Forum Ict Standards PDFDocument7 pagesMassimo-Vanetti-SBS Forum Ict Standards PDFjorgegutierrez81No ratings yet

- ITIDAT0193A Migrate To New TechnologyDocument5 pagesITIDAT0193A Migrate To New TechnologyShedeen McKenzieNo ratings yet

- Guidewire Practice OverviewDocument3 pagesGuidewire Practice OverviewSai VenkatNo ratings yet

- Swift Connectivity Brochure CommunitycloudleafletDocument7 pagesSwift Connectivity Brochure CommunitycloudleafletObilious90No ratings yet

- MiVoice Office 400 BrochureDocument4 pagesMiVoice Office 400 Brochureikponmwosa olotuNo ratings yet

- Mix FlexibilityDocument1 pageMix FlexibilityThomas TomNo ratings yet

- Performance Management in The Oil Refining IndustryDocument2 pagesPerformance Management in The Oil Refining IndustryMahmoud KhairyNo ratings yet

- IMINorgrenDocument2 pagesIMINorgrenapi-3733632No ratings yet

- WW ApplicationScoringMatrixDocument21 pagesWW ApplicationScoringMatrixbhatdinuNo ratings yet

- ITIL v3 Service OperationDocument105 pagesITIL v3 Service OperationAbdul Salam NMNo ratings yet

- Wmap GBWM Overview - 12.4.19Document26 pagesWmap GBWM Overview - 12.4.19AnuNo ratings yet

- Operation Management NokiaDocument26 pagesOperation Management NokiapkumerNo ratings yet

- Swift Reports Informationpaper Phiso20022mar16Document12 pagesSwift Reports Informationpaper Phiso20022mar16XRP SharinganNo ratings yet

- IT Governance and StrategyDocument48 pagesIT Governance and Strategymike raninNo ratings yet

- ISO 14001 - BSI Alternative PDFDocument2 pagesISO 14001 - BSI Alternative PDFleviNo ratings yet

- Aricent's Contemporary Systems Integration Saving Carriers MillionsDocument8 pagesAricent's Contemporary Systems Integration Saving Carriers MillionssakshisurimbaNo ratings yet

- Operations Technology Management Final PresentationDocument24 pagesOperations Technology Management Final Presentationgayatrishetty185No ratings yet

- Hasler Process Performance Engineer at HolcimDocument10 pagesHasler Process Performance Engineer at Holcimvikubhardwaj9224No ratings yet

- Enabling Nexo Standards For PaymentDocument37 pagesEnabling Nexo Standards For PaymentManikandan SarmaNo ratings yet

- Position Paper: SWIFT On Distributed Ledger TechnologiesDocument20 pagesPosition Paper: SWIFT On Distributed Ledger TechnologiesyezdiarwNo ratings yet

- SiemensAG Spiridon PDF eDocument4 pagesSiemensAG Spiridon PDF eSaleem Pervez100% (1)

- ITIL® 4 vs. ISO/IEC 20000-1:2018: Similarities and Differences & Process MappingDocument11 pagesITIL® 4 vs. ISO/IEC 20000-1:2018: Similarities and Differences & Process Mappingelisa navesNo ratings yet

- FundAccounting InvestmentManagers PDFDocument1 pageFundAccounting InvestmentManagers PDFmadhuNo ratings yet

- Motive HDM en DataSheetDocument2 pagesMotive HDM en DataSheetshitbox222100% (1)

- Iso 20252Document47 pagesIso 20252Bogdan Comsa100% (1)

- Implementing SOAIBMZSeriesDocument19 pagesImplementing SOAIBMZSeriesJose Marcelo TamNo ratings yet

- 28 SecuritiesCorporateActions v5 With Comments BJDocument13 pages28 SecuritiesCorporateActions v5 With Comments BJNuggets MusicNo ratings yet

