Professional Documents

Culture Documents

Joseph Mondello's Executive Branch Personnel Public Financial Disclosure Report

Uploaded by

NewsdayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joseph Mondello's Executive Branch Personnel Public Financial Disclosure Report

Uploaded by

NewsdayCopyright:

Available Formats

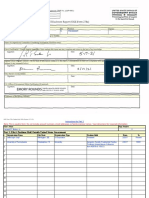

Nominee Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No.

(3209-0001) (January 2018)

Executive Branch Personnel

Public Financial Disclosure Report (OGE Form 278e)

Filer's Information

Mondello, Joseph Nestor

Ambassador to the Republic of Trinidad & Tobago, Department of State

Other Federal Government Positions Held During the Preceding 12 Months:

None

Names of Congressional Committees Considering Nomination:

● Committee on Foreign Relations

Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge.

/s/ Mondello, Joseph Nestor [electronically signed on 12/26/2017 by Mondello, Joseph Nestor in Integrity.gov]

Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations

(subject to any comments below).

/s/ Huitema, David, Certifying Official [electronically signed on 03/20/2018 by Huitema, David in Integrity.gov]

Other review conducted by

U.S. Office of Government Ethics Certification

Mondello, Joseph Nestor - Page 1

/s/ Apol, David, Certifying Official [electronically signed on 03/29/2018 by Apol, David in Integrity.gov]

Mondello, Joseph Nestor - Page 2

1. Filer's Positions Held Outside United States Government

# ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO

TYPE

1 Berkman, Henoch, Peterson, Peddy & Garden City, Law Firm Of Counsel 5/2003 Present

Fenchel, P.C. New York

2 JLEM Associates LLC Floral Park, New Corporation Managing 6/2006 Present

York Member

3 Nestor Realty LLC Pt. Jefferson, Corporation Managing 8/2002 Present

New York Member

4 Nestor Properties Pt. Jefferson, Corporation Managing 8/2002 Present

New York Member

5 Laurel Cove Associates Floral Park, New Corporation Managing 4/2001 Present

York Member

2. Filer's Employment Assets & Income and Retirement Accounts

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 Berkman, Henoch, Peterson, Peddy & N/A Of Counsel $519,332

Fenchel, P.C. (Law Firm)

2 Sep IRA No

2.1 AIG Flexible Credit Fund Cl A Yes $50,001 - None (or less

$100,000 than $201)

2.2 Alphabet Inc Cl A N/A $15,001 - None (or less

$50,000 than $201)

2.3 Amazon Inc N/A $1,001 - $15,000 None (or less

than $201)

Mondello, Joseph Nestor - Page 3

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.4 American Elec Pwr Inc N/A $15,001 - None (or less

$50,000 than $201)

2.5 Armstrong Sch Dist. PA Bond 3/17/41 N/A $15,001 - Interest $201 - $1,000

$50,000

2.6 Armstrong SD PA Bond 3/15/30 N/A $1,001 - $15,000 Interest $201 - $1,000

2.7 AT&T Inc N/A $1,001 - $15,000 None (or less

than $201)

2.8 U.S. bank Deposit Sweep Program (cash N/A $15,001 - None (or less

account) $50,000 than $201)

2.9 Blackstone Group LP Com Unit LTD N/A $15,001 - None (or less

$50,000 than $201)

2.10 California St 6.509 % VP Tran N/A $15,001 - None (or less

$50,000 than $201)

2.11 Chevron Corp N/A $1,001 - $15,000 Dividends $201 - $1,000

2.12 Chula Vista Calif Elem Sch Dist CTFS N/A $15,001 - Interest $1,001 - $2,500

$50,000

2.13 Consolidated Edison Inc. Com N/A $1,001 - $15,000 Dividends $201 - $1,000

2.14 Deere & Co N/A $1,001 - $15,000 None (or less

than $201)

2.15 Walt Disney Co N/A $15,001 - Dividends $201 - $1,000

$50,000

2.16 El Centro Calif Fingauth Lease Rev Transn N/A $15,001 - Dividends $1,001 - $2,500

Impts $50,000 Interest

2.17 Elizabeth N J PKG N/A $15,001 - Interest $201 - $1,000

$50,000

2.18 Florida Gulf Coast UNIV FING C N/A $1,001 - $15,000 None (or less

than $201)

Mondello, Joseph Nestor - Page 4

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.19 Florida State Governmental Util Auth Util N/A $15,001 - None (or less

$50,000 than $201)

2.20 Fidelity Adv Health Care - 1 Yes $50,001 - None (or less

$100,000 than $201)

2.21 Frontier Communications Corp PFD Conv. N/A $15,001 - None (or less

$50,000 than $201)

2.22 Goldman Sachs Strategic Growth Yes $15,001 - None (or less

$50,000 than $201)

2.23 Lockheed Martin Corp Com N/A $1,001 - $15,000 Dividends $201 - $1,000

2.24 Hartford Balanced Income Fund A Yes $100,001 - $5,001 - $15,000

$250,000

2.25 Hartford Schrdrs US SM MD CAP OPP-I Yes $1,001 - $15,000 None (or less

than $201)

2.26 Honeywell Intl Inc Com N/A $1,001 - $15,000 None (or less

than $201)

