Professional Documents

Culture Documents

Q08a PDF

Uploaded by

Ericha MutiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q08a PDF

Uploaded by

Ericha MutiaCopyright:

Available Formats

Quiz - Chapter 9 - Solutions

1. Royco, Inc. contracted, for the current year, to purchase $425,000 worth of light

fixtures from a retailer for $5 per unit. Royco keeps 12 1/2 percent of its annual

purchases (in dollars) on hand at the end of each calendar year to avoid stockouts

in early January, a period when most retailers are out of fixtures. If Royco

purchased $725,000 worth of inventory last year at $7.50 per unit, what are the

unit sales for the current year? Royco uses a FIFO inventory system.

A 128,542

B 97,083

C 86,458

D 84,583

ANSWER: C

(725,000/7.50) .125 + 425,000/5.00 - x = (425,000/5.00) .125

2. The Axel Company's contribution margin ratio is 25% and its total fixed costs are

$80,000. Certain changes are planned that will increase total fixed costs by 10%

but decrease variable expenses by 20% per unit. What sales volume will achieve

a pre-tax income of $16,000? (Round your answer to the nearest $1,000.)

A $149,000

B $173,000

C $260,000

D $347,000

ANSWER: C

fixed costs = 80,000 (1.10) = 88,000

.25 = (Sales – VC/Sales) VC = .75 sales

if VC decrease by 20%, then VA = .60 sales

sales - .60 sales - 88,000 = 16000

.40 sales = 88,000 + 16,000 = 104,000

Sales = 104,000/.4 = 260,000

3. The Sledge Hammer Company manufactures a line of high quality tools. The

company sold 1,000,000 hammers at a price of $4 per unit in 1993. The company

estimates that this volume represents a 20% share of the current hammers

market. The market is expected to increase by 5%. Marketing specialists have

determined that, as a result of a new advertising campaign and packaging, the

company will increase its share of this larger market to 24%. Due to changes in

prices, the new price for the hammer will be $4.30 per unit. This new price is

expected to be in line with the competition and have no effect on the volume

estimates. What are the estimated sales revenues in 1994?

A $5,040,000

B $5,160,000

C $5,418,000

D $5,689,000

ANSWER: C

1993 sales = 1,000,000 ($4) = $4,000,000

1993 market size = 1,000,000/.20 = 5,000,000

1994 sales volume = 5,000,000 (1.05) (.24) = 1,260,000

1994 sales = 1,260,000 (4.30) = $5,418,000

For the following question(s) refer to the information below.

Each column is a separate situation).

1 2 3 4

Sales 100,000 units 40,000 units $2,000,000 ?

Production 110,000 units ? 1,950,000 $55,000

Beg. Finished Goods 20,000 units 5,000 units ? 7,000

Ending Finished Goods ? 7,500 units 10,000 9,500

4. What is the ending finished goods inventory (in units) column 1?

A 10,000

B 27,000

C 30,000

D 100,000

ANSWER: C

X = 20,000 + 110,000 - 100,000 = 30,000

5. What is the production volume (in units) for column 2?

A 50,000

B 42,500

C 35,000

D 12,500

ANSWER: B

5,000 + x - 40,000 = 7,500

X = 7,500 + 40,000 – 5,000 = 42,500

6. What is the beginning finished goods in column 3?

A $40,000

B $50,000

C $60,000

D $90,000

ANSWER: C

x + 1,950,000 - 2,000,000 = 10,000

x= 2,000,000 – 1,950,000 = 10,000 = 60,000

7. What are the sales in column 4?

A $62,000

B $55,000

C $52,500

D $16,500

ANSWER: C

7,000 + 55,000 - x = 9,500

7,000 + 55,000 -9,500 = x

52,500 = x

For the following question(s) refer to the information below.

T. Jackson Retail seeks your assistance to develop cash and other budget information

for May, June, and July. At April 30, the company had cash of $5,500, accounts

receivable of $437,000, inventories of $309,400, and accounts payable of $133,055.

The budget is to be based on the following assumptions:

SALES:

Each month's sales are billed on the last day of the month. Customers are allowed a 3%

discount if payment is made within 10 days after the billing date. Receivables are

recorded in the accounts at their gross amounts (not net of discounts). 55% of the

billings are collected within the discount period; 30% are collected by the end of the

month; 9% are collected by the end of the second month; and 6% turn out to be

uncollectible.

PURCHASES:

60% of all purchases of merchandise and selling, general, and administrative expenses

are paid in the month purchased and the remainder in the following month. The number

of units in each month's ending inventory is equal to 125% of the next month's units of

sales. The cost of each unit of inventory is $30. Selling, general, and administrative

expenses, of which $3,000 is depreciation, are equal to 15% of the current month's

sales.