- ISO/IEC 20000: An Introduction to the global standard for service managementFrom EverandISO/IEC 20000: An Introduction to the global standard for service managementNo ratings yet

- Day 1 Lecture 2 HMS OverviewDocument22 pagesDay 1 Lecture 2 HMS OverviewPham BaoNo ratings yet

- Au Conf670306 Biermann enDocument14 pagesAu Conf670306 Biermann enmageshpattNo ratings yet

- NICE Solutions Guide v1.0Document8 pagesNICE Solutions Guide v1.0Ranjit PatelNo ratings yet

- Cisco - Managed Services IntelligenceDocument13 pagesCisco - Managed Services IntelligencesarujankNo ratings yet

- FFT (Fast Fourier Transform)Document20 pagesFFT (Fast Fourier Transform)Hemant Sudhir WavhalNo ratings yet

- BloomfilterDocument9 pagesBloomfilterHemant Sudhir WavhalNo ratings yet

- Hash Table 2010Document43 pagesHash Table 2010Hemant Sudhir WavhalNo ratings yet

- Iimk PGPBL Brochure 19Document4 pagesIimk PGPBL Brochure 19Hemant Sudhir WavhalNo ratings yet

- More On Divide and ConquerDocument31 pagesMore On Divide and ConquerHemant Sudhir WavhalNo ratings yet

- FPM Brochure 2018-19Document71 pagesFPM Brochure 2018-19Hemant Sudhir WavhalNo ratings yet

- Epgp - FaqsDocument4 pagesEpgp - FaqsHemant Sudhir WavhalNo ratings yet

- The Next Generation IT Function: Towards A Yin Yang Efficiency Innovation FrontierDocument22 pagesThe Next Generation IT Function: Towards A Yin Yang Efficiency Innovation FrontierHemant Sudhir WavhalNo ratings yet

- Case StudyPaytmDocument21 pagesCase StudyPaytmHemant Sudhir WavhalNo ratings yet

- M00160 HE Entrepreneurship Primer WEBDocument19 pagesM00160 HE Entrepreneurship Primer WEBHemant Sudhir WavhalNo ratings yet

- HR45 Stanford GSB AstraZeneca CaseDocument1 pageHR45 Stanford GSB AstraZeneca CaseHemant Sudhir WavhalNo ratings yet

- FIN CompanyValuationDCFDocument3 pagesFIN CompanyValuationDCFHemant Sudhir WavhalNo ratings yet

- Swift Corporate BrochureDocument23 pagesSwift Corporate BrochureHemant Sudhir WavhalNo ratings yet

- MES Fees Regulation Rules 2016Document22 pagesMES Fees Regulation Rules 2016Hemant Sudhir WavhalNo ratings yet

- ISO27k Controls (2005 2013 NIST)Document29 pagesISO27k Controls (2005 2013 NIST)Hemant Sudhir WavhalNo ratings yet

- Judgement by Delhi High Court - REP21022018CW74142017Document40 pagesJudgement by Delhi High Court - REP21022018CW74142017Hemant Sudhir Wavhal100% (1)

- Truwater - TCM SeriesDocument12 pagesTruwater - TCM SeriesnkhhhNo ratings yet

- Padma Vibhushan Dr. G. Madhavan NairDocument7 pagesPadma Vibhushan Dr. G. Madhavan NairjishnusajiNo ratings yet

- Frequency Control On An Island Power System With Evolving Plant MixDocument221 pagesFrequency Control On An Island Power System With Evolving Plant MixKing KingNo ratings yet

- Feasibility Study Notes Revised PDFDocument10 pagesFeasibility Study Notes Revised PDFGilbert BettNo ratings yet

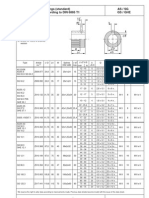

- As / SG Gs / Ghe Dimensions For Couplings (Standard) Bore With Keyway According To DIN 6885 T1Document1 pageAs / SG Gs / Ghe Dimensions For Couplings (Standard) Bore With Keyway According To DIN 6885 T1hadeNo ratings yet