2.27 Illinois Fin Auth Health-Ser A 05/10/12 CLB N/A $50,001 - Interest $2,501 - $5,000

$100,000

2.28 J Hancock Intl Growth I Yes $50,001 - None (or less

$100,000 than $201)

2.29 Kinder Morgan Inc N/A $15,001 - Dividends $1,001 - $2,500

$50,000

2.30 Knox CNTY ILL GO Alternate REV BDS N/A $15,001 - Interest $1,001 - $2,500

12/15/2023 $50,000

2.31 Madison CNTY ILL CMNTY Unit SCH DIST NO N/A $50,001 - Interest $1,001 - $2,500

007 Edwardsville Taxable- SER B 12/1/29 $100,000

2.32 Magellan Midstream Prtnrs LP Com Unit RP N/A $1,001 - $15,000 Dividends $201 - $1,000

LP

2.33 Main Street Capital Corp Com N/A $15,001 - None (or less

$50,000 than $201)

Mondello, Joseph Nestor - Page 5

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.34 Miami Gardens FLA CTFS PARTN Taxable- N/A $50,001 - Interest $2,501 - $5,000

SER $100,000

2.35 Microsoft Corp Com N/A $1,001 - $15,000 Dividends $201 - $1,000

2.36 New Jersey St Edl Facs Auth Rev Taxable-I- N/A $15,001 - Interest $201 - $1,000

Build Amerbds 7/01/40 $50,000

2.37 New York N Y City HSG DEV CORP N/A $50,001 - Interest $2,501 - $5,000

11/01/2039 $100,000

2.38 New York CMNTY Bancorp Inc COM N/A $15,001 - Interest $1,001 - $2,500

$50,000

2.39 Nike Inc CL B N/A $15,001 - None (or less

$50,000 than $201)

2.40 Northern IL UNIV REVS Taxable Auxiliary N/A $15,001 - Interest $201 - $1,000

FACS Build B/E $50,000

2.41 Northrop Grumman Corp Com N/A $1,001 - $15,000 None (or less

than $201)

2.42 Pepsico Inc Com N/A $1,001 - $15,000 Dividends $201 - $1,000

2.43 Rational Dividend Capture Fund Institutional Yes $15,001 - None (or less

Class $50,000 than $201)

2.44 Rational Risk Managed Emerging Markets Yes $15,001 - $2,501 - $5,000

FD CL A $50,000

2.45 Regency Energy N/A $50,001 - Dividends $1,001 - $2,500

$100,000

2.46 Richmond CALIF Wastewater REV Taxable B- N/A $15,001 - Interest $201 - $1,000

Build Amerbds 8/01/40 B/E $50,000

2.47 Financial Select Sector SPDR Fund Yes $15,001 - $2,501 - $5,000

$50,000

2.48 SPDR Gold Trust Gold SHS Yes $15,001 - None (or less

$50,000 than $201)

Mondello, Joseph Nestor - Page 6

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.49 Square Inc CL A N/A $15,001 - None (or less

$50,000 than $201)

2.50 St Louis Regl Arpt Auth ILL LTD Tax N/A $15,001 - Interest $201 - $1,000

4/01/2034 $50,000

2.51 Touchstone Strategic Income Fund Y Yes $100,001 - $201 - $1,000

$250,000

2.52 Telluride Colo Excise Tax Rev 12/01/2036 N/A $15,001 - Interest $1,001 - $2,500

$50,000

2.53 Under Armour Inc CL A N/A $1,001 - $15,000 None (or less

than $201)

2.54 University N C SYS Pool Rev UNC N/A $15,001 - Interest $1,001 - $2,500

Wilmington-SER 10/01/39 B/E $50,000

2.55 University West ALA Univ Revs Ser B-Build N/A $15,001 - Interest $201 - $1,000

Amer BDS Direct 1/01/41 $50,000

2.56 Verizon Communications Inc Com N/A $1,001 - $15,000 Dividends $201 - $1,000

2.57 Vulcan Materials Co N/A $1,001 - $15,000 None (or less

than $201)

2.58 Wells Fargo & Co New DEP PFD V 1/1000 N/A $15,001 - Dividends $1,001 - $2,500

$50,000

2.59 Western ILL Univ Revs Auxiliary Facs N/A $15,001 - None (or less

4/01/2022 $50,000 than $201)

2.60 Apple Inc N/A None (or less Dividends $201 - $1,000

than $1,001)

2.61 Berkley W R Corp Subdeb 56 5.75000% N/A None (or less Interest $1,001 - $2,500

06/01/2056 PHD than $1,001)

2.62 Brea Calif Redev AGYTAX Alloc HSG BDS N/A None (or less Interest $201 - $1,000

07.39200% 08/01/2029ser. 2011B than $1,001)

2.63 Cisco SYS Inc N/A None (or less Dividends $201 - $1,000

than $1,001)

Mondello, Joseph Nestor - Page 7

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.64 Connellsville PA Area SCH Dist SCH N/A None (or less Interest $201 - $1,000

06.47200% 08/15/2039Dist BDS SER. 2009A than $1,001)

2.65 Cuyahoga Ohio Met HSG Auth Rev Rev N/A None (or less Interest $201 - $1,000

BD508. 13000%09/01/2039CMHA Proj than $1,001)