Actual and projected sales are as shown below:

Dollars Units

March..................... 472,000 11,800

April..................... 484,000 12,100

May....................... 476,000 11,900

June...................... 456,000 11,400

July...................... 480,000 12,000

August.................... 480,000 12,200

8. What are the budgeted merchandise purchases (in dollars) for May?

A $338,250

B $355,500

C $357,000

D $375,750

ANSWER: A

1.25 (11,900) + x - 11,900 = 1.25 (11,400)

X = 11,275

purchases = 11,275 (30) = $338,250

9. What are the budgeted merchandise purchases (in dollars) for June?

A $319,500

B $342,000

C $364,500

D $375,000

ANSWER: C

1.25 (11,400) + x - 11,400 = 1.25 (12,000)

x = 12,150

purchases = 12,150(30) = $364,500

10. What are the budgeted cash disbursements during the month of June?

A $407,520

B $420,600

C $421,950

D $434,280

ANSWER: B

merchandise purchases = .60 (364,500) + .40 (338,250)

= $354,000

Expenses = .60 [(.15)(456,000) - $3,000] + .40[(.15) 476,000 - 3000]

= 66,600

Cash Disbursements = 354,000 + 66,600 = 420,600

11. What are the budgeted cash collections during the month of May?

A $445,894

B $453,880

C $472,114

D $474,934

ANSWER: A

From April: 484,000 (.55) (97) + 484,000 (.30) = $403,414

From March: 472,000 (.09) = $42,480

Total Cash Collections = 403,414 + 42,480 = 445,894

12. What are the budgeted number of inventory units that need to be purchased in

July?

A 15,250

B 15,000

C 12,250

D 12,000

ANSWER: C

Beg Bal + purchases –sales = ending balance

1.25 (12,000) + x - 12,000 = 1.25 (12,200)

15,000 + x -12,000 = 15,250

3,000 + x = 15,250

X = 12,250

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kellogg's Case Study AnalysisDocument3 pagesKellogg's Case Study Analysissalil1235667% (3)

- Chloe's ClosetDocument17 pagesChloe's ClosetCheeze cake100% (1)

- LoiDocument2 pagesLoiCesar MurgaNo ratings yet

- Procurement Workshop Invite 8th April 2013 PDFDocument2 pagesProcurement Workshop Invite 8th April 2013 PDFDurban Chamber of Commerce and IndustryNo ratings yet

- PM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)Document6 pagesPM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)KAY PHINE NGNo ratings yet

- McKinsey 7s Framework Final (Draft 2)Document2 pagesMcKinsey 7s Framework Final (Draft 2)Anshul Gautampurkar0% (1)

- Effective Talent Management & Succession Planning OptimizationDocument4 pagesEffective Talent Management & Succession Planning OptimizationdaabhiNo ratings yet

- T7 TCS 【愛知】Bilingual Design Engineer PDFDocument3 pagesT7 TCS 【愛知】Bilingual Design Engineer PDFchutiyaNo ratings yet

- 4 Capitalized Cost BondDocument32 pages4 Capitalized Cost BondkzutoNo ratings yet

- Ipe - Industrial & Operational ManagementDocument33 pagesIpe - Industrial & Operational ManagementwagoheNo ratings yet

- Issues Problems Within A CompanyDocument12 pagesIssues Problems Within A Companyapi-533557184No ratings yet

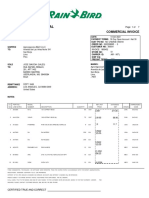

- Rain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Document7 pagesRain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Alejandra JamboNo ratings yet

- Checklist For DSA - DOADocument2 pagesChecklist For DSA - DOAkhriskammNo ratings yet

- Stratman NotesDocument2 pagesStratman NotesWakin PoloNo ratings yet

- What Informal Remedies Are Available To Firms in Financial Distress inDocument1 pageWhat Informal Remedies Are Available To Firms in Financial Distress inAmit PandeyNo ratings yet

- Dabur Sales ManagementDocument20 pagesDabur Sales Managementrohitpatil222No ratings yet

- MP Assistant ProfessorDocument3 pagesMP Assistant ProfessorSwapnil NeerajNo ratings yet

- Channel ManagementDocument19 pagesChannel ManagementRadha Raman SharmaNo ratings yet

- Caso Carvajal S.A.Document22 pagesCaso Carvajal S.A.Indrenetk Leon100% (1)

- Dragon Fruit Jam Marketing PlanDocument31 pagesDragon Fruit Jam Marketing PlanLara Rinoa LarrozaNo ratings yet

- The biggest asset of the poor is their integrityDocument88 pagesThe biggest asset of the poor is their integritysujay pratapNo ratings yet

- BS 25999-2 Basics: A Leading Business Continuity StandardDocument3 pagesBS 25999-2 Basics: A Leading Business Continuity StandardMemet H BilgitekinNo ratings yet

- ERP Software For Doctor. Complete Management Software For Hospital.Document71 pagesERP Software For Doctor. Complete Management Software For Hospital.Jyotindra Zaveri E-Library67% (3)

- BRM Research Waseem Jaffri and Urooba GhaniDocument11 pagesBRM Research Waseem Jaffri and Urooba GhaniSyed Waseem Abbas Shah JaffriNo ratings yet

- RFP 2019-100-KB Development of A Mixed-Use Project With A Cultural Component - ByRON DEVELOPMENTDocument63 pagesRFP 2019-100-KB Development of A Mixed-Use Project With A Cultural Component - ByRON DEVELOPMENTNone None NoneNo ratings yet

- HS AgroDocument42 pagesHS AgroSHIVANSHUNo ratings yet

- Business DiversificationDocument20 pagesBusiness DiversificationRajat MishraNo ratings yet

- Higher Education Financing Agency BrochureDocument6 pagesHigher Education Financing Agency BrochuremidhunnobleNo ratings yet

- Assignment On Mid-Term ExamDocument12 pagesAssignment On Mid-Term ExamTwasin WaresNo ratings yet

- Aditya Birla Capital Risk Management PolicyDocument6 pagesAditya Birla Capital Risk Management Policypratik zankeNo ratings yet