- SMA Inverter Catalogue PDFDocument290 pagesSMA Inverter Catalogue PDFxodewaNo ratings yet

- Course Add Drop Form For Ug Course 1718T2 PDFDocument1 pageCourse Add Drop Form For Ug Course 1718T2 PDFArtyomNo ratings yet

- DC and AC InterferenceDocument40 pagesDC and AC InterferenceREJI JOY ThoppilNo ratings yet

- Installation, and Maintenance Manual For Gas Fired, Wall-Hung BoilersDocument24 pagesInstallation, and Maintenance Manual For Gas Fired, Wall-Hung Boilersca3accoNo ratings yet

- Pavilion Design Workshop + Competition: Uni - Xyz/competitionsDocument14 pagesPavilion Design Workshop + Competition: Uni - Xyz/competitionsNikunj DwivediNo ratings yet

- QR 390 Manual Partes Quincy 390Document31 pagesQR 390 Manual Partes Quincy 390ramiro alvarezNo ratings yet

- Re InviteDocument16 pagesRe InviteAjay WaliaNo ratings yet

- Mohit Soni ReportDocument104 pagesMohit Soni ReportMohitNo ratings yet

- ACR Methodology For The Conversion of High-Bleed Pneumatic Controllers in Oil and Natural Gas Systems v1.1Document33 pagesACR Methodology For The Conversion of High-Bleed Pneumatic Controllers in Oil and Natural Gas Systems v1.1mlkrembsNo ratings yet

- Unit - 1: (B) Difference Between Thermodynamcis and Heat TransferDocument66 pagesUnit - 1: (B) Difference Between Thermodynamcis and Heat TransferSayyadh Rahamath Baba100% (1)

- User Manual For Online Super Market WebsiteDocument3 pagesUser Manual For Online Super Market WebsiteTharunNo ratings yet

- Shell Gadus S3 T100 PDFDocument1 pageShell Gadus S3 T100 PDFAgung BaskaraNo ratings yet

- Electrical Design Checklist v1.2Document39 pagesElectrical Design Checklist v1.2huangjlNo ratings yet

- 3600 2 TX All Rounder Rotary Brochure India enDocument2 pages3600 2 TX All Rounder Rotary Brochure India ensaravananknpcNo ratings yet

- Experiment No. 1: Aim: Study of Tanner Tools THEORY: Tanner ToolsDocument24 pagesExperiment No. 1: Aim: Study of Tanner Tools THEORY: Tanner ToolsVarun GargNo ratings yet

- Double Effect EvaporatorDocument4 pagesDouble Effect EvaporatorAditiJain100% (1)

- FGRU URAN 08.12.2015 Rev.02Document3 pagesFGRU URAN 08.12.2015 Rev.02Hitendra PanchalNo ratings yet

- O21350 CMMKKDocument2 pagesO21350 CMMKKwade.hynesoutlook.comNo ratings yet

- Know The Escalation Matrix To ReportDocument1 pageKnow The Escalation Matrix To ReportHemal GandhiNo ratings yet

- Model Variant Description Variant Code Extended Warranty Price Royal PlatinumDocument2 pagesModel Variant Description Variant Code Extended Warranty Price Royal PlatinumRiyasNo ratings yet

- Ferro Manganese Slag PDFDocument2 pagesFerro Manganese Slag PDFDebraNo ratings yet

- LAB3Document5 pagesLAB3Kaishavi UmrethwalaNo ratings yet

- Scania TruckAndBus 2023Document403 pagesScania TruckAndBus 2023Piotr ZiąbkowskiNo ratings yet

- GCCDocument265 pagesGCCzhenguoliNo ratings yet

- Building Information Modeling BIM Systems and TheiDocument13 pagesBuilding Information Modeling BIM Systems and Theipurvakul10No ratings yet