Ser.2009B

2.66 Exxon Mobil Corp N/A None (or less Dividends $201 - $1,000

than $1,001)

2.67 Franklin Mutual Quest Class Z Yes None (or less $2,501 - $5,000

than $1,001)

2.68 Goldman Sachs US Mortgage Fund Instl Yes None (or less $1,001 - $2,500

than $1,001)

2.69 Janus Balanced Classi Yes None (or less $201 - $1,000

than $1,001)

2.70 Johnson & Johnson N/A None (or less Dividends $201 - $1,000

than $1,001)

2.71 Los Angeles Calif Uni Sch Dist CTFS N/A None (or less Interest $1,001 - $2,500

08.00000% 12/01/2035Partn Cops Capital than $1,001)

Projects/ Ser.B-1

2.72 Madison Cnty Ill CMNTY Unit Sch Dist 05 N/A $50,001 - Interest $2,501 - $5,000

45000%12/01/2029NO 007 Edwardsville GO $100,000

BDS Ser 2014B

2.73 Moon Area Sch Dist PA GO BDS N/A None (or less Interest $201 - $1,000

Ser.2010B05.87000% 11/15/2035 than $1,001)

2.74 Principal Global Diversified Inc CL P Yes None (or less $2,501 - $5,000

than $1,001)

2.75 Principal Preferred Securities Func CL P Yes None (or less $2,501 - $5,000

than $1,001)

2.76 Proctor and Gamble Co Com N/A None (or less Dividends $201 - $1,000

than $1,001)

Mondello, Joseph Nestor - Page 8

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.77 South Broward Hosp Dist FLA Rev Hosp N/A None (or less Interest $1,001 - $2,500

04.75000% 05/01/2032REF Rev BDS SER. than $1,001)

2007

2.78 Sunamerica Flexible Credit Class A Yes $50,001 - $1,001 - $2,500

$100,000

2.79 Target Corp Com ISIN #us87612E1064 Sedol N/A None (or less Dividends $201 - $1,000

#2259101 than $1,001)

2.80 Williams Partners L P Note 5.4% N/A None (or less Dividends $1,001 - $2,500

03/04/2044Call Make Whole than $1,001)

3 IRA US bank No

3.1 US bank (cash account) N/A $15,001 - None (or less

$50,000 than $201)

4 Nassau County Republican Committee N/A Salary/Bonus $259,135

5 Laurel Cove Associates LLC (Commercial N/A $250,001 - Rent or $15,001 -

rental property, Lefittown, NY) $500,000 Royalties $50,000

6 Nestor Properties & Nestor Realty LLC N/A $5,000,001 - Rent or $100,001 -

(Commercial Rental Property, Pt. Jefferson, $25,000,000 Royalties $1,000,000

NY

7 JLEM Associates LLC (commercial rental N/A $5,000,001 - Rent or $1,000,001 -

property, Levittown, NY) $25,000,000 Royalties $5,000,000

3. Filer's Employment Agreements and Arrangements

# EMPLOYER OR PARTY CITY, STATE STATUS AND TERMS DATE

1 Nassau County Republican Committee Westbury, New I will continue to participate in the Committee's 3/1982

York health insurance plan. The Committee will continue

to pay $2,128 monthly for my coverage pursuant to

the Committee's Health Insurance Plan.

Mondello, Joseph Nestor - Page 9

4. Filer's Sources of Compensation Exceeding $5,000 in a Year

# SOURCE NAME CITY, STATE BRIEF DESCRIPTION OF DUTIES

1 Berkman, Henoch, Peterson, Peddy & Garden City, Of Counsel

Fenchel, P.C. New York

2 Nassau County Republican Committee Westbury, New Chairman/CEO

York

5. Spouse's Employment Assets & Income and Retirement Accounts

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 Town of Oyster Bay, NY N/A consulting fees

2 IRA No

2.1 TIAA CREF Traditional N/A $100,001 - None (or less

$250,000 than $201)

2.2 CREF Stock Yes $100,001 - None (or less

$250,000 than $201)

6. Other Assets and Income

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 US bank CD (cash account) N/A $15,001 - Interest $15,001 -

$50,000 $50,000

2 US bank account #1 (cash account) N/A $100,001 - None (or less

$250,000 than $201)

Mondello, Joseph Nestor - Page 10

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

3 US bank account #2 (cash account) N/A $1,000,001 - None (or less

$5,000,000 than $201)

4 US bank account #3 (cash account) N/A $15,001 - None (or less

$50,000 than $201)

5 US bank account #4 (cash account) N/A $1,000,001 - None (or less

$5,000,000 than $201)

6 US bank account #5 (cash account) N/A $1,000,001 - None (or less

$5,000,000 than $201)

7 US bank account #6 (cash account) N/A $250,001 - None (or less

$500,000 than $201)

8 US bank account #7 (cash account) N/A $1,000,001 - None (or less

$5,000,000 than $201)

9 US bank account #8 (cash account) N/A $100,001 - None (or less

$250,000 than $201)

10 US bank account #9 (cash account) N/A $100,001 - None (or less

$250,000 than $201)

11 US bank account #10 (cash account) N/A $1,001 - $15,000 None (or less

than $201)

12 US bank account #11 (cash account) N/A $250,001 - None (or less

$500,000 than $201)

13 US bank account #12 (cash account) N/A $100,001 - None (or less

$250,000 than $201)

14 US bank account #13 (cash account) N/A $1,001 - $15,000 None (or less

than $201)

15 US bank account #14 (cash account) N/A $1,001 - $15,000 None (or less

than $201)

Mondello, Joseph Nestor - Page 11

7. Transactions

(N/A) - Not required for this type of report

8. Liabilities

None

9. Gifts and Travel Reimbursements

(N/A) - Not required for this type of report

Endnotes

Mondello, Joseph Nestor - Page 12

Summary of Contents

1. Filer's Positions Held Outside United States Government

Part 1 discloses positions that the filer held at any time during the reporting period (excluding positions with the United States Government). Positions are reportable

even if the filer did not receive compensation.

This section does not include the following: (1) positions with religious, social, fraternal, or political organizations; (2) positions solely of an honorary nature; (3) positions

held as part of the filer's official duties with the United States Government; (4) mere membership in an organization; and (5) passive investment interests as a limited

partner or non-managing member of a limited liability company.

2. Filer's Employment Assets & Income and Retirement Accounts

Part 2 discloses the following:

● Sources of earned and other non-investment income of the filer totaling more than $200 during the reporting period (e.g., salary, fees, partnership share,

honoraria, scholarships, and prizes)

● Assets related to the filer's business, employment, or other income-generating activities that (1) ended the reporting period with a value greater than $1,000 or (2)

produced more than $200 in income during the reporting period (e.g., equity in business or partnership, stock options, retirement plans/accounts and their

underlying holdings as appropriate, deferred compensation, and intellectual property, such as book deals and patents)

This section does not include assets or income from United States Government employment or assets that were acquired separately from the filer's business,

employment, or other income-generating activities (e.g., assets purchased through a brokerage account). Note: The type of income is not required if the amount of

income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF).

3. Filer's Employment Agreements and Arrangements

Part 3 discloses agreements or arrangements that the filer had during the reporting period with an employer or former employer (except the United States

Government), such as the following:

● Future employment

● Leave of absence

● Continuing payments from an employer, including severance and payments not yet received for previous work (excluding ordinary salary from a current employer)

● Continuing participation in an employee welfare, retirement, or other benefit plan, such as pensions or a deferred compensation plan

● Retention or disposition of employer-awarded equity, sharing in profits or carried interests (e.g., vested and unvested stock options, restricted stock, future share of

a company's profits, etc.)

Mondello, Joseph Nestor - Page 13

4. Filer's Sources of Compensation Exceeding $5,000 in a Year

Part 4 discloses sources (except the United States Government) that paid more than $5,000 in a calendar year for the filer's services during any year of the reporting

period.

The filer discloses payments both from employers and from any clients to whom the filer personally provided services. The filer discloses a source even if the source

made its payment to the filer's employer and not to the filer. The filer does not disclose a client's payment to the filer's employer if the filer did not provide the services

for which the client is paying.

5. Spouse's Employment Assets & Income and Retirement Accounts

Part 5 discloses the following:

● Sources of earned income (excluding honoraria) for the filer's spouse totaling more than $1,000 during the reporting period (e.g., salary, consulting fees, and

partnership share)

● Sources of honoraria for the filer's spouse greater than $200 during the reporting period

● Assets related to the filer's spouse's employment, business activities, other income-generating activities that (1) ended the reporting period with a value greater

than $1,000 or (2) produced more than $200 in income during the reporting period (e.g., equity in business or partnership, stock options, retirement plans/accounts

and their underlying holdings as appropriate, deferred compensation, and intellectual property, such as book deals and patents)

This section does not include assets or income from United States Government employment or assets that were acquired separately from the filer's spouse's business,

employment, or other income-generating activities (e.g., assets purchased through a brokerage account). Note: The type of income is not required if the amount of

income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF). Amounts of income are not required for a spouse's earned income (excluding

honoraria).

6. Other Assets and Income

Part 6 discloses each asset, not already reported, that (1) ended the reporting period with a value greater than $1,000 or (2) produced more than $200 in investment

income during the reporting period. For purposes of the value and income thresholds, the filer aggregates the filer's interests with those of the filer's spouse and

dependent children.

This section does not include the following types of assets: (1) a personal residence (unless it was rented out during the reporting period); (2) income or retirement

benefits associated with United States Government employment (e.g., Thrift Savings Plan); and (3) cash accounts (e.g., checking, savings, money market accounts) at a

single financial institution with a value of $5,000 or less (unless more than $200 of income was produced). Additional exceptions apply. Note: The type of income is not

required if the amount of income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF).

7. Transactions

Mondello, Joseph Nestor - Page 14

Part 7 discloses purchases, sales, or exchanges of real property or securities in excess of $1,000 made on behalf of the filer, the filer's spouse or dependent child during

reporting period.

This section does not include transactions that concern the following: (1) a personal residence, unless rented out; (2) cash accounts (e.g., checking, savings, CDs, money

market accounts) and money market mutual funds; (3) Treasury bills, bonds, and notes; and (4) holdings within a federal Thrift Savings Plan account. Additional

exceptions apply.

8. Liabilities

Part 8 discloses liabilities over $10,000 that the filer, the filer's spouse or dependent child owed at any time during the reporting period.

This section does not include the following types of liabilities: (1) mortgages on a personal residence, unless rented out (limitations apply for PAS filers); (2) loans

secured by a personal motor vehicle, household furniture, or appliances, unless the loan exceeds the item's purchase price; and (3) revolving charge accounts, such as

credit card balances, if the outstanding liability did not exceed $10,000 at the end of the reporting period. Additional exceptions apply.

9. Gifts and Travel Reimbursements

This section discloses:

● Gifts totaling more than $390 that the filer, the filer's spouse, and dependent children received from any one source during the reporting period.

● Travel reimbursements totaling more than $390 that the filer, the filer's spouse, and dependent children received from any one source during the reporting period.

For purposes of this section, the filer need not aggregate any gift or travel reimbursement with a value of $156 or less. Regardless of the value, this section does not

include the following items: (1) anything received from relatives; (2) anything received from the United States Government or from the District of Columbia, state, or

local governments; (3) bequests and other forms of inheritance; (4) gifts and travel reimbursements given to the filer's agency in connection with the filer's official travel;

(5) gifts of hospitality (food, lodging, entertainment) at the donor's residence or personal premises; and (6) anything received by the filer's spouse or dependent children

totally independent of their relationship to the filer. Additional exceptions apply.

Mondello, Joseph Nestor - Page 15

Privacy Act Statement

Title I of the Ethics in Government Act of 1978, as amended (the Act), 5 U.S.C. app. § 101 et seq., as amended by the Stop Trading on Congressional Knowledge Act of

2012 (Pub. L. 112-105) (STOCK Act), and 5 C.F.R. Part 2634 of the U. S. Office of Government Ethics regulations require the reporting of this information. The primary use

of the information on this report is for review by Government officials to determine compliance with applicable Federal laws and regulations. This report may also be

disclosed upon request to any requesting person in accordance with sections 105 and 402(b)(1) of the Act or as otherwise authorized by law. You may inspect

applications for public access of your own form upon request. Additional disclosures of the information on this report may be made: (1) to any requesting person,

subject to the limitation contained in section 208(d)(1) of title 18, any determination granting an exemption pursuant to sections 208(b)(1) and 208(b)(3) of title 18; (2) to

a Federal, State, or local law enforcement agency if the disclosing agency becomes aware of violations or potential violations of law or regulation; (3) to another Federal

agency, court or party in a court or Federal administrative proceeding when the Government is a party or in order to comply with a judge-issued subpoena; (4) to a

source when necessary to obtain information relevant to a conflict of interest investigation or determination; (5) to the National Archives and Records Administration or

the General Services Administration in records management inspections; (6) to the Office of Management and Budget during legislative coordination on private relief

legislation; (7) to the Department of Justice or in certain legal proceedings when the disclosing agency, an employee of the disclosing agency, or the United States is a

party to litigation or has an interest in the litigation and the use of such records is deemed relevant and necessary to the litigation; (8) to reviewing officials in a new

office, department or agency when an employee transfers or is detailed from one covered position to another; (9) to a Member of Congress or a congressional office in

response to an inquiry made on behalf of an individual who is the subject of the record; (10) to contractors and other non-Government employees working on a

contract, service or assignment for the Federal Government when necessary to accomplish a function related to an OGE Government-wide system of records; and (11)

on the OGE Website and to any person, department or agency, any written ethics agreement filed with OGE by an individual nominated by the President to a position

requiring Senate confirmation. See also the OGE/GOVT-1 executive branch-wide Privacy Act system of records.

Public Burden Information

This collection of information is estimated to take an average of three hours per response, including time for reviewing the instructions, gathering the data needed, and

completing the form. Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this

burden, to the Program Counsel, U.S. Office of Government Ethics (OGE), Suite 500, 1201 New York Avenue, NW., Washington, DC 20005-3917.

Pursuant to the Paperwork Reduction Act, as amended, an agency may not conduct or sponsor, and no person is required to respond to, a collection of information

unless it displays a currently valid OMB control number (that number, 3209-0001, is displayed here and at the top of the first page of this OGE Form 278e).

Mondello, Joseph Nestor - Page 16

You might also like

- Read The Affidavit On The Mar-A-Lago WarrantDocument38 pagesRead The Affidavit On The Mar-A-Lago WarrantNewsdayNo ratings yet

- Brian Laundrie LettersDocument9 pagesBrian Laundrie LettersNewsdayNo ratings yet

- nextLI Blue Economy ResearchDocument73 pagesnextLI Blue Economy ResearchNewsday100% (1)

- Read The Full Decision From The Supreme CourtDocument213 pagesRead The Full Decision From The Supreme CourtNewsdayNo ratings yet

- Income Tax Law & PracticeDocument60 pagesIncome Tax Law & Practicesebastianks94% (17)

- Devos FinancialDocument80 pagesDevos FinancialThe Washington PostNo ratings yet

- Barr, William P. Final278Document36 pagesBarr, William P. Final278Erin LaviolaNo ratings yet

- Meadows, Mark July 2020 Financial DisclosureDocument11 pagesMeadows, Mark July 2020 Financial DisclosureGlennKesslerWPNo ratings yet

- Trump Court TranscriptDocument32 pagesTrump Court TranscriptNewsday50% (2)

- Taxes and Business StrategyDocument13 pagesTaxes and Business StrategyNADYA EKA PUTRI100% (1)

- Trustee Handbook Guide for 4th EditionDocument200 pagesTrustee Handbook Guide for 4th EditionBhakta PrakashNo ratings yet

- Donald J. Trump SOFDocument13 pagesDonald J. Trump SOFNewsdayNo ratings yet

- Resume of George SantosDocument2 pagesResume of George SantosNewsdayNo ratings yet

- 2020 Mock Exam - LIIIDocument143 pages2020 Mock Exam - LIIISteph O100% (2)

- Bank of America Deed To FHLMC Dory GOEBEL 10 Mar 2005Document3 pagesBank of America Deed To FHLMC Dory GOEBEL 10 Mar 2005William A. Roper Jr.No ratings yet

- Dimagiba Vs Espartero - 2pages OnlyDocument2 pagesDimagiba Vs Espartero - 2pages OnlyJoel G. AyonNo ratings yet

- GROSS INCOME SOURCESDocument45 pagesGROSS INCOME SOURCESannyeongchingu80% (5)

- Jacobs.2022 RPTDocument16 pagesJacobs.2022 RPTThomas JonesNo ratings yet

- Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e)Document18 pagesExecutive Branch Personnel Public Financial Disclosure Report (OGE Form 278e)Washington ExaminerNo ratings yet

- Abold Labreche.2022 RPTDocument13 pagesAbold Labreche.2022 RPTThomas JonesNo ratings yet

- 1542 Jeffrey D Zients Oge 278eDocument11 pages1542 Jeffrey D Zients Oge 278eWashington ExaminerNo ratings yet

- Matthew Whitaker's Financial Disclosure FormDocument10 pagesMatthew Whitaker's Financial Disclosure FormLaw&CrimeNo ratings yet

- Grosso.2022 RPTDocument34 pagesGrosso.2022 RPTThomas JonesNo ratings yet

- Farina.2022 RPTDocument10 pagesFarina.2022 RPTThomas JonesNo ratings yet

- Elias - Ne RPTDocument10 pagesElias - Ne RPTThomas JonesNo ratings yet

- Margaret J PeterlinDocument7 pagesMargaret J PeterlinWAKESHEEP Marie RNNo ratings yet

- Anita+Dunn+ +278Document93 pagesAnita+Dunn+ +278Washington ExaminerNo ratings yet

- Frueh.2022 RPTDocument9 pagesFrueh.2022 RPTThomas JonesNo ratings yet

- Sanfilippo.2022 RPTDocument8 pagesSanfilippo.2022 RPTThomas JonesNo ratings yet

- Parrish.2022 RPTDocument10 pagesParrish.2022 RPTThomas JonesNo ratings yet

- Ross, Patricia.2022 RPTDocument8 pagesRoss, Patricia.2022 RPTThomas JonesNo ratings yet

- BIDEN 278e PDFDocument11 pagesBIDEN 278e PDFMGI-OSINTNo ratings yet

- Whitaker New Entrant Form 278 CertifiedDocument11 pagesWhitaker New Entrant Form 278 CertifiedLaw&CrimeNo ratings yet

- Prietula.2022 RPTDocument11 pagesPrietula.2022 RPTThomas JonesNo ratings yet

- Peter Navarro PFDDocument12 pagesPeter Navarro PFDThinkProgressNo ratings yet

- Fulton, Brenda - Ne RPTDocument11 pagesFulton, Brenda - Ne RPTThomas JonesNo ratings yet

- Trump Donald J AssetsDocument79 pagesTrump Donald J Assetsinfinitylove_No ratings yet

- Donaghy.2022 RPTDocument13 pagesDonaghy.2022 RPTThomas JonesNo ratings yet

- Thomas, John.2021 NE RPTDocument12 pagesThomas, John.2021 NE RPTThomas JonesNo ratings yet

- Sanders.2020 Term RPTDocument14 pagesSanders.2020 Term RPTThomas JonesNo ratings yet

- Branstad Terry Final278Document13 pagesBranstad Terry Final278The GazetteNo ratings yet

- Fauci DocumentsDocument96 pagesFauci DocumentsVirutron ResearchNo ratings yet

- Gusse - Ne RPTDocument11 pagesGusse - Ne RPTThomas JonesNo ratings yet

- Boerstler.2022 RPTDocument10 pagesBoerstler.2022 RPTThomas JonesNo ratings yet

- Osborne.2022 RPTDocument10 pagesOsborne.2022 RPTThomas JonesNo ratings yet

- Torres, Linda.2021 NE RPTDocument11 pagesTorres, Linda.2021 NE RPTThomas JonesNo ratings yet

- Biden Joseph R. 2021 Annual 278Document11 pagesBiden Joseph R. 2021 Annual 278Daniel ChaitinNo ratings yet

- Remy.2022 RPTDocument33 pagesRemy.2022 RPTThomas JonesNo ratings yet

- Steve Bannon Financial DisclosureDocument12 pagesSteve Bannon Financial DisclosureM MaliNo ratings yet

- Trump Staff Public Financial Disclosure - Blase, Brian CDocument9 pagesTrump Staff Public Financial Disclosure - Blase, Brian CMonte AltoNo ratings yet

- Beard.2022 RPTDocument9 pagesBeard.2022 RPTThomas JonesNo ratings yet

- Bradsher.2022 RPTDocument8 pagesBradsher.2022 RPTThomas JonesNo ratings yet

- Gonzalez Prats.2022 RPTDocument8 pagesGonzalez Prats.2022 RPTThomas JonesNo ratings yet

- Declaración de Ingresos de Donald TrumpDocument101 pagesDeclaración de Ingresos de Donald TrumpFelipe DuarteNo ratings yet

- Trump Staff Public Financial Disclosure - Bossert, ThomasDocument9 pagesTrump Staff Public Financial Disclosure - Bossert, ThomasMonte AltoNo ratings yet

- Jerome H Powell 2018 278Document20 pagesJerome H Powell 2018 278Erin LaviolaNo ratings yet

- Harris Kamala D. 2021 Annual 278Document15 pagesHarris Kamala D. 2021 Annual 278Daniel ChaitinNo ratings yet

- Trump Staff Public Financial Disclosure - Cordish, Reed PDFDocument66 pagesTrump Staff Public Financial Disclosure - Cordish, Reed PDFMonte AltoNo ratings yet

- EFD - Annual Report For 2016 - Klobuchar, Amy JDocument7 pagesEFD - Annual Report For 2016 - Klobuchar, Amy JErin LaviolaNo ratings yet

- U.S. Rep. Randy Feenstra Financial DisclosureDocument3 pagesU.S. Rep. Randy Feenstra Financial DisclosureGazetteonlineNo ratings yet

- New Entrant Report for White House Assistant Communications DirectorDocument9 pagesNew Entrant Report for White House Assistant Communications DirectorMonte AltoNo ratings yet

- FORM DR-2: Disclosure Summary PageDocument5 pagesFORM DR-2: Disclosure Summary PageZach EdwardsNo ratings yet

- Financial Disclosure Report - Ryan ZinkeDocument4 pagesFinancial Disclosure Report - Ryan ZinkeNBC MontanaNo ratings yet

- Facebook S-1 Registration StatementDocument209 pagesFacebook S-1 Registration StatementTechCrunch100% (3)

- EFD - Annual Report For 2021 - James, NatalieDocument3 pagesEFD - Annual Report For 2021 - James, NatalieGabe KaminskyNo ratings yet

- Adirim.2022 RPTDocument12 pagesAdirim.2022 RPTThomas JonesNo ratings yet

- FORM DR-2: Disclosure Summary PageDocument6 pagesFORM DR-2: Disclosure Summary PageZach EdwardsNo ratings yet

- Jerome H Powell 2017 278Document20 pagesJerome H Powell 2017 278Eddy StoicaNo ratings yet

- For Instructions, See Back of Fo Form DR-1: 4X &cam Pisc,,Osurf BoardDocument1 pageFor Instructions, See Back of Fo Form DR-1: 4X &cam Pisc,,Osurf BoardZach EdwardsNo ratings yet

- FORM DR-2: Disclosure Summary PageDocument3 pagesFORM DR-2: Disclosure Summary PageZach EdwardsNo ratings yet

- Broers Roger - 1239 - ScannedDocument3 pagesBroers Roger - 1239 - ScannedZach EdwardsNo ratings yet

- Check One: of of Form Statement OF Organization: Ot (ItyDocument1 pageCheck One: of of Form Statement OF Organization: Ot (ItyZach EdwardsNo ratings yet

- From The Archives: Alicia Patterson Will Fly Airlift For Europe SurveyDocument1 pageFrom The Archives: Alicia Patterson Will Fly Airlift For Europe SurveyNewsdayNo ratings yet

- Bench Trial Decision and OrderDocument20 pagesBench Trial Decision and OrderNewsdayNo ratings yet

- Nassau County Coliseum LeaseDocument502 pagesNassau County Coliseum LeaseNewsdayNo ratings yet

- Sigismondi LetterDocument1 pageSigismondi LetterNewsdayNo ratings yet

- Santos IndictmentDocument20 pagesSantos IndictmentNewsdayNo ratings yet

- Documents From Babylon FOILDocument20 pagesDocuments From Babylon FOILNewsdayNo ratings yet

- Newsday/Siena Survey ResultsDocument8 pagesNewsday/Siena Survey ResultsNewsdayNo ratings yet

- South Shore Sea Gate Study - NOVEMBER 16 2022 PresentationDocument33 pagesSouth Shore Sea Gate Study - NOVEMBER 16 2022 PresentationNewsdayNo ratings yet

- Babylon DocumentsDocument20 pagesBabylon DocumentsNewsdayNo ratings yet

- DiNotoEugenePleaAgreement CourtfiledDocument16 pagesDiNotoEugenePleaAgreement CourtfiledNewsdayNo ratings yet

- SEO: What You Need To Know: (Some Slides From Kyle Sutton, Sr. Project Manager, SEO at Gannett/USA TODAY Network)Document46 pagesSEO: What You Need To Know: (Some Slides From Kyle Sutton, Sr. Project Manager, SEO at Gannett/USA TODAY Network)NewsdayNo ratings yet

- DiNotoRobertPleaAgreement CourtfiledDocument12 pagesDiNotoRobertPleaAgreement CourtfiledNewsdayNo ratings yet

- Statement by Donald J. Trump, 45th President of The United States of AmericaDocument2 pagesStatement by Donald J. Trump, 45th President of The United States of AmericaNewsdayNo ratings yet

- United States v. Frank James - ComplaintDocument10 pagesUnited States v. Frank James - ComplaintNewsdayNo ratings yet

- Statement by Donald J. Trump, 45th President of The United States of AmericaDocument2 pagesStatement by Donald J. Trump, 45th President of The United States of AmericaNewsdayNo ratings yet

- Go by LIRR? I Think I Can, I Think I CanDocument3 pagesGo by LIRR? I Think I Can, I Think I CanNewsdayNo ratings yet

- United States Attorney Eastern District of New York: U.S. Department of JusticeDocument25 pagesUnited States Attorney Eastern District of New York: U.S. Department of JusticeNewsdayNo ratings yet

- Signed Complaint JakubonisDocument6 pagesSigned Complaint JakubonisNewsdayNo ratings yet

- Genova Matter Opinion and OrderDocument6 pagesGenova Matter Opinion and OrderNewsdayNo ratings yet

- Data Incident Report - RedactedDocument3 pagesData Incident Report - RedactedNewsdayNo ratings yet

- USA Vs Oyster Bay Doc. 130Document17 pagesUSA Vs Oyster Bay Doc. 130Newsday100% (1)

- Brian Benjamin IndictmentDocument23 pagesBrian Benjamin IndictmentNewsdayNo ratings yet

- East Hampton FAA Airport LetterDocument4 pagesEast Hampton FAA Airport LetterNewsdayNo ratings yet

- FSA Module Book ListDocument4 pagesFSA Module Book ListLetsogile BaloiNo ratings yet

- Lecture Notes On RetirementDocument51 pagesLecture Notes On RetirementCéline van Essen100% (1)

- Employee Welfare and Benefit SchemesDocument31 pagesEmployee Welfare and Benefit SchemesSandhya R NairNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaMahadevan KrishnamurthyNo ratings yet

- Nidhi Mahendra Pal - 222562Document6 pagesNidhi Mahendra Pal - 222562Laksh SurveNo ratings yet

- Jeevan Shanthi - IllustrationDocument3 pagesJeevan Shanthi - IllustrationPranav WarneNo ratings yet

- Indian Income Tax Return Acknowledgement Number 285727510040322Document6 pagesIndian Income Tax Return Acknowledgement Number 285727510040322Prasad KumarNo ratings yet

- Chapter 19 2Document13 pagesChapter 19 2Phạm DiệuNo ratings yet

- GIDC - Brochure - Starting A Business in GrenadaDocument2 pagesGIDC - Brochure - Starting A Business in GrenadaOffice of Trade Negotiations (OTN), CARICOM Secretariat100% (1)

- SSS, Solidum Case 164790Document6 pagesSSS, Solidum Case 164790Alvin-Evelyn GuloyNo ratings yet

- Gratuity Work ConditionsDocument7 pagesGratuity Work ConditionshelloNo ratings yet

- Employee records with salary detailsDocument4 pagesEmployee records with salary detailsoib ameyaNo ratings yet

- Multiple Choice: Property of STIDocument2 pagesMultiple Choice: Property of STIJanineD.MeranioNo ratings yet

- Comp PaperDocument10 pagesComp Paperapi-356207567No ratings yet

- 1123 Special Pension BriefingDocument17 pages1123 Special Pension BriefingAnn DwyerNo ratings yet

- britishcolumbiap02brit_4Document252 pagesbritishcolumbiap02brit_4Branko NikolicNo ratings yet

- Auditor General of Alberta Results Analysis and Financial Statements for 2011Document34 pagesAuditor General of Alberta Results Analysis and Financial Statements for 2011zelcomeiaukNo ratings yet

- Future Income Payments IndictmentDocument9 pagesFuture Income Payments IndictmentGreenville NewsNo ratings yet

- The Family and Economic Development PDFDocument9 pagesThe Family and Economic Development PDFmineasaroeunNo ratings yet

- ACCA P2 Mock Exam QuestionsDocument10 pagesACCA P2 Mock Exam QuestionsGeo DonNo ratings yet

- ThesisDocument449 pagesThesisHang VeasnaNo ratings yet

- AALU Washington ReportDocument6 pagesAALU Washington ReportforbesadminNo ratings yet

- PAKISTAN: Employees' Old-Age Benefits Act, 1976 AmendedDocument6 pagesPAKISTAN: Employees' Old-Age Benefits Act, 1976 AmendedumarmasoodNo ratings yet

- KB J012868-Kina-Bank Account Opening Form Updated-July-2022Document7 pagesKB J012868-Kina-Bank Account Opening Form Updated-July-2022Josh Philip100% (1)